Conventional Loans With Just 3% Down

Many conventional loans are made with as little as 3% down.

The HomeReady mortgage program is one such option. It allows non-borrowing members of the household to help the loan applicant get approved.

Lenders will consider the income of mothers, fathers, extended family, and non-married partners even when they are not officially on the loan file.

The Conventional 97, as the name suggests, allows home buyers to borrow 97% of the homes price. Unlike the HomeReady option, these loans are available to applicants at any income level buying a home in any location.

The drawback to a 3% down loan? The interest rate may be higher to compensate for the smaller amount down.

Mortgage insurance may be more expensive as well, as compared to a 5% or 10% down conventional loan.

Federal Home Loan Mortgage Protection

There is an additional type of mortgage insurance. However, it is only used with loans underwritten by the Federal Housing Administration. These loans are better known as FHA loans or FHA mortgages. PMI through the FHA is known as MIP. It is a requirement for all FHA loans and with down payments of 10% or less.

Furthermore, it cannot be removed without refinancing the home. MIP requires an upfront payment and monthly premiums . The buyer is still required to wait 11 years before they can remove the MIP from the loan if they had a down payment of more than 10%.

What Is Pmi And How Is It Calculated

When you take out a home loan or refinance your mortgage, your lender may require you to pay for an additional type of insurance private mortgage insurance.

When do you have to pay private mortgage insurance and how much will it cost you? It depends on your loan-to-value ratio. Find out when you have to pay PMI and learn how to calculate the cost.

Read Also: How To Calculate Net Rental Income For Mortgage

Cost Of Private Mortgage Insurance

The cost of your PMI premiums will depend on several factors.

- Which premium plan you choose

- Whether your interest rate is fixed or adjustable

- Your down payment or loan-to-value ratio

- The amount of mortgage insurance coverage required by the lender or investor

- Whether the premium is refundable or not

- Your credit score

- Any additional risk factors, such as the loan being for a jumbo mortgage, investment property, cash-out refinance, or second home

In general, the riskier you look according to any of these factors , the higher your premiums will be. For example, the lower your credit score and the lower your down payment, the higher your premiums will be.

According to data from Ginnie Mae and the Urban Institute, the average annual PMI typically ranges from .55% to 2.25% of the original loan amount each year. Here are some scenarios: If you put down 15% on a 15-year fixed-rate mortgage and have a credit score of 760 or higher, for example, you’d pay 0.17% because you’d likely be considered a low-risk borrower. If you put down 3% on a 30-year adjustable-rate mortgage for which the introductory rate is fixed for only three years and you have a credit score of 630, your rate will be 2.81%. That happens because you’d be considered a high-risk borrower at most financial institutions.

How To Get Your Coe

Getting a Certificate of Eligibility is very easy in most cases. Simply have your lender order the COE through the VAs automated system. Any VA-approved lender can do this.

Alternatively, you can order your certificate yourself through the VA benefits portal.

If the online system is unable to issue your COE, youll need to provide your DD-214 form to your lender or the VA.

Read Also: Auto Loan Calculator Usaa

Also Check: How Can I Get Help With My Mortgage

Estimating Rates For Private Mortgage Insurance

Many companies offer mortgage insurance. Their rates may differ slightly, and your lendernot youwill select the insurer. Nevertheless, you can get an idea of what rate you will pay by studying the mortgage insurance rate card. MGIC, Radian, Essent, National MI, United Guaranty, and Genworth are major private mortgage insurance providers.

Mortgage insurance rate cards can be confusing at first glance. Heres how to use them.

Do Usda Loans Require Mortgage Insurance

*As of July 6, 2020, Rocket Mortgage® is no longer accepting USDA loan applications.

With 0% down and relatively low overall costs compared to other mortgage types, USDA loans are an incredibly affordable option for home buyers in eligible rural and suburban areas.

However, low or no down payment mortgage programs often come with costs in other areas to offset the risk that lenders assume. Most often, this comes in the form of mortgage insurance.

