Why Mortgage Lenders Need Bank Statements To Approve Fha Loan

by Wendy Thompson | Feb 23, 2022 | FHA

Getting a mortgage involves mountains of paperwork. Between applications, statements, and forms, it can be a daunting and tedious process

One thing FHA lenders look for is bank statements.

Why?

Mortgage companies want to ensure your financial situation is stable before approving you for an FHA loan.

Heres what lenders look for and how to improve your chances of getting approved.

Savings And Checking Records

Lenders ask to see checking and savings statements for the last two or three months, according to the Consumer Financial Protection Bureau. The statements ensure that the down payment originates with the borrower and not from a loan or gift from another source. Borrowers receiving large amounts of cash from family or friends as a source for the down payment or closing costs need to submit a gift letter to the underwriter to document the origin of the funds. Gift letters state the cash need not be repaid. Reviewing regular bank records allows loan underwriters to track incoming and outgoing cash to determine the financial stability of the borrower.

Special Considerations For Bank Statement Loans

- You may use statements form more than one bank account, but they cannot be a combination of personal and business accounts.

- Deposits which are transferred from a business account into a personal account are acceptable.

- You may combine W2 income with bank statement income as long as the income is not being double counted.

- No commingling of funds.

- Foreign Bank Statements and Foreign Assets may be considered and must be translated to English.

Recommended Reading: Recasting Mortgage Chase

What Will Lenders Look For In My Bank Statements

Lenders will usually ask for bank statements dating back to at least 3 months, and the underwriter may use these statements to determine your eligibility on a variety of factors.

Affordability

Underwriters will want to ensure you can affordably and reliably meet your mortgage repayments. Your bank statements will reflect your income, any regular outgoings and give a snapshot of your spending. This could include general bills, childcare, large purchases or even a routine morning coffee it all outlines your spending and ability to live within your means.

Availability of funds

Your bank statement will also reflect whether you have the funds available to go through the process of a mortgage application considering things such as the deposit , fees and the move itself. Some lenders prefer there to be an emergency cash reserve but this isnt always essential to an application.

In addition to payslips and other documents, your statements will also evidence your income- showing the lender you will be able to continually afford to meet repayments. For self-employed applicants who may not have regular payslips, this can be an effective method for proving income flow.

Deposit

Often, mortgage deposits come from savings with regular income and can be easily traced, but in some cases, you may need to prove where the money for your deposit came from, which is easily verified in your bank statements.

How To Find A Bank Statement Loan

If you arent already working with a mortgage lender who offers bank statement loans, a mortgage broker might be able to help you find one. A broker often has partnerships with several wholesale lenders, which gives them access to a variety of unique types of mortgages and deals. Brokers typically dont charge borrowers for their services instead, they charge the lender, who then passes the cost onto you in the form of fees or a higher rate. When comparing brokers, ensure whoevers on your short list is licensed to work in your state and has experience with bank statement loans.

Don’t Miss: Can You Get A Reverse Mortgage On A Condo

Can You Request A Bank Statement Early

Because you can print your statements yourself, you dont need to request one in advance. Follow the instructions from your mortgage representative or, if youre applying online without assistance, the application for the number of statements you need.

If, for example, you need 60 days worth, the lender will expect the most recent 60 days worth.

Regular Payments Irregular Activities

Watch out for a monthly payment that does not correspond to a credit account disclosed on your application.

Typically, your credit report will pull in your credit cards, auto loans, student loans, and other debt accounts. But some creditors dont report to the major credit bureaus.

For instance, if you got a private, personal, or business loan from an individual instead of a bank, those debt details may not show up on your credit report.

The monthly $300 automatic payment on your bank statement, however, is likely to alert the lender of a nondisclosed credit account.

Read Also: Chase Recast Calculator

How Do Mortgage Companies Verify Bank Statements

Mortgage lenders will verify the financial information that you provide to them. Your lender might phone your bank to verify your account and statements. However, most lenders will complete proof or verification of deposit request forms and ask your bank to verify your account this way. Most banks provide downloadable forms for lenders on their websites.

How Many Statements Do I Need To Provide

Typically, youll need to provide two months of your most recent statements for any account you plan to use to help you qualify. If the account doesnt send reports on a monthly basis, youll use the most recent quarterly statement.

Why do you need multiple statements? Lenders want to be sure that the money in the account belongs to you, and that you havent taken out a loan or borrowed money from someone to be able to qualify for the mortgage. If the money has been in the account for a couple months, they assume that it belongs to you, as any loans you took out beyond the 2-month time span will have already shown up on your credit report. If any large, unexplained deposits appear on the bank statements you provide, youll need to be able to prove they came from an acceptable source.

