Where Mortgage Rates Are Headed

Worries about a resurgence of coronavirus cases are weighing on stocks and on U.S. Treasury yields, which were in the range of 1.46 percent Wednesday. Last month, yields had climbed as high as 1.65 percent. Meanwhile, the Federal Reserve signaled Wednesday that it will raise rates in a move to rein in inflation.

Mike Fratantoni, chief economist at the Mortgage Bankers Association, says the average rate on a 30-year mortgage will reach 3.5 percent by mid-2022 and 4 percent by late 2022.

Inflation is running well above target, and the job market is booming, Fratantoni says. That is why it was no surprise that the Federal Reserve moved to accelerate their taper of Treasury and purchases, and signaled that the first rate hike will be coming sooner rather than later. Moreover, the median member now expects three rate hikes in 2022.

The Mortgage Bankers Association expects refinancing activity to disappear as rates rise. But it also expects a strong home-sales market in 2022.

Mortgage experts offer mixed predictions about the direction of rates in the next week in Bankrates latest survey.

Meanwhile, the Federal Reserve last month announced its long-anticipated taper of asset purchases, and the Fed has since said it might accelerate the pace of the taper. While that move creates upward pressure, mortgage rates are unlikely to spike as a result of the taper. However, the Feds changing stance does set the stage for a gradual rise in rates.

How Does The Apr Impact Principal And Interest

Most mortgage loans are based on an amortization schedule: You’ll pay the same amount each month for the life of the loan even though the generated interest will be highest at the beginning of the loan and will taper as the principal decreases. Ultimately, most borrowers appreciate the convenience of a fixed, predictable monthly payment.

Mortgage Rates Typically Fall During Recessions

First off, a recession is defined as a significant decline in economic activity that is spread across the economy and that lasts more than a few months, per the National Bureau of Economic Research .

In simple terms, this means a receding economy as opposed to a growing economy for a sustained period of time.

This could be evidenced by a contraction in the gross domestic product over consecutive quarters.

Basically, consumers curb spending, companies output less product, layoffs happen, and so on. The dynamic shifts from easy money spenders to stingy savers.

As noted, the Fed engineered low interest rates via QE. They purchased hundreds of billions in Treasuries and agency mortgage-backed securities to boost liquidity and encourage lending.

This turned out to be great for the mortgage industry, as interest rates fell to the lowest levels on record.

