Down Payment And Assets

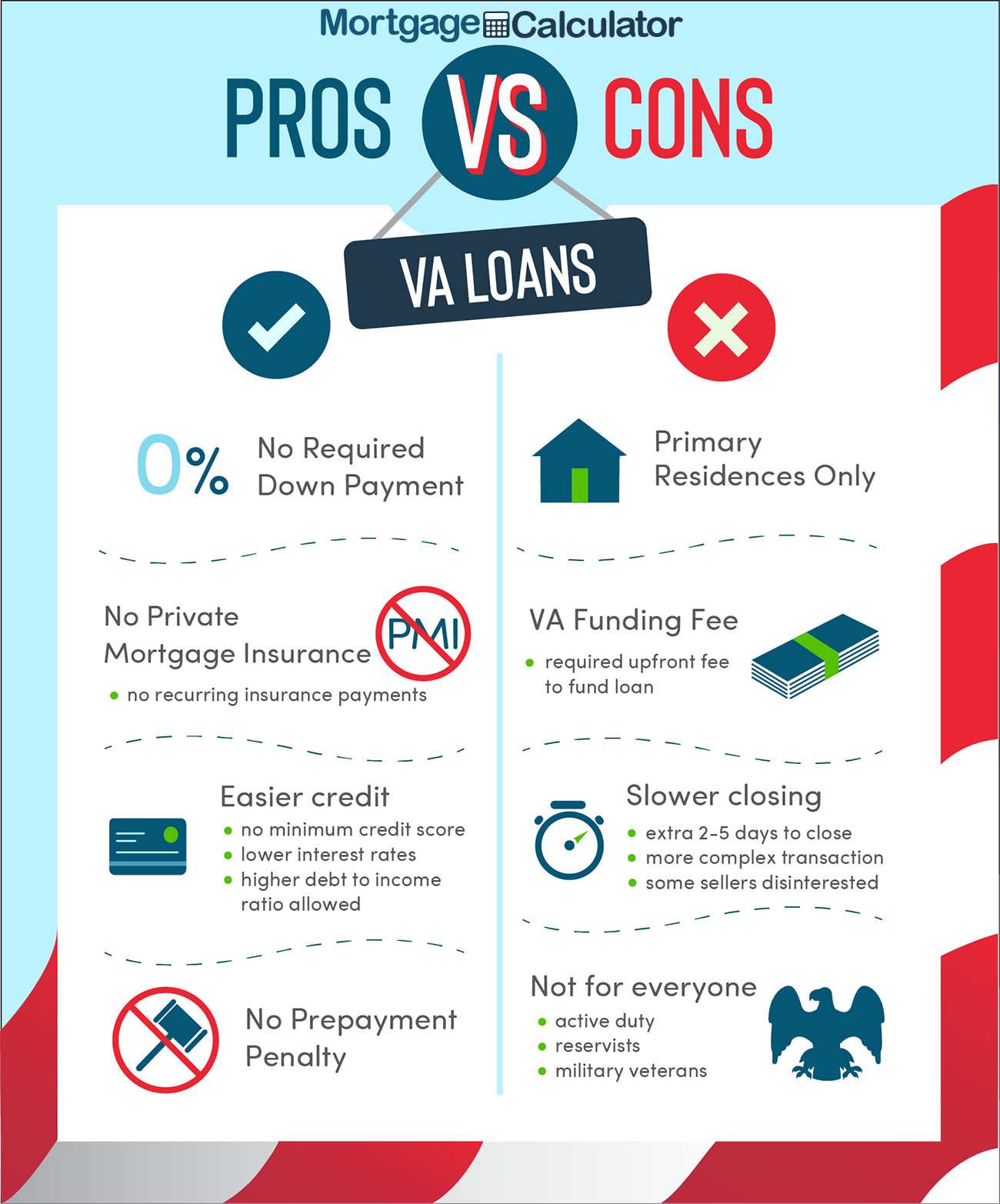

VA loans are one of the few loan options that dont require a down payment. Your lender may have specific requirements for a no-down-payment VA loan.

For example, they may require that you have a higher credit score if youre putting down less than 10%. The requirement to purchase a home with a VA loan through Rocket Mortgage® with no down payment is still a median of 580.

