Mortgage Interest Deduction Limits

The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

- If you are single or married and filing jointly, and youre itemizing your tax deductions, you can deduct the interest on mortgage debt up to $750,000

- If you are married and filing separately from your spouse, you can deduct interest payments on mortgage debt up to $375,000 each tax year

For mortgages taken out prior to 2018, the rules are a bit different.

- For any home loan taken out on or before October 13, 1987, all mortgage interest is fully deductible

- For home loan taken out after October 13, 1987, and before December 16, 2017, homeowners can deduct interest on mortgage debt up to $1 million

- The $1 million limit also applies to homeowners who entered a binding purchase agreement between

You can deduct interest payments on home equity loans and lines of credit, too, as long as the debts were used to pay for home improvements or to purchase or build your home.

If you have a home equity loan or line of credit and the funds were NOT used to buy, build, or substantially improve your home, then the interest cannot be deducted.

Other requirements to claim your deduction

Along with staying within the IRSs limits, to qualify for the mortgage interest tax deduction your home must:

Home Mortgage Interest Deduction

| Part of a series on |

A home mortgage interest deduction allows taxpayers who own their homes to reduce their taxable income by the amount of interest paid on the loan which is secured by their principal residence . By contract, most developed countries do not allow a deduction for interest on personal loans. The Netherlands, Switzerland, the United States, Belgium, Denmark, and Ireland allow some form of the deduction.

How The Mortgage Interest Tax Deduction Helps Homeowners

Writing off home acquisition debt tends to help homeowners with higher incomes. Thats because high-earning homeowners typically have larger mortgage balances and are more likely to buy a second home or vacation property both of which increase tax-deductible mortgage interest payments.

This means their home mortgage interest is more likely to exceed the federal income taxs new, higher standard deduction of $24,800 for couples filing jointly or $12,400 for individual tax filers.

Real estate agents and home builders still tout this tax deduction as an incentive to buy a home. They like to claim that it increases the homeownership rate and helps people transform from renters to homeowners.

However, thanks to the new standard deductions created by the 2017 Tax Act, a larger share of homeowners will not itemize their taxes and thus wont be able to deduct mortgage interest.

