Explanation Of Mortgage Terms

Mortgage terminology can be confusing and overly complicatedbut it doesnt have to be! Weve broken down some of the terms to help make them easier to understand.

Learn about

Home Price

Across the country, average home prices have been going up. Despite the rise in home prices, you can still find a perfect home thats within your budget! As you begin to house hunt, just make sure to consider the most important question: How much house can I afford? After all, you want your home to be a blessing, not a burden.

Learn about

Down Payment

The initial cash payment, usually represented as a percentage of the total purchase price, a home buyer makes when purchasing a home. For example, a 20% down payment on a $200,000 house is $40,000. A 20% down payment typically allows you to avoid private mortgage insurance . The higher your down payment, the less interest you pay over the life of your home loan. The best way to pay for a home is with a 100% down payment in cash! Not only does it set you up for building wealth, but it also streamlines the real estate process.

Learn about

Mortgage Types

15-Year Fixed-Rate Mortgage

30-Year Fixed-Rate Mortgage

5/1 Adjustable-Rate Mortgage

Learn about

Interest Rate

Learn about

Private Mortgage Insurance

Learn about

Homeowners Insurance

Learn about

Homeowners Association Fees

Learn about

Monthly Payment

Learn about

Property Taxes

Mortgage Calculator Uses

Calculator: Start By Crunching The Numbers

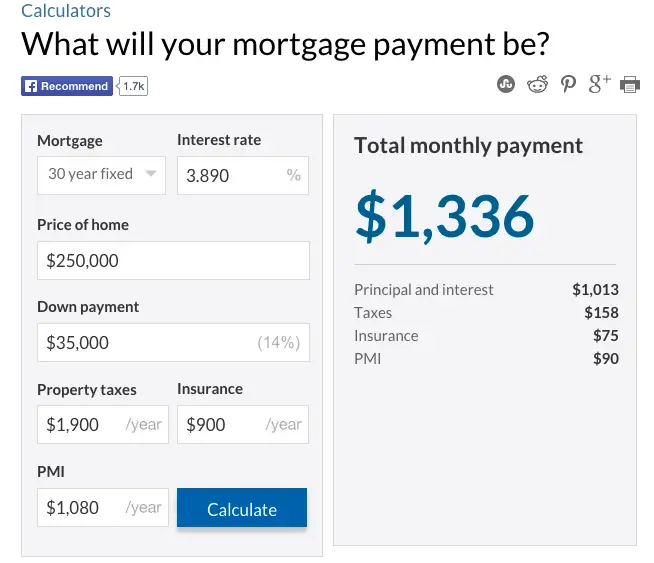

Input these numbers into our Home Affordability Calculator to get a clear idea of your homebuying budget.

How Interest Rates Work

Interest rates rise and fall over time. If youre borrowing money, interest is the amount you pay to your lender to use the money. The interest rate is used to calculate how much you need to pay to borrow money.

Financial institutions set the interest rate for your loan. This could be a mortgage, line of credit or another type of loan.

You can find your interest rate in your loan agreement. Your financial institution must provide you with certain information about interest rates on your loan.

Learn more about your right to information when you borrow money.

Also Check: What Is The Interest Rate For Home Mortgage

Does Dave Ramsey Recommend Paying Off Mortgage

To be fair, Ramsey does not advise paying off your mortgage as a first step. He wants you to pay off all of your other debt first and then start setting aside 15% of your money to stick in mutual funds. … According to Ramsey himself, you’ll get a 12% rate of return if you put your money into an index fund.

How To Get The Lowest Rate Possible

Unfortunately, you dont have a great deal of personal control over the average interest rates offered at any given time. But you do have quite a bit of control over the rates youll be offered relative to the average.

The first step to ensuring youll get the lowest rate possible is to shop around for multiple offers.

Credible is an online marketplace where you can get competitive mortgage rates from multiple, vetted lenders in real-time. It makes the entire mortgage process easy, from getting preapproved to closing, and requesting rates wont affect your credit. Youll start by filling out a quick application that will give you quotes from multiple lenders. If you like one of the quotes, you can link up to your bank accounts and upload documents to make the process not only quick, but paperless.

