Understanding Other Mortgage Approval Factors

While your credit score helps determine the loan programs you qualify for and your interest rate, it is only one of several factors that ultimately determine your mortgage approval. Even if you have a great score, your lender may still deny you due to problems with your employment history, debt ratios, cash reserves or the property.

Dont Miss: Why Is There Aargon Agency On My Credit Report

What Is Credit Scoring Models Do Most Lenders Use The Internet

While there are many different valuation models and valuation models, there is light at the end of this tangled tunnel. Of all credit scoring models, the FICO credit score is used by over 90% of the major lenders. You may have a different score that is calculated using a different scoring model with a different provider.

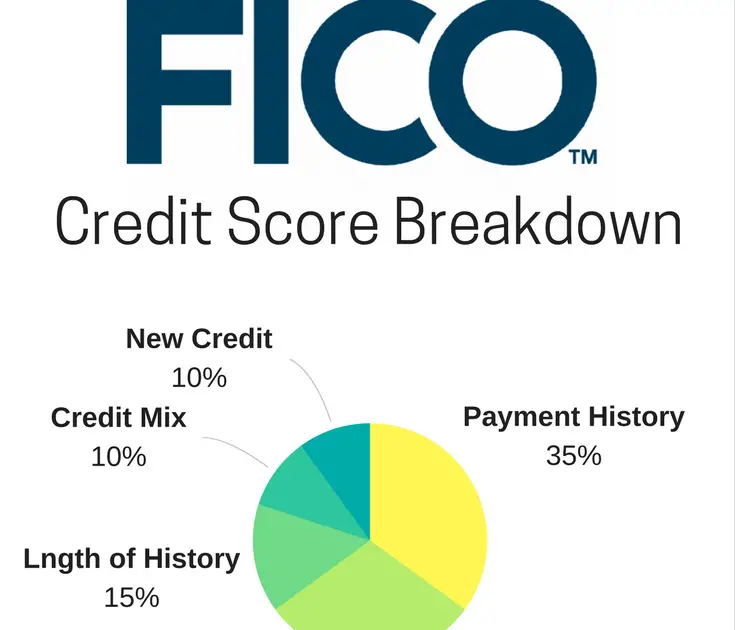

Most Important: Payment History

Your payment history is one of the most important credit scoring factors and can have the biggest impact on your scores.

Having a long history of on-time payments is best for your credit scores, while missing a payment could hurt them. The effects of missing payments can also increase the longer a bill goes unpaid. So a 30-day late payment might have a lesser effect than a 60- or 90-day late payment.

How much a late payment affects your credit can also vary depending on how much you owe. Dont worry, though: If you start making on-time payments and actively reduce the amount owed, then the impact on your scores can diminish over time.

If youre having trouble making payments at all, you could also wind up with a public record, such as a foreclosure or tax lien, that ends up on your credit reports and can hurt your scores. Sometimes a single derogatory mark on your credit, such as a bankruptcy, could have a major impact.

Also Check: Mortgage Rates Based On 10 Year Treasury

Don’t Miss: What Income Is Considered For Mortgage

Is Creditkarma Accurate

The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus. This means a couple of things: The scores we provide are actual credit scores pulled from two of the major consumer credit bureaus, not just estimates of your credit rating.

Do Lenders Use Fico 9

FICO Score 9 is already being used by hundreds of lenders, and eight of the nation’s top 10 lenders have either evaluated it, are in the process of evaluating it or plan to do so, according to FICO’s Lee. He said he expects FICO 9 to overtake FICO 8, but lenders’ testing of the new model could take years.

Read Also: Can You Cancel A Reverse Mortgage

Is Fico Score 8 Used For Mortgages

Scoring model used in mortgage applications While the FICO® 8 model is the most widely used scoring model for general lending decisions, banks use the following FICO scores when you apply for a mortgage: FICO® Score 2 FICO® Score 5

Can FICO 8 be used for mortgage?

FICO 8 and 9 are not the only versions that work. Some lenders and industries use older versions like FICO 2, 4, and 5. In fact, this is still used by the mortgage industry when assessing creditworthiness for new mortgages and deciding on interest rates.

Do most lenders use FICO score 8?

FICO Score 8: Overview. Most lenders look at a borrowers FICO score , but there are even multiple FICO scores for each borrower. 1 FICO Score 8 is the most common, especially with credit card companies, but FICO Score 5 can be popular among car lenders and mortgage providers.

Recommended Reading: Who Is Rocket Mortgage Owned By

How Mortgage Lenders Pull Credit

When you apply for a mortgage, lenders pull your credit report from all three major credit bureaus: Transunion, Equifax, and Experian.

