Bottom Line: Can You Qualify For A Home Loan

If youre planning to buy a home, the mortgage products available to you will depend largely on your credit score, your ability to provide a down payment and your debt-to-income ratio. Your options also vary depending on whether you are a veteran or a buyer in a rural area.

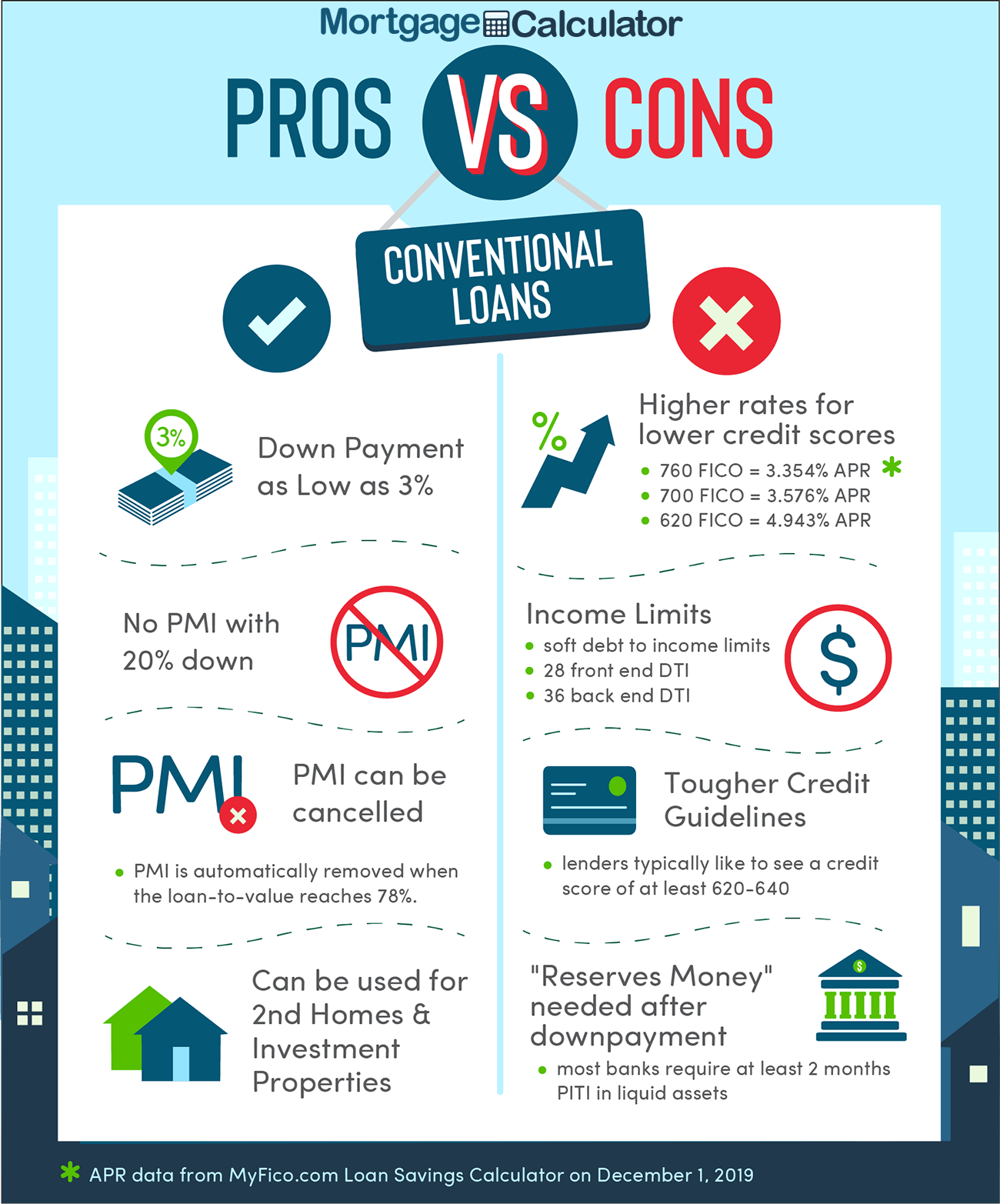

