Why You Should Wait To Buy A Home

Along the same lines of thinking, you might consider holding off on buying the house.

The bigger the down payment you can bring to the table, the smaller the loan you will have to pay interest on. In the long run, the largest portion of the price you pay for a house is typically the interest on the loan.

In the case of a 30-year mortgage the loanâs interest can add up to three or four times the listed price of the house . For the first 10 years of a 30-year mortgage, you could be paying almost solely on the interest and hardly making a dent in the principal on your loan.

Thatâs why it can make a significant difference if you make even small extra payments toward the principal, or start with a bigger down payment .

If you can afford a 15-year mortgage rather than a 30-year mortgage, your monthly payments will be higher, but your overall cost will be drastically lower because you wonât be paying nearly so much interest.

Budget For Mortgage Set

Mortgage set-up fees typically include the product arrangement fee and booking fee. To determine the mortgages annual interest calculation, lenders include valuation fees and redemption fees. The valuation fees are often referred to as the overall cost for comparison. When you apply for a mortgage, all your fees must be specified under the key facts illustration. This is a document prepared by the lender to outline the details of your mortgage and what they recommend during the early stages of application.

Take note of the following fees when you apply for a mortgage:

The Importance Of Credit Scores For Mortgage Applications

To assess your financial records, lenders usually use three major credit reference agencies . These are Experian, Equifax, and TransUnion. While there are other CRAs, these are most preferred by lenders across the UK. Out of the three, Equifax is the largest credit reference agency used by most lending institutions.

UK Experian credit scores range between 0 to 999, with good credit ratings from 881 to 960. If youre aiming for an excellent rating, your credit score must fall between 961 to 999. As for Equifax, the scoring system starts from 0 to 700, with a good credit rating from 420 to 465. To get an excellent Equifax rating, your credit score should be between 466 to 700. Meanwhile, credit scores for TransUnion range from 0 to 710, with a good credit rating from 604 to 627. If you want an excellent TransUnion rating, your credit score must fall between 628 to 710.

To distinguish different CRA ratings between major credit agencies, refer to the chart below:

| Borrowers likely declined by lenders, usually gets mortgages with high rates. |

Here are several steps to improve and maintain your credit score:

Don’t Miss: Can I Refinance My 2nd Mortgage

Why Use The Maximum Mortgage Calculator

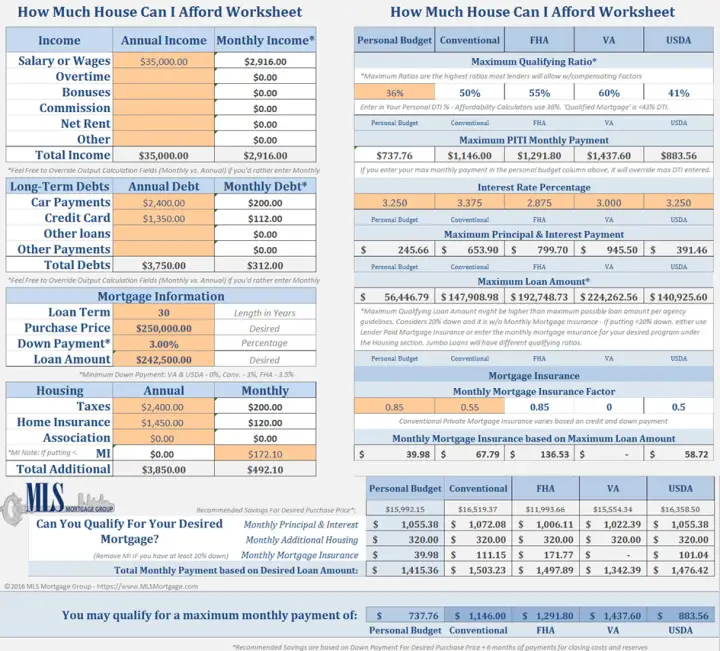

Once you input your monthly obligations and income, the Maximum Mortgage Calculator will calculate the maximum monthly mortgage payment that you can afford, based on your current financial situation. This calculator will also help to determine how different interest rates and levels of personal income can have an effect on how much of a mortgage you can afford.