Its important to keep in mind that no down payment doesnt mean zero cost. In addition to VA loan closing costs, there are some other fees to be prepared for, even if youre putting 0% down. Heres a glance at just a few of them:

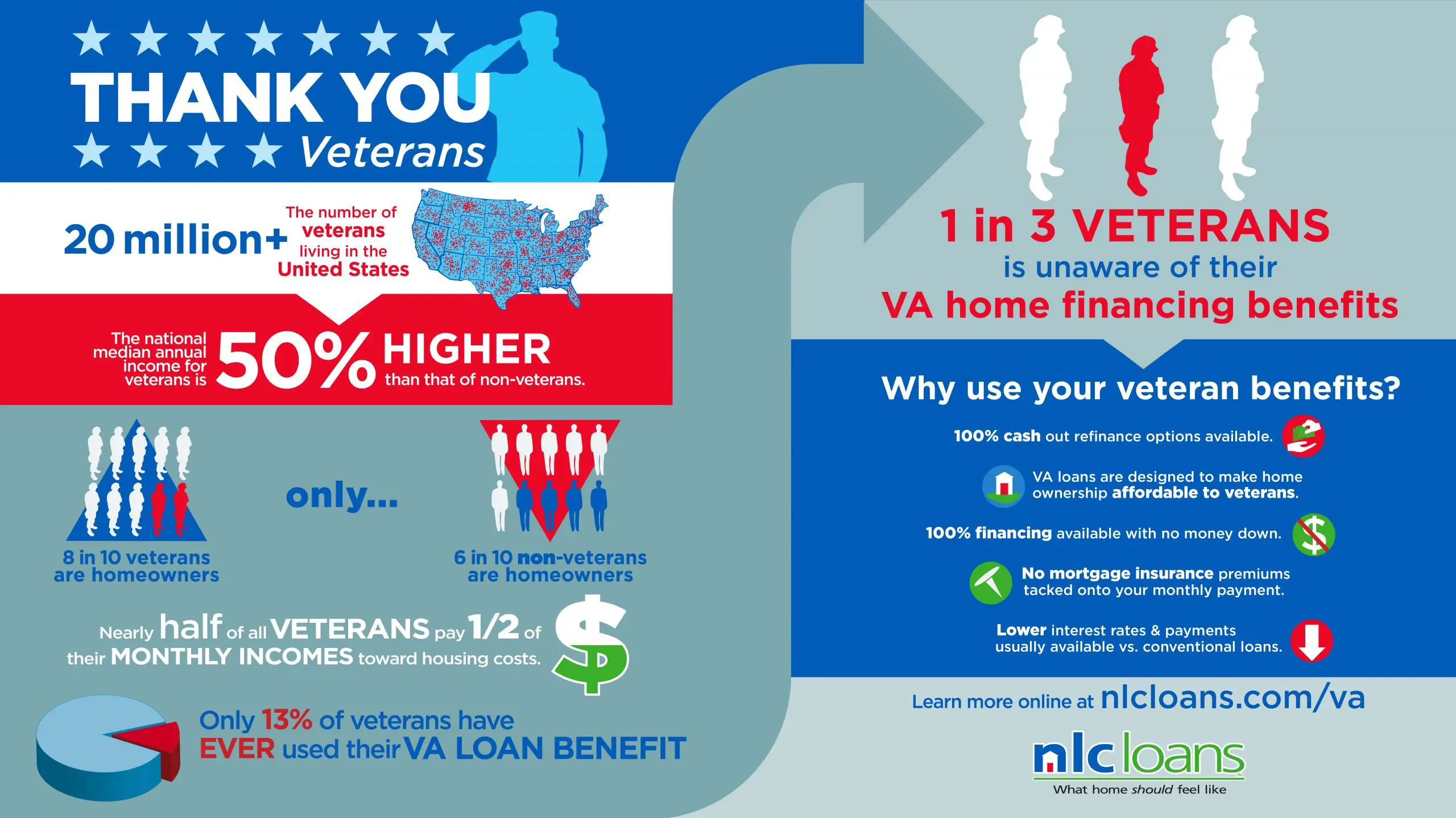

What Are The Benefits Of A Va Loan

Here are some of the key features and benefits of a VA mortgage:

How Do Va Rates Move

The interest rate on a VA mortgage is one of the most important components of the home loan. The interest rate will establish the principal and interest payment and can help approve or deny a loan application based upon how high or low the monthly payment is in relation to the borrower’s monthly income. The VA mortgage rate is included with the loan term and the loan amount to calculate the mortgage payment.