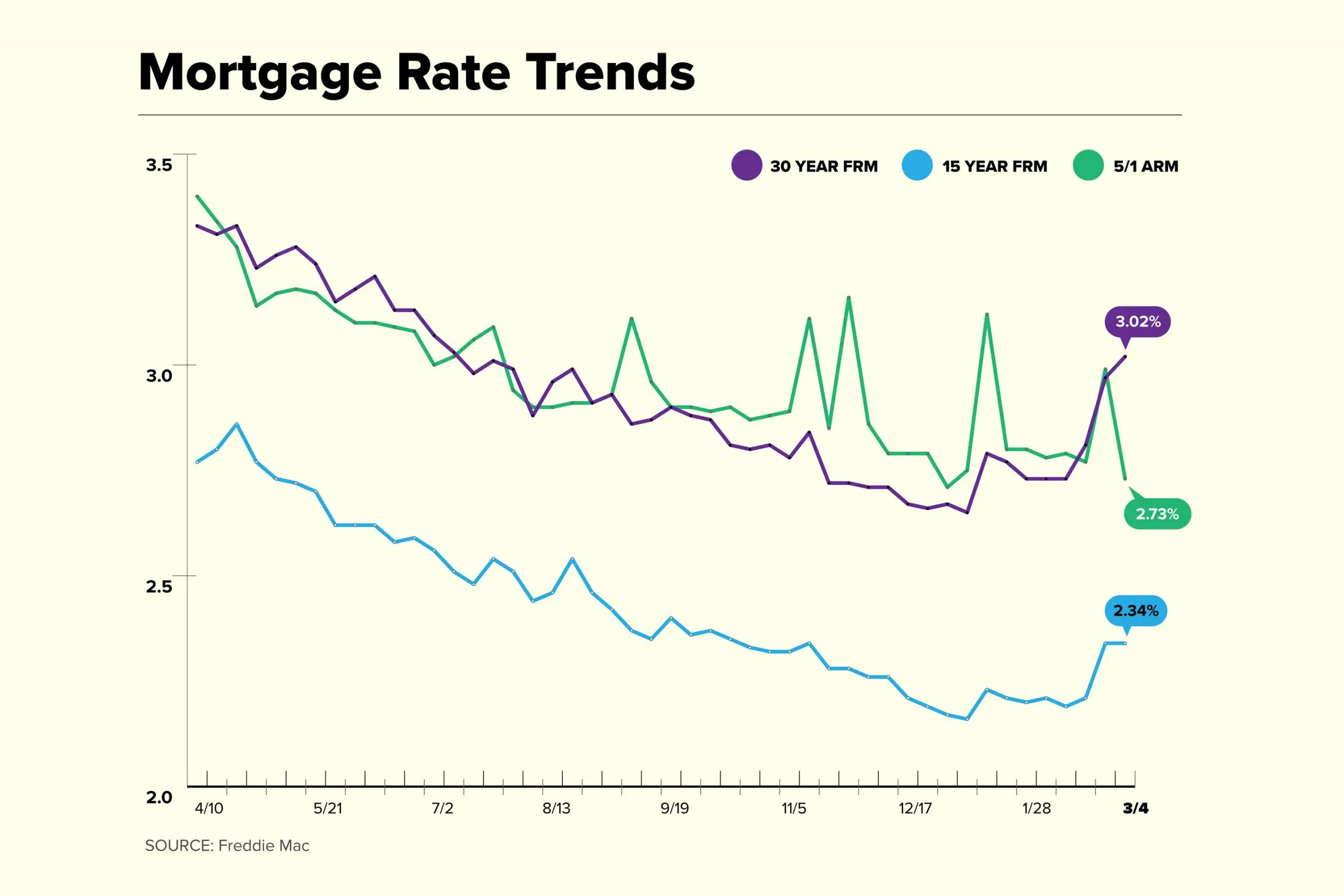

The 30-year fixed hit a mouthwatering low of 2.65% in early 2021, while the 15-year fixed dropped to 2.10% later that year.

We know good things never last and must eventually come to an end. And now we might be paying the price for all those good years.

Recommended Reading: Chase Mortgage Recast Fee

Current 30 Year Mortgage Refinance Rate Declines 012%

The average 30-year fixed-refinance rate is 5.85 percent, down 12 basis points over the last week. A month ago, the average rate on a 30-year fixed refinance was lower, at 5.22 percent.

At the current average rate, youll pay $584.21 per month in principal and interest for every $100,000 you borrow. Thats lower by $7.65 than it would have been last week.

Mortgage Rates Rise Sharply After Three Weeks Of Easing

- Mortgage rates rose sharply this week, after pulling back over the last three weeks.

- The 30-year fixed hit 5.36% Monday and then moved higher again Tuesday to 5.47%, according to Mortgage News Daily.

- Volatility in global markets Monday sent bond yields higher. Mortgage rates follow loosely the yield on the 10-year U.S. Treasury.

Mortgage rates rose sharply this week, after pulling back over the last three weeks.

The 30-year fixed hit 5.36% Monday and then moved higher again Tuesday to 5.47%, according to Mortgage News Daily. Volatility in global markets Monday sent bond yields higher. Mortgage rates follow loosely the yield on the 10-year U.S. Treasury.

The average rate on the popular 30-year fixed loan ended last week at 5.25%. The average rate on the popular 30-year fixed loan ended last week at 5.25%. The last high, three weeks ago, was 5.67%, but the rate dropped as the stock market sold off and bond yields fell.

The jump Tuesday was likely due to data released from the U.S. Manufacturing Index.

“The uptick in the manufacturing index suggests the economy isn’t slamming on the brakes very quickly,” wrote Matthew Graham, COO of Mortgage News Daily on the site.

Mortgage rates, which are much higher than they were at the beginning of the year, have slammed the brakes on the red-hot housing market over the past few weeks. Realtors are reporting lower sales, and mortgage demand to purchase a home is also dropping.

