What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score of both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

Mortgage Interest Rates Forecast 2022

Experts are forecasting that the 30-year, fixed-mortgage rate will vary from 4.8% to 5.5% by the end of 2022.

While mortgage rates are directly impacted by U.S. Treasury bond yields, rising inflation and the Federal Reserves monetary policy indirectly influence mortgage rates. As inflation increases, the Fed reacts by applying more aggressive monetary policy, which invariably leads to higher mortgage rates.

The pressure to contain inflation will grow and the Fed will have to raise its fed funds rate eight to 10 times with quarter-point hikes this year, says Lawrence Yun, chief economist and senior vice president of research at the National Association of Realtors . Additionally, the Fed will undo the quantitative easing steadily, which will put upward pressure on long-term mortgage rates.

Here are more detailed predictions from economists, as of mid-April 2022:

- Mortgage Bankers Association : Mortgage rates are expected to end 2022 at 4.8%and to decline gradually to 4.6%by 2024 as spreads narrow.

- NARs Yun: All in all, the 30-year fixed mortgage rate is likely to hit 5.3% to 5.5% by the end of the year. Some consumers may opt for a five-year ARM at 4% by the end of the year.

- Matthew Speakman, senior economist at Zillow: Competing dynamics suggest that there will be little reason for mortgage rates to decline anytime soon.

When Is A 15

A 15-year mortgage is a smart option for borrowers who want to save money on interest and can afford larger monthly payments without compromising their other financial goals and responsibilities.

For instance, a borrower who can’t take out a 15-year mortgage without sacrificing regular contributions to a savings account and a retirement fund should probably stick to a longer-term mortgage. A 20-year term is a happy medium.

For borrowers who have variable or sporadic incomes, a 15-year mortgage makes sense only if there is a realistic plan to make the mortgage payment through the lean periods.

If you have a plan, the savings are worth it. Lets say you have a $300,000 mortgage, and the rate is 4.25% for a 30-year term, compared to 4.00% for a 15-year term. By the end of the 30-year term, youll have paid $231,295.08 in interest compared to $99,431.48, a savings difference of $131,863.60. Thats pretty significant.

However, the price savings equates to a much higher monthly payment. The payment for the 30-year mortgage will be $1,475.82, compared to the 15-year loan, which is $2,219.06. Thats why its a smart idea to shop around for the lowest rates and compare terms to make sure you can comfortably afford the mortgage.

Don’t Miss: How Much Equity Can I Borrow On A Reverse Mortgage

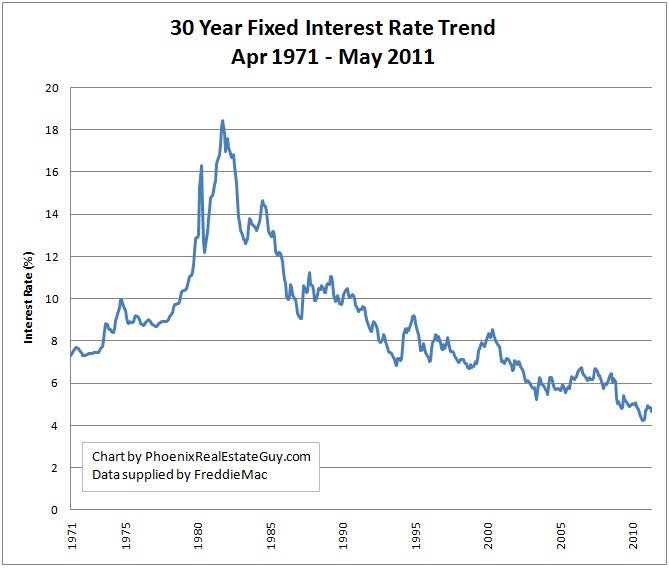

Mortgage Rate Trends: Where Rates Are Headed

Mortgage rates plunged early in the pandemic and scraped record lows below 3 percent at the start of 2021. The days of sub-3 percent mortgage interest on the 30-year fixed are behind us, and rates rose past 5 percent in 2022.