When potential VA borrowers begin their search for a VA mortgage, the first quest is often finding the best VA rate. Most often, VA lenders will have slight variances in their quoted interest rates compared to other lenders. Some may mistakenly think that the VA itself sets mortgage rates for the industry but that’s not correct. In the past, the VA did in fact set VA lending rates but today that’s simply not the case. When lenders are allowed to set their own rates, it helps the consumer by keeping the VA loan market competitive not only with other loan types but between individual VA lenders as well.

But how do interest rates change and who changes them?

GNMA 30yr

This acronym, GNMA stands for the Government National Mortgage Association and is a cousin of Fannie Mae and Freddie Mac. GNMA, or Ginnie Mae, provides a similar function that Fannie and Freddie do by providing liquidity in the mortgage market.

Rate Moves

When Do Rates Change?

Don’t Miss: How Much Money Can I Be Approved For A Mortgage

Compare Va Loan Rates & Lenders

When shopping for a VA loan, you will want to get the best rate to save the most money. Keep the following in mind when comparing VA loan rates and lenders:

- Loan amounts: Know the loan limits and make sure the home you want to purchase fits within those parameters. You dont want to find a $1 million home and realize the lender offers loans up to only $750,000.

- Minimum credit score: Does the lender have a minimum credit score required to qualify? Know what your credit score is so you know if you qualify, should look for another lender, or should improve your credit before applying.

- Interest rates: Rates fluctuate based on market conditions and vary based on your FICO score and overall financial profile. Know the rate upfront so you can compare it to other lenders.

- Customer service: How can you contact customer service if you have a question? Find out their hours and how responsive they are. This is a big purchase and you want to be confident with who youre dealing with.

The Property Must Meet Minimum Requirements

Once youve obtained your COE and qualified for a VA loan, youll also need to ensure that the property youre looking to buy can be purchased with a VA home loan. There are certain restrictions on the types of property you can purchase with a VA loan to ensure that current and former service members are living in homes that are safe and sanitary.

Some of the requirements for VA loans include:

- All mechanical systems must be safe and in good condition.

- The property must have proper and functioning heating.

- The roof should be in good repair.

- Basements and crawlspaces must be dry.

- There are no active termites infestations on the property.

- Any lead-based paint must be removed, or the original surface covered and painted if the paint cannot be removed.

- The home should be free of mold, mildew, rot and any other severe structural defects.

Additionally, the home you purchase with a VA mortgage must be purchased as your primary residence. VA loans arent available for vacation homes or rental properties.

Get approved for a VA loan.

If youre eligible, apply online today.

You May Like: How Interest Is Calculated On Mortgage

Who Sets Va Loan Rates

VA home loan rates are set by each individual mortgage lender. They take into account the overall economy, market conditions, investment activity, and your individual risk profile when setting your rate. You can improve the rate you get by increasing your credit score, shopping around for your lender, and offering a down payment.

What Is The Difference Between A Va Loan Vs 30

Compared to a conventional 30-year fixed mortgage, a 30-year VA loan has some distinct advantages and disadvantages.

Aside from what we already covered a VA loan is typically easier to qualify for than a conventional loan, assuming you meet the military service requirements. So a borrower with a weaker credit history may have a better chance of qualifying for a VA loan or getting a better mortgage rate.

However, VA loans have limitations. They cant be used for second homes or investment properties. Not only that, but the upfront funding fee increases each time a veteran takes advantage of the VA mortgage benefit. For example, if your down payment is less than 5%, the funding fee jumps from 2.3% to 3.6% after the first use of your VA loan benefit.

