What Is An Fha Loan

Federal Housing Administration loans are guaranteed by the government and designed for homeowners who may have lower-than-average credit scores and lack the funds for a big down payment. They require a lower minimum down payment and a lower credit score than many conventional loans. FHA home loans are issued by FHA-approved lenders.

How Long Does An Fha Appraisal Is Good For

This is a popular question among first-time house purchasers who are planning to use an FHA loan to purchase a property. The simple answer is that an FHA appraisal is good for 120 days. If they consent to re-certify the value before the current appraisal runs out, an appraiser may re-certify it.

If you intend to use an FHA loan to purchase a home, it is important to Always keep an eye out for the expiration date of the appraisal and take steps to ensure that the property will still meet the requirements for financing.

What Do I Need To Qualify For A Conventional Loan

You will need to complete a mortgage loan application and, along with paying applicable fees, have a credit report run that examines your credit history and provides a credit score, and also provide supporting documentation.

Such documentation can include:

- Proof of income such as pay stubs, two years of federal tax returns, two years of W-2 statements, etc.

- Asset accounting of bank statements and investments to establish that you can pay the down payment and closing costs.

- Employment verification demonstrating you have a stable work history to encourage lenders to work with you.

- Miscellaneous documents including your drivers license or state identification card and your Social Security number

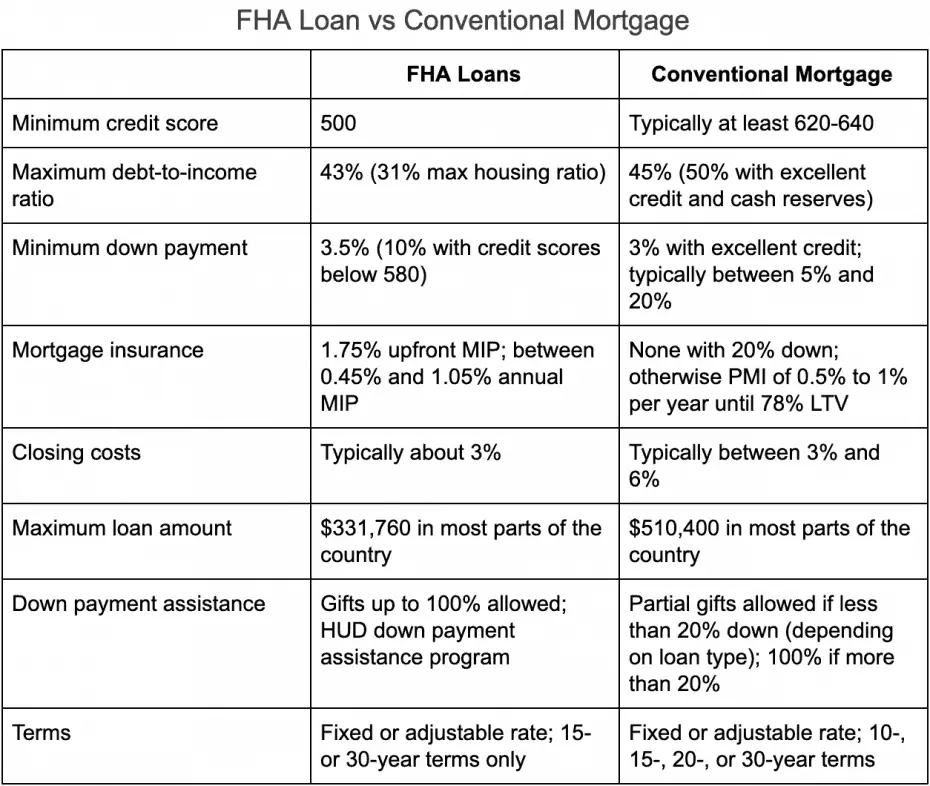

Conventional loans give the borrower more flexibility when it comes to loan amounts while an FHA loan caps out at $420,680 for a single family unit in most lower cost areas and $970,800 in most high cost areas. Conventional loans often do not come with the amount of provisions that FHA loans do. They also do not require mortgage insurance if the loan to value is less than 80%: in other words, if the borrower can make a down payment of 20%.

Because Kate has saved enough to put 20% down, this loan will be a better option because she will not have to pay for mortgage insurance. In addition, if the property you are buying is more of a fixer-upper, a conventional loan or FHA 203k loans could be an option.

