How Much Of A Mortgage Am I Qualified For

Youll need to apply for mortgage preapproval to get an estimated loan amount you could qualify for. Lenders use the preapproval process to review your overall financial picture including your assets, credit history, debt and income to calculate how much theyd be willing to lend you for a mortgage.

You can use the loan amount printed on your preapproval letter as a guide for your house hunting journey. But, be careful not to stretch your budget too thin and borrow to the maximum your preapproval amount doesnt factor in recurring bills that arent regularly reported to the credit bureaus, such as gas, cellphones and other utilities, so youll need to retain enough disposable income to comfortably cover these monthly bills, plus your new mortgage payment.

Mortgage Rate Sheets Are Printed Monday Through Friday

- New lender rate sheets are released daily throughout the week

- Monday through Friday unless its a holiday

- Sometimes interest rates will be different, sometimes theyll remain unchanged

- Depending on what transpired the day before or the morning of

Each morning, Monday through Friday, banks and their loan officers get a fresh mortgage rate sheet that contains the pricing for that day.

I know because when I first started in the industry, I got tasked with handing them out to fellow employees .

Ill never forget kicking the printer every time it broke, which as far as I can remember was also Monday through Friday.

Anyway, these rate sheets contain the days current mortgage rates, which are critical to anyone working in the biz.

Without them, loan officers cant provide quotes to borrowers unless theyre using some sort of computer system, which some of the big retail banks probably rely upon.

All loan programs offered by a given bank will be featured, including fixed rates like the 30-year fixed, 20-year fixed, and 15-year fixed, along with other loan types offered such as adjustable-rate mortgages.

Expect fixed mortgages to move more than ARMs on a daily basis, seeing that ARMs come with short-term promo rates that adjust over time, whereas mortgage bankers are taking a bigger risk by offering a rate that will never change.

There will also be a section for jumbo loans, FHA loans, VA loans, and other government loans offered such as an FHA streamline.

If Mortgage Rates Increase/decrease After I Get Approval Will The Lender Adjust My Mortgage Rate

Yes, but only if you dont lock in your mortgage rate. Locking in your mortgage protects you from rate fluctuations. Some lenders allow for a one-time “float down” that enables you to capitalize on lower rates, but you might have to pay extra. Skipping the rate lock is a gamble. You might benefit from lower interest rates or have to pay more in monthly payments if the rates rise.

Also Check: How To Apply For A 2nd Mortgage

How Do Your Credit Scores Affect Your Rate

Your credit scores influence your mortgage interest rate. Lenders call it risk-based pricing. Higher credit scores indicate a lower risk that youll default on a loan so you get a better interest rate. The lower your credit scores, the higher your interest rate.

» MORE:Mortgage rates and credit scores: Dont make a $30,000 mistake

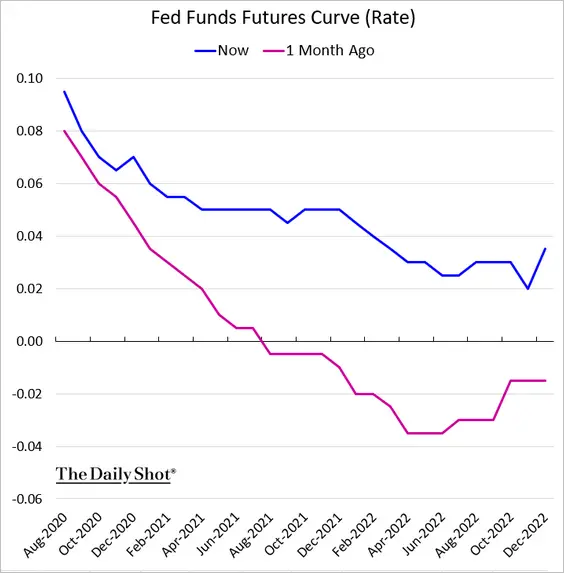

What Role Does The Federal Reserve Play

The Federal Reserve plays a significant role in determining your mortgage rate. While the Fed doesnt set mortgage rates directly, it does set the federal funds rate. The Fed meets eight times a year, and mortgage rates change both in anticipation of what the Fed will do and in reaction to what the Fed actually does.

