How Much Do You Need To Earn To Get A 250k Mortgage

Based on the standard income multiples that most lenders use, the combined income of everyone who will be involved with the mortgage would need to be just over £55,000, at least. Its difficult to give exact income amounts because there are a few different factors that affect your application and how much youll be able to borrow, namely:

- Your annual income

- The income multiple your lender offers

- Your general creditworthiness, as this will affect the number of lenders available to you

This is why getting a good mortgage broker on your side will make all the difference in how successful youll be in securing a £250k mortgage.

Can I Buy A House If I Only Make 50k A Year

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. That’s because salary isn’t the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

Can My Monthly Payment Go Up

Your monthly payment can rise in a few cases:

You have an adjustable-rate mortgage in which your payment stays the same for an initial term and then readjusts annually.

If you have an escrow account to pay for property taxes or homeowners insurance, because those taxes or insurance premiums may increase. Your monthly mortgage payment includes the amount paid into escrow, so the taxes and premiums affect the amount you pay each month.

You may have been assessed fees. Check your mortgage statement or call your lender.

Must reads

Don’t Miss: How To Shave Years Off Your Mortgage

What To Consider Before Applying For A $250000 Mortgage

Before taking out a $250,000 mortgage, youll want to be well aware of the costs it will come with. These costs include interest, your down payment, and sometimes insurance and other fees.

There are also closing costs which typically clock in somewhere between 2% and 5% of the total loan amount.

Learn More: How to Know If You Should Buy a House

What Are Fha Loan Limits

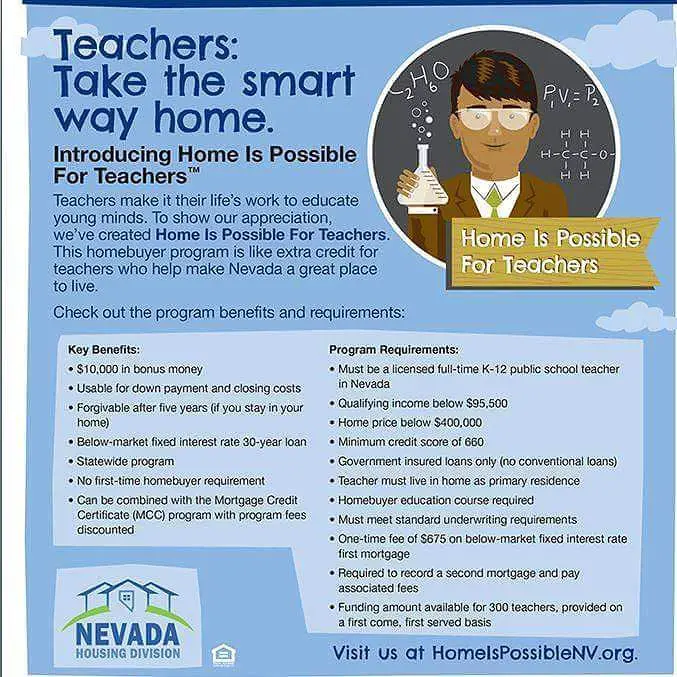

FHA loans are available in all 50 states, District of Columbia, and U.S. territories of Puerto Rico, Guam, U.S. Virgin Islands, American Samoa, and Northern Mariana Islands. FHA limits the amount you can borrow with an FHA loan depending on location. These FHA loan limits are updated annually and generally increase from year to year.

Loan limits are established by county, and an FHA loan cannot exceed the predetermined amount. If a home is being purchased and a 3.5% down payment results in a base loan amount above the county loan limit, the homebuyer must make an additional down payment to bring the FHA loan within the limit.

The majority of the FHA eligible areas have the same loan limit. However, in areas where home prices are higher, FHA loan limits are adjusted upwards. Itâs important to know the county loan limit before you begin home shopping to avoid looking for homes that exceed your countyâs maximum loan amount.

Consider these downsides before buying a modular home:

Don’t Miss: How Much Mortgage And Taxes Can I Afford

What Are My Monthly Costs For Owning A Home

There are five key components in play when you calculate mortgage payments

-

Principal: The amount of money you borrowed for a loan. If you borrow $200,000 for a loan, your principal is $200,000.

-

Interest: The cost of borrowing money from a lender. Interest rates are expressed as a yearly percentage. Your loan payment is primarily interest in the early years of your mortgage.

-

Property taxes: The yearly tax assessed by the city or municipality on a home that is paid by the owner. Property taxes are considered part of the cost of owning a home and should be factored in when calculating monthly mortgage payments. However, lenders dont control this cost and so it shouldnt be a major factor when choosing a lender.

-

Mortgage insurance: An additional cost of taking out a mortgage, if your down payment is less than 20% of the home purchase price. This protects the lender in case a borrower defaults on a mortgage. Once the equity in your property increases to 20%, you can stop paying mortgage insurance, unless you have an FHA loan.

