What Other Costs Could Be Added To A Mortgage Payment

While the principal and interest will make up the bulk of your monthly mortgage payment, other costs can increase the overall payment amount.

- Private mortgage insurance : If your down payment is less than 20% of the home purchase price, your conventional mortgage lender may require you to buy private mortgage insurance a type of insurance policy that helps secure the lender if a homeowner stops making their monthly house payments. While you can typically have it removed once you reach 20% equity, it will still drive up your mortgage payments at first.

- Property taxes: It is common to have your property tax bundled with your monthly mortgage payment. Those payments typically go into an escrow account and are automatically released when the bill is due. Even if your property tax isn’t bundled, it is still a new cost to account for on a monthly basis.

Calculating Your Mortgage Overpayment Savings

Start Paying More Early & Save Big

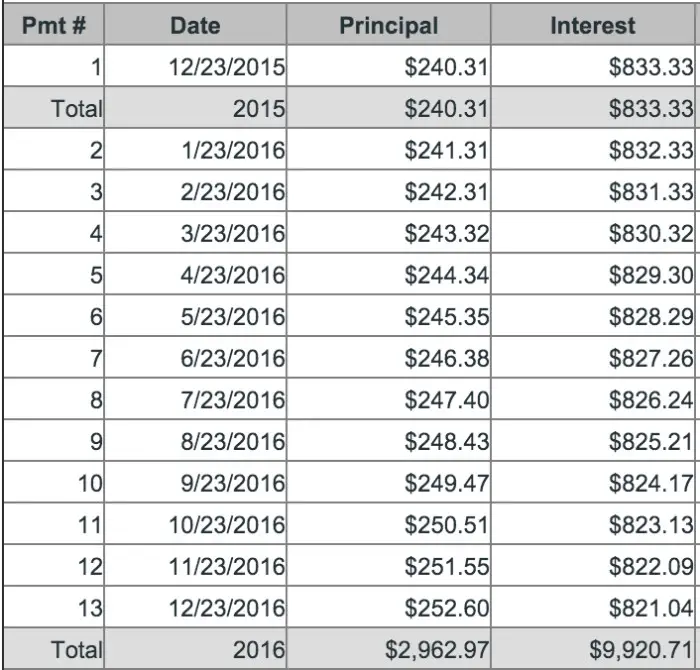

Want to build your home equity quicker? Use this free calculator to see how even small extra payments will save you years of payments and thousands of Dollars of additional interest cost. Making extra payments early in the loan saves you much more money over the life of the loan as the extinguised principal is no longer accruing interest for the remainder of the loan. The earlier you begin paying extra the more money you’ll save.

Use the above mortgage over-payment calculator to determine your potential savings by making extra payments toward your mortgage. Put in any amount that you want, from $10 to $1,000, to find out what you can save over the life of your loan. The results can help you weigh your financial options to see if paying down your mortgage will have the most benefits or if you should focus your efforts on other investment options. As you nearly complete your mortgage payments early be sure to check if your loan has a prepayment penalty. If it does, you may want to leave a small balance until the prepayment penalty period expires.

How Much Are Mortgage Fees The Costs That Come With Your Loan

When shopping for a home, it seems like theres something to pay for at every step of the way. To get your mortgage approvedthereby allowing you to actually buy your houseyoull have to pay mortgage fees. The most common mortgage fees also fall under the umbrella of closing costs, those expenses you pay when you close on your house that help facilitate the sale .

Although its difficult to put an exact figure on the mortgage fees you can expect to pay, there are some costs that almost every mortgage has in common. We spoke with Amy Bailey Oehler of PrimeLending about what they are and how much money a home buyer should plan on paying for the loan.

