What Taxes Are Part Of My Monthly Mortgage Payment

The taxes portion of your mortgage payment refers to your property taxes. The amount you pay in property taxes is based on a percentage of your property value, which can change from year to year. The actual amount you pay depends on several factors including the assessed value of your home and local tax rates.

How Much Mortgage Can I Afford With My Salary

When a mortgage lender is deciding how much it will lend you , it considers your monthly income and, more important, how large a percentage of it you put toward debt payments. The percentage of your monthly pretax income used to pay debt is called debt-to-income ratio , and from a lenders standpoint, the lower your DTI ratio is, the better. The calculations can be somewhat complex, but many mortgage lenders decline to issue loans that raise the borrowers DTI ratio to more than 36% and under federal home-lending guidelines, a loan must not cause the borrowers DTI ratio to exceed 43%. This will give you a good idea of how much mortgage you can afford.

How To Calculate My Mortgage Interest

Interested in calculating just your mortgage interest? There’s a formula for that, too. Here’s a quick way to calculate one month of mortgage interest:

Monthly Interest Interest Rate 12 \begin & \text = \frac \times \text } \\ \end Monthly Interest=12Loan Balance×Interest Rate

For example, say you have a $150,000 loan balance with a 5% interest rate. Your interest payment for the month would be:

, or 12$7,500=$625.00

Remember that your balance changes each month after you make a mortgage payment. Be sure to use the new balance to calculate the next month’s interest.

The interest rate for fixed-rate mortgages remains the same for the entire loan term. With adjustable-rate mortgages , the interest rate changes periodically based on prevailing interest rates.

You May Like: How Long Can You Go Without Paying Mortgage Before Foreclosure

Increase Your Down Payment

The smaller the amount of your mortgage, the smaller your monthly payments. If youre able to put at least 20% of the home price towards yourdown payment, youll be able to avoid PMI. Even if you cant afford a complete 20% down payment, boosting your down payment will help you get PMI removed sooner. In fact, boosting your down payment by 5% can lower your monthly PMI fees.

Consider The Cost Of Homeowners Insurance

Almost every homeowner who takes out a mortgage will be required to pay homeowners insurance another cost that’s often baked into monthly mortgage payments made to the lender.

There are eight different types of homeowners insurance, so when you buy a policy, ask the company about which type of coverage is best for your situation. The insurance policies with a high deductible will typically have a lower monthly premium.

Don’t Miss: How To Pay Off Mortgage In 10 Years Calculator

Explanation Of Mortgage Terms

Mortgage terminology can be confusing and overly complicatedbut it doesnt have to be! Weve broken down some of the terms to help make them easier to understand.

Learn about

Home Price

Across the country, average home prices have been going up. Despite the rise in home prices, you can still find a perfect home thats within your budget! As you begin to house hunt, just make sure to consider the most important question: How much house can I afford? After all, you want your home to be a blessing, not a burden.

Learn about

Down Payment

The initial cash payment, usually represented as a percentage of the total purchase price, a home buyer makes when purchasing a home. For example, a 20% down payment on a $200,000 house is $40,000. A 20% down payment typically allows you to avoid private mortgage insurance . The higher your down payment, the less interest you pay over the life of your home loan. The best way to pay for a home is with a 100% down payment in cash! Not only does it set you up for building wealth, but it also streamlines the real estate process.

Learn about

Mortgage Types

15-Year Fixed-Rate Mortgage

30-Year Fixed-Rate Mortgage

5/1 Adjustable-Rate Mortgage

Learn about

Interest Rate

Learn about

Private Mortgage Insurance

Learn about

Homeowners Insurance

Learn about

Homeowners Association Fees

Learn about

Monthly Payment

Learn about

Property Taxes

Mortgage Calculator Uses

Determining How Much You Can Afford

Financial Leverage & Economic Risks

If you put 20% down on your home that investment is using 5x leverage. If you put 10% down that investment is using 10x leverage. The results of the above calculator can offer a rough idea of max loan qualification, however for most people it is better not to get close to the limit so they have a financial cushion in case of a layoff or a downturn in the broader economy.

When mortgage lenders evaluate your ability to afford a loan, they consider all the factors in the loan, such as the interest rate, private mortgage insurance and homeowner’s insurance. They also consider your own financial profile, including how the monthly mortgage payment will add to your overall debt and how much income you are expected to make while you are paying for the home.