Its all about ensuring you arent too risky for the lender to give you a mortgage. If potential borrowers are trying to make it look like theyre better qualified to handle a mortgage than they actually are, lenders want to know about it.

You May Like: How Does Rocket Mortgage Work

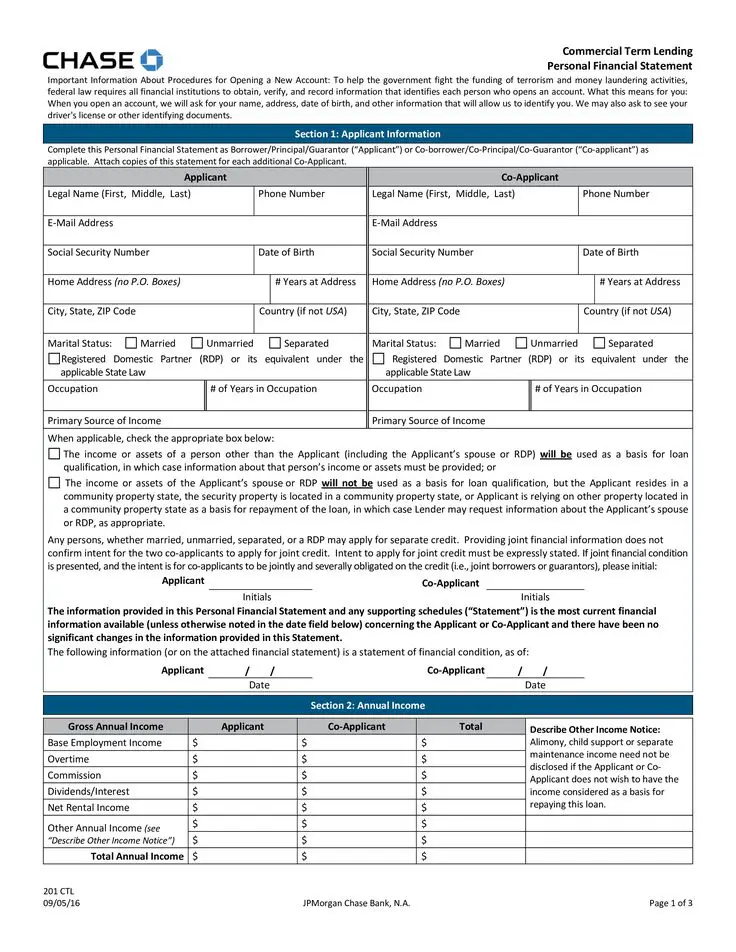

Whats An Asset Statement

When you apply for a loan, youre required to provide your lender with two consecutive months of any asset account youve listed on your loan application including any checking, savings, retirement, or investment accounts. The reason you provide the statements is to:

- Prove and document that you have all the cash you need to close the loan/buy your home

- Prove your ability to save money.

- Document where your money comes from

Note: You dont have to list every account you own. If youre not planning to use some accounts to buy your home, they dont need to be included on the application unless you transfer money between these accounts and the accounts listed on the application. Well get back to that later in the article, but for now, lets focus on what lenders look for on your asset statements.