To Calculate Your Total Debt Service Ratio:

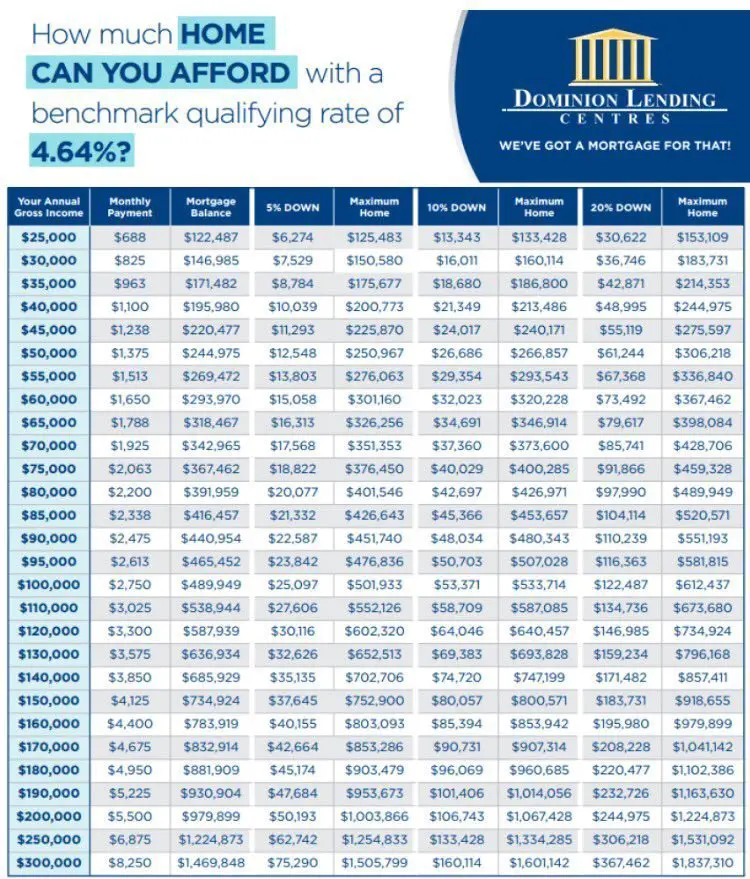

Now, on top of your housing costs listed above, lets assume your non-housing related debts come in at $800 per month . Your TDS ratio would fall within the limit, at 41%.

When it came to buying my own place, I was well within these numbers, but how much I could end up spending on a new mortgage still made me squeamish. Already in my 40s, shouldnt I be paying off my mortgage instead of adding to it?

Thats not reality, says Calla. As difficult as it might be, she says its important to not compare yourself to others. Make the decisions that best suit your lifestyle and goals.

Read Also: How To Qualify For A Va Loan Mortgage

What Can I Afford

Thank you for taking the time to complete our calculator. Based on the information your entered, your results are illustrated in the table below.

For more information, visit us at www.scotiabank.com/mortgage to locate your nearest branch or Home Financing Advisor.

| You can afford a home with: |

|---|

| A maximum purchase price of: 256,192.54 |

| Based on… |

| A minimum down payment of: 250,075.56 |

| A monthly payment of:1,600.00 |

| A total mortgage amount of: 12,810.00 |

| Includes mortgage default insurance premium of $6,693.02 |

For the purposes of this tool, the default insurance premium figure is based on a premium rate of 4.0% of the mortgage amount, which is the rate applicable to a loan-to-value ratio of 90.01% 95.00%. However, the insurance rate for your scenario may be higher or lower than this, which would normally result in a higher or lower insurance premium, respectively. Current premium rates may be found at https://www.cmhc-schl.gc.ca/en/co/moloin/moloin_005.cfm.

A maximum purchase price that is over $1,000,000 will use 20% minimum down payment for illustrative purposes, however a higher percentage may be required by your lender. Speak to your lender for exact amount.

Show The Seller Youre Making A Serious Offer

Youve probably heard of earnest money, but maybe you arent quite sure what it is. Think of it as your security deposit.

Earnest money tells the seller youre serious about buying their home. If you follow through with the contract, the money will be applied to your purchase. If you break the terms of the contract, you risk forfeiting the money to the seller.

There is no minimum requirement for earnest money. Youll negotiate an amount with the seller. Then, within a few days of the seller accepting your offer, youll deposit the earnest money into an escrow account.

Read Also: Does Prequalifying For A Mortgage Hurt Credit

Calculator: Start By Crunching The Numbers

Input these numbers into our Home Affordability Calculator to get a clear idea of your homebuying budget.

How Much Of A Down Payment Do You Need For A House

A 20% down payment is standard, if you can afford it. Though some mortgage loans may only require as little as 3.5 percent down, or none at all, a larger down payment will have a greater impact on your monthly mortgage payment.Your down payment effectively reduces the total amount of your home loan, which increases your home affordability estimate, and at the same time, decreases your mortgage payment each month. For example, below is a chart showing how a certain level of down payments, based on a percentage of the sale price, directly impacts your monthly mortgage payment :

| Percentage |

|---|

List out your expenses and then add them together to get your total monthly spending.

