What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loan amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

Factors In Your Massachusetts Mortgage Payment

On top of your principal and interest payment, you have to pay property taxes to the city or town your home is in four times a year in Massachusetts. While the Massachusetts average property tax rate seems manageable at 1.17%, the median property tax bill is $4,899. Thats due to the states strong housing market and high home values, which lead to a higher overall tax bill.

Your property taxes are based off of your homes assessed value and the areas tax rate. The Bay State assesses residential real estate each year to determine the market value. Your property bill will be based off of that number, so if you have any issue with the assessment, you can file an abatement application. This isnt guaranteed to get accepted but if it is, youll receive a refund for a portion of your property taxes. Senior citizens, veterans and blind residents can apply for property tax exemptions. The complete list of qualifying exemptions can be found on Massachusetts Department of Revenue property tax information website.

Another ongoing cost that accompanies your property tax and mortgage payments is homeowners insurance. In Massachusetts, the average annual premium is $1,485, according to Insurance.com data. That makes it one of the most expensive states for homeowners insurance premiums.

Cost To Rent A Million Dollar House In Nyc

The established practice for rent is landlords ask between 0.5% and 1% of the total cost. In higher value homes, the rents stay at the lower percentage cut as fewer people show up to rent.

The chief benefit of renting is when you are not looking for long term commitment to the city and might have to leave the city in the future. On the flip side, the running cost would make a huge portion of your earnings plus you cannot consider it as an investment for future gains.

Don’t Miss: Are Closing Costs Covered By Mortgage

Getting Your First Mortgage

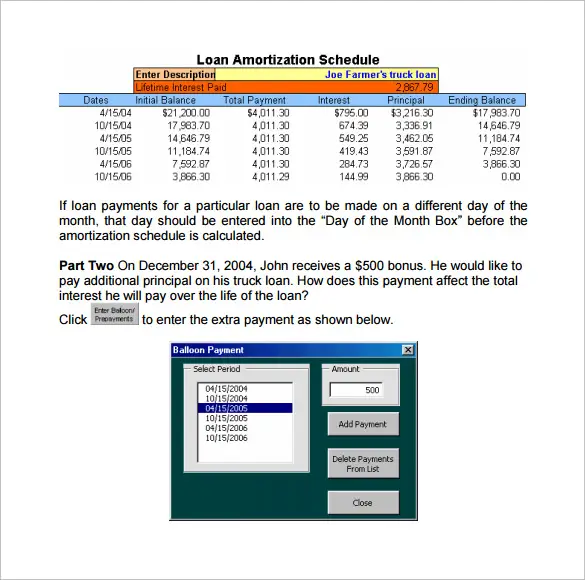

The traditional period for amortization of a mortgage is 25 years. But this is done in periods of five years at a time, though it is possible to pay the mortgage down in a shorter period, just not longer. The longer the amortization period, the smaller the monthly payments will be, but the more the loan will cost in total.

Most mortgages have a five year term, though shorter terms are possible. The five-year mortgage term is the amount of time a mortgage contract is in effect. At the end of each term, the mortgage must be renewed for another term, at which point there is an opportunity to consider making any changes. Possible changes include renegotiating the rate as well as other details of the contract for the next term. The agreed-upon interest rate remains in effect for the term.

It is possible to choose between an open mortgage, which provides a person the flexibility of being able to repay all or part of a mortgage at any time without a prepayment charge, or a closed mortgage, which limits prepayment options. The latter usually has a lower interest rate.

Traditionally, mortgage payments are made every month. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. A biweekly payment means making a payment of one-half of the monthly payment every two weeks. This results in 26 payments a year instead of 24.

There are also options for flexible or skipped payments.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make.

Don’t Miss: Can I Refinance My Mortgage Within A Year

Dont Overextend Your Budget

Banks and real estate agents make more money when you buy a more expensive home. Most of the time, banks will pre-approve you for the most that you can possibly afford. Right out of the gate, before you start touring homes, your budget will be stretched to the max.

Its important to make sure that you are comfortable with your monthly payment and the amount of money youll have left in your bank account after you buy your home.

