Choose A House You Can Handle

Being a homeowner means you cant call a landlord to fix a broken water heater or bust pipe. Beyond the upfront costs and monthly mortgage payments, be prepared to cover home repairs and upgrades. You may also have to open up your wallet for furniture and decor. So, be sure to buy a house that you can afford to furnish and maintain.

What Is A Mortgage Preapproval

When youre shopping for a mortgage, you can compare options offered by different lenders.

Mortgage lenders have a process which may allow you to:

- know the maximum amount of a mortgage you could qualify for

- estimate your mortgage payments

- lock in an interest rate for 60 to 130 days, depending on the lender

The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization. Different lenders have different definitions and criteria for each step they offer.

During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

This process does not guarantee your approval for a mortgage.

Start With A Better Homebuying Experience

At Better Mortgage, we know buying a home can be an overwhelming endeavor. Thats why were dedicated to making the entire homebuying and mortgage process faster, simpler, and less expensive.

Weve partnered with real estate agents across the country that can help make your homeownership dreams a reality.

Our Better Real Estate agents:

- Provide personalized guidance, not pushy sales tactics

- Help you secure affordable financing whether thats through Better or another lender

- Connect you with our trusted network of providers, such as home inspectors, appraisers, insurance agents, contractors, and more

When youre ready to look for homes, we can help you move fast by issuing you an official pre-approval letter online in minutes. Getting amortgage pre-approvalshows sellers youre a serious buyer. The pre-approval can also help solidify your homebuying budget and increase the likelihood that your offer will be accepted.

Our entire mortgage process from application through funding is 100% online, so updates are always just a few clicks away. Using a combination of effective technology and financial savvy, we can originate your loan for less money, and we pass those savings on to you. In fact, with Better Mortgage, youll never have to pay unnecessary lender fees or loan officer commissions, leaving you with more cash for your new place.

Are you ready to see how much you qualify for so you can find your dream home? Get pre-approved today.

Recommended Reading: How Much Mortgage Can I Get With 50k Salary

Bring The Bank To You

Use secure online and mobile banking to deposit checks, pay bills, send money to friends and more.

Clients using a TDD/TTY device:1-800-539-8336

Clients using a relay service:1-866-821-9126

Save a little more. Check yourbalance a little more often. Takeone step closer to where youwant to be.

Save a little more. Check yourbalance a little more often. Takeone step closer to where youwant to be.

Save a little more. Check yourbalance a little more often. Takeone step closer to where youwant to be.

Clients using a TDD/TTY device:1-800-539-8336

Clients using a relay service:1-866-821-9126

Why Use The Maximum Mortgage Calculator

Once you input your monthly obligations and income, the Maximum Mortgage Calculator will calculate the maximum monthly mortgage payment that you can afford, based on your current financial situation. This calculator will also help to determine how different interest rates and levels of personal income can have an effect on how much of a mortgage you can afford.

Recommended Reading: When Is A Reverse Mortgage Good

How Much Is A 150k Mortgage Per Month

If youre looking at a $150,000 mortgage, your monthly payment will be about $725. This is based on a 3% interest rate and a 30-year term. Your monthly payment may be different depending on the interest rate, loan term, and other factors. You may go through this guide to know all the nitty-gritty details about mortgage payment calculation.

How Long Does Prequalification Or Preapproval Take

Aside from their distinct roles in homebuying, prequalification and preapproval can take different amounts of time. Prequalifying at Bank of America is a quick process that can be done online, and you may get results within an hour. For mortgage preapproval, youll need to supply more information so the application is likely to take more time. You should receive your preapproval letter within 10 business days after youve provided all requested information.

You May Like: Can I Be Approved For A Mortgage

Calculating Your Mortgage Payment

This mortgage calculator can answer some of the most challenging questions in the home search journey, short of talking to a lender, including what kind of payment can I afford? How much do I need to make to afford a $500,000 home? And how much can I qualify for with my current income?

We’re able to do this by not only considering the loan amount and interest rate but the additional factors that affect your ability to qualify for a mortgage. We include your other debts and liabilities that have to be paid each month and costs like taxes and homeowner’s insurance that are part of the monthly mortgage payment. Doing so makes it easy to see how changes in costs and mortgage rates impact the home you can afford.

While determining mortgage size with a calculator is an essential step, it won’t be as accurate as talking to a lender. Get pre-approved with a lender today for exact numbers on what you can afford.

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross household income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs â mortgage principal and interest, taxes and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Recommended Reading: What Does The Bank Need For A Mortgage

Overcoming The Challenge Of A Low Credit Score

In general, you want the highest credit score possible when you apply for a mortgage. That will help you get a low interest rate, which saves you money over the life of your loan. At a minimum, you usually need a FICO score of 620 or higher to qualify for a traditional fixed-rate mortgage.

