Comparing Mortgage Amortization Periods

| $165,315 |

When comparing 20-year and 30-year amortizations to the 25-year amortization at a 2% mortgage rate:

- A 20-year amortization increases your monthly mortgage payment by $412/month, but reduces your total interest cost by $28,116

- A 30-year amortization reduces your monthly mortgage payment by $269/month, but increases your total interest cost by $30,139

If you can handle higher monthly mortgage payments, a shorter amortization period can save you thousands of dollars. Many banks and mortgage lenders also allow you to shorten your amortization period by making additional mortgage prepayments, such as through lump-sum principal prepayments, doubling your regular payment amount, and increasing your payment schedule.

The payment frequency determines how often you will make mortgage payments.

Is The Lowest Ontario Mortgage Rate The Best Rate

Not always. The lowest rates usually come with more limitations. These restrictions can cost you much more than the small rate savings. Such terms are common with low frills mortgages and typically kick in when you try to port, break or increase the mortgage after closing. When comparing mortgage rates, dont be afraid to ask potential lenders questions to ensure you understand the terms and conditions of your mortgage.

Whats The Difference Between A Fixed And Variable Rate

- A fixed interest rate will not change during your mortgage term.

- A variable interest rate can change during your mortgage term.

Having a fixed rate means that your mortgage rate will not change until your mortgage term is over. You can choose to get a fixed-rate mortgage for a long term length if you think rates will increase soon, or for a short term length if you think rates will stay the same or decrease. The 5-year fixed rate mortgage is the most popular mortgage type in Canada.

On the other hand, avariable mortgage ratecan change at any time. Your mortgage payments will still stay the same, but what changes is the percentage of your payment that goes towards paying off the mortgage principal. If rates decrease, a larger amount of your monthly payments will be going towards your principal. This means that if interest rates decrease, youâll be able to pay off your mortgage faster with a variable rate.

If interest rates rise, a larger amount of your monthly payments will go towards your mortgage interest. Your monthly payment amount is fixed for the duration of your term, so you wonât have to pay more money if rates rise. However, your mortgage payments must be enough to cover at least your monthly interest cost. If interest rates increase significantly, where your mortgage payment no longer covers the interest cost, then your mortgage payment amount will need to be increased.

You May Like: When Can I Drop My Mortgage Insurance

The End Of The Fixed Period

Fixed-rate mortgages

When your fixed period ends the rate will move to the HSBC Standard Variable Rate, unless you switch your HSBC rate.

Tracker mortgages

The tracker mortgage will track the Bank of England base rate for a 2-year fixed period, then it will move to the HSBC Standard Variable Rate, unless you switch your HSBC rate.

Current standard variable rate

|

Our current standard variable rate for residential mortgages is 4.54%, effective from 1 August 2022. These rates only apply when a fixed or tracker rate no longer applies. |

On What To Look For In The Bocs Statement

- NBC: While theres no shortage of uncertainty on the headline decision, well be just as closely watching the guidance provided in the statement. In recent decisions, the statement has read: The Governing Council continues to judge that interest rates will need to rise further, and the pace of increases will be guided by the Banks ongoing assessment of the economy and inflation. With an-already restrictive policy setting , the retention of this line would, of course, be unambiguously hawkish. Alternative, less aggressive guidance might read something like: Governing Council judges that rates may need to increase further.

Don’t Miss: Are Mortgage Discount Points Worth It

Can A Bank Change The Interest Rate On A Loan

If the loan is a fixed-interest rate loan, then a bank cannot change the interest rate on the loan for the duration of the loan. If the loan comes with an adjustable rate, then yes, a bank can change the interest rate of the loan. The changes in the rate may be predetermined or may track an index. Additionally, a maximum increase can be set in the terms of the loan.

