What Details Are Required In The Pre

A lender will generally start by asking for some basic information about you and your financial history. If you have a co-borrower, the lender will also need this information about them. Generally, a lender will then request your Social Security number and permission to pull your required credit report . If the information you provide and the information obtained from your credit report satisfies the lenders guidelines, the lender will make a preliminary determination in writing stating that you would qualify for a particular loan amount subject to the conditions outlined in your pre-approval letter. Please note that each lender has its own standards and processes for determining whether to grant a pre-approval letter.

How The Mortgage Pre

This mortgage pre-approval calculator gives you the opportunity to know in advance how much home financing you can qualify for. But please understand its a calculator only, and the official number will be determined by a mortgage lender.

In addition, the validity of the results youll get from this mortgage prequalification calculator will only be as good as the information you input. For that reason, be as accurate as you can be. If you inflate any information, like your annual income or your credit score range, you may get a higher loan amount, only to get a smaller pre-approval amount from an actual mortgage lender.

The mortgage pre-approval calculator is self-explanatory, but heres a general overview.

Provide Proof Of Income And Assets

Youll have to provide the lender with proof of all types of income, including W-2 wage statements from the past two years, as well as recent pay stubs , and other additional income . Youll also need to share your tax returns from the past two years.

Your assets make up your net worth, and let the lender know whether you have the funds for a down payment and closing costs. As part of the preapproval process, youll need to share recent bank, investment, and retirement account statements, as well as cash reserves.

Also Check: What Is Typical Debt To Income Ratio For Mortgage

Do You Have To Have A Pre

No, but having a pre-approval letter can make the buying process faster and easier. Buyers with pre-approval letters are taken much more seriously by agents and sellers, as they have written proof that they can secure financing.

An offer from someone without a pre-approval letter is a statement of interest, with considerable risk and unknowns.

Personal And Mortgage Information

Annual income

Enter your gross income, which is your total income before income taxes and other payroll deductions, like health insurance and retirement plan contributions.

Lenders base your income on your gross income, not your net income.

Mortgage term

This can be anywhere from 10 years to 30 years, but entering 30 years will have the lowest payments, and enable you to qualify for the highest loan amount.

Interest rate

This is the rate you expect to pay on the loan youll receive. Based on current rates, 4% is a safe estimate. But be aware that based on your credit situation, you may not qualify for the lowest rate available.

Read Also: How Much Second Mortgage Can I Afford

What Affects Your Home Loan Preapproval

Your income and saving are two key factors that lenders will consider during the mortgage process. However, other factors can affect how long preapproval will take and whether or not youll be preapproved at all.

Employment Status

Self-employed individuals almost always have a more challenging time getting preapproved. In addition to meeting standard loan requirements, they are asked to prove their line of work and/or the ownership of their business.

Only borrowers who have an ownership interest of 25% or more in a business and are not W-2 employees are considered self-employed. However, there is an exception if the borrower can show a two-year history in a similar line of work, which includes having documentation that proves an equal or higher income in the new role compared to the W2 position.

Debt-to-Income Ratio

The debt-to-income ratio is the percentage of your monthly gross income that goes toward paying debts. There are two types of DTI that lenders will consider during the mortgage process: front-end and back-end. The first consists only of your housing-related expenses, whereas the latter also includes all your minimum required monthly debts.

The lower your DTI, the better your chances of securing a home loan. Anything over 50% is considered unacceptable by lenders, but keep in mind that the specific DTI requirements will vary depending on the type of loan you’re getting.

Loan-to-Value Ratio

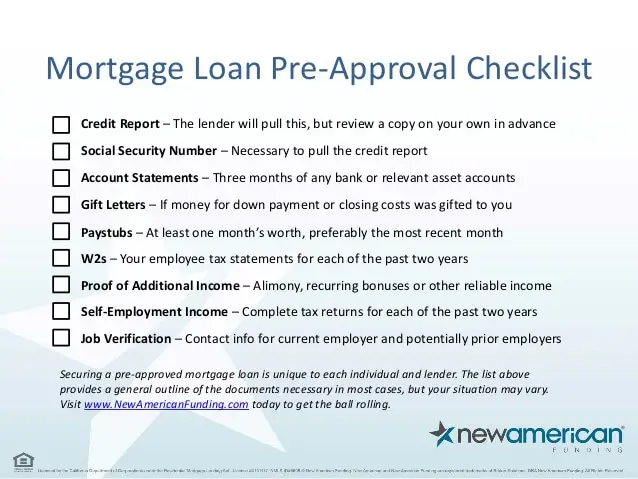

Home Loans Preapproval Checklist

- A drivers license or U.S. passport

- A Social Security number or card. If not a U.S. citizen, a copy of the front and back of your green card

- Verification of employment

- Copy of their credit reports from the three national credit bureaus

- Recent pay stubs covering the last 30 days

- W-2 forms from the previous two years

- Proof of any additional income

- Last two years of personal federal income tax returns with all pages and schedules. If self-employed, last two years of individual federal income tax returns with all pages and schedules, as well as a business license, a year-to-date profit and loss statement , a balance sheet, and a signed CPA letter stating you are still in business

- Bank account statements proving that you have enough to cover the down payment and closing costs. If someone is helping you with the down payment, a gift letter stating that the fund is a gift and not an IOU

- Last quarterly statements for asset accounts , IRA, stock accounts, mutual funds)

Don’t Miss: Is Closing Cost Part Of Mortgage

Start The Mortgage Process Asap

Dont wait until youve found the perfect home in order to start the mortgage process. The time to start is as soon as you start thinking you might want to buy a property.

