How Does A 5% Down Conventional Loan Work

A conventional loan is classified as any loan that is not guaranteed through a government agency, but rather, is insured through private lenders or a government-sponsored enterprise, . Most conventional mortgages are conforming loans, which means that they meet the requirements to be sold by government-sponsored enterprises, such as Freddie Mac or Fannie Mae. These GSEs set conforming loan limits and set the guidelines for credit score and down payments. Because these loans are not insured through the federal government, they pose a certain risk to lenders since they arent guaranteed payment in the event of a borrower default. Therefore, the eligibility requirements for conventional loans tend to be stricter than non-conventional loans.

Whats The Minimum Down Payment For A Conventional Loan

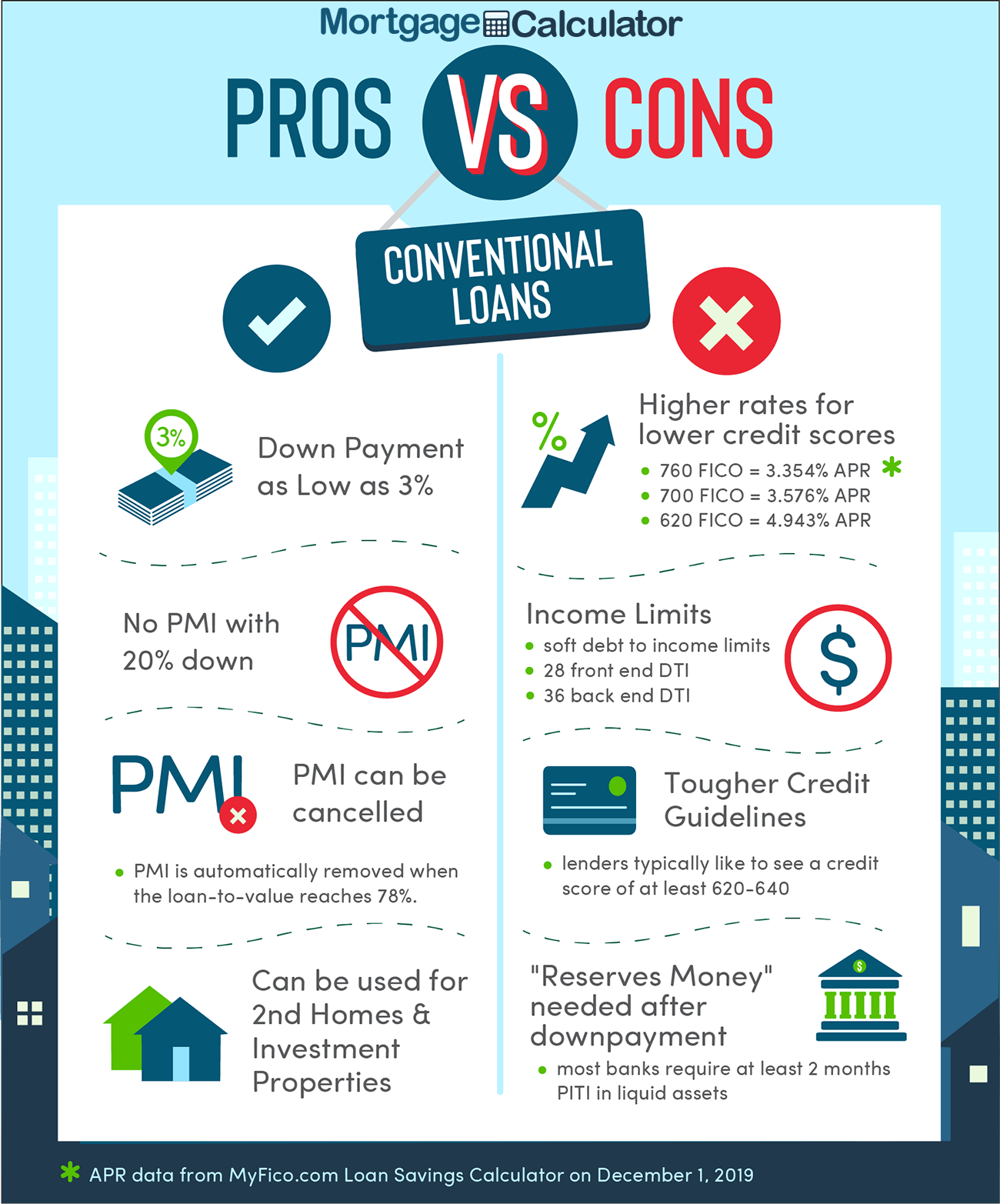

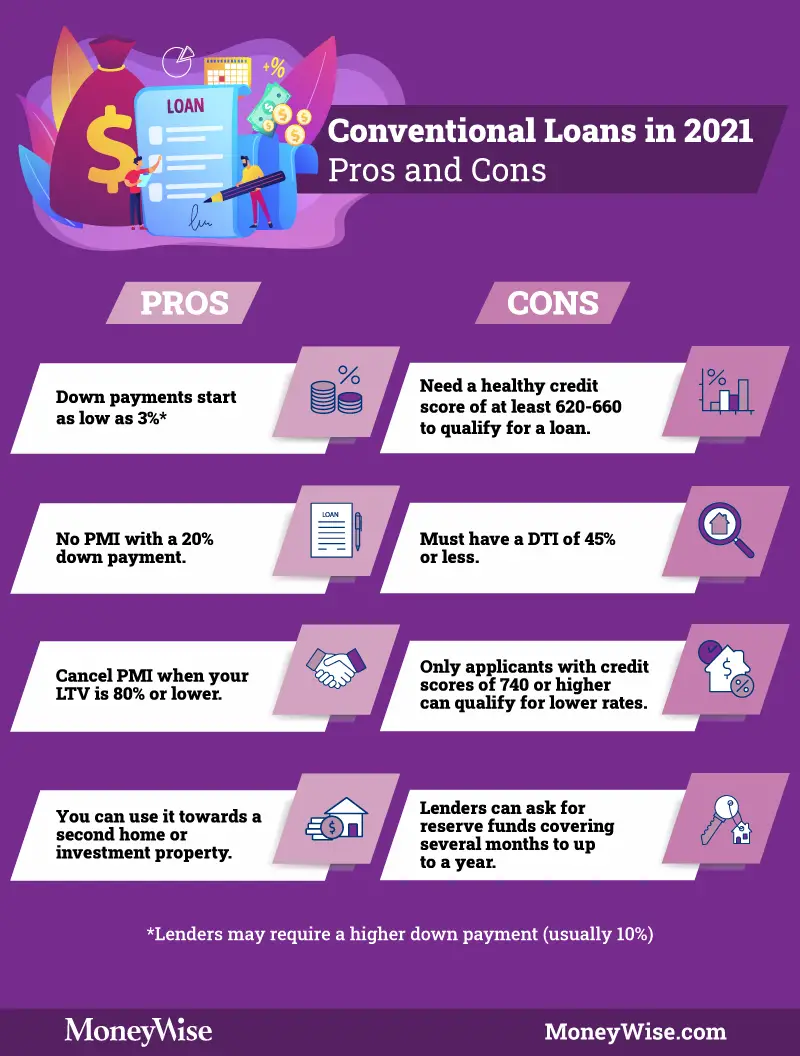

If the title of this article didnt give it away, the minimum down payment you can make for a conventional loan is 3%. Most lenders add private mortgage insurance fees to your monthly mortgage payments when your down payment is less than 20%, but that hasnt deterred most Americans. In fact, 75% of first-time homebuyers put less than 20% down.

Whats The Average Down Payment On A House For A First

Many first-time home buyers believe they need 20% down. But thats far from true.

In fact, the average down payment for first-time home buyers under the age of 30 is just 6%. On a $300,000 home, that comes out to an $18,000 down payment.

The average down payment for first-time home buyers under the age of 30 is just 6%.

