What Are The Income Requirements For Refinance Mortgages

Your lender must look at your finances to determine the interest rate to charge on your refinance and will require proof of income when you apply. You can use:

Paystub requirements apply to co-borrowers on the loan as well. Lenders use these details to make sure you can afford your mortgage payments in the future.If youre self-employed, you’ll also need to provide:

- Federal income taxes for the past 2 years

- Profit-and-loss statements

How Does My Credit History Impact Refinancing

Before we dive into refinancing for bad credit, lets first take a look at how your credit score impacts your refinance.

Lenders use your credit score to determine how likely it is that you will pay them back in full and on time. Credit scores range from 300, which is very poor, to 850, which is perfect. Your score is calculated by looking at your past payment history , amount owed , length of time youve had credit , new credit and type of credit .

As you can see, the bulk of your score is based on your past payment history and total debt, so people with too much debt or who havent paid their bills on time are going to seem high risk to lenders. Thus, a mortgage lender will charge a person with poor or bad credit a higher interest rate to refinance because the lender is taking more of a risk by lending that person money. So while someone with an 800 credit score might only pay 3.5 percent on their mortgage, someone with a 650 or below may pay a full percentage point or more higher, which will likely equate to paying the lender tens of thousands of dollars more in interest over the life of the loan.

When Is It Better To Hold Off On Refinancing

If the rate you have is close to 3 percent, it may not necessarily be worth it to refinance, especially if you are not sure how long you plan to live in or keep your home. The rate may not have fallen low enough, says Kan. Refinance when there are enough benefits to refinance. Are you taking cash out? What is the lowest possible rate? If you are going to move and sell your place in the near future a year or so you may not want to refinance. Consider the closing costs and the length of the loan as well as the rate.

There are a lot of calculators online that allow you to figure your potential savings by entering the new loan amount, the rate and the length of the loan, such as one offered by Fannie Mae. If its a larger loan amount, even if you will get a rate reduction, it may not be worth it, Kan says. Your savings depend on the loan amount and the rate drop. Smaller loans need a bigger rate drop to produce savings.

The average home loan size is $300,000 to $400,000, according to Jonathan Lee, senior director at Zillow Home Loans.

Other reasons to hold off on refinancing are: If your financial situation has either changed or deteriorated, says McBride. Another reason is if you are not saving on total interest over the life of the loan or on your monthly payment.

Recommended Reading: Where Can You Get A Mortgage With Bad Credit

Why Would Refinancing Be A Bad Idea

Refinancing is a bad idea if it doesnt represent some sort of gain, be it in the form of lower monthly payments or saving on interest by reducing the term of your loan. If the interest rate being offered isnt at least 0.5% lower than your current rate, its probably not worth the cost of a refi. Another reason not to refinance is if you plan on selling the house before you reach your breakeven point or if the new monthly payment is more than you can comfortably afford.

Lack Of Equity/ Ltv Restraints

- It can be difficult to refinance if you lack home equity due to a low down payment and/or falling home prices

- Lenders typically want your LTV to be below 100% to ensure youve got skin in the game

- However, there are some loan programs that address high-LTV and underwater mortgages

- Including streamline refinances that dont require a home appraisal

Perhaps the most typical reason for a denied refinance is a lack home equity, which translates to a loan-to-value ratio well above whats acceptable.

For example, a great number of homeowners took out interest-only home loans and option-arms during the housing boom because home prices were only going in one direction. Up.

But once things took a turn for the worse, many of those homeowners had little, no, or even negative equity as a result.

Even those who opted for traditional fixed-rate mortgages may have sapped their home equity by cash-out refinancing repeatedly.

Regardless of how, many of these homeowners found that they didnt qualify for a traditional refinance thanks to their inflated LTV.

Todays borrowers are more equity-rich thanks to rapidly rising home prices, but those who put little down can still face LTV issues.

