Which Program Should I Choose

There are a couple of different HECM programs to choose from, including fixed rate and adjustable lump sum distributions and monthly payments or lines of credits from which the borrower can draw as needed/desired. What is right or best is what is right or best for the borrowers individual circumstances.

The fixed rate loan seems attractive to many borrowers but there are several downfalls borrowers must consider.

Namely, fixed rates require a full draw of all sums available. If you do not need all the money to pay off existing liens, HUD requirements on their program only allow a portion of the line to be accessed in the first 12 months and on a fixed rate loan with no subsequent draws available, any amount not available in the initial draw is lost to the borrower.

Also, since fixed rates are often higher than the adjustable rates and since interest rates are one of the determining factors as to how much money a borrower will receive, adjustable rate borrowers most often receive higher benefits in todays interest rate environment.

Finally, the adjustable program gives borrowers more options as to how they will receive their funds . Borrowers who choose an adjustable rate loan have several options of how to receive their loan proceeds, including a line of credit, monthly payments, or even a lump sum.

For Reverse Mortgage Loans With Case Numbers Assigned On Or After August 4 2014

Your lender or servicer will determine if your non-borrowing spouse qualifies to stay in the home after you, the borrower, die or move into a healthcare facility for more than 12 consecutive months . To qualify as an Eligible Non-Borrowing Spouse, your spouse must:

- Have been married to you at the time the loan documents were signed, and stay married to you up until your death. If you and your spouse were a same-sex couple and were unable to

- be legally married at the time the reverse mortgage loan was made, your spouse must show that you were legally married to each other at the time of your death.

- Have been identified in the loan documents as a non-borrowing spouse.

- Have lived, and continue to live, in the home as their principal residence after you die or move into a healthcare facility for more than 12 consecutive months.

- Continue to meet the loan requirements and make sure the loan does not become due and payable for any other reason.

Question Should I Go To A Direct Lender Or Broker For This Program

Answer There are only a few investors that offer this program. In fact, there are only 4 investors that offer this program at the moment . Any lender or broker that offers reverse mortgages can do them.

That said, there are a few distinct advantages of working with a mortgage broker.

First, brokers can align themselves with multiple lenders or investors. Hence, youâre not bound to the guidelines of just one lender like you would be if you worked directly with a lender.

Secondly, brokers shop for you. Due to that, brokers tend to offer more competitive pricing, rates, etc. A third item to consider is that often times brokers can get your loan done more quickly.

Recommended Reading: What Fees Are Involved In Refinancing A Mortgage

What Happens To My Reverse Mortgage When I Die

Reverse mortgage loans typically must be repaid when you die.

What happens to the reverse mortgage will depend on several factors, including:

- Whether you have a co-borrower on the reverse mortgage loan,

- When you took out the reverse mortgage, and

- Whether you were married when the loan documents were signed and continued to be married up until your death.

