How Piti Affects Your Mortgage Qualification

When lenders assess whether or not you can afford a mortgage loan, theyll compare your estimated PITI with your gross monthly income .

Your PITI, combined with any existing monthly debts, should not exceed 43% of your monthly gross income this is called your debt-to-income ratio .

Your DTI is a primary factor in whether or not youll qualify for a mortgage.

Should I Choose A Long Or Short Loan Term

It depends on your budget and goals. A shorter term will allow you to pay off the loan quicker, pay less interest and build equity faster, but youll have a higher monthly payment. A longer term will have a lower monthly payment because youll pay off the loan over a longer period of time. However, youll pay more in interest.

How To Calculate Your Mortgage Payments

The calculus behind mortgage payments is complicated, but Bankrate’s Mortgage Calculator makes this math problem quick and easy.

First, next to the space labeled “Home price,” enter the price or the current value of your home .

In the “Down payment” section, type in the amount of your down payment or the amount of equity you have . A down payment is the cash you pay upfront for a home, and home equity is the value of the home, minus what you owe. You can enter either a dollar amount or the percentage of the purchase price you’re putting down.

Next, you’ll see Length of loan. Choose the term usually 30 years, but maybe 20, 15 or 10 and our calculator adjusts the repayment schedule.

Finally, in the “Interest rate” box, enter the rate you expect to pay. Our calculator defaults to the current average rate, but you can adjust the percentage. Your rate will vary depending on whether youre buying or refinancing.

As you enter these figures, a new amount for principal and interest will appear to the right. Bankrate’s calculator also estimates property taxes, homeowners insurance and homeowners association fees. You can edit these amounts or even ignore them as you’re shopping for a loan those costs might be rolled into your escrow payment, but they don’t affect your principal and interest as you explore your options.

Also Check: Who Pays Mortgage Broker Fees

Understanding Mortgage Loan Basics

When you buy property, youll often take out a mortgage loan to pay for some of the cost. You will give the lender a right to auction off or take possession of the property if you dont pay back the money and usually commit to making a monthly payment over a certain loan term, such as 30 or 40 years.

Each payment will include a mix of paying back loan principal, or the amount you initially borrowed, and interest, the extra percentage you pay to the lender in exchange for being able to take out the loan. As you continue to make payments, the percentage of each payment going toward principal will rise. As less principal is owed, less interest will be charged.

There may be other items paid through your mortgage payments, including homeowners insurance premiums, property tax and fees paid to a condo or homeowners association.

Consider The Cost Of Homeowners Insurance

Almost every homeowner who takes out a mortgage will be required to pay homeowners insurance another cost thats often baked into monthly mortgage payments made to the lender.

There are eight different types of homeowners insurance. The insurance policies with a high deductible will typically have a lower monthly premium.

Don’t Miss: Why Does My Mortgage Payment Keep Going Up

Why Use The Mortgage Loan Calculator

There are so many different mortgage and loan options to choose from, it can sometimes be a little overwhelming. Whether you are setting up a new mortgage to purchase a home or to refinance a mortgage on a home that you already own, there are always a great many aspects to consider.

To name just a few of the more common choices, there are fixed rate mortgages, adjustable rate mortgages, and fixed to adjustable rate mortgages for those who want something in between. Fixed rate mortgages with terms lasting between 15 and 30 years are currently the most common.

Whichever kind of mortgage you end up using, the information you get from the Mortgage Loan Calculator will remain relevant.

What To Expect From Your Mortgage Payment

The mortgage calculator is a great tool for anyone who has recently taken out a mortgage. It can be a little overwhelming to figure out what your monthly payments will be and how long it will take to pay off the mortgage.

The mortgage calculator is a great tool to use to figure out these things. You should also use the mortgage calculator as a way to figure out how much interest youre paying in order to pay off the mortgage faster.

