How To Make Biweekly Payments Yourself

If your lender doesn’t offer a biweekly payment option, you can create one for yourself. It’s relatively simple to do: Divide your monthly mortgage payment by 12, and make one principal-only extra mortgage payment for the resulting amount each month.

You’d technically still be making your regular mortgage payment, plus one smaller extra payment, but the cumulative effect would be the same as if you were making biweekly payments automatically.

You can also make extra payments as you come into additional funds, such as a tax refund.

You could also achieve the same results by making one single extra monthly payment once each year. In that case, it would be considered a lump-sum mortgage payment, but it could still bring your principal balance down.

The Bottom Line: Are Biweekly Payments Right For You

For the right type of borrower, biweekly payments can help you save on interest and quickly add equity into your home. As with any major financial decision, its important that you weigh the pros and cons of paying your mortgage more frequently.

If you have questions on how you can start biweekly payments through Rocket Mortgage®, you can talk to a Home Loan Expert today for more information.

Alternatives To Biweekly Mortgage Payments

Switching to biweekly mortgage payments may not be right for everyone. Fortunately, there are alternative ways to pay your mortgage faster, including:

- Paying extra each month. Review your budget to see if you have extra cash to apply to the mortgage principal. Even $50 can help reduce the principal and the total amount of interest you pay on the mortgage.

- Refinancing and paying the savings. Its possible to refinance your existing mortgage and get a new loan with a lower interest rate and monthly payment. To reduce your mortgage balance more aggressively, one trick is to continue paying your previous monthly payment amount and instructing your lender to apply the extra cash to your principal.

- Rounding up payments. Instead of sending the exact payment amount say, $1,235.50 round it up to $1,300 and apply the extra amount to the mortgage principal.

- Applying bonuses or tax refunds. Any time you receive some extra cash, such as a tax refund or year-end work bonus, apply it to your principal.

Recommended Reading: How Much Interest Will I Pay Mortgage Calculator

How To Set Up A Biweekly Mortgage Payment Plan

If your lender allows biweekly payments and applies the extra payments directly to your principal, you can simply send half your mortgage payment every two weeks. If your monthly payment is $2,000, for instance, you can send $1,000 biweekly.

In general, you wont need to involve your lender in order to start making payments this way, according to David Reischer, attorney and CEO of LegalAdvice.com.

It is simply unnecessary to involve the lender in changing the loan terms so that a borrower must make a payment every two weeks instead of the normal payment due once a month, explains Reischer. If a borrower wants to make an extra payment to accrue the benefit of a biweekly mortgage plan, then they can simply send a payment every two weeks instead of the payment due every 30 days.

You can also divide your monthly payment by 12 and park that amount in a savings account each month, then send the accumulated amount to your lender as an extra payment at the end of the year.

No matter how you do it, Heintz says you should be sure to make it absolutely clear that this entire amount goes toward your principal balance. Otherwise, your lender might return the extra amount or forward it to your next payment, which negates the goal of biweekly payments.

To confirm your biweekly mortgage payment plan works the way you intend it to, make sure that:

In addition, make sure your lender confirms any extra payments are being applied to the principal in a timely manner.

Monthly Vs Biweekly Mortgage Payments

Buying home is an important milestone and likely the biggest purchase you’ll ever make. Because it’s such a big part of your and your family’s life, it’s important to know all the options available when it comes to paying back your mortgage.

This article looks at how mortgage payments work, how to pay your mortgage and the pros and cons of monthly versus biweekly mortgage payments.

Don’t Miss: How Much Would Payments Be On A 45000 Mortgage

Should I Refinance Calculator

Use our refinance calculator to determine how much money you could save with a refinance loan from Cherry Creek Mortgage. Our tool will help you clarify the difference in your current and potential payments and see how much money you could be saving every month by refinancing now.

