Can You Put Your House Up For Collateral To Buy Another House

Buying a property with a home loan typically means using the property’s value to secure the loan a practice called mortgaging your home. But it’s also possible to use the value of your property as collateral on another loan, provided you fulfil the eligibility criteria and have enough usable equity available.

Your House Or Home Equity

If you own your home, you can use the house as collateral for a secured loan. The value of the home, or the equity you have in it, can help determine the amount you can borrow for the loan. You can use your home as collateral by taking out a second mortgage or use the equity in your home as collateral for a bank loan or revolving line of credit.

Its important to make sure that you set up your loan with payments that you can afford. Dont borrow too much against the equity or value of your home if it means the payments will become too high for you to budget for comfortably.

Can You Borrow Against Vacant Land

While it’s possible to borrow against vacant land, it’s usually not easy. Banks like to make loans against collateral that not only has value, but can be easily converted into cash for them. Given this challenge, you may need to look at a different lender than the one you’d otherwise use for most types of loans.

Also Check: How Much Mortgage Can You Afford Rule Of Thumb

What Is Prequalification For Mortgage

Mortgage pre-qualification is generally a quick, simple process. You provide a mortgage lender personal financial information, including your income, debt and assets. Based on your information, the lender will give you a tentative assessment as to how much they’d be willing to lend you toward a home purchase.

Types Of Loans That Use Land As Collateral

You can also obtain loans by using land without housing as collateral. While these loans tend to be less common, they function in a similar manner. Land loans can be used to finance a plot of land or construction on that land. Its possible to use the equity in land you already own as collateral to borrow money.

Here is a basic overview of the various types of loans secured through land equity:

You May Like: Do Mortgage Brokers Get Commission

Is It Possible To Buy Land With Conventional Loan Financing

Conventional financing is the most common type of financing borrowers try to obtain, however, if you wish to buy land, it might not be the best choice. Many lenders do not offer conventional options for a land purchase. This is because purchasing land does not offer the same type of collateral as a home does. This puts the lender at a much higher risk for default. The lender considers many factors to determine your eligibility for a land purchase, otherwise known as a lot loan.

How To Get A Collateral Mortgage

Obtaining a collateral mortgage is simple, but there are a few stages involved.

Suppose youve paid $500,000 for a home and put down a 20% down payment . That means a $400,000 mortgage is required. A collateral mortgage of up to 125 percent of the value of your property may be available from your lender. That means your collateral mortgage might be valued at $625,000 .

Every lender has their own set of standards for determining how much extra money theyll register as security for a mortgage. Some lenders might not always allow you to borrow more than the original loan amount. In either case, you can borrow up to 80% of the appraised value of your property under government restrictions, which is especially useful if the value of your home increases.

Lets imagine youve owned your property for a few years and the propertys worth has increased by 10%. Youll have more money if the value of your property continues to rise. However, youll only be able to borrow up to $625,000, which is the initial value of your collateral mortgage.

Read Also: How To Assume A Mortgage With Bad Credit

Alternatives To Collateral Loans

If you dont want to risk your property to get a loan but your credit is making it tough to get an unsecured personal loan from a traditional bank, there may be other options.

- nonprofit financial cooperatives owned by members may have less-strict eligibility requirements for unsecured personal loans. Some credit unions even offer special programs for borrowers with poor credit history. Though you have to be a member of a credit union to qualify.

- Online lenders may offer unsecured personal loans to a wider range of borrowers. These loans typically come with high interest rates, though.

Be sure to get informed about the ins and outs of getting a personal loan when you have rough credit. Your choice of loans may be limited, and the costs in interest rates and fees can end up sending even the most well-intentioned borrowers into a financial tailspin.

As another alternative, you might consider how a secured credit card could work for you, potentially giving you the flexibility of a credit line and a way to build credit when you have little or no credit history or if your credit profile is too dinged up for you to get an unsecured loan.

Is It Cheaper To Get A Loan Or A Mortgage

Even including the arrangement fees, a mortgage is still likely to be cheaper than taking out a personal loan. However, to be absolutely certain of which would give you the better deal you need to compare the total cost of borrowing – including arrangement fees for the mortgages – of the two types of loan.

