Making 1 Extra Mortgage Payment A Year: What Is The Impact

Derek

Are you thinking about making 1 extra mortgage payment a year? Did you hear that it cuts a bazillion years off the term of your mortgage? Is that actually true? And should you start making these extra payments?

These are great questions! And theres actually another good one that you may be asking What if Im already halfway into my mortgage payments? Is it still worth it for me make these extra payments?

Yup, well answer this too. Lets hit it!

Dont Miss: Who Is Rocket Mortgage Owned By

What To Consider Before Prepaying Your Mortgage

Prepaying your mortgage is a great goal to work toward, but before you do, make sure youve met these financial milestones first:

Once those bases are covered, prepaying a mortgage comes down to discipline and comfort level. Do you want to be completely debt-free, or would you prefer your money working harder for you in other ways? Ideally, you want to pay off your mortgage before retirement so you dont have those monthly payments to worry about if your income becomes more limited.

Disadvantages Of Paying Down Your Mortgage

Before you make an extra mortgage payment, keep in mind that not all mortgages have a tax-deductible interest. Typically, mortgage interest on an owner-occupied home is deductible, while the interest on a rental property can be counted as an expense against rental income. Interest in a second home or vacation property is typically ineligible.

There may be a cap to the maximum amount that can be deducted based on the specifics of your loan and the state you live in. If you are unsure, it is always a good idea to talk with your tax advisor to see if you face any restrictions in mortgage interest deductibility.

Read Also: Can You Get A Mortgage With No Job

Is Making Paying Off Your Mortgage Early The Best Use Of Your Money

Before you make extra payments, decide if this is the best use of your money. For example, if you have credit card debt with an interest rate of 17%, you may want to pay off this debt before you make extra payments on a mortgage with an interest rate of 4%. If you are saving for college or retirement, you might decide it is better to put the money in these investments. And if you don’t have an emergency fund, you might want to build up your rainy-day reserve first.

Paying Extra On Your Mortgage

Paying extra on your mortgage means that you make additional payments to your principal loan balance beyond your regular payments. For example, if you pay $1,300 per month normally, you may pay an extra $200 to the principal for a total payment of $1,500. Or if you get a bit of money, say a $5,000 tax refund, you could apply it to your principal loan balance. The faster you pay off your mortgage, the less you will pay in interest, reducing your overall loan cost. However, this option should be considered in the context of your larger financial situation.

You May Like: What Does A Cosigner Do For A Mortgage

Making Extra Payments On Mortgage: Is It The Right Move

The short answer is, it depends. Some homeowners will want to explore the possibility of a future lower mortgage payment by paying down principal now. You may feel strongly that shortening the length of your loan is ideal. Or you may want to build wealth separately and save the difference. Essentially it comes down to a few financial and homeownership goals that help you either save time, money, or a little of both.

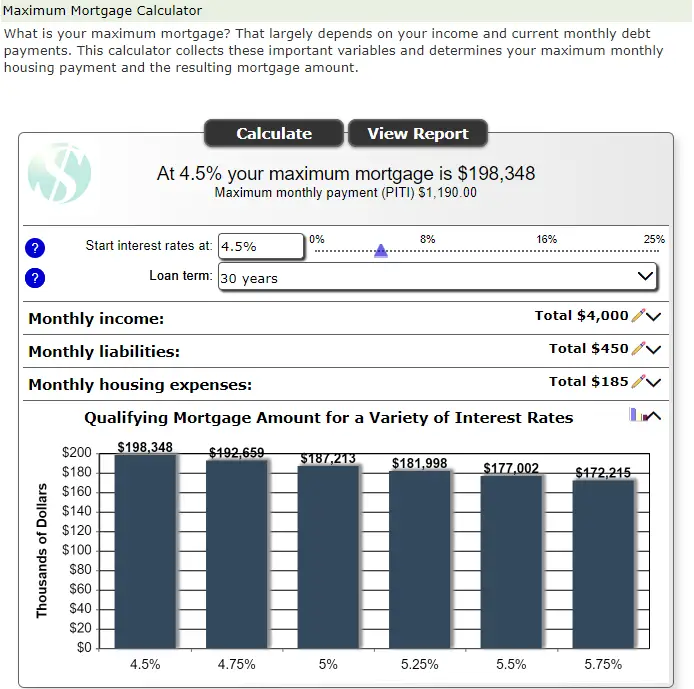

Not every homeowner will benefit from making an additional mortgage principal payment here and there. Before doing anything else, use the above extra mortgage payment calculator and see how much you may save in the long run.

How Can Making Extra Payments Help

When you make an extra payment or a payment that’s larger than the required payment, you can designate that the extra funds be applied to principal. Because interest is calculated against the principal balance, paying down the principal in less time on a fixed-rate loan reduces the interest youll pay. Even small additional principal payments can help.

