If Im Earning A $100000 Salary What Home Loan Is Right For Me

Depending on which home loan you choose, your borrowing power could vary quite a lot. Features like interest only repayments, fixed rate and variable rates can all influence the amount youâre able to borrow, not to mention that each lender has its own eligibility criteria youâll need to meet.

So which is the right home loan for you? Well, it really comes down to each personâs unique circumstances, but hereâs a rundown of how some of those features could influence your borrowing power:

How Does My Choice Of Bank Affect How Much I Can Borrow

Most banks in Australia lend between 6080% LTV. Some provide loans of up to 95% LTV, including LMI. Of the Big Four banks in Australia, CBA, ANZ and NAB currently offer the maximum LTV rate of 80% with no LMI.

Whether youll be offered that magical 80% rate depends on your personal finances and, if youre an expat, external factors such as fluctuating exchange rates and foreign tax rates.

Banks ultimately set their own rates and evaluate home loan applications as they see fit where one bank approves an 80% LTV mortgage application, another could easily reject it.

What Should I Count As Investment Property Expenses

This can include everything involved in maintaining your investment property. The costs could include strata payments, maintenance expenses, utilities and council rates.

On one hand, you and the person youre applying with may have more borrowing power your collective assets, deposit and income means you may be able to borrow more than a single applicant. But, on the other side of the coin, you may have a greater collective total debt, and this might limit what you can borrow together.

You May Like: Do Different Banks Offer Different Mortgage Rates

If You Are Applying For A Home Loan By Yourself Or With Others

If you apply for a home loan with a partner, friend or relative, you and that persons credit history and financial situation will both be put under the microscope by lenders. With that in mind, it may be a good idea to do a full assessment of both your finances, seeking professional advice if you need it. If you find that your partner, friend or relatives credit or debt issues may affect your borrowing power, you may want to discuss it with them and consider applying for the loan by yourself.

How Can I Increase My Borrowing Power

There are some things that may help increase your home loan borrowing capacity:

- Reduce your credit limit on credit cards, or close any unused credit cards

- Pay down debts, like personal loans

- Keep a good credit score

- Split your liabilities with a partner if youre borrowing on your own

- Start or keep saving to demonstrate a good savings history.

You might also be able to increase the amount you can borrow by asking a family member to guarantee all or part of your loan. At Westpac, this is called a Family Security Guarantee and it could help you get into the market quicker.

Recommended Reading: How Does A 5 1 Arm Mortgage Work

Qualify For A Mortgage Today

You can qualify for a loan! Banks and lenders in Australia can have very different and often confusing policies regarding foreign investment in property. Mortgage Broker Australia specialises in property and real estate and works with over 40 lenders Australia wide.

Enquire online to find out how much you can borrow today!

Mortgages In Australia Section

$2000 Cashback When You Refinance To Us

If youre eligible and you apply to move your home loan to us by 28 February 2023, you could get less home load with $2,000 cashback.

Loan must be funded by 30 April 2023. Min. refinance amount $250k. For borrowings up to 90% of the property value. Excludes refinances from Bankwest and CommBank. Eligibility requirements and T& Cs apply.Image for illustrative purposes only.

Home loan cashback promotion is available to Australian residents aged 18+ who refinance a property with a new Bankwest home loan.

Don’t Miss: What Happens With A Reverse Mortgage When Owner Dies

Where Can I Apply For A Home Loan

Right here at Mozo! We compare a whole range of home loans from over 80 lenders, so head over to our home loans comparison table to find a deal that suits you. Once youâve chosen the home loan that you want, simply click the blue âgo to siteâ button beside the product of your choice. Youâll then have the opportunity to apply for the loan through the lenderâs site.

See? Youâre already one step closer to snatching up your dream home!

*Assuming that both households spend $2,000 a month on living expenses and they’re looking to take out a home loan over 30 years at an interest rate of 4% p.a.

