Frequently Asked Questions Regarding Reverse Mortgage Eligibility

- Can a homeowner that has a mortgage still get a reverse mortgage loan? Yes. Many people who obtain a reverse mortgage loan use it to pay off their existing mortgage and eliminate monthly mortgage payments.1

- Does every homeowner over age 62 qualify? No. If you are 62 years of age & your wife or partner is younger than 62 year of age, you can still get a reverse mortgage.

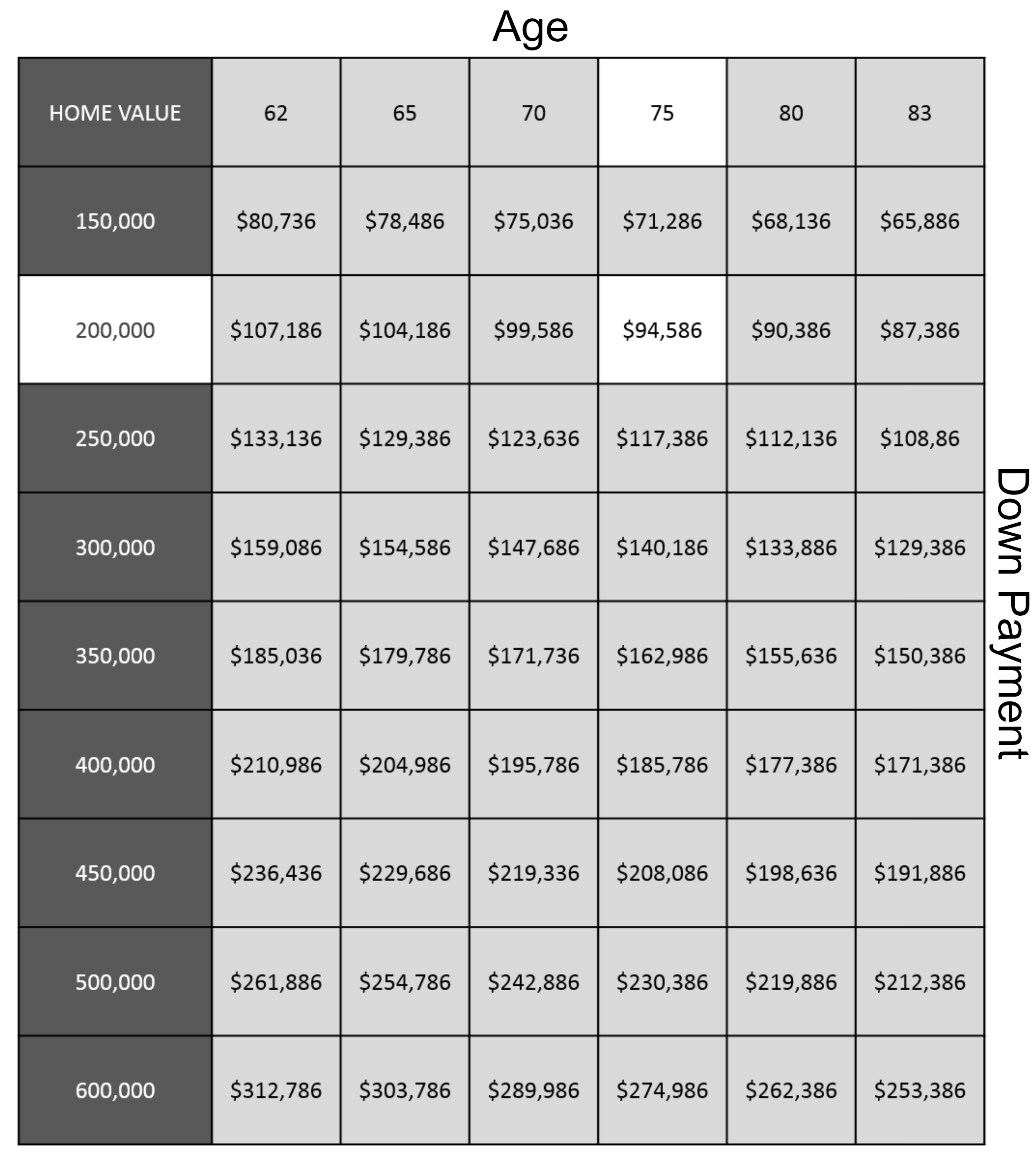

- What if there is too little home equity to qualify? If there is too little equity in your house you might not qualify for a reverse mortgage. Many people who want a reverse mortgage loan may not have enough equity in their home to qualify or may not meet other eligibility requirements. A shortfall means that the reverse mortgage loan would not generate enough loan proceeds to cover the existing mortgages on the home. In this situation, the homeowner cannot get a reverse mortgage loan until the balance of their existing mortgage is lowered or paid off. If they have money available, they can pay down their mortgage balance to qualify for the reverse mortgage loan.

