Principal And Interest: Paying Off Your Home Loan

There’s more than one way to pay back your home loan. We outline your options.

The two biggest components of your home loan repayments are typically the principal component and the interest component. You may be able to take out a home loan with both principal and interest repayments, or interest-only home loans that include a period where you only pay the interest.

Depending on your situation, one of these types of loans may be more suitable than the other.

What Is Included In My Monthly Mortgage Payment

Your mortgage payment every month will consist of interest on your loan, principal , taxes and finally homeowners and/or mortgage insurance, which is often paid through an escrow account set aside by your lender or servicer.

You can remember the major things that are included in your payment with the acronym PITI, which stands for principal, interest, taxes and insurance. If you have a conventional loan and dont make a down payment of at least 20%, you will also have to pay private mortgage insurance every month until you build a certain amount of equity.

If you have an adjustable-rate mortgage, the amount you pay toward your mortgage each month may not always be the same because the interest rate will adjust after the loans introductory period. With a traditional fixed-rate mortgage, your monthly payment may only change if the amount youre paying into escrow for taxes and insurance changes.

Over time, the portion of your payment that goes toward interest will shrink while the portion going towards principal will grow, but the total payment amount should remain the same.

Principal And Interest: Mortgage Payment Basics

There are two basic components that make up every mortgage payment: principal and interest. The principal is the amount of funding borrowed for your home loan, and the interest is the money paid monthly for use of the loan. Understanding both principal and interest can help you choose the best mortgage option for you.

In this article, well share everything you need to know about principal and interest. Well cover the differences between the two and help you determine what you owe, or will pay, on your mortgage. Keep in mind, there may be other expenses that could find their way into your monthly payment as well.

Also Check: What Are Mortgage Rates Based On

Calculate Principal And Interest Formula

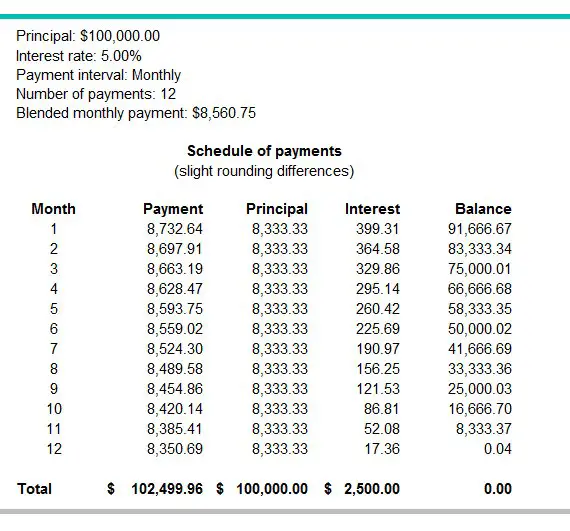

You may be able to see a breakdown of how much youâre paying in interest and principal on your mortgage statement or through your lenderâs online banking site. If you donât see it, you can use a relatively simple formula to calculate the number yourself.

Take your total outstanding balance on your mortgage . Then, take your annual interest rate and divide by 12 to find your monthly interest rate, since there are 12 months in a year. Multiply the balance by the monthly rate to find your current monthly interest payment.

Subtract the monthly interest payment from your total monthly payment. Also subtract any special amounts paid for things like property tax, homeownersâ insurance or other costs. The rest of your monthly payment is the principal.

