How To Find The Best 15

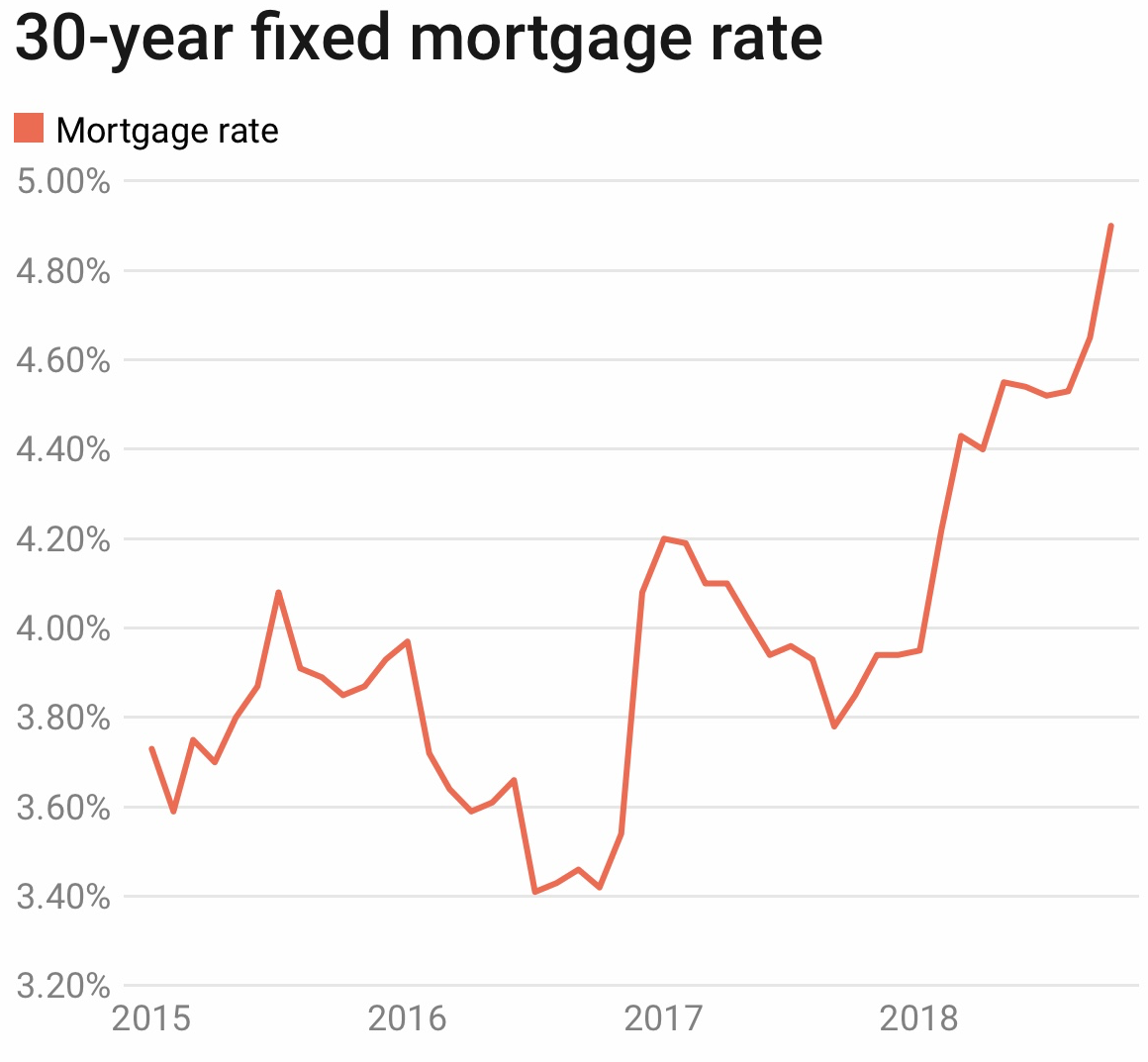

Mortgage rates tend to fluctuate daily, so its a good idea to keep an eye on rates to find a good deal. You can start with the bank or credit union that you currently have accounts with.