Whether you get approved for the loan and the terms of your loan will depend on the result of those reports.

Lenders qualify you based on your middle credit score.

For example, if your scores are 720, 740, and 750, the lender will use 740 as your FICO. If your scores are 630, 690, and 690, the lender will use 690 as your FICO.

When you apply with a spouse or co-borrower, the lender will use the lower of the two applicants middle credit scores.

Expect each bureau to show a different FICO for you, since each will have slightly different information about you. And, expect your mortgage FICO score to be lower than the VantageScore youll see in most free credit reporting apps.

In all cases, you will need to show at least one account which has been reporting a payment history for at least six months in order for the bureaus to have enough data to calculate a score.

Recommended Reading: Do Conventional Loans Require Mortgage Insurance

Is Fico Score 8 Good Or Bad

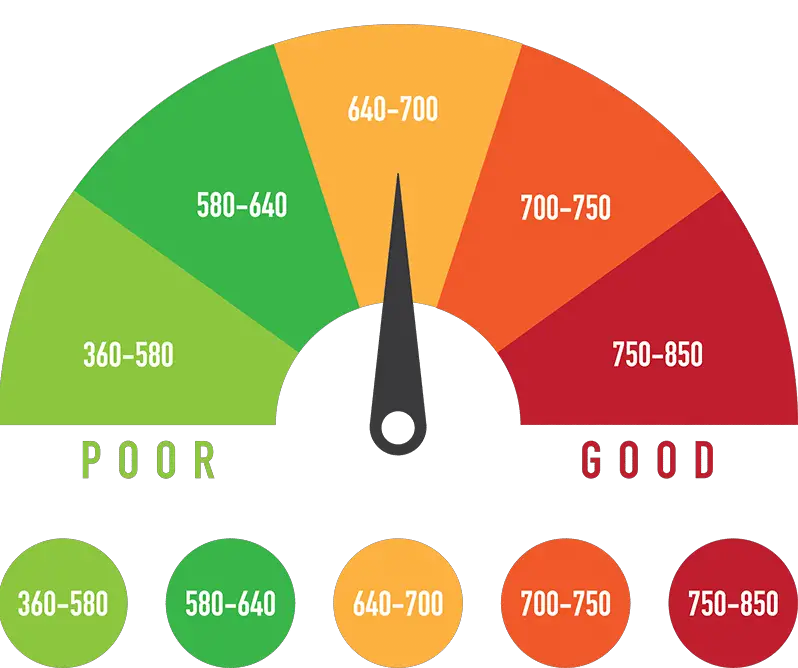

FICO 8 scores range between 300 and 850. A FICO score of at least 700 is considered a good score. There are also industry-specific versions of credit scores that businesses use. For example, the FICO Bankcard Score 8 is the most widely used score when you apply for a new credit card or a credit-limit increase.

What Credit Score Do You Need To Buy A House

Your credit score is a very important consideration when youre buying a house, because it shows your history of how youve handled debt. And having a good credit score to buy a house makes the entire process easier and more affordable the higher your credit score, the lower mortgage interest rate youll qualify for.

Lets dive in and look at the credit score youll need to buy a house, which loan types are best for certain credit ranges and how to boost your credit.

Don’t Miss: How To Find Monthly Payment For Mortgage

What Is A Fico Credit Score And How Does It Work

Most lenders use FICO credit scores to assess a borrowers creditworthiness. The FICO scoring methodology has been updated over the years and lenders can choose which version they want to use. Industry FICO scores are also available for various loan types, such as mortgages, auto loans, and credit cards. What are FICO Points?

Is A Fico Score Of 9 Good Or Bad

The FICO Score 9 is the latest edition of the widely considered credit scoring models. That means good things for your credit score, even though its rolling out very slowly. It is widely available but not yet being used by most lenders.

Why is my FICO score 9 lower?

FICO 9 counts medical bills less accurately than other bills accounts, so a surgery bill in bills will have less of an impact on your credit score than a credit card bill in bills. Additionally, FICO 9 ignores bills on charges with a zero dollar balance.

What does 9 mean on FICO score?

The FICO 9 credit scoring model includes rent payments, minimizes medical debt, and excludes paid charges. Bev OShea. November 22, 2021. The FICO Score 9 is the second most recent version of the well-known credit scoring model, but it is still not being used as widely as its predecessor, the FICO 8.

What is a good FICO 9 credit score?