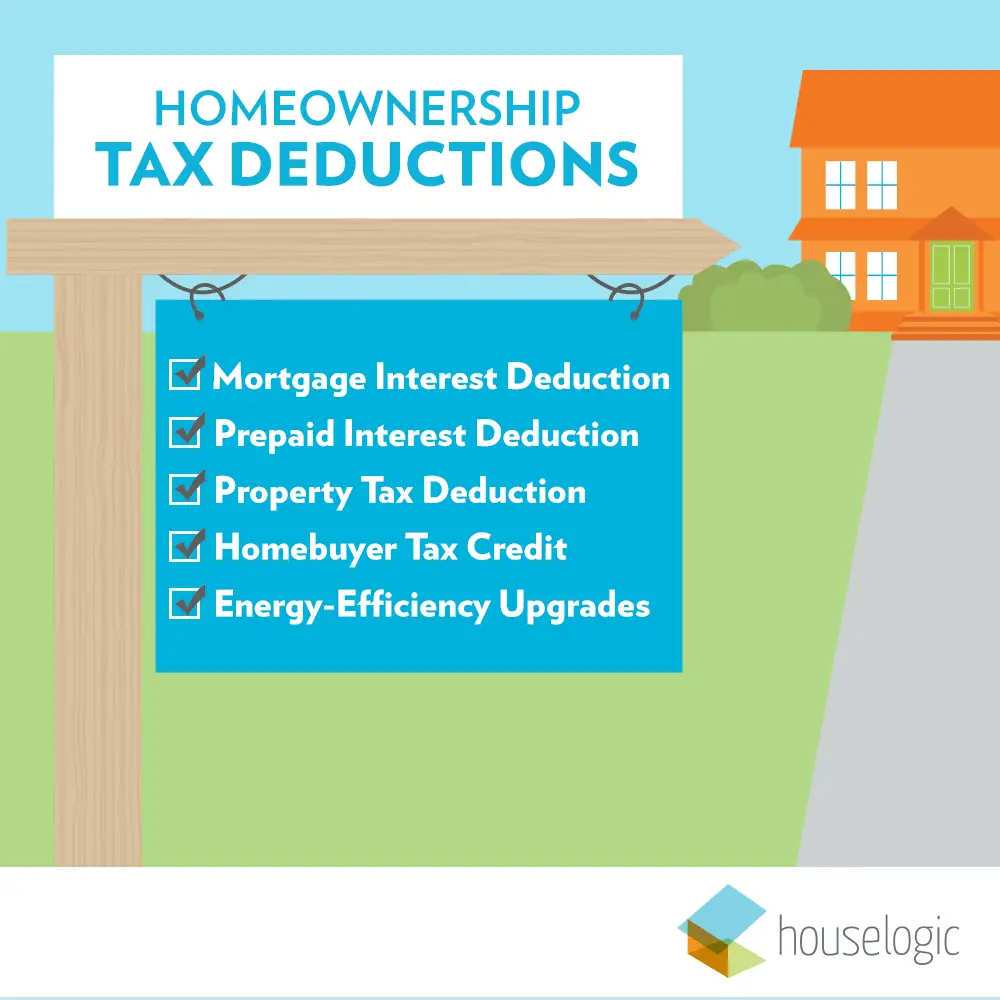

What other costs are tax-deductible?

Mortgage interest isnt the only cost of homeownership thats tax-deductible. If you choose to take itemized deductions, you could also deduct:

Property taxes are also tax-deductible, but they are not included in the mortgage interest deduction. They are written off elsewhere on the 1040 Schedule A tax form.

So, what does tax law exclude from the home mortgage interest deduction?

You May Like: What Does A Mortgage Attorney Do

Deductibility Of Home Mortgage Interest In General

For a discussion of the deductibility of points, please .

Generally, home mortgage interest is any interest you pay on a loan that is secured by your main home or by a second home. The loan may be a mortgage to buy your home, a second mortgage, a line of credit, or a home equity loan.

You can deduct home mortgage interest as an itemized deduction only if you are legally liable for the loan. In other words, you cannot deduct payments you make for someone else if you are not legally liable to make them. Further, there must be a true debtor-creditor relationship between you and the lender.

And, finally, the mortgage must be a “secured debt” on a “qualified home.” These two terms are explained later.

How The Mortgage Interest Deduction Works In 2022

The mortgage interest deduction allows you to reduce your taxable income by the amount of money youve paid in mortgage interest during the year. So if you have a mortgage, keep good records the interest youre paying on your home loan could help cut your tax bill.

As noted, in general you can deduct the mortgage interest you paid during the tax year on the first $1 million of your mortgage debt for your primary home or a second home. If you bought the house after Dec. 15, 2017, you can deduct the interest you paid during the year on the first $750,000 of the mortgage.

For example, if you got an $800,000 mortgage to buy a house in 2017, and you paid $25,000 in interest on that loan during 2021, you probably can deduct all $25,000 of that mortgage interest on your tax return. However, if you got an $800,000 mortgage in 2021, that deduction might be a little smaller. Thats because the 2017 Tax Cuts and Jobs Act limited the deduction to the interest on the first $750,000 of a mortgage.

Theres an exception to that Dec. 15, 2017, cutoff: If you entered into a written binding contract before that date to close before Jan. 1, 2018, and you closed on the house before April 1, 2018, the IRS considers your mortgage to be obtained prior to Dec. 16, 2017.

Want us to do it for you?

Get the app to see your net worth anytime, at a glance.

IRS Publication 936 has all the details, but heres the list in a nutshell.