Many sellers will require that buyers get pre-approved for a mortgage before they will accept an offer. This involves the lender checking your credit rating, debt-to-income ratio, and other financial information. Depending on your circumstances , this can take anywhere from one week to several months. Once youre approved, the lender will provide a letter stating the amount of money youre approved for, then you can get to home shopping.

Before you even begin the pre-approval process, however, youll also need to take time to compare mortgage rates and find the right lender for you. Different lenders offer different terms and interest. You can search for mortgages with banks, nonbank lenders , or mortgage brokers. How long this takes will vary depending on how thorough and efficient you are in your search.

What Is A Mortgage Pre

A pre-approval involves the same steps as a mortgage application youll provide detailed information about your income and assets that will be reviewed by the mortgage lenders underwriters.

If pre-approved, youll get a conditional commitment by the lender for a specific loan amount. This conditional commitment is called a mortgage pre-approval letter and it indicates to sellers that youre a serious buyer.

Don’t Miss: Would I Be Eligible For A Mortgage

How To Get Preapproved For A Mortgage

The preapproval process is essentially a mortgage application. This means your lender will want to take a comprehensive look at your finances. You should be prepared to provide information on the following:

- Proof of income

- Identification

- Debt-to-income ratio

Before starting the preapproval process, you’ll want the necessary documentation to ensure the process goes smoothly. Here are a few items you should have on hand:

- W-2 statements

- License

- Social Security number

Once you’ve submitted all your information to the lender, you can expect to receive your loan estimate within 3 business days, though this may be much shorter if you use an online lender. The loan estimate will let you know whether you’ve been preapproved and for how much.

How Many Times Can I Get Pre

Mujtaba Syed:

As many times as you want.

Technically until you’re ready to purchase. Once again, we want this to be a very enjoyable experience.

We want you to be able to find your perfect dream home, and sometimes it takes a little bit longer to get that dream home. We don’t want you to feel rushed.

We don’t want you to feel that you were forced into a situation or something.

It is going to be your ideal home. It’s going to be one of the biggest purchases in your life that you’ll do, one of the biggest investments you’re going to get into.

We definitely want to make sure you find the absolute best for yourself .

Karl Yeh:

Don’t Miss: How To Reduce My Monthly Mortgage Payment

Youre The Only One Who Can Decide How Much You Can Afford To Spend On A Home

Lenders preapprove you by looking at your income, assets, debts, and credit record. But your financial life is much more complicated than that. Only you can decide how much youre comfortable paying upfront and each month which means only you can decide how much to spend on a home.

- If you were preapproved for more than the home price budget you set for yourself, you can use the preapproval letter to shop for homes without changing your target home price. If youre happy with the amount you planned to spend, stick with your original budget.

- If you were preapproved for less than you were planning to spend on a home, talk with the lender. Ask if there was a particular factor that limited the preapproval amount. You may need to adjust your home price expectations.

- Be upfront with your real estate agent. If you dont want to see homes above a certain price, say so. Limiting your search is a good way to avoid falling in love with a home that costs more than you want to spend.

Get Your Financial Paperwork In Order

You are under no obligation by getting pre-approved, but you want to be comfortable with the amount and terms of your pre-approved mortgage. That’s why it’s essential that you review all your personal expenses and have a good idea of your future expenses before you talk with a mortgage broker or lender about pre-approval. Learn more about knowing how much you can afford.

Read Also: Is A Reverse Mortgage Good Or Bad

How Long Does A Mortgage Pre

Karl Yeh:

When you are, let’s say, pre-approved, how long does that last? Does that actually expire?

Mujtaba Syed:

That’s a great question.

A pre-approval lasts for three months. After three months, it expires, but if you feel like three months isn’t a long enough time period for you, we can always, always just re-approve you, pre-approve you, as long as the situation hasn’t changed for you financially.

We could keep that pre-approval going as long as possible. Some things might change in that time. Rates might change. They might go up. They might go down.

The other reason why I think a pre-approval is such a great thing to do is because if rates are good right now, it locks in that rate for you.

Even though the pre-approval is for three months, we can hold the rate for you for four months.

In a very competitive interest rate market, you want to get a pre-approval just to maybe hold that rate even though you might be two months away, you might be a month away, from finding a house.

We want to be able to get that interest rate locked in for you, so you can actually benefit from it.

How Long Preapproval Lasts

Preapproval doesn’t last forever. Check your expiration date and keep it in mind as you look at homes. Though it varies from lender to lender, preapproval is typically valid for 60 90 days. If you haven’t settled on a house, you can request a renewal by giving your lender your most up-to-date financial and credit information.

