With Monthly Interest And Current Loan Balance

1

Look up the amount credited toward interest and get the current loan balance from your latest mortgage statement. Many regular monthly statements provide a breakdown explaining how your payment is allocated.

2

Multiply the amount of interest for the month by 12. This provides the interest at an annualized rate. For example, if the interest is $900, multiplying by 12 results in a yearly interest of $10,800.

3

Divide the annualized interest by the current mortgage balance. The result will be the interest rate on the mortgage. Multiply the result by 100 to convert the rate to a percentage. Using the example from Step 2, with a mortgage balance of $170,000, gives a result of 0.0635. Multiply times 100 to get an interest rate of 6.25 percent.

How Do Mortgage Lenders Calculate Monthly Payments

For most mortgages, lenders calculate your principal and interest payment using a standard mathematical formula and the terms and requirements for your loan.

Tip

The total monthly payment you send to your mortgage company is often higher than the principal and interest payment explained here. The total monthly payment often includes other things, such as homeowners insurance and taxes. Learn more.

You May Like: Usaa Pre Qualify Auto Loan

What Do Rising Interest Rates Mean If Youre Selling Your Home

So, what does all this mean for sellers? How do rising interest rates impact the sale of your home? And is it possible to sell a home fast and for top dollar to negate the rising interest rates?

Rising interest rates tend to lower buyer demand, which can lead to homes sitting on the market longer than anticipated. On the other hand, rising rates can also temporarily boost demand, as buyers hurry to find a home before rates rise even more.

For this reason, the key to selling your home as fast as possible in these market conditions is pricing it correctly. Higher interest rates mean you may have to lower the overall price of your home to keep it affordable for buyers.

However, its still possible to get top dollar for your home if you properly prepare it in advance.

This is where investing in your home to maximize its sale potential can help you get the highest price possible.

Other factors, like effective marketing strategies and understanding the buyers motivation, will help you sell your home for top dollar.

For a more in-depth explanation of these factors, take a look at our 9-Step System. If you follow each step in the system, youll have a better chance of selling your home fast and for the most amount of money possible.

Read Also: Reverse Mortgage Mobile Home

Costs Associated With Home Ownership And Mortgages

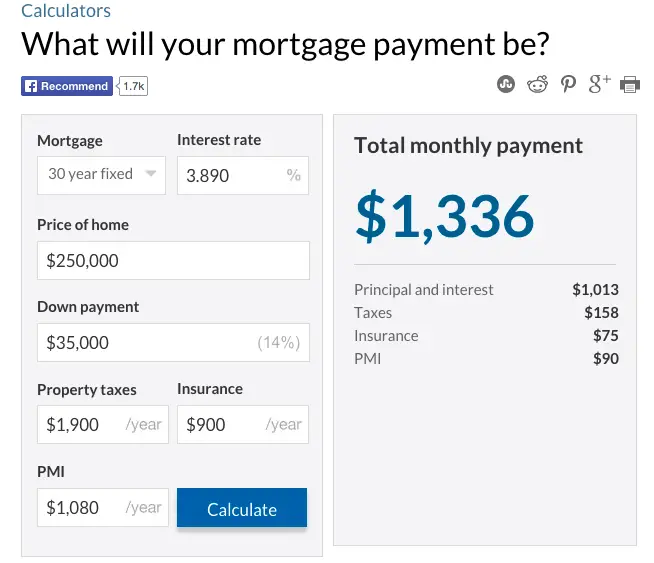

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Why Should I Calculate Mortgage Interest

Mortgages are among the largest financial obligations most Canadians hold. The calculation of interest is quite complex, but it is important to consider because it can help you plan, make financial choices and catch errors. In addition, knowing your mortgage interest amount means you know the real cost of financing which can be ambiguous at face value. Once you know the cost, you can make educated financial decisions, such as whether to refinance, ask for different conditions or choose another mortgage lender. By the end of this guide, youll know how to calculate interest on a mortgage.