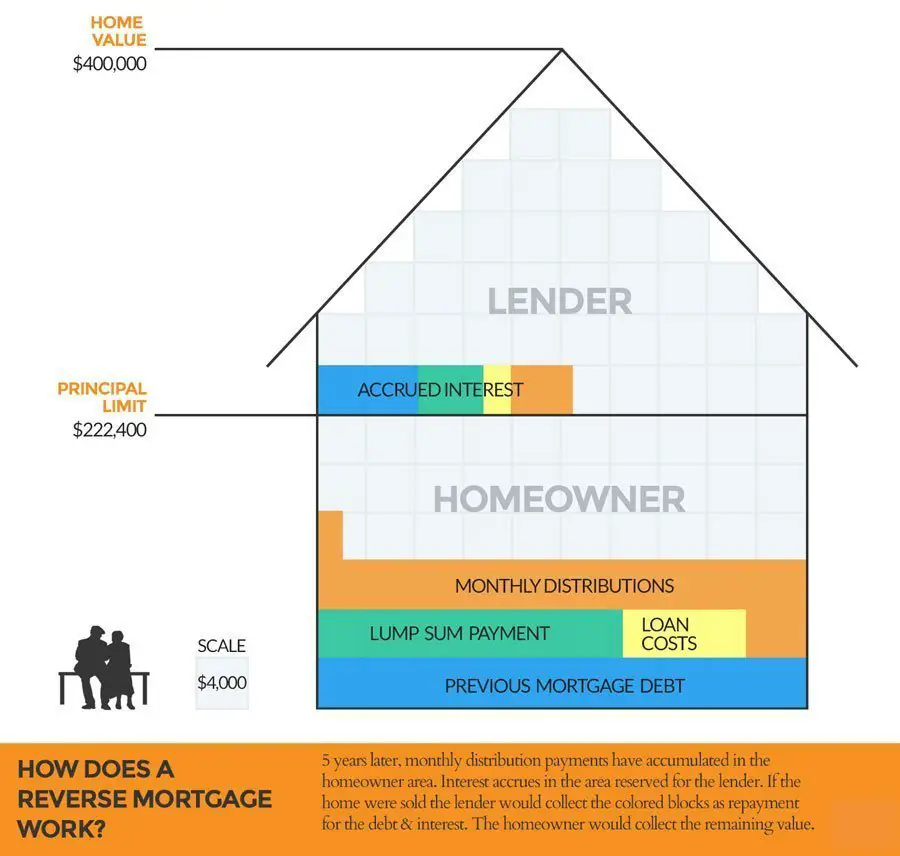

How Does It Work

With a reverse mortgage, you don’t need to make regular repayments.Interest is calculated on the outstanding balance and added monthly to your loan.Voluntary repayments can be made at any time, which reduces the balanceand interest charged.

The total loan amount, including accumulated interest,is repayable when you move permanently from your home.This could occur when you sell your property, move intolong-term care or pass away.

To be eligible, you need to be over the age of 60,own your own home outright, or have a standard mortgagethat can be paid off by the reverse mortgage.The amount you can access depends on your age and the value of your home.

Learn more in our Reverse Mortgage Fact Sheet

Secondary Property Loan

You can also take a reverse mortgage against a secondary propertysuch as an investment property or holiday home.A Secondary Property Loan provides you the same benefitsof a reverse mortgage on your primary home.

Streamline Application

If youre looking to release less than $100,000 equityfrom your home, our Reverse Mortgage – Streamline Applicationmay be right for you. It has all the protections of our regularReverse Mortgage with a few added benefits including:

- no registered valuation required

You continue to own and live in your home for as long as you choose.

Recommended Reading: How Does The Fed Rate Affect Mortgage Rates

Home Equity Conversion Mortgage

A Home Equity Conversion Mortgage is a federally backed loan thats regulated by the Federal Housing Administration and the U.S. Department of Housing and Urban Development . They’re only available through HUD-approved lenders.

HECMs offer a number of payment options:

- A single lump-sum payment: You receive one large payment upfront after closing. This option is only available on fixed-rate reverse mortgages.

- Monthly payments: You receive a monthly payment for a specific number of months or for as long as the house is your primary residence .

- A line of credit: You can withdraw funds as you need them. Meanwhile, the unused principal balance grows over time based on your interest rate. For example, assuming you get a $200,000 line of credit with a 4% interest rate, if you don’t use any of that money, the principal loan amount would go up to roughly $300,000 over the next 10 years. While this does mean you owe more money than you did at the start, you also have access to a larger line of credit in the long run. This means that you can potentially receive a larger amount of funds than originally requested over the life of the loan.

- A combination of the above: You can also choose to combine monthly term or tenure payments with a line of credit. You cant combine the lump sum with any other payment option, though.

What to know about HECMs

HECMs are insured by the FHA and are non-recourse loans, which means you’ll never owe more than what your house sells for .

Reverse Mortgage At Age 55

Most people think that the point of entry for a reverse mortgage is age 62. For years, that was true. However, in 2018 a program was introduced that lowered the reverse mortgage minimum age to those that are aged 60 plus. Then a a few options became available earlier in 2021 that lower the reverse mortgage minimum age to 58. Now, as of September 2021, there is a new program that allows you to do a reverse mortgage at age 55 and up. The good news is, this program isnât as conservative as the reverse mortgage for 60 year olds that came out in 2018.

Don’t Miss: How Hard To Get A Mortgage

Getting Started With Reverse Mortgages

If youre looking to get started with a reverse mortgage, these articles can help guide you through all aspects of the process.