**Prices taken on 16 August 2019 for a home loan period of up to 30 years

Written by: Katherine OâChee, Mozo Money Writer

AS SEEN ON

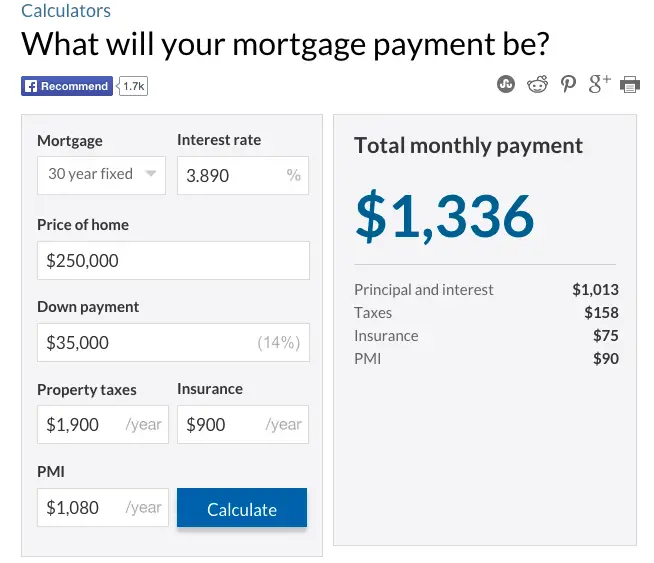

How Does The Borrowing Power Calculator Work

Generally speaking, your borrowing power is calculated as your net income minus your expenses. Your expenses can be impacted by things like the number of dependents in your family, any current home or personal loan repayments and other financial commitments such as private health insurance. The more accurate the details you enter into the calculator, the more realistic your estimated borrowing capacity is likely to be so you may want to start by understanding your expenses.

The borrowing power calculator estimates how much you may be able to borrow based on the information you provide and the following assumptions:

- Loan term of 30 years

- Principal and interest repayments

- ANZ Standard Variable rate for home loans or an ANZ Standard Variable rate for residential investment property loans, depending on the type of property you select. Rate includes a discount on the ANZ Standard Variable index rate.

Note the borrowing power calculator is designed to give you an idea of how much you might be able to borrow, but it shouldnt be taken as a guarantee that youll be able to borrow this amount. It doesnt take into account your complete financial position or whether you meet home loan eligibility criteria. For a more detailed conversation and to discuss next steps, speak with one of our home loan specialists.

Also Check: How Much A Month Is A 500k Mortgage

Im On A Good Salary Why Cant I Borrow More For My Mortgage

Having a reliable source of income is important when it comes to estimating your borrowing power, but its not quite as simple as the more you earn, the greater your borrowing capacity. When looking at what you can afford to borrow, in addition to your income, a lender will take into account your current expenses as well as your broader financial circumstances, behaviours and any ongoing financial commitments. These indicators are likely to have just as much of an impact on your borrowing power as your salary. See What influences my borrowing capacity?

How Do My Finances Affect How Much I Can Borrow

Your finances will play a large role in how much the lender decides to offer for your loan. To land an LTV of 80% or higher, youll first need to show that you can pay back those relatively high home loan payments each month by providing evidence of your income.

As a real estate investor, you may be more likely to be approved for a higher loan compared to applicants who plan to use the property to live in. Thats because banks will often take into account the rental income youre likely to make on the property as part of your wider earnings.

Also Check: How To Figure Out What Mortgage You Qualify For

How Much Deposit Do I Need To Buy A House As An Owner/occupier

There is no magic number when it comes to a deposit, however in Australia the majority of lenders require you to have saved 10% of the propertys value . This means if youre looking to buy a house with a value of $800,000, youll need a deposit somewhere between $40,000 and $80,000.If you only have a 5% deposit, be aware that this needs to comprise genuine savings i.e. its not dependent on your brother selling his car, or a loan from a friend. These are the things that make lenders nervous. Your deposit will affect how much you are able to borrow from your lender. Please keep in mind that money from a parent or third party is known as a gift and not considered genuine savings.A rule of thumb is, the smaller your deposit, the more rigid the regulations are on it. If youve only got a 5% deposit it has to be genuine savings. if youve got 10% or more, a gift can be part of it.

How High Will Home Loan Interest Rates Go

A few bank economists have put forward their predictions of how high the cash rate will rise, of course these are only predictions and no one is 100% certain.

Forbes Advisor contributor Jason Murphy offers his thoughts on how high they will go, and notes that the narrow path the RBA is on might actually be more of a tightrope walk.

