Why Do I Need To Show So Many Different Documents To Get A Mortgage

Most mortgage lenders are required to do a certain amount of due diligence to ensure that you can afford the loan you’re taking out. This is known as the ability-to-repay rule.

To comply with the ability-to-repay rule, lenders need to document your income, assets, employment, credit history, and monthly expenses, according to the Consumer Financial Protection Bureau.

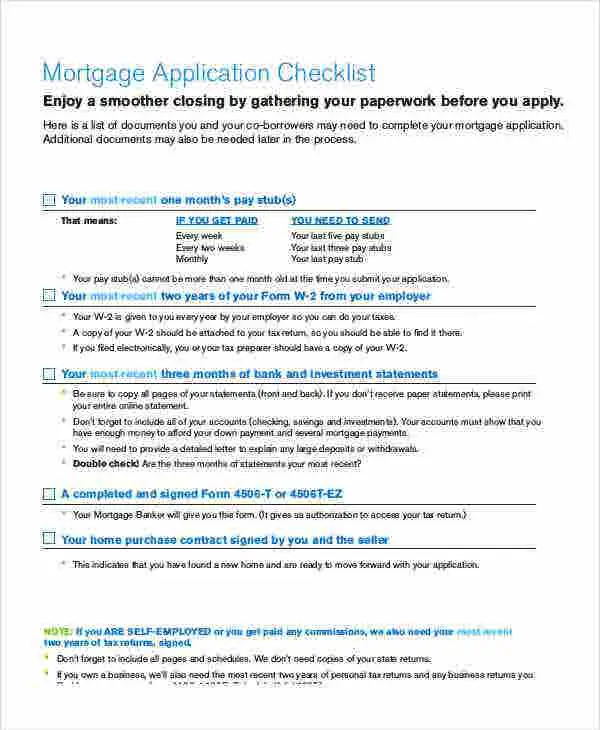

Checklist Of Documents Youll Need For A Mortgage

Through December 31, 2023, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

If you’re applying for a home loan, your mortgage lender will want to take a deep dive into your financial life. This is to ensure that you meet all of their underwriting guidelines and are in the position to easily afford your new mortgage payment. Throughout the approval process, you can expect to be asked for documents that substantiate different aspects of your income, work status, expenses and more. It’s little wonder that it can take up to 60 days to complete.

Getting your paperwork organized in advance is a great way to streamline the process and improve your odds of getting approved. Here we take a closer look at the supporting documents you’ll need if completing the uniform residential loan application . It’s the form most lenders use to determine a borrower’s mortgage eligibility.

Choose The Right Type Of Mortgage Lender

Make a list of mortgage companies and get loan estimates from at least three to five lenders. Or use a rate comparison tool to have lenders contact you before completing a mortgage loan application. Luckily, youll have no shortage of options, including:

Mortgage bankers. Mortgage banks offer a wide variety of programs, and the entire mortgage process is usually handled in-house. This could translate to a faster closing and more flexibility to work with borrowers who have unique situations.

Mortgage brokers. Mortgage brokers work with multiple lenders to provide more options than a single mortgage bank. However, brokers generally rely on the banks to approve and fund your loan, and dont have any say in whether your loan is approved or denied.

Institutional banks. Your local bank may offer mortgages with a lower rate if you carry a large deposit balance. Depending on the bank, though, loan offerings may be limited.

Also Check: Why Bank Statements For Mortgage

What Else Do You Need To Know About Mortgages

Mortgage. The banks right to your mortgage is certified by a security a mortgage. It can be drawn up at any time before you pay the entire amount of the debt.

The bank can sell this document or transfer it to another legal entity without your consent. Do not worry: only the payment details will change for you the amount of the loan and interest will remain the same according to the law.

Privileges. Since 2018, preferential mortgages have been available for families in which a second or third child is born. The state subsidizes mortgage interest rates above 6% per annum if you decide to buy a home on the primary market or refinance a mortgage that you took out earlier.

Taxes. You can get a tax deduction if you spend money on buying or building a home. This rule applies to cases where the money was received from the bank for a mortgage loan. But to receive such a deduction, you must have official income that is taxed.

You can reduce the amount of income tax payments or refund overpaid taxes .

You can be compensated for the cost of buying a home and the cost of paying interest .

For example, if you paid 5 million rubles for an apartment, 13% of only 2 million rubles will be returned to you. If the apartment cost 1.5 million dollars, you will be refunded 13% of 1.5 million rubles. The same goes for mortgage interest. For 15 years of the loan, you paid 14 million rubles of interest on the loan you will be returned 13% of only 3 million dollars.

Documents Needed For A Mortgage In Winfield Fl

It is easy to feel a bit overwhelmed by the number of documents you need to get approved for a mortgage in Winfield, FL. Fortunately, knowing the documentation you need ahead of time can help you get prepared, whether you are buying a home or refinancing a mortgage. Summit Funding will work with you and your lender to make the application process as easy as it can be.

Throughout the loan process, you will need to provide many types of documents to your lender such as information about your bank account, employment history, credit history, and more which is used to assess your risk as a borrower.