To assist you in better understanding this type of loan we suggest you read our What is a Reverse Mortgagepage or look into calculating how much you may be able to receive using our free reversemortgage calculator.

CONTACT MIGUEL A. VAZQUEZ AT TO SET UP YOUR FREE REVERSE MORTGAGE CONSULTATION TODAY!

Reverse Mortgage Qualification Eligibility & Requirements

The basic requirements to qualify for a reverse mortgage loan include: the youngest borrower on title must be at least 62 years old, live in the home as their primary residence and have sufficient home equity. Borrowers must also meet financial eligibility criteria as established by HUD.

The amount you can access from your home equity is based on a Federal Housing Administration calculation that considers among others, the following factors:

- Age of the youngest homeowner: Age 61+

- Current value of the property: Any value is okay as long as it has 50%-60% equity

- Balance on existing mortgage loans Balance on your existing mortgage should be about 40%-50%

Reverse Mortgage Financial Requirements

You must show that you have the financial capacity to meet your loan obligations and cannot be delinquent on any federal debt. While you wont necessarily have to repay your loan as long as you remain in the home, you must still maintain the property and pay property taxes and homeowners insurance.

Another reverse mortgage requirement is a financial assessment of the borrower. Depending on the results, some borrowers may be required to save a portion of their proceeds to ensure that property taxes and insurance costs are covered. These funds are placed into a Life Expectancy Set-Aside, similar to an escrow account.

Read Also: When Can You Remove Fha Mortgage Insurance

What To Know About Reverse Mortgage Qualifications

Fly View Productions / Getty Images

Terri Williams is an expert in mortgages, real estate, and home buying. As a journalist she’s covered the “homes” corner of personal finance for more than a decade, with bylines in scores of publications, including Realtor.com, Bob Vila, Yahoo, Time/Next Advisor, The San Francisco Chronicle, Real Homes, and Apartment Therapy.

A reverse mortgage allows you to use the equity youve built in your home to obtain cash. Its a popular second-mortgage option for homeowners who are over age 62 and who live on a fixed income because they wont have to make monthly mortgage payments on the loan. But there are several strict requirements for the borrower, their current debts, and the property.

What An Equity Release Agreement Costs

It’s not a loan, so you don’t pay interest. Instead, you pay fees such as:

- an application fee

- periodic service fees, potentially deducted in advance from your home’s equity

- a fee to end the agreement

Get the fund to go through projections with you, showing the impact on your home equity over time. Get a copy of this to take away, and discuss it with your adviser. Ask questions if there’s anything you’re not sure about.

Don’t Miss: What Are The Payments On A $200 000 Mortgage

Reverse Mortgage Home Requirements

You must own the home as your primary residence and have at least 50% equity to qualify for a reverse mortgage. According to the HUD, eligible properties for HECM loans include:

- Single-family homes

- Up to four-unit properties if the borrower occupies one of the units

- Manufactured homes built after June 1976

- Properties in planned unit developments

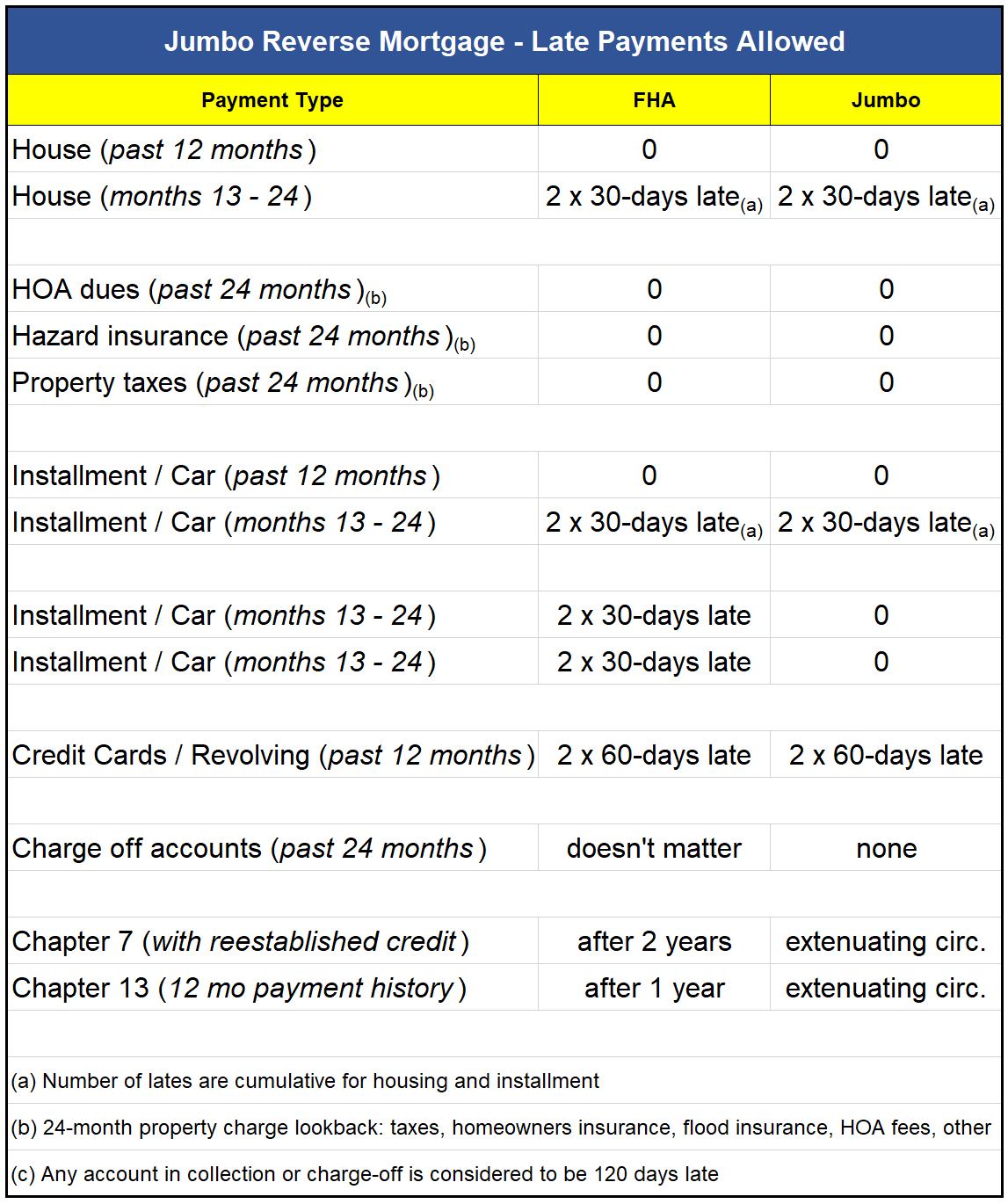

Income And Credit Checks

Reverse mortgages dont have income or credit score requirements. This is one of the ways in which reverse mortgages differ from a home equity loan or a home equity line of credit . HELOCs provide homeowners access to home equity. Unlike a reverse mortgage, home equity loans and HELOCs require borrowers to make payments and to qualify you must have a respectable credit score. On the other hand, they may come with fewer fees and can be a less expensive alternative to a reverse mortgage.

You May Like: Is It Better To Pay Off Mortgage Or Refinance

Types Of Reverse Mortgages

As you consider whether a reverse mortgage is right for you, also consider which of the three types of reverse mortgage might best suit your needs.

Single-purpose reverse mortgages are the least expensive option. Theyre offered by some state and local government agencies, as well as non-profit organizations, but theyre not available everywhere. These loans may be used for only one purpose, which the lender specifies. For example, the lender might say the loan may be used only to pay for home repairs, improvements, or property taxes. Most homeowners with low or moderate income can qualify for these loans.

Proprietary reverse mortgages are private loans that are backed by the companies that develop them. If you own a higher-valued home, you may get a bigger loan advance from a proprietary reverse mortgage. So if your home has a higher appraised value and you have a small mortgage, you might qualify for more funds.

Home Equity Conversion Mortgages are federally-insured reverse mortgages and are backed by the U. S. Department of Housing and Urban Development . HECM loans can be used for any purpose.