Recommended Reading: Does Prequalifying For A Mortgage Affect Your Credit

Shall I Get A Variable Rate Mortgage

Variable rates are typically a little lower than fixed rates because the borrower takes on the risk of rates changing over time.

Variable rates are expected to remain below 3 percent well into 2023. That’s pretty low, but you could also lock in a 5-year guaranteed fixed rate lower than 3 percent today.

What Happens If Interest Rates Are Negative

Having negative interest rates would be unprecedented in the UK and could impact borrowers and savers alike.

In theory:

- Savers: could be charged to hold money with a bank or building society

- Mortgage customers: could be paid interest by their lender

In practice:

- Savers: rates are unlikely to turn negative because banks and building societies rely on savers to raise money and fund mortgage lending

- Mortgage customers: negative interest rates would lead to some borrowers being on lower but not negative rates due to the way mortgage deals work

Tracker mortgages have their costs set at the base rate plus a certain percentage charged by the lender. For example:

- With the base rate at +0.1% and with a lender charging 2% interest rate on top, the borrowers mortgage rate would be2.1%

- If the base rate were to fall to -0.25%, the rate on the tracker mortgage would be 1.75%. In such a circumstance, lenders may simply withdraw such tracker mortgage deals from the market

- If the base rate rises, your monthly mortgage payments will increase

Find out more about how to calculate inflation to plan for your future.

Recommended Reading: Can You Do A Reverse Mortgage On A Mobile Home

Mortgage Rates: What The Experts Are Saying

With mortgage rates so low, most experts agree the only direction to go is up. The question now: how fast will it happen?

Experts have been saying all year that mortgage rates will continue ticking upwards through the end of 2021. News of the Omicron COVID-19 variant has created fresh economic uncertainty and is putting upward pressure on rates. At the same time, rates are getting downward pressure due to the highest inflation in nearly 40 years. The result is volatility. For example, since November 10th, rates have followed this up and down pattern each week: 3.15% 3.22% 3.24% 3.2% 3.24% and most recently 3.28%.

While experts still expect rates to increase as the economy recovers, the recent volatility could continue through the end of the year and into 2022. Most experts believe increases would be incremental. Were not expecting an overnight shoot up where all of a sudden mortgage rates are at 3.5% or 4%, says Ali Wolf, chief economist at Zonda, a California-based housing data and consultancy firm.

Despite the ups and downs, todays mortgage rates are still close to 1% lower than pre-pandemic levels. So, if you are in the market to refinance or purchase a home, now is a good time to take action. Here is everything you need to know about scoring the best rate and how much it can save you.

Why Its Important To Shop For Multiple Quotes

When youre getting a mortgage, its important to compare offers from a variety of lenders. Every lender will evaluate your financial situation differently. So getting multiple quotes will allow you to choose the offer with the best rate and fees. The rate difference between the highest and lowest rates lenders offer you could be as high as 0.75%, according to a report by the fintech startup Haus.

However, the interest rate isnt the only factor you need to consider when comparing mortgage lenders. The fees each lender charges can vary just as much as the interest rate. So the offer with the lowest rate may not be the best deal if youre paying excessive upfront fees. To compare rates and fees, take a look at the Loan Estimate form that lenders are required to provide within three business days of receiving your application. The Loan Estimate is a standardized form, which makes it easy to compare quotes.

You can visit NextAdvisors comprehensive list of mortgage lender reviews here.

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

% Say Rates Will Go Up

Ken H. Johnson

Real estate economist,Florida Atlantic University

After a confusing week in the bond markets caused by uncertainty brought on by the omicron variant, the 10-year Treasury note market is beginning to react rationally to tightening Fed policies. The yield on the 10-year Treasury notes is rising and long-term mortgage rates will soon follow. Mortgage rates will rise in the coming week.

Greg McBride

Vote: Up. Inflation and omicron will keep mortgage rates yo-yoing up and down within a range.

Robert Brusca

Chief economist,Facts and Opinions Economics,New York

Higher.

Will Homebuyers Be Discouraged By The Higher Rates

While some potential buyers may no longer be able to qualify for a mortgage due to the higher rates, demand isnt expected to drop off of a cliff.

Borrowers are often shocked by the increases, says Mike Villano, the national sales director of Veterans Lending Group. The mortgage lender specializes in Veterans Affairs loans with nearly two dozen locations across the country. Many of his borrowers think rates are still under 3%.