Reverse Mortgage Taxes Reverse Mortgages and Heirs

Proprietary reverse mortgages are administered through individual lending companies, so they can determine for themselves what their policies and rates are. And, depending on the company, some lenders might allow borrowers younger than the 62 year old HECM limit.

If you think a proprietary reverse mortgage might work best for your financial situation, consider speaking with a GoodLife Reverse Mortgage Specialist, who will be happy to walk you through the process and your eligibility.

What Are The Types Of Reverse Mortgages

There are different types of reverse mortgages, and each one fits a different financial need.

- Home Equity Conversion Mortgage The most popular type of reverse mortgage, these federally-insured mortgages usually have higher upfront costs, but the funds can be used for any purpose. In addition, you can choose how the money is withdrawn, such as fixed monthly payments or a line of credit . Although widely available, HECMs are only offered by Federal Housing Administration -approved lenders, and before closing, all borrowers must receive HUD-approved counseling.

- Proprietary reverse mortgage This is a private loan not backed by the government. You can typically receive a larger loan advance from this type of reverse mortgage, especially if you have a higher-valued home.

- Single-purpose reverse mortgage This mortgage is not as common as the other two, and is usually offered by nonprofit organizations and state and local government agencies. A single-purpose mortgage is generally the least expensive of the three options however, borrowers can only use the loan to cover one specific purpose, such as a handicap accessible remodel, explains Jackie Boies, a senior director of housing and bankruptcy services for Money Management International, a nonprofit debt counselor based in Sugar Land, Texas.

Recommended Reading: How Much Are House Mortgages

How Much Does A Reverse Mortgage Cost

The closing costs for a reverse mortgage arent cheap, but the majority of HECM mortgages allow homeowners to roll the costs into the loan so you dont have to shell out the money upfront. Doing this, however, reduces the amount of funds available to you through the loan.

Heres a breakdown of HECM fees and charges, according to HUD:

- Mortgage insurance premiums There is a 2 percent initial MIP at closing, as well as an annual MIP equal to 0.5 percent of the outstanding loan balance. The MIP can be financed into the loan.

- Origination fee To process your HECM loan, lenders charge the greater of $2,500 or 2 percent of the first $200,000 of your homes value, plus 1 percent of the amount over $200,000. The fee is capped at $6,000.

- Servicing fees Lenders can charge a monthly fee to maintain and monitor your HECM for the life of the loan. Monthly servicing fees cannot exceed $30 for loans with a fixed rate or an annually adjusting rate, or $35 if the rate adjusts monthly.

- Third-party fees Third parties may charge their own fees, as well, such as for the appraisal and home inspection, a credit check, title search and title insurance, or a recording fee.

Keep in mind that the interest rate for reverse mortgages tends to be higher, which can also add to your costs. Rates can vary depending on the lender, your credit score and other factors.

Can Anyone Take Out A Reverse Mortgage Loan

No. Home Equity Conversion Mortgages , the most common type of reverse mortgage loan, are a special type of home loan available to homeowners who are 62 and older.

Aside from age, other reverse mortgage requirements include:

- Your home must be your principal residence, meaning you live there the majority of the year.

- You must either own your home outright or have a low mortgage balance. Owning your home outright means you do not have a mortgage on it anymore. If you have a mortgage balance, you must be able to pay it off when you close on the reverse mortgage. You can use your own funds or money from the reverse mortgage to pay off your existing mortgage balance.

- You cannot owe any federal debt, such as federal income taxes or federal student loans. You may, however, use money from the reverse mortgage loan to pay off this debt.

- You must have enough of your own money or agree to set aside part of the reverse mortgage funds at your loan closing to pay ongoing property charges, including taxes and insurance, as well as maintenance and repair costs.

- Your home must be in good shape. If your house does not meet the required property standards, the lender will tell you what repairs need to be made before you can get a reverse mortgage loan.

- You must receive counseling from a HUD-approved reverse mortgage counseling agency to discuss your eligibility, the financial implications of the loan, and other alternatives.

Don’t Miss: Can I Refinance My Mortgage After 3 Months

Reverse Mortgage Loan Requirements

- To apply for a reverse mortgage loan you must be at least 55 years or older. It is designed to help seniors thus the loan is available to you in retirement age.

- Your home must be your primary residence.