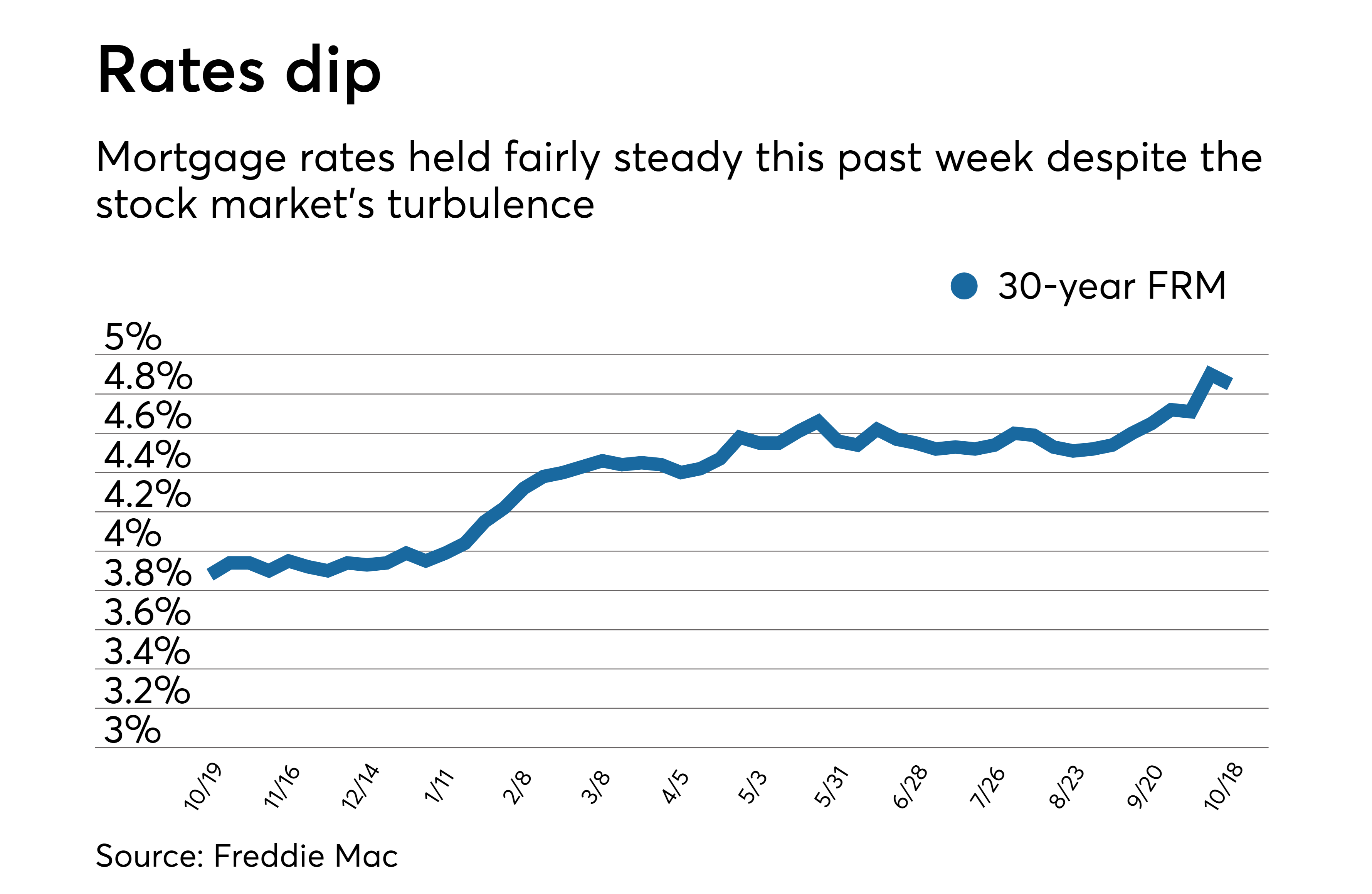

Mortgage Rates And The Pandemic

It looked like a puzzle: As the COVID19 pandemic spread, central banksincluding the Bank of Canadaquickly cut interest rates to cushion the blow. But rates on new mortgages didnt decline much, and some actually went up. Why?

Remember that your lenders funding cost determines most of the mortgage rate. The cost of funding jumped in the early days of the pandemic as investors became nervous. Many simply wanted to hold on to their cash given how uncertain everything was. So, the funding that is normally easy for lenders to get slowed to a trickle. This drove up the funding cost, even as the Bank of Canadas policy interest rate fell.

The Bank of Canada has taken many steps to help financial markets work better during the pandemic, along with the federal government and other public authorities. The goal is to ease strains in funding markets, so lenders can keep supplying credit to households and businesses.

These steps include launching programs to make sure lenders can access the funding they need. As a result of these actions, funding costs fell and some mortgage rates on new loans started to decline.

Keep in mind: existing mortgages didnt become more expensive during the pandemic. They either have an interest rate that is fixed until its next renewal, or a variable interest rate that declined along with the Bank of Canada policy rate.

Read Also: Can I Get A Mortgage Loan After Chapter 7

Comparing Mortgage Payment Frequency

| $134,166 | $134,009 |

There are slight interest savings to be had from increasing your mortgage payment frequency. This keeps your mortgage amortization the same, which is why you wonât realize as much interest savings.

Many mortgage lenders offer accelerated payment frequencies, such as accelerated bi-weekly and accelerated weekly mortgage payments. With accelerated payments, you will be paying the equivalent monthly payments, which means that you will be making an extra payment per year. In the above table, a monthly payment would have been $2,117.