And if you want cash out with your refinance, expect an even lower max LTV, such as 80% or lower if a multi-unit property.

Solution: There are several government-backed programs, as well as lender-based programs out there at the moment that address high LTVs, at least with regard to rate and term refis.

Read Also: How To Get A Contractor Mortgage

Refinance Time Frame Faqs

Take a look through some frequently asked questions regarding the average time to refinance a home.

Is Refinancing a Home Difficult?

Refinancing a home is often less complicated than the home-buying process.

Does Refinancing Hurt Credit?

Refinancing a home may lower your credit score initially, but you should see it bounce back within a couple of months.

What Can Stop You From Refinancing a Home?

Three factors that could keep you from refinancing your home include: Low credit score

Sometimes Its Best To Stay Put

Home mortgage refinancing can look appealing to homeowners looking to reduce expenses. But its not always a good idea. Depending on your situation, refinancing can either save you money or cause a variety of problems. While the lure of lower interest rates and smaller monthly payments makes sense at first glance, its crucial to understand the potential risks involved.

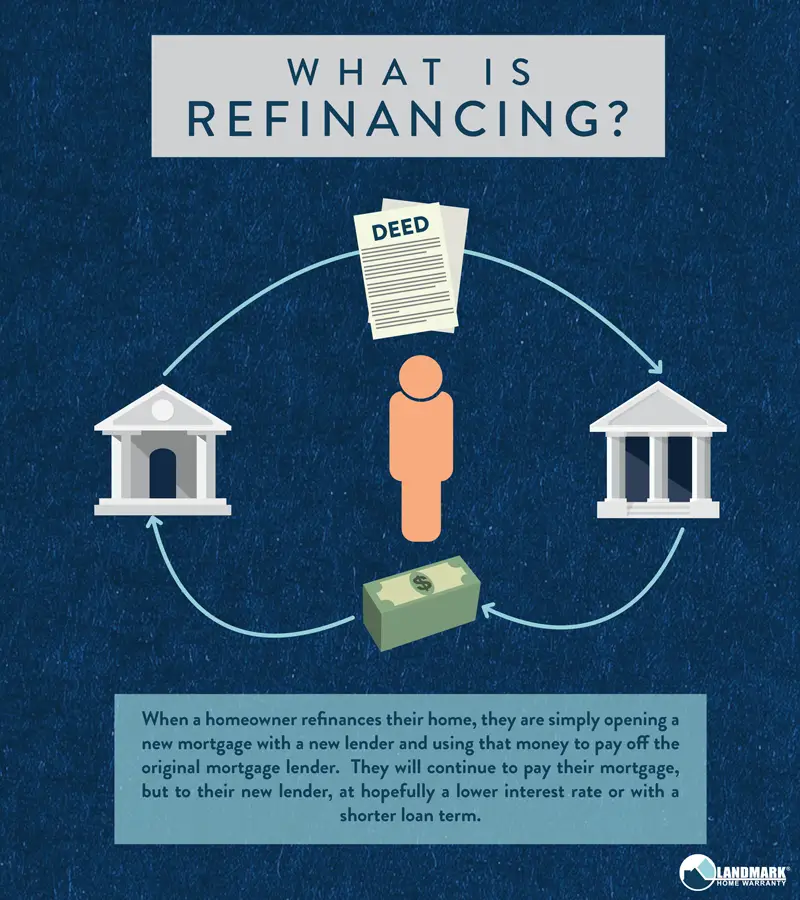

This page specifically covers how home mortgage refinancing can land you in hot water or be a welcome change providing a financial boost. If you just want an overview of how home mortgage refinancing works before weighing the pros and cons, get the facts by reviewing Mortgage Refinancing Basics. As a refresher, when you refinance your mortgage, you get a new loan that pays off your existing debt. Doing so can result in lower monthly payments unless you take out a substantial amount in cash.

In general, you should avoid refinancing your mortgage if youll waste money and increase risk. Its easy to fall into the traps below, so make sure you steer clear of these common mistakes.