What Salary Do You Need To Buy A 2 Million Dollar House

Therefore, if you want to buy a $2 million house, you need to make at least $667,000 a year. You should also have enough for a 20% down payment, or $400,000, plus a $100,000 cash buffer in case you lose your job. In this low interest rate environment, you can stretch to buy a home up to 5X your annual gross income.

Recommended Reading: How To Calculate Interest Payment On Mortgage

Details Of Massachusetts Housing Market

Home of Plymouth Rock and the famed Mayflower landing, Massachusetts has a long history as one of the 13 original colonies. Nicknamed the Bay State for its coastline, Massachusetts has 1,519 shoreline miles and 7,800 square land miles. According to the U.S. Census Bureau, the states population sits at almost 6.9 million. The largest cities by population include Boston, Worcester, Springfield, Lowell and Cambridge.

Currently, the median home value is $418,600. But the housing market is currently hot in certain areas, like in Suffolk County, home to the capital city of Boston, where the median home value is $496,500.

You May Like: Reverse Mortgage For Condominiums

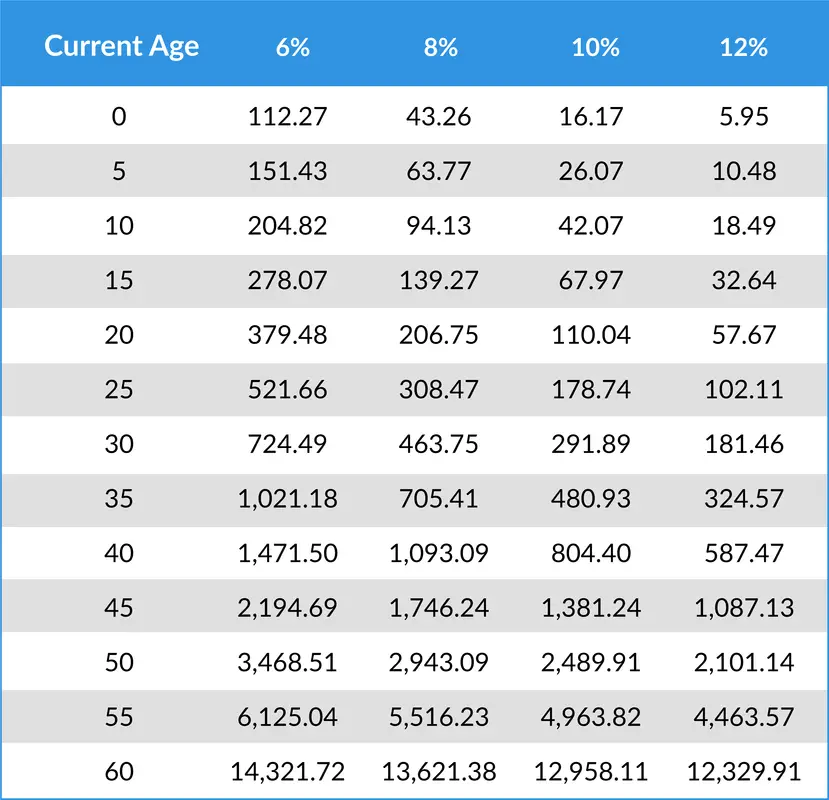

Rule : 70% Of Working Income

This rule estimates that you will need between 70% and 100% of your pre-retirement income in retirement: 70% if you are typical and do not have a mortgage, and up to 100% if you are still paying a hefty mortgage plus other atypical expenses while retired.

The idea behind this rule is that your expenses are generally expected to be lower in retirement: no mortgage payments, no longer need to save for retirement, kids are financially dependent, etc. After computing this amount, you can then proceed to calculate how much you need by going back to Rule 1 or 2.

For example, assume you earn $100,000 per year before retiring. Using the 70% rule, you will need approximately $70,000 in annual income to maintain your lifestyle in retirement. Going back to Rule 2, it implies you need:

â $70,000 x 25 â $1.75 million in retirement.