Recommended Reading: Who Owns Prosperity Home Mortgage

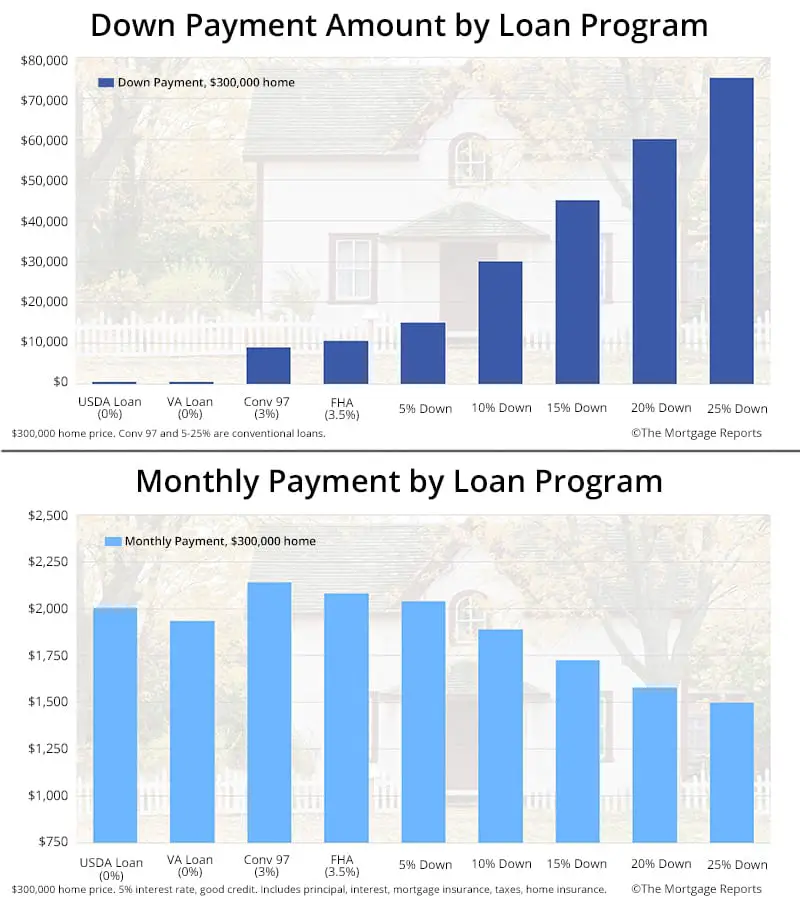

How A Larger Down Payment Impacts Mortgage Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment calculations above do not include property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that play a role in determining your mortgage rate and, therefore, your payments over time.

Rules Of Thumb For How Much To Spend On A Mortgage

There are many ways to use your DTI ratio to figure out how much to spend on a mortgage payment. For example, there are maximum limits in place, but it’s often a better choice to err on the conservative side so that you don’t wind up house poormeaning your mortgage payments are so big, you struggle to meet other expenses.

Only you and your financial advisor can determine what the best rule of thumb is for you. Here are the ones that people commonly use:

Read Also: Is 4.875 A Good Mortgage Rate

How Much Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.â

Ultimately, when deciding on a property, you need to consider several additional factors. First, itâs a good idea to have some understanding of what your lender thinks you can afford . Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Also Check: Recasting Mortgage Chase

What Is The Required Debt

Online resource Investopiea.com explains that the lower an applicants debt-to-income ratio, the greater the chances that the borrower will be approved for a credit application.

As a customary rule, 43 percent is the highest debt-to-income read DTI ratio a borrower can have and still be qualified for a mortgage.

However, lenders prefer a debt-to-income ratio lower than 36 percent, with no more than 28 percent of that debt as a mortgage or rent payment.

In reality, though, the maximum DTI ratio varies from lender to lender.

Read Also: What Is The Monthly Payment On A 50000 Mortgage

Pitfalls Of Paying Off Your Mortgage Early

Many homeowners think that they should pay off their mortgage early to get out of debt, but does it always make sense?

You do not want to pay off your mortgage and end up low on cash. It’s much easier to take cash out of a checking account when needed than it is to refinance by pulling it out of your home loan.

Ask yourself if you’ll need liquid cash in the near future. If the answer is yes, you’re better off putting your extra money in savings not toward your mortgage.

Always have a small savings buffer to help you pay for immediate expenses.

How Lenders Assess What You Can Afford

Mortgage lenders base their decisions on whats known as the loan-to-income ratio the amount you want to borrow divided by how much you earn.

The most you can borrow is usually capped at four-and-a-half times your annual income

Have you had mortgage advice?

You can get advice directly from a lender who will discuss their own products, or from a broker wholl be able to look at mortgages from a range of providers.

Read Mortgage advice: should you use a mortgage adviser? for details of where to get advice.

Recommended Reading: How To Become A Mortgage Broker In Pa

Understanding Your Mortgage Payment

Your mortgage payment isnt just what you pay toward your principal loan balance each month. It also includes interest, taxes, and homeowners insurance. There are also other costs that could get tacked on, depending on what type of loan you have or how much you put toward a down payment.