However, if you are applying for an FHA loan, you can qualify with a much lower score. If you plan on having a 3.5% down payment, you can qualify with a FICO of 580 or above. In addition, if you can put 10% down, then you can have a score as low as 500.

Important note about putting less than 20% down

If you put less than 20% down on a mortgage, your mortgage lender will require you to pay Private Mortgage Insurance each month on your mortgage until you pay off 20% of the value of your home. PMI is special insurance that lenders apply when your Loan-to-Value Ratio is less than 80%.

Once you pay off 20% of your homes value to get below 80% LTV, you will no longer need to pay PMI. Your monthly payments would be reduced.

Let’s Start With The Basics

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage. Enter an income between $1,000 and $1,500,000.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

Selecting your province or territory helps us personalize your mortgage results.

Enter your total monthly payments towards any car loans, student loans or personal loans.

You May Like: Is 5.375 A Good Mortgage Rate

What Does This Possibly Mean For Me

Based on your income, expenses, and the loan you selected, the amount above represents the most you will likely be comfortably able to pay for a home. This assumes that your total costs for your loan payments , taxes, and insurance should not be higher than 45% of your monthly income. Also, remember that you’ll have additional homeownership costs that you may need to factor into your monthly budget, including insurance, association fees, and maintenance expenses.Mortgage insurance expenseswhich you may have to pay if your down payment is less than 20%are not included in this calculation. We suggest that all buyers get pre-qualified or pre-approved prior to starting their new home search.

You selected an adjustable rate mortgage or ARM. Based on your income, expenses, and the loan you selected, the amount above represents the most you can comfortably afford to pay for a home*. This assumes that your total costs for your loan payments , taxes, and insurance should not be higher than 45%. Also, remember that you’ll have additional homeownership costs that you may need to factor into your monthly budget, including insurance, association fees, and maintenance expenses. Mortgage insurance expenseswhich you may have to pay if your downpayment is less than 20%are not included in this calculation. We suggest that for all buyers to get pre-qualified prior to starting their new home search.