You May Like: What Is Los In Mortgage

Thoroughness Of Property Appraisals

Property appraisals for FHA loans are extensive. Compared to conventional loan property assessments, inspectors will conduct a detailed analysis of the safety, structural integrity, design, HUD property guideline alignment and true value of your desired home, as well as compliance with local ordinances and standards.

Make A Final Decision: Fha Or Conventional Mortgage

Youve done your homework and learned the difference between FHA loans and conventional mortgages. Take the next step and work with a loan officer who asks the right questions like the knowledgeable, experienced ones at Capital Bank and can find the loan that fits you best. Then youll have everything you need to make your final decision!

Read Also: Where Can I Find My Mortgage Account Number

What Is The Difference Between An Fha And Conventional Loan In Cost And Benefits

For home buyers with limited funds for a down payment, both FHA and conventional loans are available to help facilitate the purchase of a new dwelling.

FHA loans are insured by the U.S. Federal Housing Administration and are offered by FHA-approved lenders.

Conventional loans are not government-insured and are available through many banks, credit unions, and other mortgage lenders.

You may qualify for both, but there are real differences between them, so take the time to understand the advantages and disadvantages of each before making a decision.

What Is A Debt

A persons debt-to-income ratio is the percentage of their gross monthly income spent to cover debts such as a mortgage, student loans, car loans, credit cards, etc. Lenders take your DTI into consideration because its often a strong indicator of how likely you are to have a hard time paying your bills.

To qualify for an FHA loan, you cannot spend more than half of your gross income on debt that is, a DTI of 50% or more. In some cases, a person may qualify with such a DTI. In general, however, lenders will want to see your debt-to-income ratio be no greater than 43%.

You May Like: How To Pay Your Mortgage With A Credit Card

Conventional Loan Vs Fha: Whats Better

Theres no one-size-fits-all mortgage. When deciding between conventional loans vs. FHA loans, youll have to compare costs and benefits based on your personal finances.

A conventional loan is often better if you have good or excellent credit because your mortgage rate and PMI costs will go down. But an FHA loan can be perfect if your credit score is in the high-500s or low-600s. For lower-credit borrowers, FHA is often the cheaper option.

These are only general guidelines, though. And the choice between conventional vs. FHA might be different for you. So be sure to look closely at both loan types and choose the best one for your situation.

In this article

| Annual and upfront fee |

Conventional Loan 3% Down Payment

With a conventional home loan, you can go as low as 3%something thats actually called a conventional 97 loan. Since a conventional 97 loan is technically a different program than a standard conventional loan, it has a few extra restrictions:

- The loan must be a 30-year fixed-rate loan

- The property must be a one-unit, single-family home, co-op, PUD, or condo.

- The property will be the buyers primary residence

- The buyer cant have owned a house in the last 3 years

- The loan amount is at or under $453,100

Many first-time homebuyers meet these restrictions automatically, so they may not present major obstacles. For those that do, theres still the option to put 5% down.

You May Like: What Does Mortgage Forbearance Mean

Fha Vs Conventional Loans: The Loan

FHA loans tend to have higher loan-to-value ratios than conventional mortgage loans. To explain why, itll help to explain what FHA loans are and why they exist. FHA stands for Federal Housing Authority. The FHA is part of HUD, the U.S. Department of Housing and Urban Development.

FHA loans arent actually issued or serviced by the FHA. Instead, theyre guaranteed by the FHA but issued and serviced by regular private mortgage lenders. Since 1934, FHA loans have been helping first-time homebuyers go from renting to buying.

Driven by the mission to help more Americans become homeowners, FHA loans offer a higher loan-to-value ratio. To put it in simpler terms, FHA loans comes with lower down payment requirements than conventional loans do. With an FHA loan, you can put as little as 3.5% down. The goal of the program is to help put homeownership in reach of more people.

Fha Vs Conventional Mortgages: Mortgage Insurance

If you put less than 20% down on a conventional mortgage, youll have to pay whats called private mortgage insurance . Its a compensation to the lender for taking a chance on a borrower with a lower down payment. But once your loan-to-value ratio dips below 78% your lender will stop adding PMI charges to your monthly mortgage payment. And if you put 20% down, youll never have to pay PMI.

