Your Home Value Has Increased

If the value of your home has gone up, you might also get some benefit from refinancing, especially if you have other high-interest debt to pay off or another financial goal.

A cash-out refinance lets you take out a new mortgage thats larger than what you previously owed on your original mortgage, and you receive the difference in cash. A cash-out refi is an alternative to a home equity loan.

You also might consider a cash-out refi for home improvements or to pay for a childs education.

But youll want to make sure you dont end up paying more in mortgage interest than the interest you would pay on any debt youre using the cash to pay off.

How Much Will You Save In The Long Run By Refinancing

You may be wondering exactly how much youd save by refinancing your home. Well take a look at an example to demonstrate your long-term savings.

Lets say that you currently have a 30-year mortgage that youve been paying for 5 years. You have 25 years left on the mortgage and you still owe $150,000. Your current loan interest rate is 3.5% and your current monthly mortgage payment is $800.

You decide to refinance to a 15-year mortgage with a new interest rate of 2.5%. Your loan balance remains at $150,000 and your new monthly mortgage payment is $1,000. To refinance your loan, you also need to pay $3,000 in closing costs .

If you plan to live in the home close for more than a few years are able to make the higher mortgage payment and pay the closing costs, it may be worth it to refinance. Refinancing from a 30- to a 15-year mortgage will help you build equity quicker and save you almost $60,000 in interest.

When Is Refinancing Worth It

There are many scenarios where refinancing makes sense. In general, refinancing is worth it if you can save money or if you need to access equity for emergencies.

Borrowers with FHA loans must refinance into a conventional loan in order to get rid of their mortgage insurance premium, which can save hundreds or thousands of dollars per year.

Some borrowers refinance because they have an adjustable-rate mortgage and they want to lock in a fixed rate. But there are also situations when it makes sense to go from a fixed-rate to an adjustable-rate mortgage or from one ARM to another: Namely, if you plan to sell in a few years and youre comfortable with the risk of taking on a higher rate should you end up staying in your current home longer than planned.

Read Also: Rocket Mortgage Loan Types

How To Refinance Your Mortgage

If you want to refinance, you can probably complete most of the application and approval process from your home computer.

To refinance your mortgage, you should:

What Are Todays Mortgage Rates

Todays 15year and 30year mortgage refinance rates continue to drop, according to Freddie Mac. So now could be an advantageous time to replace your 30year loan with a new 15year loan.

The spread between 30 and 15year loans is always a consideration when you choose a refinance loan.

Bear in mind that the interest rate you qualify for will depend on a number of factors, including your credit score, debttoloan ratio, type of loan, and the current equity in your home.

Also, the lender underwriting your loan affects your refi rate so be sure to shop your refinance around with multiple mortgage providers.

Recommended Reading: Does Prequalifying For A Mortgage Affect Your Credit

Determine Your Estimated Home Equity

Many lenders require you to have a certain amount of equity in your home in order to qualify for a refinance.

The required equity amount varies based on the mortgage program youre applying for, but conventional loans typically require at least 3% equity, while government-backed loans might allow you to refinance with 2.25% equity or less. These requirements apply to rate-and-term refinances.

If youre planning to apply for a cash-out refinance, youll need at least 20% equity for conventional or FHA loans and 10% equity for VA loans.

Other Common Mortgage Repayment Strategies

We also know that many of our readers believe you should take out as big a loan as possible and for as long as you can and use those funds to invest in the stock market.

Letâs say you borrowed the money at around 3 percent and you can use that cash to invest in stocks and earn 8 percent on your money, that would be neat, right? But some of our readers canât stomach any sort of risk when it comes to their homes. These readers would prefer to know that they have paid off their mortgages, no longer have to deal with a mortgage lender and that they own their home free and clear.

We also have plenty of readers who will take out a mortgage and never prepay that loan. They will feel that theyâve borrowed money at a cheap interest rate, and use the extra cash to either save for retirement, invest or perhaps buy another property. They hope that by leveraging historically cheap interest rates, theyâll make their money work harder for them.

So, how much risk are you willing to take? Will you sleep at night if you invest the difference and the stock market declines by 30 percent, as it did at the start of the Covid-19 pandemic? Or, will you sleep better knowing your home is paid off.

Only you can decide whatâs right for your financial and personal life.