Do USDA loans come with mortgage insurance, and if so, how much does it cost? Lets look at everything borrowers need to know about USDA mortgage insurance.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Recommended Reading: What Is The Cost Of Mortgage Insurance

Shop Mortgage Lenders And Loan Options

While mortgage insurance can increase your monthly payment, it may be a small price to pay to move into a home of your own. If you’re ready to buy a home, shop around to find loan options and offers from different mortgage lenders. Compare the total cost, including the closing costs, interest and mortgage insurance, to find the option that will work best. And remember, even if you have to pay for mortgage insurance now, you may be able to remove it later.

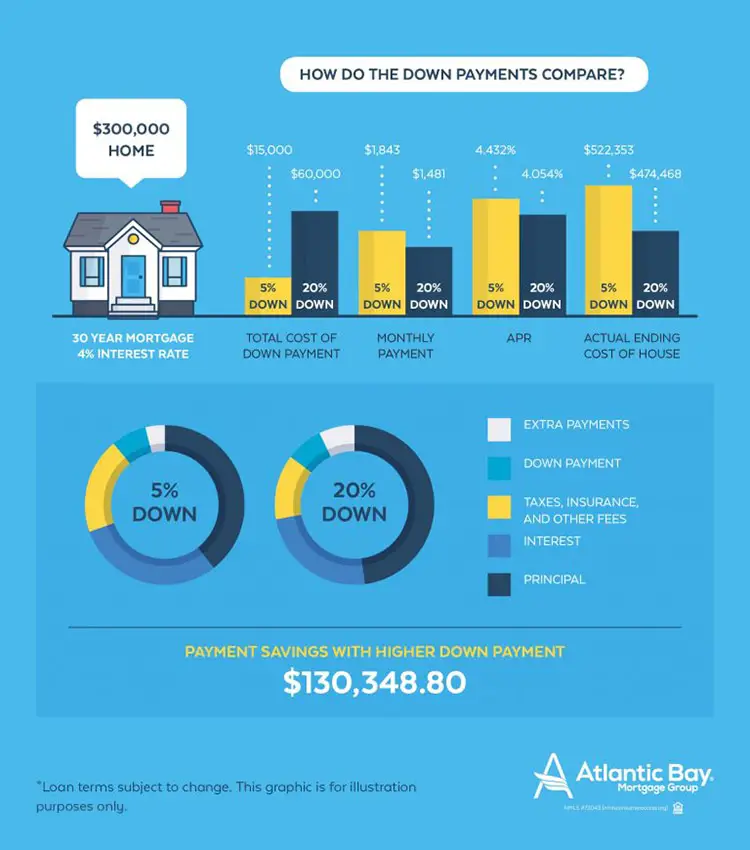

How We Calculate Your Monthly Conventional Loan Payment

To estimate your monthly conventional mortgage payment, the calculator considers the price of the home you want to buy, as well as the down payment you plan to make. It then takes into account the conventional loans term how many years it will take you to pay it off if you never miss a monthly payment and a fixed interest rate.

Not sure what your loan term or interest rate will be? Use the calculatorâs suggestion of a 30-year fixed term and a 4% fixed interest rate so you can still see a general estimate of your monthly principal-and-interest payment. Try entering 15 or 20 years, too, to see how a shorter term would affect your payments.

Nerd Tip: Principal and interest are two of the main components of any mortgage. A loans principal is the total amount you have to pay back. Your principal balance will likely decrease monthly as you make payments. Loan interest is the additional amount you pay a lender in exchange for being able to borrow the money. Thats why its so important to get the best mortgage rate available.

Also Check: Rocket Mortgage Qualifications

You May Like: Will Mortgage Rates Keep Dropping

What Is The Usda Annual Guarantee Or Funding Fee

So, what about USDA loans? Similar to VA loans, USDA loans dont technically require mortgage insurance, but they do have whats called a guarantee fee, which works like mortgage insurance in helping to guarantee the loan.