Mortgage insurance is an extra expense youll pay on some government-backed loans and on most conventional loans when your LTV is less than 80%. This insurance typically costs 0.5% and 1% of the loan amount every year, so it can add a lot to your monthly payments.

Outside of your mortgage payment, homeowners also have other expenses to account for, like homeowners association dues. Youll also want to set aside funds for regular maintenance and unexpected home repairs. You may even be on the hook for higher utilities, compared to renting, if your rent included water, sewer, and trash.

How Much Of A Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford .

Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Don’t Miss: Can You Have 2 Mortgages On The Same Property

What Are The Income Requirements For Refinancing A Mortgage

Mortgage refinancing options are reserved for qualified borrowers, just like new mortgages. As an existing homeowner, youll need to prove your steady income, have good credit, and be able to prove at least 20 percent equity in your home.

Just like borrowers must prove creditworthiness to initially qualify for a mortgage loan approval, borrowers have to do the same for mortgage refinancing.

Recommended Reading: How Does The 10 Year Treasury Affect Mortgage Rates

How Much House Can I Afford Calculator

Maximum Mortgage Payment

How Much House You Can AffordBased on a interest rate on a -year fixed mortgage.

Now that you know what you can afford, get your mortgage here or try our full mortgage calculator.

As you can see from our calculator, how much house you can afford really depends on the relationship between your income and mortgage.

To figure out how much mortgage you can afford with your income, different lenders use different guidelinesbut most lenders dish out mortgages that are way too expensive and keep borrowers in debt for decades!

We want to help you buy a home thats a blessing, not a burden. And the only way to do that is to calculate your home-buying budget the smart wayand stick to it!

Thats what our calculator does for you. How does it work? Well show youget ready for some math!

You May Like: How To Become A Mortgage Underwriter With No Experience

How To Calculate Extra Mortgage Payments

Using our Mortgage Payment Calculator, you can crunch the numbers and discover how much you could save in interest, or how much you would need to pay each month to pay your loan off sooner.

For example, according to the calculator, if you have a 30-year loan amount of $300,000 at a 4.125% interest rate, with a standard payment of $1,454, if you increase your monthly payment to $1,609, you could pay your loan off five years and one month earlier while saving $43,174 during the loan’s lifetime.

Examples Of Mortgage Payment Percentage

Now, lets look at some examples of mortgage payment percentages so you can work out how much you can afford to borrow from a lender and what percentage of income you need for your mortgage.

What value of property can you afford on a $60,000 a year income?

As mentioned above, the rule of thumb is that you can typically afford a mortgage two to 2.5 times your yearly wage. Thats a mortgage between $120,000 and $150,000 at $60,000 per annum. However, youll have to be able to afford the monthly mortgage payments.

What are the payments on a $200,000 mortgage?

Lets imagine a $200,000, 30-year mortgage with a 4% interest rate. This would set you back about $954 per month.

What are the monthly payments on a $300,000 mortgage?

With a 4% fixed interest rate, monthly mortgage payments on a 30-year mortgage would total around $1,432.25 a month. However, if you opt for a 15-year plan, it could cost up to $2,219.06 a month.

Don’t Miss: Can A Mortgage Be Transferred

How To Afford A Bigger Mortgage

You can afford a more expensive home by following three simple steps as you prepare to apply for a mortgage:

- Pay down some debt, especially credit card balances. Not only do you reduce your DTI, but lowering card debt should also improve the state of your credit report

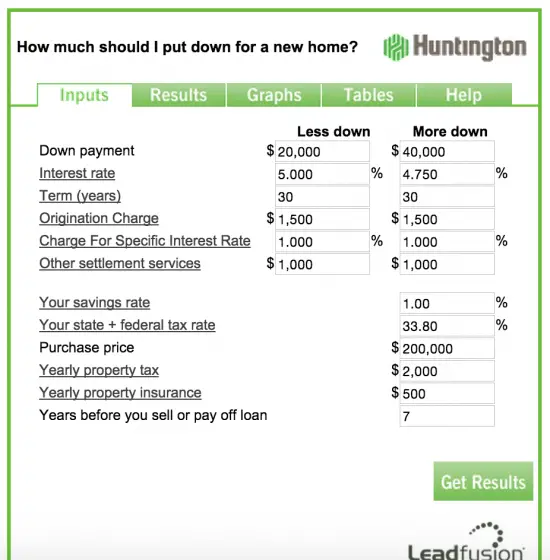

- Save a bigger down payment. The more skin you have in this game, the more lenders like you. A bigger down payment often earns you a lower interest rate and better home

- Work on your credit score. As long as youre paying bills promptly, credit card balances are often the main drag on your score. Each needs to be below 30% of the cards credit limit. Also, in the months leading up to a mortgage application, you should avoid opening and closing any lines of credit

Of course, these steps may be easier said than done, especially for a first-time home buyer.