Fixed Rate Vs Adjustable Rate

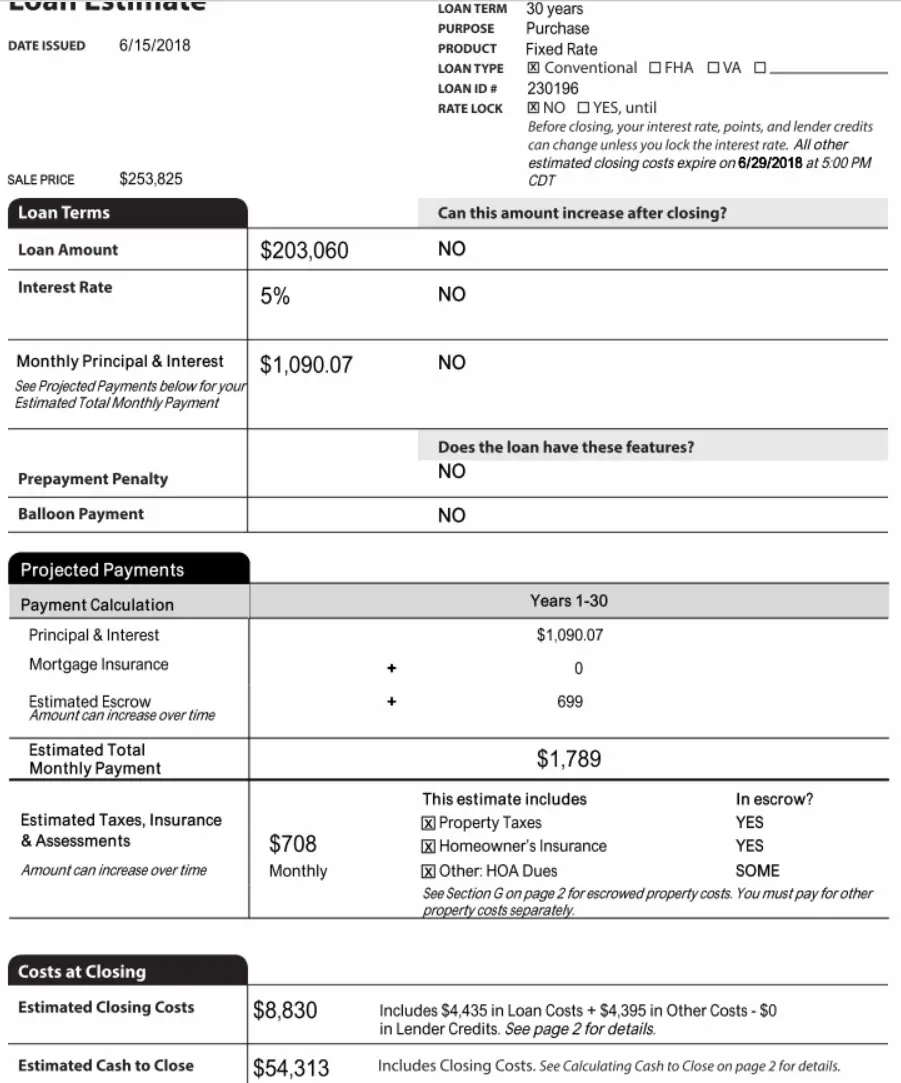

A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment.

Also Check: How To Figure Out How Much A Mortgage Would Be

Consider All Mortgage And Housing

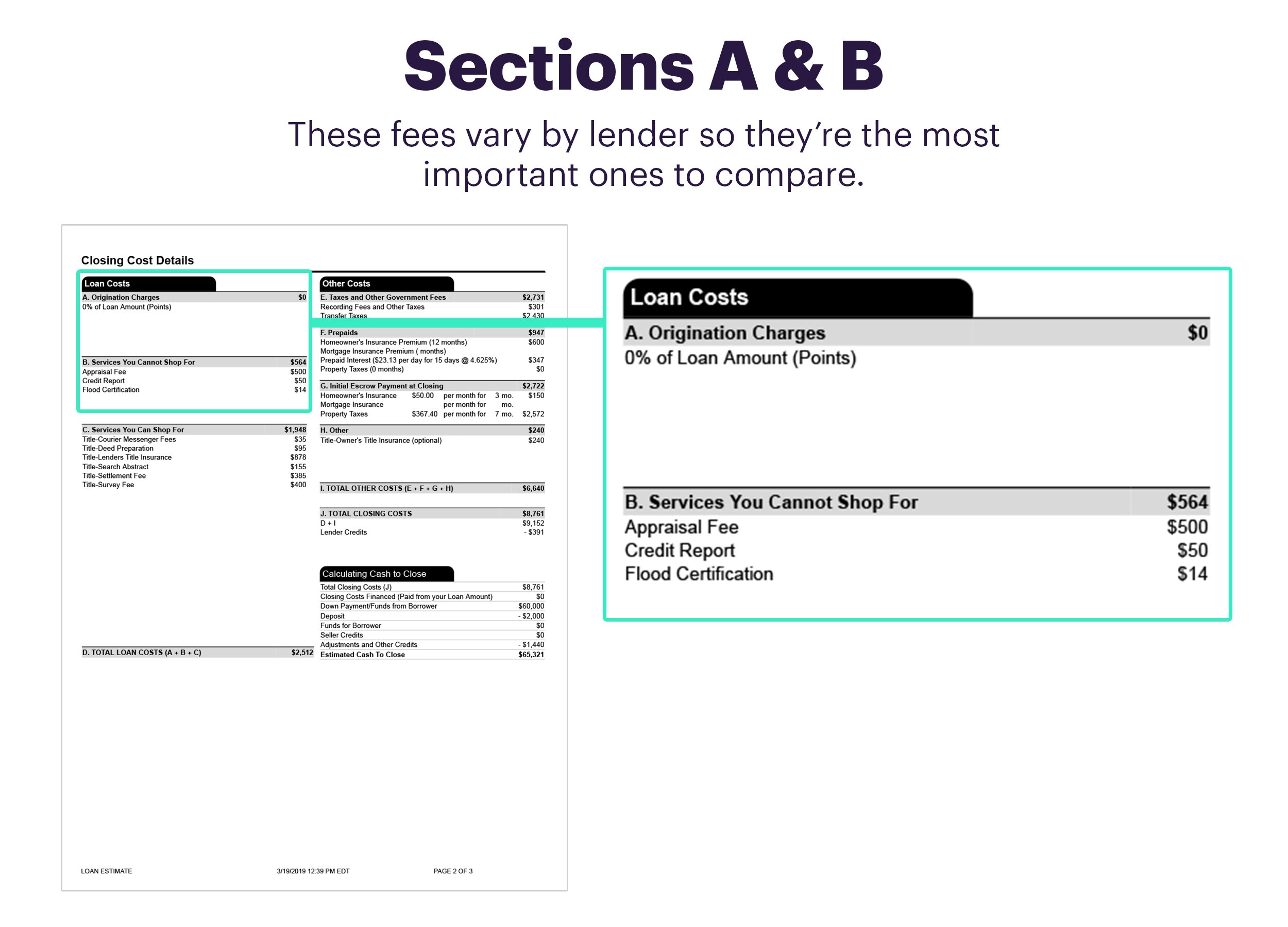

Getting a mortgage means more than just a new monthly payment. Youll want to consider all the upfront and ongoing costs that are associated with your mortgage and housing costs, too. When budgeting, you should factor in your down payment,closing costs, principal payment, interest on your loan, property taxes, and homeowners insurance. You may also have to factor inprivate mortgage insurance or a homeowners association membership, depending on your situation.