Recommended Reading: Does Rocket Mortgage Sell Their Loans

What Should I Not Refinance My Mortgage

While a refinance can be a great way to unlock equity in your home, it can come with an expensive prepayment penalty. If you have a fixed rate mortgage and have a few years left on your mortgage contract, it can be very expensive to refinance your home. In these cases, it can be better to use aHELOCor asecond mortgageto draw from your home equity without interfering with your original mortgage.

Paying Off Your Mortgage Faster

This one is a no-brainer. Having a 15-year mortgage forces you to pay off your mortgage twice as fast as a 30-year mortgage.

When you no longer have a mortgage payment, you can put all that money toward other things, like retirement savings or investments. Plus, owning your home debt-free can feel great.

Recommended Reading: Will Mortgage Pre Approval Hurt Credit Score

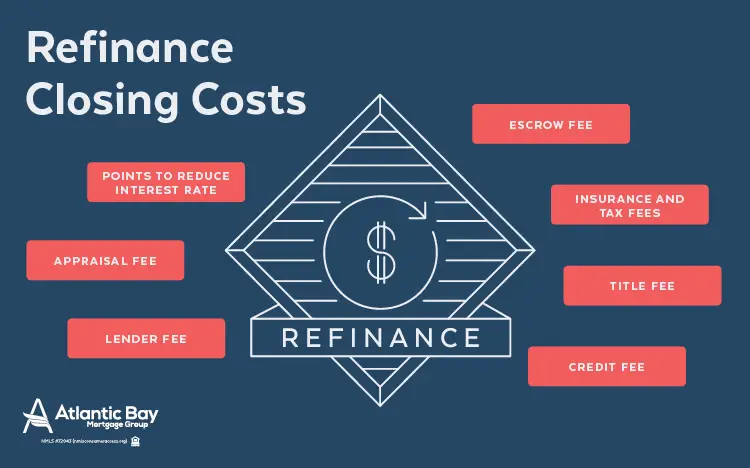

What Is The Average Cost Of A Refinance

Refinancing a mortgage can yield significant interest savings over the life of a loan. But all those savings dont come for free. Generally, youll encounter costs $5,000 on average, according to Freddie Mac when refinancing your mortgage.

Your exact refinancing costs will depend on multiple factors, including the size of your loan and where you live. Typical refinancing costs include:

- The cost of recording your new mortgage

- Appraisal fees

- Mortgage points

- Prepaid interest charges

Keep in mind theres no such thing as a truly no-cost refinance. Lenders who market “no-cost loans” typically charge a higher interest rate and roll the costs into the loan which means youll pay more interest over the life of the loan.

Evaluate Your Credit Score

Your is an important factor in determining your refi eligibility, along with the interest rate on your new loan. Youll need a minimum 620 credit score for a conventional refinance and a 580 for an FHA refinance. There is no credit score minimum for VA refinances.

However, to qualify for the most competitive 15-year refinance rates, aim for a 740 credit score or higher.

Use LendingTrees to estimate your credit score, though its worth noting that each lender may evaluate your score a little differently. You can also pull your credit report from each of the three major credit bureaus once a year for free at AnnualCreditReport.com.

Also Check: How Much Does Getting Pre Approval Hurt Credit

Mortgage Balance And Prepayments

While you can change the mortgage interest rate, payment frequency, and term length when negotiating your renewal, your mortgage principal balance will remain the same. You can pay off 0 to 20% of your mortgage before renewal depending on your current mortgage contract.

Open mortgages allow you to prepay before the end of the term without incurring prepayment charges, however they come with higher mortgage interest rates. Closed mortgages offer a lower interest rate, but it can come with prepayment charges depending on the amount. Some lenders offer prepayment privileges that will allow you to pay up to a certain amount of the principal, with that amount directly paying down the principal. Prepayments may be limited to a single lump-sum payment per year at some lenders. If your mortgage lender is federally regulated, payment privileges must be clearly displayed in your mortgage agreement contract.

Annual prepayment limits do not roll over. If you do not use your limit in one year, you cannot apply it to the next year. Mortgage prepayment allowances depend on your lender. RBC, TD, CIBC, and BMO all allow principal prepayments of any amount at the time of renewal without prepayment penalties.

Keep Reading To Find Out

Youre Payment Will Increase Can you Afford It?

You have to consider your budget. You are going to pay less interest over the life of the loan, but you are also going to pay more principal with each payment. You just cut your loan from 30 years to 15 years. That means you have to pay more principal to pay the loan off in half the time.

This may be ideal if you have the income to support the higher payment. Take a close look at your budget. Do you have a lot of disposable income? What happens when you increase your mortgage payment? Do you still have adequate disposable income? .