Obtaining Investment Returns

Those who are seeking investment returns will usually obtain higher returns in the stock market & stock investments are much more liquid & easier to sell than homes. Over the longterm real estate generally appreciates only slightly better than the inflation rate across the broader economy. Since 1963 U.S. residential real estate has appreciated about 5.4% per year in the United States. Over the past 140 years U.S. stocks have returned 9.2%.

Recommended Reading: Is Rocket Mortgage The Same As Quicken Loans

Find Your Mortgage Principal

First, you need to find your mortgage principal. This is the initial amount of the loan. If you borrow $50,000, the mortgage principal is $50,000.

There are two types of mortgages you can pay with your principal investment. A fixed-rate mortgage allows you to pay the same thing every month, and there is consistency in your payments.

There are other types of payments that allow variation in monthly payments. However, a fixed mortgage tends to be the easiest.

How Do You Calculate Simple Interest

Simple interest is based on your mortgage principal, or the total amount of money borrowed, and can be calculated with this formula:

Simple interest = principal x interest rate x number of years

So, if you borrow $100,000 with a 15-year term and 3% interest rate, your calculation would look like this:

$45,000 = 100,000 x 0.03 x 15

This shows that youll pay $45,000 in interest while repaying this loan. Next, you can add the interest total with your principal to determine the total amount youll pay the lender, which comes to $145,000.

In real estate, simple interest isnt quite so simple. Your interest costs will be bundled with additional lender fees as an annual percentage rate . This includes administration costs, origination fees and more. Calculating the APR costs youll owe each month with your mortgage payment requires a different formula:

Luckily, you dont have to do this math yourself. Your lender is required to show you your loans APR, including all fees, scheduled payments and the total cost of your loan.

You May Like: What Is The Highest Interest Rate On Mortgage

Are Mortgage Points Right For You

Buying mortgage points is a way to pay upfront to lower the overall cost of your loan and reduce its monthly payment. It makes the most sense if you plan to be in the home for a long period of time. The amount youll save each month is likely to make the upfront cost worth it.

Of course, if you dont plan to stay in a home for a long time, paying points is likely to lose you money overall.

Another consideration is whether you should put money toward points or a larger down payment. A larger down payment can often help you secure a lower interest rate anyway. Additionally, hitting the 20% down payment mark can also let you avoid the additional cost of PMI.

A bigger down payment can get you a better interest rate because it lowers your loan-to-value ratio, or LTV, which is the size of your mortgage compared with the value of the home.

Borrowers should consider all the factors that could determine how long they plan to stay in the home, such as the size and location of the property and their job situation, then figure out how long it would take them to break even before buying mortgage points.

How Does Your Debt

Lenders will also look at your debt-to-income ratio, or DTI, to get a clear picture of how risky it is to loan you money. Simply put, the higher your debt-to-income ratio, the more the lender will doubt your ability to pay the loan back.

Lenders have maximum DTIs in place that could stand in the way of getting approved for a mortgage. On conventional loans, for example, lenders usually like to see debt-to-income ratios under 43 percent, although in some cases, 50 percent is the cutoff. If you want to shrink your debt-to-income ratio before applying for a mortgage which is a good idea pay off your credit cards and other recurring debts like student loans and car payments.

Here’s how to figure out your DTI:

Add up your total monthly debt and divide it by your gross monthly income, which is how much you brought home before taxes and deductions. Heres an example:

- Add up your monthly debt: $1,200 + $200 + $150 + $85 = $1,635 total

- Now, divide your debt by your gross monthly income : 1,635 ÷ 4,000 = .40875. By rounding up, your DTI is 41 percent.

- If you get rid of the $85 monthly credit card payment, for example, your DTI would drop to 39 percent.

Read Also: Can You Switch Mortgage Companies Before Closing

Determine Your Mortgage Principal

The initial loan amount is referred to as the mortgage principal.

For example, someone with $100,000 cash can make a 20% down payment on a $500,000 home, but will need to borrow $400,000 from the bank to complete the purchase. The mortgage principal is $400,000.

If you have a fixed-rate mortgage, you’ll pay the same amount each month. With each monthly mortgage payment, more money will go toward your principal, and less will go toward paying interest.