The right home is out there.

Find it online at RocketHomes.com.

Don’t Miss: Can You Wrap Closing Costs Into Mortgage

What Are The Advantages Of Conditional Pre

Not only does conditional pre-approval show sellers that youre serious, it can also help to be well progressed with your finance as soon as you find your dream home.

If youre early on in your home buying journey, getting conditional pre-approval can help you focus your property search by giving you a clear idea of what youre likely to be able to afford based on what a lender is prepared to loan you. If something changes while youre looking for a new home your financial situation, for example you can always renew your conditional pre-approval.

How Long Does It Take For Underwriting To Approve A Loan

As a general rule, underwriting will usually approve your purchase application within a week of your loan officer receiving your complete application, including all required documentation. The underwriter themselves should be able to underwrite your purchase application within 72 hours of submission from your loan officer.

However, there are many factors that can slow this process down. First, if your application is incomplete, that will add days to the process as you and your loan officer work to gather the necessary documents. There are also internal staffing factors and external factors like weather, holidays, and seasonal rushes, that can affect your timeline.

Read Also: Is A Home Equity Line Of Credit Considered A Mortgage

Everything A Homebuyer Needs To Get Pre

Bottom Line PersonalConsumer ReportsPrevention

As you search for a home, getting pre-approved for a mortgage can be an important step to take. Consulting with a lender and obtaining a pre-approval letter provides you with the opportunity to discuss loan options and budgeting with the lender this step can serve to clarify your total house-hunting budget and the monthly mortgage payment you can afford.

As a borrower, its important to know what a mortgage pre-approval does , and how to boost your chances of getting one.

Three Factors That Affect How Long It Takes To Get Your Mortgage Approved

Waiting for your mortgage to be approved can be nerve-wracking. After all, the approval will determine if you could get your dream home or not. Even if youre sure you sent all correct requirements, the wait can still make you anxious. And despite the copious promises of faster mortgage application approval youve heard, all you can do is wait.

Factors in play

Many factors affect how long it takes to get your mortgage approval. The length of time to get your approval is affected by the type of mortgage you applied for, the property you want financing for, and your lenders standard timeline.

Some factors that affect your mortgage approval and how long it takes are as follow:

- Your credit score. Lenders use your credit score to determine if they will lend you money and how much interest to charge when you borrow. Your credit score is calculated from the information in your credit report.

If you have spotless credit and have all necessary paperwork, you may be given a type of approval a lot faster, often within 72 hours. However, this approval isnt the final one. Your lender may issue you a conditional approval after this short period. Lenders will usually ask for more documents to support your income claims before giving you final approval.

If your credit is a bit blemished, it could cause a significant slowdown in getting that sweet mortgage approval. It will also make you pay higher mortgage interest rates.

Get pre-approved

Pre-approval requirements

Recommended Reading: Is 720 A Good Credit Score For Mortgage

Can You Be Denied A Loan After Pre

In some cases, yes. While pre-approval is an indication youâre a good candidate for a loan at the time of application, that can change. Inevitably, some time will pass between the issuance of your pre-approval letter and when the loan underwriter begins to process your loan application, and there are several events that could result in a denied application, if they happened after pre-approval.

If you changed jobs, youâll likely have to reconfirm your income and employment before a loan is approved. If youâve opened new credit card accounts recently, or stopped servicing your debts, that could result in a lower credit score, which could derail your loan. Similarly, any large cash withdrawals that significantly draw down your cash reserves could adversely affect your application.

Do You Need To Use The Lender Who Issued Your Pre

At this point, you have started a relationship. You are turning over a substantial amount of private information. The decision usually has been made in your mind to use this person for the loan, Bogan says.

Often, once borrowers start the preapproval process with a lender, they often use the same one for their home loan.

But its a competitive industry and youre not locked in. If you find better mortgage options with another lender for example, a better mortgage rate or better loan terms then its worth considering making the switch.

Read Also: Who Is The Trustee In A Mortgage Loan

Preparing For The Preapproval Process

Before contacting a lender, buyers should visit AnnualCreditReport.com to obtain a free copy of their credit reports from the three national credit bureaus . Buyers can save both themselves and their lenders some time if they can identifyand attempt to correctany errors or major deficiencies in their credit history. Some mortgage lenders recommend reaching out to them as early as 12 months before a buyer plans to buy a home for these same reasons.

Reaching out to a lender 12 months in advance may seem too early, says Christopher Jordan, branch manager for Main Street Home Loans in Silver Spring, Maryland. But if theres anything you need to work on, it gives us time to prepare. A credit issue may take four to six months to fix, and we want to make sure that we build enough time into the purchase process.

The extra time also comes in handy for gathering the financial documents a lender needs to issue the preapproval letter. The list can be long. In many cases, the buyer may not have looked at or accessed the files in years. Heres a sampling of the paperwork that a buyer may need to provide:

- Copy of your Social Security card

- Employment W-2 forms from multiple years

- Pay stubs

- Recent statements for every bank and investment account

- Tax returns from at least the past two years