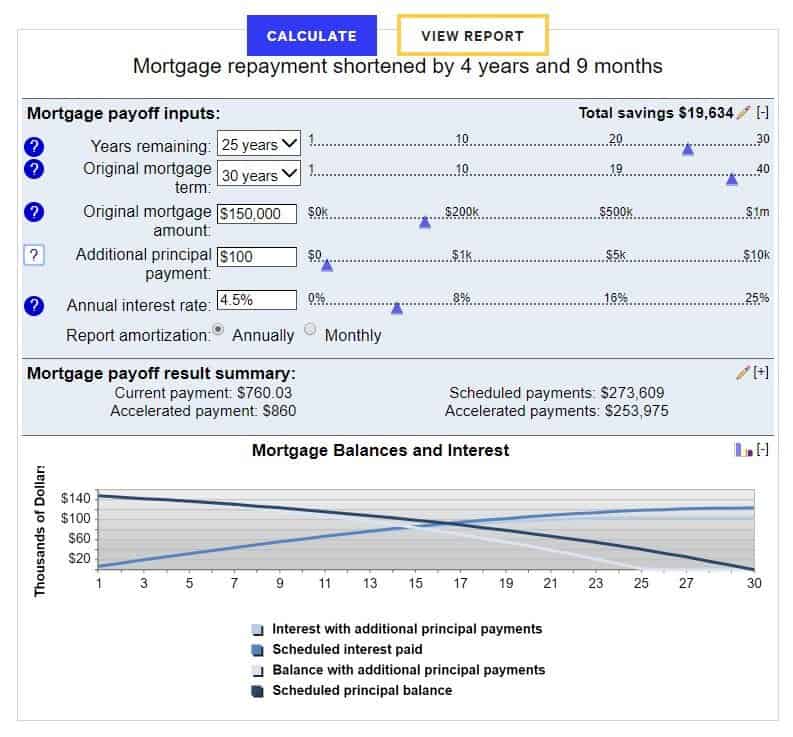

Paying Your Loan Forward

If you have ever looked at a loan payment schedule, you can clearly see the benefits of paying extra to the principal on your mortgage. It is especially valuable during the early years, when even a small amount of prepayment can move you forward several months on the schedule. You can use an online mortgage calculator to enter the details of your loan and see how this works. Lets say your regular mortgage payment is $1,000, but you pay $1,100 each month. After three payments, you will have your principal paid down to where it would have been after four payments if you had made just the required payment.

Also Check: What’s Taking Out A Second Mortgage

Fixed Rate Vs Adjustable Rate

A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment.

Loan Principal Vs Interest

When calculating any loan, Interest is a crucial factor determining the amount to be paid back. But the Loan Principal is equally important to help understand how much you will be expected to repay. While loan principal is the amount you have borrowed, the Interest will be the cost attached to lending that money. This is added by any bank, credit union, or business lender, as the Interest is what helps them make a profit.

The key here is that your Loan Principal will be a fixed number or amount, while the Interest will be the percentage. Thus, the amount you owe to the lender is calculated as the amount borrowed plus the Interest charged.

Don’t Miss: What Is Current Interest Rate On Reverse Mortgage

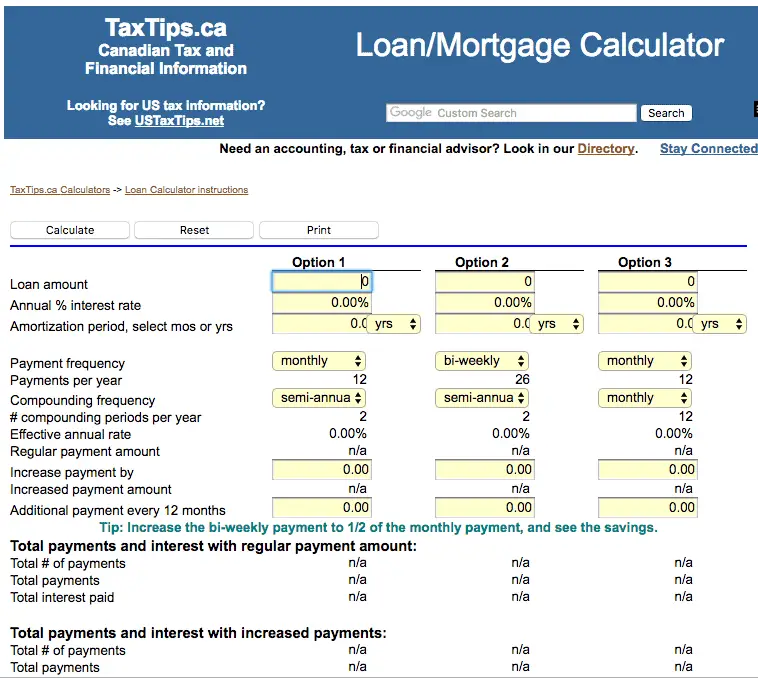

Mortgage Effective Annual Rate Formula

To account for semi-annual compounding, you can calculate your mortgages effective annual rate . The number of compounding periods in a year is two. To use the effective annual rate formula below, convert your interest rate from a percent into decimals.

For example, if your mortgage lender quotes a mortgage rate of 3%, then your effective annual rate will be:

If your mortgage lender quotes a mortgage rate of 5%, then your effective annual rate will be:

This calculation assumes that interest will be compounded semi-annually, which is the law for mortgages in Canada. For a more general formula for EAR:

Where n is the number of compounding periods in a year. For example, if interest is being compounded monthly, then n will be 12. If interest is only compounded once a year, then n will be 1.

Youll Own Your Home Faster

If you plan to retire without a mortgage payment, paying extra principal each month can help you get to that point. The more you pay towards the principal, the quicker you will own your home free and clear.

Even if you arent looking at the finish line quite yet, paying more principal up front can give you more equity in your home. The more equity you have, the better financial position you may have. Whether you need to tap into that equity at some point to fund college or to make improvements on your home or you just enjoy being mortgage-free earlier, it can be a wise choice.