To calculate the accelerated bi-weekly payment amount, you would divide $2,117 in half to get $1,058.50. Your accelerated bi-weekly payments will be $1,058, higher than the regular bi-weekly amount of $977. This increased amount allows you to pay off your mortgage faster, which shortens your amortization and saves you interest.

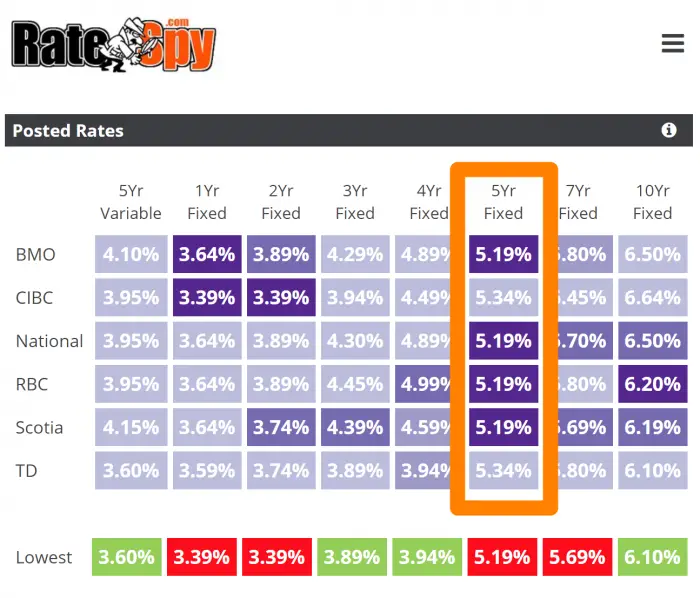

Posted Rates Vs Best Rates

When comparing bank mortgage rates, itâs important to know that these rates represent the banks’ posted mortgage rates. The posted rate is simply the rate that the bank is advertising in public. However, banks are often able to offer even lower rates in order to secure a borrower’s business. You may be able to access these discounted rates through negotiation, or by reaching out to a representative mortgage broker. Some banks offer rates several percentage points below what is posted, so it’s worth taking the time to see if you can get a better offer.

You May Like: Can You Get A Mortgage Loan With No Credit

Tips To Get The Lowest Mortgage Rate

If you want the lowest mortgage rate available, you have to shop around. Thats the number one rule.

But there are other strategies you can use to get lower offers from the lenders you talk to.

- Try for a last-minute credit boost. See what you can do to improve your credit before buying or refinancing. Your credit score makes a big difference in your mortgage rate, and improving it just a few points could lead to real savings

- Consider discount points. If you can afford it, you can pay more upfront for a better mortgage rate over the life of the loan. This could be smart if you plan to keep your home a long time. A discount point costs 1% of the loan amount and typically lowers your rate by 0.25%

- Negotiate your rate. Negotiating with a lender might sound intimidating, but trust us when we say it can be done. Mortgage lenders have flexibility with the rates they offer, and they want your business. A lower interest rate from a different company might be the only leverage you need to negotiate a better offer with the lender you want

- Negotiate your closing costs. Some closing costs are non-negotiable, like the third-party appraisal and credit reporting fees. But the fees your lender charges can sometimes be negotiated to save you money on the front end

- Know when to lock your rate. Mortgage rates move up and down every day. If you want to get the lowest possible rate, keep an eye on daily rate movements and be ready for a rate lock when they fall

Canada Vs Usa Mortgage Terms

Canadaâs mortgage term lengths are relatively short when compared to mortgages in the United States. The most common mortgage in the U.S. is the 30-year fixed mortgage, which means that homeowners donât need to renew their mortgage for the entirety of their amortization. This is a large departure from the Canadian mortgage market, where homeowners expect to renew and renegotiate their mortgage rates often.

You May Like: What Is Mortgage Pmi Rate

Choosing A Mortgage Term

There are other considerations to your mortgage term length besides just the mortgage rate. Breaking your mortgage, which happens when you sell your home and move or renegotiate your mortgage before the end of the term, will come with significantmortgage prepayment penalties. You will be able to avoid mortgage penalties if you wait until your term expires. A short mortgage term would be more suitable if youâre thinking of selling your home soon or refinancing your mortgage.

Thereâs also a chance that mortgage rates might not move in the direction that youâre predicting it will, or it might not move as much as you thought it would. For example, a 10-year fixed mortgage rate might be at 5% while a 5-year fixed mortgage rate might be at 3%.

If interest rates stay the same for the next ten years, youâll be paying a mortgage rate of 5% while you could have had a mortgage rate of 3% for two 5-year terms.

If interest rates increase by 2%, where the first 5-year mortgage term has a rate of 3% and the second 5-year mortgage term has a rate of 5%, youâll still be worse-off with a 10-year mortgage as youâre paying the 5% rate for the first five years rather than 3%.

