How Much House Can I Afford 50k Salary

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. Thats because salary isnt the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

You May Like: Recast Mortgage Chase

I Make $60000 A Year How Much House Can I Afford

You can afford a $150,397.13 house with a monthly payment of $1,200.00.

| $1,300.00 | $0.00 |

Estimate how much house you can afford if you make $60,000 a year with our home affordability calculator. Generate an amortization schedule that will give you a breakdown of each monthly payment, and a summary of the total interest, principal paid, and payments at payoff. You have the options to include property tax, insurance, and HOA fees into your calculation.

How To Choose A Mortgage Lender

You have many options when it comes to choosing a mortgage lender. Banks, credit unions and online lenders all offer mortgages directly, while mortgage brokers and online search tools help you compare options from different lenders.

Its important to make sure you feel comfortable with the broker or company youre working with because youll need to communicate with them frequently during the application processand in some cases, after the loan closes.

You may want to start with the banks or other institutions where you already have accounts, if you like their service. Also, ask your network of friends and family, and any real estate professionals youre working with, for referrals.

Read Also: Can You Add Debt To Your Mortgage

How Much Is A 60000 Mortgage

A number of factors are involved with taking out a mortgage, the length of repayment, the interest on the loan and most importantly how much to take out in the first place. For a mortgage of £60k the costs of repayment can vary dramatically when the different criteria is applied.

Play with our calculator here for an accurate measure of what a mortgage will cost, and you can also check how much you can borrow as well as get approved by the best lender, with our partners Mojo, for FREE!

You May Like: What Does Rocket Mortgage Do

The Monthly Payment On A House Worth $500000

Using a fixed rate of 4%, your monthly payment on a 30-year mortgage may total $2,387.08, while your monthly mortgage payment on a 15-year mortgage might total $3,698.44 per month.

The FHA loan limitations will increase by $65,000 in 2022.

The Federal Housing Administrations lending limitations are increasing in 2022. The revised baseline limit, which would apply to most single-family houses, will be $420,680.

That represents a roughly $65,000 increase over the FHA loan maximum of $356,360 set last year. The Federal Housing Administration is increasing its loan restrictions to keep up with housing prices.

Borrowers will have more access to a greater variety of properties through low-cost FHA financing due to these increased limits.

The FHA loan limitations determine the maximum amount you can obtain on an FHA-backed home loan. Starting on January 1, 2022, the total amount you could spend on a single-family home in most regions was $420,680.

FHA loan limitations are significantly higher in upscale neighborhoods, with single-family loans in expensive metro areas having a maximum of $970,800 in single-family loan limits.

Read Also: How To Become A Mortgage Broker In Fl

How To Calculate Your Mortgage Payment

Mortgage calculators take into account a variety of different factors when determining your monthly mortgage costs. They can include the price of your home, your down payment, your monthly interest rate and the term length of your mortgage. If your math skills are a little rusty, a mortgage calculator does the hard work for you in order to determine your monthly payment and associated costs.

The basic formula for calculating your mortgage costs: P = A/

- P stands for your monthly payment

- A stands for your loan amount

- T stands for the term of your loan in months

- R stands for the monthly interest rate for your loan

For example, lets say that John wants to purchase a house that costs $125,000 and has saved up a $25,000 down payment. His loan amount is $100,000, the term length is 15 years and the monthly interest rate is 4.20%. In this scenario, Johns monthly mortgage payment will be $749.75.

Johns mortgage cost formula will look like: 749.75 = 100,000[4.2^180/[^180-1)

If John wants to purchase the same house with a 30-year term length, the formula works in much the same way. In this scenario, his loan amount is $100,000, term length is 30 years and monthly interest rate is 4.20%. With a 30-year mortgage, Johns monthly mortgage payment will be $489.02.

Johns mortgage cost formula will look like: 489.02 = 100,000[4.2^360/[^180-1)

How Much Would A $600k Mortgage Cost

So you are considering getting a $600k mortgage but want to know what it will end up costing you.

