How Much Is A $250k Loan

The monthly payments for a $250K loan are $1,342.05 and $233,139.46 in total interest payments on a 30 year term with a 5% interest rate. There might be other costs such as taxes and insurance.Following is a table that shows the monthly mortgage payments for $250,000 over 30 years and 15 years with different interest rates.

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

What Is A Mortgage Payment

Your mortgage payment is the amount of money you must pay every month to pay down, and ultimately pay off, your mortgage loan. Your mortgage payment covers both the principal and the interest on the loan. It can also include mortgage default insurance, also sometimes known as CMHC insurance , property taxes and other fees. When you first begin making payments, more of it goes towards covering interest, but over time, more of your payment will eventually go to paying down your mortgage balance.

Read Also: How Much Is The Average Monthly Mortgage

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

How To Increase Your Mortgage Affordability

If you have found that your maximum affordability is lower than you expected, here are some reasons that might beand what you can do about it.

- GDS ratio: If your GDS ratio is limiting your mortgage affordability, youll need to increase your gross household income.

- TDS ratio: If its your TDS ratio, the likely culprit is existing debt. Focus on paying off your credit card balances or car loans to increase your mortgage affordability.

- Down payment: Youll need to save at least 5% of your homes purchase price or more, depending on the desired purchase price. If this is a limiting factor, consider options to increase your down payment, such as putting more money aside each month, accessing up to $35,000 in RRSP funds through the Home Buyers Plan or asking a family member for a monetary gift.

- Get a co-signer: Having a family member co-sign your mortgage will add their income to your application, increasing how much mortgage you can afford. Keep in mind that if you default on your payments, your co-signer will be responsible for the debt.

You May Like: Does Rocket Mortgage Service Their Own Loans

You May Like: How Much Faster Can I Pay Off My Mortgage Calculator

How To Get A $250000 Mortgage

If youve weighed both the upfront and long-term costs of a $250,000 mortgage and are comfortable moving forward, its time to start the mortgage process.

Here are the steps to follow to get a mortgage:

What Is The Total Interest On A 250000 Mortgage

On a 30-year mortgage with a 4% fixed interest rate, youll pay £179,673.77 in interest over the life of your loan. Thats about two-thirds of what you borrowed in interest.

If you instead opt for a 15-year mortgage, youll pay £82,859.57 in interest over the life of your loan or about 46% of the interest youd pay on a 30-year mortgage.

-

See how much you’d pay in total interest based on the interest rate.

Interest £261,010.10

You May Like: How Much Do I Have Left On My Mortgage Calculator

Best Mortgage Lenders For A 250k Loan

When you want to buy a house with a mortgage of 250k, its a huge deal, so its wise to find the best mortgage lender to help you do that. We recommend shopping for offers from at least three different lenders to find the best rate.

You can compare mortgage rates and other loan terms and choose the best fit for you. Taking the time to do your research can really pay off big, Im talking about thousands of dollars over the life of the loan.

To help you choose the best mortgage lender, Smarts has picked the best mortgage lenders that weve found that offer an online easy application to help you get a home loan with the best terms.

What Is An Amortization Schedule

An amortization schedule shows your monthly payments over time and also indicates the portion of each payment paying down your principal vs. interest. The maximum amortization in Canada is 25 years on down payments less than 20%. The maximum amortization period for all mortgages is 35 years.

Though your amortization may be 25 years, your term will be much shorter. With the most common term in Canada being 5 years, your amortization will be up for renewal before your mortgage is paid off, which is why our amortization schedule shows you the balance of your mortgage at the end of your term.

Read Also: How Much Is Mortgage For A Million Dollar Home

My Mortgage Payment Plan

This line graph shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.

Find out how much you can save by changing your payment frequency.

This table shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.| Amortization |

|---|

* These calculations are based on the information you provide they are approximate and for information purposes only. Actual payment amounts may differ and will be determined at the time of your application. Please do not rely on this calculator results when making financial decisions please visit your branch or speak to a mortgage specialist. Calculation assumes a fixed mortgage rate. Actual mortgage rates may fluctuate and are subject to change at any time without notice. The maximum amortization for a default insured mortgage is 25 years.

** Creditor Insurance for CIBC Mortgage Loans, underwritten by The Canada Life Assurance Company , can help pay off, reduce your balance or cover your payments, should the unexpected occur. Choose insurance that meets your needs for your CIBC Mortgage Loan to help financially protect against disability, job loss or in the event of your death.

