How To Interpret The Results

The calculator shows two sets of results:

Most lenders require borrowers to keep housing costs to 28% or less of their pretax income. Your total debt payments cant usually be more than 36% of your pretax income.

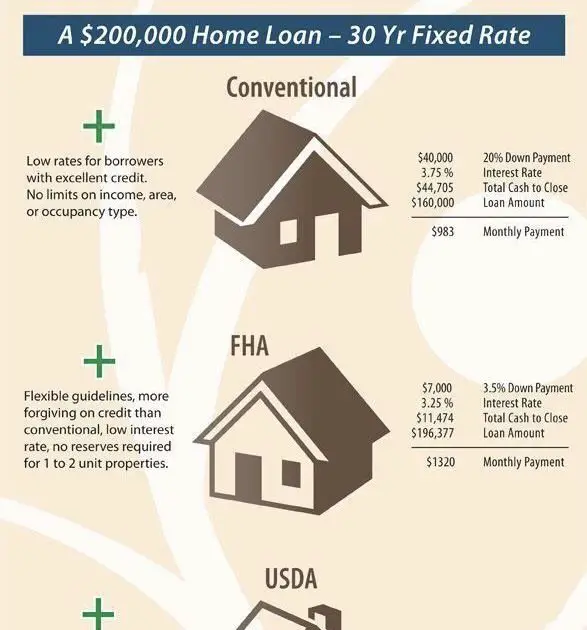

Some mortgage programs – FHA, for example – qualify borrowers with housing costs up to 31% of their pretax income, and allow total debts up to 43% of pretax income.

Use our Debt-to-income Calculator to find your DTI ratio and learn more about debts role in your home purchase.

I Make 125 Ka Year How Much House Can I Afford

Monthly Payment. $1,558.67. Total Interest Paid. $224,558.96. Total Paid. $561,120.00. Use this calculator to calculate how expensive of a home you can afford if you have $82k in annual income. Make sure to consider property taxes, home insurance, and your other debt payments.

samsung tablet 7

Select city in Pakistan: Summary: Family of four estimated monthly costs are 912.31$ without rent. A single person estimated monthly costs are 274.30$ without rent. Cost of living in Pakistan is, on average, 75.02% lower than in United States. Rent in Pakistan is, on average, 93.01% lower than in United States. On your $50,000 salary, if your monthly take-home pay is $3,500, for example, your monthly rent should not exceed $1,050. 2. Theres still the issue of your specific expenses. For.

gaffney high school district code

How Do Lenders Determine Mortgage Loan Amounts

While each mortgage lender maintains its own criteria for affordability, your ability to purchase a home will always depend mainly on the following factors.

Many different factors go into the mortgage lenders decision on homebuyer affordability, but they boil down to income, debt, assets, and liabilities. A lender wants to know how much income an applicant makes, how many demands there are on that income, and the potential for both in the futurein short, anything that could jeopardize its ability to get paid back.

Income, down payment, and monthly expenses are generally base qualifiers for financing, while and score determine the rate of interest on the financing itself.

Recommended Reading: What Happens If I Outlive My Reverse Mortgage

Aim To Put 20 Percent Down

The amount of mortgage you can afford also depends on the down payment you make when buying a home. In a perfect world, we recommend a 20 percent down payment to avoid paying mortgage insurance, Neeley says.

When your down payment is less than 20 percent, your costs rise. You typically have to pay private mortgage insurance, which can cost up to 1 percent of the entire loan amount each year until you build up 20 percent equity in your home. On a $240,000 mortgage, thats $200 per month.

Keep in mind that you will have other ongoing costs related to homeownership as well, including taxes, insurance, and utilities. All of these expenses need to be estimated before you settle on a monthly mortgage payment.

How Much Is Dollar To Naira

lax is life tournament 2022

See full list on calculator.net.

In our Learning Center, you can see today’s mortgage rates and calculate what you can afford with our mortgage calculator before applying for a mortgage. Home Equity Line of Credit You might be able to use a portion of your home’s value to spruce it.

For more information on how to earn Robux, visit our Robux Help page. Purchase Roblox Premium to get more Robux for the same price. Roblox Premium is billed every month until cancelled. Learn more here. Buy Robux. Subscribe. and get more! Because you Subscribed! $4.99. 400. 450 /month. $9.99. 800. 1,000 /month. $19.99. 1,700.

Monthly debt: $750. Credit score: Excellent After plugging in these numbers, HomeLight estimates that you can afford a home that costs $173,702, with monthly.

