How Useful Is Aprc For Mortgages

On the whole, APRC is a useful tool for people who want to make a quick comparison between two mortgage deals.

Taking the confusion out of comparing mortgage rates is the reason APRC was introduced.

It should help you make a more informed choice when youre looking at mortgage deals, so youre not lured in by deals with tempting introductory rates.

But APRC might not be that useful for everyone.

One big assumption APRC makes is that youre going to stick with the same mortgage throughout the whole term e.g. 30 years.

If youre planning on remortgaging or switching lenders after the fixed term comes to an end, APRC might not work for you.

When you compare mortgages through our service, well show you both the introductory rate as well as the APRC. This should help most people make a fair comparison of mortgage deals.

What Are Origination Fees

Origination fees are upfront charges a lender requires you to pay in exchange for funding your mortgage. They may refer to a variety of different fees added together, such as underwriting and processing fees and other administrative costs. Origination fees are listed on Page 2 of your loan estimate.

What Is Interest Rate

Your interest rate is the percentage you pay to borrow money from a lender for a specific period of time. Your mortgage interest rate might be fixed, meaning it stays the same throughout the duration of your loan. Your mortgage interest rate might also be variable, meaning it might change depending on market rates.

Youll always see your interest rate expressed as a percentage. Youre responsible for paying back the initial amount you borrow plus any interest that accumulates on your loan.

Lets consider an example. Say you borrow $100,000 to buy a home, and your interest rate is 4%. This means that at the start of your loan, your mortgage builds 4% in interest every year. Thats $4,000 annually, or about $333.33 a month.

Your principal balance is high at the beginning of your loan term, and youll pay more money toward interest as a result. However, as you chip away at your principal through monthly payments, you owe less in interest and a higher percentage of your payment goes toward your principal. This process is called mortgage amortization.

You May Like: Should I Refinance My Home Mortgage Calculator

How Do I Find Out What My Rate Is

Knowing your personal loan rate before you apply could save you time, and help you move forward with your plans.

To make things simple, if you bank with us, you can check if were able to tell you what your personal rate is in advance online or in the Barclays app. Plus, we may already have a provisional loan limit ready for you1. Find out more.

Loans are subject to application, financial circumstances and borrowing history.

Whats More Important: Lower Fees Or A Lower Yearly Rate

These days, most lenders will use a combination of AIR and APR to tally up the total cost of your loan. Then again, there are specific circumstances where either type of rate could be considered better than the other. For instance:

- AIR Your Annual Interest Rate produces more accurate results than APR when calculating your yearly interest rate and the initial size of your monthly payments. It fluctuates according to your lenders current rates, as well as your financial health. The stronger your income and credit are, the lower your rate will be.

- While your Annual Percentage Rate offers a broader percentage thats set by the lender, its a simpler way of calculating the yearly cost of loan, as it takes other factors into account, including discounts and fees. By law, all lenders must display their APR on their loan agreements.

Learn how to pay off your high interest debt.

Why Does The Length Of Your Loan Term Matter?

So, when you take out a loan, is it better to have a lower AIR with a higher APR or a higher AIR with lower APR? The answer can depend on a number of things, one of the most significant being the length of your repayment term. Here are two more examples:

- High APR & Low AIR Generally, a shorter repayment term leads to a higher APR because the lender has to maximize profit over a shorter period. However, loans with higher APRs often come with fewer upfront fees. This way, you might have a lower AIR overall .

| Loan Amount |

Read Also: Can You Get A Mortgage With Less Than 20 Down

Why Is Apr Important

Before the enactment of the Truth in Lending Act, including more recent amendments to it like the TRID Disclosures, consumers found it difficult to effectively compare loans because each lender presented information differently. Today, all lenders must use the same terminology and display rates the same way with an APR that takes into account all up-front fees. Even with APR information available, its still important to ask every lender for an itemized list of fees they charge.