The Fed has started raising rates, with the most recent rate hike occurring in 2022, and more expected this year. This rate increase has already had an impact, with mortgage rates climbing. Suspected future rate increases are expected to continue to cause mortgage rates to rise.

You May Like: Where To Find Mortgage Note

How Often Do Interest Rates Change

Mortgage rates can change daily, sometimes multiple times a day. Theyre difficult to predict, though theyre often influenced by economic changes, world events, and the Federal Reserve . While the Federal Reserve does not set the specific interest rates in the mortgage market, its actions in establishing the Fed Funds rate significantly influence them.

The bottom line: bad news and uncertainty are generally good for mortgage interest rates. Investors tend to flock to bonds in bad times, and more demand pushes interest rates lower.

What Is The Best Mortgage Loan Type

The best mortgage is the one that helps you meet your housing needs for as little financing costs as possible. There are a few factors to consider when it comes to getting the right mortgage.

Some experts recommend getting a 15-year mortgage because youll pay far less interest and be debt-free in half the time compared to a 30-year loan. With a 30-year loan, your monthly payments can be significantly lower, but youll pay much more in interest over the loans life. So its a tradeoff.

There are also tradeoffs in choosing a government-backed versus a conventional loan. For example, FHA mortgages can have lower requirements than conventional loans. But unlike conventional loans, FHA loans require mortgage insurance even if your loan-to-value ratio drops below 80%.

If you want a set interest rate for the life of the loan and more stable monthly payments, then a fixed-rate mortgage is ideal. The interest rate on a fixed-rate mortgage never changes.

Regardless of what loan type you go with, remember, its not the loan you have to keep forever. Even if you stay in the same home for the rest of your life, you can refinance your mortgage to take advantage of better terms or rates.

You May Like: What Information Is Required For Mortgage Pre Approval

Current Mortgage Rates: Compare Today’s Rates

Here’s how you can secure the best possible mortgage rate in 2022.

Alix Langone

Reporter

Alix is a staff writer for CNET Money where she focuses on real estate, housing and the mortgage industry. She previously reported on retirement and investing for Money.com and was a staff writer at Time magazine. She has written for various publications, such as Fortune, InStyle and Travel + Leisure, and she also worked in social media and digital production at NBC Nightly News with Lester Holt and NY1. She graduated from the Craig Newmark Graduate School of Journalism at CUNY and Villanova University. When not checking Twitter, Alix likes to hike, play tennis and watch her neighbors’ dogs. Now based out of Los Angeles, Alix doesn’t miss the New York City subway one bit.

Mortgage rates are leveling off after climbing steadily since the beginning of the year. Although rates reached historic lows during the COVID-19 pandemic, they quickly reached their highest levels since 2008 earlier this year. Interest rates have been increasing in response to surging inflation, which is at its highest point in four decades, as well as the Federal Reserve raising rates multiple times for the first time since 2018. The Fed raised interest rates by 0.75 percentage points for the second time in July, one of the largest rate hikes since 1994.

Here’s everything you need to know about mortgage rates and how they work.

How Is My Mortgage Interest Rate Determined

Lenders determine your mortgage interest rate based on the type of loan you take out, your credit score, and the overall loan amount, as well as your down payment amount and the length of the loan.

- Loan Type: Government-backed loans are handled differently than conventional loans.

- : People with high credit scores generally receive lower interest rates. Although those with lower credit scores may still qualify, their mortgage terms may not be as favorable.

- Loan Amount: Your mortgage rate will be influenced by the total amount of money you need to borrow. Higher amounts tend to suggest higher interest rates.

- Down Payment Amount: A higher down payment can significantly lower your interest rate.

- Length of Loan: Long-term loans tend to bring lower monthly payments with higher interest rates, while short-term loans bring higher monthly payments and lower interest rates.

Recommended Reading: How Can I Avoid Paying Pmi On My Mortgage

Should I Get An Adjustable Rate Mortgage Or A Fixed Rate Loan

While fixed rate loans have interest rates that stay the same over the life of the loan, an adjustable rate mortgage fluctuates depending on the market, but usually has a cap limiting fluctuation.

