How To Calculate Annual Income For Your Household

In order to determine how much mortgage you can afford to pay each month, start by looking at how much you earn each year before taxes. Consider all your earnings for the year, which could include salary, wages, tips, commission, etc.If you have a spouse or a partner that has an income which will also contribute to the monthly mortgage, make sure to include that as well into your gross annual income for your household. Then take your annual income and divide by 12 to determine your monthly income.

Follow the 28/36 debt-to-income rule

This rule asserts that you do not want to spend more than 28% of your monthly income on housing-related expenses and not spend more than 36% of your income against all debts, including your new mortgage. Keeping within these parameters will ensure you enough money left over for food, gas, vacations, and saving for retirement.Example: Lets say you and your spouse have a combined monthly income of $5,000. Applying the 28/36 rule, you wouldnt want to spend more than:

$1,400 on house related expenses

$1,800 on total debt

Get Matched With The Right Mortgage Broker

We understand that each situation is unique. If you would like a detailed insight into how much you could borrow on a mortgage from your household income, get in touch today.

Call Online Mortgage Advisor today on 0808 189 2301 or make an enquiry online

Then sit back and let us do all the hard work in finding the broker with the right expertise for your circumstances. It costs nothing to make an enquiry and theres absolutely no obligation or marks on your credit rating.

Ask us a question

Want to know exactly how much you could borrow based on your income?Drop us a query with your exact income and we will have an expert broker answer any questions you have about how much you could borrow.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage.

Find Out How Much House You Can Afford

So, how much house can you afford while earning $70K a year?

The bottom line is that factors other than salary determine your price range.

Yes, income is a big component of the equation. But you must consider other monthly costs, your down payment, and of course, your interest rate.

Before heading out to open houses with your real estate agent or Realtor, get your finances in order and shop around for the lowest rate. You can maximize your home buying power on any salary.

Popular Articles

Monthly homeowners association fee

You May Like: Can You Take A Cosigner Off A Mortgage

Can I Buy A House If I Make 30k A Year

Whether you are able to purchase a home with $30,000 a year will greatly depend on where you live. In many of the more expensive cities, like Los Angeles or New York, buying a home for $30,000 may seem nearly impossible. In other cities and smaller towns, you may be able to get a mortgage with that amount. In any case, if your income is $30,000 a year you will want to ensure that you have an excellent credit score and a good down payment. Both of those will put your odds of purchasing a house up.

The Mortgage Qualifying Calculator Says I Cant Afford My Dream Home What Can I Do

It can be disappointing to learn that the home you have set your heart on is out of financial reach, but donât give up hope! It may be that you can reach your goal by adjusting some of your other constraints. Perhaps you can save for a little longer in order to amass a larger down payment, or wait until your credit card and loans are paid off.

These small but significant changes could make all the difference and enable you to get the mortgage you require. If the down payment is causing you an issue, you might consider an FHA loan, which offers competitive rates while requiring only 3.5 percent down, even for borrowers with imperfect credit.

You May Like: How Much Are The Fees To Refinance A Mortgage

Learn About Your Mortgage Options

Home buyers can typically choose from two main types of mortgages:

- A conventional loan that is guaranteed by a private lender or banking institution

- A government-backed loan

When choosing a loan, youll want to explore the types of rates and the terms for each option. There may also be a mortgage option based on your personal circumstances, like if youre a veteran or first-time home buyer.

Conventional loans

A conventional loan is a mortgage offered by private lenders. Many lenders require a FICO score of 620 or above to approve a conventional loan. You can choose from terms that include 10, 15, 20 or 30 years. Conventional loans require larger down payments than government-backed loans, ranging from 5 percent to 20 percent, depending on the lender and the borrowers credit history.

If you can make a large down payment and have a credit score that represents a lower debt-to-income ratio, a conventional loan may be a great choice because it eliminates some of the extra fees that can come with a government-backed loan.

Government-backed loans

Buyers can also apply for three types of government-backed mortgages. FHA loans were established to make home buying more affordable, especially for first-time buyers.

Rate types

First-time homebuyers

Why Do I Have To Complete A Captcha And What Can I Do To Prevent This In The Future

If you are on a personal connection, like at home, you can run an anti-virus scan on your device to make sure it is notinfected with a virus or malware.

If you are at an office or shared network, you can ask the network administrator to run a scan across the networklooking for misconfigured or infected devices.

Your IP is: 168.196.237.110

The unique Ray ID for this page is: 74c7676379ee1993

comparethe.com is a trading name of Compare The Market Limited. Registered in England No. 10636682. Registered Office: Pegasus House, Bakewell Road, Orton Southgate, Peterborough, PE2 6YS. Compare The Market Limited is authorised and regulated by the Financial Conduct Authority for insurance distribution . Energy and Digital products are not regulated by the FCA.