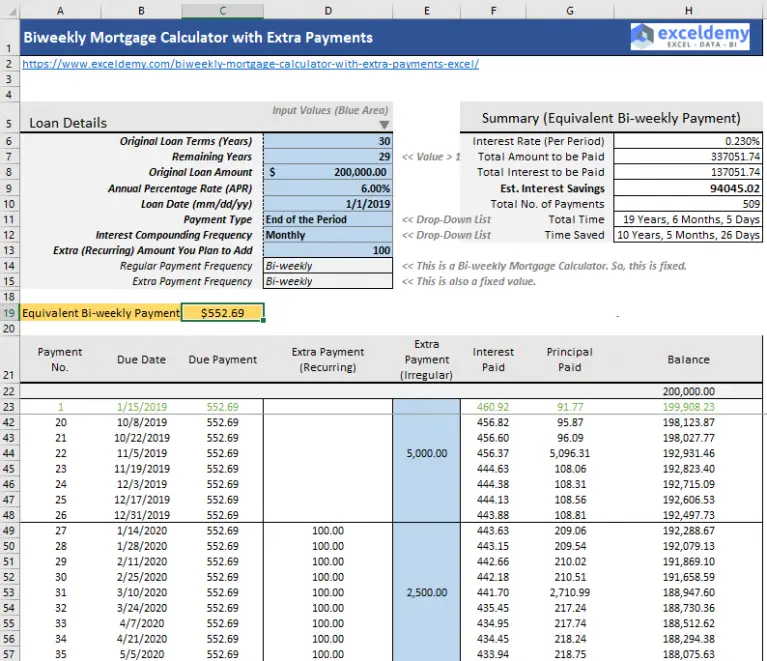

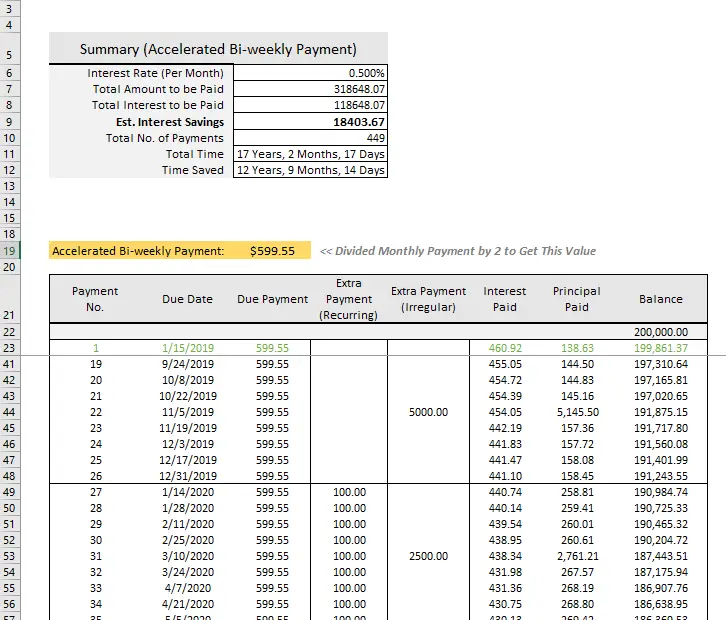

Using biweekly payments can accelerate your mortgage payoff and save you thousands in interest. Use this calculator to compare a typical monthly payment schedule to an accelerated biweekly payment.

Make Extra Payments Every Quarter

Best if: Your cash flow is irregular

Biweekly mortgage payments can be logical for people who get a steady paycheck every two weeks. But if youre a small business owner or independent contractor, your income can vary a lot in the short run.

Making an extra mortgage payment each quarter instead of every two weeks might better align your income with your expenses while still allowing you to save on interest and pay off your mortgage sooner.

Also Check: How Much Is A Mortgage On 1.4 Million

Biweekly Mortgage Payments: Are They For You

A mortgage is one of the biggest debts youll have in your life. And while you may be tackling your credit debt, car loan or student loans, your mortgage may be a little harder to chip away. Did you know theres a way to make an additional mortgage payment every year? This can be achieved by switching to biweekly mortgage payments, or paying your mortgage twice a month, making half the payment each time. Just by making an extra payment each year, you can pay your mortgage off several years earlier than planned.

Before you hop on the biweekly bandwagon, take a moment to consider if its right for you. There are many factors that go into biweekly mortgage payments. Its important to know what they are and how they can impact your finances before making the switch.

Get approved to refinance.

How Much Can You Save By Making Bi

Do you want to pay off your mortgage early?

Not sure where you will find the extra funds to make it happen?

Thankfully, you can significantly reduce your debt without feeling pinched by making biweekly mortgage payments.

This Bi-Weekly Mortgage Calculator makes the math easy. It will figure your interest savings and payoff period for a variety of payment scenarios.

You can make biweekly payments instead of monthly payments, and you can make additional principal payments to see how that also accelerates your payoff.

Each of these payment alternatives will take you closer to being debt free.

Here’s everything you need to know to get started . . . .

Recommended Reading: Where To Get The Best Mortgage

How To Make Biweekly Mortgage Payments To Save Money

Whether you’ve been a homeowner for 15 minutes or 15 years, paying off your mortgage faster could help you free up cash for other financial goals. Your mortgage is likely your largest single monthly expense, and each payment is due on a specific day and for a minimum amount. But switching from monthly to biweekly payments could provide substantial financial benefits.