How Can I Get A Lower Apr

Your credit score and credit history play an important role in the APR youll be able to get. Whether youre taking out a mortgage or simply opening a new credit card, you can boost your credit profile by making your payments on time and avoiding maxing out credit cards. Its considered best practice to avoid using more than 30% of your available credit at any given time. Also, be sure to monitor your credit for fraud or mistakes, which can negatively affect your score.

For more mortgage related tips, visit our Mortgage Learning Center.

Related Topics

Recommended Reading: Can You Have 3 Mortgages On One Property

Whats The Difference Between Apr Vs Apy

Theres another important number to consider when taking out a loan or applying for a credit card: the annual percentage yield.

As previously mentioned, APR is a measure of the yearly cost of your loan if your loan is based on simple interest. APY is used in cases where interest is compounded, such as with savings accounts or credit card debt. In the APR calculation example, the borrower paid $120 in interest for a $2,000 loan. That means that they were charged 6% of the principal, calculated once, which would be the simple interest.

In some cases, interest on your loan is compounded, or calculated at a regular interval and then added to the principal owed. When interest is next compounded, its calculated using the now higher principal amount. This is how credit cards and adjustable-rate mortgages work. APY represents the annual cost of your credit card or loan while also factoring in how often interest is applied to the balance you owe on the card or loan.

Why Does Apr Matter

If you dont pay attention to the APR when shopping for a loan or credit card, you could end up paying substantially more over the long term. A loan with an interest rate of 5% and an APR of 10% will still cost you more than one with 6% interest and 9% APR.

The terms of an APR may also influence how you use a new credit card. If theres a 0% APR introductory grace period, for instance, you may want to make larger purchases during that time. As long as you pay them off in full before the grace period ends, youll be saving money by not having to pay the APR. Just be sure you can pay off those purchases quickly, otherwise youll be saddled with the high interest payments once the grace period ends.

Recommended Reading: How Much Mortgage Would I Get

Tips For Obtaining A Lower

How do you get a low APR credit card? Thereâs no single answer. But maintaining a good credit score can make you a better candidate for cards with low APRs and additional benefits.

Thereâs no magic formula for building credit, but these principles from the CFPB may help:

What Is The Difference Between A Mortgage Interest Rate And An Apr

An annual percentage rate reflects the mortgage interest rate plus other charges.

There are many costs associated with taking out a mortgage. These include:

- The interest rate

- Fees

- Other charges

The interest rate is the cost you will pay each year to borrow the money, expressed as a percentage rate. It does not reflect fees or any other charges you may have to pay for the loan.

An annual percentage rate is a broader measure of the cost of borrowing money than the interest rate. The APR reflects the interest rate, any points, mortgage broker fees, and other charges that you pay to get the loan. For that reason, your APR is usually higher than your interest rate.

If you have applied for a mortgage and received a Loan Estimate from one or more lenders, you can find the interest rate on page 1 under Loan Terms, and the APR on page 3 under Comparisons.

Tip: Take care when comparing loan options to be sure you understand any differences between the terms being offered:

Read Also: How Can Self Employed Refinance Mortgage

What Does Variable Apr Mean

If an , then it can change over time. With some loans, you know exactly how much youll pay in interest: you know how much youll borrow, how long youll take to pay it back, and what interest rate is used for interest charges. Loans with a variable APR are different. The interest rate might be higher or lower in the future than it is today.

Variable-rate loans are risky because you might think you can afford to borrow given todays rate, but you may end up paying a lot more than you expected. On the other hand, youll typically get a lower initial interest rate if youre willing to assume the risks of using a variable APR. In some cases, variable APRs are the only option availabletake it or leave it.

How Does Apr Work

Knowing what the APR is on a mortgage and how it impacts your loan is an important part of mortgage shopping. When comparing offers, its better to use the APR in order to understand the true cost of the loan.

Your APR can include:

- Closing costs

- Mortgage insurance

Your home loans APR is calculated by determining what the loan will cost you each year and is displayed as a percentage. Its important to remember that this percentage is separate from your interest rate.

Your APR could also change after taking out the loan. This can happen if you have an adjustable-rate mortgage or if you choose to refinance your home loan.