Don’t Miss: Does Fha Require Mortgage Insurance

What Is The Most Affordable State For Buying A House

According toBusiness Insider, the cheapest state to buy a house is West Virginia, with a median list price of $169,000. When looking at the most affordable city to buy a house,Forbessays that Detroit, Michigan is the most affordable, with a median listing price of just $59,000. That’s well below the third-place runner up city of Toledo, Ohio, which has a median listing price of $95,000.

However, housing prices dont reflect the total cost of living in any particular state. According toUS News, Mississippi has the lowestcost of living in the United States, but it does have a slightly higher average home price at $252,725.

How To Calculate An Affordable Mortgage

Although you cannot determine an exact budget until you know what mortgage rate you will get, you can still estimate your budget.

Assuming an average 6% interest rate on a 30-year fixed-rate mortgage, your mortgage payments will be about $650 for every $100,000 borrowed. .

For the couple making $80,000 per year, the Rule of 28 limits their monthly mortgage payments to $1,866.

x $100,000 = $290,000

Ideally, you have a down payment of at least 10%, and up to 20%, of your future homes purchase price. Add that amount to your maximum mortgage amount, and you have a good idea of the most you can spend on a home.

Note: if you put less than 20% down, your mortgage lender will require you to pay private mortgage insurance , which will increase your non-mortgage housing expenses and decrease how much house you can afford. Read all about PMI in our article here.

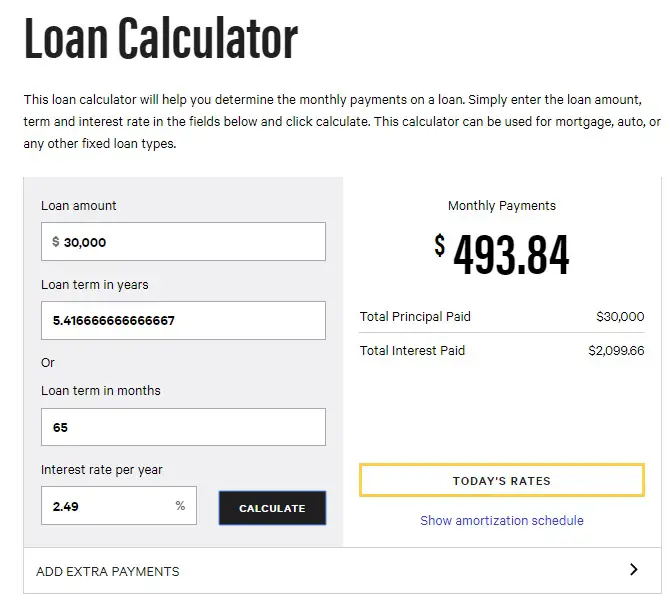

To get a better sense of your payments, check out our mortgage calculator below:

Read Also: Can I Be Added To A Mortgage

How Much Do I Need To Make To Afford A 150k House

This depends on the amount youre able to put down as a deposit. If youre a first-time buyer and only have a 5% deposit to put down, youd need to be earning around £32,000 to be offered the £142,500 mortgage required for a £150,000 house. If on the other hand you could put down a deposit of 10% you might only need to earn £30,000, or if you had a 20% deposit, youd need a smaller mortgage of £120,000 and therefore a lower salary of around £27,000. Remember that if youre buying jointly, the income requirements can be split between you.

Can I Afford A $360k House

To afford a mortgage loan worth $360k, you would typically need to make an annual income of about $100k and be able to afford monthly payments worth $2,000 and upwards. For example, with a 30-year loan term, 5% interest rate and 5% down, you’d need an annual income exceeding $105,000 to afford the $2,478 monthly mortgage payment

Also Check: How Much Does Paying Mortgage Bi Weekly Save

What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

Mortgage Affordability & How To Qualify For A Home Loan

Purchasing a home is one of the most costly transactions people make. It entails ample financial preparation and commitment to make timely payments. Thus, long before you submit your mortgage application, its crucial to assess your financial eligibility and how much you can afford.

What does it take to qualify for a mortgage? Our guide will discuss vital factors that determine your mortgage affordability. Well also talk about the importance of maintaining a good credit score and how major credit issues hinder chances of favourable mortgage rates. Well give a rundown on the required debt-to-income ratio, deposit, and primary costs you must consider before taking a mortgage. If youre looking for effective government schemes, we also included a section on Help to Buy mortgage assistance programs.

Also Check: How To Determine My Mortgage Payment

How Much House Can I Afford On A 120k Salary

Using the basic 3-4 times your annual income rule, with a $120K income you should be able to purchase a home that ranges in value from $360,000 to $480,000. In general, your interest rate and the term that you choose for the repayment of your mortgage will greatly influence the type of property that you can afford. To best determine the house, you can actually afford based on your expenses and income you may want to use an online mortgage calculator. Many banks, lenders, and financial tools will offer online mortgage calculators for free.

What Are The Income Requirements For Refinancing A Mortgage

Mortgage refinancing options are reserved for qualified borrowers, just like new mortgages. As an existing homeowner, youll need to prove your steady income, have good credit, and be able to prove at least 20 percent equity in your home.