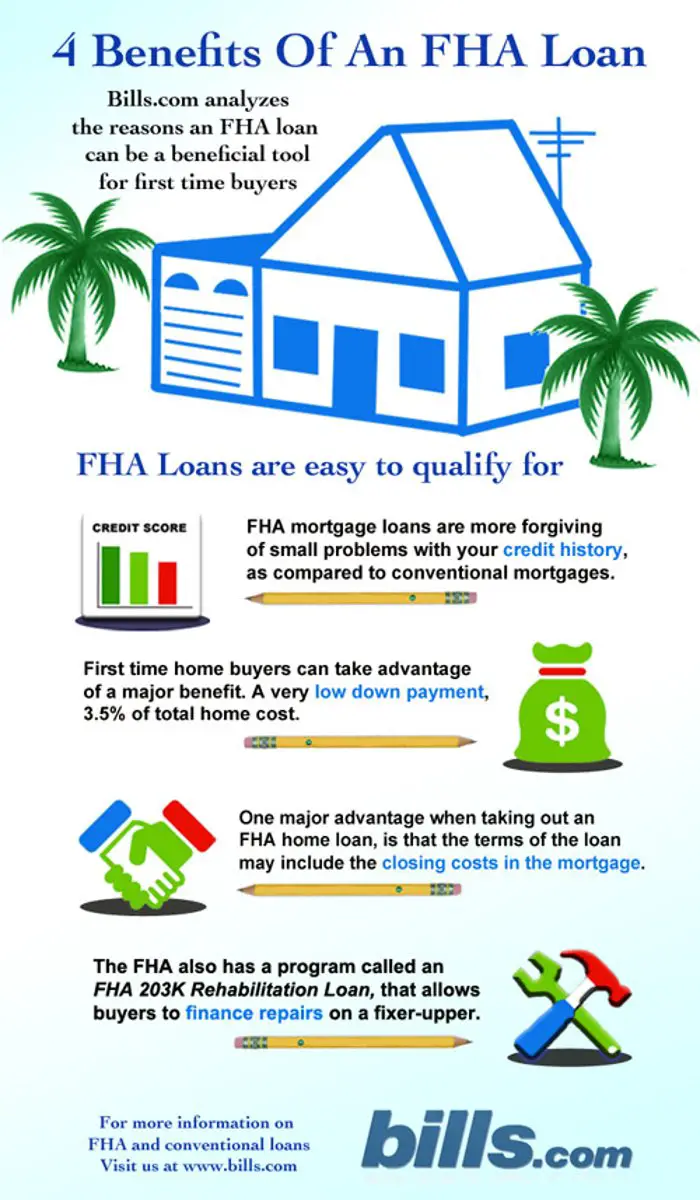

For borrowers with excellent credit and the ability to offer a significant down payment, conventional loans may offer lower interest rates. However, for first-time homebuyers without much cash reserved, FHA loans may be enticing because they dont require a big down payment or a high credit score.