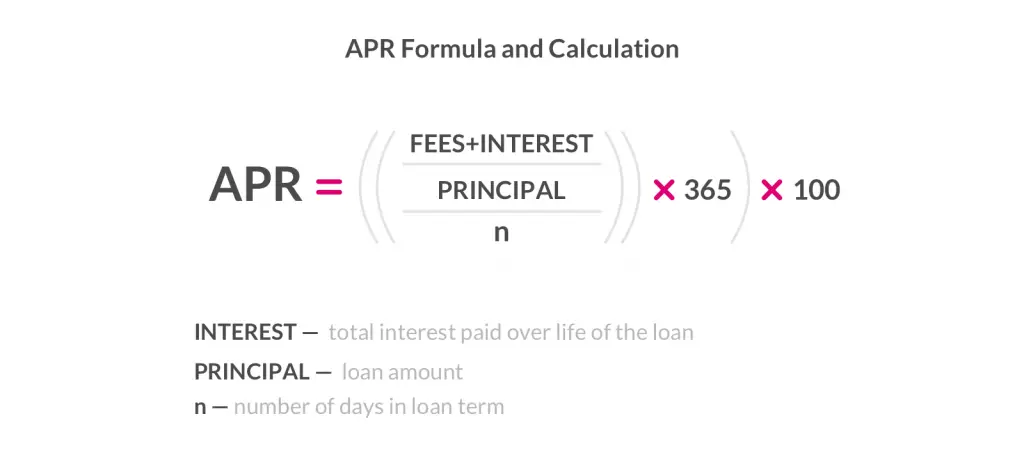

To calculate your APR, add all fees to your loan amount and determine what the monthly payment would be if all fees were included in the loan. That payment can then be converted into an interest rate.

Heres an example:

You take out a $300,000 mortgage with a 6.0% interest rate and you pay $7,000 in upfront fees. Your monthly principal and interest payment is about $1,798. If you add all fees and convert that into an annual rate, the APR would be 6.22%.

Total Mortgage has branches across the country. Find a Total Mortgage branch near you and speak to one of our friendly mortgage advisors to explore your borrowing options.

Don’t Miss: How Much Can You Get On A Reverse Mortgage

What Is The Apr On A Mortgage

When referring to the rate on a mortgage, its easy to confuse the .

The APR annual percentage rate on a mortgage reflects the interest rate, but also includes additional mortgage fees that are paid upfront, such as origination fees, broker fees and points, explains Nilay Gandhi, senior financial advisor with Vanguard Personal Advisor Services in Philadelphia.

The APR helps the borrower evaluate the true all-in cost of their mortgage, Gandhi says.

Because the APR factors in costs beyond just the interest rate, its smart to pay attention to every expense to get the best overall rate for your mortgage. Small changes in the APR can have a big impact on the total amount youll pay for your home over time.

To sum it up, the higher the APR, the more youll pay, everything else being equal, Gandhi says.

Whats A Good Apr On A Mortgage

The mortgage market changes on an almost daily basis, so its smart to keep an eye on mortgage rates so you can understand how they fluctuate and also learn about longer-term trends and whats considered a fair rate. Bankrates mortgage rate table can help in your research.

In general, borrowers today can expect an APR in the neighborhood of 2.5 percent to 3.5 percent, depending on the length of their loans and the strength of their borrowing credentials, Gandhi says.

Also Check: How Much Is A Mortgage On A 265 000 Home

An Example Of Apr Vs Apy

Say XYZ Corp. offers a credit card that levies interest of 0.06273% daily. Multiply that by 365, and thats 22.9% per year, which is the advertised APR. Now, if you were to charge a different $1,000 item to your card every day and waited until the day after the due date to start making payments, youd owe $1,000.6273 for each thing you bought.

To calculate the APY or effective annual interest ratethe more typical term for credit cardsadd one and take that number to the power of the number of compounding periods in a year subtract one from the result to get the percentage:

\begin & ^ ) – 1 = .257 \\ \end 365)1=.257

If you only carry a balance on your credit card for one months period, you will be charged the equivalent yearly rate of 22.9%. However, if you carry that balance for the year, your effective interest rate becomes 25.7% as a result of compounding each day.