Recommended Reading: What Is A 5 1 Arm Mortgage

How To Use The Va Loan Calculator

To use the VA loan calculator, adjust the inputs to fit your unique homebuying or refinancing situation. The calculator updates your estimated VA loan payment as you change the fields. In the “Advanced Settings” section, you can update the property taxes and insurance estimates for your specific location, though 1.2% and 0.35% are typical.

Va Mortgage Rates Faq

Are VA loans lower interest?

You bet. VA loans are consistently the lowest among all the major mortgage programs. If youre eligible for a VA loan, its highly likely youll save a lot of money by getting one.

Who has the lowest VA refinance rates?

The lender with the lowest VA refinance rates varies every day and from one borrower to the next. You need to get quotes from multiple lenders to find the one offering the best deal for you when you apply.

What are current VA IRRRL rates?

VA IRRRL rates are typically in line with VA home purchase rates. That is to say, theyre among the lowest refinance rates on the market. Scroll to the top of this page to see current VA mortgage rates today.

What is the current VA funding fee?

The current VA funding fee is 2.3 percent of the loan amount for first-time home buyers with zero down 0.5 percent for the VA Streamline Refinance and 2.3-3.6 percent for a VA cash-out refinance. The amount of the funding fee depends on your loan type, your down payment, and whether or not youve used a VA loan before.

Do you pay closing costs with a VA loan?Are VA loans harder to close?

Yes, VA loans are often a little more difficult for lenders because there are additional verification steps with the VA that need to be completed before closing. VA loans can be harder to close for borrowers, too, because they have to provide additional documentation.

Do VA rates vary by lender?Does my credit score affect VA loan interest rates?

Also Check: Can You Get A Mortgage To Buy A Foreclosed Home

A Look At The Va Loan Calculator’s Inputs

| Input | |

|---|---|

| Home value is the potential purchase price of the home, not including a down payment. | |

| Down Payment | The down payment is an upfront amount paid towards the principal. VA loans do not require a down payment, and most VA borrowers choose $0 down. However, if you decide to put money down, it can reduce the VA funding fee – if required – and your overall monthly payment. |

| Interest Rate | The interest rate is the cost of borrowing. Interest rates in the calculator include APR, which estimates closing costs and fees and is the actual cost of borrowing. Interest rates in the calculator are for educational purposes only, and your interest rate may differ. You can view current VA mortgage rates here. |

| Loan Term | Loan term is the length you wish to borrow – typically 15 or 30 years. |

| Interest rates typically vary based on several factors, including credit score. Estimate your credit score for a more accurate VA loan payment. | |

| Loan Type | VA loans provide both purchase and refinance options. Calculations for loan types differ due to the VA funding fee. While this calculator works for refinancing, we also have a specific VA refinance calculator for cash-out and IRRRLs here. |

| VA Specifics | VA specifics relate to the VA funding fee. VA buyers exempt from the VA funding fee include those with a disability rating greater than 10%, those who’ve received a Purple Heart and surviving spouses. Borrowers who aren’t exempt and have used a VA loan before are subject to a slightly higher VA funding fee. |

Enter Your Military Status To Get The Most Accurate Results Possible

The fifth section of the calculator contains multiple important variables for veterans. Namely it lists VA status, loan use & if the funding fee is financed in the loan. By default these are set to active duty/retired military, first time use & funding fee financed.

Military Status

If you are a reservist or a member of the guard, please change this variable to reflect your funding fee.

First or Subsequent Use

If this is an additional use rather than first time use then reset that field to reflect the higher funding fee for subsequent uses.

Roll Funding Fee Into Loan

If you do not want to finance the funding fee, then set the financing option to No.

Injured in Service

If you were 10% or more disabled while in service, your funding fee can be waived. Set “finance the funding fee” to No and deduct that number from your cash due at closing to get your actual closing costs.

Don’t Miss: What Is Ltv In Mortgage Terms

Best Arm Loan: Lendingtree

- Starting Interest Rate: Contact for rates

- Loan Terms: Contact for terms

- Minimum Credit Score: Contact for credit score requirements

Lending Tree offers multiple types of loans including VA loans with ARMS of varying lengths.