Also Check: How To Remove Pmi From Wells Fargo Mortgage

The Pros And Cons Of Property Taxes

Transfer taxes are levied on real estate transactions, in addition to transfer taxes. This tax applies to 2.5% of the sale price as of the current date. In the end, owning a home has many advantages and disadvantages. Property taxes can also provide homeowners with valuable protection, despite the fact that they are a financial burden. Property taxes may be higher in higher-priced neighborhoods, but they may be lower in lower-priced ones.

Breakdown Of Mortgage Payments

Its important to understand your mortgage payment structure so that you can find ways to save money. Lets take a look at mortgage payments and their payment breakdowns.

Your mortgage principal balance and your mortgage interest will change during your mortgage term, but something that doesnt change is your monthly payment amount. Your selected amortization period determines your monthly payment amount which will be fixed for the duration of your term. When you first get a mortgage, most of your monthly payment will go towards interest. You havent had time to pay down your mortgage balance yet, and so when interest is charged, youll need to pay interest on a higher mortgage balance.

As time passes by and your balance decreases, there is less balance remaining for interest to be charged. This reduces the proportion of interest charged compared to your monthly payment. The amount remaining can then go towards paying down your mortgage balance further. This is similar to compound interest but in reverse.

- Mortgage Principal Balance: $500,000

Recommended Reading: What Is Deferred Interest On A Mortgage Loan

Determining The Right Down Payment Amount

A purchase calculator can help you determine the down payment you need. There are minimum down payments for various loan types, but even beyond that, a higher down payment can mean a lower monthly payment and the ability to avoid mortgage insurance.

On the flip side, a higher down payment represents a more significant hurdle, particularly for first-time home buyers who dont have an existing home to sell to help fund that down payment. The calculator can show you options so that you can balance the amount of the down payment with the monthly mortgage payment itself.

How Much Income Do I Need To Buy A $400k Home

This answer isnt just about your income. Your interest rate and your plans for a down payment play an important role. For example, if youre planning to secure an FHA loan and put down 3.5 percent on a $400,000 home, youll need to earn just over $102,000 per year for a 30-year mortgage with a 5 percent interest rate.

If youre sitting on the money you need for a 20 percent down payment, your income needs look a lot different. For example, if you can put down $80,000 and lock in a 4.75 percent interest rate on a 30-year mortgage, you only need to earn $78,000 per year.

Don’t Miss: Where Are Mortgage Interest Rates Going

The High Cost Of Quick Decisions

Between 2015 and 2016, nearly one in three UK consumers chose mortgage products which cost them more than £550 per year. They got more expensive options over cheaper alternatives that were readily available and which they also qualified for. This fee difference amounts to 12.7% of what consumers spend annually on their mortgage.

The remortgage market is more competitive amongst lenders than the first-time buyer market. So only around 12% in that category opted for strongly dominated product choices. About 18% of first-time buyers fall into the strongly dominated product choice category, and well over 20% of mover mortgages fall in this category. Movers who are in a rush often make emotionally driven or time-sensitive decisions. This compromises their ability to obtain the best deal the way a person who is remortgaging can.

About 14% of borrowers in the top credit score quartile secured strongly dominated products, while more than 20% of consumers in the bottom quartile did not. In general, people who are young, including borrowers with low incomes, low credit scores, and limited funds for deposit are more likely to get an unfavourable mortgage deal. If there are factors that make your transaction more complex, you might find it more challenging to obtain a good loan.

How Do I Manually Calculate House Payments

Related Articles

If you are in the market for a new place to call home, one of the most significant questions you are probably asking yourself is, Can I afford this? After all, with home prices soaring in the San Francisco area, committing to purchasing a home is a weighty decision that carries with it a series of long-term implications. That being said, it is possible to take a proactive approach toward your property search by learning how to manually calculate what your house payments would likely be if you purchased any one of your preferred properties. Fortunately, this can be accomplished relatively easily if you have the correct information on hand.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