Another option for getting quotes is Fiona. With Fiona, you compare and shop for mortgage rates from multiple lenders at once, so you can easily decide which offer is the best for your needs. Your credit score wont be checked until you decide to move forward with one of the lenders, so there is no need to worry about hurting your score just for pre-qualifying. The service is 100% free, and youre under no obligation to go with any of the lenders who provide a quote.

Also Check: How Long Would It Take To Pay Off My Mortgage

A Quick Primer On How Interest Rates Work On Mortgages

A mortgage is a type of loan used to purchase a home or other real estate. The interest rate on a mortgage is the percentage of the total loan amount that you will have to pay in addition to the principal, or original, loan amount.

The interest rate on a mortgage is usually expressed as an annual percentage rate, or APR. This means that you will have to pay back the loan plus interest charges over the course of the life of the loan. The interest rate on a mortgage can be fixed or variable, depending on your lenders terms and conditions.

If you have a fixed-rate mortgage, then your interest rate will not change over the life of the loan. But if you have an adjustable-rate mortgage, then it can fluctuate based on the Prime rate, for example.

Other Ways To Reduce Monthly Mortgage Payments

Reducing interest is one of several techniques that may allow you to pay less each month towards your housing obligation.

- Eliminate Private Mortgage Insurance PMI is a type of insurance that helps reduce the mortgage lenders risk. PMI is required for mortgages when borrowers put down less than 20% of the purchase price. For those with monthly insurance premiums, getting rid of PMI on your mortgage or reducing your PMI of an FHA loan is likely the easiest way to reduce your monthly payments.

However, a borrower may request that their PMI payments be waived if the existing mortgage and property value meet specific criteria. PMI, which began at mortgage origination/closing, can often be eliminated if the principal is reduced or the property appreciates.

- Reduce Your Property Taxes Property taxes are calculated by multiplying the jurisdictions tax rate by the most recent value of the property . An assessed value is a value as viewed through the eyes of an authorized property valuation professional. Knowing how much your home is worth is the first step in reducing your property taxes.

You May Like: Can A Mortgage Include Renovation Costs

Early Mortgage Payoff Calculator: How Much Should Your Extra Payments Be

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

One way to pay off your mortgage early is by making larger monthly payments. But how much more should you pay? NerdWallet’s early mortgage payoff calculator figures it out for you.

The mortgage payoff calculator shows you:

-

How much more principal you would have to pay every month to pay off the loan in a certain number of years.

-

How much interest you would save by paying off the loan early.

To fill out the fields, it might help to have one of the following:

-

A recent monthly statement.

Check out tips below in Mortgage payoff calculator help.

Mortgage Interest Compounding In Canada

Mortgage interest in Canada is compounded semi-annually. This means that while you might be making monthly mortgage payments, your mortgage interest will only be compounded twice a year. Semi-annual compounding saves you money compared to monthly compounding. Thats because interest will be charged on top of your interest less often, giving interest less room to grow.

To see how this works, lets first look at credit cards. Not all credit cards in Canada chargecompound interest, but for those that do, they usually are compounded monthly. The unpaid interest is added to the credit card balance, which will then be charged interest if it continues to be unpaid. For example, you purchased an item for $1,000 and charged it to your credit card which has an interest rate of 20%. You decide not to pay it off and make no payments. To simplify, assume that there is no minimum required payment.

The same applies to mortgages, but instead of monthly compounding, the compounding period for mortgages in Canada is semi-annually. Instead of adding unpaid interest to your balance every month like a credit card, a mortgage lender is limited to adding unpaid interest to your mortgage balance twice a year. In other words, this affects your actual interest rate based on the interest being charged.