-

Fill out one application and lenders compete

-

User-friendly online form

-

Need to contact for rates and terms

-

Contact for minimum credit score requirements

-

Solicitation emails

LendingTree is an online loan marketplace for mortgages, auto loans, small business loans, personal loans, credit cards, and more. Starting in 1996 with the goal of making comparison shopping for loans easy, it puts the rates online to make banks compete. The company seeks to empower its customers with choice, education, and support through its website services.

Fewer lenders offer the adjustable-rate mortgage product compared to the fixed-rate purchase and refinance loans. Therefore, we chose LendingTree as the best source for finding a competitive ARM loan because you fill out a single application and many lenders will see your application and offer the best terms. The large supply of lenders on LendingTree provides the borrower with more choices to compare.

Regardless of which lender you choose on LendingTree, the loan process for a VA loan will require an eligibility certification evaluation of the borrowers credit, income, and debt situation an appraisal and a home inspection. Plan on four to six weeks for the entire process.

Pentagon Federal Credit Union: Best Overall Experience

The Pentagon Federal Credit Union is one of the top credit unions in the country and serves military members and their families. Providing 30- and 15-year fixed VA home loans, this credit union also provides a host of additional banking services, including student refinancing, personal loans, rewards credit cards and auto loans.

Pentagon Federal Credit Unions current 30-year and 15-year VA mortgage rates are 2.5% and 2.750% respectively. APR rates for 30-year loans are offered as low as 2.631%, while the 15-year loan APR is offered as low as 2.997%.

Read Also: How To Get Mortgage Help From The Government

When Is The Best Time To Get A Va Home Loan

When shopping around for a mortgage, many people wonder if there is a “good time” to apply. For some mortgage products, there is no doubt that key market conditions affect how much they’re going to pay. However, there is no tried and true advice for when you should – or shouldn’t – apply for a VA home loan. The things that affect the interest rates that are attached to the typical VA home loan are so varied and complex that there is no hard and fast rule to refer to.

If you are considering a VA home loan, contact a number of qualified lenders and ask them what the current rate is. Try to get a feel for whether rates have recently crept up or gone down, and act accordingly. Either way, you’re going to be paying a lot less than those who don’t qualify for VA loans are going to. Also, without the worry of private mortgage insurance and without having to make a down payment, you’re going to be ahead of the game financially anyway. In fact, the relaxed conditions for VA home loans makes any time a good time to get one. The VA loan benefit is flexible and widely used across the country. Here are usage stats for fiscal year 2018.

| Loan Type |

|---|

| $264,197 |

How Does Credit Score Impact Your Va Home Loan

According to the guidelines defined by the VA, having an outstanding credit score is not mandatory to qualify for a VA loan. However, it is a general rule that most lenders expect you to have a minimum score of 620.

Moreover, you could qualify for additional benefits with a fair credit score, like lower interest rates and more flexible guidelines. Having a good credit score can simplify the eligibility process and help you get a loan with lower monthly payments.

Also Check: How Much Does A 200 000 Mortgage Cost Per Month

How Do You Lock In Your Va Loan Interest Rate

Buyers have to be under contract in order to be eligible for a rate lock. Once thats in hand, the timeline can vary depending on a host of factors, including the type of loan, the overall economic environment and more.

If you’re ready to see where rates are right now, or if you have more questions, contact a home loan specialist at 1-800-884-5560 or start your VA Home Loan quote online.

There’s no obligation, and you’ll be one step closer to owning your brand new home.

How To Qualify For A Va Home Loan

As stated above, to qualify for a VA loan, you must get your Certificate of Eligibility , meet the lenders requirements, and ensure that the house meets all the MPRs.

Here is what you can do to qualify for a VA loan.

- Choose a home that meets all of the MPRs.

- Improve your credit score before applying.

- Get your COE to validate your eligibility.

Read Also: How To Become A Mortgage Underwriter In Arizona

Cons Of Choosing A Va Mortgage

- They come with a funding fee, which is paid to support the program.

- The funding fee increases after every subsequent use of VA loan benefits. You will pay more in funding fees the second time you borrow a loan.

- The loans could exceed market value.

- The loans are provided only by VA-approved private lenders.

- You cannot purchase a vacation home or an investment property with these loans.