Why Didn’t I Get The Rate I Was Expecting

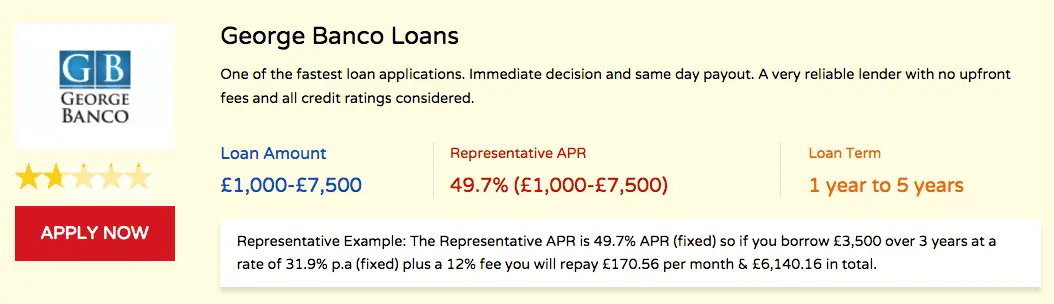

You won’t necessarily get the advertised APR. All applications are assessed on an individual basis, so the APR you get is determined by your own circumstances and credit history. This is your personal APR.

More than half of all successful applicants will receive the representative APR. If you did not receive the representative APR, there could be several reasons. For example, you may have applied for a larger or smaller amount of lending than the representative APR covers, or your individual circumstances mean you are not eligible for this rate.

Also Check: Is The Property Tax Included In Mortgage Payments

What Is The Difference Between Interest Rate And Apr

The main difference between interest rate and APR is that interest rate represents the cost youll pay each year to borrow money, while APR is a more extensive measure of the cost to borrow money that takes additional fees into account. Since APR includes your interest rate and other fees connected with your loan, your APR will reflect a higher number than your interest rate. You can also consider APR to be your effective rate of interest.

Thanks to the Truth in Lending Act , your lender must tell you both your interest rate and your APR. Youll see this information on your Loan Estimate and your Closing Disclosure .

Remember to consider both the interest rate and the APR when deciding on the best mortgage loan for you.

Save money with a lower interest rate.

Lock in your rate today before they rise.

What Is Apr On A Credit Card

APR should be advertised on all borrowing products, from and loans to mortgages.

As part of industry regulations, all lenders calculate APR the same way. To make it easier to compare loan products, APR takes into account any additional fees and how often you’re charged interest.

Our repayment calculator shows you:

-

The total cost of your credit card

-

How much interest you’ll pay on the debt

-

How quickly you could clear the balance by changing your monthly repayment amount

Read Also: What’s The Rule Of Thumb For Mortgage Payments

How Will The Apr Affect My Mortgage Payment

Comparing APRs for home loans can help you understand how much you’ll be paying over the life of the loan. When you shop for your mortgage, discuss the following details with your lender to ensure you get the best financing deal for your needs:

- Rates: Request a list of each lender’s current mortgage interest rates. Ask whether they’re fixed or adjustable rates. If they’re adjustable, ask how your loan payment may fluctuate.

- Points: Ask lenders to quote the points in a dollar amount to clarify what you’ll actually be paying. These points are fees paid to the lender for the loan and they help lower the interest rate.

- Fees: Request a breakdown of charges to understand what each fee includes. If you don’t understand certain fees, ask your lender for an explanation.

- Down payments: Some lenders require 20% of the total home purchase price at closing, while other loan types can require as little as 3% down. Check with your lender for details.

- Private mortgage insurance : If you can’t put down the full 20%, lenders may require you to get PMI, which increases your monthly mortgage payment.

Having these costs broken down will help you compare quotes properly and identify who’s offering the best deal. When you choose the right mortgage, you’ll feel secure about your monthly payment and overall budget.

Your lender will provide you with a Loan Estimate which will show loan terms and all of the costs associated with the loan.