Read Also: How To Modify Mortgage Loan

Things To Consider Before Refinancing

Before you consider a refinance, it’s important to keep a few things in mind.

First, you’ll have to pay closing costs. Freddie Mac estimates these run around $5,000 per loan, but the exact total will depend on your lender, loan amount and location. You can also roll these costs into your loan and pay them off over time, just remember: It will mean a higher loan amount, monthly payment and long-term interest costs.

Refinancing can also hurt your credit score at least temporarily. That’s because your lender will do a hard credit inquiry when processing your application. This causes a temporary decline in your score. As long as you make your payments on time, though, the score should recover fairly quickly.

What Does It Mean To Refinance A Loan

Loan refinancing refers to the process of taking out a new loan to pay off one or more outstanding loans. Borrowers usually refinance in order to receive lower interest rates or to otherwise reduce their repayment amount. For debtors struggling to pay off their loans, refinancing can also be used to get a longer term loan with lower monthly payments. In these cases, the total amount paid will increase, as interest will have to be paid for a longer period of time.

Read Also: Can You Get A Mortgage To Include Renovations

You Have Too Much Debt

The most common reason why refinance loan applications are denied is that the borrower has too much debt. Because lenders have to make a good-faith effort to ensure you can repay your loan, they typically have limits on whats called your debt-to-income ratio. This ratio compares the amount of money you bring in each month to the total monthly payments you make toward your debt.

You Listed Your Home For Sale

- Banks arent keen on offering financing to borrowers who were unable to sell their home on the open market

- If no one is willing to buy your home, it might be hard to refinance it

- Once de-listed, there may be a waiting period of 6 months before you can get financing

- But some lenders today now just ask that the property be off the market at time of funding

If you happened to list your home for sale, then quickly realized no one was interested, or simply had a change of heart, you may now be pondering a refinance.

Unfortunately, your prospective lender probably wont be too thrilled about it, considering the fact that you may sell again if given the chance and prepay your new loan.

You may also run into problems when it comes time to appraise the property if it wasnt selling at your asking price.

While a waiting period may not apply, you will likely be asked to confirm your intent to occupy the property as your primary residence.

Additionally, the underwriter will probably scrutinize the listing price and appraised value to ensure the proposed value is supported.

Solution: Call around and see which bank or lender doesnt mind that the home is/was listed.

Then remove the listing before you apply to ensure there arent any complications. And be prepared to write a letter of explanation regarding the change of heart.

You May Like: What Changes Mortgage Interest Rates

Can You Refinance With Your Current Mortgage Lender Pros And Cons

See Mortgage Rate Quotes for Your Home

If youre looking to lower your monthly mortgage payment, refinancing with your current lender could save you the hassle of switching financial institutions, filling out extra paperwork and learning a new payment system.

But before you sign on the dotted line, its smart to shop with multiple mortgage companies to get the best refinance rate. After all, hefty savings may make it worth it to change lenders.

Extending A Loans Term

When you refinance, you typically extend the amount of time youll repay your loan. For example, if you get a new 30-year loan to replace your existing 30-year loan, payments are calculated to last for the next 30 years. If your current loan only has 10 or 20 years left to go, refinancing is likely to result in higher lifetime interest costs.

