How Do Conventional Loans Work

Conventional loans work like this: the bank purchases property on your behalf and turns the title over to youhowever, you promise to pay back the lender with interest.

Interest is the percentage rate you pay the bank for the trouble of lending you money, and its how the bank makes money from having lent you such a large sum. Interest rates are either fixed or adjustable in the latter case, they typically change once per year depending on the state of the economy. The interest rate you receive on a conventional loan will also vary based on your own personal financial profile .

Interest rates and qualifications for a mortgage can vary significantly across the wide range of home loan products available to consumers, but conventional home loan terms tend to fall into a narrower set of categories. One distinction youll find between two types of mortgage products is conforming vs nonconforming loans.

Conventional mortgages are typically lent out with 15 or 30 year repayment periods the one thats right for you depends on your personal finances, your income, and the interest rate you can secure.

How Can I Stop Paying Pmi On A Conventional Loan

Once you reach the 80% LTV meaning you have 20% home equity you can request that your lender remove the PMI charge. Keep in mind, you have to ask for its removal, your lender does not automatically remove PMI until you reach 22% home equity. Keep in mind that the lender may use the original purchase price as a basis for that equity figure.

For instance, you purchased the home for $100,000 with 5% down. Its now worth $120,000 and the loan amount is $90,000. Using the current value, you have 25% equity. But if your lender uses the original purchase price, you only have 10% equity and would have to refinance to get out of PMI.

In addition, if your house value went down, dont be surprised if the lender uses your homes new, lower value.

Not all lenders and loan servicers use these conservative calculations. But its worth exploring other options if the lender says you dont yet have adequate equity.

To cancel PMI, the borrower must:

- Have at least 20% equity in the home according to the lenders or servicers calculations

- Make the request for PMI removal verbally or in writing to their lender

- Have an on-time payment history with no payment made more than 30 days late in the 12 months prior to the removal request

- Have an on-time payment history with no payment made more than 60 days late in 24 months, or two years, leading up to the removal request

How Much Does Mortgage Insurance Cost

Not every potential homebuyer can afford the traditional 20% down payment. In fact, many Americans struggle to pull together enough finances for a substantial down payment on a mortgage. However, that doesnt mean your dream home is out of reach. When that happens, potential buyers can still purchase their property with the help of mortgage insurance. Mortgage insurance is one of the ways lenders protect themselves from potential loss. And while its a common cost, it doesnt last forever. Consider consulting a financial advisor on how to make sure your mortgage doesnt disrupt your financial plan.

Recommended Reading: Reverse Mortgage Mobile Home

How To Avoid Pmi

How you can avoid PMI depends on what type you have:

- Borrower-paid private mortgage insurance, which youll pay as part of your mortgage payment.

- Lender-paid private mortgage insurance, which your lender will pay upfront when you close, and youll pay back by accepting a higher interest rate.

Lets review how each type works in more detail, and what steps you can take to avoid paying either one.

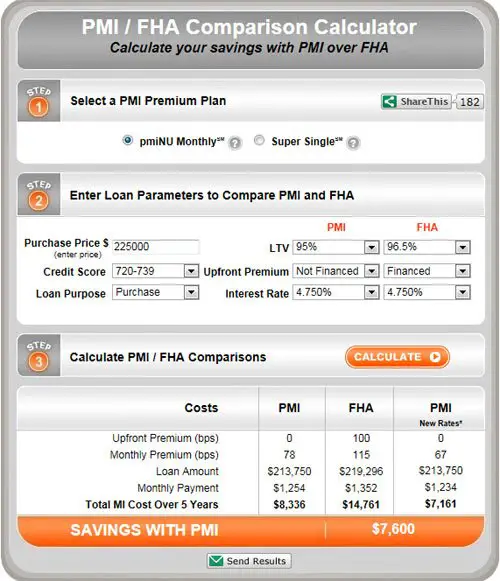

An Example Quote For Private Mortgage Insurance

Check out this PMI example quote. This is from the private mortgage insurance company, Radian.

When calculating this rate, we put in a 5% down loan, a $200,000 loan amount, one borrower, a 760 credit score, single family residence, and we selected it to be a primary residence. With this, youd be looking at $60 a month at a mortgage insurance factor of 0.36%. They calculate the amount by taking 0.36% of the loan amount and dividing it by 12, to get your monthly amount. Youll pay mortgage insurance monthly and then there is an adjustment period after the 10th year. In this example, the MI rate would go down to 0.2% at the 10 year mark however, the adjustment period isnt always hit because a lot of people refinance before that 10th year.