And youre allowed to put down even less. If you have a credit score of 620, you might qualify for a mortgage with just 3% down or $9,000 out of pocket for a $300,000 home.

Thanks to the low-down-payment mortgages available today, many first-time home buyers find the process a lot more affordable than they initially thought. Yet, keep in mind that if you dont put 20% down, youll have the additional cost of private mortgage insurance . We discuss this in more detail below.

Don’t Miss: How Long Can I Lock In A Mortgage Rate

Low Down Payment Insured Mortgage

Most lenders now offer insured mortgages for both new and resale homes with lower down payment requirements than conventional mortgages-as low as 5%. Low down payment mortgages must be insured to cover potential default of payment as a result, their carrying costs are higher than a conventional mortgage because they include the insurance premium.

Mortgage default insurance is a one time premium paid when your purchase closes. You can pay the premium or add it to the principal amount of your mortgage. Talk to your mortgage specialist to find out which option is best for you

Typical Conventional Mortgage Down Payment Amount

Conventional loans are very popular still. Older people usually have 20 percent down because they are downsizing or upsizing, and they sell a house. They put that money towards a new place, Stevenson says.

But she usually sees the majority of people putting down between five and 10 percent of the loan amount. With a down payment of at least 5%, conventional loan rates drop compared to the 3% down payment option.

Also Check: What Is Deferred Interest On A Mortgage

How Is A Conventional Loan Different From A Government

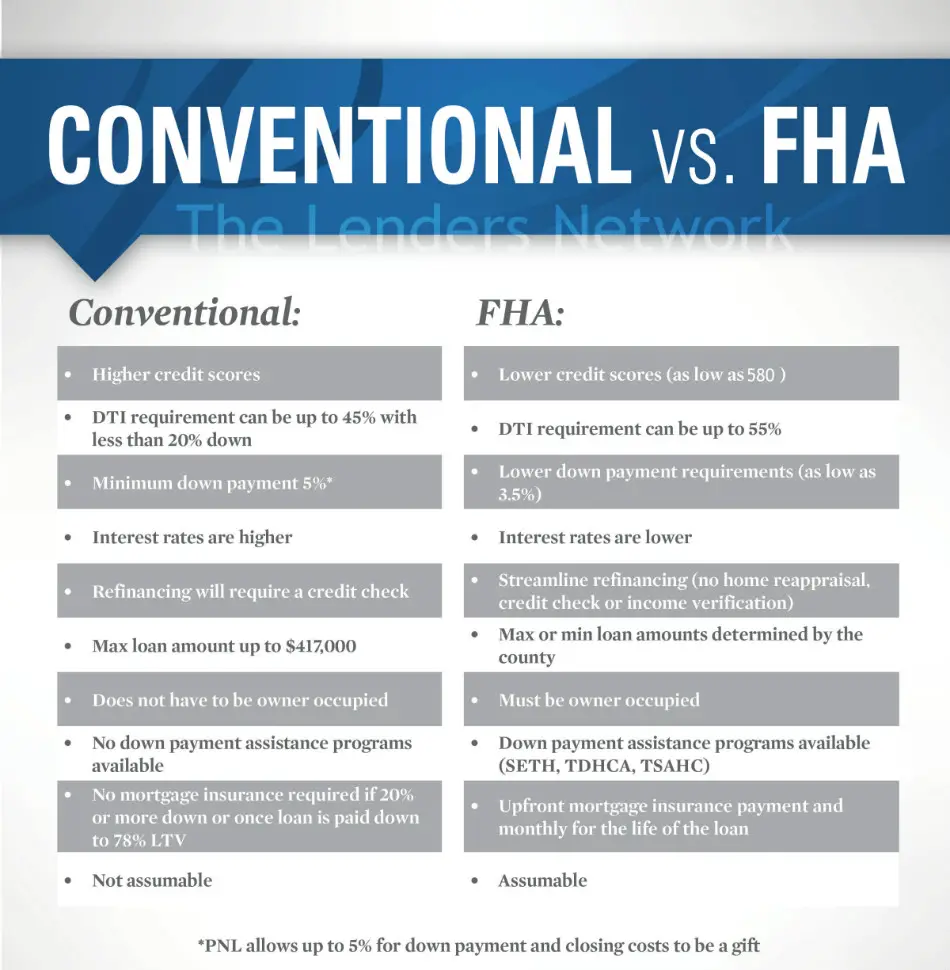

The biggest difference between conventional and government-backed loans is who actually backs, or secures, the loan. Conventional mortgages arent guaranteed by the government, which means lenders tend to be choosier when it comes to vetting applicants.