Interest on a mortgage for your main home

Prepayment penalties

Recommended Reading: How To Calculate Interest Only Mortgage Payment

How To Claim Your Deduction

Eligible homeowners can claim the mortgage interest tax deduction on Schedule A of their annual tax returns. Schedule A accompanies Form 1040 or 1040-SR .

To find out how much mortgage interest you paid during the year, look at your mortgage interest statement, IRS Form 1098. Your lender will send one copy of this form to you and one copy to the IRS. Youâll receive it in January or February each year.

IRS Publication 936, updated annually, contains all the information most taxpayers will need to determine their eligibility for the mortgage interest tax deduction. Taxpayers with complex situations may need to ask a Certified Public Accountant for help.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Thanks for the great question and all the best to you.

Also Check: How To Calculate Monthly Mortgage Payment

Who Can Claim The Home Mortgage Interest Deduction

Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to $750,000 worth of mortgage debt on their primary or second home. For debts incurred before December 16, 2017, these numbers increase to $1 million and $500,000, respectively. The home must be a qualified home, which the IRS defines in Publication 936.

Mortgage Points You Have Paid

When you take out a mortgage, you may have the option to buy mortgage points, which pay some of your loan interest upfront and in advance. Each point, which typically costs about 1% of your mortgage amount, can get you about .25% off your mortgage rate. Mortgage points are paid at closing and must be paid directly to the lender to qualify you for the deduction. In certain instances, points can be deducted in the year they are paid. Otherwise, you have to deduct them ratably over the life of the loan. If you have questions, you should consult a tax professional.

Also Check: How Do You Calculate Points On A Mortgage

More Information On Deducting Home Mortgage Interest

Copyright ©2022 MH Sub I, LLC dba Nolo ® Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Sign Up For Kiplingers Free E

Profit and prosper with the best of Kiplingers expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of Kiplingers expert advice – straight to your e-mail.

If you change your mind about renting the lake house to others, youll still be able to deduct the mortgage interest as long as you dont lease it out for more than two weeks a year. And any rental income you receive will be tax-free, too, if you stay within the two-week limit.

If you rent out the house for longer than that, youll have to report the rental income to the IRS. But you can still deduct some of the mortgage interest and rental expenses, such as insurance and utilities, for the portion of the time that you rent out the house. Calculating the deduction gets complicated because youll need to determine how much of those costs should be allocated to when you were leasing out the house and when you were personally using it.

Read Also: What Is The Monthly Mortgage

Indebtedness That Exceeds The Threshold

You can only deduct a pro-rata portion of your interest if your loan comes in over the applicable amount in other words, you can claim the interest that was generated by the first $750,000 of a mortgage loan you took out in 2018 or later, but not on the balance. Otherwise, you can deduct 100 percent of your interest if your loan comes in under this limit and you meet all the other requirements.

The TCJA is slated to expire at the end of 2025, so its possible that the $1 million threshold could return at that time and home equity loan proceeds used for personal reasons might get a nod again as well. But even then, home equity loans are treated differently from regular mortgages. They would have a much lower limit, just $100,000 of indebtedness.

Make Sure You Can Afford It

Evaluate why you want to buy the property and if you will be able to cover the maintenance costs, said Peter J. Creedon, CEO of Crystal Brook Advisors in New York.

“It’s not just what you will pay for the mortgage,” Creedon said. “It’s all the other things that will have to go into the house.”

That includes maintenance for everything from a fresh coat of paint to major repairs that inevitably crop up.

Don’t Miss: Is Mr Cooper A Legitimate Mortgage Company

Get Your 1098 From Your Lender Or Mortgage Servicer

To fill out the information about the interest you paid for the tax year, youll need a 1098 Form from your mortgage lender or mortgage servicer, the entity you make your payments to. This document details how much you paid in mortgage interest and points during the past year. Its the proof youll need for your mortgage interest deduction.

Your lender or mortgage servicer will provide the form for you at the beginning of the year, before your taxes are due. If you dont receive it by mid-February, have questions not covered in our 1098 FAQ or need help reading your form, contact your lender.

