What Is The Best Mortgage Loan Type

The best mortgage is the one that helps you meet your housing needs for as little financing costs as possible. There are a few factors to consider when it comes to getting the right mortgage.

Some experts recommend getting a 15-year mortgage because youll pay far less interest and be debt-free in half the time compared to a 30-year loan. With a 30-year loan, your monthly payments can be significantly lower, but youll pay much more in interest over the loans life. So its a tradeoff.

There are also tradeoffs in choosing a government-backed versus a conventional loan. For example, FHA mortgages can have lower requirements than conventional loans. But unlike conventional loans, FHA loans require mortgage insurance even if your loan-to-value ratio drops below 80%.

If you want a set interest rate for the life of the loan and more stable monthly payments, then a fixed-rate mortgage is ideal. The interest rate on a fixed-rate mortgage never changes.

Regardless of what loan type you go with, remember, its not the loan you have to keep forever. Even if you stay in the same home for the rest of your life, you can refinance your mortgage to take advantage of better terms or rates.

Stock Market Is Dipping Bond Prices Increase Yields And Fixed Rates Decrease

On the other hand, when the Canadian economy becomes less stable and stocks do not look as enticing, investors are more likely to invest in safer investments such as bonds. Thus the demand for bonds increases, meaning that the price of bonds increases, and the bond yield decreases. As such, fixed rates will likely decrease.

What Role Does The Federal Reserve Play

The Federal Reserve plays a significant role in determining your mortgage rate. While the Fed doesnt set mortgage rates directly, it does set the federal funds rate. The Fed meets eight times a year, and mortgage rates change both in anticipation of what the Fed will do and in reaction to what the Fed actually does.

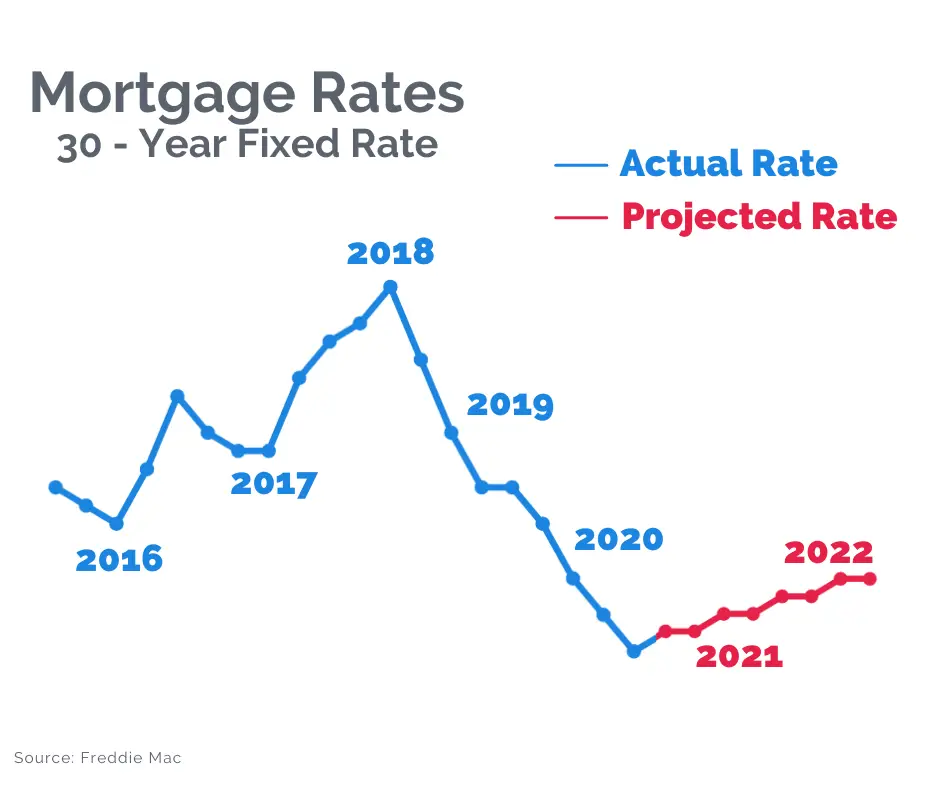

The Fed has started raising rates, with the most recent rate hike occurring in 2022, and more expected this year. This rate increase has already had an impact, with mortgage rates climbing. Suspected future rate increases are expected to continue to cause mortgage rates to rise.