How are you supposed to pay down debt and increase your savings at the same time? Often its a struggle to even meet monthly expenses.

But nearly everyone at least, nearly everyone with homeownership plans can find some savings in their household budgets. And its surprising how often just a small improvement in your DTI, down payment, or credit score can make a big difference to the mortgage deal youre offered.

So do what you can. But if your financial situation isnt perfect, dont let that stop you. Mortgage loan programs today are flexible, and you might be surprised at what it takes to qualify.

Upfront Costs To Expect

Buying a home requires a lot of money from the get-go. Here are three factors to consider:

- Down payment: Do you have the minimum down payment amount your mortgage requires? You’ll need 3% for a conforming mortgage backed by Freddie Mac or Fannie Mae, 20% for a jumbo mortgage, and 3.5% for an FHA mortgage. You might not need any down payment for a USDA or VA mortgage.

- Closing costs: Closing costs include expenses like an application fee, appraisal fee, and settlement fee. According to mortgage technology company ClosingCorp, the average closing costs in 2021 were $6,905 including transfer taxes, or $3,860 without taxes.

- Remaining savings: You probably don’t want to drain 100% of your savings to buy a home, only to find yourself in a bind if a financial emergency occurs. Think about how much money you want to have left in savings once you’ve made the down payment and covered closing costs.

Also Check: Can You File Bankruptcy On A Second Mortgage

Mortgage Payments By City

Especially in coastal cities where space is at a premium, a monthly home payment can be much higher than the national average or median payment. According to US Census Bureau data from the 2019 American Community Survey, the median monthly home payment was more than $2,600 per month in Los Angeles, and over $2,800 per month in the New York City area.

But, not all metro areas are as expensive in Phoenix, Arizona, the median home payment is about $1,500 per month, and about $1,800 per month in Dallas. Here’s how the most populated metro areas stack up in monthly living costs according to Census Bureau data. Cities are listed by size.

| City |

| $1,609 |

Is It Worth It To Pay Off A Mortgage Early

A: As long as you aren’t charged a prepayment penalty by your lender and saving money is your goal, then yes, it could be worth it for you to pay it off early. However, consider that everything depends on your financial goals and what is going on in the housing market. It’s always a great idea to talk to a salary-based mortgage consultant when in doubt. Find out more about makingextra mortgage payments.

Recommended Reading: How To Buy Back A Reverse Mortgage

Where Should I Stash My Down Payment

You could stash your down payment in a simple money market savings account. Youre not going to make tons on interest, but you wont lose money either. Keep in mind: Saving a down payment is not the same as investing for retirement. Saving a down payment should only take you a year or twoso you want to keep your savings in a place thats easy for you to access.

What Can You Afford

To start, you’ll need a good grasp of your finances, specifically the total income you’re bringing in each month and the monthly payments for any debts you owe .

Generally speaking, no more than 25% to 28% of your monthly income should go toward your mortgage payment, according to Freddie Mac. You can plug these numbers into a mortgage calculator to break down the monthly payment you can afford and your desired home price.

Keep in mind that this is only a rough estimate. You should also take into account the consistency of your income. If your income fluctuates or is unpredictable, you may want to aim for a lower monthly payment to relieve some financial pressure.

See if you’re a good candidate to take out a mortgage right now by answering a few quick questions.

Remember, costs also may vary by location, so you’ll also want to take that into account when determining which town or city you’re looking to buy in.

Don’t Miss: When Is Best To Refinance Mortgage

What Percentage Of Your Salary Should Go For A Mortgage

Buying and owning real estate usually involves having a mortgage loan. If youâre contemplating becoming another happy homeowner, you should have an idea what mortgage lenders look for as a percentage of your compensation. Along with acting as a major qualification component, statistics prove that spending this percentage â or less â for your mortgage payment predicts your success at meeting your loan obligations.