Biweekly Mortgage Payment Calculator For An Existing Mortgage

Hudson Valley Credit Union137 Boardman RdPoughkeepsie, NY 12603

Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Recommended Reading: How Long Of A Mortgage Should I Get

How To Set Up Your Own Biweekly Payments Schedule

If youre facing fees for getting on a biweekly payments schedule, you can do it yourself without involving the lender or a third party at all. Heres how:

Step 1 Divide your monthly payment by 12.

Step 2 Put that much money in a savings account each month and continue making your monthly payments normally.

Step 3 At the end of the year, make one extra principal-only payment in full with the money you saved.

Then you will have made the equivalent of 13 monthly payments all without needing to get on a special payment plan.

Will A Weekly Bimonthly Or Biweekly Payment Mortgage Really Save Me Money

Do Biweekly Payments Save Money?

canstockphoto.com / AndreyPopov

Lenders who offer mortgages with shorter payment periods than the standard monthly payment mortgage usually do claim that they will save the borrower money. But they seldom explain how.

The Sources of Borrower Savings

There are only three possible sources of savings to the borrower from increasing the frequency of mortgage payments. One possibility is that the lender offers a rate or fee reduction on the high payment frequency mortgage. I have yet to see an example of this, and will discuss it no further.

The second possibility is that the lender amortizes the loan using the shorter payment period on the loan. If the mortgage calls for two payments a month, for example, the lender will reduce the loan balance on the 15th day of the month as well as the 1st. This will reduce the amount of interest due for the month, leaving more of the payment for further balance reduction. Amortizing the loan using a shorter period generates a real saving for the borrower, but it doesnt amount to much.

The third possibility is that the higher payment frequency is accompanied by larger total payments. This will also pay down the balance faster and reduce the interest cost, but the benefit is due entirely to the extra payment made by the borrower. The lender makes no contribution beyond providing the mortgage that credits the extra payment.

Weekly Payments

Bimonthly Payments

Biweekly Payments

Also Check: Can You Sell House Before Paying Off Mortgage

How To Change To Biweekly Mortgage Payments

Some lenders have to grant permission before you can switch to biweekly payments. If approved, there are two things to keep in mind. First, your biweekly payments won’t be applied to your account until you’ve reached your full monthly payment amount. Also, during your first month of enrollment, youll likely need to pay both your regular monthly payment plus your two half payments.

Some lenders charge fees to change payment agreements, while others do not. When you talk to your lender, find out if fees are associated with making the switch.

If your lender does not agree to the biweekly payment terms that you propose, simply pay extra every month to get the same benefits. You can also save up and make an extra payment every year, rather than every month. When you make any kind of extra mortgage payment, make sure it’s being applied to your loan principal rather than the interest.

Its important to note that certain mortgages don’t permit early payoffs. When early payoffs aren’t allowed, lenders may charge fees known as prepayment penalties. These fees may equal the amount of interest youre eliminating. If you aren’t sure if your mortgage allows early payoffs, look over your contract or talk to your lender.

How To Do It Yourself

The good news is that if your lender doesnt offer a biweekly payment option, you can take matters into your own hands.

Take your monthly mortgage payment and divide it by 12. Make an extra principal-only payment of that amount every month. Or save that amount every month for 12 months in a separate savings account, then make one extra mortgage payment for that year using the total, which is the equivalent of how much extra you would pay annually on a biweekly plan.

Before you go this route, however, confirm with your lender that there are no prepayment penalties on your loan and that the extra payments will be applied entirely to your loans principal rather than to principal plus interest.

Biweekly payments are certainly worth making if your finances allow for it, Torres says. You can use a biweekly mortgage payment calculator to estimate your potential savings.

» MORE FOR CANADIAN READERS: Mortgage payment options in Canada

Also Check: Can I Make A Large Payment On My Mortgage

Why Switch To Biweekly Payments

If you pay your mortgage monthly, like most homeowners, youre making 12 payments a year. When you enroll in a biweekly payment program, youre paying half your monthly amount once every two weeks instead. There are 52 weeks in a year, so this works out to 26 biweekly payments or, in effect, 13 monthly payments.

Because youre making the equivalent of 13 monthly payments each year, youll pay less total interest while lowering your principal balance at a much quicker pace, says Joe Zeibert, senior director of Ally Home, a division of Ally Bank in Charlotte, North Carolina.