Recommended Reading: Reverse Mortgage On Condo

What Is Pmi And How Is It Calculated

When you take out a home loan or refinance your mortgage, your lender may require you to pay for an additional type of insurance private mortgage insurance.

When do you have to pay private mortgage insurance and how much will it cost you? It depends on your loan-to-value ratio. Find out when you have to pay PMI and learn how to calculate the cost.

How Much Is Mortgage Insurance And Is It Worth It

Homebuyers are generally required to pay mortgage insurance if they make a down payment thats less than 20% of the homes purchase price.

Mortgage insurance may seem like just another expense when it comes to buying a home one that youd be better off avoiding.

But mortgage insurance is not a bad thing. In fact, for most first-time homebuyers, its what allows them to purchase homes at all, since they dont need to save up a 20% down payment.

Read Also: Reverse Mortgage For Condominiums

How Fha Mortgage Insurance Works

An FHA loan is a certain type of mortgage thats backed by the Federal Housing Administration. Its designed to help prospective homeowners who wouldnt otherwise qualify for an affordable conventional loan, especially first-time homebuyers. FHA loans are available to borrowers with credit scores of at least 500. Its possible to put as little as 3.5% down with a credit score of at least 580, otherwise a down payment of at least 10% is required.

Unlike private mortgage insurance, FHA mortgage insurance is required on all FHA loans regardless of the down payment amountand cant be cancelled in most cases.

Currently, if you put down less than 10% on an FHA loan, youre required to pay mortgage insurance for the entire length of the loan. If you put down 10% or more, the mortgage insurance can be removed after 11 years of payments.

Four Ways To Get Rid Of Pmi

Understandably, most homeowners would rather not pay for private mortgage insurance .

Luckily, there are multiple ways to get rid of PMI if youre eligible. Not all homeowners have to refinance to get rid of mortgage insurance.

Homeowners with conventional loans have the easiest way to get rid of PMI. This mortgage insurance coverage will automatically fall off once the loan reaches 78% loantovalue ratio .

Or, the homeowner can request that PMI be removed at 80% LTV instead of waiting for it to be taken off automatically when home equity reaches 22% .

When requesting PMI removal, the loantovalue ratio may be calculated based on your homes original purchase price or based on your original home appraisal .

Or, if your homes value has risen, you may be able to order another appraisal and remove PMI based on your homes current value.

You May Like: Who Is Rocket Mortgage Owned By

Piggyback Mortgages And Pmi

Some lenders recommend using a second piggyback mortgage to avoid PMI. This can help lower initial mortgage costs rather than paying for PMI. It works like this: You take out a first mortgage for most of the homes purchase price . Then you take out a second, much smaller mortgage for the remainder of the homes purchase price, less the first mortgage and down payment amounts. As a result, you avoid PMI and have combined payments less than the cost of the first mortgage with PMI.

However, a second mortgage generally carries a higher interest rate than a first mortgage. The only way to get rid of a second mortgage is to pay off the loan entirely or refinance it into a new standalone mortgage, presumably when the LTV reaches 80% . However, these loans can be costly, particularly if interest rates increase from the time you take out the initial loan and when youd refinance both loans into one mortgage. Dont forget youll have to pay closing costs again to refinance both loans into one loan.

How To Cancel An Fha Mortgage Insurance Premium

In 2013, the Department of Housing and Urban Development issued a press release that outlined the steps the FHA would take to increase its capital reserves. Among other things, HUD announced they would charge annual mortgage insurance for the life of the loan, in most cases.

Here iss an excerpt from that press release:

FHA will also require most borrowers to continue paying annual premiums for the life of their mortgage loan. This will permit FHA to retain significant revenue that is currently being forfeited prematurely.

And here is a direct quote from the policy letter sent to lenders:

For any mortgage involving an original principal obligation with a loan-to-value ratio greater than 90%, FHA will assess the annual MIP until the end of the mortgage term or for the first 30 years of the term, whichever occurs first.

So, for borrowers who use the customary 3.5% down payment option in 2017, the only way to cancel the annual MIP is to either pay off the loan or refinance. Otherwise, the mortgage insurance premium will stick with the loan for its full term, or at least up to 30 years.

Don’t Miss: Rocket Mortgage Requirements

What Is A Loan Amortization Schedule

A loan amortization schedule shows the process of repaying a loan with interest. It breaks down how much of each payment goes to the principal and how much is applied toward interest. With a loan amortization schedule, you can see how the principal and interest distribution changes over time.