Don’t Miss: How Much Would I Get Pre Approved For A Mortgage

A Home Affordability Calculator Doesnt Tell You:

- Whether the lender will approve you for financing at the sales price shown

- What your final mortgage interest rate or closing costs will be

- How much your payment might vary based on your actual credit score

The bottom line: While the home affordability calculator gives you an idea of what you might qualify for, youre better off getting a mortgage preapproval if youre looking for a dollar amount based on your unique financial circumstances.

MORTGAGE CALCULATOR TIP

Our calculator is pre-set to a conservative 28% DTI ratio. You can slide the bar up to an aggressive 50% DTI ratio to see how much more home you can buy. However, be sure your budget can handle the extra debt lenders dont look at expenses like utilities, car insurance, phone bills, home maintenance or groceries when they qualify you for a home loan. Lenders may also require a higher credit score, or extra mortgage reserves to cover a few months worth of mortgage payments, if the high payment becomes unaffordable.

Help To Buy Equity Loan

The equity loan scheme finances the purchase of newly built houses. You can borrow a minimum of 5% and a maximum of 20% of the propertys full price. As a requirement, you must make a 5% deposit and obtain a mortgage to shoulder 75% of the loan. The house must also be bought from a builder recognized by the program. As an advantage, interest is not charged during the first 5 years of the equity loan. For more information on this government scheme, visit the Help to Buy equity loan page.

Recommended Reading: What Is Refinancing Your Mortgage

How Much Is A Downpayment On A 300k House

If you are purchasing a $300,000 home, youd pay 3.5% of $300,000 or $10,500 as a down payment when you close on your loan. Your loan amount would then be for the remaining cost of the home, which is $289,500. Keep in mind this does not include closing costs and any additional fees included in the process.

How Will My Debt

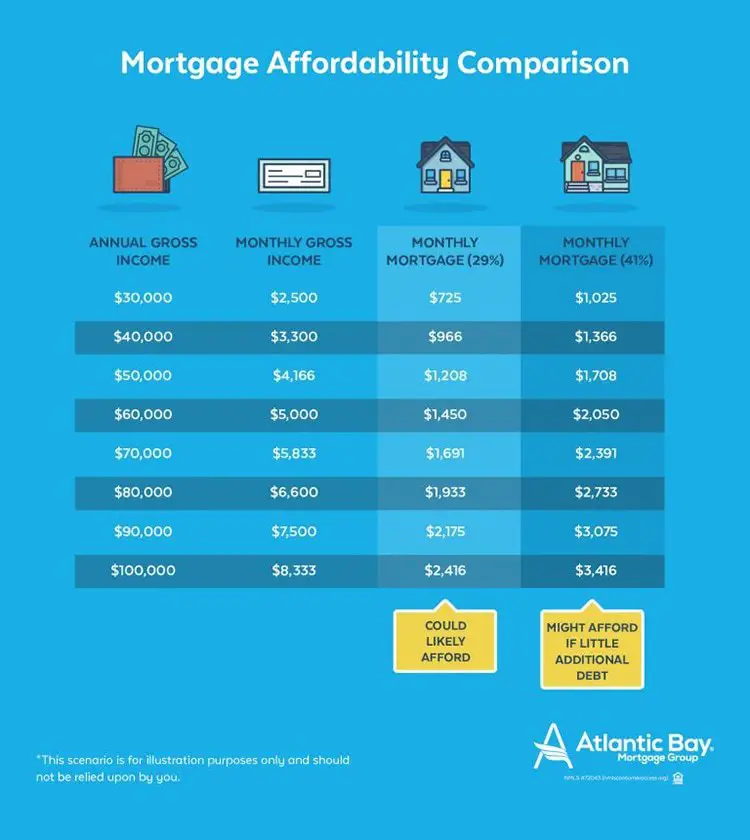

When you apply for a mortgage, lenders usually look at your debt-to-income ratio your total monthly debt payments divided by your gross monthly income written as a percentage.

Lenders often use the 28/36 rule as a sign of a healthy DTImeaning you wont spend more than 28% of your gross monthly income on mortgage payments and no more than 36% on total debt payments .

If your DTI ratio is higher than the 28/36 rule, some lenders will still be willing to approve you for financing. But theyll charge you higher interest rates and add extra fees like mortgage insurance to protect themselves in case you get in over your head and cant make mortgage payments.