You May Like: Where To Find Mortgage Note

Also Check: Is Paying Points On A Mortgage Worth It

Strong Economic Growth Means More Demand For Money

In general, strong economic growth tends to lead to higher interest rates, while weak growth leads to low interest rates. Heres why: When the economy is strong, more companies want to borrow from investors to expand their business. So, a mortgage provider has to pay a higher interest rate to get investors to lend to it. And when the economy is weak, the reverse is true.

Again What Are Mortgage Rates Based On

Before you confirm your mortgage rate lock, its important to understand several market-based and personal factors have a direct impact on your mortgage rate. None of them can be removed from the process.

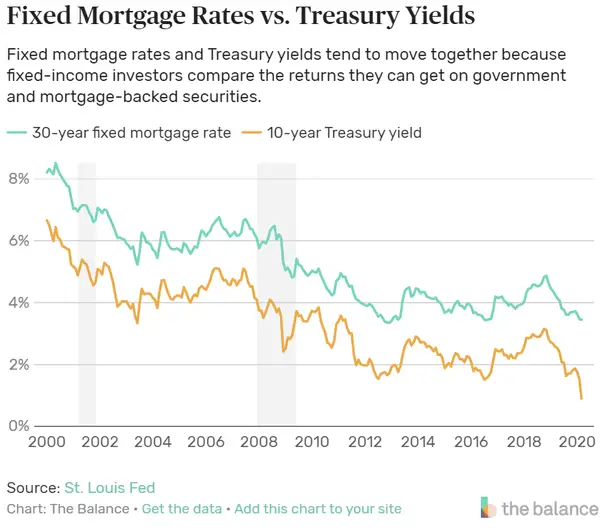

On the market side, the biggest direct influence is from the bond market which is where the MBS that provide the funding for residential mortgages are traded. In turn, this market is impacted by the moves of the Federal Reserve which is moved to act based on indicators in the economy overall.

Beyond movement in the market, personal financial situations play a big role. The relative levels of risk associated with mortgage-backed securities are based on factors including a persons credit score, their down payment or level of the existing equity, how they plan to occupy the property and their purpose in getting the mortgage.

Read Also: What Type Of Credit Is A Mortgage

Always Lock In Your Interest Rate

If you have a specific interest rate that you want, its important to lock it in as soon as its available. Dont wait, thinking that rates might fall again, because you never know. In fact, that interest rate that you wanted might not even be available for long. It depends on the reason that rates fell at that time. Was it a fluke thing, such as a reaction to some random news bulleting? If so, rates might go right back up to where they started once the news spreads and things calm down.

Your rate is never secure until you lock it. If you hesitate, thinking that rates might fall the next day or next week, you could be in for an unpleasant surprise. The best way to hedge against this risk is to lock your rate with a lender that offers a float down. This stipulation allows you to take a lower interest rate even after you have locked in your interest rate. Its like getting the best of both worlds.

Because interest rates are affected by the economy and whats going on in the world, its important to continually ask your loan officer about interest rates on a daily basis. Dont assume that once you hear a rate one day that it will still be there a few weeks down the road when you are ready to lock it. Staying cognizant of the current rates will help you make the right choice for your situation.

How Do Rates Fluctuate

Mortgage rates can change daily depending on the state of the economy. Numerous factors influence this such as consumer demand for housing and unemployment levels. During a slow economic period, the Federal Reserve will provide more funding which allows rates to go down. When the economy picks up speed theres a fear of inflation so the Fed will restrict funding and interest rates will go up. Many factors influence this and its impossible to know when rates will fluctuate and by how much.

Read Also: How To Get Someone Off A Mortgage

Factors That Affect Mortgage Rates

Most of the factors that affect mortgage rates are out of your control: there are larger forces at work in the economy and in the countrys biggest financial markets. There are some factors in your control like , or loan-to-value ratios and well get to those later. But first, its important to understand the bigger forces at work.