Don’t Miss: What Is A Fixed Mortgage Rate For 30 Years

Calculate The Cost Of Borrowing

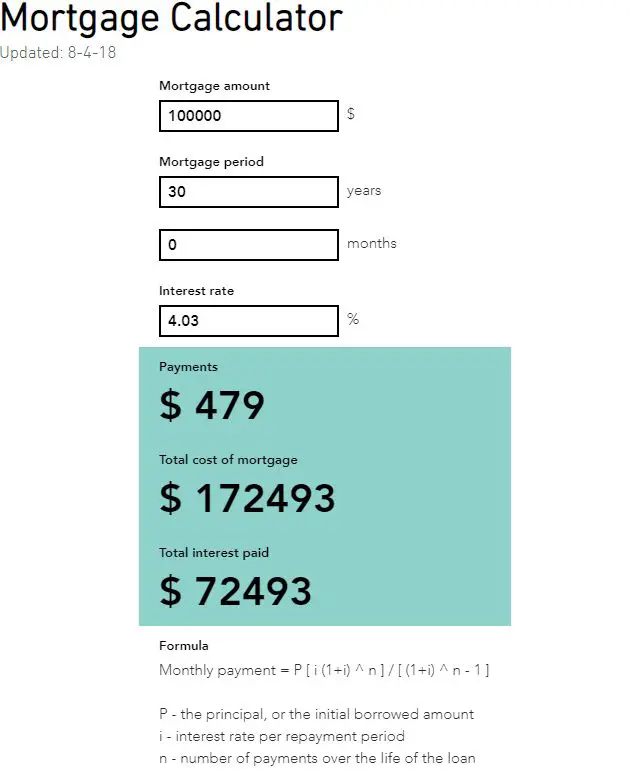

When you buy a home, you already know that you’re going to pay a lot of interest over the life of the loan. However, you may not be prepared for just how much you are going to have to pay. In many cases you could buy your house two or three times over with the amount you end up paying back to your loan.

A good mortgage calculator like the ones we offer at MortgageCalculator.org can help you determine your monthly payment and your total interest payments. However, looking at the total interest you pay may seem too abstract. For instance, if you pay 5 percent on a $250,000 30-year fixed loan, you will end up paying $233,139.46 in interest alone. Since this amount is spread out over 30 years, it may be harder to contextualize the impact of.

Understanding exactly how much you pay in interest each month and each year rather than cumulatively over several decades can help make the amount seem more concrete and immediate. Breaking it down further by every thousand dollars of your mortgage can help you how it all adds up.

On that same $250,000 loan with 5 percent interest, you would pay $5.41 in interest each month for every $1,000 of the loan. You would pay $64.91 each year for every $1,000 of the loan.

Is there something else you could or should have invested in which would have offered better returns?

Higher Returning & More Diversified Opportunities

What The Early Mortgage Payoff Calculator Does

Do you want to pay off your mortgage early? Maybe you have 27 years remaining on your home loan but you would rather pay it off in 18 years instead. The early payoff calculator demonstrates how to reach your goal.

The mortgage payoff calculator shows you:

-

How much more principal you would have to pay every month so you can pay off the loan in a certain number of years.

-

How much interest you would save by paying off the loan early.

There are many reasons you might want to accelerate the mortgages payoff, but the motivation usually boils down to either or both of these:

-

You want to own your home free and clear by a milestone in life, such as your retirement or the beginning or end of your kids college years.

-

You want to reduce the total interest you pay over the life of the loan.

To steadily pay off the mortgage early, you need to know how much more to pay toward the principal balance every month to accomplish that goal. This calculator lets you do that.

When paying down the principal on a mortgage faster, keep in mind that each servicer has its own procedures for assuring that your extra payments go toward the principal balance instead of toward future payments. Contact your servicer for instructions.

Also Check: What’s The Longest Mortgage You Can Get

What Happens After You Get Preapproved For A Home Mortgage Loan

Getting preapproved for a mortgage is just the beginning. Once the financial pieces are in place, its time to find your perfect home! While its one of the most exciting stages of the process, it can also be the most stressful. Thats why its important to partner with a buyers agent.

A buyers agent can guide you through the process of finding a home, negotiating the contract, and closing on your new place. The best part? Working with a buyers agent doesnt cost you a thing! Thats because, in most cases, the seller pays the agents commission. Through our Endorsed Local Providers program, our team can match you with the top real estate agents we recommend in your area.