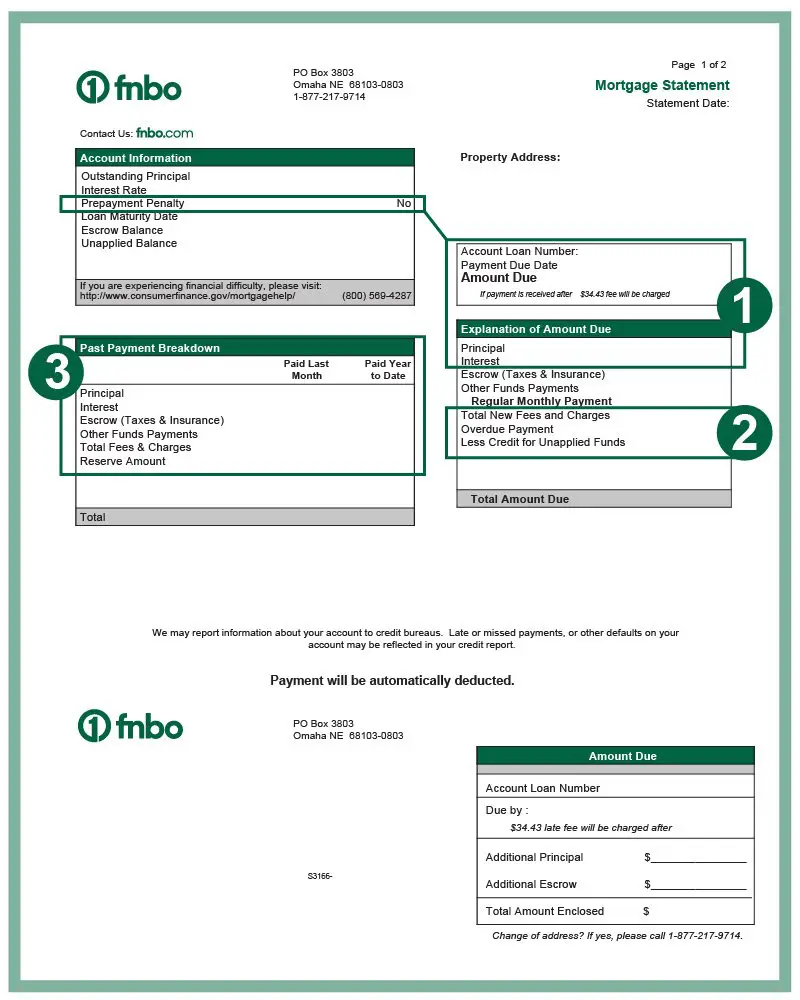

What Information Do These Documents Contain

Bank statements and transaction histories have to include certain details in order for a lender will accept them. The information they contain is slightly different. For a bank statement, which may be digital or physical , lenders will want to see the following information:

- Your name

- The period covered by the statement

- The accounts opening and closing balances

- A list of transactions during the period covered

Transaction histories may come in the form of a screen shot youve taken on your computer screen. They will contain less identifying information but should include the following information:

- Your account number

- A list of transactions for the period covered

- A running balance

Some online lenders may ask to securely access your banking app to assess your transaction history directly.

Also Check: Bofa Home Loan Navigator

Why Does The Lender Need My Bank Statements And How Do I Obtain Them

The reason a lender will need to see your bank statements is to learn more about you as a person and what your spending habits are like. How you have acted lately and the presentation of this on your bank statements can be the difference in how much a lender will let you borrow, if anything at all.This is down to risk. A lender needs to know youre responsible with your money and can be trusted to handle finances appropriately. After all, a mortgage is likely the biggest financial commitment you will ever make in your life and is not something to be taken lightly.Your bank statements are easily obtained either in the post from your bank, over the counter from your local bank, or as often seen these days, as a printable version from your banks online platform.

How Do Mortgage Lenders Check & Verify Bank Statements

- Post author

- Post date September 29, 2021

If you seek a mortgage for buying a new home or for refurbishing, it has to be approved by a mortgage lender for you to get your loan. One of the major factors involved in loan approval is the verification of the borrowers financial information, but how do mortgage lenders verify bank statements for loan approval.

Banks and other financial institutions may demand a proof of verification deposit form to be filled in and sent to the borrowers bank for process completion. A proof of deposit may also require the borrower to provide a minimum of 2 consecutive months bank statements. During the loan approval process, if youve ever wondered why is verification of bank statements for mortgages required? then the answer is to reduce the chances of people with fake documents acquiring funds for illegal activities.

With thousands of sophisticated technologies out there, it doesnt take more than minutes to forge bank statements and other documents. Keeping this in mind, mortgage lenders are legally obligated to identify and authenticate bank statements. In recent years, there have been multiple instances where mortgage lenders have been scammed out of their money with fake bank statements. To save themselves such cases of financial fraud, mortgage leaders need to find ways to check and verify bank statements.

Read Also: Requirements For Mortgage Approval

Why Lenders Need Bank Statements To Approve Your Mortgage

The law requires that lenders make a good-faith attempt to determine whether or not borrowers are capable of making their mortgage payments. Bank statements offer insight into your financial situation that helps lenders make that determination.

For example, your deposits help the lender verify your income and its source, and your savings tell the lender if youve got sufficient funds to cover a major repair or weather a financial emergency.

| What lenders want to see in your statements | What lenders dont want to see in your statements |

|---|---|

| Cash reserves for your down payment and closing costs | Overdrafts |

| Regular deposits that are consistent with your disclosed income | Large deposits from undisclosed sources, such as gifts |

| Withdrawals that are consistent with regular household expenses and payments on debt you reported in your application | Large withdrawals you cant explain |

With Credible, you can find prequalified mortgage rates in a matter of minutes. Our online tools allow you to easily compare all of our partner lenders and secure a great rate on your home loan its free, and you dont even have to leave our platform.

Credible makes getting a mortgage easy

What Do Underwriters Look For In Bank Statements

Lenders use a process called underwriting to verify your income. Underwriters conduct research and assess the level of risk you pose before a lender will assume your loan. Once underwriting is complete, your lender will tell you whether or not you qualify for a home loan. Here are a few red flags that underwriters look for when they check your bank statements during the loan approval process.