-

Homeowners association fee: This cost is common for condo owners and some single-family neighborhoods. Its money that must be paid by owners to an organization that assists with upkeep, property improvements and shared amenities.

What Does Mortgage Affordability Mean

Your lender wants to make sure you can afford your mortgage repayments not just on paper, but in practice. This means that they will look at your other outgoings and spending both essential and non-essential to determine how much you can really afford.

For example, if you work in a city but your home will be outside that city, you will have to spend money on commuting. This is an essential expense so your income is effectively reduced. The lender will want assurance that you can afford both your mortgage repayments and £200 a month in train tickets.

When making your mortgage application, youll have to reveal how much you typically spend per month, as accurately as you can. A good tip is to reduce your non-essential spending as much as possible in the months before you apply . Also see how much you can trim your essential spending try shopping in cheaper stores, swapping the train for a bike, etc.

Provided you can show a regular surplus each month that would comfortably cover your monthly mortgage repayment, you should be able to borrow the amount you want.

Recommended Reading: How To Shop For A Mortgage

$260000 House At 400%

| $693 |

Mortgage Tips

- Get a free copy of your to make sure there are no errors which might negatively affect your credit score.

- Shop around. Make sure to get multiple mortgage quotes. Over 30 years, a difference of 0.25% in APR might end up being over $10,000 in extra payments!

- Bigger down payments are better. You can often qualify for a mortgage with as little as 3.5% down. But, unless your down payment is at least 20%, you will likely have to pay Private Mortgage Insurance . This can add significant cost to the price of the mortgage.

Can I afford a $260,000 house?

Traditionally, the “28% rule” means a person should not spend more than 28% of their pre-tax income on total housing costs.

Let’s assume that taxes and insurance are 2% of the house price annually. Here’s how much you’d have to make to afford a house that costs $260,000 with a 4.00% loan:

| % Down |

|---|

Fha Mortgage Insurance Premiums

The FHA loan program is sustained by way of mortgage insurance premiums collected at loan inception and annually as part of your FHA loan payment. The two types of mortgage insurance are included on all FHA loans.

FHA Upfront Mortgage Insurance Premiums

The first mortgage insurance premium is an upfront fee charge at loan inception. UFMIP is financed into your FHA loan and not required to be paid out of pocket.

UFMIP is calculated by taking the upfront premium rate and multiplying it by the FHA base loan amount.

Example

$300,000 purchase price â $10,500 down payment = $289,500 base loan amount

$289,500 base loan amount * 1.75% = $5,066 UFMIP

$5,066 UFMIP is added to $289,500 to establish your FHA loan amount of $294,566.

FHA Annual Mortgage Insurance Premium

The second FHA insurance premium is an annual fee paid monthly as part of your FHA loan payment. The premium is calculated from your annual average monthly FHA principal balance and is divided by 12 in order to evenly include it as part of your mortgage payment.

Accurately computing FHA MIP is complicated but our FHA loan calculator can be trusted to provide a reliable FHA mortgage payment.

Also Check: 10 Year Treasury Vs 30 Year Mortgage

Also Check: How Much Of Your Mortgage Interest Is Tax Deductible

How Are Modular Homes Built

Modular home manufacturers build 80 to 90 percent of the homeâs sections or modules in a factory. Factories construct the walls, install drywall, appliances, and roof framing, paint, and inspect for quality-control. The factory work happens simultaneously with on-site work to prepare the foundation.

Once the modules are delivered to the construction site, a crane lifts them into place over a permanent foundation. Contractors assemble the sections, connect the utility lines, and attach each piece to the foundation. Sometimes, the home is kept on the steel frame it was delivered on as part of the foundation.

Contractors complete the home finishings and conduct minimal inspections. Now the home is ready to move into.

Monthly Payment: Whats Behind The Numbers Used In Our Mortgage Payment Calculator

The NerdWallet mortgage payment calculator cooks in all the costs that are wrapped into your monthly payment, including principal and interest, taxes and insurance. Youll just need to plug in the numbers. The more info youre able to provide, the more accurate your total monthly payment estimate will be.

For example, you may have homeowners association dues built into your monthly payment. Or mortgage insurance, if you put down less than 20%. And then theres property taxes and homeowners insurance. It helps to gather all of these additional expenses that are included in your monthly payment, because they can really add up. If you dont consider them all, you may budget for one payment, only to find out that its much larger than you expected.

For you home gamers, heres how we calculate your monthly mortgage payments on a fixed-rate loan:

M = P /

The variables are:

-

M = monthly mortgage payment

-

P = the principal, or the initial amount you borrowed.