When a government agency backs a loan, such as a USDA loan or an FHA loan, theyre essentially providing insurance to the lender. If the borrower defaults on a government-backed loan, that agency pays the lender to help them recoup their losses. Fees that come with these loan programs, such as the guarantee fee, help pay for that insurance.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

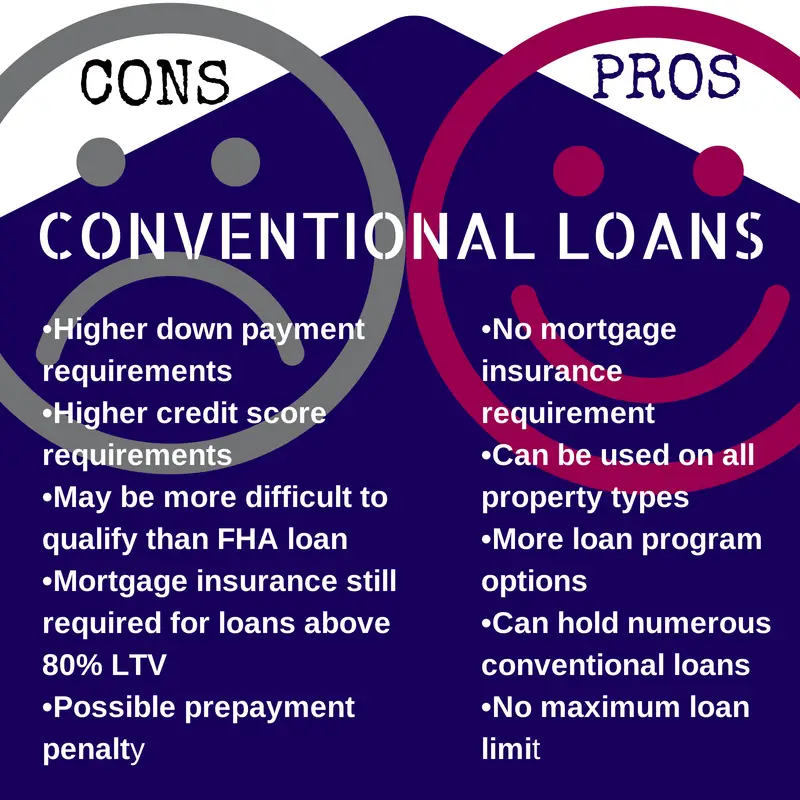

How Conventional Loans Work

The term conventional loan means it is not associated with any government programs. They are secured by private lenders: banks, credit unions, or mortgage companies. Conventional mortgages typically require higher credit scores than government-sponsored loans. FHA loans and USDA loans, for example, are backed by the Federal Housing Administration and the U.S. Department of Agriculture. Since government loans have less-strict lending requirements, they tend to have higher interest rates and fees, but can be a path to homeownership to those who may otherwise not qualify by conventional standards.

Maximum loan amounts are set by the U.S. government, but other conforming rules and requirements are set by government-sponsored entities, such as Fannie Mae and Freddie Mac. Mortgages backed by Fannie Mae and Freddie Mac are more desirable to be sold off to investors. This process reduces lender risk and helps maintain loan affordability. Loans not guaranteed by Freddie Mac and Fannie Mae are seen as riskier and therefore more expensive.

Conventional loans can have a fixed interest rate or an adjustable interest rate. In the case of fixed-rate conventional loans, the interest rate does not change at any point during the loan term. Alternatively, the interest rate for variable-rate loans will vary over time depending on the market.

With a conventional loan, a borrower submits an application through a lender and is approved or denied based on a few key factors, including:

Also Check: Do You Have To Pay Fees To Refinance A Mortgage

How Much Do I Have To Put Down For A Conventional Loan Mortgage

Conventional loan mortgages do not require a 20 percent down payment, although doing so eliminates the need for Private Mortgage Insurance . Conventional mortgages typically require a minimum 3% down payment, but that number can be higher depending on a borrowers credit score, loan to value, credit history and debt-to-income ratio.