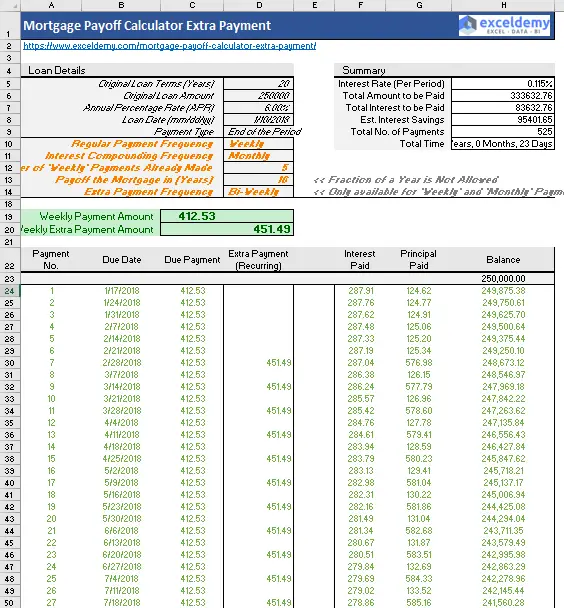

Zeibert gives the example of a 30-year fixed loan of $250,000 at a 4% interest rate. Biweekly payments would save a borrower nearly $30,000 in interest charges and have the loan paid off in five fewer years, he says. Even if homeowners stayed in their home for only seven years, they would still save several thousand dollars in interest charges while paying off $10,000 more in principal, which they could then use toward a larger down payment on their next home, Zeibert says.

The Difference Between Regular And Accelerated Payments

The one major difference between regular and accelerated payments is how the payment is calculated. With an accelerated payment option, you end up making roughly one extra payment a year. Itâll cost you a little more on a monthly basis, but will save you thousands in interest and help you pay off your mortgage even sooner.

Read Also: What Is A Good Fixed Mortgage Rate

Other Ways To Save Money On Your Loan

If you have built up sizeable savings then applying a portion of your savings to your mortgage will permanently lower your interest cost by lowering the principal balance you are charged interest on. If your loan was made during a period of higher mortgage rates, it might also make sense to refinance your loan at a lower rate & perhaps over a shorter duration of time. The following table highlights local rate information.

How To Use The Bi

Not sure where to start? Let us help you:

You May Like: How Do You Buy Back A Reverse Mortgage

How To Make Biweekly Payments Through Your Lender

In many cases, switching to biweekly payments is as simple as asking your lender to alter your current payment plan. However, its important to get the timing right if youre already enrolled in automatic drafts for your payments.

If you switch to biweekly payments in the middle of the month after making your regular mortgage payment, youll need to schedule your first biweekly payment for the beginning of the next month. Otherwise, youd be making one and a half payments in the same month, which could strain your budget.

To calculate a mortgage, you need a few details about the loan. You can then complete the calculations by hand or use this mortgage calculator to crunch the numbers.

When switching to biweekly payments with your lender, be sure to ask how your payments will be credited. Specifically, you need to know whether the extra payment that results from making biweekly payments will automatically be applied to the principal.

You also must make sure that your lender will immediately credit each biweekly payment upon receipt. If your lender waits until the second payment has been received before crediting your loan, youll never see the financial benefits of biweekly payments.

Things To Watch Out For

Making biweekly payments is a handy tool, but be careful of scams or special programs that claim they can do this for you. Some companies offer to convert your monthly mortgage payment into biweekly payments for a one-time fee. Avoid those offers. It shouldnt cost you anything to make extra payments on your loan.

Make sure that making biweekly payments fits your budget. If youre typically paid once per month, you might be used to paying all of your bills at once instead of spreading them out. If youre paid weekly, make sure that youre holding enough cash in reserve each week to make your next biweekly payment once it comes due.

Finally, make sure there isnt a penalty for prepaying your mortgage. Most mortgages these days do not have a prepayment penalty, but there are still some out there that will penalize you for trying to pay off your mortgage early. Just be sure that you wont be doing more harm than good by making extra biweekly payments.

Also Check: Can You Get A Mortgage While In Chapter 13

You May Like: What Is The Interest Rate To Refinance A Mortgage

How Much Faster Do You Pay Off A 20

It is rare for a 30-year loan to be kept to its full term. The average homeowner stays in their home for only 13 years and their mortgages may have an even shorter life if they refinance. Homeowners who plan to sell or refinance soon are usually not concerned about paying off their mortgage early. But what about those who stay put? The interest payments can still seem burdensome, especially when compared with todays loans with lower interest rates. You might be wondering how to pay off your mortgage faster so you can live debt-free and own your home completely. These steps will help.

- Refinance to a shorter-term

- Invest in a bi-weekly mortgage payment

- Recast your mortgage instead of refinancing

- Reduce your balance with a lumpsum payment