Be Careful About Closing Credit Cards

While you dont want to open any new credit cards in the lead-up to your applying for a mortgage, you dont want to close any, either. Thats because closing a card means your available credit has dropped, reducing your borrowing power. More importantly, it will impact your , the measure of how much credit you have used relative to your total credit availability.

How Lenders Verify Nontraditional Credit Histories

Even with documentation provided by the potential borrower, lenders will generally take additional steps to verify the payment history. Often, this comes in the form of an Anthem Report a type of nontraditional credit report that can be provided to independently verify all the information if you arent able to provide canceled checks or bank statements for alternative credit accounts. This will generally only work if the accounts that need to be verified are verifiable through a third party.

For example, the credit reporting company can contact a property manager if you rent an apartment in an apartment complex, or can get a payment history directly from an electric or cable company. Some lenders may require this in addition to the documents you provide, so that all of the information is verified.

Your lender will indicate if an Anthem Report is necessary, and they will order the report. You will need to provide them with the name, contact number and account information for each item for the report to be completed, and may need to provide some of the proof of payment documentation needed to produce the report.

Freddie Mac Home Possible: Minimum Credit Score 660

Freddie Macs firsttime home buyer program, Home Possible, is helping buyers get into homes with a very low down payment and moderate credit.

Home Possible is available for low and moderateincome borrowers and allows for a down payment of just 3%. And, for borrowers who cant save up the down payment, Home Possible allows a variety of down payment assistance programs.

To qualify for the Home Possible loan with reduced private mortgage insurance rates, most lenders will require a 660 or better credit score.

Don’t Miss: Rocket Mortgage Loan Requirements

Hard Money Is Hard For A Reason

There is one source of money that even those with terrible credit can access if they can afford it.

So-called hard money, also known as private lending, can be a decent way to access fast cash to buy or flip a home. However, its not cheap. Thats because hard money lenders base their fees and guidelines on the assumption theyll end up foreclosing on your home so they wont lose money if you default.

Expect high upfront fees , high-interest rates and a high loan-to-value ratio. In most cases, youd be better off improving your credit picture and getting a mainstream loan. But not always. Even investors with good credit may choose hard money financing when they need fast cash for a great investment.

But most home buyers are better off sticking to a more affordable mortgage with a low credit score.

Stay Away From Hard Credit Inquiries

While getting an insurance quote wont affect your credit score, applying for any type of new credit will. Having too many hard inquiries on your credit is not a good thing.

When applying for any type of financial transaction that requires a credit pull, always check if its a hard or soft pull. Avoid doing anything requiring a hard pull close to when you apply for a mortgage.

Recommended Reading: Bofa Home Loan Navigator

What Are Credit Reference Agencies Do Lenders Look At

UK mortgage lenders tend to use three credit reference agencies Experian, Equifax and TransUnion, although there are many others that are referred to by lenders across the UK.

If youve ever checked your credit score before, you may already know that each of these agencies and the many others that provide information about your credit history, use different scoring systems.

This can be frustrating because one lender may refer to Experian and use their scoring system whereas another may use data from Transunion.

Home Loans For Borrowers With Bad Credit

- Conventional non-conforming loan Even with bad credit, you might be able to qualify for a conventional loan thats non-conforming, or falls outside of Fannie Mae and Freddie Mac requirements for factors like credit score. This can be an option if youve declared bankruptcy or are otherwise credit-challenged.

- FHA loanFHA loans are insured by the Federal Housing Administration and allow lenders to accept a credit score as low as 580 with a 3.5 percent down payment, or as low as 500 with a 10 percent down payment. The drawback here is that youll pay mortgage insurance.

- VA loan If youre a member of the military, a veteran or married to someone who has served in the armed forces, one of your benefits is the VA loan program backed by the U.S. Department of Veterans Affairs. You dont have to come up with a down payment for this type of loan, and there are no minimum credit score requirements, although lenders do have their own credit standards.

- USDA loan If you meet certain qualifications earn less than a certain amount each year and want to buy a property in a certain area the U.S. Department of Agriculture-backed lending program can help you become a homeowner with subpar credit.

You May Like: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Shop Around For Lenders

When searching for bad credit mortgage lenders, keep in mind that borrower requirements and rates will vary between types of lenders. For example, a local credit union may have more forgiving terms than a national bank, while an online lender may have a proprietary loan program that you could qualify for. Be sure to consider options from multiple lenders and compare rates and terms.