Just like borrowers must prove creditworthiness to initially qualify for a mortgage loan approval, borrowers have to do the same for mortgage refinancing.

Recommended Reading: How To Calculate Mortgage Amount Qualification

Help To Buy Shared Ownership

Under the shared ownership program, you can purchase a share of your home and pay rent on the remaining mortgage balance until its cleared. This enables you to purchase between 25% to 75% of your propertys full price. To be eligible, you must be a first-time homebuyer, or you used to own a house but now have limited income to afford one. This scheme is also available for current shared owners planning to move. It also imposes required incomes limits. To qualify, your annual household income must be £80,000 or less outside of London. If you reside in London, your annual household income must be £90,000 or less. To learn more about the Help to Buy shared ownership scheme, visit their official site.

Can I Afford A $650000 House

To determine whether you can afford a $650,000 home you will need to consider the following 4 factors.

1. Income

Based on the current average for a down payment, and the current U.S. average interest rate on a 30-year fixed mortgage you would need to be earning $126,479 per year before taxes to be able to afford a $650,000 home. In this calculation, we have stuck with the 28% rule which wants your home expenses to not be any more than 28% of your pre-tax income.

2. Expenses and debts

While the calculation above can be accurate for some people, it will not be accurate for those who have not cleared off all of their other debts, or who have many running expenses each month. Paying off debts, paying insurance costs, utilities, child support payments or medical costs can all reduce the amount that you have available to spend on your mortgage. Therefore, this will also alter the income that you need.

3. Savings

Making a larger down payment will often result in both better terms for your loan and in you needing a lower-income each year to pay off your mortgage. Your down payment can truly alter the amount that you are able to pay on a house in the best possible way.

4. Interest Rates/ Credit Score

Your credit score and down payment will help your lender determine how much your interest rate will be. The lower the interest rate the lesser the income you will require annually will be. Therefore, trying to get the best possible rate could allow you to get a much larger home.

Also Check: Does Having A Mortgage Help Your Credit

What Else Is Included In Dti

Your debt-to-income ratio also considers auto loans, minimum credit card payments, installment loans, student loans, alimony, child support, and any other expenses you must make each month. It doesn’t typically include recurring monthly charges for utilities, internet service, cable or satellite TV, mobile phone subscription or other charges for ongoing services or other things where the cost is newly incurred each month.

To calculate if you have the required income for a mortgage, the lender takes your projected monthly mortgage payment, adds your expenses for credit cards and any other loans, plus legal obligations like child support or alimony, and compares it to your monthly income. If your debt payments are less than 36 percent of your pre-tax income, you’re typically in good shape.

What if your income varies from month to month? In that case, your lender will likely use your average monthly income over the past two years. But if you earned significantly more in one year than the other, the lender may opt for the year’s average with lower earnings.

Note: Your required income doesn’t just depend on the size of the loan and the debts you have but will vary depending on your mortgage rate and the length of your loan. Those affect your monthly mortgage payment, so the mortgage income calculator allows you to take those into account as well.

How Much House Can I Afford With A Jumbo Loan

Jumbo loansare mortgages that do not fit theconforming loans limitsset by theFederal Housing Finance Association . These mortgages are too large to be insured by agencies such as Fannie Mae and Freddie Mac. Therefore, this type of home loan has a larger minimum down payment and higher credit score requirements. If you have a high income and low DTI ratio you can afford a larger home with a jumbo loan as compared to a traditional mortgage.

Don’t Miss: How Many Months Can You Go Without Paying Mortgage

Who Is The Mortgage Qualifying Calculator For

This calculator is most useful if you:

- Are a potential homeowner needing to know your budget constraints

- Have decided on a new home but want to ensure you can afford it

- Are looking to plan and budget for the future

If you’re ready to connect with a trusted lender and receive exact figures, fill out this short form here and request personalized rate quotes tailored to you. This will give you a better idea of what interest rate to expect and help gauge your ability to qualify for a mortgage.

How Much Do You Have To Make A Year To Afford A $400000 House

The amount that you will need to make to afford a $400,000 home will vary based on the loan term that you put in place for its repayment. Your initial down payment and interest rate could also lead to you getting ranging values for your required annual income. For all of the amounts used below it is assumed that the down payment will be 6% which is the average down payment in the USA.

The following are some examples of how much your annual income would need to be. The exact annual income would be determined based on your interest rate. For all of the

- If you wanted to get a $400,000 home and were looking to repay it in 15 years you would need an income that ranges from $136,000 to $47,000.

- If you wanted to get a $400,000 home and were looking to repay it in 20 years you would need an income that ranges from $115,000 to $126,000.

- If you wanted to get a $400,000 home and were looking to repay it in 25 years you would need an income that ranges from $102,000 to $114,000. The exact amount will depend on how favorable your interest rate is.

- If you wanted to get a $400,000 home and were looking to repay it in 30 years you would need an income that ranges from $94,000 to $107,000. The exact amount will depend on how favorable your interest rate is.

Read Also: Does Spouse Have To Be On Mortgage