What If My Rate Lock Will Expire Before My Loan Closing Date

If your rate lock will expire prior to closing and disbursement of funds, a rate lock extension will be required to close your loan. We will extend your rate lock at no cost to you. Please be sure to respond promptly to all requests for information and documentation so we can move closer to closing your loan.

Some common reasons a rate lock extension may be needed include:

- Information you provide us is incomplete or delayed.

- The property is not ready to be occupied.

- There are issues clearing the title.

If your closing date becomes unknown or uncertain and you need more time to close the loan, you may be able to return to float by unlocking your rate.

You may cancel/withdraw your loan application at any time.

If youre using a Bond program and your loan will not close by the rate lock expiration date, contact your home mortgage consultant to see if the bond program youve chosen allows your rate to be extended, or you may cancel/withdraw your loan.

Read Also: How Do I Get A Mortgage Credit Certificate

The Federal Reserve Plays A Role

The Federal Reserve doesnt directly impact interest rates, unless they need to. If the flow of money in the economy is too high, causing inflation, the Fed may increase interest rates. If there is a less than desired amount of money flowing around the economy, the Fed may lower interest rates to get more people to borrow. The Fed does this by buying Treasury Bonds, which puts money into the economy, bringing interest rates back down.

Are Mortgage Interest Rates The Same For All Lenders

Mortgage rates vary by lender. Different lenders have different overhead costs they have to consider. They also have to consider the borrower’s financial situation, including their debt-to-income ratio, credit score and down payment. To find the best mortgage rate, you need to find the right lender.

Don’t Miss: Is 680 Credit Score Good Enough For Mortgage

Can I Return My Loan To A Floating Interest Rate

If your closing date becomes unknown or uncertain and it wont occur on or before the rate lock expiration date, you may have the option to unlock and float your rate.

Some common reasons for an unknown or uncertain closing date may include circumstances such as:

- Departure home sale falls through

- Legal action pending on the purchase property title

You can relock in 14 calendar days or less at your original rate and loan terms.

- If you relock after 14 calendar days, youll receive a new current market interest rate and rate lock expiration date.

There is no fee to return your loan to float.

If you believe you have an unknown or uncertain closing date, please contact your home mortgage consultant or private mortgage banker.

Note: If you’re using a Bond program and your rate lock expires, returning to float is not available. Contact your home mortgage consultant with any questions.

Strategies To Reduce Mortgage Payments

Reducing mortgage payments is a key step to financial freedom. While we cant provide financial advice, in a low mortgage rate environment, one can review with their financial advisor if refinancing can help them reduce their mortgage payments and the overall debt burden.

Every refinance has an associated closing cost. It would make sense to refinance only if the net tangible benefit of the refinance outweighs the closing costs.

Recommended Reading: What Lender Has The Lowest Mortgage Rates

What Impacts Variable Rates

Variable rate mortgages are affected by the Bank of Canadas overnight lending rate. The overnight rate is the cost of lending and borrowing short-term funds in Canada. The Bank of Canada makes 10 announcements per year about whether or not it will increase, decrease or hold the current the overnight lending rate. With this information, the Major Banks and mortgage lenders in Canada determine their bank prime. Currently, all major banks and mortgage lenders in Canada have a bank prime of 2.45%, except TD Bank, their bank prime is 2.60%.

Currently, Variable rates are trading at a discount to prime. Prime 1.0% means a rate of 1.45%.

Variable rates fluctuate with changes to the bank prime. Borrowers should count on some changes to their mortgage payments during the term of the mortgage, up or down!

The Federal Reserve And The Prime Rate

This is the one youre probably hearing a lot about lately. Thats for two reasons: One, because the prime rate is going up. And two, because its one of the more important factors behind mortgage rates.

The federal reserve controls the prime rate, and the prime rate is basically the rate that banks borrow from one another. And as the cost of funds increases and they raise rates, rates that the consumer is going to get will be subsequently higher, said Mayer Dallal, managing director at digital mortgage lender MBANC.