The overall FICO score range is between 300 and 850. In general, scores in the range of 670 to 739 indicate a good credit history, and most lenders will consider this score to be favorable. In contrast, borrowers in the 580 to 669 range may find it difficult to obtain financing at attractive rates.

You May Like: How Do I Apply For A Mortgage

The Scoring Model Used In Mortgage Applications

While the FICO® 8 model is the most widely used scoring model for general lending decisions, banks use the following FICO scores when you apply for a mortgage:

As you can see, each of the three main credit bureaus use a slightly different version of the industry-specific FICO Score. That’s because FICO tweaks and tailors its scoring model to best predict the creditworthiness for different industries and bureaus. You’re still evaluated on the same core factors , but the categories are weighed a little bit differently.

It makes sense: Borrowing and paying off a mortgage arguably requires a different mindset than keeping track of and using a credit card responsibly.

The FICO 8 model is known for being more critical of high balances on revolving credit lines. Since revolving credit is less of a factor when it comes to mortgages, the FICO 2, 4 and 5 models, which put less emphasis on , have proven to be reliable when evaluating good candidates for a mortgage.

Pay Off Debt Completely

Try paying off high-interest debt like credit card debt for example. Paying your cards in full on a month to month basis is ideal for boosting your credit score. If you have outstanding debt that youre having trouble paying off, ask your lender to work with you. More than likely, theyll establish a payment plan for you.

You May Like: How Do You Figure Out Your Monthly Mortgage Payment

Is Your Credit Score High Enough To Buy A House

If your credit score is above 580, youre in the realm of mortgage eligibility and homeownership. With a score above 620, you should have no problem getting credit-approved to buy a house.

But remember: Credit is only one piece of the puzzle. A lender also needs to approve your income, employment, savings, and debts, as well as the location and price of the home you plan to buy.

To find out whether you can buy a house and how much youre approved to borrow get pre-approved by a mortgage lender. This can typically be done online for free, and it will give you a verified answer about your home buying prospects.

Dont Put Your Eggs In One Basket

Before you go out, keep in mind that few lenders have abandoned FICO entirely. Most use a combination of bothparticularly for borrowers with credit issues. This is why its important for consumers to understand the scoring model used by a lender before signing a loan application and agreeing to credit being pulled. Submitting loan applications haphazardly as a way to land a hit can result in excessive , which can further depress a credit score.

Few lenders have abandoned the FICO scoring model completely.

Part of a loan officers job is to understand his employers criteria for approving applicants. This includes knowing which credit models are used and how they are weighted versus one another. Borrowers who want to be scored by VantageScore should glean this information from the loan officer up front.

Read Also: How Does Private Mortgage Insurance Work

What Is A Credit Score

The term credit score usually refers to a FICO score. FICO stands for the Fair Isaac Corporation, the company that developed the most commonly used credit scoring system. With FICO, everyone is assigned a score ranging from 300 to 850. The higher the number, the better the credit.

Your credit score takes several things into account including current debt, payment history, new credit and types of credit.

Your credit score is important because its one of the key factors lenders look at when deciding whether to offer you a loan.

Lenders Might Use Only One Score In Some Cases

We use all three bureaus scores Experian, Equifax and TransUnion, said Christopher M. Petersen, president and CEO of CP Financial & CP Realty.

There are some caveats associated with certain programs.

For instance, on some home equity lines of credit we use only one bureaus score, but for the vast majority we utilize all three, Petersen said.

And in some rare cases, a borrower may have only two scores, in which case he would use the lower score.

In the past, there were programs that would utilize the average of the top two scores, but that is rarely used now, Petersen said.

See related: How many credit cards do you need to get a mortgage?

Also Check: How Long Does It Take To Qualify For A Mortgage

Increase Your Available Credit

Another thing lenders look at when assessing a borrowers creditworthiness is their credit utilization ratio. This ratio compares the borrowers debt, particularly credit card debt, to their overall credit limits.

For example, if you have one credit card with a $2,000 balance and a $4,000 credit limit, your credit utilization would be 50%. Lenders look for borrowers with lower credit utilization because maxing out credit cards can be a sign of default risk.

A credit utilization of 30% is good, but less than 10% is better. So if you have a card with a $1,000 credit limit, to optimize your credit score youll want no more than $100 outstanding on the statement date for the card.

That means that one of the easiest ways to boost your credit score is to decrease your credit utilization ratio. You can do this by paying down debt or increasing your credit limits.

If youve had a credit card for a while and have built a good payment history, most card issuers will be willing to offer a credit limit increase. You can typically request an increase through your online account.