Low interest rates were the medicine for economic recovery following the financial crisis, but it was a slow recovery so rates never went up very far, says Greg McBride, CFA, Bankrate chief financial analyst. The rebound in the economy, and especially inflation, in the late pandemic stages has been very pronounced, and we now have a backdrop of mortgage rates rising at the fastest pace in decades.

How Are Mortgage Rates Determined

Mortgage rates, in general, are determined by a wide range of economic factors, including the yield U.S. Treasury bonds, the economy, mortgage demand and the Federal Reserve monetary policy.

Borrowers have no control over the wider economy, but they can control their own financial picture to get the best rate available. Typically, borrowers with higher FICO scores, lower debt-to-income ratios and a larger down payment can lock in lower rates.

Related:How To Improve Your Credit Score

Also Check: How Do I Calculate My Mortgage Payoff Amount

Is It Harder To Qualify For A 15

On paper, its no harder to qualify for a 15-year mortgage loan than a 30-year one. Guidelines vary by loan type , but within each program, requirements for a 15- and 30-year loan are generally the same.

For instance, a 15-year FHA loan will likely require a credit score of at least 580, down payment of 3.5%, and debt-to-income ratio below 50%, just like a 30-year FHA mortgage.

But in reality, its much harder to qualify for a 15-year loan because of the higher monthly payments.

A bigger mortgage payment means your home loan will eat up more of your monthly income. This will have an impact on your debt-to-income ratio.

For most home buyers, a 15-year mortgage payment plus existing debts will take up more than 43% to 50% of their monthly income, which is the maximum DTI range most lenders allow.

If youre set on a 15-year mortgage but have a tighter monthly budget, paying down existing debts before you apply for the home loan could help you qualify.

How Are Mortgage Rates Set

Lenders use a number of factors to set rates each day. Every lender’s formula will be a little different but will factor in the current federal funds rate , competitor rates and even how much staff they have available to underwrite loans. Your individual qualifications will also impact the rate you are offered.

In general, rates track the yields on the 10-year Treasury note. Average mortgage rates are usually about 1.8 percentage points higher than the yield on the 10-year note.

Yields matter because lenders don’t keep the mortgage they originate on their books for long. Instead, in order to free up money to keep originating more loans, lenders sell their mortgages to entities like Freddie Mac and Fannie Mae. These mortgages are then packaged into what are called mortgage-backed securities and sold to investors. Investors will only buy if they can earn a bit more than they can on the government notes.

You May Like: How Soon Can You Take Out A Second Mortgage

Mortgage Rate Forecast: What Is Driving Mortgage Rate Change

The surge in mortgage rates so far this year is due to a variety of economic factors. Persistently high inflation is a big one, Jacob Channel, senior economic analyst at LendingTree told us. Julys inflation report shows 8.5%inflation year-over-year. Thats lower than Junes 9.1%, a sign that inflation is starting to cool.

Though still high, in response, the Federal Reserve increased its benchmark short-term interest rate to combat that inflation. The Fed raised rates by 50 basis points in May, 75 points in June, and by 75 basis points in July.

Recently, we saw mortgage rates surge after the inflation report and ahead of the Feds announcement. I think what were seeing is that lenders had already anticipated that the Fed was going to raise the fed funds rate by 75 basis points and they began to preemptively push mortgage rates up, Jacob Channel, senior economist at LendingTree, told us.

Energy prices are half responsible for these increases, Dawit Kebede, senior economist for the Credit Union National Association, said in a statement. There are signs that some of the main drivers of inflation are easing, such as lower oil and other commodity prices in July, slower wage growth, and declining supply chain pressures. However, service price increases led by housing and pent-up demand for vehicles will keep inflation elevated in the coming months.

Should I Lock In My Mortgage Rate Today

Locking in a rate as soon as you have an accepted offer on a house can help guarantee a competitive rate and affordable monthly payments on your home mortgage. A rate lock means that your lender will guarantee you an agreed-upon rate for typically 45 to 60 days, regardless of what happens with average rates. Locking in a competitive rate can protect the borrower from rising interest rates before closing on the mortgage

It may be tempting to wait to see if interest rates will drop lower before getting a mortgage rate lock, but this may not be necessary. Ask your lender about float-down options, which allow you to snag a lower rate if the market changes during your lock period. These usually cost a few hundred dollars.