Know Whats On Your Credit Reports

Sometimes inaccurate information can show up on your credit reports. Take the initiative to request a copy of your credit reports from the three main credit bureaus Equifax, Experian and TransUnion at AnnualCreditReport.com and review them for errors before looking into bad credit home loans. If you spot any incorrect information, you can follow these procedures to submit a dispute and get the error removed from your reports.

Also Check: Can You Refinance A Mortgage Without A Job

Home Loans For Bad Credit

- There are actually plenty of options for homeowners with questionable credit

- Including popular government home loans like FHA, USDA, and VA loans

- Along with non-government mortgages such as those backed by Fannie Mae and Freddie Mac

- However you might pay a premium for the privilege, so good credit should always be a priority

To get back to my point, you need to assess how low your credit score is to determine your chances of getting approved for a mortgage.

In short, if your score is closer to the bottom of that aforementioned range, your chances of landing a mortgage will become slimmer and slimmer, even for so-called bad credit home loans.

Conversely, if your score is simply imperfect and youre a perfectionist, you might not have anything to worry about. Other than lacking perfection

Regardless, there are plenty of home loan options for those of us with imperfect credit, or dare I say, bad credit.

In fact, you technically only need a 500 credit score to get an FHA loan, which is actually a popular choice among homeowners these days for its equally low 3.5% down payment requirement. You dont even have to be a first-time home buyer.

And lets get one thing straight, a 500 credit score is pretty abysmal. Its bad credit, no ifs, ands, or buts. Im not here to judge, but Im going to give it to you straight.

You dont just wind up with a 500 credit score after racking up some credit card debt, or because you have student loans. It doesnt happen by accident.

What Credit Score Do Mortgage Lenders Use

As explained above, the most commonly used mortgage credit scores are the FICO credit scores that you have with the UKs main three credit reference agencies: TransUnion, Experian, and Equifax.

Mortgage lenders will normally look at your credit score from each of the CRAs when you apply for a mortgage. If a borrower has three different scores according to each scoring system, then they will use the middle credit rating to assess your application.

But, if two credit agencies agree on your credit score, the mortgage lender will just use that credit rating in their assessment.

Also Check: Monthly Mortgage On 1 Million

How Can I Get Something Wrong On My Credit Report Removed

If you think that information on your credit report is wrong, you have the right to dispute it with the company that has registered the error. This can sometimes be a tedious process but errors on credit reports can delay mortgage applications and can exclude you from access to the best rates.

If you decide to seek help from a mortgage broker, youll be happy to know that they can assist with helping you to get bad credit removed from your record as well as advising you on how to improve your score with the CRAs in the UK.

When Can Lower Credit Score Borrowers Apply For Fha

The new policy has been rolled out for a few years , so your chosen lender may have changed its internal policy already. But some are slower to adopt new regulations.

Typically, theres a step-down effect across the lending landscape. One lender will slightly loosen guidelines, followed by others until a majority function similarly. If the new standards work, lenders loosen a bit more.

Lower credit home shoppers should get multiple quotes and call around to multiple lenders. One lender might be an early adopter of new policies, while another waits to see results from everyone else.

Despite when lenders adopt FHAs new policy, there is strong reason to believe that they will. Thousands of renters who have been locked out of homeownership due to an imperfect credit history could finally qualify.

Want to know if you qualify now? Contact an FHA lender now who will guide you through the qualification process.