You may be surprised to find out that at first, most of your mortgage payments will go to interest. As you near the end of your term, more of your payments will be allocated toward the principal. Thats why you typically wont build up much equity in the first few years of your mortgage.

The good news is you can consider paying extra on your mortgage. Not only will this help you build equity faster to cancel PMI, it will also save you money in interest payments over the life of your loan.

Check out our loan amortization calculator.

How To Get Rid Of Pmi On Fha Usda & Conventional Loans

If mortgage comes up as a topic, eventually the term PMI is mentioned. PMI stands for private mortgage insurance and most want to avoid it at all costs if possible. However, once the benefits of mortgage insuranceare explained correctly, the potential borrower warms up to the idea of it allowing low to no down payment. Although at some point, a couple comments come up: Tell me how to get rid of PMI. and When does PMI go away?

Even though many believe all PMI is the same, it is not. The amounts are different and the ability to cancel vary as well. If a loan with PMI is in place already, this information is worth knowing. If looking to buy a home, this is excellent information to understand up-front. Understanding how each form of PMI works could play an important role in the mortgage decision. So, lets explain how to get rid of PMI for each loan type.

You May Like: 10 Year Treasury Vs 30 Year Mortgage

Can I Waive My Fha Mip

The good news about taking out an FHA mortgage is that you dont have to pay for private mortgage insurance, so you dont have to worry about getting PMI dropped. The bad news is that you do have to pay for mortgage insurance premiums, which you can get dropped after youve paid down your mortgage and built equity in your home.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Read Also: How Does The 10 Year Treasury Affect Mortgage Rates

When Does A Conventional Loan Make Sense

A conventional loan gives you the best chance of getting your offer accepted, given the competitive nature of the current housing market.

Conventional loans are more favorable in the eyes of a seller. Many times, conventional offers will be accepted over FHA due to the conventional borrower having a higher credit score, as well as looser appraisal guidelines, says Mandy Phillips, branch manager at Vista Home Loans.

What Is A Conforming Conventional Loan

A conventional loan or mortgage is a type of financing for homebuyers which is not provided or secured by a government entity. These are offered by private lenders such as banks, mortgage companies, and credit unions. In other cases, some conventional mortgages may also be guaranteed by two government-sponsored institutions: Fannie Mae and Freddie Mac.

A conventional loan is referred to as a conforming loan when it does not exceed the conforming limit, which is the dollar limit established by government-sponsored institutions.

Recommended Reading: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

How To Calculate Mortgage Insurance

This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.There are 7 references cited in this article, which can be found at the bottom of the page.wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status. This article has been viewed 351,924 times.

Private mortgage insurance is insurance that protects a lender in the event that a borrower defaults on a conventional home loan. Mortgage insurance is usually required when the down payment on a home is less than 20 percent of the loan amount. Monthly mortgage insurance payments are usually added into the buyer’s monthly payments.

How We Calculate Your Monthly Conventional Loan Payment

To estimate your monthly conventional mortgage payment, the calculator considers the price of the home you want to buy, as well as the down payment you plan to make. It then takes into account the conventional loans term how many years it will take you to pay it off if you never miss a monthly payment and a fixed interest rate.

Not sure what your loan term or interest rate will be? Use the calculator’s suggestion of a 30-year fixed term and a 4% fixed interest rate so you can still see a general estimate of your monthly principal-and-interest payment. Try entering 15 or 20 years, too, to see how a shorter term would affect your payments.

Nerd Tip: Principal and interest are two of the main components of any mortgage. A loans principal is the total amount you have to pay back. Your principal balance will likely decrease monthly as you make payments. Loan interest is the additional amount you pay a lender in exchange for being able to borrow the money. Thats why its so important to get the best mortgage rate available.

Also Check: Rocket Mortgage Qualifications

How Do I Avoid Paying Pmi Altogether

To avoid PMI, youll need at least 20 percent of the homes purchase price set aside for a down payment. For example, if youre buying a home for $250,000, you need to be able to put down $50,000.

Another strategy is a piggyback mortgage. With a piggyback loan, youd actually get two separate mortgages, one for 80 percent of the homes value and one for 10 percent. Youd make a 10 percent down payment from your savings, and use the smaller of the two loans to complete the 20 percent down payment.

The upside of this strategy is avoiding PMI, but a piggyback mortgage means having two loans and two monthly payments to make, so consider this option carefully. Some piggyback loans also have shorter terms than the primary mortgage, so your monthly payments will be higher.