Read Also: Can You Get Help With Mortgage Payments

I’m Not Sure What My Interest Rate Will Be What Should I Do

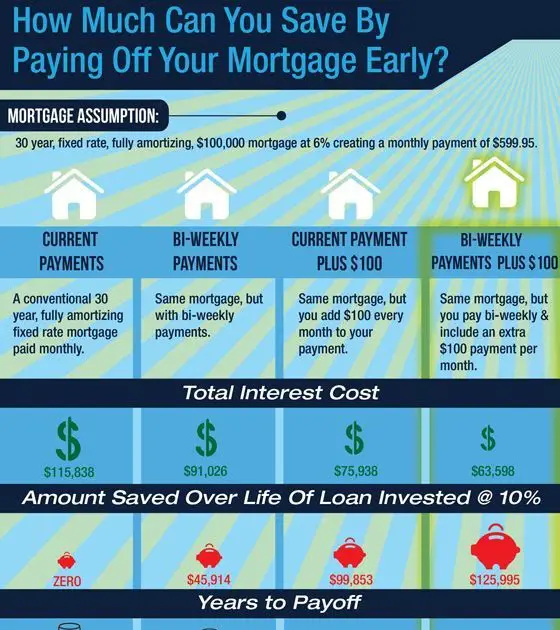

Fortunately, you don’t have to have a specific mortgage rate in mind to use the Mortgage Qualifying Calculator. You can choose an approximate rate, enter the rest of your information, then use the sliding tool to see how a higher or lower rate will affect your results. That includes changing your amortization table and the interest paid over the life of the loan. You can adjust other values as well to see what effect a different figure there would have.

If I Make 2000 A Month How Much Mortgage Can I Afford

In the UK, £2,000 per month after tax comes to around £31,000 per year.

If you are on this amount, the mortgages on offer to you would likely range between £139,500 and £186,000. This is because UK providers usually cap their lending between 4.5 and 6 times the borrowers salary, but keep in mind that your choice of approachable lenders, and therefore the best rates, will be more difficult to come by if you need to borrow 6 times your income.

Also Check: What Is A Mortgage Inspection

How Much House Can You Really Afford

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

It’s more than tempting to dive right in and start favoriting houses on real estate listing sites, but it’s not worth falling in love or even lust if the property’s way beyond your budget. But how do you determine your price range? You could reach out to mortgage lenders and see what they’d be willing to let you borrow, but you’re likely better off working backward from the monthly mortgage payment. Here’s why.

» MORE: Try NerdWallet’s home affordability calculator

Can I Get A Mortgage If I Have Debt

Having some degree of debt like an auto loan doesnt disqualify you from getting a mortgage. But your DTI certainly will influence how a lender evaluates your loan application. Generally speaking, a lender wont approve you for a mortgage if your DTI is above 43%.

Personally, I advise you to hold off on a mortgage until your DTI is below 40% max. And a 33% DTI is an even better goal before applying for a mortgage. Going into a mortgage with a lower DTI gives you more financial breathing room in the event that unexpected expenses pop up.

You May Like: How To Get A Higher Mortgage With Low Income

How Much Should I Spend On A House

Anaffordability calculatoris a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

Can You Afford A 100000 Mortgage

Is the big question, can your finances cover the cost of a £1,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering yes then its worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered. See how much it will cost you to move home when buying a property worth £1,000.00

Do you need to calculate how much deposit you will need for a £1,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances

Did you know that we review the UKs leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesnt charge you fees, so you get the best mortgage deals without the hassle.

You May Like: What To Look Out For With Mortgage Lenders

Read Also: How Much Is A 260 000 Mortgage

How To Calculate How Much House You Can Afford

To produce estimates, both Annual Property Taxes and Insurance are expressed here as percentages. Generally speaking, and depending upon your location, they will typoically range from about 0.5% to about 2.5% for Taxes, and 0.5% to 1% or so for Insurance.

Front End and Back End debt ratios are to determine how much of your monthly gross income can be used for your mortgage debt and how much can be used to satisfy all your regular obligations . The 28% and 36% ratios are standard in the mortgage world, but lenders may have other combinations available, such as 33%/38%.

Also Check: How To Get A Mortgage Loan After A Foreclosure

Rates On A 2000 Per Month Mortgage

Mortgage rates arent calculated based purely on income and affordability, so its impossible to give an exact idea of what rates you would expect on a mortgage costing £2,000 per month, without considering all the criteria discussed above.

To give an idea of how rates affect your mortgage payments, weve put together the table below

| Interest Rate |

You May Like: How To Become A Mortgage Underwriter With No Experience

What Is The Most Affordable State For Buying A House

According toBusiness Insider, the cheapest state to buy a house is West Virginia, with a median list price of $169,000. When looking at the most affordable city to buy a house,Forbessays that Detroit, Michigan is the most affordable, with a median listing price of just $59,000. That’s well below the third-place runner up city of Toledo, Ohio, which has a median listing price of $95,000.