Read Also: Reverse Mortgage Mobile Home

You May Like: How Do Mortgage Rates Work

Find The Right Mortgage Lender

Finding the right mortgage for you also means finding the right mortgage lender. Thereâs over 100 in the UK and lots of them are suited to different types of customers. And, they all have their own lending criteria â thatâs their set of rules for who theyâll lend to and how much.

For instance, some lenders donât like self-employed people, and others love them! Some lenders donât like people with a low deposit, and again others love them.

A mortgage broker will know what lender is right for you, to give you the best chance of getting a mortgage in the first place, and to borrow as much as youâd like to.

If you do apply to the wrong lender, and you get rejected, it can negatively affect your credit rating, which could make it harder for you to get a mortgage afterwards.

Verification Of Your Debts

Mortgage approval doesn’t just hinge on how much money you have in your bank, or how much you earn each month how much money you’re spending each month on debts and other obligations also plays a major role in your ability to qualify for a mortgage.

Lenders can gather a lot of this information by looking at your credit report. But you may need to provide additional documentation regarding certain obligations, such as your student loans or any alimony or child support you’re required to pay.

You May Like: How Many Co Signers Can Be On A Mortgage

Bringing It All To A Close

Youve made it to the final step in the home-buying process. All the planning, preparation and waiting are finally over. But before you get the keys to your new home, you have one more thing to do.

At your closing, you will meet with your closing agent to sign all your mortgage documents. Take your time, make sure you understand what youre signing and dont be afraid to ask questions. And voilà, once youve dotted all the Is and crossed all the Ts, youll officially be a homeowner!

The closing process doesnt have to be nerve-wracking if you know what to expect. We can help you prepare for this exciting step, so your big day is a success.

We understand how overwhelming the home-buying and mortgage process can be. You can count on us to help you through it. Buying a home can be one of the most exhilarating and stressful moments of your life. But finding a home you can call your own makes it all worthwhile.

What Is A Home Equity Loan

Home equity loans function much like other types of loans. When approved by a lender, the borrower receives the entirety of the loan as a single lump sum. The borrower can spend the money however they see fit, such as for debt consolidation, paying emergency bills, or a home remodeling project. The borrower must then repay the loan through a series of scheduled payments. A home equity loan’s term can last anywhere from 5 to 30 years.

Home equity loans have a fixed interest rate. That rate will usually be lower than the borrower could get on other kinds of loans because using the home as collateral makes the loan a safer bet for the lender.

Home equity loans are also commonly referred to as second mortgages or home equity installment loans.

Recommended Reading: How Much Is A Mortgage On A 350k House

Consider Your Credit Score

Lenders will want to know your . As you gear up to start your mortgage application process, check your credit rating and make sure it’s in good shape. Though each lender will typically have a minimum credit score in mind for prospective mortgage applicants, Experian estimates that the minimum FICO score needed to secure a conventional mortgage is in the 620 range.

Loan Application Information Required

The first thing youll do when applying for a mortgage is complete a federally required mortgage application. Regardless of whether the application is in the paper format linked here, an online form, or done verbally with your loan officer, this linked document contains the application with the information youll need to provide, including:

- Full name, birth date, Social Security number, and phone number

- Residence history for at least two years. If youre a renter, your rent payment is needed. If youre an owner, all mortgage, insurance and tax figures are needed for your primary residence and all other properties owned.

- Employment history for at least two years, including company name, address, phone number, and your title.

- Income history for at least two years. If you receive commissions, bonuses, or are self-employed, you must provide two years of bonus, commission, or self-employed income received. Most lenders average variable and self-employed income over two years.

- Asset account balances including all checking, savings, investment, and retirement accounts.

- Debt payments and balances for credit cards, mortgages, student loans, car loans, alimony, child support, or any other fixed debt obligations.

- Confirmation whether youve had bankruptcies or foreclosures within the past seven years, whether youre party to any lawsuits, or you co-sign on any loans.

- Confirmation if any part of your down payment will be borrowed.

Read Also: How Many Pay Stubs For Mortgage

What Do I Have To Do To Apply For A Mortgage Loan

To apply for a mortgage loan, you will have to provide a lender with personal financial information and information about the house you want to finance.

The first step of applying for a mortgage is to request a Loan Estimate from three or more lenders.

To receive a Loan Estimate, you need to submit only six key pieces of information:

- Your Social Security number

- The address of the home you plan to purchase or refinance

- An estimate of the home’s value

- The loan amount you want to borrow

Although you’re not required to provide documents in order to get a Loan Estimate, it’s a good idea to share what you have with the lender. The more information the lender has, the more accurate your Loan Estimate will be.

Tip: It’s a good idea to request Loan Estimates from several lenders. That way, you can compare your options and choose the best loan for you. Each lender is required to send you a Loan Estimate within three business days of receiving your six key pieces of information.