Recommended Reading: Can You Get A Reverse Mortgage On A Condo

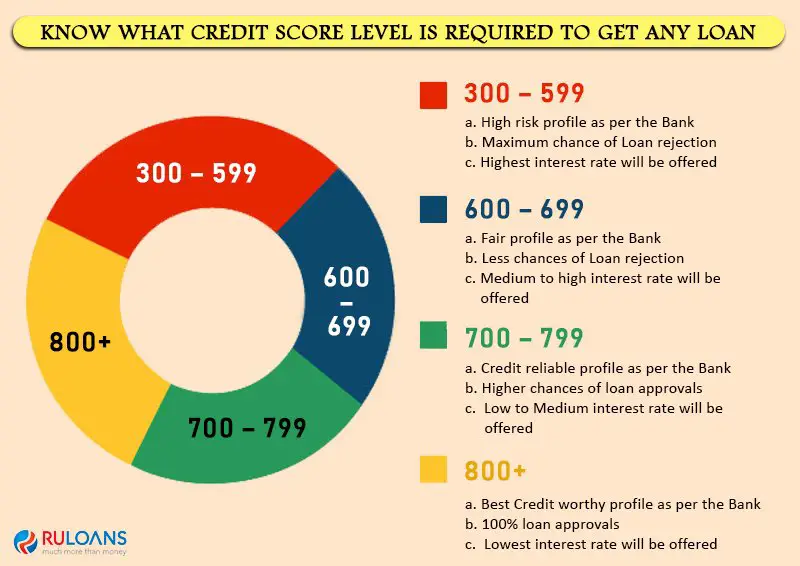

How Much Extra Will A Low Credit Score Cost You

Mortgage lenders check your credit score when deciding whether to approve your loan application. It doesnt just impact whether youre approved, though it also plays a major role in the interest rate you receive. The best mortgage rates are reserved for the borrowers who present the lowest risk.

Lenders consider other factors, as well, including loan-to-value and debt-to-income ratios, but credit scores are especially important.

The examples below are based on national averages for a 30-year fixed loan in the amount of $282,240 80 percent of the national median home price, according to the National Association of Realtors, reflecting a 20 percent down payment.

| $1,412 | $226,205 |

While it might not seem like there is a big gap between a 2.8 percent APR and a 4.3 percent APR, there is a dramatic difference more than $90,000 in interest over the life of the loan. Although this example doesnt go below 620, the data is clear: Credit scores lower than that result in even higher financing costs.

What Does Your Credit Score Mean

Your credit score is a number that reflects your creditworthiness. Banks, credit unions and other financial institutions use your credit score to determine your risk level as a borrower. To calculate your credit score, credit bureaus use formulas that weigh factors like:

- How many loan and credit card accounts you have and the remaining balances

- The age of your loan and credit card accounts

- If you pay your bills on time

- How much debt you have

- The number of times you’ve recently requested more credit

It’s easy to assume that you have just one credit score, but that isn’t the case. In fact, several organizations have their own credit scoring models. Lenders may rely on one or more to assess your creditworthiness, but mortgage lenders typically use the Fair Isaac Corporation model.

Lenders use credit scores to determine which home loans borrowers qualify for. In most cases, borrowers with a high credit score are eligible for home loans with lower interest rates and more favorable terms.

You May Like: 10 Year Treasury Vs Mortgage Rates

Can You Get A Bad Credit Home Loan

Yes, it is possible to get a bad credit home loan. But first, its worthwhile to understand how mortgage lenders evaluate credit scores and other financial information for those buying a house with bad credit. In addition, its crucial to understand whats considered bad credit.

When you apply for a home loan, lenders will look at your credit scores and your overall financial picture. While specific mortgage requirements vary by lender and loan program, bad credit in mortgage lending usually means having a score near the minimum allowed for a particular loan. It could also mean your credit history shows one or more of the following:

- High balances on credit cards and loans

- Multiple new accounts

- Negative events including collection items, loan default, bankruptcy, foreclosure or short sale

Private Mortgage Lenders For Bad Credit

There are plenty ofprivate mortgage lendersthat offer bad credit mortgages in Canada. A few examples include Alpine Credits, Prudent Financial, Clover Mortgage, Canadalend, and Guardian Financing. Forprivate mortgage lenders in Ontario, a few examples include Castleton Mortgages, MortgageCaptain, and MortgageKings. You might be required to go through a bad credit mortgage broker in order to access some private lenders, as some may only work through brokers.

Some private lenders have no minimum credit score requirements, and some even allow you to make interest-only payments on your mortgage. This can help you keep up with your payments if you are having cash-flow issues. Making regular mortgage payments to a private lender can also help improve your credit score, making it easier to eventuallyrefinance your mortgageat a lower mortgage rate with another lender.

Also Check: Chase Mortgage Recast

Can You Get A Mortgage With A Low Credit Score But Good Income

- FHA loans allow FICO scores as low as 500, and VA loans have no minimum credit score

- Portfolio lenders keep non-prime loans on their own books and accept bad credit and scores as low as 500

- Private lenders accept low credit scores but have very high fees and interest rates

Heres what you need to know about options for low credit scores. And check out our list of best mortgages for a 550 credit score.