Mortgage Rate Factors You Can’t Change

- The Federal Reserve: The Federal Reserve doesn’t set mortgage rates, but its policy decisions influence them. The Fed sets the federal funds rate, the short-term rate at which banks borrow money from each other. When the rate increases, it’s more expensive for banks to borrow from other banks and the extra costs can get passed on to consumers.

- Inflation: Inflation doesn’t directly affect mortgage rates, but it influences the Fed’s monetary policy decisions. When inflation increases too quickly, the Fed might raise short-term interest rates, making it more expensive to borrow money.

- The overall economy: Mortgage rates tend to increase when the economic outlook is good . Conversely, rates tend to drop when the economy slows. The bond market also plays a role, as mortgage rates usually do the opposite of what the bond market is doing.

Also Check: How Much Interest You Pay On A Mortgage

Changes In Mortgage Interest Rates

Most new mortgages are sold in the secondary market soon after being closed, and the prices charged borrowers are always based on current secondary market prices. The usual practice is to reset all prices every morning based on the closing prices in the secondary market the night before. Call these the lenders posted prices.

The posted price applies to potential borrowers who have been cleared to lock, which requires that their loan applications have been processed, the appraisals ordered, and all required documentation completed. This typically takes several weeks on a refinance, longer on a house purchase transaction.

To potential borrowers in shopping mode, a lenders posted price has limited significance, since it is not available to them and will disappear overnight. Posted prices communicated to shoppers orally by loan officers are particularly suspect, because some of them understate the price to induce the shopper to return, a practice called low-balling. The only safe way to shop posted prices is on-line at multi-lender web sites such as mine.

How To Calculate Repayments On A Mortgage

To calculate how much interest youll pay on a mortgage each month, you can use the monthly interest rate. Generally, youll find this by dividing your annual interest rate by 12. Then, multiply this by the amount of principal outstanding on the loan. Note that this means youll pay less interest later in the life of the mortgage, but keep in mind that this wont always hold true for adjustable rate mortgages.

TL DR

Divide you annual mortgage interest rate by 12 to get your monthly rate. Multiply this number by the total amount outstanding on the loan to get how much interest you owe for the month.

Dont Miss: Rocket Mortgage Loan Types

Don’t Miss: What Is A Non Qm Mortgage

How Do Lenders Calculate My Dti

At a minimum, lenders will total up all the monthly debt payments youâll be making for at least the next 10 months Sometimes they will even include debts youâre only paying for a few more months if those payments significantly affect how much monthly mortgage payment you can afford.

Lenders primarily look at your DTI ratio. There are two types of DTI: front-end and back-end.

Front end only includes your housing payment. Lenders usually donât want you to spend more than 31% to 36% of your monthly income on principal, interest, property taxes and insurance. For example, if your total monthly income is $7,000, then your housing payment shouldnât be more than $2,170 to $2,520.

Back-end DTI adds your existing debts to your proposed mortgage payment. Lenders want this DTI to be no higher than 41% to 50%. Letâs say your car payment, credit card payment and student loan payment add up to $1,050 per month. Thatâs 15% of your income. Your proposed housing payment, then, could be somewhere between 26% and 35% of your income, or $1,820 to $2,450.

How To Get A Mortgage

Getting the best possible mortgage rate can save you hundreds of dollars a month and tens of thousands of dollars over the life of the loan. But getting a mortgage starts long before you buy a home. Here are the basic steps.

Editorial Disclosure: All articles are prepared by editorial staff and contributors. Opinions expressed therein are solely those of the editorial team and have not been reviewed or approved by any advertiser. The information, including rates and fees, presented in this article is accurate as of the date of the publish. Check the lenders website for the most current information.

Recommended Reading: Should I Get 15 Year Mortgage

How Much Interest Will I Have To Pay

The Bankrate loan interest calculator can help you determine the total interest over the life of your loan and the average monthly interest payments. This calculator only applies to loans with fixed or simple interest.

To use the calculator, enter the beginning balance of your loan and your interest rate. Next, add the minimum and the maximum that you are willing to pay each month, then click calculate. The results will let you see the total interest and the monthly average for the minimum and maximum payment plans.