However, housing prices dont reflect the total cost of living in any particular state. According toUS News, Mississippi has the lowestcost of living in the United States, but it does have a slightly higher average home price at $252,725.

The Traditional Model: 35% Or 45% Of Pretax Income

In an article on how the mortgage crash of the late 2000s changed the rules for first-time homebuyers, the New York Times reported:

If youre determined to be truly conservative, dont spend more than about 35% of your pretax income on mortgage, property tax, and home insurance payments. Bank of America, which adheres to the guidelines that Fannie Mae and Freddie Mac set, will let your total debt hit 45% of your pretax income, but no more.

I would hardly call 35% of your pretax income conservative, let alone truly conservative.

Lets remember that even in the post-crisis lending world, mortgage lenders want to approve creditworthy borrowers for the largest mortgage possible. So when you obtain mortgage pre-approval, lenders will likely approve you for a loan amount with payments of up to 35% of your pretax income. That may tempt you to take on more home than you should. But dont just assume that because the bank approved it, you can afford it. They are two very different things.

Remember: The more you spend on your home, the less you have available to save for everything else. You may be able to afford a housing payment that is 35% of your pretax income today, but what about when you have kids, buy a new car, or lose your job?

Read Also: What Are Prepaid Items On A Mortgage

How Much Home Can I Afford

Purchasing a home is a decision that will impact your financial situation for the next 15 to 30 years. Its important to calculate your monthly income and expenses carefully to avoid winding up with a mortgage loan you cant pay in the long run.

And, if youre ready to buy, visit our best mortgage lenders page to find the right lender for you.

How much house you can afford will mainly depend on the following:

- Your loan amount and mortgage term

- Your gross monthly and annual income

- Your total monthly debt or monthly expenses, including credit card debt, student loan payments, car payment, child support, and other expenses

- State property taxes, which are paid annually or biannually and vary by state

- Current mortgage rates and closing costs, which vary by location

- Homeowners association and condo fees

Generally, most new homebuyers will consider taking out a conventional mortgage loan. These loans typically require a down payment of no less than 3% of the property value, a minimum credit score of 620, a debt-to-income ratio of 36% and that the monthly payment doesnt exceed 28% of the buyers pre-tax income.

Lenders will also look at a buyers ability to deal with all the fees and upfront costs associated with buying a home, such as closing costs and insurance fees.

Despite Bigger Budgets Buyers Have Fewer Options In Many Metros

Back in June, homebuyers thought they could take advantage of low rates and get a good deal because of the pandemic, said Providence, RI Redfin agent Lisa Bernardeau. Now theyre seeing thats not the case because inventory is so tight and theres so much competition, but most buyers are still powering through. Regardless of high prices, a lot of buyers have been watching the market and they dont want to miss out on historically low rates or risk prices going even higher. Low interest rates are the number one driver right now.

There were fewer homes for sale on a $2,500 monthly budget than last year in the majority of metros included in this report, including Providence, where 74.4% of homes are affordable on that budget now versus 75.9% in July 2019.

Salt Lake City , Kansas City , Austin and Boston saw the biggest declines in the share of affordable homes for sale. Miami , Jacksonville , Columbus and Milwaukee experienced the biggest increases.

You May Like: What Is Negotiable On A Mortgage Loan

What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: What Is The Longest Mortgage Term

Summary Of Moneys Guide To Home Affordability

How much house you can afford depends mainly on two factors: your eligibility for a mortgage loan and your actual budget when it comes to paying a monthly bill, along with taxes and insurance. Remember these steps when youre getting ready to make your home purchase:

- Calculate your monthly debt and compare it to your gross income to get an idea of your DTI.

- Take into account other monthly expenses such as utilities and groceries.

- Save up for a down payment.

- Consider all your loan options, such as FHA and VA loans.

- Use a mortgage calculator to avoid any surprises.

How The Loan You Choose Can Affect Affordability

The loan you choose can also affect how much home you can afford:

- FHA loan. Youll have the added expense of up-front mortgage insurance and monthly mortgage insurance premiums.

- VA loan. You wont have to put anything down and you wont have to pay for mortgage insurance, but you will have to pay a funding fee.

- Conventional loan. If you put down less than 20%, private mortgage insurance will take up part of your monthly budget.

- USDA loan. Both the upfront fee and the annual fee will detract from how much home you can afford.

Also Check: How To Calculate Rental Income For Mortgage Loan

Can I Get A Buy

You could likely buy a property worth £800,000 and expect to pay around £2,000 for an interest-only, buy-to-let mortgage. Your rental income from the property would need to be around £2,500-£2,900.

Buy-to-let mortgages are different from typical residential mortgages in two important ways:

Ask a quick question

We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in all different mortgage subjects.Ask us a question and we’ll get the best expert to help.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.