What Is A Good Interest Rate On A Mortgage

A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details fit your needs. Consider details such as the loan type , length of the loan, origination fees and other costs.

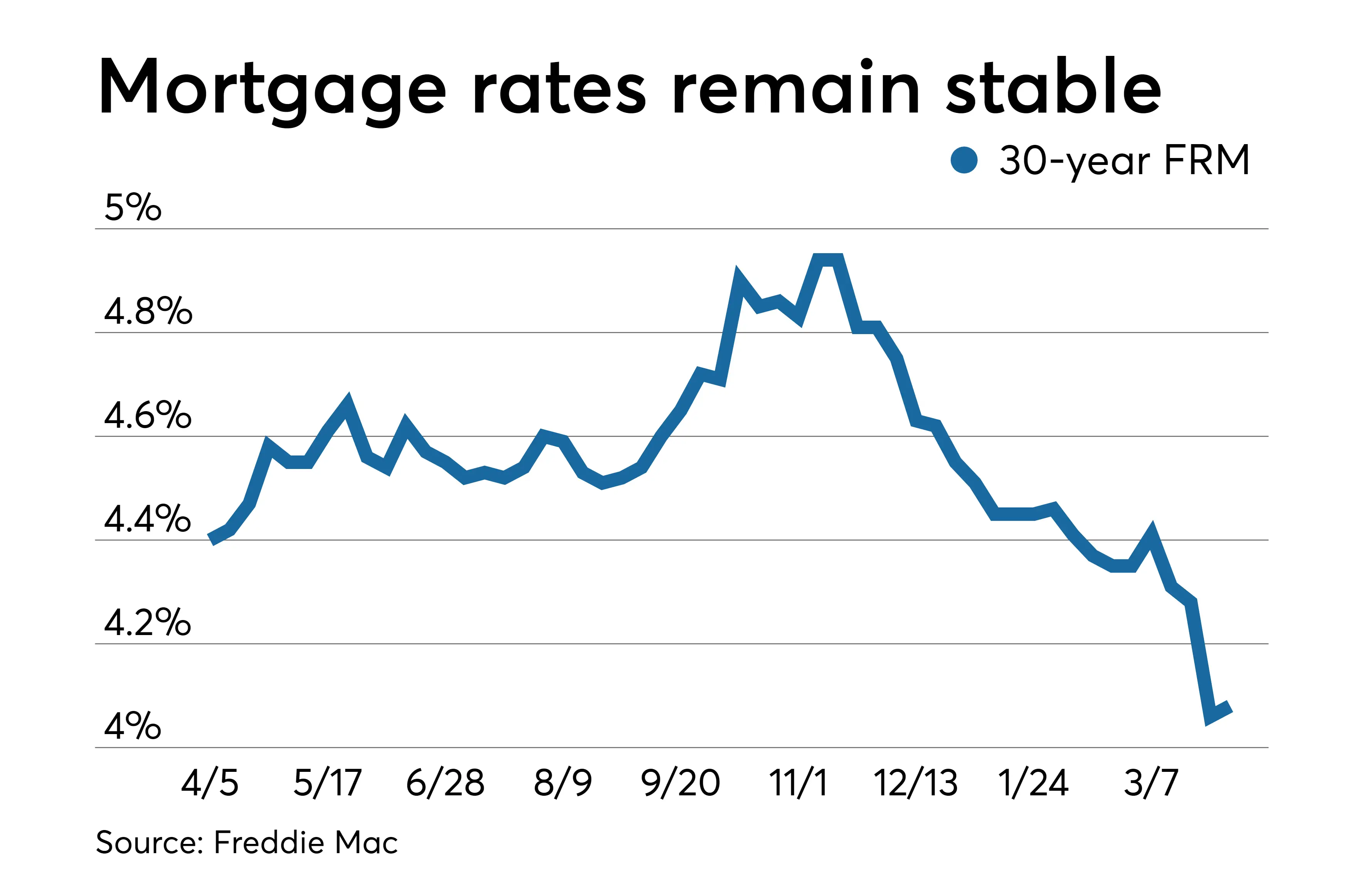

That said, today’s mortgage rates are near historic lows. Freddie Mac’s average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower or are taking out a non-conforming mortgage, you may see a higher rate. Moneys daily mortgage rate data shows borrowers with 700 credit scores are finding rates around 3.6% right now.

Whats The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing money whereas the APR is the yearly cost of borrowing as well as the lender fees and other expenses associated with getting a mortgage.

The APR is the total cost of your loan, which is the best number to look at when youre comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders , so youll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate.

The Market Consensus On The Mortgage Rate Forecast In Canada Is For The Central Bank To Increase Mortgage Interest Rates By 125% In 2022

The main tool we have when reading the current mortgage rate market is the Government of Canada Bond Yield. The Canadian bond is essentially a government debt security that pays a return to an investor. The % based return is called the yield and it is considered to be one of the safest investments because the Government would have to go bankrupt, in order for it not to pay its investors.