How Much House Can I Afford

Even though you may qualify for the amount listed above, it may not be suitable for you. You should review your personal situation, and work with your nancial advisor, to decide how much you can comfortably aord to borrow. Subject to individual program loan limits.

Your debt-to-income ratio is calculated by adding up all of your monthly debt payments and dividing them by your gross monthly income. Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out. For example, if you pay $1500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2000 . If your gross monthly income is $6000, then your debt-to-income ratio is 33 percent .

Results of the mortgage aordability estimate/prequalication are guidelines the estimate is not an application for credit and results do not guarantee loan approval or denial.

Tools and calculators are provided as a courtesy to help you estimate your mortgage needs. Results shown are estimates only. Speak with a Chase Home Lending Advisor for more specific information. Message and data rates may apply from your service provider.

For the Adjustable-Rate Mortgage product, interest is fixed for a set period of time, and adjusts periodically thereafter. At the end of the fixed-rate period, the interest and payments may increase. The APR may increase after the loan consummation.

Read Also: What Does It Take To Become A Mortgage Broker

Major Factors That Influence Mortgage Eligibility

When qualifying for a mortgage, lenders rely on standard indicators that determine whether a borrower can repay a loan. These financial factors also influence how much they are willing to lend borrowers. Lenders will thoroughly evaluate your income and assets, credit score, and debt-to-income ratio.

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Read Also: What Do I Need For A Mortgage Pre Qualification

Explore All Of Your Mortgage Options

Believe it or not, there are severaltypes of mortgage loansavailable to homebuyers. You may want to explore conventional mortgages,FHA loans, and other government-backed financing options, like VA or USDA loans, to help determine which may be right for your situation. There are also manyfirst-time homebuyer resources, which could reduce your upfront costs or help you more easily qualify.

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

Don’t Miss: How Do You Figure Out Your Mortgage Payment

Learn More About The Benefits Of Prequalification And Preapproval

As you look for a home, you may be asked to get prequalified or preapproved. Before you start, its important to understand the difference.

When you want to talk to a lender to establish a general range of home prices, you can get prequalified, which is simply a lenders estimate of what you could potentially borrow.

This can be completed easily and conveniently online, in person, or over the phone in just a few minutes with basic information like your income and expected down payment.

When you want to give yourself a competitive edge over other buyers in the market, you can get preapproved. Having a preapproval lets sellers know that you already qualify for the home financing which greatly increases your chance of having your offer selected.

Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay stubs, bank statements and tax returns.

The lender will then use these documents to determine exactly how much you can be preapproved to borrow.

Once youre preapproved, youll have 90 days to find a home you love. Then you can lock your rate and complete your application.

Whether you choose to get prequalified or preapproved, you will have a better sense of whats in your price range and can hunt for a house with confidence.

Estimate How Much House You Can Afford

To help you get started, you can use our calculator on top to estimate the home price, closing costs, and monthly mortgage payments you can afford based on your annual income. For our example, lets suppose you have an annual income of $68,000. Youre looking to get a 30-year fixed-rate loan at 3.25% APR. For your down payment and closing costs, youve saved $55,000. See the results below.

- Annual income: $68,000

| Total Monthly Mortgage Payment | $1,587 |

Based on the table, if you have an annual income of $68,000, you can purchase a house worth $305,193. You may qualify for a loan amount of $252,720, and your total monthly mortgage payment will be $1,587. Since your cash on hand is $55,000, thats less than 20% of the homes price. This means you have to pay for private mortgage insurance . Take note: This is just a rough estimate. The actual loan amount you may qualify for may be lower or higher, depending on your lenders evaluation.

The following table breaks down your total monthly mortgage payments:

| Monthly Payment Breakdown | |

|---|---|

| Total Monthly Mortgage Payment | $1,587 |

According to the table, your principal and interest payment is $1,099.85. When we add property taxes and home insurance, your total monthly mortgage payment will be $1,481.34. But because you must pay PMI, it adds $105.30 to your monthly payment, which results in a total of $1,587 every month.

Read Also: How To Determine My Mortgage Payment