-

i = your monthly interest rate. Your lender likely lists interest rates as an annual figure, so youll need to divide by 12, for each month of the year. So, if your rate is 5%, then the monthly rate will look like this: 0.05/12 = 0.004167.

-

n = the number of payments over the life of the loan. If you take out a 30-year fixed rate mortgage, this means: n = 30 years x 12 months per year, or 360 payments.

Recommended Reading: What’s The Monthly Mortgage Payment

Other Factors That Affect Getting A 250000 Mortgage

Several other circumstances may help determine whether or not you can borrow the full 4.5 times your income. These are:

Youll need a good history of borrowing and repaying money. Find out what can affect your credit score and how to improve it.

Lenders prefer borrowers to have steady, predictable sources of income. This means it can be harder if youre self-employed, or in a profession considered to be less secure or more risky. Find out about getting a mortgage if youre self-employed.

Age

There is no set age limits on mortgages, but lenders tend to have their own cap, sometimes as low as 55. A steady sufficient income for the next 20+ years can be difficult to prove if youre in your late 50s or older.

Can You Afford A 26000000 Mortgage

Is the big question, can your finances cover the cost of a £260,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering ‘yes’ then it’s worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered. See how much it will cost you to move home when buying a property worth £260,000.00

Do you need to calculate how much deposit you will need for a £260,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances

Did you know that we review the UK’s leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesn’t charge you fees, so you get the best mortgage deals without the hassle.

Also Check: Are House Taxes Included In Mortgage

Can I Lower My Monthly Payment

There are a few ways to lower your monthly payment. Our mortgage payment calculator can help you understand if one of them will work for you:

-

Increase the term of the loan. The longer you take to pay off the loan, the smaller each monthly mortgage payment will be. The downside is that youll pay more interest over the life of the loan.

-

Get to the point where you can cancel your mortgage insurance. Many lenders require you to carry mortgage insurance if you put less than 20% down. This is another charge that gets added to your monthly mortgage payment. You can usually cancel mortgage insurance when your remaining balance is less than 80% of your homes value. However, FHA loans can require mortgage insurance for the life of a loan.

Look for a lower interest rate. You can think about refinancing or shop around for other loan offers to make sure youre getting the lowest interest rate possible.

How Can A Mortgage Broker Help Me Get A 250k Mortgage

Your best chance of being able to borrow the maximum you can afford is to use a mortgage broker. Your broker will give you independent advice on the best deal for you and will help you with every stage of your application. An independent mortgage broker also has access to more deals than youll find on the high street or online, so youll know you really are getting the best deal you can achieve at this time.

Did you find this article helpful? Then you might also find our article on renting vs buying informative, too!

Read Also: Does Fha Offer 40 Year Mortgage

Total Interest Paid On A $250000 Mortgage

The total amount of interest youll pay on a $250,000 mortgage will vary based on your interest rate and loan term. High interest rates and long terms will result in the most interest over time, while shorter terms and low interest rates will save you on interest.

Example:

However, if you chose a 30-year mortgage at the same rate, your interest costs would jump significantly, and youd pay $179,673 by the end of your loan term.

How To Get A $250000 Mortgage

If youve weighed both the upfront and long-term costs of a $250,000 mortgage and are comfortable moving forward, its time to start the mortgage process.

Here are the steps to follow to get a mortgage:

Read Also: What To Know About Getting A Mortgage

Design & Size Differences By Region

Prices tend to be about the same nationwide, but there may be regional design differences to match the local building codes and the style of your neighborhood. Bigger cities typically have more models on display and a larger selection of modular home floor plans.

More extended units are more difficult to transport. On the East Coast, the maximum length is 60 to 70 feet, while it can be longer in the West and Midwest. In urban areas, the maximum ceiling height is 10 feet to allow trucks to drive under overpasses with a 14-foot clearance.

Read Also: Chase Recast Mortgage

What Is A Modular Home

A modular home consists of sections or âmodulesâ constructed in a factory, then delivered and set-up on-site. Modular homes come in pre-designed plans or can be customized to any shape or size. Modular homes follow the same building codes as site-built homes, but are stronger and more energy-efficient. Plus, it looks the same as a regular house.

Types of Modular Homes

Modular homes can either be on-frame or off-frame with differences in price, classification, and long-term value.

- Off-frame The most-common, highest-quality modular homes are lifted off of their transport frame and placed onto a permanent foundation, which makes them more expensive and difficult to relocate. These homes can appreciate in value like site-built homes since they have lasting foundations, and the buyers also own the land.

- On-frame These modular homes remain on a steel-frame chassis after delivery. Since the transport frame stays in place and they arent permanently attached to a foundation, many lenders and appraisers classify them as mobile homes. Theyâre more affordable because they dont need a permanent foundation, and relocating them is easier.

Recommended Reading: What Documents Do I Need For A Mortgage