What Are The Types Of Conventional Loans

If you are considering taking out a conventional mortgage loan, there are a few different types to choose from. The market of conventional loans is complex, and loans can be grouped in various ways, depending on the measures you look at. Most commonly, investors refer to the difference between conforming loans and non-conforming loans.

- Conforming Loans

Recommended Reading: Is Rocket Mortgage And Quicken Loans The Same

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Read Also: How Does The 10 Year Treasury Affect Mortgage Rates

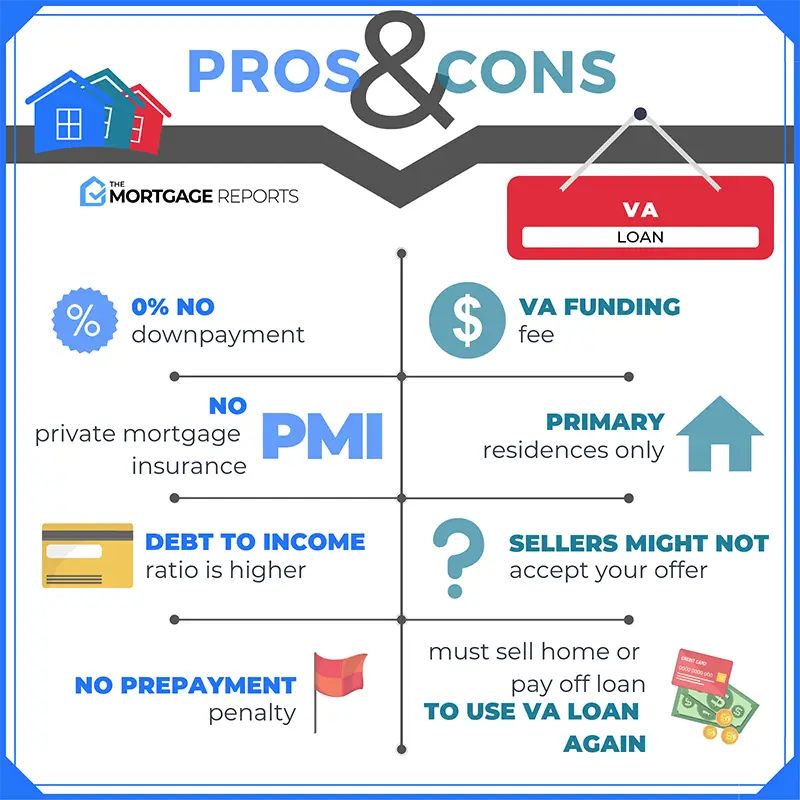

Mortgage Insurance For Va Loans And Usda Loans

VA loans and USDA loans do not have mortgage insurance requirements. These loans do have fees that help insure the mortgage, however. When you finance a home with a VA loan, you will need to pay a one-time VA funding fee. Surviving spouses and some disabled veterans are exempt from paying this fee. When you finance a home with a USDA loan, you will need to pay an upfront guarantee fee as well as an annual fee.

Also Check: Can You Have 3 Mortgages On One Property

A Lender You Can Trust

If you feel prepared to start your home loan journey, Capital Bank Home Loans has all the resources you need. Capital Bank proudly guides veterans, service members and spouses who have not remarried through the VA home loan process, helping them to become homeowners, or helping them to save through a VA refinance.

Selecting The Right Mortgage Option For You

Even though conventional mortgages tend to be the most typical option, they are by no means the only one. Mortgages come in a variety of different forms. Choosing the right one is important to ensure a successful home-buying process.

There are fixed-rate mortgages, variable-rate mortgages, convertible mortgages, bridge mortgages. hybrid mortgages, closed mortgages, among many others. Although understanding each of these mortgage term types fully may take a significant amount of research, its more than worth it to ensure you approach the mortgage application process with strong background knowledge to best inform your choices.