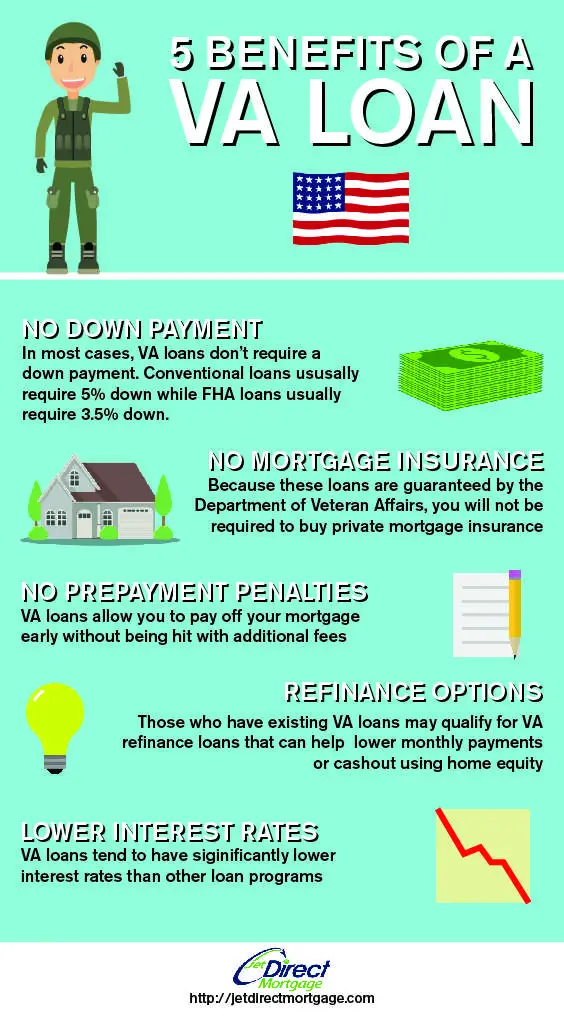

If youre a veteran, VA loans are a great option unlike conventional loans, they dont have a mortgage insurance requirement, even if you put down less than 20%. USDA loans also provide an affordable option for many, though these are only available in specific rural areas.

Buying a house is a huge move, and its smart to get in touch with a trusted loan officer at your financial institution who can help evaluate your situation to find which loan options youre eligible for.

How To Apply For A Va Mortgage Loan In Texas

If you are a veteran or active duty military personnel, you may be eligible for a VA mortgage loan. And if you are, you dont want to miss out!

A VA mortgage can be the answer to financing your dream home. Read on to learn all about how to apply for a VA mortgage loan in Texas – and why a VA home loan is the way to go.

Can Existing Va Borrowers Lower Their Interest Rates By Refinancing A Va Loan

On top of that, its also possible to reduce your interest rate by refinancing a VA loan through the interest rate reduction refinance loan . This loan requires you to use additional VA financing to replace your current loan and comes with an upfront VA funding fee of 0.50% of the loan amount.

In the end, the VA loan program can be a big help to those who have sacrificed their country and want to achieve the dream of homeownership.

You May Like: Bofa Home Loan Navigator

Determining Your Va Loan Limit Amount

If you have reduced entitlement and dont want to make a down payment, then a VA loan limit will apply. To determine yours, youll need to find out the conforming loan limit for the county youre buying in. This amount which varies from $647,200 to $970,800 for a single-family home will be the maximum amount you can borrow with your VA loan.

The Federal Housing Finance Agency has the conforming loan limits for each U.S. county listed here. Keep in mind: Loan limits are higher in pricier housing markets and lower in more affordable areas.

Verifying Your Va Loan Eligibility Status

Lenders need what’s known as a Certificate of Eligibility to verify if a Veteran meets the minimum service requirements. Your COE provides the lender with confirmation that you qualify for VA loan benefits.

For most Veterans, this is an easy step. Your lender can typically pull your COE with only your social security number and date of birth.

In some cases, the process may be more complex. However, the important piece is you don’t need this document before applying for a VA loan.

Speak with a Home Loan Specialist to get your COE today. The process typically takes minutes to complete and ensures your home financing moves forward without delays.

Also Check: What Does Gmfs Mortgage Stand For

Local Housing And Planning Authority Code Enforcement

Some areas enforce their local code requirements whenever a home is sold. If the place you want to buy is in such an area, your appraiser will pay special attention to the propertys compliance with the code.

Suppose the appraiser spots any improvements that are not up to code. They must note those failures. And they will make an allowance in the appraisal for the repairs necessary to remove them or make them compliant.

How To Lower Your Va Mortgage Payments

Choose a payment amount that you are comfortable with. While VA home loans come with affordable monthly payments, there are ways to reduce them further.