Read Also: Can I Get A Reverse Mortgage On A Condo

How To Calculate Mortgage Payments

Zillows mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The principal is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowners insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowners association dues , these premiums may also be included in your total mortgage payment.

Why Mortgage Rates Matter

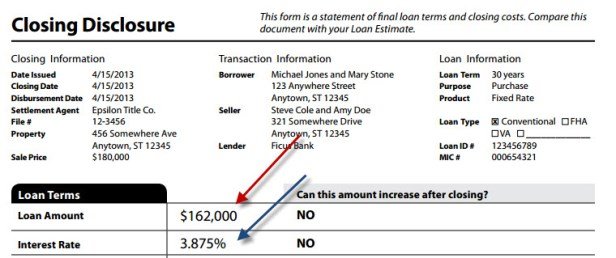

Your mortgage rate represents the cost of borrowing money to buy a home. Its represented as a percentage of the loan amount. Mortgage rates have a major influence on a home loans affordability.

Heres an example: Lets say youre quoted a 3% interest rate on a 30-year mortgage for a $200,000 home and youre making a 20% down payment . The principal and interest portion of your monthly payment would be approximately $675.

If you take that same loan but increase the interest rate to 4%, your estimated principal and interest payment would jump to $764 a monthly difference of nearly $90, and a more than $32,000 difference in interest over the life of the loan.

Don’t Miss: Can You Do A Reverse Mortgage On A Mobile Home

How Much Are Prepayment Penalties

When you agree to a particular mortgage term, your are signing a contract for that amount of time, generally between 1 and 10 years. If you break your mortgage before that term is over, you’ll be charged a prepayment penalty, as a way to compensate the mortgage provider. How much this can cost varies wildly based on the type of mortgage you have, the time remaining on your term, as well as your mortgage provider – each lender has a different way to calculate prepayment penalties.

The exact prepayment penalty calculation that applies to you will be laid out in your contract, but there are two methods used, outlined below.

What You Can Do To Protect Yourself If Interest Rates Rise

If the interest rate rises, your payments increase. Make sure that you can adjust your budget in case your payments increase.

Ask your lender if they offer:

- an interest rate cap: a maximum interest rate your lender can charge on a mortgage. You never have to pay more in interest than the maximum cap, even if the interest rates rise

- a convertibility feature: where, at any time during your term, you can convert or change your mortgage to a fixed interest rate

Note that if you choose a convertibility feature and change your mortgage to a fixed interest rate:

- you usually have to pay a fee

- certain conditions may apply

Don’t Miss: Recast Mortgage Chase

What Factors Affect The Amount Of Interest You Pay

The following factors will affect the amount of your mortgage interest payments:

- The mortgage interest rate. This is the rate the lender charges you as the cost of financing. Even a small difference in the interest rate can add up to thousands over the life of the loan.

- The prime interest rate. The interest rate on your loan is often connected to the prime rate, or overnight rate, set by the Bank of Canada. The prime rate dictates the rate banks lend money to each other overnight. If you have a variable interest rate, paying attention to the prime interest rate can help you predict what your interest rate will do.

- The amount you borrow. The more you borrow from your bank, the more interest youll need to repay. For example, 5% of $1 million will always be a larger amount than 5% of $500,000.

- The outstanding loan amount. As you gradually pay off the money you borrow, you will be paying interest on a smaller loan amount and your interest payments will slowly reduce.

- The loan term. The time you take to pay off your loan will affect the amount of interest you pay paying your loan off over a shorter period of time will minimize your interest.

Amerisave Mortgage Corporation: Best For Refinancing

AmeriSave Mortgage Corporation is an online mortgage lender, available in every state except New York, offering an array of loan products. Along with conventional loans and refinancing, the lender also offers government loans, and is one of Bankrates best FHA lenders in 2021.

Strengths: Like other online mortgage lenders, AmeriSave Mortgage Corporation has some of the most competitive rates out there, and about half of consumers have had their loans closed in 25 days. The lender also doesnt charge a separate origination fee.

Weaknesses: Youll still need to pay a flat $500 fee.