FHA mortgages, on the other hand, all come with mortgage insurance. When you take out an FHA mortgage youll pay an up-front mortgage premium, plus a monthly premium. If you put less than 10% down on your FHA mortgage, that monthly mortgage insurance premium will stay on your mortgage bill for the length of your loan, no matter how much equity you build up.

You May Like: Does American Express Do Mortgages

Alternatives To An Fha Or Conventional Loan

Although most homebuyers choose FHA or conventional loans to finance their homes, there are other specialized loan programs worth considering if youre eligible.

VA loans. Eligible military borrowers can purchase a home with no down payment and no mortgage insurance if they qualify for a loan guaranteed by the U.S. Department of Veterans Affairs .

USDA. The U.S. Department of Agriculture backs loans to low- to moderate-income borrowers as long as they buy a home in a USDA-designated rural area. No down payment is required.

Non-qualified mortgages. A non-qualified mortgage may be worth a look if you dont meet the guidelines for any of the conventional or government-backed loans listed above. With a non-QM loan you may be able to verify your income with bank statements instead of tax returns, qualify with major credit issues in the past year or convert a high net worth into income.

Fha Down Payment Requirements

You might be asking: what should I save for a down payment? For a homebuyer choosing an FHA loan, the required amount can be as low as 3.5% of the purchase price. That means, if you are buying a house for $200,000, youll need to put $7,000 down in order to be eligible for FHA financing, making this loan type a good consideration for first-time buyers.

Also Check: What’s A Normal Mortgage Interest Rate

Who Should Not Get An Fha Loan

Borrowers turned off by the loan limit may find FHA mortgages too restrictive.

Likewise, most lenders recommend your monthly mortgage payments should not exceed 31 percent of your gross monthly income. Some private lenders offering FHA loans may allow up to 40 percent. If either of those rates proves to siphon too much of your monthly income, an FHA loan still may not be right for you.

Get The Right Inspection For Your Future Home

Learning the difference between an FHA home inspection and a conventional inspection could save you time and money.

So consider what kind of loan you need to move into your next house. Youll match your financial goals with the inspection that supports them, resulting in a home thats move-in-ready without surprise renovation costs or health concerns.

Don’t Miss: What To Look Out For With Mortgage Lenders

Benefits Of An Fha Loan

FHA loans typically donât require a big down payment â you can put as little as 3.5% down. If youâve had credit problems such as a foreclosure or a bankruptcy, FHA loans have a shorter waiting period to qualify for new credit. If necessary, you can enlist another borrower such as a relative to help you qualify for the loan. Also, FHA loans are eligible for streamlined refinancing, a faster way to refinance if interest rates fall.

Conventional Loan Interest Rates

Conventional rates usually beat FHA loan interest rates by a small amount. Like FHA loans, your rate depends on your qualifying factors. The more positive factors you present, the lower the interest rate youll get.

Its always best to shop around to find the best interest rate. Getting at least three quotes should help you secure the right rate.

Also Check: How To Qualify For Mortgage Modification

Fha Vs Conventional Mortgage: Pros And Cons

Are you trying to decide between an FHA and a conventional mortgage for your home loan?

The easy answer is to find the loan that best fits your particular situation and needs! Heres information to help you with the pros and cons of FHA loans and conventional mortgages. Weve also included a comparison chart between the two types of loans at the end of the blog.

Comparing Fha Versus Conventional Loans Limitations

There are a few major takeaways when comparing conventional loans versus FHA loans uses and restrictions.

- Owner Occupation: Conventional loans do not require the borrower to live in the property. FHA mortgages do.

- Refinancing: Refinancing is available for both FHA and conventional loans. However, conventional loans refinancing is more detailed, requiring a credit check, home reappraisal, income verification and more.

- High-cost and low-cost areas affecting loan values: Both FHA and conventional mortgages have loan floors and ceilings, i.e., the minimum and maximum values you can receive. FHA loans are determined by the median home value in a county. Conventional loans vary by county, state and lender but will generally follow Fannie Mae and Freddy Mac protection standards.

- Debt-to-income ratios: The lower your debt-to-income ratio , the harder it will be to secure a conventional loan. Conventional loans typically accept DTIs in the 30-43 percent range FHA mortgages can go up to 50 percent.

