Whats Included In My Mortgage Payment

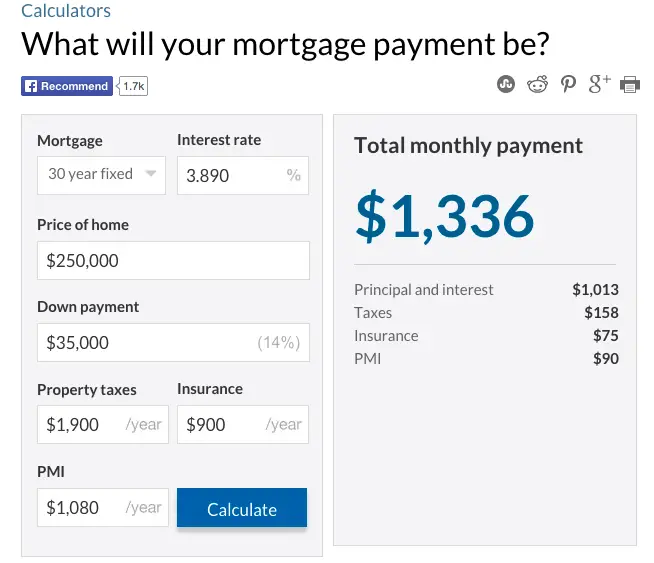

A typical monthly mortgage payment has four parts: principal, interest, taxes and insurance. These are commonly referred to as PITI.

The mortgage payment estimate youll get from this calculator includes principal and interest. If you choose, well also show you estimated property taxes and homeowners insurance costs as part of your monthly payment.

This calculator doesnt include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose.

How To Lower The Interest On Your Mortgage

With the above factors in mind, here are a few things you can do to help lower your interest payments when you get a mortgage:

- Improve your credit. Although it can take time, try to improve your credit before taking on a mortgage. One potentially quick way to do this is by paying down credit card debt or consolidating credit card debt with a personal loan. However, you should avoid taking on a new loan if you plan on buying a home in the near future as new debt could compromise mortgage approval.

- Save up a large down payment or buy a cheaper home. While you may want to move right away, taking more time to save up a large down payment could help you secure a lower interest rate and avoid extra mortgage insurance costs. If you can’t wait, consider a less expensive home to increase the amount of your down payment relative to the home’s cost.

- Choose a shorter term or variable rate. Regardless of the loan amount, a shorter term and variable rate can also help you lock in a lower interest rate. However, they both come with additional risk as it may be difficult to afford the large payments in the future.

Mortgage Interest Is Paid In Arrears

In the United States, interest is paid in arrears. Your principal and interest payment will pay the interest for the 30 days immediately preceding your payments due date. If you are selling your home, for example, your closing agent will order a beneficiary demand, which will also collect unpaid interest. Lets take a closer look.

For example, suppose your payment of $599.55 is due December 1. Your loan balance is $100,000, bearing interest at 6% per annum, and amortized over 30 years. When you make your payment by December 1, you are paying the interest for the entire month of November, all 30 days.

If you are closing your loan on October 15, you will prepay the lender interest from October 15 through October 31.

It may seem like you get 45 days free before your first payment is due on December 1, but you do not. You will pay 15 days of interest before you close, and another 30 days of interest when you make your first payment.

Read Also: How Much Interest You Pay On A Mortgage

Exercising Additional Payment Options

When you sign on for a 30-year mortgage, you know you’re in it for the long haul. You might not even think about trying to pay off your mortgage early. After all, what’s the point? Unless you’re doubling up on your payments every month, you aren’t going to make a significant impact on your bottom line right? You’ll still be paying off your loan for decades right?

Not necessarily. Even making small extra payments over time can shave years off your loan and save you thousands of dollars in interest, depending on the terms of your loan.

Monthly Interest Accrual Versus Daily Accrual

The standard mortgage in the US accrues interest monthly, meaning that the amount due the lender is calculated a month at a time. There are some mortgages, however, on which interest accrues daily. The annual rate, instead of being divided by 12 to calculate monthly interest is divided by 365 to calculate daily interest. These are called simple interest mortgages, I have discovered that borrowers who have one often do not know they have one until they discover that their loan balance isnt declining the way it would on a monthly accrual mortgage. Simple interest mortgages are the source of a lot of trouble.

Also Check: How Do Mortgage Lenders Determine Loan Amount

Structural Mortgage Market Shifts: Increasing Loan Duration & Explicit Government Backing

While the stamp duty holiday was widely discussed, the UK also pushed through other structural shifts to the mortgage market in the wake of the COVID-19 crisis.