> > Read Bankrate’s full AmeriSave Mortgage Corporation review

Also Check: Rocket Mortgage Loan Types

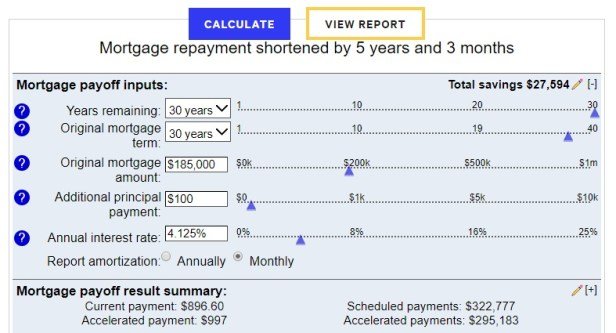

How To Make Extra Payments On My Mortgage

There are two primary strategies for making extra payments on your mortgage:

- Biweekly mortgage payments

- Extra monthly payments

With biweekly mortgage payments, you make a payment toward your mortgage every two weeks. If you pay half of your minimum payment with each payment, youll always make your minimum monthly payment.

However, there are 52 weeks in a year and just 12 months. Over the course of a year, youll make 26 biweekly payments which would total the amount of 13 monthly payments. In effect, you make an extra monthly payment each year. The extra money goes toward reducing principal, helping you pay the loan off more quickly.

You can also choose to make pay more toward your loan balance each month. For example, if your loans minimum payment is $2,000, you can set up a monthly payment of $2,200.

Each month, the extra $200 will pay down the principal of your loan and help you pay it off more quickly.

Put Down A Healthy Deposit

Generally speaking, the bigger the deposit you put down, the better your interest rate will be. This is usually because the more money you commit, the less you appear as a risk to the mortgage lender. Typically, a 15% deposit should get you some decent deals, while those looking for the best rates may need to put down 25% or more.

Comparison services are provided free however we will receive commission payments from lenders or brokers we introduce you to. Information about the commission we receive from brokers for mortgages and secured loans and insurance can be found in our help section.

All free and paid for Experian consumer services are provided by Experian Ltd Experian Ltd is authorised and regulated by the Financial Conduct Authority . Experian Ltd is registered in England and Wales with registered office at The Sir John Peace Building, Experian Way, NG2 Business Park, Nottingham, NG80 1ZZ. The web monitoring feature and its alerts within CreditExpert is not Financial Conduct Authority regulated activity.

Read Also: How Much Is Mortgage On A 1 Million Dollar House

Calculating The Numbers Yourself

If you don’t want to use a premade calculator, you can do the math yourself with a pocket calculator, a calculator app or a spreadsheet program.

First, you’ll want to compute yourmonthly interest rate. This is found by dividing your annual interest rate by 12, since there are 12 monthly payments in a year. For example, if your annual interest rate is 6 percent, your monthly interest rate is 6 / 12 = 0.5 percent. Once you have that rate, determine how much principal is currently owed on your mortgage. You should be able to see that on your most recent mortgage statement or through an online banking site or app.

Then, multiply the principal amount by the monthly interest rate to get the monthly interest amount. If the principal is $200,000 and the monthly interest rate is 0.5 percent, for example, the monthly interest amount is $200,000 * = $200,000 * = $1,000.

Your monthly mortgage payment minus the interest portion is the amount of principal you are paying down in that particular month.

Fixed Or Variable Interest Rate

- You can choose a loan with a fixed interest rate during the first 5 years or with a variable interest rate during the whole loan period, at your convenience.

If you value peace of mind and want to be sure that your mortgage loan payment will not change during the next 5 years, consider the fixed rate loan. A fixed interest rate is available for mortgage loans in PLN.

- Selecting a loan with a fixed interest rate you have 30 days to accept the credit decision and to sign the agreement.

- During the first 5-year period of validity of the fixed rate you cannot switch over to a variable interest rate.

- After this period os over you can decide to have another 5-year period of fixed interest rate or to switch over to variable interest rate, which is the sum of the banks margin and the WIBOR 6M reference rate.