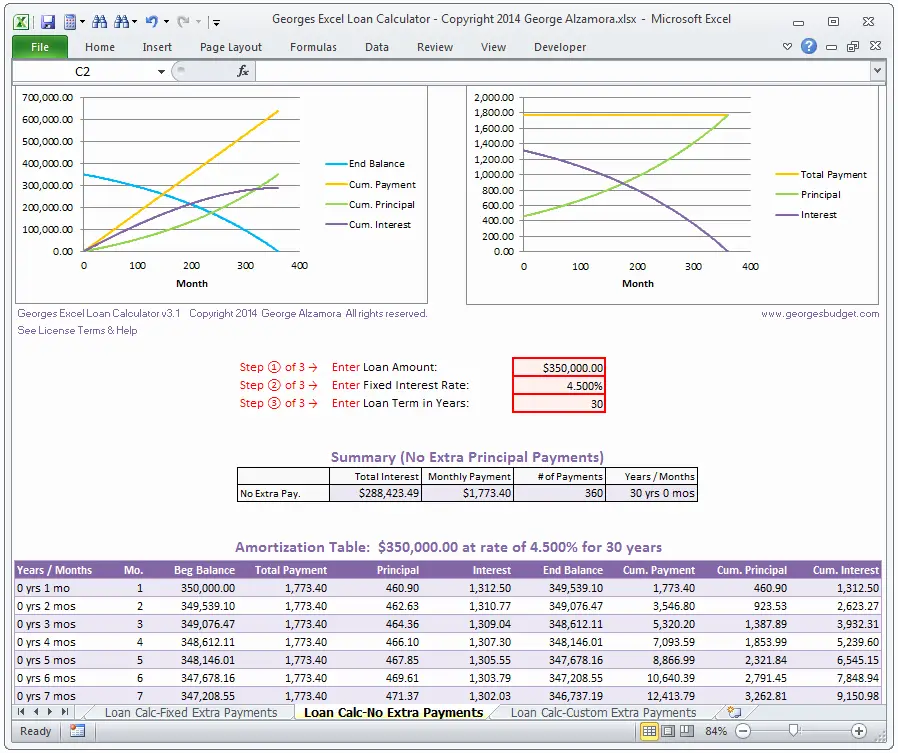

Here are a few example scenarios with some estimated results for additional payments. Lets say you have a 30-year fixed-rate loan for $200,000, with an interest rate of 4%. If you make your regular payments, your monthly mortgage principal and interest payment will be $955 for the life of the loan, for a total of $343,739 . If you pay $100 extra each month towards principal, you can cut your loan term by more than 4.5 years and reduce the interest paid by more than $26,500. If you pay $200 extra a month towards principal, you can cut your loan term by more than 8 years and reduce the interest paid by more than $44,000.

Another way to pay down your loan in less time is to make half-monthly payments every 2 weeks, instead of 1 full monthly payment. When you split your payments like this, youre making the equivalent of 1 extra monthly payment a year . This extra payment may be applied directly to your principal balance. Be sure to first check with your lender if this is an option for your loan.

Recommended Reading: How Soon Can You Lock In A Mortgage Rate

Review Your Current Budget

Take a look at your monthly statements, savings, debt, and overall spending to get a better understanding of your financial layout. Knowing your current financials gives you a grasp of your spending and saving habits, which in turn gives you insight into how you can tweak those habits to contribute more to your mortgage.

Coming Up With Extra Money Monthly

Most borrowers do not believe that it is possible for them to afford to pay more towards their mortgage. Although they do not believe they have the additional funds required for this, most consumers use their revolving credit accounts to purchase luxuries such as televisions, or daily luxuries like gum or soda. Most definitely, there is absolutely nothing wrong with making these purchases, but if the consumer is seeking an early pay off of their mortgage, they might want to reconsider.

As income tax time rapidly approaches, many consumers will be expecting reimbursement for overpaid taxes or credits. For a borrower considering paying off a mortgage early, they may want to apply their refunds to the principle of their mortgage. This can also be said of any funds that arent already obligated, such as settlements from insurance companies, and financial awards.

The rate in which a mortgage can be paid off more quickly varies depending on the additional amount paid and when it is applied to the account. The earlier a larger extra payment is applied to the mortgage, the more the consumer will save. Just to show the effect that making an additional monthly payment can have on a mortgage, consider this:

Don’t Miss: What Of Salary Should Go To Mortgage

Set A Reasonable Goal

Big ambitions get overwhelming pretty quickly. To keep on track with your savings plan, start by setting a goal you know you can achieve. For instance, if you know you can save $10 a month, start there. Put that extra $10 into your mortgage payment for one month. Once youve reached that goal for a few months, bump it up to $20.