Keep in mind, you will only get a 1098 Form if you paid more than $600 in mortgage interest. If you paid less than $600 in mortgage interest, you can still deduct it.

Dont Miss: What Is The Sales Tax In Mississippi

How The Mortgage Interest Deduction Works

The name says it all: The mortgage interest deduction allows you to deduct only the interestânot the principalâyou pay on your mortgage.

Letâs say your monthly mortgage payment is $1,500. You donât get to deduct $1,500. Look at your mortgage statement and youâll see that perhaps $500 of your payment goes toward principal and $1,000 goes toward interest. The $1,000 is the part you can deduct.

The interest you pay decreases slightly each month, with more of your monthly payment going toward principal. So your total mortgage interest for the year isnât going to be $12,000 it might be more like $11,357 or $12,892.

In the later years of your mortgage, that same $1,500 payment may put $1,000 toward your principal and only $500 toward interest. The mortgage interest deduction saves you more in the early years.

Also Check: How Do I Calculate Points On A Mortgage

Mortgage Interest Deductionpersonal Residence

If your second property is considered a personal residence, you can deduct mortgage interest in the same way you would on your primary homeup to $750,000 if you are single or married filing jointly. The limit is $375,000 if youre married and filing separately.

To qualify for the deduction, the mortgage must be a secured debt on a qualified home you own, and you must itemize your deductions by filing Schedule A. According to the IRS, a home is “qualified” if it’s your main home or a second home. The home can be a house, condominium, cooperative, mobile home, house trailer, boat, or similar property, as long as it has basic living accommodations .

The $1 million mortgage interest limit will return in 2025 when the TCJA expires unless lawmakers act to keep the law in place.

Deducting Interest On Your Second Mortgage

The federal government understands that home mortgages are the largest financial burdens many Americans will ever assume in their lifetimes. In order to provide a break , the Internal Revenue Service allows taxpayers to take deductions on the interest paid on their mortgages.

But what if you get a second home mortgage? Does it matter what you use it for? Can you just deduct interest indefinitely?

We’ll take an in-depth look at the tax implications of taking on a second mortgage, showing you how to go about calculating your deduction on your taxes as well as highlighting various restrictions and pitfalls.

Also Check: How To Purchase A House That Has A Reverse Mortgage

You Don’t Own The Property

You’re not allowed to claim the mortgage interest deduction for someone else’s debt. You must have an ownership interest in the home to deduct interest on a home loan. This means that your name has to be on the deed or you have a written agreement with the deed holder that establishes you have an ownership interest. For example, a parent who buys a home for a child that is in the child’s name alone cannot deduct mortgage interest paid on the child’s behalf.

Are Closing Costs Tax Deductible

Can you deduct these closing costs on your federal income taxes? In most cases, the answer is no. The only mortgage closing costs you can claim on your tax return for the tax year in which you buy a home are any points you pay to reduce your interest rate and the real estate taxes you might pay upfront.

Recommended Reading: Is Paying Points On A Mortgage Worth It

Deducting Your Mortgage Interest After The Tax Reform

This past week, the IRS offered guidance on its website on the new restrictions placed by the Tax Cuts and Jobs Act on the home mortgage interest deduction.

The guidance is noteworthy for the U.S. expat community, because when it comes to the home mortgage interest deduction, the tax code does not distinguish between a home in the U.S. and a home abroad. In appropriate circumstances, the mortgage interest deduction can be an important tax saving method for citizens living abroad.

You Don’t Live In The Home

You can deduct the interest on a home mortgage only for:

- your main home — that is, the home where you ordinarily live most of the time, and

- a home that you choose to treat as your second home.

If you have a second home and rent it out part of the year, you also must use it as a home during the year for it to be a qualified home. You must use this second home more than 14 days or more than 10% of the number of days during the year that the home is rented at a fair rental, whichever is longer. If you do not use the home long enough, it is considered rental property and not a second home.

Don’t Miss: How To Find The Cheapest Mortgage Rates