Also, be sure to shop around and compare your options from as many mortgage lenders as possible. This way, youll have an easier time getting a loan that suits your needs. In addition to rates, be sure to consider other loan factors such as lender fees and eligibility requirements.

The Comprehensive Guide To 30

Guide published by Jose Abuyuan on October 2, 2020

Homeownership is a major life goal which requires ample financial preparation and commitment. Apart from maintaining a good credit rating, you must also save enough funds for a down payment.

Once youre ready to buy a house, there are many factors to consider. You should shop around for different lenders to secure the lowest rate. On top of this, you must choose the right loan term that fits your budget.

Among many mortgage options, the most common is the 30-year fixed-rate loan. Most lenders offer it, and many homebuyers choose it. It seems like a safe option with low monthly payments. This is especially beneficial for first-time homebuyers with limited funds. However, 30-year fixed mortgages also come with several drawbacks.

Our guide will explain how 30-year mortgages work, as well as their pros and cons. Well also discuss different mortgages such as conventional loans and government-backed mortgages that offer this type of loan. Knowing these options can help you choose the right mortgage deal that suits your needs.

Why Use An Apr Mortgage Calculator

Your lender will figure your APR for you, and will advertise it in loan offers. However, you may wish to see yourself how the APR will vary if you make certain changes in the loan, such as buying more or fewer points. Or you may want to compare loan offers from lenders with different fee schedules and want to see how different fee schedules affect the APR and total cost of the loan.

FAQ: It is also helpful if you: Are working with a tight budget and need to know exactly how much you can afford.

FAQ: You want to compare the true total monthly payment required from two or more providers. For the best way to do this, .

Don’t Miss: How Much Does A Down Payment Lower A Mortgage

Find Out Whether You Need Private Mortgage Insurance

Private mortgage insurance is required if you put down less than 20% of the purchase price when you get a conventional mortgage, or what you probably think of as a “regular mortgage.” Most commonly, your PMI premium will be added to your monthly mortgage payments by the lender.

The exact cost will be detailed in your loan estimate, but PMI typically costs between 0.2% and 2% of your mortgage principal.

Oftentimes, PMI can be waived once the homeowner reaches 20% equity in the home. You also may pay a different type of mortgage insurance if you have another mortgage, such as an FHA mortgage.

Calculating Arms Refinances And Other Mortgage Types

The equations that we’ve provided in this guide are intended to help prospective borrowers understand the mechanics behind their mortgage expenses. These calculations become more complicated if you’re trying to account for ARMs or refinances, which call for the use of more specialized calculators or spreadsheet programs. You can better understand how these loan structures work by referring to one of our guides about mortgage loans below:

Don’t Miss: What Mortgage Can You Afford Based On Salary

What Is A 30

Thirty-year fixed-rate mortgages are the apple pie à la mode of secured credit. Homeowners get:

- A low, unchanging interest rate

- A steady, affordable payment

- A larger loan .

Wait, theres more. As their income grows, homeowners can make extra payments against principle to pay off the mortgage faster. Prepayment penalties do exist, but they are rare.