Recommended Reading: Is It Better To Get A 15 Year Mortgage

What To Know About Loans Fees

Anytime you take out a home loan, your decision should factor in the loans closing costs. The closing costs can be anywhere from 3-6% of the loan amount, including origination fees, prepaid interest, and property taxes.. Choosing a higher interest rate in exchange for lender credit can reduce your upfront costs. There is a possibility that you will be selling your home or refinancing in five to eight years, so this strategy could save you money in the short-term.

Is It Worth Refinancing To A 15

You can save money and build home equity faster with a 15-year mortgage than with a 30-year mortgage. But the monthly mortgage payment will be higher on a 15-year mortgage because there is less time to pay off the loan.

Its worth comparing 15-year mortgage rates if youll be able to afford the monthly payments and still have enough money for other needs, such as saving for retirement.

Getting a lower interest rate could save you hundreds of dollars over a year of mortgage payments and thousands of dollars over the life of the mortgage.

When you compare 15-year refinancing offers using the Loan Estimates you receive from lenders, youll feel confident when you identify the offer that has the best combination of rate and fees.

You May Like: Who Is In The Rocket Mortgage Commercial

Dont Wait On Closing Costs

Like when you first took out your mortgage, you can expect to pay 3% to 6% of your loan amount in closing costs if you choose to refinance. Some lenders provide the option of rolling these costs into your loan however, doing so usually means having to pay a higher interest rate and greater overall loan cost.

How Do I Find Current 15

NerdWallets mortgage rate tool can help you find competitive 15-year fixed mortgage rates. In the filters above, enter a few details about the loan youre looking for, and youll get a personalized rate quote in moments, without providing any personal information. From there, you can start the process to get preapproved for your home loan. Its that easy.

» MORE: Pros and cons of a 15-year fixed mortgage

Read Also: How To Get Mortgage Forgiveness

How Does A 15

A 15-year fixed-rate mortgage has a 15-year term with a fixed interest rate and payments, while a 5-year ARM has a longer 30-year term with a fixed-rate for the first 5 years, and then a variable rate for the remaining term. 5-year ARMs generally offer a lower initial interest rate compared to fixed-rate mortgages, which may save you thousands of dollars in interest over the life of the loan. When5-year ARMs adjust, rates and payments may increase. Unless you plan to sell or refinance the home before the 5-year ARMs fixed period ends, a 15-year mortgage is the lower risk option.

How Are Mortgage Rates Impacting Home Sales

The housing market continues to lose steam as mortgage rates rise. The number of overall mortgage applications ticked down by 0.8% for the week ending September 2, according to the Mortgage Bankers Association.

- The seasonally adjusted number of purchase applications was 1% lower than the previous week and 23% lower than a year ago. Mortgage applications have now declined for nine out of the last 10 months.

“Recent economic data will likely prevent any significant decline in mortgage rates in the near term, but the strong job market depicted in the August data should support housing demand,” said Mike Fratantoni, MBA’s senior vice president and chief economist. “There is no sign of a rebound in purchase applications yet, but the robust job market and an increase in housing inventories should lead to an eventual increase in purchase activity.

- The number of people refinancing their home loans continues to decline. Refinance applications decreased by 1% from the previous week and were 83% lower than the same week last year.

Recommended Reading: Is The Harp Mortgage Program Real

How Do Fixed Rate Mortgages Work

Fixed rate mortgages lock in the interest rate you pay over the duration of the fixed term. The result is that youll know exactly what your monthly repayment will be for the entirety of the fixed term, regardless of whether the Bank of England changes interest rates or not.

This way you can manage your finances and know how much youll have left over to put into savings or use for other purposes like going on holiday.

While a fixed rate mortgage will provide certainty on what your monthly mortgage outgoings will be, do bear in mind that BoE interest rates could go down as well as up during your fixed term, but your payments will always remain the same.

Fixed rate mortgages also tend to be more expensive the longer you tie your fixed in rate for, so youll need to weigh this up when deciding what type of mortgage you want to apply for.