I think the 70% rule is a fairly liberal estimate of retirement income needs . A survey conducted by Sunlife and released in 2016, shows that Canadian retirees were on average living on 62% of their pre-retirement income.

Also Check: What Is The Yield Spread Premium On A Mortgage

What Is The Simple Interest Formula

According to the simple interest rate formula, the principal amount is multiplied by the rate of interest and time period. It can be expressed as follows:

SI = P x R x T

Where SI is Simple Interest, P is Principal Amount, R is Rate of Interest and T is Time Period.

As per the simple interest formula, the principal amount will remain constant when the SI is calculated over a period of time for different years.

Why Should I Use A Mortgage Repayment Calculator

A home loan is the biggest expense most people will ever have. Thats why its important to use a mortgage repayment calculator to work out how much your potential home loan repayments could be before applying for a loan, so you know how much you can afford to borrow.

A home loan repayment calculator can help you compare the costs of taking out a home loan and give you an idea of what your monthly repayments could be. Having an understanding of what your monthly repayments could be can help you to work out whether the loan is something you can afford, and what the total cost of the loan will be over the full loan term.

Recommended Reading: How Much Is Monthly Payment On 200 000 Mortgage

Can You Buy A $1 Million Home

If you’re considering buying a $1 million home, you’ll want to make sure you can comfortably make those monthly payments. Ideally, that means your total housing costs will be well below 30% of your income. That’s the maximum experts recommend you spend on housing.

You should also be aware that other expenses of home ownership, such as utilities and maintenance, are typically higher with a more expensive home. So be sure to take these expenditures into account when you decide if it’s worth buying a home at such a high price.

Finally, consider your other financial goals and your ability to cover those large payments in an emergency. Consider whether paying so much for a house will make it more difficult to accomplish other things you dream of, such as early retirement or saving for a vacation. And make sure you have enough savings in an emergency fund to see you through a job loss or other unexpected event. If you don’t, you may want to scale down your expectations and choose a lower-priced home.

On the other hand, perhaps you can come up with the requisite down payment, easily cover your monthly mortgage payments, and still meet your financial goals. As long as you can easily save up enough in an emergency fund to cover three to six months of living expenses — including your new mortgage payment — then you’re in a good position to move forward. You can go ahead and purchase that $1 million property you’ve been dreaming of.

Can You Afford A Million

Hereâs the short answer: To buy a million-dollar home in Canada, youâll need a yearly income of at least $175,230, as well as a cash down payment of at least $200,000. Thatâs the minimum youâll need in order to qualify for a large enough mortgage. Well, that or youâll need $1 million in cash, to avoid taking out a mortgage altogether.

Also Check: What Are The Best Mortgage Lenders

Example Mortgages On A 1 Million Dollar Home

Lets imagine you want a 1 million dollar home and can afford a 20% down payment. Based on current interest rates, your monthly payments would likely land up around $4,500 . This amounts to annual expenses of $54,000.

Assuming you have a sufficient credit score, what would you need to make to meet a 32% debt-to-service ratio? You would need to make over $168,750 to meet the 32% ratio .

Now imagine that you have an additional $1500 in monthly expenses – car loans, student loans, and other miscellaneous loans. Now your monthly payments are $6,000, and the annual expenses are $72,000. When lenders consider all your expenses, they are looking at your total debt service ratio. They are a bit more lenient when they consider these other expenses and look for ratios near 40% .

In this case, you would need to make over $180,000 to meet a 40% ratio and afford a 1 million dollar home.

These two examples are the typical baseline estimation of a mortgage for a million-dollar home. If you can afford a larger down payment, have a higher annual income, and a better financial record, you will likely make lower monthly payments and get more flexible interest rates.