“In the UK, usually the longest term fixed mortgage you could normally get was five years. Boris Johnson has now. Nobody can pretend that this has anything to do with Covid, and in fact when Johnson announced it, his stated aim was to give young people access onto the housing ladder. This is a good example of how the magic money tree was discovered for Purpose A, i.e. Covid, and is being used for Purpose B, furthering social justice.” – Russell Napier

When governments guarantee loans they lower the risk of making the loans, which in turn increases the flow of capital into the associated market. That typically leads to faster appreciation.

Programs created to “help” people get into the market are initially effective, but after prices adjust to reflect said capital shifts and risk-free profits the market becomes structurally dependent on such programs & the incremental help they offer declines as prices rise.

The property market has been frenzied throughout the first half of 2021 with Rightmove stating the first half of the year has been the busiest since 2000. Average home prices across England, Wales and Scotland rose to £338,447, an increase of £21,389 or 6.7% since the end of 2020.

Mortgage Balance Calculator Terms & Definitions:

- Mortgage Loan A debt instrument, secured by the collateral of specified real estate property, that the borrower is obliged to pay back with a predetermined set of payments.

- Mortgage Balance The full amount owed at any period of time during the duration of the mortgage.

- Principal Denoting an original sum of money lent.

- Annual Interest Rate Money paid regularly at a particular rate for the use of money lent in this case, it’s a percentage.

- Monthly Payment The action or process of paying someone or something on a monthly basis in this case, a mortgage.

- Loan Term The length time it takes to pay off a loan in this case, a mortgage.

Read Also: Can You Get A Mortgage With A 550 Credit Score

Should I Choose A Long Or Short Loan Term

It depends on your budget and goals. A shorter term will allow you to pay off the loan quicker, pay less interest and build equity faster, but youll have a higher monthly payment. A longer term will have a lower monthly payment because youll pay off the loan over a longer period of time. However, youll pay more in interest.

How Much Should You Save For A Down Payment

Save up a down payment of at least 20% so you wont have to pay private mortgage insurance . PMI is an extra cost added to your monthly payment that doesnt go toward paying off your mortgage. If youre a first-time home buyer, a smaller down payment of 510% is okay toobut then you will have to pay PMI. No matter what, make sure your monthly payment is no more than 25% of your monthly take-home pay on a 15-year fixed-rate mortgage. And stay away from VA and FHA loans!

Saving a big down payment takes hard work and patience, but it’s worth it. Here’s why:

- Youll have built-in equity when you move into your home.

Recommended Reading: How To Calculate House Mortgage

Refinanceor Pretend You Did

Another way to pay off your mortgage early is to trade it in for a better loan with a shorter termlike a 15-year fixed-rate mortgage. Lets see how this would impact our earlier example. If you keep the 30-year mortgage, youll pay more than $158,000 in total interest over the life of the loan. But if you switch to a 15-year mortgage, youll save over $85,000and youll pay off your home in half the time!

Sure, a 15-year mortgage will probably come with a bigger monthly payment. But if it fits within your housing budget, itll totally be worth it! And hey, maybe youve boosted your income or lowered your cost of living since when you first took out your mortgagethen youd definitely be able to handle the bigger payment.

You can refinance a longer-term mortgage into a 15-year loan. Or if you already have a low interest rate, save on the closing costs of a refinance and simply pay on your 30-year mortgage like its a 15-year mortgage. What if you already have a 15-year mortgage? If you can swing it, imagine increasing your payments to pay it off in 10 years!

How To Determine How Much House You Can Afford

Your housing budget will be determined partly by the terms of your mortgage, so in addition to doing an accurate calculation of your existing expenses, it’s important to get an accurate picture of your loan terms and shop around to different lenders to find the best offer. Lenders tend to give the lowest rates to borrowers with the highest credit scores, lowest debt and substantial down payments.

Also Check: Can I Be Approved For A Mortgage

What Are Interest Rates

An interest rate is a percentage you are charged on an amount of money you borrow or paid on the amount you save.

Your bank account will have an interest rate. Each month your bank will pay you that interest. For example, if you opened an account with £1,000 and the interest rate is 1 per cent, after a year your bank would pay you £10.

If you have taken out a loan, you will pay the interest to whoever loaned you the money, at a pre-agreed rate. The same goes for mortgages.

All interest rates are not made equal. The most important is the Bank Rate, which is set by the Bank of England.

The Bank of England explains: We use Bank Rate in our dealings with other financial institutions, which influence lots of other interest rates in the economy. This includes the various lending and savings rates offered by high-street banks and building societies.

For example, in 2020 Bank Rate was cut to 0.1 per cent during the Covid-19 crisis. This reduced the rates at which high street banks could borrow money from the Bank of England, which in turn meant they could lend to their customers at lower rates. Banks lowered the interest rates on some loans, such as mortgages, but also offered lower interest rates on some savings accounts.