Don’t Miss: How Much Can I Loan For Mortgage

How Much Deposit Should I Save Up For A Home Loan

While there are loans available with all kinds of deposits the magic number is 20% of the propertyâs value, if you want to avoid Lenders Mortgage Insurance . So if youâre looking to buy a property for $500,000, that means youâll need to have a deposit of $100,000.

Of course, saving up $100,000 is no easy feat – if youâre earning $100,000 a year, thatâs one yearâs worth of salary before tax!

These days, the minimum deposit you need for a home loan is 5%, as the maximum you can borrow is 95% of the property value. But keep in mind that if youâve saved up less than 20% of deposit, you will have to pay LMI, which could eat up thousands of dollars out of your budget.

For instance, Sam is a first home buyer who wants to buy a $500,000 house. If he has only saved up a 5% deposit of $25,000, then he could expect to pay $15,960 in LMI!** That would be a huge blow to his bank account.

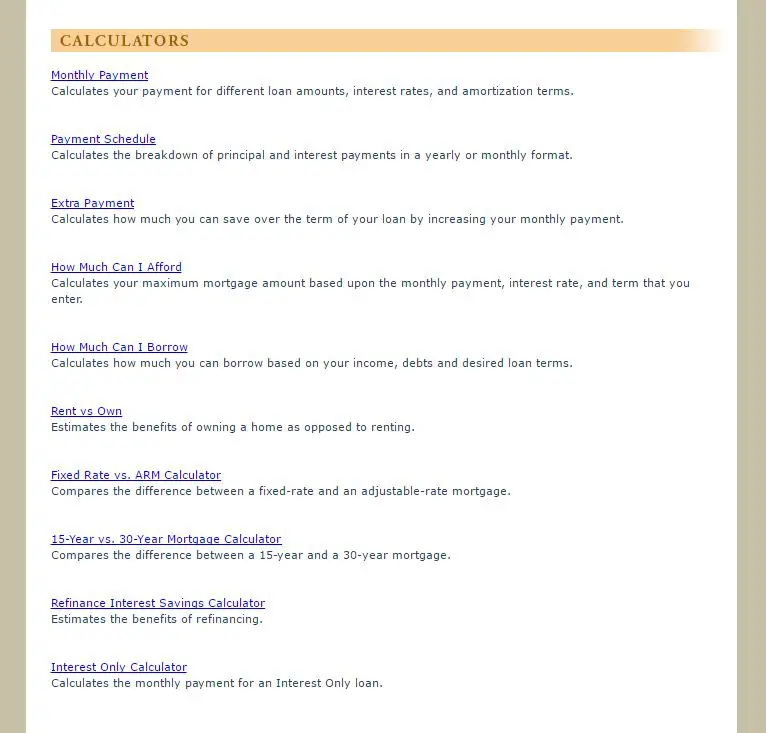

What Is My Borrowing Power How A Home Loan Borrowing Calculator Can Help You

Your borrowing power is determined by a number of factors. Lenders will look at your income , marital status, the number of dependents you may have, your credit score and expenses. Youre no doubt wondering about how much you can borrow on your current salary and whether being self-employed will impact your borrowing power.Lets say youre a single person earning $100,000 a year. You hold a credit card with a $10,000 limit, and your living expenses amount to around $2000 a month. UNOs home loan borrowing calculator will estimate your borrowing capacity somewhere between $470,000 and $580,000.Now lets say youre a couple with one child, with a combined salary of $175,000 and living expenses of $2500 a month. You also have a credit card with a limit of $20,000. Your borrowing capacity now is somewhere between $880,000 and $1.1 million. Try the UNO calculator or speak to one of our qualified brokers to find out more about your borrowing capacity.

Recommended Reading: Should I Take Out A Mortgage At Age 60

What Is My Borrowing Power

Your borrowing power is the amount of money you may be able to borrow from a lender. It is based on your financial situation, including how much you earn, your expenses, your existing debts and the size of your deposit. Other factors like your credit score and whether you have a guarantor can also play a role.

You can use Canstars Home Loan Borrowing Power Calculator to estimate your borrowing power. This is based on your income and expenses as well as the home loan interest rate and loan term you select.

You can click the Assumptions button to change the calculators default assumptions about your expenses. Bear in mind that the calculator should be used as a general guide only, as it does not factor in potential changes to your income or expenses that may occur over time.