Read Also: Does Cash Out Refinance Increase Mortgage Payment

Conventional Loan Vs Fha Mortgage Payments

For home buyers with good credit scores, a conventional loan may be more attractive. Thats because conventional loan costs are more dependent on your credit and down payment than FHA loan costs. And as a result, your monthly payments and PMI are lower when your credit score is higher. This is a key difference from how FHA loans work.

With an FHA loan, your mortgage rate and MIP cost the same no matter what your FICO score.

That means in the short term, FHA loans may be more advantageous.

But over the long-term, borrowers with above-average credit scores will typically find Conventional 97 loans more economical relative to FHA ones.

Remember, mortgage insurance for conventional loans can be canceled at 20% loan-to-value ratio. But FHA mortgage insurance lasts the entire life of the loan.

So if youll be staying in the home long enough to reach 20% equity and especially if you have a good credit score a conventional loan could be your cheaper option in the long run.

How Do Purchasing Restrictions And Limitations Compare To Fha Loans

Generally speaking, conventional mortgages carry more restrictions than their FHA counterparts. Private mortgages tend to require:

- Higher monthly income

- Higher down payment amounts, namely to access lower interest rates

Its important to remember that one mortgage type is not better than the other. Rather, FHA and conventional loans fit particular situations that are always best reviewed with a local loan officer.

Recommended Reading: How Much Per Month Is A Mortgage

Loan Limits For Fha And Conventional Mortgages

The loan limits are set by Congress each year. There are some county exceptions, here are the typical lending limits for most US counties. For a home buyer seeking to purchase a $500,000 one unit home, the FHA home buyer will need a larger down payment than the buyer purchasing the home with a conventional mortgage. Loans that exceed the loan limits are known as jumbo mortgages.2021 Single-Family LimitFHA – $356,362 to $1,233,550 Conventional – $548,250

Fha Loans Are Insured By The Fha Conventional Loans Are Not

FHA loans are loans that are backed by the Federal Housing Administration, and they must be issued by an FHA-approved lender.

Conventional loans are not backed by the FHA but are insured by private lenders and therefore they can be issued by a wider selection of lenders.

So what does it mean when the FHA insures a loan? If the buyer defaults on the home and the home forecloses, the lender is protected from a certain degree of loss by the FHA. This extra layer of protection encourages lenders to extend loans to borrowers with lower down payments and , expanding the opportunity of homeownership to borrowers that may otherwise be ineligible under traditional conventional loans.

Recommended Reading: California Mortgage License Requirements

Recommended Reading: How To Get Someone Off A Mortgage

Fha Appraisal And Inspection Requirements

Unless its renewed, an FHA appraisal is valid for 120 days. Although they may be retained beyond this period if they are updated otherwise, they can endure up to 240 days.

However, if there are repairs that need to be made for the home to meet minimum property standards, the appraiser may require that they be completed before the loan is approved.

The FHA also requires a home inspection to be performed by a licensed home inspector. The purpose of a further inspection is to make sure that the home meets minimum property standards and to identify any health, and other threats. The inspector will also be looking for evidence of termite infestation and wood-destroying insects.

If you are getting an FHA loan, be prepared for a higher level of scrutiny when it comes to your home appraisal and inspection. But, remember that this is for your own protection and to ensure that you are getting a safe and secure home loan.

The FHA appraisers follow the HUD standards for minimum property requirements. To be approved for FHA loans, a home must satisfy the following assessment or be restored to fulfill them:

While this list may seem daunting, remember that the FHA Appraisal is just trying to protect you and ensure that you are getting a safe and secure home loan, you can also keep this list in to be FHA approved.

What An Fha Appraiser Looks For During An Inspection

Specific, factual details will be highlighted in every FHA appraisal. Beside those objective considerations, some more subjective observations may vary due to each homes unique characteristics.

Overall, however, FHA appraisals are meant to determine if everything is working as it should, if there are any defects that present a safety or health concern and if there are any conditions that would affect the marketability of the home.

Here is a general breakdown of what an FHA appraiser must inspect during the appraisal of the home.

Don’t Miss: How To Get Approved For A 400k Mortgage

Conventional Loan Down Payment

Contrary to popular belief, a 20% down payment is not a requirement to obtain a conventional loan. However, if you cant come up with a 20% down payment, youll have to pay private mortgage insurance , which is a lenders protection in case you default on your loan.

A smaller down payment equals more risk, so you mitigate that risk for the lender when you pay for mortgage insurance. PMI payments are built directly into your monthly mortgage payments.