There are many aspects to consider when applying for a $600,000 mortgage. This includes the down payment, interest rate, mortgage length, and monthly payments.

A 15-year $600k mortgage could save you a considerable amount of money compared to a 30-year mortgage when taking interest into account.

Below you will find how much you could expect to pay each month with various interest rates. On top of that, you will also find the different down payment options explained in detail so you can choose the best way to go about getting a $600,000 mortgage.

This post may contain affiliate links. For more information, see our disclosure policy.

Read Also: When Does Mortgage Refinance Make Sense

Whats Included In A Mortgage Payment

Your mortgage payment consists of four costs, which loan officers refer to as PITI. These four parts are principal, interest, taxes, and insurance.

- Principal: The amount you owe without any interest added. If you buy a home for $400,000 with 20% down, then your principal loan balance is $320,000

- Interest: The amount of interest youll pay to borrow the principal. If the same $320,000 loan above has a 4% rate, then youll pay $12,800 for the first year in interest repayment

- Taxes: Property taxes required by your city and county government

- Insurance: Homeowners insurance and, if required, private mortgage insurance premiums on a conventional loan

When determining your home buying budget, consider your entire PITI payment rather than only focusing on principal and interest. If taxes and insurance are not included in a mortgage calculator, its easy to overestimate your home buying budget.

What Are My Monthly Payments

Use the Mortgage Calculator to get an idea of what your monthly payments could be. This calculator can help you estimate monthly payments with different loan types and terms. You may be able to afford more depending on factors including your down payment and/or the purchase price. The calculator will estimate your monthly principal and interest payment, which represents only a part of your total monthly home expenses. Additional monthly costs may include: real estate taxes, insurance, condo or homeowners association fees and dues, plus home maintenance services and utility bills.

Recommended Savings

Add All Fixed Costs and Variables to Get Your Monthly Amount

Calculator Disclaimer

Also Check: How To Calculate Mortgage Insurance On A Conventional Loan

Should I Choose A Long Or Short Loan Term

It depends on your budget and goals. A shorter term will allow you to pay off the loan quicker, pay less interest and build equity faster, but youll have a higher monthly payment. A longer term will have a lower monthly payment because youll pay off the loan over a longer period of time. However, youll pay more in interest.

Down Payment For A Mortgage

One of the first considerations is the down payment. The larger the down payment you make, the higher likelihood you will receive a lower interest rate.

There are many different types of loans that have different requirements for how much money needs to be put down initially.

Some have requirements of as little as 0% down, some require 3.5%, and some require 20% or greater.