How Do I Calculate Total Credit Card And Overdraft Limits

Simply check your account statements or online banking dashboard. Each credit card and account with an overdraft should display a credit limit alongside the amount youve already borrowed from that credit account. If your bank doesnt display overdraft limits online or in statements, give them a call and ask.

An accurate summary of all your credit and overdraft accounts will help your lender process your application faster when you apply.

While homebuyers tend to think in terms of how much savings/deposit or equity they have and an estimated property price, banks tend to talk about ‘LVR’ and have their own assessment of the value of the property.

LVR is the ‘loan-to-value ratio’ your loan amount divided by the lender’s valuation of the property. It’s given as a percentage to guide lenders and homebuyers.

For example: A $400,000 home loan ÷ $480,000 valuation = 0.83 x 100 = 83% LVR.

When working out your LVR, remember to base it on the banks valuation rather than the price youre prepared to pay.

Here’s how a difference in your assumed property price and lender valuation can affect the deposit you need:

- $100k deposit ÷ $500k assumed price = 0.2 = 20% deposit

- $100k deposit ÷ $480k bank valuation = 0.21 = 21% deposit

The type of home loan and the interest rate associated with each type of loan will affect your borrowing power.

Also Check: When Does Mortgage Refinance Make Sense

Can I Increase My Borrowing Power

Its generally not recommended to borrow more than you can comfortably afford because you dont want to overstretch yourself and struggle to meet your repayments. However, the amount you can borrow may differ from lender to lender so it can be worth boosting your borrower power.

Here are some ways to do that:

To understand more about borrowing capacity, read more on this page: Borrowing capacity explained

How To Use Our Borrowing Power Calculator

Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity, or how much you would be eligible to take out on a home loan. If youre not sure, just put an estimate.

There are three parts to this calculator: Annual income, monthly expenses and loan details.

-

Annual income. The calculator will ask you to provide all your income streams including your net salary before tax, rental income, and any other regular sources of income.

-

Monthly expenses. Youll need to enter your overall day-to-day expenses, existing loan repayments and any other financial commitments such as insurance, additional superannuation contributions, and the combined limit of your credit cards and overdrafts.

-

Loan details. Lastly youll need to fill in the details of your loan including the interest rate and the loan term. Take note the calculator will estimate your borrowing power based on a fixed interest rate over a loan term.

Don’t Miss: How To Apply For A Home Mortgage

Does The Amount I Can Borrow Differ By Lender

The amount you can borrow can differ by lender. It is dependent on a range of factors. A UNO mortgage broker knows what each lender is looking for and will work with you to find the best lender for your borrowing capacity. We talk to lenders daily and will use our knowledge to present the right loan options for you.

Plus, when you search for home loan rates online with UNO, our technology actually shows you which lenders are more likely to consider lending you the loan size you are looking for. You can get started in searching for home loans and comparing lender borrowing power here.

UNO works with major lenders CBA, National Australia Bank , St George Bank, Westpac and ANZ. We also work with a bunch of smaller lenders, including Adelaide Bank, AMP Bank, Bank of South Australia, Bankwest, Macquarie Bank, ING Direct, Me Bank, Pepper Home Loans, and Suncorp.

Home Loan Terms Worth Knowing

Home loan serviceability

Another way of looking at how much you can borrow, is your ability to meet your loan repayments known as serviceability. Lenders will generate a figure based on your monthly debt expenses as a proportion of your monthly income, which is known as the debt service ratio.

Our team of experts will be able to guide you through these questions and key terms, but in the meantime, here are some things to consider:

Type of employment

If you are self-employed, some lenders will see you as higher risk. This is because its hard to put a fixed amount on your income. The same applies for casual or contract workers, who lack the security that a full-time job allows. Many lenders will also want you to have passed probation, or worked for a company for a certain amount of time, before they enable you to borrow.

Cost of living and expenses

Its also worth noting that bank hopping bouncing from bank to bank until youre approved can hurt your credit history. Its a good idea to check your credit score on Get Credit Score, which will bring up the history of your credit applications, missed credit card payments, mortgages youve applied for, and any disputes youve had with a bank or lender. Our team of qualified experts can shortlist lenders that are friendlier to your circumstances.

Loan term

Location

You May Like: How Are Mortgage Interest Rates Determined