- Before selecting the quote, compare the rate with different loan terms, ranging from 10-year to 30-year. You might be able to get lower monthly payments with a 30-year mortgage. A longer loan term will decrease the price.

- Another way to reduce your monthly payments is by cutting off the interest rate. You can decrease the interest rate by comparing quotes provided by different lenders, improving your credit score, and applying for additional benefits.

- The last way to reduce your monthly payment is by making a downpayment to reduce your monthly expenses and help you save thousands.

Read Also: Rocket Mortgage Loan Types

How Does Credit Score Impact Your Va Home Loan

According to the guidelines defined by the VA, having an outstanding credit score is not mandatory to qualify for a VA loan. However, it is a general rule that most lenders expect you to have a minimum score of 620.

Moreover, you could qualify for additional benefits with a fair credit score, like lower interest rates and more flexible guidelines. Having a good credit score can simplify the eligibility process and help you get a loan with lower monthly payments.

Can I Get A Coe In Any Other Situations

You may be able to get a COE if you meet at least one of the requirements listed below.

At least one of these must be true. You:

- Are a U.S. citizen who served in the Armed Forces of a government allied with the United States in World War II, or

- Served as a member in certain organizations, like a:

- Public Health Service officer

- Cadet at the United States Military, Air Force, or Coast Guard Academy

- Midshipman at the United States Naval Academy

- Officer of the National Oceanic & Atmospheric Administration

- Merchant seaman during World War II

Read Also: Rocket Mortgage Qualifications

How To Qualify For A Mortgage

Related articles

Just so you know everything you need to bring to the table when you need to qualify for a mortgage, heres a guide on how to please the lending gods so they deem you worthy of receiving a huge pile of cash and a great mortgage rateand what to do if you havent covered these bases quite yet so youll pass muster soon enough.

Lets jump in! First off, you need to gather a mess of paperwork from bank statements to pay stubs to tax returns and W-2s. But in addition to paperwork, you need a few other items to get a mortgage loan. Here are the essentials:

When You Want To Purchase An Investment Property Or Vacation Home

The main aim of VA financing involves assisting active-duty service members or veterans to purchase and reside in a home of their own. These loans are not for building real-estate portfolios. A VA loan is only for a primary residence, so when you are looking to buy a vacation home or ski cabin, we suggest going for one of the conventional loans.

Also Check: Can You Refinance A Mortgage Without A Job

What Does My Mortgage Payment Include

Your mortgage payment includes the principal, interest, funding fees , taxes, and insurance premiums.

For instance, if you are borrowing a loan amount of $153,450 at an interest rate of 3.125% and choose not to make a downpayment, your estimated monthly payment will be $852. This total is composed of $643 in principal and interest, $150 in taxes, $44 in insurance, and $15 in VA funding fees, given you have a good credit score and the loan term is 30 years.

Community Water Supply And Sewage Disposal

Suppose the home you want to buy is in a homeowners association area or a planned development. Sometimes, the HOA or a private company supplies water and/or sewage facilities.

The VA appraiser must note such an arrangement. And they must obtain documentary proof that water quality has been approved by relevant health authorities. Sewage must be processed in ways that stop it from being a threat to public health.

In the event that local or state authorities dont monitor or enforce compliance, set rates and ensure swift resolution of issues, a trust deed will be needed. Thats a legal document that should ensure standards are maintained.

Read Also: Chase Recast Calculator

Va Loan Eligibility Requirements

First of all, you need to make sure you’re eligible for a VA loan. The government has service requirements for veterans or those on active duty, and also offers opportunities for certain military spouses to qualify for VA loans. You can get more information from the government’s website, but the basic requirements include:

- You’re currently on active military duty, or you’re a veteran who was honorably discharged and met the minimum service requirements.

- You served at least 90 consecutive active days during wartime or at least 181 consecutive days of active service during peacetime.

- Or, you served for more than six years in the National Guard or Selective Reserve.