Theres no risk when requesting a credit limit increase. The worst a lender can do is say no, leaving you exactly where you started. In the best-case scenario, youll get a big credit limit increase, dropping your credit utilization ratio and giving your credit score an immediate boost.

Calculating Your Qualifying Credit Score

Wondering what your credit score is and what kinds of mortgages you may qualify for? If so, the mortgage professionals at Maple Tree Funding can help!

If you are interested in purchasing a home in New York, we can help you determine your qualifying credit score, calculate how much you can afford to spend on a home and help you understand the mortgage options available to you. We will guide you every step of the way, from mortgage pre-qualification to the closing table, helping you to secure the mortgage that is right for you and your budget.

We work with clients of all kinds, from first time homebuyers and individuals with less-than-perfect credit to homeowners looking to refinance their current homes. As a mortgage broker based in Upstate NY, our broad spectrum of home loan options includes government mortgages, conventional loans, fixed rate loans, adjustable rate mortgages and more.

Interested in taking the first step towards owning a home in NY? Give us a call at or contact us online today and well calculate your credit score and get you started on the path to homeownership!

Editors Note: This post was originally published in 2014 but has been updated as of March 2017.

Recommended Reading: How Much Mortgage Will I Qualify For

After My Down Payment What Other Related Mortgage Fees Do I Need To Consider

Once youve settled on a down payment, its important to take stock of your closing costs. Closing costs often run between two to three percent of your total loan. Other fees include the loan origination fee, the loan application fee, the title services fee and appraisal fee. Additionally, you might consider setting up an escrow account, which guarantees 12 months of property taxes and homeowners insurance.

You May Like: Paypal Credit Soft Pull

What’s The Difference Between Fico Score 8 And 9

FICO 9 is similar to FICO 8 but differs when it comes to collections and rent payments. … Additionally, FICO 9 ignores accounts in collections that have a zero dollar balance. If you had a credit card account go to collections but later paid it off, FICO 9 will no longer use said collections account against your score.

Recommended Reading: What Is The Average Mortgage Payment In Colorado

Check Your Mortgage Rates

Your credit score is only one factor that goes into determining your mortgage rate. Other important factors include your loan type, loan term , and the current interest rate market.

If you want to know what rate you qualify for, check with a mortgage lender. You can fill out a quick preapproval application that will give you a good idea of your interest rate, home buying budget, and future monthly payment.

Ready to get started?

Also Check: Requirements For Mortgage Approval

Are Mortgage Credit Scores Different

- Mortgage lenders use FICO scores just like other finance companies

- But pull one version from each of the three major credit bureaus

- To create what is known as a tri-merge credit report

- The mid-score is used for qualifying and mortgage rate purposes

First and foremost, you might be wondering which credit score mortgage lenders use, seeing that theres no sense focusing on something they wont actually look at to determine your creditworthiness.

Ill save you the suspense. The short answer is FICO scores, which are the industry standard and relied upon by just about everyone.

I think something like 9 out of 10 lenders use FICO, and its pretty much 100% in the mortgage world.

As for the version of FICO, I dont know if any mortgage lenders use the newer FICO 8 or FICO 9 scores, which are the latest iterations available, because they tend to upgrade slowly to avoid any unwelcome risk.

This also explains why FICO is pretty much the only game in town its hard to change the status quo because there are a lot of moving parts in the mortgage space, so one seemingly small alteration could have major ramifications.

Don’t Miss: What Are The Drawbacks Of A Reverse Mortgage

Improve Your Credit Scores Before Applying

The FICO® Score versions used in mortgage lending and the more recently released versions, such as FICO® Score 9 and 10, have the same 300 to 850 range. VantageScore, a competing maker of credit scores, also uses that range for its latest VantageScore 3.0 and 4.0 model credit scores.

For all these scoring models, which use the information from one of your credit reports to determine your score, a higher score is better. As a result, you may notice similar trends in all your scores. This is why making on-time payments can help raise all your credit scores, while missing payments could hurt all your scores.

However, there are also differences between the scoring models. For example, the latest FICO® and VantageScore models ignore paid collection accounts and give less weight to medical collection accounts. But the older FICO® Score models continue to count collection accounts against you after you pay off the balance.

In general, whether you’re looking to buy a home or take out a different type of credit, there are a few things that can help improve all your scores:

- Pay your bills on time.

- Pay down credit card balances.

- Don’t apply for other types of credit in the months leading up to your mortgage application.

In addition to getting your application, you want to get your finances in order as well. Saving up for a larger down payment, increasing your income and paying off debts may all help you qualify for a mortgage with better terms.