Ultimately, a conventional mortgage is a lower risk transaction for lenders since the additional equity in the property serves as a buffer from potential losses in the event of a loan default. Single family conventional home loans are typically cheaper, in that the cost of added insurance is avoided.

In the case of multifamily property loans, often conventional mortgages are more expensive as a result of the additional risk component, and high amount of capital required for non-insured deals. CMHC insured multifamily loans are also available through CMIs commercial mortgage division.

Take the time to consider your situation, crunch the numbers and work directly with a mortgage professional. This will allow you to proceed through the mortgage process with confidence and move into your dream home.

You May Like: Can You Get A Mortgage Loan On Unemployment

Federal Housing Administration Mortgage Insurance

Mortgage insurance works differently with FHA loans. For the majority of borrowers, it will end up being more expensive than PMI.

PMI doesn’t require you to pay an upfront premium unless you choose single-premium or split-premium mortgage insurance. In the case of single-premium mortgage insurance, you will pay no monthly mortgage insurance premiums. In the case of split-premium mortgage insurance, you pay lower monthly mortgage insurance premiums because you’ve paid an upfront premium. However, everyone must pay an upfront premium with FHA mortgage insurance. What is more, that payment does nothing to reduce your monthly premiums.

As of 2021, the upfront mortgage insurance premium is 1.75% of the loan amount. You can pay this amount at closing or finance it as part of your mortgage. The UFMIP will cost you $1,750 for every $100,000 you borrow. If you finance it, youll pay interest on it, too, making it more expensive over time. The seller is permitted to pay your UFMIP as long as the sellers total contribution toward your closing costs doesnt exceed 6% of the purchase price.

With an FHA mortgage, you’ll also pay a monthly mortgage insurance premium of 0.45% to 1.05% of the loan amount based on your down payment and loan term. As the FHA table below shows, if you have a 30-year loan for $200,000 and you’re paying the FHA’s minimum down payment of 3.5%, your MIP will be 0.85% for the life of the loan. Not being able to cancel your MIPs can be costly.

Va Loans And Second Homes

Federal regulations limit loans guaranteed by the Department of Veterans Affairs to primary residences only.

However, primary residence is defined as the home in which you live most of the year.

Therefore, if you own an out-of-state residence in which you live for more than six months of the year, this other home, whether its your vacation home or retirement property, becomes your official primary residence.

For this reason, VA loans are popular among aging military borrowers.

Recommended Reading: Is Bayview Loan Servicing Legitimate

Don’t Miss: Is Now Good Time To Refinance Mortgage

Mortgage Insurance Premiums For Fha Loans

One important difference between the mortgage insurance requirements for FHA and conventional loans is the upfront mortgage insurance premium. Every person who buys a house with an FHA loan has to pay an upfront fee which is currently 1.75% of the purchase price of the house. That means if you buy a house that costs $250,000, you have to pay an upfront premium of $4,375. Conventional loans do not have upfront mortgage insurance premiums.

Another important difference between MIP and PMI are the monthly insurance premiums. Every person who buys a house with an FHA loan must also pay monthly insurance premiums . The cost of MIP depends on the term of your mortgage, the amount of your base loan amount, and your loan-to-value ratio . While the cost of the annual premium can vary from borrower to borrower, the annual cost of MIP generally runs between 0.45% and 1.05% of the loan amount.

The same is true when you refinance an FHA loan. You will need to pay upfront and annual mortgage insurance premiums when you refinance using an FHA loan.

Conventional Mortgages: What You Need To Know

The benefits of conventional mortgage and how you can qualify

A conventional mortgage is a mortgage with a down payment of at least 20% of the purchase price of the home . Among the major benefits of a conventional mortgage is that you have more home equity and a lower monthly payment. When speaking of conventional mortgages, it is important to note that lenders need to undergo multiple steps while determining your eligibility. Those stepsplus other frequently asked questions related to conventional mortgagesare as follows.

Don’t Miss: Can I Get A Mortgage Without Tax Returns