You May Like: How To Calculate Commercial Mortgage Payment

How Much Mortgage Can I Afford

Even though Martin can technically afford House #2 and Teresa can technically afford House #3, both of them may decide not to. If Martin waits another year to buy, he can use some of his high income to save for a larger down payment. Teresa may want to find a slightly cheaper home so sheâs not right at that maximum of paying 36% of her pre-tax income toward debt.

The problem is that some people believe the answer to âHow much house can I afford with my salary?â is the same as the answer to âWhat size mortgage do I qualify for?â What a bank is willing to lend you is definitely important to know as you begin house hunting. But ultimately, you have to live with that decision. You have to make the mortgage payments each month and live on the remainder of your income.

So that means youâve got to take a look at your finances. The factors you should be looking at when considering taking out a mortgage include:

- Income

- Private mortgage insurance

- Local real estate market

Plugging all of these relevant numbers into a home affordability calculator can help you determine the answer to how much home you can reasonably afford.

But beyond that youâve got to think about your lifestyle, such as how much money you have leftover for travel, retirement, other financial goals, etc. You might find that you donât want to buy the most expensive home that fits in your budget.

How Much House Can I Afford Based On My Salary

To find out if a house might be affordable for you, estimate your total housing expenses. Housing expenses include the principal and interest you pay on your mortgage. They also include mortgage insurance, property taxes, homeowners insurance and homeowners association fees, if you pay them.

Next, divide that number by your gross monthly income. For example, if youre thinking of a total monthly housing payment of $1,500 and your income before taxes and other deductions is $6,000, then $1,500 ÷ $6,000 = 0.25. We can convert that to a percentage: 0.25 x 100% = 25%. Since the result is less than 28%, the house in this example may be affordable.

In addition to deciding how much of your income will go toward housing, you should also consider how much a mortgage would add to your existing debts. You can then decide if youd be able to keep up with all of your debt payments, and if youd have enough room left over in your budget for food, healthcare and other spending categories.

Don’t Miss: What Qualifies You For A Mortgage Loan

Mortgage Affordability & How To Qualify For A Home Loan

Purchasing a home is one of the most costly transactions people make. It entails ample financial preparation and commitment to make timely payments. Thus, long before you submit your mortgage application, its crucial to assess your financial eligibility and how much you can afford.

What does it take to qualify for a mortgage? Our guide will discuss vital factors that determine your mortgage affordability. Well also talk about the importance of maintaining a good credit score and how major credit issues hinder chances of favourable mortgage rates. Well give a rundown on the required debt-to-income ratio, deposit, and primary costs you must consider before taking a mortgage. If youre looking for effective government schemes, we also included a section on Help to Buy mortgage assistance programs.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Can I Afford A Second Mortgage

How To Get Your Finances Ready To Buy A House

Take stock of your finances to see if youre ready to apply for a mortgage. Make sure that you can provide evidence of at least two years worth of regular income, and figure out your total assets, debt and monthly expenses.

Check your credit reports. If you want to apply for new credit cards or other loans, keep in mind that these applications may add inquiries to your credit history and could lower your scores. Plan to apply for other types of credit well in advance of applying for a mortgage or wait until after youve closed on your home loan.Home affordability calculator

Ask lenders what information they need from you to issue a mortgage preapproval letter, and confirm that you have the documents on hand.

How Much Can I Afford For A House

Buying a house is one of the largest financial purchases youll ever make. But, before you do, understand how much you can afford so you dont get in over your head in debt.

Knowing how much you can afford means being realistic about how much you make and your current and potential future debts. You must consider unexpected expenses and occurrences and how your life might change in the future.

You May Like: Can You Refinance A Second Home Mortgage

How Does Where I Live Impact How Much House I Can Afford

Where you live plays a major role in what you can spend on a house. For example, youd be able to buy a much bigger piece of property in St. Louis than you could for the same price in San Francisco. You should also think about the areas overall cost of living. If you live in a town where transportation and utility costs are relatively low, for example, you may be able to carve out some extra room in your budget for housing costs.

House Affordability Based On Fixed Monthly Budgets

This is a separate calculator used to estimate house affordability based on monthly allocations of a fixed amount for housing costs.

In the U.S., conventional, FHA, and other mortgage lenders like to use two ratios, called the front-end and back-end ratios, to determine how much money they are willing to loan. They are basic debt-to-income ratios , albeit slightly different and explained below. For more information about or to do calculations involving debt-to-income ratios, please visit the Debt-to-Income Ratio Calculator.

Because they are used by lenders to assess the risk of lending to each home-buyer, home-buyers can strive to lower their DTI in order to not only be able to qualify for a mortgage, but for a favorable one. The lower the DTI, the more likely a home-buyer is to get a good deal.

Don’t Miss: How Much Will I Save If I Refinance My Mortgage