If your spouse died in the line of duty, you may qualify for a VA loan.

In order to apply, you need to obtain a VA Certificate of Eligibility, or COE. Without this certificate, you won’t be able to get your loan.

What Housing Benefits Can A Child Of A Veteran Get

Although children of veterans and service member do not qualify for VA loans, they may be permitted to be the primary resident in a house purchased with a VA loan by a qualified borrower. Applicable occupancy situations can vary by lender and should be discussed with the assigned loan officer at the applicable financial institution.

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

Va Mortgages Are Available In Many Types

VA loans can have either adjustable rates or fixed rates.

You can also choose to use a VA loan to purchase a condo, house, duplex, manufactured home, new-built home, along with other property types. You can also use your VA loan to refinance your current mortgage, make improvements or repairs to your property, or improve the energy efficiency of the home. There are many options to choose from and VA-approved lenders can assist you with your decision.

National Guard And Reserves Requirements

For National Guard/Selected Reserve members, eligibility for VA Loans tends to be a little bit stricter. National Guard/Reserve members that served since the Gulf War period need only 90 days of active service. However members must also have six years of service in the Selected Reserve or National Guard. The must be:

- Honorably discharged

- Placed on the retired list

- Transferred to the Standby Reserve or an element of the Ready Reserve

- Continue to serve in the Selected Reserve.

Whether a National Guard/Selected Reserve member, or a veteran that does not meet the minimum service requirements, can still be eligible if discharged due to: -hardship -government convenience -layoffs -certain medical conditions -a disability connected to the service

Read Also: Rocket Mortgage Requirements

How Long Does It Take To Close On A House With A Va Loan

Closing times vary and depend on each buyer’s situation. But according to mortgage software company Ellie Mae, closing on a house with a VA loan takes an average of 4550 days a pace in line with doing so with a conventional mortgage. To help ensure a speedy closing time, have the proper documentation at the ready to complete your loan application.

Can You Get A Va Home Loan After Bankruptcy

Its possible to buy a house after bankruptcy, and yes, VA loans are available after bankruptcy, too. In certain circumstances, VA loans may be easier to obtain than other loans . Active and retired military services members may still qualify for VA loans, but eligibility will depend on a handful of factors:

- The type of bankruptcy youve filed

- The reason youve filed for bankruptcy

- Your ability to meet standard VA eligibility requirements

Recommended Reading: Recast Mortgage Chase

Take The Eligibility Test To Find Out Who Qualifies For A Va Loan And Learn If You Make The Cut:

- Are you an active duty service member who has served for 90 continuous days?

- Are you a veteran with a record of 90 to 181 days of continuous service ?

- Are you a National Guard or Reserve member with a record of six years of service? Did you receive an honorable discharge, continue to serve in the Selected Reserve, transfer honorably to Standby Reserve or transfer to the retired list?

- Are you the un-remarried surviving spouse of a veteran or service-member who died as a result of military service or of a service-connected disability? Or the un-remarried spouse of a service-member who is missing in action or a prisoner of war? Or a surviving spouse who remarried after turning 57, on or after December 16, 2003?

If you made it through that list and you answered yes to one of the questions, you could be the proud owner of a VA loan. The VA loan guidelines allow anyone who meets one of the above descriptions to apply for a VA home loan.

Benefits Of Owning A Home

For most people, a large part of the American Dream is owning their own home. It brings up visions of settling down, putting down roots and becoming part of a community. It doesnt matter if you are in your 20s and just starting out or in your 60s looking to downsize and retire. Buying a home often feels like a new beginning. Its also a wise financial move, opening up a world of opportunities not available to you while renting. If you are thinking about buying a house, here are some things to consider:

· Equity your house is a solid investment. If you purchase a $200,000 home, every payment you make reduces the amount you owe to the bank. At the same time, chances are good that the value of your house will increase. When you decide to sell your home, you get that money back. If in 10 years that $200,000 home is worth $250,000, and you owe $165,000 on your mortgage, you get $85,000 cash in your pocket. If youre renting and decide to move after 10 years, you have nothing to show for it.