Read Also: Is It Better To Use A Mortgage Broker

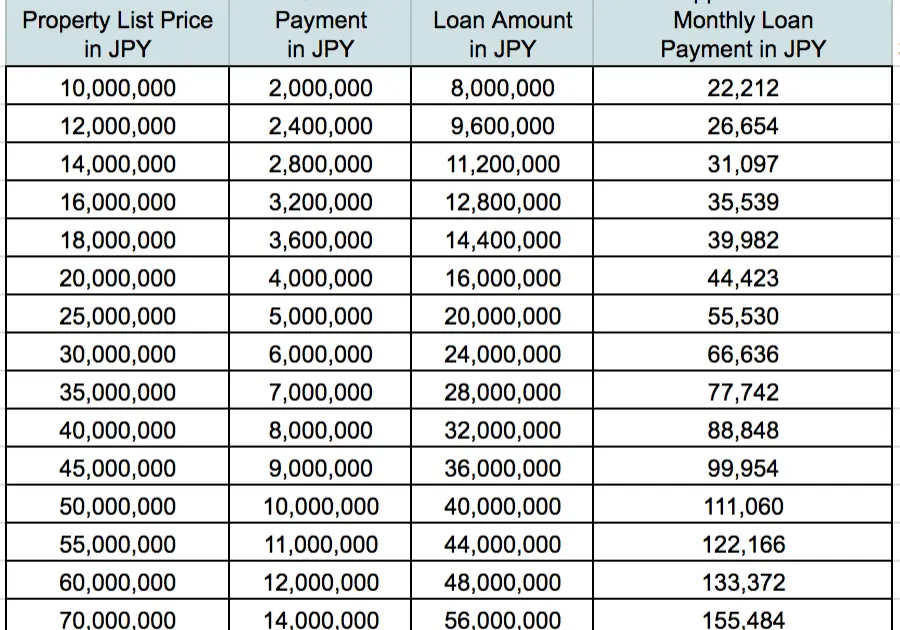

Can You Afford A 60000000 Mortgage

Is the big question, can your finances cover the cost of a £600,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering ‘yes’ then it’s worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered. See how much it will cost you to move home when buying a property worth £600,000.00

Do you need to calculate how much deposit you will need for a £600,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances

Did you know that we review the UK’s leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesn’t charge you fees, so you get the best mortgage deals without the hassle.

How Accelerated Mortgage Payments Work

Accelerated mortgage payments are the payment frequency options that will allow you to pay off your mortgage faster and save you potentially thousands in mortgage interest costs.

With accelerated bi-weekly payments, youll still make a payment every 14 days , which adds up to 26 bi-weekly payments in a year. The part that makes it accelerated is that instead of calculating how much an equivalent monthly mortgage payment would add up to in a year, and then simply dividing it by 26 bi-weekly payments, accelerated bi-weekly payments does the opposite.

To find your accelerated bi-weekly payment amount, youll divide the monthly mortgage payment by two. Note that there are 12 monthly payments in a year, but bi-weekly payments are equivalent to 13 monthly payments. By not adjusting for the extra monthly payment by taking the total annual amount of a monthly payment frequency, an accelerated bi-weekly frequency gives you an extra monthly payment every year. This pays off your mortgage faster, and shortens your amortization period.

The same calculation is used for accelerated weekly payments. To find your accelerated weekly payment amount, youll divide a monthly mortgage payment by four.

Recommended Reading: How To Calculate Interest Only Mortgage Payment

How Piti Affects Your Mortgage Qualification

When lenders assess whether or not you can afford a mortgage loan, theyll compare your estimated PITI with your gross monthly income .

Your PITI, combined with any existing monthly debts, should not exceed 43% of your monthly gross income this is called your debt-to-income ratio .

Your DTI is a primary factor in whether or not youll qualify for a mortgage.

Monthly Payments For A $150000 Mortgage

Your mortgage payment will include a few line items, including principal, interest, and sometimes, escrow costs.

Heres what those entail:

- Principal: This money is applied straight to your loan balance.

- Interest: This one is the cost of borrowing the money. How much youll pay is indicated by your interest rate.

- Escrow costs: Sometimes, your lender might require you to use an escrow account to cover property taxes, homeowners insurance, and mortgage insurance. When this is the case, youll pay money into your escrow account monthly, too.

Let us know where you are in the homebuying process below. Credible can help you find a great mortgage in just a few minutes and put you on the path to pre-approval.

See what your estimated monthly payment will be using our mortgage payment calculator below.

For a $150,000, 30-year mortgage with a 4% rate, your basic monthly payment meaning just principal and interest should come to $716.12. If you have an escrow account, the costs would be higher and depend on your insurance premiums, your local property tax rates, and more.

Heres an in-depth look at what your typical monthly principal and interest payments would look like for that same $150,000 mortgage:

| Interest rate |

|---|

Read Also: Can I Throw Away Old Mortgage Papers

What Is An Amortization Schedule

The process of repaying a loan with interest to the lender is described in an amortization schedule. Each payment is broken down in terms of how much is applied to the principal and how much is interest. The distribution between principal and interest varies over time so the amortization schedule specifically illustrates the changes.