Don’t Miss: What Is The Mortgage Payment On 1.5 Million

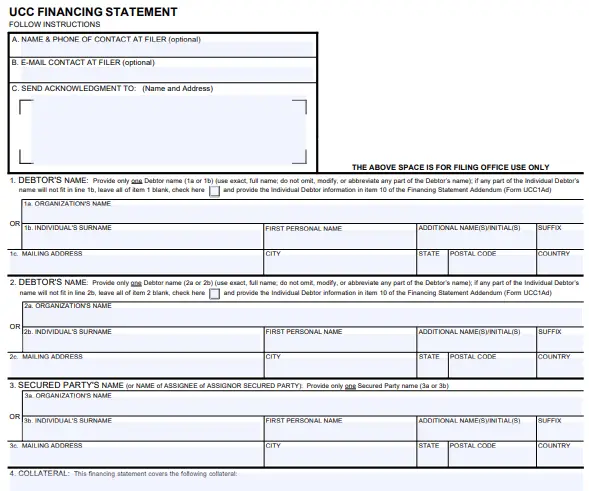

How Can I Use My Property As Collateral

How to Use Property as Collateral for Loans

The Pros And Cons Of Using Your Land As Collateral

Steve Smith / Getty Images

Land equity is the value of land you own, or the difference between the propertys market value and what you owe lenders. Its similar to home equity, but it applies only to the land.

You can use equity you have in land in a number of ways, such as for collateral for a land equity loan. Learn about how land equity works and your options for leveraging equity in your property.

Recommended Reading: Is It Best To Pay Off Mortgage Early

What Is A Collateral Loan

When you take out a collateral loan, you agree to give a lender the right to take the property thats securing the loan like a car, home or savings account if you fail to repay it as agreed. This property is considered the collateral on the loan itself. There are pros and cons to consider before taking a collateral loan, which well take a closer look at later in the article.

Using Land As Collateral For Construction

If you already own the land and have been investing money into it, then you may have sufficient land equity when you go to build. Of course, there are other factors that come into play when securing a construction loan.

When it comes to using land as collateral it is key to ensure you research the location and even have a valuation done before purchasing the property. This is to ensure you are getting the best deal possible. Valuing the land first also means you may have more success with the bank lending you the amount you need when you go to build and use the land as collateral.

You May Like: How Do Banks Make Money On Reverse Mortgages

Where To Find The Best Land Loan Lenders

If youâre ready to pursue a land loan, one of the best places to start is your own backyard. Local lenders will have the ability to assess the land and its potential, as well as the flexibility to offer better terms. You can also turn to the web. Online lenders have little overhead, which means they can pass on those savings to you in the form of lower rates and fewer fees.

Whichever lender you choose, be sure to spend time evaluating all of your options and crunching the numbers. There may be many options for securing a land loan, but many arenât cheap.

Can You Use Land For The Down Payment On A Construction Loan We Bought A Plot Of Land With Cash And Want To Know If It Can Be Used As A Down Payment When We Apply For A Construction Loan To Build A Home

The down payment required for a construction or construction-to-permanent loan varies but is usually 20% to 25%. The good news is that the value of the land can be used for all or part of the down payment.

For example, if you buy a plot of land for $20,000 in cash and want to construct a home with a total building cost of $80,000, you need a construction loan for $80,000. If the lender requires a 25% down payment, that means you need to put down $20,000. In this case, you can use the value of your land instead of your personal funds to meet the down payment requirement.

If the value of the land is higher than the down payment required, you may be eligible for a higher construction loan amount. If the value of the land is lower, you likely need to contribute your own funds to qualify for the loan. Returning to the example above, if the land is valued at only $15,000, you need to personally contribute $5,000, to meet the required $20,000 down payment.

We recommend that you contact multiple lenders in the table below to learn about construction and C2P loan terms and qualification requirements. Shopping lenders enables you to find the lender and program that best meet your needs.

Using the net value of the land is a non-issue if you own the property free and clear but if a property has significant debt then it may not help you satisfy the lender’s down payment guideline.

Read Also: How Much Is A Million Dollar Mortgage Per Month

The Most Common Assets Used As Collateral For A Home Loan

If you are in the market for a home, or looking to make updates to your existing home, the first step is often determining how much money you can borrow. Banks will not lend to just anyone, so you will need to have assets to secure your loan and when you do this, your assets become collateral. Collateral is defined by Investopedia as property or other assets that a borrower offers a lender to secure a loan. The day all the loan is paid off by the borrower is the day the home will no longer be collateral, and the lender wont have any rights to the asset. This is a way of allowing the bank to recoup the funds in the event of nonpayment. Traditionally a mortgage is backed by the home you are buying but if you need more financing or have other mitigating circumstances, you can turn to other forms of collateral.