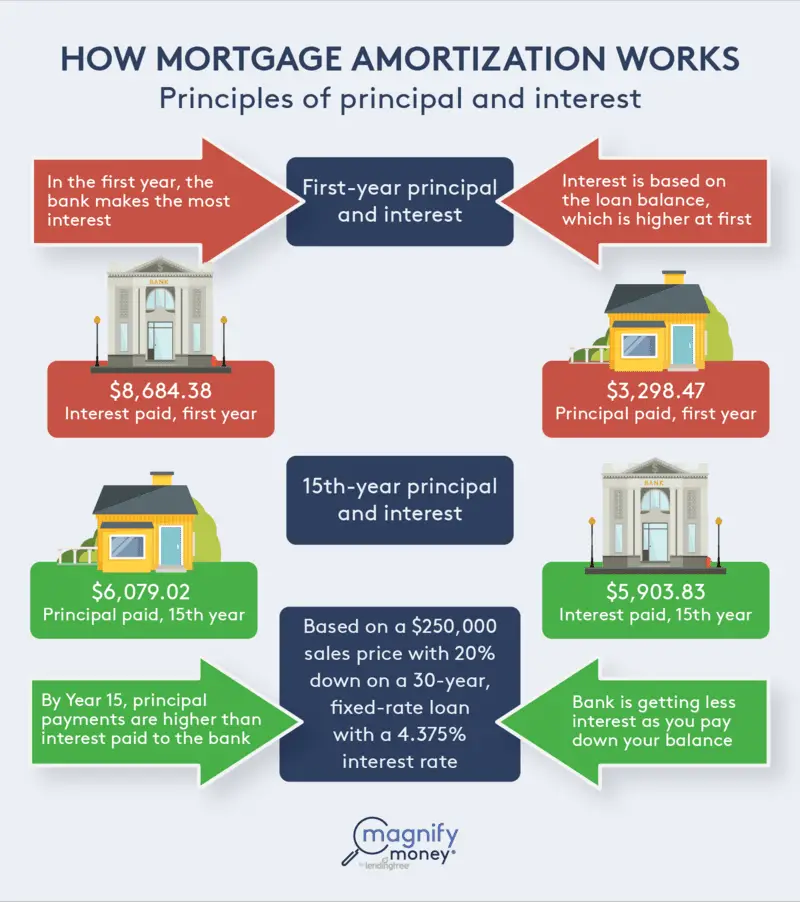

Heres why: When you get a new loan with a long term, most of your payments go toward interest charges in the early years. But with an existing loan, you might have already moved past those years, and your payments could be making a meaningful dent in your loan balance. If you refinance, you have to start from scratch. To avoid losing substantial ground, you could choose a shorter-term loan, such as a 15-year mortgage.

To see this in action, plug your numbers into our mortgage calculator to see how much interest youll pay over the life of the new loan. While youre at it, learn how amortization works if youre curious about the process of paying down loan balances.

Read Also: Requirements For Mortgage Approval

Don’t Miss: What Is The Downside Of Refinancing Your Mortgage

What Is A Good Mortgage Rate

It can be hard to know if a lender is offering you a good rate, which is why it’s so important to get preapproved with multiple mortgage lenders and compare each offer. Apply for preapproval with at least two or three lenders.

Your rate isn’t the only thing that matters. Be sure to compare both what your monthly costs would be as well as your upfront costs, including any lender fees.

Even though mortgage rates are heavily influenced by economic factors that are out of your control, there are some things you can do to help ensure you get a good rate:

- Consider fixed vs. adjustable rates. You may be able to get a lower introductory rate with an adjustable-rate mortgage, which can be good if you plan to move before the intro period ends. But a fixed rate could be better if you’re buying a forever home because you won’t risk your rate going up later. Look at the rates your lender offers and weigh your options.

- Look at your finances. The stronger your financial situation, the lower your mortgage rate should be. Look for ways to boost your or lower your debt-to-income ratio, if necessary. Saving for a higher down payment also helps.

- Choose the right lender. Each lender charges different mortgage rates. Picking the right one for your financial situation will help you land a good rate.

Your Lender May Be Able To Offer Other Options Besides A Refi

When I was exploring refinancing, I went all in. I filled out piles of paperwork, researched lenders and spent hours on the phone. Because we have a farm, our loan situation is also more complicated, so the process was incredibly daunting. I was even told at one point that we likely wouldnât be eligible for a refinance.