What Is A 30

Thirty-year fixed-rate mortgages are the apple pie à la mode of secured credit. Homeowners get:

- A low, unchanging interest rate

- A steady, affordable payment

- A larger loan .

Wait, theres more. As their income grows, homeowners can make extra payments against principle to pay off the mortgage faster. Prepayment penalties do exist, but they are rare.

And if rates sink, you always can refinance!

Recommended Reading: Is It A Good Idea To Pay Off Your Mortgage

Calculate Monthly Interest Amount

Current Annual Mortgage Interest Amount / 12 Months = Monthly Mortgage Interest Amount

This formula calculates the total interest on your mortgage per month.

From the previous example we have an annual interest amount of $6,375.

$6,375 / 12 months = $531.25 per month

Here you would pay $531.25 in interest per month.

Other Ways To Use Your Extra Cash

Making a lump-sum mortgage payment isn’t your only option if you’re fortunate enough to have extra money. If you choose to pay down your mortgage, you will have opportunity coststhe value of what your money could have done if you hadnt used it to pay down your mortgage. Here are some of the other things you could do with that extra cash:

- Upgrade your home

You May Like: Are Mortgages Cheaper Than Rent

The Bottom Line: Keep Track Of Your Principal And Interest

Your monthly mortgage payment has two parts: principal and interest. Your principal is the amount that you borrow from a lender. The interest is the cost of borrowing that money.

Your monthly mortgage payment may also include property taxes and insurance. If it does, your lender holds a percentage of your monthly payment in an escrow account.

Your mortgage payment usually stays the same every month. If you choose a mortgage with an adjustable interest rate or if you make extra payments on your loan, your monthly payments can change.

If youre interested in getting a mortgage, the first step is to get preapproved. Learn more about preapproval so you can get started today!

Take the first step toward buying a house.

Get approved to see what you qualify for.

Calculate Daily Interest Amount

Monthly Mortgage Interest Amount / 30 Days = Daily Mortgage Interest Amount

This formula calculates the total daily interest on your mortgage.

From the previous example we have a monthly interest amount of $531.25.

$531.25 / 30 days = $17.70

In this example, you are paying $17.70 in interest per day on your mortgage.

Next Steps?

If youre wondering how you can strategically use your mortgage interest to help you pay off your mortgage quickly, consider using it as a metric to track your progress. Overtime youll see your daily, monthly and annual rate decrease which means that youre getting closer to achieving your goal. #debtfree

Recommended Reading: Can A Student Get A Mortgage

Principal And Interest: Mortgage Payment Basics

There are two basic components that make up every mortgage payment: principal and interest. The principal is the amount of funding borrowed for your home loan, and the interest is the money paid monthly for use of the loan. Understanding both principal and interest can help you choose the best mortgage option for you.

In this article, well share everything you need to know about principal and interest. Well cover the differences between the two and help you determine what you owe, or will pay, on your mortgage. Keep in mind, there may be other expenses that could find their way into your monthly payment as well.

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Read Also: How Do You Get Out Of A Mortgage With Someone

How Does Pay Extra On Your Mortgage Reduce The Interest Calculation

In my last post, I said one thing you can do to reduce the interest paid on your mortgage is by paying extra on the mortgage. Let put that in our example and see how $100/month extra can reduce the interest.

The first month will be the same as we havent made any payment. We will still have $2083.33 interest needs to pay. However, if we increase the monthly payment to $2183.33, we will reduce the mortgage amount by $2183.33 2083.33 = $700.78. On your second month, the new mortgage balance is $499,299.22 and the daily interest will be $499299.22 x 5% / 365 = $68.40. At the end of the month, we will accumulate $2080.41 in interest, $0.42 less.

You may think that just $0.42, hardly make any difference. However, that is the saving on the second month only. You will save more and more each month. Paying extra on the mortgage will have a knock on effect on the mortgage amount reduced. You will end up pay off your mortgage in 27.6 years and saved $42.6K on interest.

Dont Miss: Rocket Mortgage Vs Bank

When Recasting Makes Sense

If making a lump-sum mortgage payment is in the cards for you and you’re also trying to decide whether or not to recast your mortgage, heres how to tell if it might be a good option for you:

- You’re ahead on paying off your mortgage or will be soon.

- You’re OK with paying an administrative fee of $150 to $500.

- You’ve contacted your lender to see whether you qualify for a mortgage recast.

- You already have a lower interest rate than what you could get through a refinance.

- You want a smaller monthly payment, but you don’t want to refinance your mortgage.

You May Like: How To Get Removed From A Mortgage

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the country at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.