HECMs and proprietary reverse mortgages may be more expensive than traditional home loans, and the upfront costs can be high. Thats important to consider, especially if you plan to stay in your home for just a short time or borrow a small amount. How much you can borrow with a HECM or proprietary reverse mortgage depends on several factors:

Life Expectancy Set Aside

If the borrower is unable to meet the monthly income test and a LESA is required, the lender calculates how much money will be required to pay the property taxes, homeowner’s insurance, association fees, and flood insurance cost for the life of the youngest borrower .

Needless to say, the set aside can be a substantial amount of money. The set aside is usually deducted from the reverse mortgage proceeds. The property taxes and other charges will be paid by the lender from the set aside.

Unfortunately, some LESA set aside amounts can exceed the reverse mortgage loan amount, in which case, the loan could be denied.

Read Also: How Much Equity Do I Need For A Second Mortgage

Compare The Residual Income To Huds Requirements

HUD requires that residual income be sufficient to pay for items that cannot be documented with a credit report. Those household costs tend to vary by region and family size. Therefore, the underwriter will use the following charts to determine the required threshold:

Required Residual Income by Region and Family Size

States by Region

If it does not appear that there is sufficient residual income, there are several compensating factors that an underwriter may consider. In addition, family size may be reduced if an underwriter wishes to document the income and credit history for a non-borrowing household member that has the financial capacity to carry their own weight.

If the residual income is still not sufficient, a portion of the principal limit may be earmarked for paying property charges. This is accomplished by using a Life Expectancy Set-Aside.

For more clarification on how the reverse mortgage works, please subscribe to this blog and consider purchasing your copy of Understanding Reverse.

Dan Hultquist

What To Expect With Reverse Mortgage Counseling

The counseling sessions are designed to help the prospective borrower to evaluate the pros and cons of whether a reverse mortgage is right for their situation.

The counselor will explain:

Don’t Miss: What Is The 20 Year Fixed Mortgage Rate

How Does A Reverse Mortgage Work

So you know that a reverse mortgage is an exchange of your homes equity for cash but how exactly do you get it? Heres how:

Pick a way to receive your funds. There are multiple ways you can receive the proceeds from a reverse mortgage:

- Lump sum. You receive all of the proceeds at once and are free to use them as you see fit. How much you can receive, for all payment methods, will depend on how old you and any other borrowers on the reverse mortgage are and the amount of equity you have in your home.

- Monthly payments. For as long as you live in your home, you can choose to receive monthly payments of an amount you and your lender decide on.

- Term payments. You can choose to receive monthly payments for a number of years instead of until you move out of your home.

- Line of credit. With a line of credit extended to you in exchange for equity in your home, youll be able to control how much you take out on a day-to-day basis, and youll only pay interest on the amount you borrow.

Keep in mind that all payment options besides the lump sum are adjustable rate loans. However, the funds you receive are generally exempt from taxes, no matter the payment type.

There are fees included. Taking out a reverse mortgage isnt as simple as trading equity for cash straight up. As with almost every loan in the book, there are fees and closing costs involved. Speak with your financial advisor and go over your finances carefully before deciding to take out a reverse mortgage.

Receiving A Financial Assessment

An integral part of the counseling session is the financial assessment, which is designed to help ensure the borrower is able to uphold their loan obligations, such as continuing to pay their property taxes and homeowners insurance.

Overall, the counselors job is to be a neutral source of information who acts in a homeowners best interest, meaning they will not push you into any course of action. Their job is to make sure you completely understand how the reverse mortgage process works and explain any other options you might have.

Above all, reverse mortgage counselors are required to follow specific practices. These practices are designed to ensure you receive quality counseling services and are protected against fraud and abuse.

Don’t Miss: Are Mortgage Rates Based On Credit Score

Reverse Mortgage Income Requirements

When a homeowner applies for an HECM, theyre subject to a cash flow/residual income analysis. According to HUD, the purpose of this analysis is to determine the capacity of the mortgagor to meet his or her documented financial obligations with his or her documented income.

The HECM program can use income from a borrower, a co-borrower, and an eligible non-borrowing spouse for cash flow analysis calculations. Countable income can include both taxable and nontaxable income sources, such as:

- Wages, salaries, commissions, and tips

| $1,160 |

Reverse mortgage companies are allowed to consider extenuating circumstances for borrowers who dont meet the minimum cash flow/residual income analysis guidelines. For example, someone who has received notice that theyre approved for Supplemental Security Income benefits that will begin within the next 12 months may be able to use that future income to be approved for a reverse mortgage.