You May Like: How Do Mortgage Appraisals Work

What Is Mortgage Amortization

Mortgage amortization is the transition of your monthly payments from going mostly toward interest to going mostly toward the loan principal. As we explained above, the longer you pay on your loan, the more your payment will contribute to paying down the principal balance.

As you slowly pay down your principal, you are building home equity that will hopefully grow in market value over time. Equity is important because it helps you build wealth through the value of your home. This value can be cashed out if needed to fund home projects or consolidate debt.

If youre currently paying on a mortgage, you can figure out your current home equity with our mortgage amortization calculator.

Is Making Larger Payments Better For Principal Payments

The larger your principal payment, the more interest youll save. As such, the more you overpay, the greater your savings. The exception to this is where your mortgage has early repayment charges, also known as penalties for overpayments. In this scenario, a penalty may make your overpayment uneconomical if the cost of paying the penalty is higher than the amount of interest saved.

What should you do if you have multiple debts with high interest rates?

Multiple debts refers to when a borrower has borrowed money using a number of separate financial accounts. When faced with a number of debts at higher interest rates, its important that you use your funds wisely to maximise your interest savings. The best way to handle this situation is to pay off the loans with the highest interest rates first. This will allow you to reduce your interest costs faster than any other method.

Once this is done, you should compare products from different lenders to check whether you could reduce your interest costs further by refinancing your loan or mortgage.

Read Also: Am I Approved For A Mortgage

How Taxes And Insurance Factor Into Your Mortgage Payment

Property taxes and homeowners insurance might be included in your mortgage payment if your lender requires you to escrow these payments. Your lender might require a mortgage escrow account if you put down less than 20%, and itâs required if you get an FHA or USDA loan.

Letâs say your property taxes are $2,500 per year and your homeowners insurance is $1,000 per year. Your lender will divide each amount by 12 so that you pay your taxes and insurance gradually over the year.

The lender holds this money in your escrow account, then sends the money to your local tax collector and your insurer when the payments are due. Your monthly mortgage payment would be $1,134.67 after adding the $291.67 per month for taxes and insurance to your $843 principal and interest payment.

If you are required to pay for private mortgage insurance or flood insurance, your lender will escrow these amounts as well.

How Is The Principal Paid Back

When you start to pay off a large loan, most of the minimum monthly payment you make will be on the interest, and then some will go toward your principal. Thats because the higher your principal, the higher the interest and interest owed gets paid first.

Your monthly payments can stay about the same , but how much of your payment is allocated to each portion will change over time. As your payments continue, youll slowly start to pay more in principal and less in interest the lower your principal, the less interest grows.

Some loans allow for principal-only payments. These are usually extra monthly payments on top of your minimum amount. You can set up your monthly payments as usual and then make an additional payment to go toward just your principal.

Some lenders require notice if you want an additional payment to be applied only to the principal instead . Not every lender offers principal-only payment options, so make sure you check with yours before sending that extra check.

There may be a way to structure your payments to pay all of your interest first, too. But it might not be the best idea. Your interest wouldnt decrease since you wouldnt be paying down the principal.

You May Like: What Is The Current Fixed Mortgage Interest Rate

Definition Of Mortgage Principal

Mortgage principal refers to the outstanding balance of your mortgage.

Mortgage Principal is the amount borrowed from the lender, minus the amounts repaid to the lender, and which have been applied to the reduction of principal. As monthly mortgage payments are made, the mortgage principal is reduced.

Example

Want to get started with a Mortgage Application? Apply now!

Other Factors To Consider

We primarily considered the 30-year fixed-rate mortgage in the above examples because 30-year fixed-rate mortgages account for almost 90% of the home purchase market, according to Freddie Mac. However, some homebuyers opt for shorter mortgage terms or an adjustable-rate mortgage .

The second-most popular fixed-rate mortgage has a term of 15 years. The 15-year fixed-rate mortgage is structurally similar to the 30-year fixed-rate mortgage, though the shorter term length means that monthly payments will be higher while the overall cost of the loan is lower. This is because interest is lower. With the shorter term and higher monthly payments, homeowners with a 15-year fixed-rate mortgage pay more in principal than interest beginning with their first monthly payment. The table below compares a $200,000 15- and 30-year fixed-rate mortgage, each with a 4% interest rate.

Another available mortgage option is an ARM. Unlike a 15- or 30-year fixed-rate mortgage, an ARM has a variable interest rate. With an ARM, most homeowners commit to a low interest rate for a given term, after which the interest rate becomes adjustable for the rest of the loans life. This means that homeowners with an ARM carry the risk that interest rates will rise, but also stand to gain if rates fall.