Read Also: Can You Sell A House With A Mortgage On It

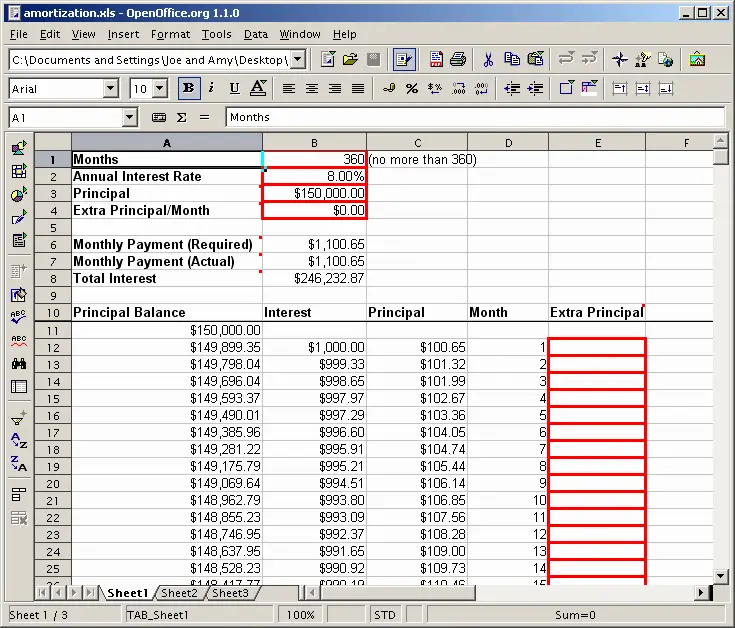

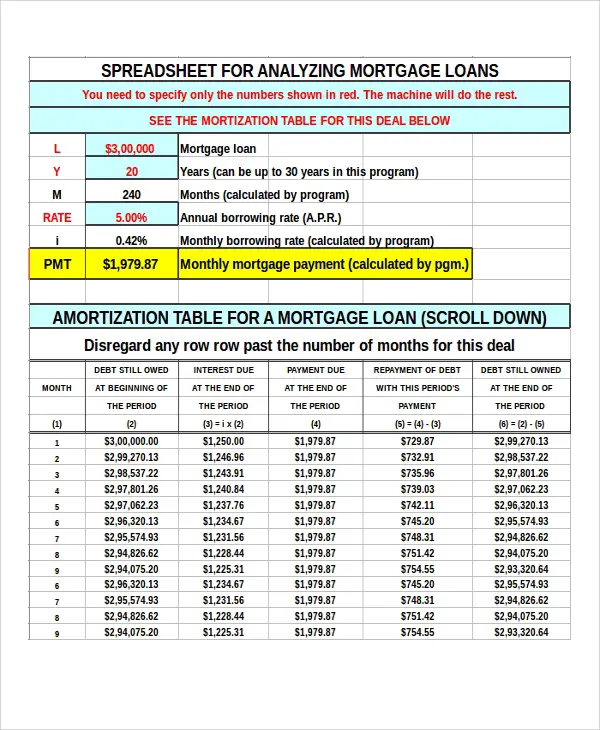

How Much Interest Do You Pay

Your mortgage payment is important, but you also need to know how much of it gets applied to interest each month. A portion of each monthly payment goes toward your interest cost, and the remainder pays down your loan balance. Note that you might also have taxes and insurance included in your monthly payment, but those are separate from your loan calculations.

An amortization table can show youmonth-by-monthexactly what happens with each payment. You can create amortization tables by hand, or use a free online calculator and spreadsheet to do the job for you. Take a look at how much total interest you pay over the life of your loan. With that information, you can decide whether you want to save money by:

- Finding a lower interest rate

- Choosing a shorter-term loan to speed up your debt repayment

Shorter-term loans such as 15-year mortgages often have lower rates than 30-year loans. Although you would have a bigger monthly payment with a 15-year mortgage, you would spend less on interest.

Recommended Reading: Reverse Mortgage For Mobile Homes

Add All Fixed Costs And Variables To Get Your Monthly Amount

Figuring out whether you can afford to buy a home requires a lot more than finding a home in a certain price range. Unless you have a very generous and wealthy relative who’s willing to give you the full price of your home and let you pay it back without interest, you can’t just divide the cost of your home by the number of months you plan to pay it back and get your loan payment. Interest can add tens of thousands of dollars to the total cost you repay, and in the early years of your loan, the majority of your payment will be interest.