Government-backed loans, on the other hand, are backed by government entities which are on the hook if borrowers miss payments.

Since conventional mortgage lenders dont have the promise of a government safety-net should the borrower fail to make payments, they need to be comfortable that borrowers are going to repay on time. That translates to tougher restrictions like higher down payment and credit requirements and sometimes higher interest rates.

While government-backed loans tend to be available to those with lower credit scores, they may have their own restrictions. For example, they may only be available for homes purchased in specific areas or certain property types.

Heres a breakdown of how conventional loans compare to the others.

What Credit Score Do You Need To Get A Conventional Loan

You’ll need at least a 620 credit score to qualify for a conventional loan with most lenders. You may want to try a USDA loan if you don’t meet the minimum credit score requirements, which doesn’t have a credit score requirement, or an FHA loan, which lets you borrow with a credit score of at least 500.

Read Also: Does Mortgage Modification Affect Credit Score

What Kind Of Down Payments Are Mortgage Lenders Talking About

First-time home buyers have plenty of financing options, but it’s critical to make sure the loan you choose doesn’t leave you with high-interest rates that make your new home more expensive than it needs to be.

Work with one of the best mortgage companies Texas offers and an FHA-approved lender to review types of land and down payment requirements, like:

Conventional Loans Vs Other Types Of Mortgages

Conventional loans are similar to other types of home loansespecially those that are government-backed, such as FHA and USDA loans. However, because conventional mortgages are issued by private lenders and may not be insured by the government, they typically require higher minimum credit scores in order to qualify.

The biggest difference between conventional mortgages and other government-backed home loans is that government-backed loans are typically designed to help low-to-moderate-income borrowers or those with lower credit scores. Conventional loans, on the other hand, are ideal for those with good credit, steady jobs and low debt-to-income ratios.

You May Like: Is Fico Score 8 Used For Mortgages

Down Payment And Your Loan

Your down payment plays a key role in determining your loan-to-value ratio, or LTV. To calculate the LTV ratio, the loan amount is divided by the homes fair market value as determined by a property appraisal. The larger your down payment, the lower your LTV . Since lenders use LTV to assess borrower risk and price mortgages, a lower LTV means you pay lower interest rates on your mortgageand may avoid additional costs.

A lower LTV ratio presents less risk to lenders. Why? Youre starting out with more equity in your home, which means you have a higher stake in your property relative to the outstanding loan balance. In short, lenders assume youll be less likely to default on your mortgage. If you do fall behind on your mortgage and a lender has to foreclose on your home, theyre more likely to resell it and recoup most of the loan value if the LTV ratio is lower.

In addition to assessing your risk, lenders use the LTV ratio to price your mortgage. If your LTV ratio is lower, youll likely receive a lower interest rate. But if the LTV ratio exceeds 80%, meaning youve put less than 20% of the homes value as a down payment, expect higher interest rates. These rates cover the lenders increased risk of lending you money.

For loans that will accept down payments of 5% or less, consider Fannie Mae and Freddie Mac, individual lender programs, Government-insured FHA loans, VA loans, or USDA loans.

Should I Put 20% Down On A $300k House

When does 20% make sense as the down payment for a $300,000 house? The brief answer is: When you can afford it.