Fixed rate mortgages also tend to have fewer extra features, such as options to lower your interest payments by using on offset account. However, this can vary from lender to lender.

How To Get A Good 15

Lenders take your finances into consideration when determining an interest rate. The better your financial situation is, the lower your rate will be.

Lenders look at three main factors: down payment, credit score, and debt-to-income ratio.

- Down payment: Depending on which type of mortgage you take out, a lender might require anywhere from 0% to 20% for a down payment. But the more you have for a down payment, the lower your rate will likely be. If you can provide more than the minimum, you could snag a better rate.

- : Many mortgages require at least a 620 credit score, and an FHA loan lets you get a mortgage with a 580 score. But if you can get your score above the minimum requirement, you’ll probably land a better interest rate. To improve your score, try making payments on time, paying down debts, and letting your credit age.

- Debt-to-income ratio: Your DTI ratio is the amount you pay toward debts each month in relation to your monthly income. Some lenders want to see a maximum DTI ratio of 36%, but you can get a lower mortgage rate with a lower ratio. To decrease your DTI ratio, you either need to pay down debts or consider ways to increase your income.

You should be able to get a low 15-year fixed rate with a sizeable down payment, excellent credit score, and low DTI ratio.

You might like a 15-year fixed mortgage if you plan to stay in your home for a long time and want to be aggressive about paying off your mortgage.

Also Check: What Is A Pre Qualified Mortgage

How Much Can You Afford To Borrow

You want to have a sense of how much you can afford to borrow before you start looking for a home and applying for a mortgage. Usually, since you pay off a 15-year home loan in half the time it takes to pay off a 30-year loan, the amount you can afford to borrow is less. You might be able to purchase a $200,000 home by putting 20% down if you apply for a 30-year loan. Since the monthly payments on a 15-year loan are often about twice as much as those on a 30-year loan, you might be able to purchase a $150,000 home with a 15-year loan.

You can use a mortgage calculator to compare the monthly payments on a 15-year versus a 30-year mortgage.

To determine how much you can borrow with a 15-year mortgage, pay attention to how much you can afford to pay each month. Look at your total debt compared to your total income. When getting a mortgage, your ideal housing ratio, also known as a front-end debt-to-income ratio, is 28%. With insurance and property taxes included, your housing payments should be within 28% of your total income.

Lenders also use the back-end ratio, which is all your debts compared to your income. An ideal back-end ratio is 36%. If you have other significant debts, such as student loans or car loans, your ideal monthly mortgage payment can end up being much lower than 28% of your total income.

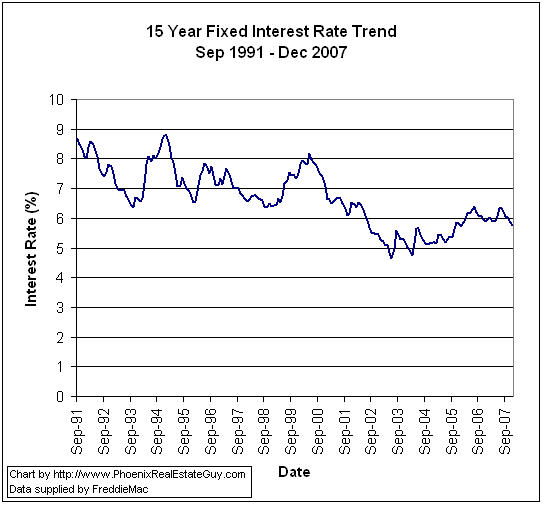

Monthly Average Commitment Rate And Points On 15

Opinions, estimates, forecasts, and other views contained in this document are those of Freddie Macs economists and other researchers, do not necessarily represent the views of Freddie Mac or its management, and should not be construed as indicating Freddie Macs business prospects or expected results. Although the authors attempt to provide reliable, useful information, they do not guarantee that the information or other content in this document is accurate, current or suitable for any particular purpose. All content is subject to change without notice. All content is provided on an as is basis, with no warranties of any kind whatsoever. Information from this document may be used with proper attribution. Alteration of this document or its content is strictly prohibited. ©2022 by Freddie Mac.

You May Like: Is A Timeshare Considered A Mortgage