Many other variables can influence your monthly mortgage payment, including the length of your loan, your local property tax rate and whether you have to pay private mortgage insurance. Here is a complete list of items that can influence how much your monthly mortgage payments will be:

Also Check: Can I Get A Mortgage In Another Country

Considerations For Extra Payments

Pay Off Higher Interest Debts First

Paying off your mortgage early isn’t always a no-brainer. Though it can help many people save thousands of dollars, it’s not always the best way for most people to improve their finances.

Compare your potential savings to your other debts. For example, if you have , it makes more sense to pay it off before putting any extra money toward your mortgage that has only a 5 percent interest rate.

Further, unlike many other debts, mortgage debt can be deducted from income taxes for those who itemize their taxes.

Also consider what other investments you can make with the money that might give you a higher return. If you can make significantly more with an investment and have an emergency savings fund set aside, you can make a bigger financial impact investing than paying off your mortgage. It is worth noting volatilility is the price of admission for higher earning asset classes like equities & profits on equites can be taxed with either short-term or long-term capital gains taxes, so the hurdle rate for investments would be the interest rate on your mortgage plus the rate the investments are taxed at.

How To Use Our Mortgage Payment Calculator

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

Recommended Reading: How Much Do I Need For A Mortgage

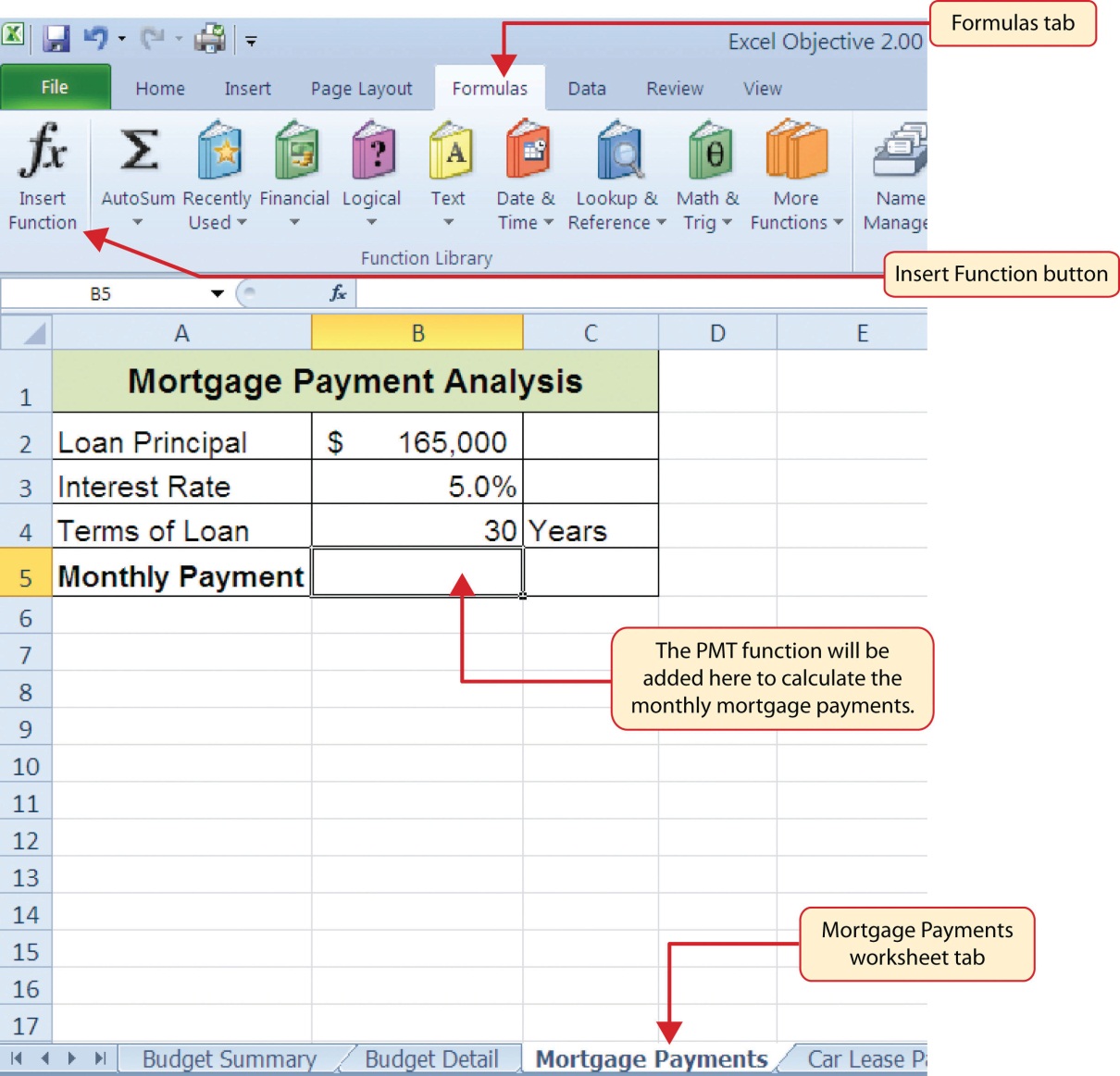

How Do You Calculate A Loan Payment

Heres how you would calculate loan interest payments.

then What is the formula for calculating a 30 year mortgage? Multiply the number of years in your loan term by 12 to get the number of total payments for your loan. For example, a 30-year fixed mortgage would have 360 payments .

Which formula should be used to correctly calculate the monthly mortgage payment? Use the formula P= L / to calculate your monthly fixed-rate mortgage payments. In this formula, P equals the monthly mortgage payment.

Calculating Interest On A Car Personal Or Home Loan

These loans are called amortizing loans. The mathematical whizzes at your bank have worked them out so you pay a set amount each month and at the end of your loan term, youâll have paid off both interest and principal.

You can use an interest calculator to work out how much interest youâre paying all up, or, if youâd rather do it by hand, follow these steps:

1. Divide your interest rate by the number of payments youâll make in the year . So, for example, if youâre making monthly payments, divide by 12.

2. Multiply it by the balance of your loan, which for the first payment, will be your whole principal amount.

This gives you the amount of interest you pay the first month.

So for example, on a personal loan of $30,000 over a period of 6 years at 8.40% p.a. and making monthly repayments:

Because youâve now begun to pay off your principal, to work out the interest you pay in the following months, you need to first calculate your new balance. So:

1. Minus the interest you just calculated from the amount you repaid. This gives you the amount that you have paid off the loan principal.

2. Take this amount away from the original principal to find the new balance of your loan.

To work out ongoing interest payments, the easiest way is to break it up into a table. So using the above example, your calculations might look like this:

Also Check: What Is Mortgage Rate Vs Apr

Also Check: How To Assume A Va Mortgage

What Is An Interest

An interest-only mortgage is a home loan that allows you to only pay the interest for the first several years you have the mortgage. After that period, you’ll need to pay principal and interest, which means your payments will be significantly higher. You can make principal payments during the interest-only period, but you’re not required to.

Want To Make Irregular Payments Do You Need More Advanced Calculation Options

- Biweekly Payment Method: Please see our bi-weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment.

- Extra Payments In The Middle of The Loan Term: If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan. For example, if you are 3.5 years into a 30-year home loan, you would set the loan term to 26.5 years and you would set the loan balance to whatever amount is shown on your statement. If you do not have a statement to see the current balance you can calculate the current balance so long as you know when the loan began, how much the loan was for & your rate of interest.

- Irregular Extra Payments: If you want to make irregular extra contributions or contributions which have a different periodicity than your regular payments try our advanced additional mortgage payments calculator which allows you to make multiple concurrent extra payments with varying frequencies along with other lump sum extra payments.

For your convenience current Los Angeles mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions.

Don’t Miss: What Is A Good Fico Score To Get A Mortgage