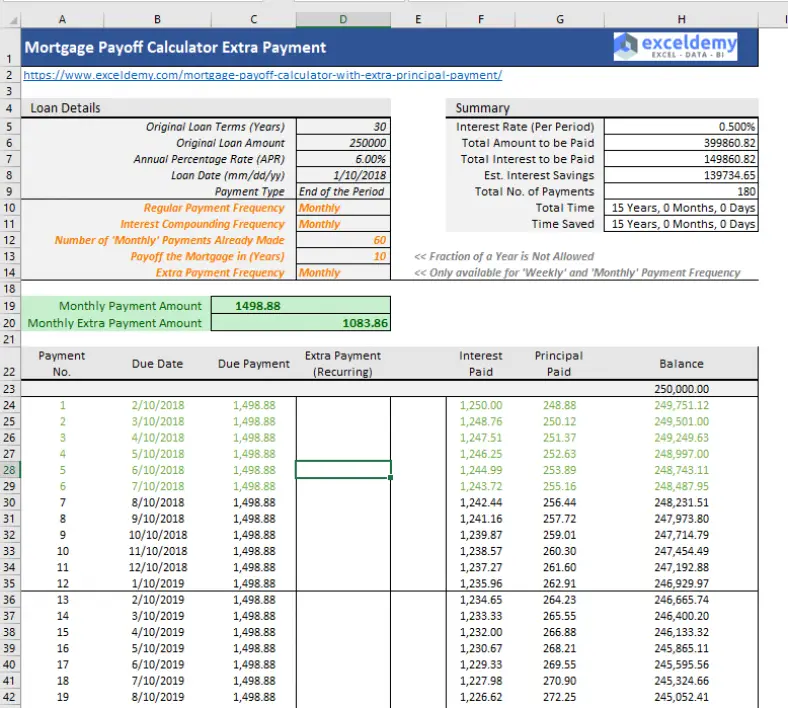

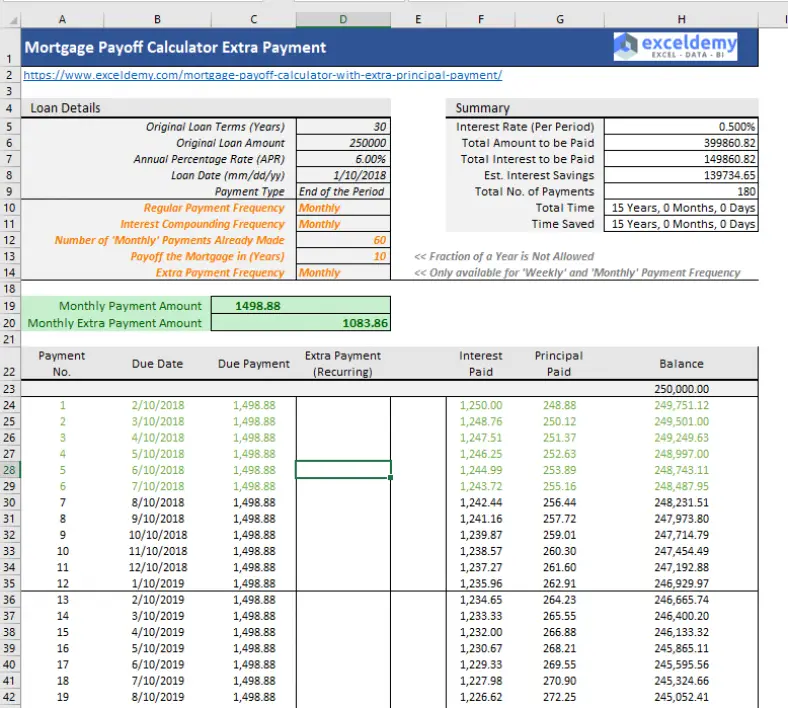

Cut Your Loan Costs By Prepaying Principal

This PITI calculator offers another feature that can help you cut your loan costs. See how adding additional principal payments can shorten the life of the loan by years. Determine if you could add to your payment on a monthly or yearly basis, or even just one time. Hit “view results” to see a side-by-side comparison of your regular payment schedule versus the prepayment payment schedule.

This mortgage calculator with taxes and insurance will show you just how much you’ll be paying in interest for the life of the loan under both scenarios, as well as how much you can save by making extra principal payments along the way.

Learn more about specific loan type rates| LOAN TYPE |

|---|

Recommended Reading: Can You Sell A House With A Reverse Mortgage

Whats Included In My Mortgage Payment

A typical monthly mortgage payment has four parts: principal, interest, taxes and insurance. These are commonly referred to as PITI.