Identifying The Value Of Your Property

If you are intent on using your land as collateral, the next step is to determine precisely how much your land is worth. Given the wide variety of factors that can influence the value of your land holdings, it is quite possible that an appraisal will be required before you execute your loan. To do this, you will need to hire a professional appraiser who has been approved by the lender you have selected. Once the value of your land has been finalized, your lender will be able to provide you with loan terms that you can either accept or reject as you see fit.

Don’t Miss: Can I Get A Mortgage After Filing Bankruptcy

Can I Use My Land As Equity For A Construction Loan

The short answer to the question Can I use my land as equity for a construction loan is yes.

If you own you land outright you can likely use your equity in the land toward the purchase of a new home. In this scenario, you could use your equity in the land as collateral or obtain a nwe loan against property and use the funds as a down payment on building your new home.

There are other factors, of course. The value of your land, the sales price of the home you wish to build, your credit score/credit history and loan programs you can qualify for will all be determining factors in the use of land as equity for a loan.

Your Savings And Investments

Some banks allow you to use the money in your savings account as collateral for a secured loan. One of the biggest advantages of a savings-secured loan is that you can borrow against the money that youve saved without having to use it or take it out of your account. It can be easier to qualify for a loan that uses your savings as collateral, even if your credit score is low.

You can usually continue to earn interest on your savings while using it as collateral, although the rate may be lower than what youd earn under other circumstances. If youve done a good job saving your money, then a savings-based secured loan can be an easy and safe option for you.

If you have a robust stock and investment portfolio, you can sometimes use it to secure a loan based on your investments. These secured loans are a little different because youll most likely have to go through your investment banker to apply for a loan that uses your stocks as collateral.

The disadvantage of a loan that uses your investment portfolio this way is that the market fluctuates. If the market experiences significant losses, your stock values can drop below what you owe. In that case, the lender can demand that you pay immediately to make up the difference. Keep market variations in mind before you decide to use your stocks as collateral for a loan.

Read Also: Which Credit Report For Mortgage

What Is A Land Equity Line Of Credit

Land equity loans can be compared to credit cards because they allow you to spend up to a certain credit limit each month. Just like a credit card, you have to make a minimum payment, and you have the option of paying off the entire sum at any time. You can continue to use your line of credit as long as you dont spend more than your credit limit at any time. If your borrowing needs vary, and you want to make on-going purchases, a personal line of credit is probably a better fit.

- Type of disbursement: A line of credit is reusable. Once you are approved for it, you can access any portion of the credit line at any time.

- Interest rates: Variable

- Line of credit amount: Depends on land equity and banks approved loan-to-value ratio. As with a secured loan, lines of credit secured by collateral typically result in a lower interest rate and higher credit limit.

- Repayment Options: You pay interest on the amount you use, not the entire credit limit as you do with an installment loan. No matter how much you borrow, all of it plus interest must be repaid by the end of the term.

How Do Land Loans Work

Land and lot loans are obtained in the same way a buyer would obtain a mortgage loan for a house, but unlike receiving a dollar amount assigned to the property, it can be harder to determine what the land is worth because there is no property collateral.

This means that land loans are a riskier transaction for lenders, which results in higher down payment requirements and interest rates than a typical home loan.

Read Also: How Large Of A Mortgage Can I Get

The Vacant Land Problem

From a bank’s perspective, vacant land isn’t very good collateral. Unlike buildings that can be rented out or resold relatively quickly to an end user, vacant land usually doesn’t have an immediate economic use and can take months or years to sell. Furthermore, vacant land can be a burden, since owning it requires you to pay property taxes and other carrying costs. Unless you’re an extremely well-qualified borrower who, in the scheme of things, might not need the loan, or your land is extremely valuable, finding a loan for vacant land may be challenging.

Shop Lenders And Find The Right One For Your Project

Be sure to find a lender that has experience with residentiail construction financing. Shop rates and get the best terms you can. You will need an accurate budget to work with lenders. You contractor and a good residential constuction lender can help you come up with an accurate budget for the home that you want to build.

Also Check: Are There Income Requirements For A Reverse Mortgage

Collateral Loans Could Help You Build Credit

If you have little to no credit history, a secured loan could be a way to improve your credit score and start building a strong credit profile as long as you make timely monthly payments of the minimum amount or more. Just make sure the lender will be reporting your payments to the main consumer credit bureaus.