You May Like: Can I Get A Reverse Mortgage On A Condo

What Are Other Options

Keep in mind that if you work for yourself, you may still be able to get a traditional home loan. This could include a conventional or FHA mortgage.

Most lenders verify income by looking at the average of the last two years of your tax returns. If youve been self-employed for a while , and your income has stayed steady or grown during that time, you may still be able to get a conventional loan.

A larger down payment and good credit can also help your chances of getting a mortgage as a self-employed person. It also helps to borrow with someone who has a high credit score.

A bigger down payment and better credit may also help you get a lower interest rate.

You may also want to work with a mortgage broker. These are pros who can help you with your loan shopping.

Brokers have access to many lenders. They may be able to point you to a loan program that fits your needs, even if you don’t have a steady income.

Why You Should Speak To A Whole

Weve helped over 120,000 find the right mortgage by introducing them to a broker, even those who may have been declined a mortgage or have a bad credit history.

In fact, our customers consistently rate us 5 stars on Feefo, mainly due to our high levels of service, but also because we offer a 5-star service with access to expert brokers who are:

- Whole of market.

- Have a working relationship with all mortgage lenders, not just a select few.

- Already know the lenders to go to as they successfully arrange these already.

- OMA Accredited advisors.

- Have completed a 12 module LIBF accredited training course

- Are experts on the subject of mortgages and bank statements

Read Also: Rocket Mortgage Conventional Loan

Do Mortgage Lenders Need Bank Statements

Nearly all mortgage lenders need bank statements when you submit a mortgage application. A bank statement will show not only your overall bank account balance but also a listing of your monthly transactions. The mortgage company will review 2 or 3 months of bank statements to make sure that your overall financial picture matches what you stated in your loan application.

For most borrowers, the easiest way to get your bank statements is to log on to your online account and either print them or save them as a PDF file. Youll want to get bank statements for each of your checking and savings accounts you plan to use as part of the home buying process. Providing all of your bank statements upfront can speed up the mortgage application process.

What Do Underwriters Look For During Loan Approval

Lenders use a process called underwriting to verify your income. Underwriters conduct research and assess the level of risk you pose before a lender will assume your loan. Once underwriting is complete, your lender will tell you whether or not you qualify for a mortgage loan. Here are a few red flags that underwriters look for when they check your bank statements.

You May Like: Chase Mortgage Recast

Do You Qualify For A Mortgage Loan

Bank statements are just one of many factors lenders look at when you apply for a mortgage.

Almost all areas of your personal finances will be under scrutiny including your credit score and report, your existing debts, and any source of income youll use to qualify for the loan.

These factors help determine how large of a loan you qualify for, as well as your interest rate. The cleaner your finances look across the board, the better deal youre likely to get on your new home loan or refinance.

What Constitutes A Large Deposit

Large deposits to your bank account will be scrutinized by the underwriters. But, what constitutes a large deposit? It depends on your loan program, loan amount, and your income. An underwriter is going to view your entire loan application to determine which amount you may need to verify a deposit over.

Consider if you have just enough available in your checking account to cover your funds to close and not much wiggle room. An underwriter can require you to verify a deposit of just $100!! You need to always be careful depositing cash while you are going through the loan process. A cash deposit no matter how small can cause an underwriter to request you to source the deposit. Any deposits that are obvious like payroll, social security, and retirement most likely will not need to be sourced.

Sourcing, simply put, is showing evidence of where the money came from. A deposit can be difficult if it is cash or a personal check or money order. If you are not able to source a deposit to the underwriters liking they can remove the deposit out of your total funds they have approved for closing. In other words, if you cant source a $500 deposit the underwriters may not allow you to use it for closing costs leaving you $500 dollars short.

Always check with your loan officer before depositing anything out of the ordinary into your account during the loan process, they will be able to help you determine if this will hurt your loan or it is safe to deposit.

You May Like: Recast Mortgage Chase

Why Does My Mortgage Lender Need My Bank Statements

Applying for a mortgage might seem like youre being put under a microscope. Even those who are in good financial standing may find themselves uneasy about the scrutiny of their mortgage lender.

The silver lining is that this process benefits you, too. Your mortgage lender wants to be sure you arent at risk of defaulting on a loan, which would be bad for everyone involved the lender loses money, and you risk losing your home.

To avoid this scenario, mortgage applicants are asked to provide all sorts of documents that prove they have the money to buy a home. This includes paystubs, tax returns, gift letters and you guessed it bank statements.