How Long Do You Want The Mortgage Term To Be

Most mortgages are fully repaid over 25 years, but you can opt for a longer or a shorter mortgage term. Your mortgage term could be as long as 35 years, or as short as five years .

Longer mortgage terms generally mean lower monthly repayments, as you have longer to pay off the loan. Against that, the total amount you repay will be greater for the same reason.

Heres an example:

A £250,000 25-year mortgage with a 2 per cent fixed-rate deal would mean an initial monthly payment of £1,060. However, the same mortgage on a 15-year term would mean an initial monthly payment of £1,609.

However, assuming you could keep 2 per cent interest , with the 25-year mortgage you would repay £318,000 in total but with the 15-year mortgage you would repay only £289,620 in total.

Read Also: How To Find Total Interest Paid On A Mortgage

Details Of Minnesota Housing Market

Minnesota, also known as the North Star State, has just 5.6 million residents, according to the Census Bureau. In comparison, thats about 65% of New York Citys population. What Minnesota lacks in population, however, it makes up for in size. The Canada-bordering state is the 12th largest in the U.S. by size, encompassing roughly 86,900 square miles. While much of the land is farm or forest, you will find a number of metro areas in the state. The largest cities in Minnesota are Minneapolis, St. Paul, Rochester, Duluth and Bloomington. The twin cities of St. Paul and Minneapolis are on the southeastern side of the state and border Wisconsin. Duluth is northeast and borders Lake Superior. The most northern and southern and western parts of the state have the least number of residents.

Minneapolis and St. Paul experienced an extreme shortage of homes available for sales, according to the University of St. Thomas Real Estate Analysis. In St Louis County, home to Duluth, the median home value is $152,000. In Ramsey County, home to St. Paul, the median home value is $219,400.

Some of the most affordable places to live in Minnesota, as ranked by our study, are Otsego, Montevideo, Redwood Falls and Austin. This study factored in average closing costs, property taxes, homeowners insurance, average mortgage payment and median income.

How Much A $250000 Mortgage Will Cost You

Theres more to a mortgage than just the monthly payment. Before you take out a $250,000 mortgage, youll need to account for things like interest, insurance, taxes, closing costs, and more.

Edited byChris JenningsUpdated August 8, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. By refinancing your mortgage, total finance charges may be higher over the life of the loan. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

The monthly payment isnt the only cost youll want to think about when taking out a mortgage. To gauge the real cost of your loan, youll need to think about interest, too or how much it costs to borrow the money over time.

Learn more about how much a $250,000 mortgage will cost you throughout the life of the loan:

You May Like: How To Find Mortgage Payment

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

Recommended Reading: How Much Would My Mortgage Payment Be

How Much Are Repayments On A $250k Mortgage

The exact repayment amount for a $250,000 mortgage will be determined by several factors including your deposit size, interest rate and the type of loan. It is best to use a mortgage calculator to determine your actual repayment size.

For example, the monthly repayments on a $250,000 loan with a 5 per cent interest rate over 30 years will be $1342. For a loan of $300,000 on the same rate and loan term, the monthly repayments will be $1610 and for a $500,000 loan, the monthly repayments will be $2684.

Also Check: How Much Is A 95000 Mortgage Per Month

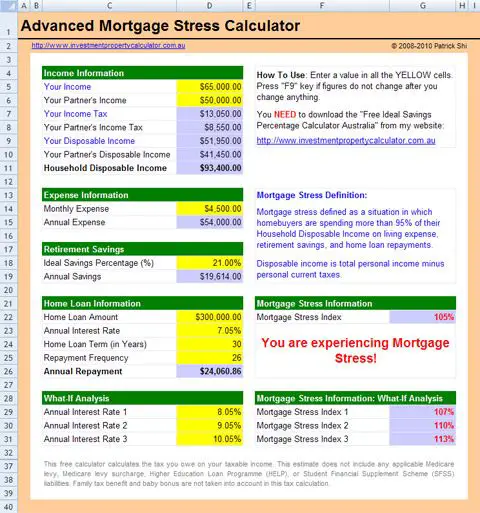

Dont Overextend Your Budget

When you buy a more costly home like a 300k mortgage or 400k mortgage, banks and real estate agents make more money.

Most of the time, banks pre-approve you for the maximum amount that you can afford. Your budget will be stretched to its limits right out of the gate.

Its critical to ensure that youre happy with your monthly payment and the amount of money youll have after purchasing a house.