- You need to attend a counseling session with the Department of Housing and Urban Development . It will provide you with a list of third-party agencies that will make you aware of the pros and cons of a reverse mortgage.

- You must have enough money so that you are able to pay property taxes, insurance, and home maintenance expenses.

Tips To Protect Yourself

- Consult with an independent financial adviser to find out what reverse mortgage package best suits your financial situation and needs.

- If you do not have a financial advisor, discuss your situation with a counselor approved by the US Department of Housing & Urban Development HUD-approved counseling agencies are available to assist you with your reverse mortgage questions. You can call 800-569-4287 to find a counselor in your area.

- Make sure you understand all the costs and fees associated with the reverse mortgage.

- Find out whether the reverse mortgage you are considering is federally-insured. This will protect you when the loan comes due.

- Find out whether your repayment obligation is limited to the value of your home at the time the loan becomes due.

- Make sure any reverse mortgage payments are first made directly to you do not allow anyone to persuade you to sign over the funds to someone else.

- Be wary of anyone who tries to pressure you into a decision that you are not completely comfortable with, such as investing the payments from your reverse mortgage into an annuity, insurance policy, or other investment product, or pressuring you into receiving a lump-sum payment over monthly payments.

- If you are uncomfortable with the reverse mortgage that you entered into, exercise your right of rescission within three days of the closing. A right of rescission allows you to cancel the mortgage within three days of closing without penalty.

You May Like: What Is The Average Cost Of A Mortgage Refinance

How Do You Pay Back A Reverse Mortgage

A reverse mortgage can be paid back in one of two ways. The home can be sold and the proceeds used to pay off the loan . You can also voluntarily pay down the balance of the loan while you’re still alive, or your heirs can pay it off if they want to keep the home.

Want to read more content like this? for The Balances newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Shopping For A Reverse Mortgage

If youre considering a reverse mortgage, shop around. Decide which type of reverse mortgage might be right for you. That might depend on what you want to do with the money. Compare the options, terms, and fees from various lenders. Learn as much as you can about reverse mortgages before you talk to a counselor or lender. And ask lots of questions to make sure a reverse mortgage could work for you and that youre getting the right kind for you.

Here are some things to consider:

You May Like: What Are 30 Year Mortgage Rates

For Reverse Mortgage Loans With Case Numbers Assigned Before August 4 2014

As explained in more detail below, after you, the borrower, die or move into a healthcare facility for more than more than 12 consecutive months, your lender or servicer can choose to either:

- Foreclose on the home, or

- Enter a process called Mortgage Optional Election Assignment that allows an Eligible Non-Borrowing Spouse to stay in the home.

First Lets Review The Reverse Mortgage Basics:

A reverse mortgage loan is a type of loan that is insured by FHA and it allows older homeowners to access a portion of the equity in their home. One of the benefits of reverse mortgages is that there is no monthly payment due to the bank for as long as you live. However, if you move out permanently, the loan will be called due . That being said, since you still own the home you are obligated to pay and maintain your property taxes on time. Also, just like with any home loan, you are required to have homeowner insurance for the duration of the loan.

You May Like: What Do I Need To Become A Mortgage Broker

A Word Of Warning About Reverse Mortgage Scams

Unfortunately, seniors need to beware of the many bad actors in the reverse mortgage space. The Federal Trade Commission regulates reverse mortgage scams and warns consumers against working with anyone who urges homeowners to invest the proceeds of the reverse mortgage with them.

If you suspect a scam while applying for a HECM, let your counselor, lender or loan servicer know. Then, file a complaint with the FTC, your state Attorney Generals office or your states banking regulatory agency.

The FBI also investigates reverse mortgage scams. They accept tips about unscrupulous activity.

What Is A Reverse Mortgage And How Does It Work

19 min read

https://money.com/what-is-a-reverse-mortgage/

A reverse mortgage is a type of home loan for older homeowners. Unlike traditional mortgages, they dont require homeowners to make monthly payments. Instead, the borrower receives payment from the lender either monthly, via a line of credit or in a single lump sum at closing.

These loans are typically reserved for borrowers 62 and up . Homeowners often use them to reduce their monthly housing costs or increase their income in retirement.

Keep reading to learn more about reverse mortgages, how they work and whether one might be right for your financial goals.

Recommended Reading: Can You Write Off Mortgage Payments