Increase incrementally until youve reached your sweet spot. Its more effective to start small and calibrate than it is to start too big and give up shortly thereafter.

How To Make Extra Mortgage Payments

When it comes to making extra payments on your mortgage, there are a variety of tactics that can be used. Each has the same goal in mind: to reduce the principal and, thereby, reduce interest.

The tactics for making extra mortgage payments include:

Accelerated Payment Schedule

Rather than making your mortgage payment once per month, or the equivalent of every four weeks, you could make payments every two weeks. This biweekly payment plan results in 26 half-payments, which is the equivalent of 13 full payments for the year. The extra payment each year can shave off eight years from a 30-year loan.

Extra Principal with Each Monthly Payment

If youre looking to chip away at your mortgage at a more gradual pace, pay a little extra each month. Check with your lender to make sure the additional payment goes directly to the principal. Depending on how much extra principal you pay, you could shorten your loan significantly. And, best of all, because your are shortening the loan duration, you will save significant amounts in interest.

One Additional Payment Per Year

Another tactic is to make one additional, principal-only payment per year. Some people who do this use their income tax refund for this purpose.

One Additional Payment Per Quarter

Making an additional payment each quarter results in four extra payments per year. On a $220,000, 30-year mortgage with a 4% interest rate, you would cut 11 years off your mortgage and save $65,000 in interest.

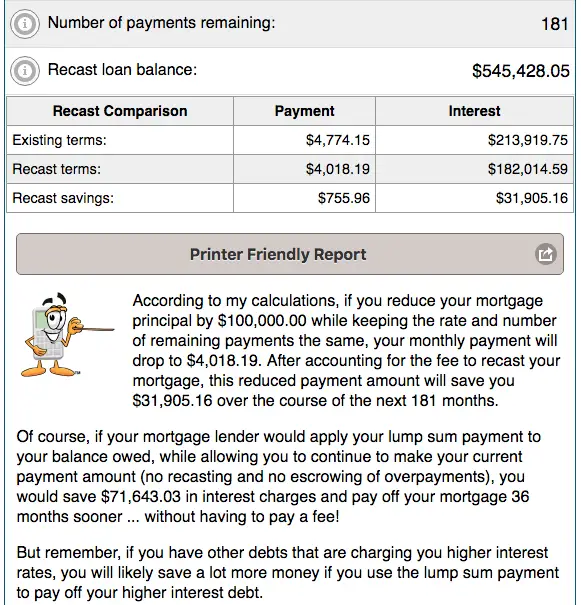

Lump-Sum Payment

Read Also: What Qualifies You For A Mortgage Loan

Start Planning Your Early Mortgage Pay Off

The next step is planning how you intend to pay off your mortgage early. Mortgage calculators are an invaluable resource for visualizing a way forward. They can break down a clear path to follow and a realistic timeline. Call a nonprofit for guidance on approaching and planning your mortgage payoff. They offer free financial advice that will give you a clearer picture of where you stand, clarifying financial strengths and limitations. Consider a debt management plan if you need help understanding your debts and organizing your bills.

About The Author

Paying Off Your Mortgage Early: Is It Worth It

If you find yourself with a little extra cash at the end of the month, should you put it toward your mortgage loan or refinance to a shorter term? Theres no simple yes or no answer. There are both risks and benefits to paying off your loan early or switching loan terms, and the right decision will be different for everyone. In this section, well look at a few instances in which it makes sense to pay off your mortgage early and when it doesnt.

Get approved to refinance.

Don’t Miss: How To Add A Mortgage Calculator To My Website

Tips For Buying A Home

- A financial advisor can guide you through major financial decisions, like the purchase of a home. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Securing a mortgage can be a stressful and confusing process. For starters, you need to figure out what term is best for you, whether you want a fixed or variable interest rate and where to get the best mortgage rates.

Is It True If You Pay One Extra Mortgage Payment A Year

3. Make one extra mortgage payment each year. Making an extra mortgage payment each year could reduce the term of your loan significantly. For example, by paying $975 each month on a $900 mortgage payment, youll have paid the equivalent of an extra payment by the end of the year.

Do extra mortgage payments go to principal or interest?

When you make an extra payment or a payment thats larger than the required payment, you can designate that the extra funds be applied to principal. Because interest is calculated against the principal balance, paying down the principal in less time on a fixed-rate loan reduces the interest youll pay.

What is the fastest way to pay off a mortgage?

How to Pay Off Your Mortgage Faster

How many years does making an extra mortgage payment take off?

This means you can make half of your mortgage payment every two weeks. That results in 26 half-payments, which equals 13 full monthly payments each year. Based on our example above, that extra payment can knock four years off the 30-year mortgage and save you over $25,000 in interest.