Read Also: How Much Could I Get A Mortgage Loan For

The Bottom Line: Keep Track Of Your Principal And Interest

Your monthly mortgage payment has two parts: principal and interest. Your principal is the amount that you borrow from a lender. The interest is the cost of borrowing that money.

Your monthly mortgage payment may also include property taxes and insurance. If it does, your lender holds a percentage of your monthly payment in an escrow account.

Your mortgage payment usually stays the same every month. If you choose a mortgage with an adjustable interest rate or if you make extra payments on your loan, your monthly payments can change.

If youre interested in getting a mortgage, the first step is to get preapproved. Learn more about preapproval so you can get started today!

Take the first step toward buying a house.

Get approved to see what you qualify for.

How To Choose A Mortgage Lender

You have many options when it comes to choosing a mortgage lender. Banks, credit unions and online lenders all offer mortgages directly, while mortgage brokers and online search tools help you compare options from different lenders.

Its important to make sure you feel comfortable with the broker or company youre working with because youll need to communicate with them frequently during the application processand in some cases, after the loan closes.

You may want to start with the banks or other institutions where you already have accounts, if you like their service. Also, ask your network of friends and family, and any real estate professionals youre working with, for referrals.

You May Like: What Does Cash Out Mortgage Mean

You May Like: Can I Refinance If I Have A Second Mortgage

Exercising Additional Payment Options

When you sign on for a 30-year mortgage, you know youre in it for the long haul. You might not even think about trying to pay off your mortgage early. After all, whats the point? Unless youre doubling up on your payments every month, you arent going to make a significant impact on your bottom line right? Youll still be paying off your loan for decades right?

Not necessarily. Even making small extra payments over time can shave years off your loan and save you thousands of dollars in interest, depending on the terms of your loan.

Read Also: Whats The Average Mortgage Payment

S To Calculating How Much A Mortgage Payment Would Cost You Every Month

Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective. Terms apply to offers listed on this page. Read our editorial standards.

- You can calculate a monthly mortgage payment by hand, but its easier to use an online calculator.

- Youll need to know your principal mortgage amount, annual or monthly interest rate, and loan term.

- Consider homeowners insurance, property taxes, and private mortgage insurance as well.

More often than not, a homeowner who borrowed money to buy a house is making one lump-sum monthly payment to their mortgage lender. But while it may be called the monthly mortgage payment, it includes more than just the cost of repaying their loan and interest.

For many of the millions of American homeowners carrying a mortgage, the monthly payment also includes private mortgage insurance, homeowners insurance, and property taxes.

Its possible to estimate your total monthly payment by hand using a standard formula, but its often easier to use an online calculator. Either way, heres what youll need:

Recommended Reading: Can You Lower Your Mortgage Payment

How To Calculate Your Mortgage Payments

The calculus behind mortgage payments is complicated, but Bankrate’s Mortgage Calculator makes this math problem quick and easy.

First, next to the space labeled “Home price,” enter the price or the current value of your home .

In the “Down payment” section, type in the amount of your down payment or the amount of equity you have . A down payment is the cash you pay upfront for a home, and home equity is the value of the home, minus what you owe. You can enter either a dollar amount or the percentage of the purchase price you’re putting down.

Next, you’ll see Length of loan. Choose the term usually 30 years, but maybe 20, 15 or 10 and our calculator adjusts the repayment schedule.

Finally, in the “Interest rate” box, enter the rate you expect to pay. Our calculator defaults to the current average rate, but you can adjust the percentage. Your rate will vary depending on whether youre buying or refinancing.

As you enter these figures, a new amount for principal and interest will appear to the right. Bankrate’s calculator also estimates property taxes, homeowners insurance and homeowners association fees. You can edit these amounts or even ignore them as you’re shopping for a loan those costs might be rolled into your escrow payment, but they don’t affect your principal and interest as you explore your options.

How Do You Calculate The Principal Amount In A Home Loan

This is not as complex as you think, there is an easy formula that you can use to calculate the principal amount in a home loan

Where is the amount of interest?

P is the principal amount

R is the Rate of interest annually

N is the time period in years

Lets suppose a bank sanctioned a home loan of Rs.5 lakhs to you at the rate of 7.35% P.A. for 10 years.

In this example, the simple interest amount for all years will be Rs.3,67,500/- . Now in a span of 10 years, you must pay the bank a total of Rs.8,67,500/- i.e. . Here in this example, Rs.5 lakhs which the bank already sanctioned is the principal amount of the home loan. Also, read about Everything You Need to Know About Income Tax Benefits on Home Loans from here.

Now we will calculate the principal amount as follows:

P= /

Recommended Reading: How To Start A Mortgage Company