Finally, I decided to just call our existing lender to see if they had any options I hadnât explored yet. Much to my surprise, they did. Our lender offered us something called an interest rate conversion. With only one page to sign and a simple $800 fee, our lender kept our existing fixed-rate mortgage and loan terms but lowered our interest rate by a full point.

Although interest rate conversions are more commonly done when converting an adjustable rate mortgage to a fixed loan, Spaniel says there has been a recent trend of some lenders offering them in order to keep the loan â in some cases, with no fees at all. In our case, the interest rate conversion made the most sense, allowed us to keep our lender and was the most straightforward process. The lower interest rate, along with a small, extra monthly payment toward our principal, will allow us to save $100,000 over the life of the loan.

Read Also: What Does Gmfs Mortgage Stand For

Don’t Miss: Have Mortgage Rates Gone Up Or Down

Refinancing To Shorten The Loan’s Term

When interest rates fall, homeowners sometimes have the opportunity to refinance an existing loan for another loan that, without much change in the monthly payment, has a significantly shorter term.

For a 30-year fixed-rate mortgage on a $100,000 home, refinancing from 9% to 5.5% can cut the term in half to 15 years with only a slight change in the monthly payment from $805 to $817. However, if you’re already at 5.5% for 30 years , getting, a 3.5% mortgage for 15 years would raise your payment to $715. So do the math and see what works.

Options For Refinancing A Mortgage With Bad Credit

Do you have a bad credit score? If so, you might think that a refinance is completely out of your reach. Hold up it might not be. There are a few methods and special circumstances to help you possibly refinance with a lower score.

Well take a look at a few ways you can refinance your mortgage even with a bad credit score. Well give you a quick refresher on what a refinance is and offer a few simple tips you can use to raise your score before you refinance.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

You May Like: Can You Refinance Your Mortgage

You May Like: Do Mortgage Inquiries Hurt Your Credit

Do An Fha Streamline Refinance

The FHA Streamline Refinance program is a special refinance program for people who have a Federal Housing Administration loan. Unlike a traditional refinance, an FHA Streamline Refinance allows a borrower to refinance without having to verify their income and assets. FHA does not have a minimum credit score required for a streamline refinance, but individual lenders might, so be sure to shop around for a lender.

Dont Open More Loans Too Soon

The more applications you complete, the more hard inquiries youll see on your credit report. And its not restricted to refinanced home loans. If you apply for a credit card, a car loan or even a personal loan in the weeks leading up to refinancing, your credit score will likely go down.

If you want to complete a few applications with many different lenders, make sure you do within a few weeks of your first completed application. That way the hard inquiry only counts as one inquiry, not one inquiry for every application you complete.

Dont Miss: How To Mortgage Property In Monopoly

Also Check: Is The Payoff Amount On A Mortgage Less Than Balance

Ways To Speed Up Your Refinance Timeline

If refinancing your loan benefits your budget, you may be eager to get your new loan. Luckily, there are a few tricks to speed up this process:

- Round up your paperwork ahead of time: Just like you would gather your paperwork before heading to get a new drivers license, do the same for your lender. Look up your states refinancing loan requirements and create a checklist of required documents.

- Double-check your credit: As most lenders require a , it may be the right time to check in on your score. Use our app to see your , your credit history, and helpful tips to boost your ranking.

- Avoid taking on more debt: Your credit score is impacted by your debt. Maxing out your credit card could negatively impact your credit score and cost more in the long run. Focus on paying off debts and only spending your readily available money to improve .

- Dont apply for new credit: Inquiring about new debt opportunities could drop your credit score up to eight points. Next time youre offered a new or a deal on a car loan, take a few days to analyze the potential credit changes that could impact your refinanced mortgage.

- Do what you can to accommodate your appraiser and lender: You may run into a couple issues during this process, such as needing different paperwork or extra signatures. While life can get busy, do your best to make your appraisers and lenders jobs easy. Doing so could speed up the process and earn you a better home loan in no time!