Mortgage rates will need to increase significantly for a 10-year mortgage term to break-even over shorter-term options.

Some Factors Are Part Of The Cost Of All Mortgages

Think of a mortgage as a product you buy. Any business that sells you something tries to make a profit. To do that, the price they charge for the product has to be higher than the cost to make it. A lender profits on your mortgage because you pay more in interest than what they paid to borrow the money themselves .

This funding cost makes up most of the interest rate on your mortgage. Other factors include your lenders operating costs and how much the lender needs to cover the risk that you wont repay the loan. But funding cost is the most important factor.

So, what determines funding cost?

Also Check: When Was The Lowest Mortgage Rate

Frequently Asked Questions Relating To Interest Rates

What is the OCR?

OCR stands for Official Cash Rate and is the rate of interest which the central bank charges on overnight loans to commercial banks. The OCR influences the price of borrowing money in New Zealand and provides the Reserve Bank with a means of influencing the level of economic activity and inflation. The OCR gets reviewed 7 times per year.

How does the OCR affect interest rates?

Can I break out of a fixed interest loan to get a better interest rate?

It might be possible to break out of a fixed loan before the term is up, but youre likely to be charged a break fee for doing so. This is because the bank is incurring a loss by you breaking the term early. This loss is passed on to you in the form of a break fee. There are some instances where its worth breaking your fixed term, but it could also end up costing you more in the long run. Every situation is different so get in touch with one of the team to help you work out whats best for you. Check out our interest rates page for more info on break fees.

Should I fix my loan?

There are a number of factors to consider when deciding to lock in a rate for a fixed amount of time. Will you be selling in that time? Do you prefer the certainty of a fixed rate or the flexibility of a variable rate? Will you feel regret if rates dropped and you were stuck on a higher rate? Our advisers can help you work out the best solution for your lifestyle, so get in touch with one of the team.

Home Loan: 6.45%

What Happens At The End Of A Term

At the end of each term, you have the option to renew or refinance your mortgage.

- Renewing your mortgageinvolves signing for another term with your existing lender. Your monthly payment and mortgage interest rate may change.

- Refinancing your mortgageinvolves signing a new term agreement, possibly with a different rate or lender. Refinancing allows you to take advantage of lower mortgage rates or better options not offered by your current lender. You can also borrow more money by using your home equity and receiving it in cash.

Your mortgage lender might not reassess your credit score or debt service ratios if youâre renewing at the same lender. If youâre switching to a new lender, youâll need to be reassessed and you may need to pass the mortgage stress test.

Read Also: Who Uses Equifax For Mortgages

How To Find The Best Mortgage Rates

Pamela Rodriguez is a Certified Financial Planner®, Series 7 and 66 license holder, with 10 years of experience in Financial Planning and Retirement Planning. She is the founder and CEO of Fulfilled Finances LLC, the Social Security Presenter for AARP, and the Treasurer for the Financial Planning Association of NorCal.

Looking for the best mortgage rates? A great place to start is a mortgage calculator, which lets you estimate your monthly house payment and get a better sense of how much house you can afford. Armed with that knowledge, you can narrow your home search and find the right mortgageand the best rates.

Open Vs Closed Mortgages

You may often notice a significant difference in mortgage rates betweenopen and closed mortgages. Open mortgages allow you to make principal prepayments at any time without any charges or penalties, which makes it very flexible. This flexibility is counterbalanced by open mortgage rates being higher than closed mortgage rates.

Choosing a closed mortgage can let you access much lower mortgage rates at the risk of prepayment penalties if you go over your lenderâs annual prepayment limit. Things like selling your home or a mortgage refinance can cause you to have to pay significant prepayment penalties. This could be avoided with an open mortgage, but youâll have to pay a higher mortgage rate.

Don’t Miss: How Do Reverse Mortgage Lenders Make Money

Consider Interest Rates And Closing Costs

The interest rate is important, but theres more to compare. Is there a prepayment penalty if you decide to refinance at some point? What are the total closing costs? Closing costs generally amount to 2% to 5% of the price of the home. If your home costs $150,000, expect to pay $3,000 to $7,500 in costs. Thats a big range, so it behooves you to see what a lender typically charges. The loan estimate sheet you get from your lender will give you the real numbers to check out before you sign on the dotted line.

How To Shop For Mortgage Rates

Its easy to compare mortgage rates and fees if you know what youre doing. There are five basic steps:

That last step comparing Loan Estimates is key to finding the best mortgage rate and most affordable mortgage overall.

Each lender you get preapproved with will give you a Loan Estimate. These documents are in a standard format thats easy to compare side by side.

For more information, see our complete guide to shopping for a mortgage.

Recommended Reading: Can You Get A Mortgage If You Filed Bankruptcy