Budget For Mortgage Set

Mortgage set-up fees typically include the product arrangement fee and booking fee. To determine the mortgages annual interest calculation, lenders include valuation fees and redemption fees. The valuation fees are often referred to as the overall cost for comparison. When you apply for a mortgage, all your fees must be specified under the key facts illustration. This is a document prepared by the lender to outline the details of your mortgage and what they recommend during the early stages of application.

Take note of the following fees when you apply for a mortgage:

You May Like: Can You Get A Reverse Mortgage On A Condo

What Is Principal And Interest

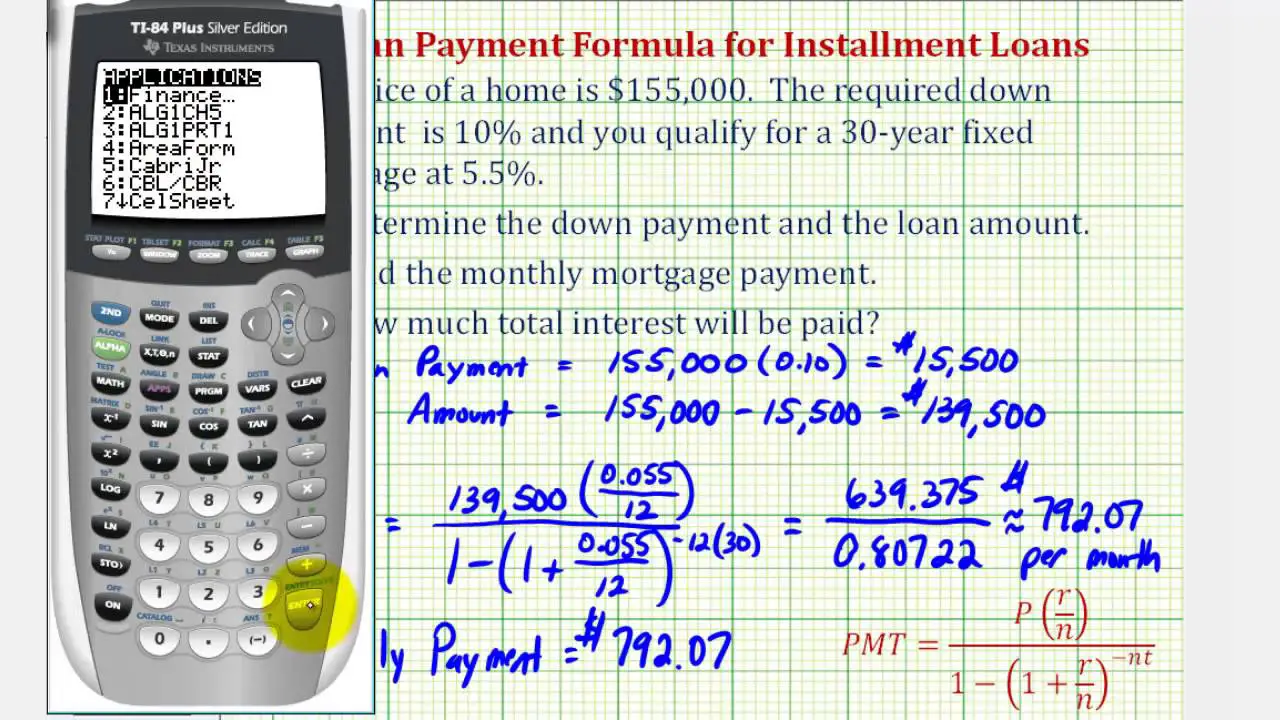

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

Get Prequalified Or Preapproved

Being prequalified or conditionally approved for a mortgage is the best way to know how much you can borrow. A prequalification gives you an estimate of how much you can borrow based on your income, employment, credit and bank account information. To move things along, consider getting preapproved once youve found a house. This step takes longer than prequalification but shows buyers you’re serious. If you decide to go this route, you’ll need to provide your lender with several financial documents, including:

- W-2s for the past two years

- Pay stubs for the last 30 days

- Bank statements for two to three months

- Balances on any retirement or investment accounts

- Monthly debts, such as car payments, student loans and credit cards

- Divorce documents, if applicable, including child support and alimony

- Gift letters, if you’re receiving gift money from family or friends

If you plan to co-sign on a mortgage with your spouse or anyone else, they’ll also need to provide copies of their financial records. The result is a valuable negotiating tool, especially in a sellers market where buyers are competing for homes.

Read Also: Rocket Mortgage Loan Types

Should I Take Out A 15

The loan payment calculator can also help you determine your loan terms. Just enter your expected home price and interest rate, and see what the costs come to for both a 15-year and a 30-year term.

- The 30-year term will come with a lower monthly payment, but youll pay more in interest over time.

- The 15-year loan will mean less in interest, though youll have a higher monthly payment.

The right decision depends on your budget and what you can manage financially, given your income and existing debts.