Once you’re ready to choose a loan offer, you need to notify the lender that you are ready to proceed with the loan application. If you don’t notify a lender that you’d like to proceed within 10 business days, the lender may revise the Loan Estimate or close your application as incomplete and you may need to start over. The 10 business days are calculated from when the lender delivers the Loan Estimate to you or places it in the mail, whichever is earlier.

Keep Credit Card Balances Low

If youve already taken out a big loan, theres not a lot you can do about it now. But you can still look out for shorter-term credit purchases. Try to avoid financing or refinancing anything before closing, if you can.

Of course, its tempting. Youre going to need a ton of stuff for your new home and you might want to start stocking up on furniture, decorations, and so on. But loan officers nowadays routinely pull your credit score in the days leading up to closing. Any new account you open or any significant purchase you make on your plastic could drag that score down enough to re-open your mortgage offer.

This may only increase your mortgage rate a little. But in extreme circumstances, it could see your whole approval pulled and your journey to homeownership stalled. So avoid making those purchases until after you close. If it helps, imagine the shopping spree you can go on the moment you become a homeowner.

Read Also: How Much Does Biweekly Mortgage Payments Save

How Long Does It Take To Get A Mortgage

Thanks to online forms and digital documentation, your initial mortgage application can be completed quickly. But the amount of time it takes to get approved and actually close the loan can vary a lot depending on the type of mortgage you use and your personal circumstances.

Most conventional loans can close within 30 days, provided the application is straightforward. But closing can take as long as 60 days or more in cases where the borrower has a complicated financial situation. An extremely busy lender or home appraiser can also delay the mortgage process.

Some types of mortgages take a little longer to close than others. For example, government-backed loans have additional stages in the approval process:

- VA loans require a specialty VA home appraisal

- Similarly, FHA loans have their own appraisal process

- USDA loans require the Department of Agriculture to sign off on the loan application

Still, the extra steps needed for these loan programs shouldnt cause too much delay during the home-buying process.

What Part Of My Income Am I Ready To Give To The Bank Every Month To Repay The Loan And During What Period Am I Able To Do This

- Estimate your income and future expenses.

- If your loan payments exceed ½ of your annual income, then there is a risk of not being able to pay off the loan.

- Take your time, be picky and compare the offers of different banks, carefully study the terms of the contract. Make sure you understand each point.

From January 30, 2020, all new mortgage lending agreements must contain a table that indicates individual loan conditions for each client in particular, the amount, currency, loan term, interest rate, fines and other parameters.

The structure of the table is the same for all banks, microfinance organizations and credit consumer cooperatives . There are 16 points in total, and none of them can be excluded. General conditions for all clients, such as the rights and obligations of the borrower and lender, are still set out in the contract in plain text.

Types of interest rates on a mortgage loan

If the amount of payments changes, the bank is obliged to send you an updated schedule . Until you get it, pay according to the old schedule. The bank cannot change the amount of the payment retroactively.

The full cost of the loan in percent per annum and in the currency in which you take a loan) is indicated on the first page of the agreement in the upper right corner. It takes into account all your expenses on the loan: interest on the loan and any other fees that you will have to pay to the bank under the agreement.

Don’t Miss: How Does Making Extra Payments On Mortgage Work

Youll Need Proof Of Income

Mortgage lenders will want to see proof of how much you earn, so youll probably need a P60 form which you get every year from your employer and shows a summary of your pay and how much tax has been deducted.

Youre also likely to be asked for three months worth of bank statements and payslips so the lender can look at both how much you have coming in as well as your outgoings.

Check Your Credit Scores And Reports

Most cliché advice ever. Yes, but theres a reason. Its very, very important, if not the most important aspect of home loan approval.

It also happens to take a lot of time to fix credit-related issues, so its not a last-minute activity if you want to be successful.

These days its also super easy to check your credit scores and reports for free, thanks to services like Credit Karma or Credit Sesame.

Simply taking the time to sign up and monitor your credit could make or break you when it comes time to apply for a mortgage.

It may also save you a ton of money as higher credit scores are typically rewarded with lower mortgage rates, which equates to lower monthly payments and lots of interest saved.

If your scores arent all good, tackle the issue immediately so youre in excellent standing when it comes time to apply.

Read Also: How Much Does An Average Mortgage Cost

History Of Mortgage Or Rent Payments

Understandably, your lender wants proof you’ll follow through with on-time monthly mortgage payments. To verify this, they might ask about your current mortgage .

Current mortgage statement

If you own a home and currently have a mortgage balance, you’ll likely need to submit your most recent statement showing how much you still owe on the home. This is especially true if you’d like the ability to close on your new home before you sell the old one.

Landlord information

If you’re currently a renter, you’ll need to provide contact information for your landlord, as well as documentation showing that you’ve paid rent.

A Note About Technology

The detailed list above is only partial. As mortgage industry technology improves, more lenders will be able to obtain many of the documents above from their sources rather than getting paper, emails, or uploads from you.

Improved technology may help with convenience, but it wont reduce the documentation needed, so this list provides the proper perspective of what goes into a loan approval.

Also Check: Does Making Biweekly Mortgage Payments Help