How Much Income Do I Need For A 600k Mortgage

Before you invest 600k into a home, youll want to be sure you can afford it.

To be able to borrow a 600k mortgage, youll require an income of $184,575 per year.

The income you need is calculated using a 600k mortgage on a payment that is 24% of your monthly income. In your situation, your monthly income should be about $15,381.

Also Check: How Do You Get Your Name Off A Mortgage

Do Your Own Research For A $600k Mortgage

Our final piece of advice is simple: do your own research. Were confident that weve put together a solid guide here for a 600k mortgage, but its not the be-all and end-all. We dont tackle your specific financial or personal situation , nor can we provide advice for every single location on the planet. And ultimately, a lot of what weve said is subjective and a matter of opinion.

We recommend taking the resources and advice weve pointed you to and then doing some more leg work. That final call to buy a home is ultimately yours to make.

What Is The Best Mortgage Term For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

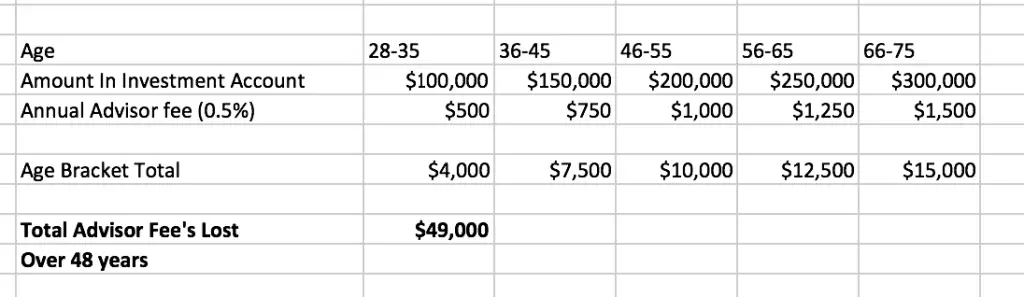

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

Don’t Miss: What Is The Mortgage Rate For Bank Of America

$600000 House At 375%

| $1,500 |

Mortgage Tips

- Get a free copy of your to make sure there are no errors which might negatively affect your credit score.

- Shop around. Make sure to get multiple mortgage quotes. Over 30 years, a difference of 0.25% in APR might end up being over $10,000 in extra payments!

- Bigger down payments are better. You can often qualify for a mortgage with as little as 3.5% down. But, unless your down payment is at least 20%, you will likely have to pay Private Mortgage Insurance . This can add significant cost to the price of the mortgage.

Can I afford a $600,000 house?

Traditionally, the “28% rule” means a person should not spend more than 28% of their pre-tax income on total housing costs.

Let’s assume that taxes and insurance are 2% of the house price annually. Here’s how much you’d have to make to afford a house that costs $600,000 with a 3.75% loan:

| % Down |

|---|

Here’s What Your Monthly Payment And Total Interest Could Look Like On A $600000 Mortgage

- 5 year fixed rate from 5.29%

- Prepay up to 25% annually

- All provinces & territories

If youre ready to buy a home, youll first need to find out how much mortgage you can afford based on your income and down payment. If youve qualified for a mortgage of $600,000, heres a breakdown of what you might face monthly, in interest and over the life of the mortgage.

Also Check: How Can I Get Help With My Mortgage

Buy What You Can Afford

There are other considerations that you may need to take into account such as the cost of living. The cost of living varies state by state, if you buy a house, do you need to cut costs on your other expenses, such as eating out?The most important thing to remember is to buy what you can afford as costs can add up quickly. If you are not sure what kind of house you can afford, always take the conservative route and buy a house that you are 100% sure that you can afford.Every family is different, it is hard to calculate exactly how much you can afford based on your income. However, you can use our home affordability calculator to get a general sense of what kind of house you can afford.

You May Like: Chase Mortgage Recast