The mortgage payment estimate youll get from this calculator includes principal and interest. If you choose, well also show you estimated property taxes and homeowners insurance costs as part of your monthly payment.

This calculator doesnt include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose.

What Is A Jumbo Loan

A jumbo loan is used when the mortgage exceeds the limit for Fannie Mae and Freddie Mac, the government-sponsored enterprises that buy loans from banks. Jumbo loans can be beneficial for buyers looking to finance luxury homes or homes in areas with higher median sale prices. However, interest rates on jumbo loans are much higher because lenders don’t have the assurance that Fannie or Freddie will guarantee the purchase of the loans.

You May Like: What Does Paying Points On A Mortgage Mean

Homes Not In Designated High

The limits in the first row apply to all areas of Alabama, Arizona, Arkansas, Delaware, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Rhode Island, South Carolina, South Dakota, Texas, Vermont, Wisconsin & most other parts of the continental United States. Some coastal states are homes to metro areas with higher property prices which qualify the county they are in as a HERA designated high-cost areas.

The limits in the third row apply to Alaska, Guam, Virgin Islands, Washington D.C & Hawaii.

| Units |

|---|

Determine What You Can Afford

Simply accepting the amount that the lender says you can pay is a recipe for stress and potential disaster. If youre living paycheck to paycheck, as millions of Americans are, then give yourself some wiggle room in your monthly payment amount.

Set up an automatic savings draft of the difference in payments to go directly to your emergency fund. Once your emergency fund is filled, set it to go to your retirement account. Doing this will help you weather financial storms such as a job loss, a major home repair, or an unexpected health expense.

If youre a two-income household, then qualifying for the mortgage off one income can give you significant financial freedom if one of you needs to take time off from a job. Make sure that your monthly mortgage payment is something that you can easily afford and isnt a budget stretch that you would struggle to come up with after meeting an unexpected expense.

You May Like: How Do You Refinance A Reverse Mortgage

Fixed Rate Vs Adjustable Rate

A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment.

How To Determine How Much House You Can Afford

Your housing budget will be determined partly by the terms of your mortgage, so in addition to doing an accurate calculation of your existing expenses, it’s important to get an accurate picture of your loan terms and shop around to different lenders to find the best offer. Lenders tend to give the lowest rates to borrowers with the highest credit scores, lowest debt and substantial down payments.

Recommended Reading: How Much Should Your Monthly Mortgage Be

Interest: The Difference 15 Years Can Make

The longer the term of your loan say 30 years instead of 15 the lower your monthly payment but the more interest youll pay.

Say youve decided to buy a home thats appraised at $500,000, so you take out a $400,000 loan with an interest rate of 3.5%. First, lets take a look at a 30-year loan. For quick reference, again, the formula is: M = P /

Our P, or principal, is $400,000.

Remember, with i, we must take the annual interest rate given to us 3.5%, or 0.035 and divide by 12, the number of months in a year. This calculation leaves us with 0.002917, or i.

Our n, again, is the number of payments. And with one payment every month for 30 years, we multiply 30 by 12 to find n = 360.

When alls said and done, for a 30-year loan at 3.5% interest, well pay $1,796.18 each month.

For a 15-year loan, the math is nearly identical. All thats different is the value of n. Our loan is half the length, and so the value for n is 180. Each month well pay $2,859.53, over 60% more than with the 30-year loan.

Over the length of the loan, though, the 15-year loan is a far better deal, considering the interest you pay $514,715 in total. With the 30-year, you pay $646,624 total over $100,000 more.

Your decision between these two, quite simply, hinges on whether or not you can float the significantly higher monthly payments for a 15-year loan.

A little math can go a long way in providing a how much house can I afford? reality check.

What Credit Score Do I Need To Buy A House

Credit scores do not factor into the mortgage calculator directly, but they have a major influence on the interest rate charged on your loan. are designed to predict your likelihood of defaulting on a loan, or going 90 days without making a payment. People with lower credit scores are statistically more likely to default than those with higher credit scores. A widespread lending industry practice known as risk-based pricing typically assigns higher interest rates to loan applicants with lower credit scores and reserves the lowest rates for applicants with high credit scores.

Lenders make their own determinations, based on prevailing interest rates and their own lending strategies, when deciding which credit scores ranges they will assign which interest rates. Because each lenders approach is different, its prudent to apply to multiple lenders when seeking a mortgage, because some may offer you a lower interest rate than others.

You May Like: What Does A Mortgage Payment Consist Of