The Government of Canada 5 year Bond Yield factors in all known economic data on a day to day, and even a minute to minute basis. Simply put when the market/ bond traders think that the Central Bank of Canada will increase rates, the Bond Yield increases. When the Bond market thinks the Central Bank rate will decrease, then the yield drops. In other words, the Bond yield trades, or is priced in anticipation of where the Central Bank of Canada rates will move. The Central Bank of Canada makes its rate decisions, based on the status of the economy.

Currently, the Canadian Bonds are priced in anticipation of a 1.25% increase in rates in 2022. However, the Bond yield at the time of writing is down from an October 2021 high of 1.51%. The trend seems to be downwards, however, there will likely be volatility in this yield in early 2022 as the market digests and prices in a huge amount of economic data.

Recommended Reading: Monthly Mortgage On 1 Million

Year Mortgage Rate Forecast For 2021 2022 2023 2024 And 2025

| Month |

| 31.1% |

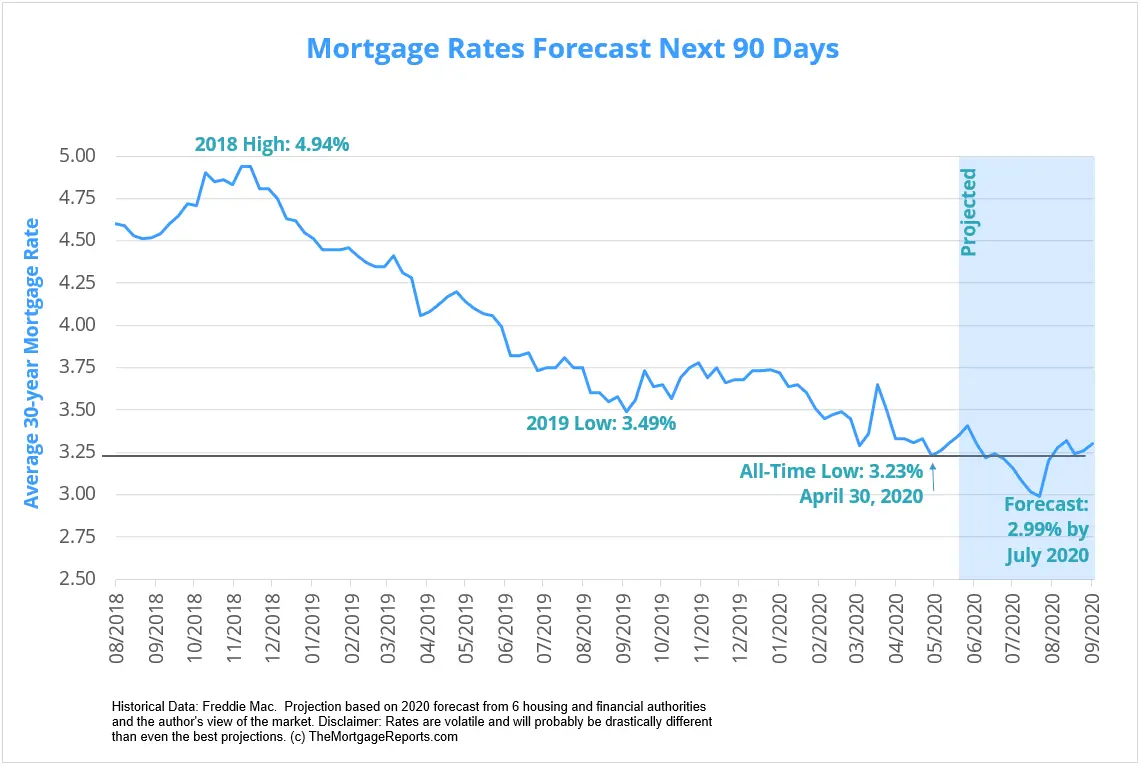

30 Year Mortgage Rate forecast for .Maximum interest rate 3.14%, minimum 2.96%. The average for the month 3.05%. The 30 Year Mortgage Rate forecast at the end of the month 3.05%.

Mortgage Interest Rate forecast for .Maximum interest rate 3.07%, minimum 2.89%. The average for the month 3.00%. The 30 Year Mortgage Rate forecast at the end of the month 2.98%.

30 Year Mortgage Rate forecast for .Maximum interest rate 3.02%, minimum 2.84%. The average for the month 2.94%. The 30 Year Mortgage Rate forecast at the end of the month 2.93%.

Mortgage Interest Rate forecast for .Maximum interest rate 2.98%, minimum 2.80%. The average for the month 2.90%. The 30 Year Mortgage Rate forecast at the end of the month 2.89%.