Should I Buy A House With Bad Credit Or Wait To Improve My Score

While it may be technically possible for you to get a mortgage when you have a poor credit history, you also have the option of trying to improve your credit score first, in order to increase your chances of getting accepted for a ânormalâ mortgage. Here are some of the pros and cons of getting a bad credit mortgage:

Recommended Reading: 10 Year Treasury Vs 30 Year Mortgage

Why Were You Turned Down For A Loan

If you are still having trouble getting a loan, ask your lender why. Bad credit is just one of many reasons you may be denied a loan. Other reasons you may be denied a home loan include:

- Overextended credit cards: If you miss payments or exceed your limit, thats a red flag to lenders.

- Failure to pay a previous or existing loan: If you have defaulted on other loans, a lender will think twice.

- Bankruptcy: Filed for bankruptcy in the past seven years? You might have trouble getting a loan.

- Overdue taxes: Lenders check your tax payment record.

- Legal judgments: If you have a judgment against you for such things as delinquent child support payments, it could harm your credit.

- Collection agencies: Lenders will know if collection agencies are after you.

- Overreaching: You might be seeking a loan outside what you can reasonably afford.

Increase The Length Of Your Credit History

The longer you have a credit account open and in use, the better it is for your score. Your credit score may be lower if you have credit accounts that are relatively new.

If you transfer an older account to a new account, the new account is considered new credit.

For example, some credit card offers come with a low introductory interest rate for balance transfers. This means you can transfer your current balance to this new product. The new product is considered new credit.

Consider keeping an older account open even if you dont need it. Use it from time to time to keep it active. Make sure there is no fee if the account is open but you dont use it. Check your credit agreement to find out if there is a fee.

Read Also: Chase Recast

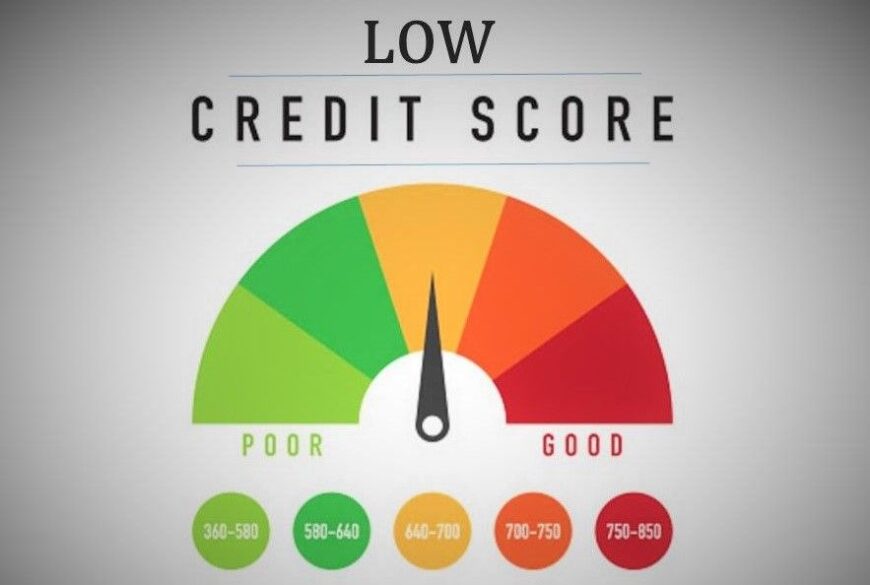

Bad Or Poor Credit Score Ranges

A credit score represents âa snapshot of a personâs creditworthiness,â the Consumer Financial Protection Bureau says. And thatâs why the CFPB says potential lenders might use your credit score to make decisions about things like approving loans and extending credit.

Credit-scoring companies use different formulas, or models, to calculate credit scores. There are many different credit scores and scoring models. That means people have more than one score out there. Most range from 300 to 850, according to the CFPB. And the CFPB says some of the most commonly used credit scores come from FICO® and VantageScore®.

But how they determine scores and their definitions of what constitutes poor credit differ. Itâs important to remember that credit decisionsâand whatâs considered a bad scoreâare determined by potential lenders. But here are some more details about how FICO and VantageScore generally view credit scores.