· Taxes you are allowed to deduct mortgage interest, property taxes and certain energy efficient upgrades from your taxes. The tax savings is a huge benefit to owning your own home instead of renting.

These are just a few of the benefits of home ownership. Your house should be a welcoming, stable place for you relax and be at peace. A veteran home loan program can get you there.

You May Like: 10 Year Treasury Yield And Mortgage Rates

I Have Bad Credit Can I Still Qualify For A Va Loan

There is no minimum credit score requirement to take out a VA loan. But lenders will need to decide whether you represent “a satisfactory credit risk.” So while your credit score is taken into account, a low score may not automatically disqualify you. Many lenders look at a range of factors to determine your risk level.

Are There Va Loan Home Occupancy Requirements

Once you secure a home through a VA loan, you will probably be required to move into that residence within two months of the purchase. The VA wants approved borrowers to use the program for primary residences, asking that you settle into your new address within eight weeks of purchase.

Exceptions may apply in certain cases where the applicant cannot move into the new house at the time of purchase. For example, if a married VA holder is deployed at the time of purchase or during the weeks that immediately follow, the spouse can occupy the house on the holderâs behalf.

Read Also: Chase Recast Mortgage

Va Loan Limit Calculator For 2022

VA loans are available up to $647,200 in most areas but can exceed $900,000 for single-family homes in high-cost counties. Calculate your VA loan limit to see your personalized loan limits don’t apply to all borrowers.

Your VA loan limit or how much you can borrow without making a down payment is directly based on your entitlement. In many cases, you may have no limit whatsoever.

Heres what you need to know about calculating your VA mortgage limits and how they may apply to you.

How Does A Va Loan Differ From A Conventional Mortgage

VA loans differ from conventional mortgages in many important ways.

The VA warns that adding the funding fee and closing costs to your loan, rather than paying for them upfront, could leave you owing more than your house is worth or could reduce benefits of refinancing because your payments wont be lowered by as much.

Don’t Miss: How Much Is Mortgage On 1 Million

Va Loans And Rental Properties

You are not allowed to use your VA loan to purchase rental properties. However, you can use your VA loan if you want to refinance a rental home that you once used as your primary residence.

When it comes to buying a home, to secure your VA loan you need to certify or guarantee that you plan to occupy this property as your main residence. If you buy a four-unit, triplex, or duplex apartment, you are required to live in one of these units. Only then you will be permitted to rent the rest of the units out.

The only exception to this particular rule is known as the VAs IRRRL . These loans are also called the VA Streamline Refinance, which you can use to refinance your existing VA loan on a property that you once lived in or currently live in.

Va Funding Fee Vs Private Mortgage Insurance

One upside of VA loans over conventional mortgages or other government home loans is that you dont pay private mortgage insurance, even with no money down. Instead, you pay a VA funding fee.

You can pay the funding fee upfront or include it in your loan. The seller can also cover the funding fee.

The funding fee is calculated as a percentage of your loan and is based on your down payment and whether youve used a VA loan in the past.

VA funding fees for first-time borrowers

| Down payment |

|---|

| $362,600 | $337,990 |

Making a 5% down payment can pay off, especially if youve used a VA loan before. In the above example, Buyer 4 saves over $5,000 in funding fee costs compared to Buyer 3, and ends up with a loan amount roughly $22,000 lower. If you dont have the funds for a down payment, a VA loan is still a great option. Talk with your lender and real estate agent about folding your funding fee into the loan or finding other funding sources.

Keep in mind, though, that rolling the funding fee into the loan could mean that youll owe more than the house is worth. That can create problems down the road if you need to sell the home..

For that reason, veterans should plan to keep the property for at least 3-5 years, either by living in it or renting it out if they have to move.

Read Also: Does Rocket Mortgage Service Their Own Loans