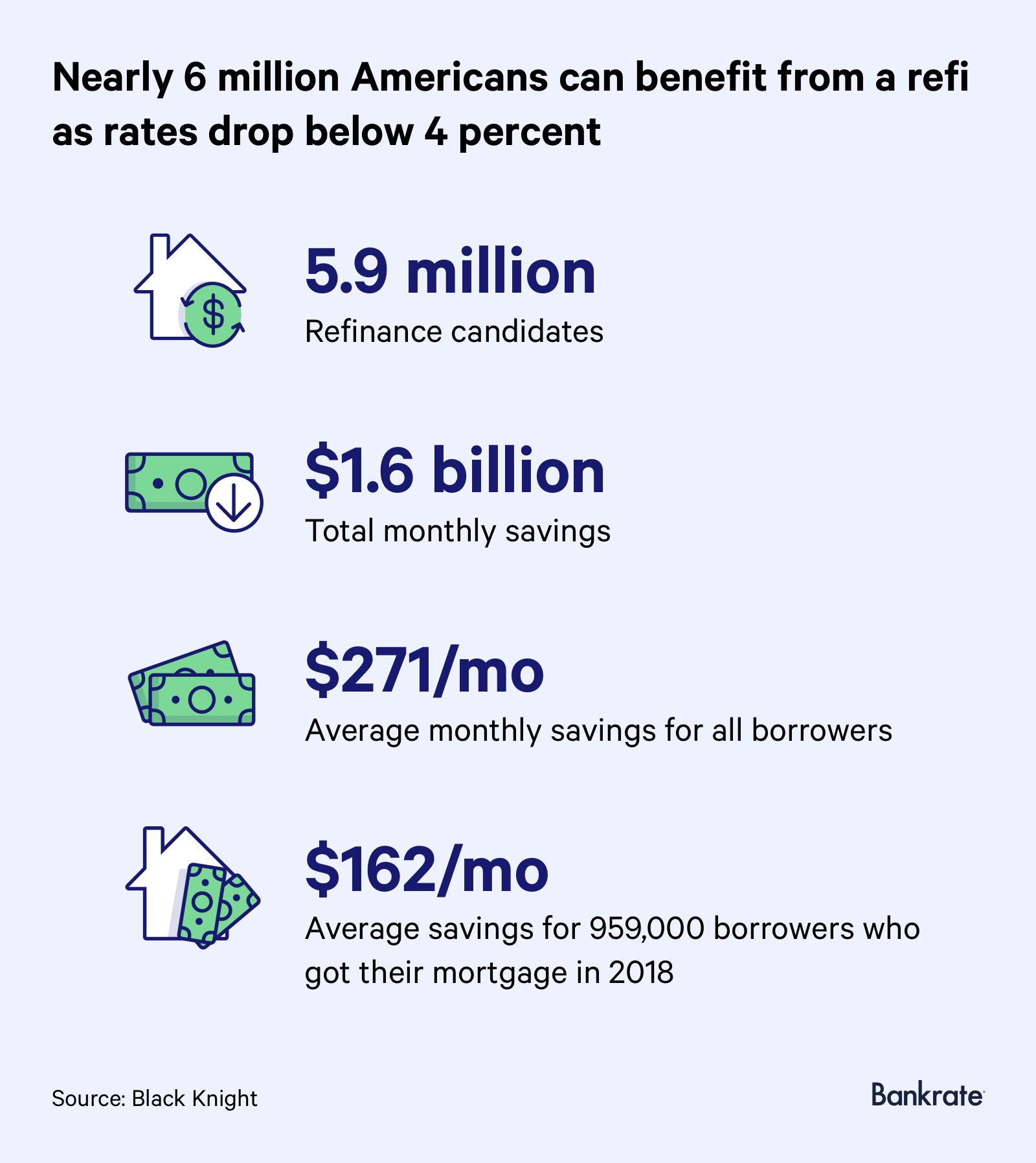

And if rates sink, you always can refinance!

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Read Also: How Much Does A 400000 Mortgage Cost

The Benefits And Drawbacks Of 30

Low monthly payments are the main advantage of a 30-year fixed mortgage. If you currently have a tight budget, this can work well for you. Its also why so many homebuyers choose it over shorter terms.

Furthermore, the long term allows you to qualify for a larger loan amount compared to a shorter term. With a bigger loan, you can buy a bigger house or select a better residential area for your family. And since your interest rate is fixed, it guarantees that your monthly principal and interest payments wont increase throughout the entire term.