If youre including rental income on your application for a reverse mortgage, you must report that income on your taxes for it to be included in your cash flow calculation.

Are There Fees Associated With Reverse Mortgages

As with all mortgages, there are costs and fees connected to securing a reverse mortgage. Fees include those associated with loan origination, mortgage insurance premiums, closing costs, and monthly servicing fees. These fees are often higher than the fees associated with traditional mortgages and home equity loans. Make sure you understand all the costs and fees associated with the reverse mortgage.

Be aware that if you choose to finance the costs associated with a reverse mortgage, they will increase your loan balance and accrue interest during the life of the loan.

You May Like: What Documents Needed To Refinance Mortgage

How To Get Started With A Reverse Mortgage

If youre interested in getting a reverse mortgage and meet all of the requirements of the loan, the first thing to do is shop around for lenders who offer this loan product and compare rates. It may also help to talk to a financial advisor, who can help you decide if its the right loan option for you.

When youre ready, youll work with your lender to fill out a reverse mortgage application and set up a counseling session. To get started, you can find a HUD-approved counseling agency near you by using thissearch tool from HUD.

Here Are The Income Requirements For A Reverse Mortgage

If youre applying for a reverse mortgage for the first time, you will be subject to meeting new minimum income requirements as part of the financial assessment underwriting guidelines. The financial assessment for a reverse mortgage is a lot like the process for getting a traditional or forward mortgage.

Its a way for the lender to get a sense of your financial situation, to determine that youll still be on solid financial footing after you get the reverse mortgage. In addition to a , one of the most important components of the financial assessment is: income.

But income may not be as simple as it sounds. In addition to the most traditional types of income you might have such as Social Security or income from a full-time job, your lender will ask for all types of income.

Don’t Miss: How Much Income To Qualify For 200 000 Mortgage

How Much Will I Owe When My Reverse Mortgage Becomes Due

The amount you will owe on your reverse mortgage will equal all the loan advances you received , plus all the interest that accrued on your loan balance. If this amount is less than your home is worth when you pay back the loan, then you keep whatever amount is left over.

With most reverse mortgages, you can never owe more than your home is worth. The technical term for this cap on your debt is a “non-recourse limit.” It means that the lender, when seeking repayment of your loan, generally does not have legal recourse to anything other than your home’s value and cannot seek repayment from your heirs.

Be aware that since the home will likely need to be sold to pay back the reverse mortgage, these types of loans may not be a good option if you want to leave your home to your children.

Is There An Income Requirement For A Reverse Mortgage

If youre applying for a home equity conversion mortgage , you need to be able to show sufficient income and financial resources to pay certain costs, including homeowners insurance, property taxes, homeowners association fees, maintenance, repairs, and upkeep. The amount of income that you need to qualify can depend on where your home is located.

Recommended Reading: Is It Harder To Get A 15 Year Mortgage

What If You Don’t Qualify

If you dont qualify for any of these loans, what options remain for using home equity to fund your retirement? You could sell and downsize or you could sell your home to your children or grandchildren to keep it in the family, perhaps even becoming their renter if you want to continue living in the home.

Reverse Mortgage Property Requirements

Your property has to be in shape to qualify for a reverse mortgage. If the lender determines it’s not, they will inform you of what repairs you must make before qualifying for a reverse mortgage.

Government-backed loans are subject to more stringent property requirements. The Department of Housing and Urban Development allows you to take out a HECM for several types of properties:

- Single-family homes

- Condominium units that meet FHA Single-Unit Approval requirements

- FHA-approved manufactured homes

Don’t Miss: Does Bank Of America Do Mortgage Loans

These Loans Are Not Available To Just Anybody

Taking out a reverse mortgage can allow retirees to access their home equity without having to make payments toward a home equity loan or a home equity line of credit . There are a number of requirements to qualify for a reverse mortgage, and income is an important consideration. Reverse mortgage companies use income and financial resources to assess a homeowners ability to meet certain costs, including property taxes and upkeep.

Your Property Must Meet Minimum Fha Standards

Aside from finances, there are also a number of qualifications regarding the home that all applicants must meet in order to obtain a reverse mortgage. Many people may think they are eligible but come to find out once they apply they are lacking one or more qualifications when it comes to their home.

Recommended Reading: What Is The Typical Closing Costs For A Mortgage