While both offer advantages, your circumstances can determine which might be right for you.

An adjustable rate mortgage:

- Can be a popular option for new homeowners as they offergreat upfront savings.

- Have an initial fixed interest period.

- Cap how much a loan can adjust so borrowers can try to plan accordingly.

Consider an ARM if you expect to make more money in the future, plan to move early in the life of your loan,or refinance before your loan adjusts.

There are many types of fixed-interest rate mortgages, including 30-Year and 15-Year mortgages. They offer a clear view of the future, as borrowers are able to more accurately account for costs over the life of the loan. For those who want greater stability when planning their monthly costs, fixed-interest mortgages are popular.

What Is Affecting Mortgage Rates Right Now

Experts predict fairly stable mortgage rates in September as we wait to see which direction the economy will take. The U.S. Gross Domestic Product has contracted for two quarters in a row, which is a classic marker of recession. But the National Bureau of Economic Research, a private nonprofit agency, also considers other factors before it .

There have been mixed signals, says George Ratiu, senior economist and manager of economic research for Realtor.com. Consumers keep spending. The employment market is still solid, with unemployment at 3.5%. The weekly jobless claims data has been steady at pre-pandemic levels. So by most recent measures, our economy, despite concerns of a recession, remains resilient. That would keep upward pressure on mortgage rates.

On the other hand, Ratiu says, the Federal Reserve is still committed to lowering inflation, which was at 8.5% in Julydown from 9.1% the month before.

As we head into a traditionally slightly slower season, the fall, I do expect the Feds monetary tightening to exert a downward pressure on mortgage rates, Ratiu says.

That push-and-pull effect will likely stabilize mortgage rates in September.

Read Also: How Difficult Is It To Refinance A Mortgage

When Can I Lock In A Mortgage Interest Rate

You can choose to lock in your mortgage rate from the moment you select a mortgage, up to five days before closing. Locking in early can help you get what you were budgeting for from the start. As long as you close before your rate lock expires, any increase in rates won’t affect you.

The ideal time to lock your mortgage rate is when interest rates are at their lowest, but this is hard to predict even for the experts.

It’s worth noting that interest rates could decrease during your lock period. Should this happen, you’ll most likely have to pay the rate you initially locked in. If your lock period has lapsed before the closing, you may be able to negotiate with your lender for a new rate lock, but it’ll depend on the circumstances and the lender.

Check Out Daily Mortgage Rates On Lender Websites

- If you dont have access to lender rate sheets

- Visit lender websites to access their daily mortgage rates

- Keep track of them over time and make note of any changes

- To determine their direction or any obvious trends

If youre a consumer without access to mortgage lenders rate sheets, you can check their websites for purchase and refinance rates, though these arent nearly as reliable, and are typically just advertised rates with lots of assumptions.

While probably closer to national averages, you can at least glean some information, like mortgage rate trends if you see that theyre rising or falling over time.

Prospective home buyers may want to bookmark some mortgage lenders pages that feature todays mortgage rates to chronicle them over time and stay in the know.

Youll be able to get a better idea of monthly payments and hone in on the rent vs buy question.

Anyway, to answer the initial question, yes, mortgage rates can change daily, but only during the five-day workweek.

Mortgage rates do not change during the weekend, though pricing can definitely change between Friday and Monday depending on what happens on Monday morning.

In other words, pricing you receive on Friday could certainly differ from the pricing you receive on Monday morning depending on what transpires between then.

This is similar to the stock market or any other financial market for that matter. Its constantly in flux and as such, things change, a lot.

Also Check: How To Calculate Your Monthly Mortgage Payment By Hand

How Are Mortgage Rates Determined

Mortgage rates are set by the lender. The lender will consider a number of factors in determining a borrower’s mortgage rate, such as the borrower’s credit history, down payment amount or the home’s value. Inflation, job growth and other economic factors outside the borrower’s control that can increase risk also play a part in how the lender sets their rates. There is no exact formula, which is why mortgage rates typically vary from lender to lender.