In essence, theres a cost to the money that banks are borrowing in the first place, and they then need to make a profit when they lend the money to a homebuyer. So as the Fed raises the prime rate, the banks will raise the mortgage rates to keep their profit margin intact.

Read Also: How To Pay Off Mortgage In 15 Years Calculator

Should I Lock My Mortgage Rate

Since your mortgage rate isnt guaranteed, it might be a good idea to lock it as soon as possible so youre not caught off guard. Make sure youve compared multiple quotes before doing so. Other scenarios in which it might be a good idea to lock your mortgage rate would be if youre closing on a home soon, you have enough assets and income to proceed with the closing process and youve already sold your current home.

Why Do Mortgage Interest Rates Change

To understand why mortgage rates change we need to know why do interest rates change? And there is not one interest rate, but many interest rates!

Supply and Demand for Mortgages

Interest-rates move because of the laws of supply and demand. If the demand for credit increases, so do interest rates. This is because there are more people who want money, buyers, so people who are willing to lend it, sellers, can command a better price, i.e. higher interest rates.

If the demand for credit reduces, then so do interest rates. This is because there are more people who are ready to lend, sellers, than people who want to borrow, buyers. This means that borrowers, buyers, can command a lower price, i.e. lower interest rates.

When the economy is expanding there is a higher demand for credit so interest rates go up. When the economy is slowing the demand for credit decreases and thus interest rates go down.

This leads to a fundamental concept:

- Bad news is good news for borrowers as it means lower interest rates.

- Good news is bad news for borrowers as it means higher interest rates.

Another major factor driving interest rates is inflation. Higher inflation is associated with a growing economy. When the economy grows too strongly the Federal Reserve increases interest rates to slow the economy down and reduce inflation.

Likewise, if prices are rising rapidly, people are inclined to borrow todays money so as to repay it with tomorrows money, which will be worth less.

Bonds Rates

Don’t Miss: How Do You Calculate Self Employed Income For A Mortgage

What Is A Float

A float-down is an additional option you can take out with your lender. This option means you’ll lock in at the agreed upon rate, but should interest rates drop within the period, you’ll be closing at the lower rate.

Both lender and borrower will have to agree to the terms of the float-down option, including how long it will last and how much the interest rates have to drop to be enforced. Float down options do cost more than locking your mortgage rate. That cost is often dependent on how long the option lasts.

Ask For Mortgage Rate Updates Daily

- Ask for rate updates daily until you lock in your rate

- Rates can move higher or lower based on a number of factors

- Economic news, reports, data, and even geopolitical activity

- Can significantly impact rates throughout the week

If you want to know where mortgage rates are for a given day, call your bank or broker and ask and dont be afraid to call every day to keep track of mortgage rates, as its their job to keep you informed.

Sure, they might be annoyed that youre constantly asking for updates, but its their duty to provide you with this information.

Its extremely important because it will determine how much you pay each month and over the life of the loan. So they should be more than understanding and happy to provide updated pricing.

Want a fast, free rate quote? Quickly get matched with a top mortgage lender today!

After all, youre the one that will be stuck paying that rate for the next 360 months if you go with a 30-year loan, so its worth the small effort.

Dont just assume that the last rate quote they gave you, or the initial one to get you in the door, still stands. It could be completely different a week or even a day later.

Tip: Freddie Macs weekly survey just details what rates average during the week from several lenders, not necessarily the daily rate available to you.

Also Check: What Would I Be Approved For Mortgage

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinancing if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage points . It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money you’d save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and you’d pay off your house sooner.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.

The Best Time To Lock A Mortgage Rate

Whether you’re getting ready to buy your first home or you’ve done this before, you’ll benefit from discovering the best time to lock in a mortgage rate. Understanding how it works and what it’s for can help make the homebuying process a little easier.

When paying off a mortgage, buyers need to pay interest on the money borrowed. The money that you borrow initially is called the principal, and the interest gets charged as a percentage of that principal.

The interest rate for your mortgage will ultimately determine how much interest you’ll pay over the life of the loan. Therefore, the lower the mortgage interest rate is, the better.

You May Like: How Mortgages Work In Usa