- If you choose another period, we will give you a proposal of the fixed interest rate for the next 5 years.

- If you do not accept the new fixed interest rate, after this period your loan will be subject to variable interest rate and your monthly payments will depend on WIBOR and the margin defined in the loan agreement.

- If you accept the terms and sign the annex to the loan agreement, you will be able to enjoy the fixed rate with the new terms during the next 5 years.

- If you already have a loan in PLN with variable interest rate, you can applyfor change to a fixed interest rate, valid during 5 years.

Fixed or variable interest rate

Don’t Miss: What Does Gmfs Mortgage Stand For

Monthly Interest Accrual Versus Daily Accrual

The standard mortgage in the US accrues interest monthly, meaning that the amount due the lender is calculated a month at a time. There are some mortgages, however, on which interest accrues daily. The annual rate, instead of being divided by 12 to calculate monthly interest is divided by 365 to calculate daily interest. These are called simple interest mortgages, I have discovered that borrowers who have one often do not know they have one until they discover that their loan balance isnt declining the way it would on a monthly accrual mortgage. Simple interest mortgages are the source of a lot of trouble.

Are There Still Good Reasons To Choose A Variable Rate Over A Fixed

The gap between variable and fixed rates continues to shrink in 2022 and the latest Bank of Canada rate rise means those in the market for a mortgage probably want a bit of advice on what to consider and what is best when choosing a home loan.

Two years ago, this decision probably wasnt so hard. There was virtually no inflationary pressure and variable was hands-down the winner for the majority of mortgage applicants compared to fixed.

But with another three rates hikes expected from Canadas central bank this year, prospective buyers and homeowners looking to renew their mortgage loan will probably consider a fixed-rate mortgage, that locks in your rate over the length of the loan term.

The problem is fixed-rates on mortgages are also rising and choosing between a fixed or variable rate mortgage isnt always easy, even when the gap between the two shrinks, as its done in recent months.

You May Like: Mortgage Rates Based On 10 Year Treasury

Reasons Mortgage Borrowers Refinance Their Loans

Since its next to impossible to lower your mortgage rate without refinancing, you might be considering whether a mortgage refinance is worth your time and money.

Refinancing your mortgage can serve a variety of needs, and not all borrowers refinance for the same purpose. Here are some common reasons to refi and scenarios when they might make sense for you:

Common reasons to refinance a mortgage

A Higher Credit Score Could Increase What You Can Borrow

Your has a big part to play in how much you can borrow. In the most extreme cases a low credit score could prevent a mortgage lender from even considering you or, more likely, a low score could mean that the lender uses a lower multiple of your income to decide how much you can borrow.

Thats why youll want to make sure your credit score is up to scratch before you even consider applying for anything. Our guide on improving your credit rating will be able to help you with this.

You May Like: Rocket Mortgage Launchpad

Fixed Rate Mortgage Penalty Interest Rate

For fixed-rate mortgages, lenders usually use the greater of three months of interest or an interest rate differential . Each lender has their own IRD calculation. The interest rate that they use for their IRD is usually based on either their current advertised mortgage rates or their posted rates, which can often be much higher.

| Advertised Rate IRD |

|---|

Daily Interest And Annual Interest Mortgages

As mentioned, most lenders work out your interest on a monthly basis and advertise the rate on an annual calculation.

With a daily interest or simple interest mortgage, interest will be added to your balance each month based on the number of days in the coming month.

Youâll see a decreasing monthly balance which will take into account the amount you paid last month and the amount of interest added for the coming month. Thereâs not a huge amount in it between daily and monthly interest, with the difference between the longest and shortest month being just 3 days.

On an annual interest mortgage, your lender will take your balance on 31st December of the previous year, calculate the amount of interest they expect you to pay in the coming year, and divide that amount by 12.

In the first year of your mortgage, theyâll take the balance from the date they lend it to you and calculate what they expect you to have to pay until 31st December.

Don’t Miss: Rocket Mortgage Conventional Loan