Every major purchase should begin with a carefully-constructed budget, which should include your debt, income and assets. You should include how much you need to bring to the table in order for this purchase to make sense.

First-time homebuyers often have more debt than they do income, which makes it necessary to start with a bare bones plan of how the money will be spent on housing and other expenses before jumping into homeownership. Having a plan to get out of debt is often necessary.

Youll also want to realistically assess costs associated with homeownership. For example, how much will it cost to maintain your home?

Make sure you have enough available monthly income so that your mortgage payments, property insurance, taxes and homeowners association fees are manageable.

To get a clear picture of what you can afford and how much you have available for a downpayment, view SmartAssets downpayment calculator in minutes to determine your monthly payment using a mortgage calculator.

What Would You Like To Do

Your approximate payment is $*.

|

Mortgage default insurance protects your lender if you can’t repay your mortgage loan. You need this insurance if you have a high-ratio mortgage, and its typically added to your mortgage principal. A mortgage is high-ratio when your down payment is less than 20% of the property value. Close. |

|---|

Don’t Miss: How Much Does A Loan Officer Make On A Mortgage

Typical Costs Included In A Mortgage Payment

- Principal: This is the amount you borrowed from the lender.

- Interest: This is what the lender charges you to lend you the money. Interest rates are expressed as an annual percentage.

- Property taxes: Local authorities assess an annual tax on your property. If you have an escrow account, you pay about one-twelfth of your annual tax bill with each monthly mortgage payment.

- Homeowners insurance: Your insurance policy can cover damage and financial losses from fire, storms, theft, a tree falling on your home and other hazards. If you live in a flood zone, youll have an additional policy, and if youre in Hurricane Alley or earthquake country, you might have a third insurance policy. As with property taxes, you pay one-twelfth of your annual insurance premium each month, and your lender or servicer pays the premium when its due.

- Mortgage insurance: If your down payment is less than 20 percent of the homes purchase price, youll probably be on the hook for mortgage insurance, which also is added to your monthly payment.

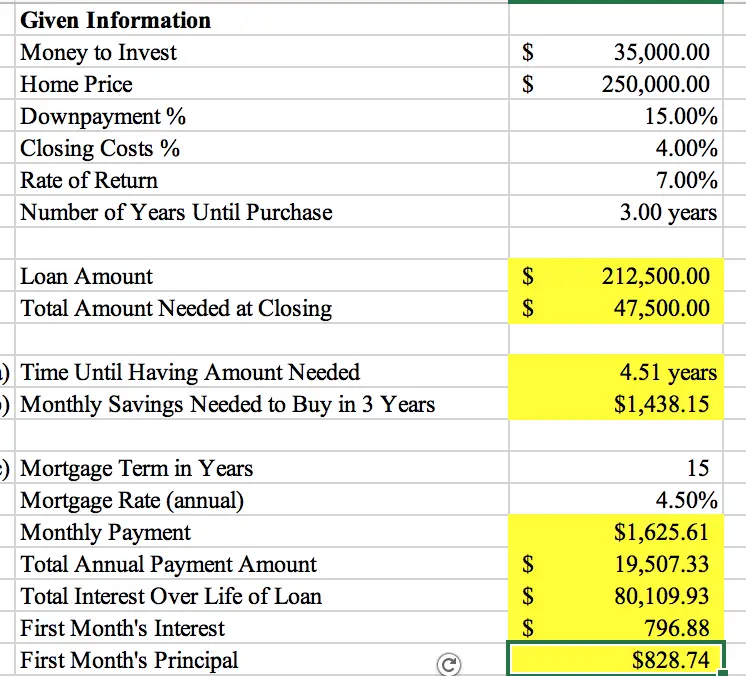

How Much Income Do I Need For A 250k Mortgage

Before you invest 250k into a home, youll want to be sure you can afford it.

To be able to borrow a 250k mortgage, youll require an income of $76,906 per year.

The income you need is calculated using a 250k mortgage on a payment that is 24% of your monthly income. In your situation, your monthly income should be about $6,409.

Read Also: Why Are Mortgage Rates Going Down

Factors In Your California Mortgage Payment

Your monthly mortgage payment will consist of your mortgage principal and interest. On top of that bill, youll have to consider property taxes and homeowners insurance as two more recurring expenses.

Property taxes in California are a relative bargain compared to the rest of the nation. With limits in place enforced by Proposition 13, generally property taxes cannot exceed 1% of a propertys market value. Assessed value cannot exceed increases of more than 2% a year. With those rules, Californias effective property tax rate is just 0.73%. On the local and county level, additional taxes can be levied if you live in a special district thats financing an improvement or other local concern.