Do you have other debts that you will ignore by taking the higher mortgage payment? Credit card and personal loan interest payments are often much higher than mortgage interest. You arent doing yourself any favors by staying in debt with these types of loans just to pay off your mortgage faster. Instead, you may want to pay those debts off first. You can then focus on your mortgage.

Do you have retirement funds set up already? Do you regularly invest in those funds? If not, taking the higher mortgage payment may not be the best choice. Sure, youll own your home free and clear, but you wont have retirement money. Youll end up having to sell your home just to have funds to live off of, but then where do you live?

Also Check: Chase Mortgage Recast

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Refinancing To Tap Equity Or Consolidate Debt

While the previously mentioned reasons to refinance are all financially sound, mortgage refinancing can be a slippery slope to never-ending debt.

Homeowners often access the equity in their homes to cover major expenses, such as the costs of home remodeling or a child’s college education. These homeowners may justify the refinancing by the fact that remodeling adds value to the home or that the interest rate on the mortgage loan is less than the rate on money borrowed from another source.

Another justification is that the interest on mortgages is tax-deductible. While these arguments may be true, increasing the number of years that you owe on your mortgage is rarely a smart financial decision nor is spending a dollar on interest to get a 30-cent tax deduction. Also note that since the Tax Cut and Jobs Act went into effect, the size of the loan on which you can deduct interest has dropped from $1 million to $750,000 if you bought your house after Dec. 15, 2017.

Many homeowners refinance to consolidate their debt. At face value, replacing high-interest debt with a low-interest mortgage is a good idea. Unfortunately, refinancing does not bring automatic financial prudence. Take this step only if you are convinced you can resist the temptation to spend once the refinancing relieves you from debt.

It takes years to recoup the 3% to 6% of principal that refinancing costs, so don’t do it unless you plan to stay in your current home for more than a few years.

Don’t Miss: How Does Rocket Mortgage Work

Should I Refinance My Mortgage

9 Minute Read | September 28, 2021

Ever since the Federal Reserve dropped interest rates in 2020, theres been a new wave of hype around getting your mortgage refinanced. And for good reason too.

Last year, the annual average interest rates for common mortgages was between 2.613.11%the lowest theyve been since Freddie Mac started reporting several decades ago!1,2 And with the Feds saying they wont raise interest rates until 2023, now even more folks are wondering, Should I refinance my mortgage?3

Lower interest rates are great and all, but how do you know if its the right time for you to actually do a mortgage refinance? Well show you how to make a smart decision.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

Average Costs Of Refinancing

As with any loan, a refinance may come with certain fees, including:

- Application fee

- Recording fee

- Title search and insurance

While the costs will vary depending on your loan and lender, you can expect to pay about 2 3% of your loan balance. For example, if you refinance to a $200,000 loan, you can expect your closing costs to be around $4,000 $6,000.

If youre considering refinancing to save money, keep in mind the costs to refinance. How long will it take for you to recoup these expenses? Will you stay in the home long enough for that to happen? If not, you arent saving money.

Pros And Cons Of A 15

| Pros | |

| Youll build home equity faster

Youll pay off your mortgage and own your home outright sooner Youll likely receive long-term cost savings You might secure a lower rate |

Your monthly payment will be higher

Youll have less room in your budget to meet other financial goals You may find it difficult to make extra principal payments Youll pay closing costs upfront |

You May Like: Does Chase Allow Mortgage Recast

What Is A No Closing Cost Refinance

No closing cost refinances are simply mortgage refinances withclosing costs rolled into the loan. While you won’t pay your closing costs out-of-pocket at the time of closing, doing so will typically increase your total amount borrowed and monthly payments.

Theprocess of refinancingwill follow these typical steps:

Select a type of mortgage refinance: You have many refinancing options, including refreshing your rate and term , applying more cash toward your equity , pulling money out of your home equity , or opting for a streamline refinance to lower your monthly payments.

Shop refinance rates:Compare different interest ratesusing the custom rates tool or refinance calculator above to determine if refinancing at a current rate would accomplish your refinancing goals. Contact the lender, orfind a lenderto work with in your area.

Apply for a refinance: Once you apply, your lender will provide you with initial disclosures that outline the terms of the loan. Read and sign.

Lock your refinance rate: Work with your lender to lock your interest rate when you believe it’s the lowest.

Complete a home appraisal: Most lenders require a home appraisal.

Close your loan: Review the closing documents and disclosures, pay any applicable closing costs, and sign.