How many years does 2 extra mortgage payments take off?

The additional amount will reduce the principal on your mortgage, as well as the total amount of interest you will pay, and the number of payments. The extra payments will allow you to pay off your remaining loan balance 3 years earlier.

Recommended Reading: How To Remove A Co Borrower From A Mortgage

How Extra Mortgage Payments Work

Real estate attorney Rajeh Saadeh explains the concept behind accelerated payments:

Say you have a 30-year mortgage. You can make additional payments applied to your principal at the time your mortgage payment is normally due, or earlier.

Or you can do so at more frequent intervals during the year, he says.

Any time you pay extra on your mortgage, you need to indicate to your lender that the money should go toward loan principal not interest.

That will reduce your loans term and enable you to pay off your loan more quickly, Saadeh explains.

But you dont want any extra payments to go toward your loans interest that wont reduce your principal owed or shorten the life of your loan.

Make sure your lender or servicer is applying any extra money toward principal as its first priority. Otherwise, youll need to indicate that your extra payments should be applied that way.

Why Paying Extra On Your Mortgage Actually Reduces The Term

How is it that just one extra payment a year can save you 4 years and $22,000 in interest?

The answer isnt as complex as you might think.

Lets say you owe $300,000 on your house and your interest rate is 3% per year. In that first year, youre going to pay $9,600 in interest . If, however, you made the principle payment early , then you dont owe the interest on that payment!

So, when you make one extra payment a year, youre essentially cutting out the interest of one payment per year.

With our example above, the full year interest is $9,600 over the course of 12 months. So, by cutting out one payment, youre essentially cutting out 1/12th of that $9,600 interest payment, or $800. Do that for 26 years and youll have four years worth of interest already paid for and youll therefore be done paying your mortgage four years early!

Do you have a higher interest rate than 3.2%? Your extra mortgage payment each year will have a greater impact.

Have a lower interest rate than 3.2%? Then your extra payment per year will have a lesser impact. If you can do it though, theres still a definite benefit!

Related: Pay Off the Mortgage Fast With This FREE Tool!

Recommended Reading: How Can I Legally Get Out Of My Mortgage

The Benefits Of Paying Sooner Rather Than Later

Mortgage amortization, which is the process used to determine how much of your payment goes toward principal and how much goes toward interest, is a complicated subject. To put it simply, mortgage payments tend to be interest-heavy at the beginning of your loan . Since less of your scheduled payment is going to principal, extra principal payments have a larger impact, and deliver greater savings, when theyre made early in your mortgage. Adding even a little extra to your payments can have a significant impact on the amount of interest that youll ultimately pay, the total cost of your loan, and the length of time it will take you to pay it off.

Read Also: Does Pre Approval For Mortgage Affect Credit

Not Asking If Theres A Prepayment Penalty

Mortgage lenders are in business to make money and one of the ways they do that is by charging you interest on your loan. When you prepay your mortgage, youre essentially costing the lender money. Thats why some lenders try to make up for lost profits by charging a prepayment penalty.

Prepayment penalties can be equal to a percentage of a mortgage loan amount or the equivalent of a certain number of monthly interest payments. If youre paying off your home loan well in advance, those fees can add up quickly. For example, a 3% prepayment penalty on a $250,000 mortgage would cost you $7,500.

In the process of trying to save money by paying off your mortgage early, you could actually lose money if you have to pay a hefty penalty.

You May Like: Why Is My Mortgage So High

Extra Dollars In Each Monthly Payment

Divide your monthly mortgage payment by 12, and then add that amount to each monthly payment.

For example, if your monthly mortgage payment is $1,200, that would be 1,200 divided by 12 months, which equals $100. Thats the extra money you would add to each monthly payment to chip away at your mortgage balance.

In this scenario, you would then increase the amount you send in for your mortgage payment to $1,300 a month . Be sure to confirm that the extra funds will be applied to your principal loan balance.

Before You Do Anything Check Your Mortgage Terms For Penalties Or Special Instructions

Some mortgages come with prepayment penalties. What that basically means is that if you try to make an extra annual payment, increase your monthly payments, or make a lump sum payment, you may have to pay a fee for paying your mortgage off faster.

Similarly, other mortgages allow prepayments, but they only allow them at specific times, such as the anniversary of the mortgage. The best thing to do is call your lender to ask how you can go about paying more aggressively without paying penalties.

Lastly, when you talk to your lender, ask if there are any specific instructions that you have to give along with your additional payments. Some lenders require that you explicitly state or write a note explaining that you want the payment applied to the principal.

Otherwise, your payment could be applied improperly, making your effort for naught. For example, say you sent an additional end-of-year payment. Some lenders might, without the note, simply apply the additional payment to the following month instead of doubling up.

Read Also: What House Mortgage Can I Afford