What Factors Impact The Amount You Can Borrow

Lenders consider several factors in determining the amount you qualify for, including:

-

Your debt-to-income ratio. Our How much can I borrow calculator? depends on an accurate input of your income and recurring debt. Youll want to really hone those figures down to a fine point, because lenders will be using them too.

-

Your loan-to-value ratio. This ratio is a function of the amount of money you put down. If you want to drill down on this calculation, use NerdWallets loan-to-value calculator.

-

Your credit score. This number impacts the pricing of your loan, more than how much youll qualify for. But thats really important. If you dont know your score, get it here.

Read Also: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

How To Calculate Your Mortgage Repayments

Gauging the approximate cost of your monthly repayments using our mortgage calculator is easy. First, simply input in the total amount that you think youll need to borrow and detail how many years you would like the loan over normally for new mortgages for first-time buyers this will be around 25 years, however more lenders are now happy to offer mortgages over periods of up to 40 years.

Next, you need to specify the interest rate in order to calculate your monthly mortgage repayments. If you have no idea of the mortgage interest rate, you can always take a look at our mortgage comparison charts to get an idea of the deals currently available for your needs and circumstances.

Finally, our mortgage repayments calculator will need to know what type of loan repayment you need: capital and interest or interest only. Dont panic if you arent sure. Simply put, capital and interest repayments mean that each month you pay off a proportion of the sum borrowed plus interest, while interest only means that you are just paying off the monthly interest on your loan without ever repaying the sum youve borrowed. To find out more about the different types of mortgage repayment options and those that may be suitable for you check out our handy guide: Repayment and interest-only mortgages explained.

Why Should I Use A Mortgage Calculator

Also Check: Rocket Mortgage Vs Bank

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Do Mortgage Calculators Require A Credit Check

No, our mortgage calculator simply uses the information you enter to calculate how much you might be eligible to borrow, along with the value of a home you could afford. You wont even be required to enter your name.

Only when you apply for a mortgage will you undergo a full credit check, which will be marked on your file and potentially impact your credit score.

You May Like: 10 Year Treasury Vs 30 Year Mortgage

How Much Mortgage Can I Qualify For

The question of how much mortgage one can qualify for can often be a trap as it is a question that will vary from lender to lender. While many lenders cap the amount that you are able to borrow at maximum debt to income ratio of 28%, some completely disregard that limit by setting the amount that they are willing to let you borrow for up to 30% or 40%. While at first, it may seem like an attractive option to take advantage of the larger mortgage offered, in the long run, it may backfire in the long-run.

While this may seem counterintuitive to some, for other the reason for this will seem relatively easy to understand. Regardless of what your lender can provide you with, your budget is something that you should know and be aware of. For most people, spending 30% or 40% on just their mortgage will simply end up being unreasonable, and sooner or later they will likely default on their payment as they will be unable to contribute that much towards their home. Therefore, just because you are able to qualify for a mortgage of a certain amount it does not necessarily mean that you should. Instead try to keep to some of the general principles of what your monthly mortgage payment should be, as in the long run that will surely benefit you.

How Do You Calculate Loan With Points

Calculate your origination points. For example, if you are obtaining a $200,000 mortgage and you are required to pay 1.5 percent in origination, simply multiply the fractional equivalent of this percentage by the total loan amount. In this case your origination is $3,000. Calculate your discount points, if you choose to pay them.

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

What You Can Learn From A Mortgage Loan Payment Calculator

With a mortgage loan payment calculator, you can determine:

- Your monthly payment

- The total cost of your loan over time

- The total amount of interest youll pay to borrow the money

This can help you make a smarter, more informed decision for your finances.

Mortgage loan payment calculators arent just for homebuyers, either. You can use one when considering a home equity loan, HELOC, or refinance to help gauge your options and calculate your costs.

Tip:

Learn More: Mortgage Points: What Are They and Are They Worth It?

How Much Mortgage Can I Afford

A good method of determining the amount that you can afford to take on as a home loan is by following the 28%/36% rule. According to this rule, no more than 28% of your gross monthly income should be spent on home-related costs. These costs relate to not only your mortgage payments but also to your home insurance costs and taxes. The 36% on the other hand refers to the relation between your home debt and other debts. Therefore, according to this rule, your mortgage should not amount to more than 36% of your total debts. By following this rule, you are very likely to get an affordable mortgage. Apart from doing the math yourself and applying this principle based on your situation, you can also use an online affordability calculator to determine whether the house that you are looking to purchase with a mortgage is one that you can afford on your income.

Some of the factors that will affect how much mortgage you can afford include:

- Your income

- Your expenses

- Your credit scores

Oftentimes all of the above will also be used by your lender to determine whether you should be approved for the mortgage that you are requesting. Therefore, being aware of all of these can help you calculate better the amount that you can borrow for a home without risking your finances.

Also Check: Rocket Mortgage Loan Requirements

How Much Of A Mortgage Can I Afford Based On My Salary

Your salary is your main tool for repaying your monthly mortgage payments and as such ensuring that you have taken on an affordable mortgage should be a top priority when looking at what home you would like to purchase.