However, it comes with several disadvantages. In exchange for low monthly payments, youll spend greater interest costs. Thats years of interest payments that you could have saved. It could be money for more important expenses, such as your childs college education.

Thirty-year fixed mortgages also have higher rates than shorter terms. Its typically 0.25 percent to 1 percent higher than 15-year fixed mortgages. Moreover, if you do buy a larger house, this requires higher maintenance expenses and property insurance. Lastly, 30-year fixed terms build home equity much slower. Its a long time, which means you could be paying it until retirement.

We created the table below to summarize the pros and cons of 30-year fixed-rate loans:

What Are The Disadvantages Of A 30

A 30-year fixed mortgage typically has a higher interest rate than a mortgage with a shorter repayment term. It also takes longer to build equity, and you pay more in total interest over a 30-year term than with a 15- or 20-year fixed-rate mortgage.

»MORE: See NerdWallets picks for best 15-year fixed-rate mortgage lenders

Read Also: How Much Do I Need To Earn For A Mortgage

How To Figure A Mortgage Insurance Premium

A fixed-rate mortgage is a fixed-term loan at a fixed interest rate, meaning both the rate and the length of the mortgage will not change. Mortgages are available with terms ranging from 10 years to 40 years, though a 30-year fixed-rate mortgage is most common. Once you have found a home to purchase, you will need to calculate the mortgage and interest payments. This is a simple process using free online calculators.

After 9 Years 2 Months Option A Will Be Less Expensive Than Option B

When we took into account upfront costs and interest, both options cost the same at the 9 year 2 month mark. Ifyou plan to ownyour home less than9 years2 months,Option Bis a better choice.

Break-even period

This is when both loan options cost the same amount of money overall. After this, your total cost for one loan may be higher than the other.

Points and credits

Points are a one-time payment you make at closing in exchange for a lower rate. Credits are a rebate you receive to help cover closing costs, resulting in a higher interest rate.

Interest rate

This is the interest youll be charged for your loan each year. Its slightly different than your Annual Percentage Rate , which also takes into account things like taxes and insurance.

Monthly payment

This is the amount you pay toward the principal on a monthly basis. For a fixed loan, this payment will stay the same throughout the life of the loan.

Total amount

This is the amount you end up paying over the life of the loan it takes into account the initial amount you borrowed, as well as the interest.

Option A

$590,791

Recommended Reading: How Much Is A Mortgage On A 400k House

How To Account For Taxes And Recurring Expenses

Accounting for recurring charges like PMI and HOA fees requires a little more work, but even these aren’t very difficult to calculate. You can find the total cost of recurring expenses by adding them together and multiplying them by the number of monthly payments . This will give you the lifetime cost of monthly charges that exclude the cost of your loan.

The reverse is true for annual charges like taxes or insurance, which are usually charged in a lump sum, paid once per year. If you want to know how much these expenses cost per month, you can divide them by 12 and add the result to your mortgage payment. Most mortgage lenders use this method to determine your monthly mortgage escrow costs. Lenders collect these additional payments in an escrow account, typically on a monthly basis, in order to make sure you don’t fall short of your annual tax and insurance obligations.