They may not be able to qualify for loans as large as they could have just a few weeks ago now, diminishing their buying power at a time when home prices are still going up. But Villano hasnt seen buyers making any big changes, at least not yet.

If rates do creep up into the mid-4% or even 5% , people will either have to spend less or theyll go into cheaper areas, he says.

Right now, the rise in rates could lead to a short-term burst in interest as those who were thinking of purchasing a home later in the year want to close before rates go up even higher.

Even with high prices and rates, owning a home is still more affordable than renting one in many parts of the country, if buyers can save up the down payment, find a home, and have their offer on it accepted. Nationally, the monthly mortgage payment on a median-priced home is $1,260compared with the typical rent of $1,540, according to NAR. And rents have been rising rapidly over the past year.

Plus, there are more folks reaching peak homebuying years in the market.

Read Also: Rocket Mortgage Payment Options

Will Rates Ever Go Down Again

Brokers also give their views on the growing number of people taking out longer term fixes as a result of increasing rates

UK interest rates achieved all-time lows during the pandemic, but the past several months have seen interest rates climbing once again as the costs of living continue to rise.

Last week, the Bank of England raised its base rate to 1.25%, marking a fifth consecutive rate hike and pushing borrowing costs to their highest in 13 years. The rate rises are an attempt to cool the UKs red-hot inflation, which has reached a 40-year high of 9.1% well above the banks target of 2%.

With inflation expected to rise further to double digits within the year, more rate increases are imminent.

So, is the age of rock bottom rates over?

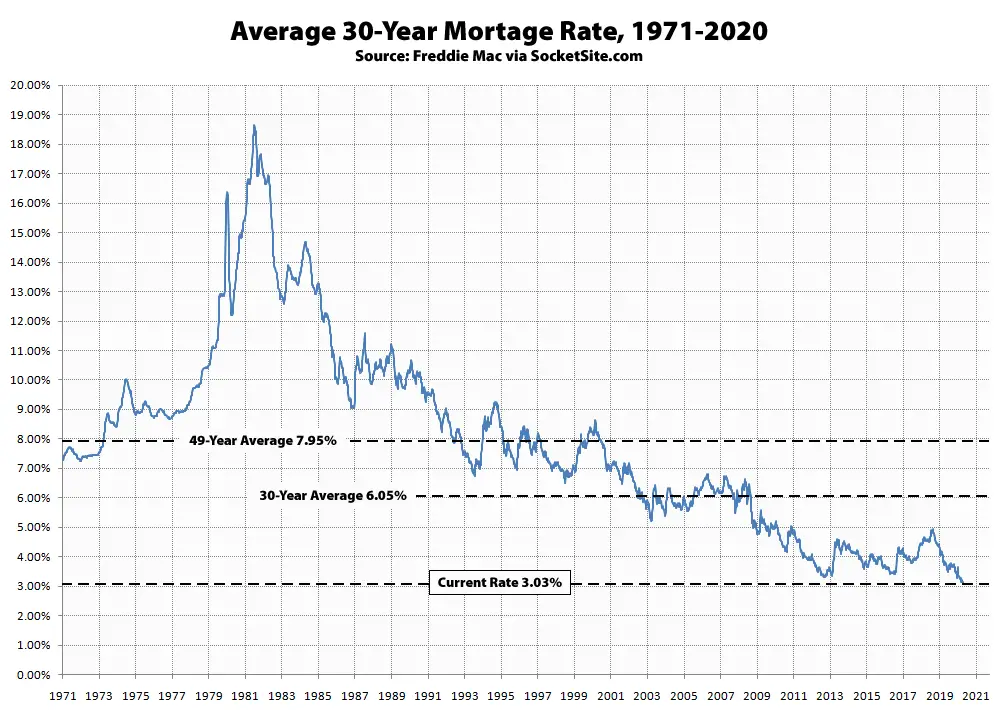

Rates have risen to combat inflation, and this is likely to continue further. To say how much further is conjecture but if you look at rates, historically, we are still well under the average, Robert Payne, director at Langley House Mortgages, commented.