What Is The Best Mortgage Term For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

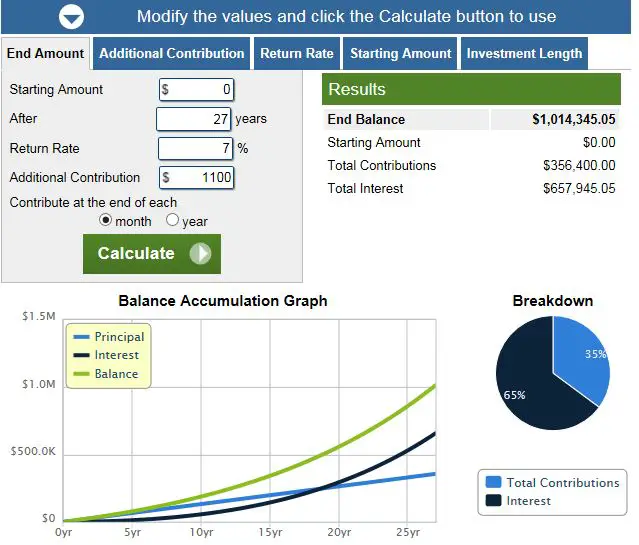

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

You May Like: Does Paying Off A Mortgage Help Your Credit Score

How Much Would The Monthly Payments Be On A Million

The median sales price of houses sold in the U.S. hit $347,500 in the first quarter of 2021, according to the St. Louis Federal Reserve. That means a million-dollar home is worth close to three times what most people pay for their properties.

That kind of spending will either buy you a mansion in most parts of the country — or a nice place in an expensive city. But, what exactly would you have to spend to get it?

Let’s take a look at what the monthly payments might look like if you bought a $1 million place to call your own.

Jump To

How To Use Our Home Loan Calculators

Our home loan calculators are simple to use. You need to have an idea of your loan amount, the interest rate, repayment type, loan term, repayment frequency, and other information as required.

If youre not sure what your loan amount is because youre a first time buyer or have only just started thinking about taking out a home loan, thats okay. Have a think about what your budget is and enter rough numbers into the calculator that matches your budget.

Other calculators, like the stamp duty calculator, may require you to enter your location, while our income tax calculator will require you to include your income and current expenses.

Also Check: How Much Income Should You Spend On Mortgage

How Much Do You Have To Make A Year To Afford A $300 000 House

What income is needed for a 300k mortgage? + A $300k mortgage with a 4.5% interest rate over 30 years and a $10k down-payment will require an annual income of $74,581 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: What Is The Average Time To Pay Off A Mortgage

Can I Retire Early With 2 Million Dollars

Not sold on the $1.5 million number? What about a little more? Can you retire early with 2 million dollars?

You sure can!

In fact, two people should be able to retire with 2 million dollars if they are able to live simply and lean, have paid off all of their debts, and can afford their lifestyle .

Related: Early Retirement Is It Really Possible?

What Is The Difference Between Amortization And Term

The mortgage amortization is an estimate of the total amount of time it takes to pay off your mortgage in full. It is based on the interest rate and the amount of your monthly payment in your current mortgage term. A mortgage term, on the other hand, is the period of time you are contractually bound to a lender and their mortgage conditions. For example, the most common mortgage term in Canada is 5 years. That means you are committed to that lender, interest rate, payment obligation, and other conditions for 5 year period. The term is simply how long you are stuck with a lender and their rules, not the length of the mortgage itself. The maximum amortization is 30 years for mortgages with a 20% down payment or more, and 25 years for mortgages with less than a 20% down payment.

Also Check: When Does Mortgage Refinance Make Sense

The Mortgage On A $1 Million Home Vs A $2 Million Home

The first thing to know about a mortgage loan on a $1 million or $2 million home is that your homes value isnt the same as your mortgage. When you buy a home, mortgage lenders generally require that you provide a down payment.

For a conventional loan, lenders require a down payment of at least 3% for anything less than 20%). However, for the mortgage on a $1 million or $2 million home, you can expect a lender to require closer to 20%. As a result, the mortgage on a $1 million home would be closer to $800,000. Meanwhile, a $1 million mortgage would actually be for a home priced at about $1.25 million.

Obviously, the numbers for a $2 million home are even greater. With a 20% down payment, the mortgage on a $2 million home would actually be about $1.6 million. And for a $2 million mortgage, you could purchase a $2.5 million home.