Some good principles to follow to ensure that your home is within the realm of affordable include the following:

1. Ensuring that your home expenses, that is your mortgage payment, insurance cost and taxes do not amount to more than 28% of your gross annual salary

2. Getting a mortgage that is only 2 to 2.5 times more than your gross annual salary.

While both of these principles will assist you with borrowing from your lender an amount that you can repay, there are other aspects of your budget that you should consider when deciding on the amount that you are willing to borrow. Life expenses and more importantly debts can be incredibly big factors in assessing the amount that you can spend on your mortgage. This is why the following two rules which relate both to your debts and your salary can also help you steer away from getting a home loan that is way above your means.

1. Ensuring that your mortgage payment does not amount to more than 36% of your total debt.

2. Ensuring that your total debts dont exceed 43% of your gross annual income.

Diy Extra Payment To Prepay Mortgage

Lets say you want to budget an extra amount each month to prepay your principal. One tactic is to make one extra mortgage principal and interest payment per year. You could simply make a double payment during the month of your choosing or add one-twelfth of a principal and interest payment to each months payment. A year later, you will have made 13 payments.

Make sure you earmark any additional principal payments to go specifically toward your mortgage principal. Lenders typically have this option online or have a process for earmarking checks for principal payments only. Ask your lender for instructions. If you dont specify that the extra payments should go toward the mortgage principal, the extra money will go toward your next monthly mortgage payment, which wont help you achieve your goal of prepaying your mortgage.

Once you have built sufficient equity in your home , ask your lender to remove private mortgage insurance, or PMI. Paying down your mortgage principal at a faster rate helps eliminate PMI payments more quickly, which also saves you money in the long run. You can also refinance your mortgage to eliminate PMI altogether.

Read Also: Chase Recast Calculator

Want To Pay Your Loan Off Quicker

With strong property prices, its not uncommon for people to take out loans extending beyond 25 years. However, with the rise of technology and automation, who knows what the world would look like in a quarter century? Paying extra on your home means your balance is lower today AND your balance is lower tomorrow. The earlier you make mortgage overpayments, the more interest expense you will save.

Making early overpayments reduces your balance for the duration of the loan. Just take note of early repayment charges . Some lenders allow you to overpay up to a certain amount before prompting early repayment penalty fees. These fees can range between 1% to 5% of your loan amount. Be sure to make qualified overpayments to avoid this extra cost.

Suppose you want to pay off your loan in 15 years. Your original mortgage has with a 25-year term. To estimate the overpayment amount you need to make, adjust the above calculator to 15 years. For example, a £180,000 loan structured over 25 years will see you pay £56,581.78 in interest over the life of the mortgage. However, if you pay off the loan within 15 years, your monthly payment would jump from £788.61 to £1,182.51. See the example in the table below.

Loan Amount: £180,000

| £56,581.78 | £32,851.43 |

Which Home Mortgage Option Is Right For You

With so many mortgage options out there, it can be hard to know how each would impact you in the long run. Here are the most common mortgage loan types:

- Adjustable-Rate Mortgage

- Federal Housing Administration Loan

- Department of Vertans Affairs Loan

- Fixed-Rate Conventional Loan

We recommend choosing a 15-year fixed-rate conventional loan. Why not a 30-year mortgage? Because youll pay thousands more in interest if you go with a 30-year mortgage. For a $250,000 loan, that could mean a difference of more than $100,000!

A 15-year loan does come with a higher monthly payment, so you may need to adjust your home-buying budget to get your mortgage payment down to 25% or less of your monthly income.

But the good news is, a 15-year mortgage is actually paid off in 15 years. Why be in debt for 30 years when you can knock out your mortgage in half the time and save six figures in interest? Thats a win-win!

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

How To Calculate The Total Cost Of Your Mortgage

Once you have your monthly payment amount, calculating the total cost of your loan is easy. You will need the following inputs, all of which we used in the monthly payment calculation above:

- N = Number of periods

- M = Monthly payment amount, calculated from last segment

- P = Principal amount

To find the total amount of interest you’ll pay during your mortgage, multiply your monthly payment amount by the total number of monthly payments you expect to make. This will give you the total amount of principal and interest that you’ll pay over the life of the loan, designated as “C” below:

- C = N * M

- C = 360 payments * $1,073.64

- C = $368,510.40

You can expect to pay a total of $368,510.40 over 30 years to pay off your whole mortgage, assuming you don’t make any extra payments or sell before then. To calculate just the total interest paid, simply subtract your principal amount P from the total amount paid C.

- C P = Total Interest Paid

- C P = $368,510.40 – $200,000

- Total Interest Paid = $168,510.40

At an interest rate of 5%, it would cost $168,510.40 in interest to borrow $200,000 for 30 years. As with our previous example, keep in mind that your actual answer might be slightly different depending on how you round the numbers.