30 Year Mortgage Rate forecast for .Maximum interest rate 3.10%, minimum 2.89%. The average for the month 2.97%. The 30 Year Mortgage Rate forecast at the end of the month 3.01%.

Mortgage Interest Rate forecast for May 2022.Maximum interest rate 3.25%, minimum 3.01%. The average for the month 3.11%. The 30 Year Mortgage Rate forecast at the end of the month 3.16%.

30 Year Mortgage Rate forecast for .Maximum interest rate 3.37%, minimum 3.16%. The average for the month 3.24%. The 30 Year Mortgage Rate forecast at the end of the month 3.27%.

Mortgage Interest Rate forecast for .Maximum interest rate 3.42%, minimum 3.22%. The average for the month 3.31%. The 30 Year Mortgage Rate forecast at the end of the month 3.32%.

How Are Mortgage Rates Set

Mortgage rates fluctuate for the same reasons home prices change supply, demand, inflation, and even the U.S. employment rate can all impact mortgage rates. The demand for homes isnt necessarily a sign of where mortgage rates are headed. The best indicator of whether rates will go up or down is the 10-year Treasury bond rate.

When a lender issues a mortgage, it takes that loan and packages it together with a bunch of other mortgages, creating a mortgage-backed security , which is a type of bond. These bonds are then sold to investors so the bank has money for new loans. Mortgage bonds and 10-year Treasury bonds are similar investments and compete for the same buyers, which is why the rates for both move up or down in tandem.

Thats why, in a slumping economy, when more investors want to purchase safer investments, like mortgage-backed securities and treasury bonds, rates tend to go down. The Federal Reserve has been purchasing MBS and treasury bonds, and this increased demand has led to the lowest mortgage rates on record.

Read Also: Does Rocket Mortgage Sell Their Loans

What Is The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing the money, and it is advertised as a percentage of the loan. , and it includes the interest rate plus other fees associated with the mortgage. So the APR will provide you with a better idea of the total cost of financing the loan. You may find lenders offering the same interest rate and monthly payments, but if one is charging higher upfront fees, then the APR will be higher.

The Federal Truth in Lending Act requires lenders to disclose the APR, but the fees can vary. When comparing APRs between lenders, ask which fees are not included for better comparison.

Mortgage Rates Decrease Slightly

Even with this week’s decline, mortgage rates have increased more than a full percent over the last six months. Overall economic growth remains strong, but rising inflation is already impacting consumer sentiment, which has markedly declined in recent months. As we enter the spring homebuying season with higher mortgage rates and continued low inventory, we expect home price growth to remain firm before cooling off later this year.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey.

Read Also: How Much Is Mortgage On A 1 Million Dollar House

Comparing Current Mortgage Rates

Borrowers who comparison shop tend to get lower rates than borrowers who go with the first lender they find. You can compare rates online to get started. However, to get the most accurate quote, you can either go through a mortgage broker or apply for a mortgage through various lenders.

The advantage of going with a broker is you do less of the work and youll also get the benefit of their lender knowledge. For example, they might be able to match you with a lender whos suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. However, depending on the broker, you might have to pay a fee.

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you dont have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time wont show up on your credit report as its usually counted as one query.

Finally, when youre comparing rate quotes, be sure to look at the APR, not just the interest rate. The APR reflects the total cost of your loan on an annual basis.

About Our Data Source For This Tool

The lenders in our data include a mix of large banks, regional banks, and credit unions. The data is updated semiweekly every Wednesday and Friday at 7 a.m. In the event of a holiday, data will be refreshed on the next available business day.

The data is provided by Informa Research Services, Inc., Calabasas, CA. www.informars.com. Informa collects the data directly from lenders and every effort is made to collect the most accurate data possible, but they cannot guarantee the datas accuracy.

Recommended Reading: How Does The 10 Year Treasury Affect Mortgage Rates

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

The Feds Monetary Policy Can Increase Or Decrease Interest Rates

While the Federal Reserve does not set mortgage rates, it certainly affects them through its conduct of monetary policy. Because of the housing sectors economic importance, mortgage rates are an important channel through which changes in the Feds monetary policy affect consumer balance sheets and spending.

Read Also: Who Is Rocket Mortgage Owned By

How Does The Loan Term Impact My Mortgage

One important thing to consider when choosing a mortgage is the loan term, or payment schedule. The loan terms most commonly offered are 15 years and 30 years, although you can also find 10-, 20- and 40-year mortgages. Mortgages are further divided into fixed-rate and adjustable-rate mortgages. For fixed-rate mortgages, interest rates are stable for the life of the loan. Unlike a fixed-rate mortgage, the interest rates for an adjustable-rate mortgage are only fixed for a certain amount of time . After that, the rate fluctuates annually based on the market rate.