Putting down 20% on a home purchase earns you real advantages because:

- You dont have to pay for private mortgage insurance

- Youre likely to get a lower mortgage interest rate than those with smaller down payments

- Youll have lower monthly payments because youre borrowing less. Your loan amount is $240,000 with 20% down as opposed to $291,000 with 3% down

- Youll have a far lower total cost over the loan term

A bigger down payment can also earn you some extra wiggle room when qualifying for a mortgage. For example, suppose a lender wants a minimum credit score of 700. You might get away with a score a few points below that if youre putting 20% down.

Don’t Miss: Does The Va Offer Reverse Mortgages

Conventional Loan Vs Government Loans

Home buyers have dozens of mortgage loan options today.

In general, though, mortgages can be divided into two broad categories government-backed loans and conventional loans.

The rule of thumb is that if you have good credit and a large down payment , a conventional loan is often best. If you have lower credit and/or a smaller down payment, a government-loan can help.

But those are not universal rules. The best type of mortgage for you will depend on your budget, your credit, and your home buying goals.

To help guide you in the right direction, heres a broad overview of conventional vs. government loans, and who theyre best for:

If youre not sure which type of loan is best for you, read up on your options or chat with a loan officer about what you might qualify for.

How Conventional Loans Work

The term conventional loan means it is not associated with any government programs. They are secured by private lenders: banks, credit unions, or mortgage companies. Conventional mortgages typically require higher credit scores than government-sponsored loans. FHA loans and USDA loans, for example, are backed by the Federal Housing Administration and the U.S. Department of Agriculture. Since government loans have less-strict lending requirements, they tend to have higher interest rates and fees, but can be a path to homeownership to those who may otherwise not qualify by conventional standards.

Maximum loan amounts are set by the U.S. government, but other conforming rules and requirements are set by government-sponsored entities, such as Fannie Mae and Freddie Mac. Mortgages backed by Fannie Mae and Freddie Mac are more desirable to be sold off to investors. This process reduces lender risk and helps maintain loan affordability. Loans not guaranteed by Freddie Mac and Fannie Mae are seen as riskier and therefore more expensive.

Conventional loans can have a fixed interest rate or an adjustable interest rate. In the case of fixed-rate conventional loans, the interest rate does not change at any point during the loan term. Alternatively, the interest rate for variable-rate loans will vary over time depending on the market.

With a conventional loan, a borrower submits an application through a lender and is approved or denied based on a few key factors, including:

You May Like: How Long To Pay Off 70000 Mortgage

Using Your Rrsp As A Down Payment

Under the federal government’s Home Buyer’s Plan, first-time home buyers are eligible to use up to $35,000 in RRSP savings per person for a down payment on a home. The withdrawal is not taxable as long as you repay it within a 15-year period. To qualify, the RRSP funds you plan to use must have been in your RRSP for at least 90 days.

Even if you already have enough money for your down payment, it may make sense to access your RRSP savings through the Home Buyers’ Plan.

For example, if you have already saved $35,000 for a down payment-and assuming you still had enough “contribution room” in your RRSP for a contribution of that amount, you could move your savings into an RRSP at least 90 days before your closing date. Then, simply withdraw the money through the Home Buyers’ Plan.

The advantage? Your $35,000 RRSP contribution will count as a tax deduction this year. Use any tax refund you receive to repay the RRSP or other expenses related to buying your home.

However, the money you borrow from your RRSP won’t earn the tax-sheltered returns it would if left in your account. Ask your financial planner if this strategy makes sense for you.

- Learn more about RRSPs.

- Learn more about the Home Buyer’s Plan.

Advantages Of A Conventional Mortgage

One big advantage of a conventional mortgage is the borrower has much more flexibility in what property they can purchase compared to a government-backed loan. For example, FHA loans are only available for homes that meet the FHAs minimum property requirements. Other government-secured mortgages have even more specific limitations. U.S. Department of Agriculture mortgages are only available for properties in designated rural areas, and only qualifying veterans and their spouses are eligible for Department of Veterans Affairs mortgages.

Conventional mortgages dont have any of these sweeping limitations. You can even take out a conventional loan for an investment property or a vacation home. And conventional jumbo mortgages are an option if you need to borrow more than the FHFA loan limits for your area.