Why And How Often Do Mortgage Rates Change

Mortgage rates are in constant flux, changing all the time every day. Each morning, Monday through Friday, banks and other lenders receive mortgage rate sheets that stipulate that days interest rates. These rate sheets are released daily, Monday through Friday, except on holidays.

So, why do mortgage rates fluctuate so much? A lot of factors impact mortgage rates same as with stocks.

Recommended Reading: Can I Get A 30 Year Mortgage

Summary Of Current Mortgage Rates

Mortgage rates were higher this week

- The current rate for a 30-year fixed-rate mortgage is 5.89% with 0.7 points paid, an increase of 0.23 percentage points from a week ago. This week last year, the 30-year rate averaged 2.88%.

- The current rate for a 15-year fixed-rate mortgage is 5.16% with 0.8 points paid, 0.18 percentage points higher week-over-week. The 15-year rate averaged 2.19% a year ago this week.

- The current rate on a 5/1 adjustable-rate mortgage is 4.64% with 0.4 points paid, up by 0.13 percentage points from a week ago. The average rate on a 5/1 ARM was 2.42% this week a year ago.

Qualifying For A 30 Year Fixed Mortgage

Those applying for a 30 year or 15 year fixed mortgage will first be required to be preapproved.

Why you should have a credit preapproval:

Read Also: Should I Take Out A Mortgage At Age 60

How Your Credit Score Affects Your Mortgage Rate

You dont need a high credit score to qualify for a home purchase or refinance, but your .

This is because credit history determines risk level.

Historically speaking, borrowers with higher credit scores are less likely to default on their mortgages, so they qualify for lower rates.

For the best rate, aim for a credit score of 720 or higher.

Mortgage programs that dont require a high score include:

- Conventional home loans minimum 620 credit score

- FHA loans minimum 500 credit score or 580

- VA loans no minimum credit score, but 620 is common

- USDA loans minimum 640 credit score

Ideally, you want to check your credit report and score at least 6 months before applying for a mortgage. This gives you time to sort out any errors and make sure your score is as high as possible.

If youre ready to apply now, its still worth checking so you have a good idea of what loan programs you might qualify for and how your score will affect your rate.

You can get your credit report from AnnualCreditReport.com and your score from MyFico.com.

What Things May Affect My Interest Rate

We consider a variety of factors when we determine the interest rate and costs of your loan. The process of reviewing these factors to determine your rate is called “risk-based pricing.”

The typical factors we look at include:

- We’ll obtain a credit report that shows your current debts and payment history. The report will also include a credit score based on your overall credit history.

- Property type: Investment properties, condominiums, manufactured homes, and multifamily homes are generally considered to be higher risks than single family detached homes.

- Loan-to-value ratio: The amount you want to borrow compared to the appraised value of the property. Generally, the lower your LTV ratio, the lower your interest rate and costs.

- Debt-to-income ratio: The amount of your mortgage payments and total debt payments compared to your income. A higher DTI ratio may mean higher interest rates and costs.

- Type of loan: Purchase versus refinance, an adjustable rate versus fixed rate, or cash-out refinance versus rate-and-term refinance, may affect overall risk.

Some other things that may affect your interest rate:

Read Also: How Much Does A Mortgage Payment Increase For Every 100000

What Else Do I Need To Know

Mortgage deals offering the cheapest rates usually come with fees attached. You can opt to pay these upfront or add them to the loan. To factor in the cost of the fee, order your the results by initial period cost .

Alternatively, you can order results by initial rate, lowest fee or monthly repayment even by the lenders follow on rate that the deal will revert to at the end of the term.

While mortgage rates change daily, the very cheapest are reserved for bigger deposit amounts, usually of 60% of the property value or more. And in all cases you will need a sufficient income and clean credit history to be accepted for a mortgage.

If you want to see what your monthly mortgage payments might look like in different scenarios while overlaid with household bills, our mortgage calculator will do the sums.

While Trussle lists around 12,000 mortgage deals from 90 lenders which accounts for the vast majority of the market occasionally some deals are available exclusively through a handful of brokers, so you may not see these listed.