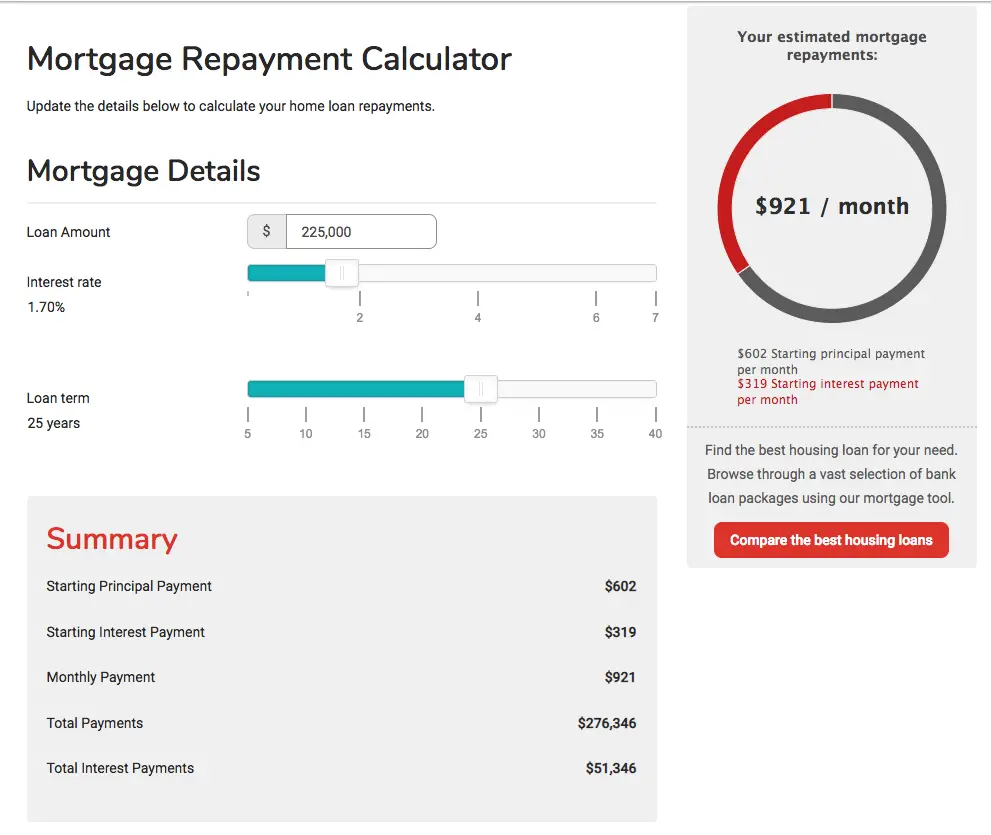

How To Calculate Mortgage Payments

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

You May Like: How Often Do You Pay Your Mortgage

How A Mortgage Calculator Can Help

As you set your housing budget, determining your monthly house payment is crucial it will probably be your largest recurring expense. As you shop for a purchase loan or a refinance, Bankrate’s Mortgage Calculator allows you to estimate your mortgage payment. To study various scenarios, just change the details you enter into the calculator. The calculator can help you decide:

Calculations For Different Loans

The calculation you use depends on the type of loan you have. Most home loans are standard fixed-rate loans. For example, standard 30-year or 15-year mortgages keep the same interest rate and monthly payment for their duration.

For these fixed loans, use the formula below to calculate the payment. Note that the carat indicates that youre raising a number to the power indicated after the carat.

Payment = P x x ^n] / ^n – 1

Also Check: What Is Rocket Mortgage Fieldhouse

Early Loan Repayment: A Little Goes A Long Way

One of the most common ways that people pay extra toward their mortgages is to make bi-weekly mortgage payments. Payments are made every two weeks, not just twice a month, which results in an extra mortgage payment each year. There are 26 bi-weekly periods in the year, but making only two payments a month would result in 24 payments.

Instead of paying twice a week, you can achieve the same results by adding 1/12th of your mortgage payment to your monthly payment. Over the course of the year, you will have paid the additional month. Doing so can shave four to eight years off the life of your loan, as well as tens of thousands of dollars in interest.

However, you don’t have to pay that much to make an impact. Even paying $20 or $50 extra each month can help you to pay down your mortgage faster.

Calculating Your Potential Savings

If you have a 30-year $250,000 mortgage with a 5 percent interest rate, you will pay $1,342.05 each month in principal and interest alone. You will pay $233,133.89 in interest over the course of the loan. If you pay an additional $50 per month, you will save $21,298.29 in interest over the life of the loan and pay off your loan two years and four months sooner than you would have.