Recommended Reading: Should You Buy Mortgage Points

Shop Around For Lenders

As the buyer, you get to choose which mortgage company you want to work with. Dont be afraid to take some time to shop around for lenders.

Contact a few competing loan providers and ask what types of fees they charge. Choose a lender that offers low fees and competitive interest rates for lower overall closing costs.

Using Gift Funds To Cover Your Down Payment

Many first-time home buyer programs let you cover the whole down payment with gift funds.

For example: If youre buying a $250,000 home with a 3.5% down FHA loan, your entire $8,750 down payment could be a gift from your parents.

The Conventional 97 loan and Freddie Mac Home Possible also allow 100% of the down payment to come from gift funds

Gift money can come from a parent, friend, employer, or anyone generous enough to help you out with your home purchase.

However, if youre going to use gift funds toward your down payment, they have to be properly documented by the gift giver and the home buyer. That means writing a gift letter to show your mortgage lender the money came from a verified source.

This extra step in your home buying process will be worthwhile. Be sure to let your loan officer or real estate agent know early in the process that youll be using gift funds for a down payment.

You May Like: Will Mortgage Rates Continue To Rise

What Is The Minimum Down Payment On A House

There is no law or rule for a universal minimum down payment, but the more you pay upfront, the lower your monthly mortgage payments, the lower the interest rate you will qualify for, and the less likely you will be to have to pay mortgage insurance or other fees. Generally, however, 3%-5% would be the absolute minimum, and only for certain borrowers.

Interest Rates For Conventional Mortgages

Conventional loan interest rates tend to be higher than those of government-backed mortgages, such as FHA loans .

The interest rate carried by a conventional mortgage depends on several factors, including the terms of the loanits length, its size, and whether the interest rate is fixed interest or adjustableas well as current economic or financial market conditions. Mortgage lenders set interest rates based on their expectations for future inflation the supply of and demand for mortgage-backed securities also influences the rates. A mortgage calculator can show you the impact of different rates on your monthly payment.

When the Federal Reserve makes it more expensive for banks to borrow by targeting a higher federal funds rate, the banks, in turn, pass on the higher costs to their customers, and consumer loan rates, including those for mortgages, tend to go up.

Typically linked to the interest rate are points, fees paid to the lender : the more points you pay, the lower your interest rate. One point costs 1% of the loan amount and reduces your interest rate by about 0.25%.

The final factor in determining the interest rate is the individual borrowers financial profile: personal assets, creditworthiness, and the size of the down payment they can make on the residence to be financed.

A buyer who plans on living in a home for 10 or more years should consider paying for points to keep interest rates lower for the life of the mortgage.

Read Also: How Much Do You Pay Back On A Mortgage

Down Payment Options For A $300k Home

How big of a down payment do you need for a $300,000 house? Thats going to depend entirely on the type of mortgage you choose.

For some, it could be literally nothing not a dime. But most will need at least 3% of the purchase price or 3.5% . And if you have 20% down , you could save yourself thousands in mortgage insurance and mortgage interest.

Its all about finding the right down payment amount for you. Heres how.

In this article

> Related:How to buy a house with $0 down: First-time home buyer

Benefits Of A Smaller Down Payment

If you want to get into a house sooner, it often makes sense to make a smaller down payment with what you have saved now .

Some of the benefits of making a smaller down payment include:

- You keep money in your emergency fund

- You save money to make improvements and repairs to your new place

- You can get into a house and start building equity sooner instead of waiting to save up the 20% down payment requirement to avoid PMI on a conventional loan

- If you wait, the price of real estate will likely continue to rise along with how much money you need to save

Finally, remember that your mortgage isnt set in stone.

If you put down a smaller amount of money, you can usually refinance a few years down the road to get rid of mortgage insurance and reduce your monthly mortgage payment.

In other words, you can get your foot in the door of homeownership with a smaller down payment on your first mortgage loan. Then, after you build some equity, you can transition to a more ideal loan.

Also Check: What Is 1 Point On A Mortgage