One thing to think about when deciding between a fixed-rate and adjustable-rate mortgage is how long you plan on living in your home. If you plan on living long-term in a new house, fixed-rate mortgages may be the better option. While adjustable-rate mortgages might offer lower interest rates upfront, fixed-rate mortgages are more stable in the long term. However you may get a better deal with an adjustable-rate mortgage if you’re only planning to keep your home for a few years. There is no best loan term as an overarching rule it all depends on your goals and your current financial situation. It’s important to do your research and know your own priorities when choosing a mortgage.

Find the Best Refinance Rates with the CNET Rate Alert

Mortgage Rates Continue To Climb After A Brief Drop Some Experts Predicting That They Could Top 6 Percent By End Of Year When Will They Come Down Again

Americans have been battered by rising prices at the pump, in the supermarket and for those buying a home, mortgage rates that have rocketed at the same time housing prices continue to surge. Despite a brief dip in mortgage rates, the 30-year fixed-rate surged more than half a percentage point last week, the largest one-week increase in Freddie Macs survey since 1987.

These higher rates are the result of a shift in expectations about inflation and the course of monetary policy, said Sam Khater, Freddie Macs Chief Economist. Higher mortgage rates will lead to moderation from the blistering pace of housing activity that we have experienced coming out of the pandemic, ultimately resulting in a more balanced housing market.

Recommended Reading: How Does Rocket Mortgage Work

Why Are Interest Rates Going Up

In times of strong economic growth, more people want to borrow money to expand their businesses. Just like higher demand for anything else means price increases for those items, more people wanting to borrow money means that mortgage lenders need to pay investors a higher interest rate to get them to lend that money. So, interest rates generally go up when the economy is strong and go down when the economy is weak. This was also one of the reasons why interest rates dropped during the pandemic.

When inflation is high, Bank of Canada may raise the interest rate to slow things down a little. The 6.8 percent pace of inflation in April was the fastest rise from one year to another in over three decades.

Other factors that affect Bank of Canadas interest rate policy include what is happening in other economies especially the United States as well as continuing supply-chain issues, the war in Ukraine and the lockdowns in China that make investors nervous.

When Will Interest Rates Rise

The Bank of England has voted to increase the base rate to 0.25% from its record low of 0.10%.

The spike in inflation has put pressure on the Banks Monetary Policy Committee to increase rates.

While this should slow down rising inflation, there are concerns that increasing the cost of debt will put pressure on households that are already struggling with a cost of living crisis.

In this article, we explain:

This article contains affiliate links that can earn us revenue*

You May Like: Rocket Mortgage Qualifications

What’s Happened With House Prices In The 12 Months To February 2022

It will come as no surprise to anyone who has watched, read, or listened to a news article in the past 12 months that housing is up in a big way. The national median is up by 20.6%% to $880,000 with areas like West Coast and Canterbury up by around 30%. Auckland remains the most expensive area with a median house price of $1,200,000 however this has been stagnant for a few months now . .

How The Bank Of England Base Rate Is Set

The MPC is the nine-person committee, within the BOE, that determines the BOE base rate. Usually, every six weeks the Bank announces the MPC’s interest-rate decision. You can find a full schedule of decision dates on the Bank of England website. Whenever a decision is announced the MPC meeting minutes are also published. These minutes are scrutinised by investors for any hints of when rates might go up or down in the future. For example, they would see how many of the nine-person committee voted for interest rates to go up, down or stay the same.

The forecasting of the Bank of England base rate has been transformed in recent years. The former Governor of the Bank of England , Mark Carney, originally created a notional link between the UK unemployment rate and the BOE base rate before replacing this with 18 economic indicators which still inform the BOE’s interest rate decision making today, under current Governor, Andrew Bailey.

Recommended Reading: Chase Mortgage Recast

Make Fortnightly Repayments Instead Of Monthly

“Simply making repayments every two weeks instead of once a month can save you significant money,” says financial advisor Kate McCallum.

It’s all down to a timing trick. There are only 12 months in the year, but 26 fortnights.

So, you’ll end up making an extra two repayments for the year without even realising it.

Let’s crunch the numbers.

If you have an $800,000 loan for 30 years at an interest rate of 5 per cent, over the life of the loan you’ll save more than $210,000 in interest, says Kate McCallum.

And you’ll pay off your loan more than five years earlier.

Whats A Good Mortgage Rate

Mortgage rates can change drastically and oftenor stay the same for many weeks. The important thing for borrowers to know is the current average rate. You can check Forbes Advisors mortgage rate tables to get the latest information.

The lower the rate, the less youll pay on a mortgage. Todays rate environment is considered extremely well-priced for borrowers. However, depending on your financial situation, the rate youre offered might be higher than what lenders advertise or what you see on rate tables.

If youre hoping to get the most competitive rate your lender offers, talk to them about what you can do to improve your chances of getting a better rate. This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile.

Also Check: 10 Year Treasury Vs Mortgage Rates