Unlike many other states which employ local assessors to determine market value, California bases your initial property tax rate on the purchase price of the property. Each year the value will increase by the rate of inflation, capped at 2%. If the property is your principal place of residence, youre entitled to the homeowners exemption of $7,000 decreased assessed value, which cannot surpass $70 in savings.

As for homeowners insurance, California has reasonable rates. Despite the relatively frequent occurrence of natural disasters, including wildfires and earthquakes, the state has lower insurance costs than half of the nation. The average annual policy is about $1,166 a year, according to Insurance.com data.

Recommended Reading: Recasting Mortgage Chase

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

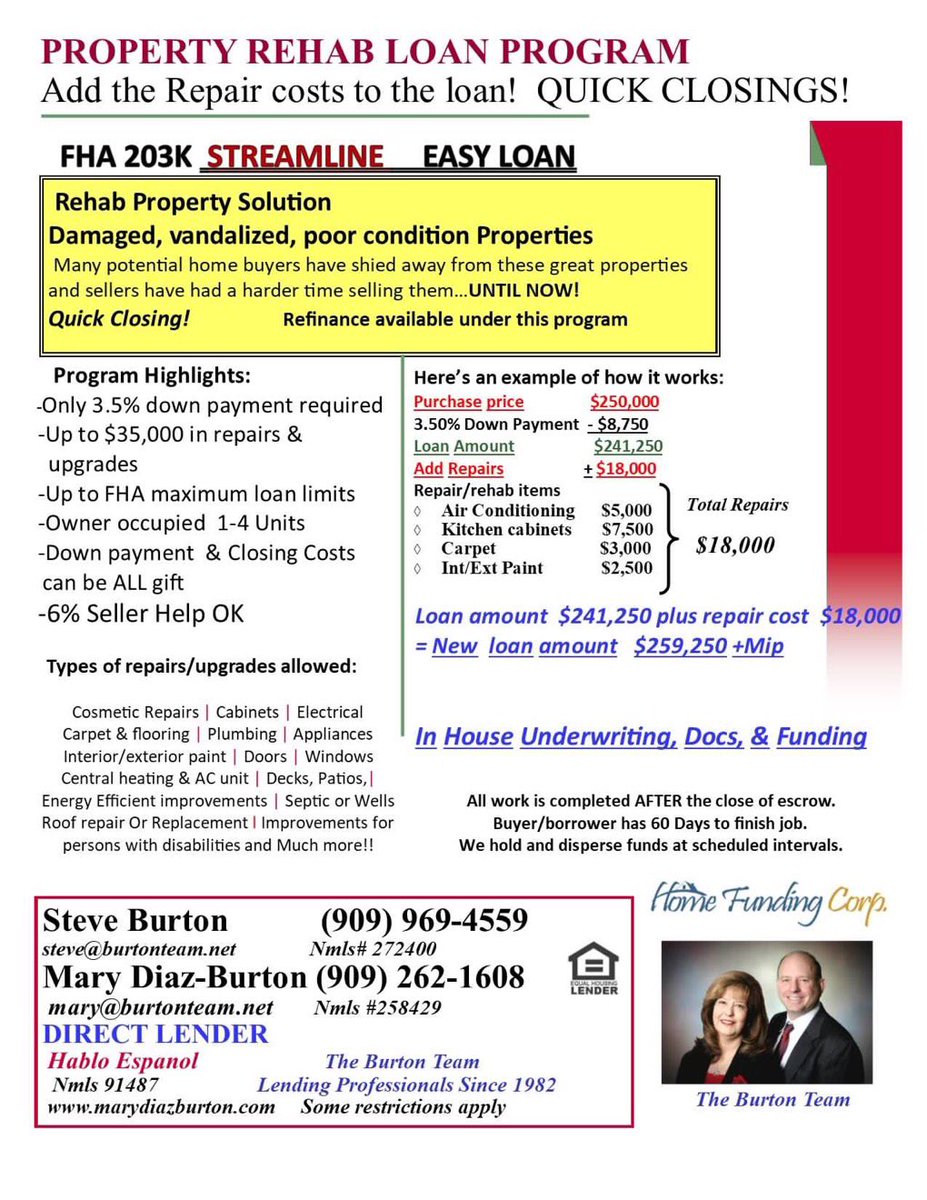

Read Also: Can You Use Mortgage Loan For Renovations