You can also make one-time payments toward your principal with your yearly bonus from work, tax refunds, investment dividends or insurance payments. Any extra payment you make to your principal can help you reduce your interest payments and shorten the life of your loan.

How To Determine Which Home Loan Is Right For You

When reviewing your mortgage options, youll want to consider the following:

- How your mortgage will fit into your monthly budget. This can help answer the question, how much home can I afford?

- Your savings, which can help determine your down payment and ability to purchase mortgage points.

- Your future plans, especially how long you expect to live in the home.

Its important to note that what you see in the mortgage comparison calculator may vary from your actual mortgage figures. However, having a visual that shares how different mortgages affect your short- and long-term costs can help you narrow down the right option.

Don’t Miss: How Much Is A 400 000 Mortgage A Month

What Other Expenses Does Homeownership Entail

It’s important to recognize that the estimated total cost of your home purchase is only an estimate and not necessarily representative of future conditions. There are many factors that are not taken into account in the calculations we illustrated above we include a few below for your consideration.

Taxes

While these fixed fees are charged regularly, they have a tendency to change over time, especially in large metropolitan areas like New York and Boston. New-home purchases often have their values reassessed within a year or two, which impacts the actual taxes paid. For that reason, your originally forecasted tax liability may increase or decrease as a result of new assessments.

HOA Dues

For buyers considering condos, homeowners associations can increase their monthly dues or charge special HOA assessments without warning. This can make up a large portion of your housing expenses, especially in large cities with high maintenance fees. You might also be subject to increased volatility in HOA fees if the community you live in has issues keeping tenants or a troubled track record.

Maintenance Costs

Finally, typical mortgage expenses don’t account for other costs of ownership, like monthly utility bills, unexpected repairs, maintenance costs and the general upkeep that comes with being a homeowner. While these go beyond the realm of mortgage shopping, they are real expenses that add up over time and are factors that should be considered by anyone thinking of buying a home.

How To Lower Your Monthly Mortgage Payment

If the monthly payment you’re seeing in our calculator looks a bit out of reach, you can try some tactics to reduce the hit. Play with a few of these variables:

- Choose a longer loan. With a longer term, your payment will be lower .

- Spend less on the home. Borrowing less translates to a smaller monthly mortgage payment.

- Avoid PMI. A down payment of 20 percent or more gets you off the hook for private mortgage insurance .

- Shop for a lower interest rate. Be aware, though, that some super-low rates require you to pay points, an upfront cost.

- Make a bigger down payment. This is another way to reduce the size of the loan.

Recommended Reading: Can You Split Your Mortgage Payment

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

Mortgage Loan Apr Explained

A mortgage loan APR stands for annual percentage rate, a way of showing the true cost of a home loan or other type of loan. It takes into account not only the interest rate you pay, but also the closing cost fees that are charged as part of the loan and expresses them in terms of an annual percentage. Our mortgage APR calculator makes it easy to calculate the numbers and compare lenders.

FAQ: Shopping for a mortgage can be confusing. Borrowers have to sort through a mix of interest rates, fees, points and all the rest to try to figure out what’s the best deal.Many borrowers make the mistake of focusing solely on the mortgage interest rate when they go shopping for a home loan. But the mortgage rate is only part of the picture. Closing costs and other fees can significantly affect the total cost of a mortgage. Discount points in particular can reduce your rate but mean much higher costs up front. The mortgage APR takes all of these into account and expresses them in terms of an interest rate.

Mortgage APR is defined as the annualized cost of credit on a home loan. It is the interest rate that would produce the same monthly payment on your loan amount with no fees as you would pay if you rolled all your fees into the loan itself.

That’s what this mortgage APR calculator can determine for you, in addition to calculating your interest costs and producing a full amortization schedule.

Also Check: How To Check Credit Score For Mortgage