We certainly wont be seeing sub-1% mortgages again, at least any time soon, according to Lewis Shaw, founder and mortgage expert at Shaw Financial Services.

Edward Checkley, managing director at Advias, said that assuming inflation comes down, then rate cuts could be introduced.

However, we feel the time of super low borrowing rates is over, forever, Checkley stressed.

Graham Taylor, managing director at Hudson Rose, thinks the era of low rates is over.

How Will Interest Rate Rises Affect Me

If you have a loan or mortgage that charges you a variable interest rate, you might find that the cost of your repayments go up.

Say you have a £130,000 mortgage that you want to pay off over 25 years. If the interest rate on the mortgage is 2.5%, the monthly repayment will be £583.

But if the interest rate is 0.25% higher the amount we raised Bank Rate in February 2022 the monthly repayment rises by £17 to £600.

If youre on a fixed rate you wont see any change until the end of your fixed period.

Its important to understand how a change in interest rates could impact your ability to pay. You can use a mortgage calculator to work out how your monthly payments might be affected.

If you have savings in a bank account that pays interest then you might see interest rates on your savings go up.

You May Like: Chase Recast Mortgage

What Are Todays Mortgage Rates

Low mortgage rates are still available. Connect with a mortgage lender to find out exactly what rate you qualify for.

1Todays mortgage rates are based on a daily survey of select lending partners of The Mortgage Reports. Interest rates shown here assume a credit score of 740. See our full loan assumptions here.

Selected sources:

Popular Articles

Resources

What This Means For Borrowers

Now that weve discussed likely interest rate trends for the rest of the year, its important that we also share what this means for borrowers and what you can do with this information.

First, if youve thought about refinancing your mortgage, consider doing so sooner rather than later. If experts are correct and mortgage rates rise in June, and throughout the next year, then there isnt likely to be a cheaper time to refinance.

Next, if youve been planning to buy a home and have your finances in order, it may also be worth buying soon, before rates have a chance to increase. By purchasing a home today rather than six months from now, you could potentially be saving yourself tens of thousands of dollars in interest.

But what if youre not quite ready to buy yet?

It can be easy to feel that youre missing out by not buying while rates are low. And yes, waiting to buy might mean a higher interest rate. But ultimately, its better to wait until youre financially ready for a mortgage than to lock in a low interest rate before youre really ready.

And remember, the current market rate isnt the only thing that affects your mortgage rate. Your , debt-to-income ratio, and down payment will all factor into the rate youre able to get.

Read Also: How Does Rocket Mortgage Work

Why Do Interest Rates Impact The Uk Housing Market

Rising interest rates can increase mortgage costs, making repayments more expensive and increasing the overall size of the home loan.

Rising rates can also hit house prices. A one percentage point rise in the base rate could reduce house prices from between 2% and 11% according to Sir Jon Cunliffe, the Bank of Englands deputy governor.

However many experts suggests that the UK housing market is robust enough to weather any rise in interest rates, especially with demand outstripping supply.

Refinancing Will Slow In 2021

As mortgage rates continue to climb, fewer homeowners will be able to save money by refinancing their mortgages.

Were seeing this happen in real time. In February, 18 million homeowners were refinance eligible, that is they could reduce their interest rate by 0.75% or more, according to data from Black Knight, a mortgage technology, data and analytics provider. But as rates surged above 3%, the number of eligible candidates shrunk to just 12.9 million homeownersa 30% reduction in less than a month.

The MBA predicts that refinancing volume will fall from $2.149 trillion in 2020 to $1.191 trillion in 2021, mainly due to rising rates. There will be an even sharper decline of refinancing volume in 2022 to $573 billion, according to MBAs latest forecast. The refinance share of all mortgage originations is predicted to drop to 41% in 2021 from 57% in 2020.

Refinance activity will depend on rates. Even if rates rise a few basis points above where were at now, we can expect a pretty robust refi demand market in 2021, says Odeta Kushi, deputy chief economist for First American Financial Corporation, a title insurance provider. There are still many homeowners who can save money by refinancing.

As rates rise, the pool of people who can save money by refinancing their mortgage will start to shrink again. If rates hit 3.13%, 6.2 million borrowers will no longer be able to cut costs with a new mortgage.

Read Also: Mortgage Recast Calculator Chase