Example Of A Down Payment

The mechanics behind making a down payment are fairly straightforward. Imagine you find a house for sale, and you have an accepted offer to buy it for $500,000 with a 20% down payment. The down payment amount would be $100,000 = . This sum of money must be deposited in a timely manner into an escrow account that will be held until closing. At closing, it will be credited toward the final amount due.

Benefits Of Making A Larger Down Payment

Your ability to save for a down payment is a good sign youre ready for the financial commitment of owning a home. Here are some clear benefits to waiting until you have a large down payment:

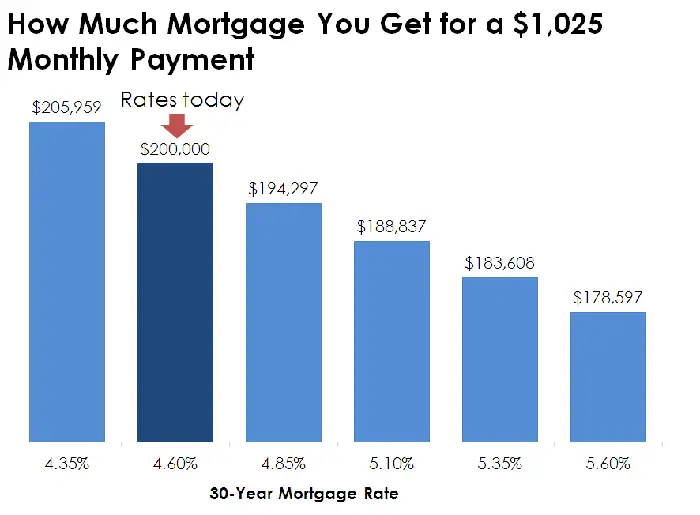

- Lower mortgage rate: The less money you borrow as a percentage of the homes value, the less risk your loan poses to the mortgage lender. As a result, larger down payments tend to correlate with lower interest rates.

- More equity: The greater percentage of your home you own outright, the more equity you have. That can be especially handy if youre looking to finance a big renovation project or other purchase because you can tap your home equity through a cash-out refinance, home equity loan or home equity line of credit to borrow money against the value of your home relatively inexpensively.

- Lower monthly payments: Because youre borrowing less money and you likely have a lower interest rate, you can expect lower monthly payments, giving you more cash flow for other financial goals and lifestyle needs.

- Cheaper closing costs: The fees you pay to your lender at closing are usually calculated as a percentage of your loans total value, so the less you borrow, the less youll owe them at closing, too.

- More competitive offer: If youre in a sellers market and competing with several other buyers, a larger down payment can make your offer more competitive than the others. By showing that you can afford to put more down, you might give the seller more confidence that your loan will close.

You Might Qualify For Special Programs

Dealers may offer special financing programs with low rates or other incentives. In some cases, these programs require you to make a larger down payment.

When dealers advertise special incentives, theyre required to disclose the terms, so read the fine print carefully and ask questions to make sure you understand the down payment requirements.

Also Check: Rocket Mortgage Qualifications

Recommended Reading: Requirements For Mortgage Approval

Va Loan And Usda Loan: Zero Percent

The U.S. Department of Veterans Affairs and the U.S. Department of Agriculture guarantee zero-down payment loans for qualified homebuyers.

VA loans are available to most members of the armed forces and veterans and their families. USDA loans, on the other hand, are available to borrowers planning to purchase homes in designated rural areas. The USDA has maps on its website that show which areas are eligible.

Neither loan program requires mortgage insurance. With VA loans, youll pay a one-time funding fee, which ranges from 1.40 percent to 3.60 percent, depending on how many VA loans youve had and your down payment amount. With USDA loans, youll pay an upfront and annual guarantee fee, both of which are independent of your down payment amount.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: 10 Year Treasury Yield And Mortgage Rates

How Interest Rate Changes Affect Your Variable Rate Mortgage

When it comes to mortgages, there are two basic options for homeowners to consider: fixed rate and variable rate mortgages. A fixed rate mortgage is pretty straightforward. You negotiate the interest rate youll pay your financial institution and its locked in for the duration of the mortgage period – typically five years. If interest rates go up or down, your mortgage payment stays the same. But what happens to your payments if you have a variable rate mortgage and interest rates change?

How Much Is The Average Down Payment

The median down payment on a home was 12 percent for all buyers, according to a 2020 National Association of Realtors report. It was lowest for first-time homebuyers, at only 6 percent, and highest for repeat buyers at 16 percent.

Only 28 percent of homebuyers put down 20 percent or more, according to a separate 2021 NAR report.

Also Check: Can You Get A Reverse Mortgage On A Condo

Calculating How Much House You Can Afford

When figuring out how much house you can afford, it can be helpful to start with the 28 percent rule, which stipulates you should spend no more than 28 percent of your gross monthly income on your mortgage payment.

For example, if your gross income is $5,000 per month, you should spend, at most, $1,400 on a mortgage payment, including the mortgage, homeowners insurance, property taxes and HOA fees.

Depending on your other expenses and risk tolerance, however, you might be able to adjust this rule somewhat.

Youll also need to account for the down payment and closing costs, the latter of which ranges from 2 percent to 5 percent of homes price. In general, if you have more cash saved up for these purposes, you can afford more home.

The Average Down Payment On A House

Even though a greater share of buyers are putting down 20%, most first-time home buyers dont make that oft-quoted benchmark.

Because outliers can skew an average, the telling figure for what other home buyers put down is the median down payment, meaning half paid that much or above, and half paid that much or below.

For first-time home buyers who financed the purchase, the median down payment was 7%, according to a 2020 survey by the National Association of Realtors. The median down payment for repeat buyers who financed was 16%.

» MORE:8 first-time home buyer loans and programs

You May Like: Mortgage Rates Based On 10 Year Treasury

Percent Down Payment Faq

Do I have to put 20% down on a house?

You do not have to put 20 percent down on a house. In fact, the average down payment for firsttime buyers is just 7 percent. And there are loan programs that let you put as little as zero down. However, a smaller down payment means a more expensive mortgage longterm. With less than 20 percent down on a house purchase, you will have a bigger loan and higher monthly payments. Youll likely also have to pay for mortgage insurance, which can be expensive.

What is the 20% down rule?

The 20 percent down rule is really a myth. Typically, mortgage lenders want you to put 20 percent down on a home purchase because it lowers their lending risk. Its also a rule that most programs charge mortgage insurance if you put less than 20 percent down . But its NOT a rule that you must put 20 percent down. Down payment options for major loan programs range from 0% to 3, 5, or 10% percent.

Is it better to make a large down payment on a house? How can I avoid PMI without 20% down?

Its possible to avoid PMI with less than 20% down. If you want to avoid PMI, look for lenderpaid mortgage insurance, a piggyback loan, or a bank with special noPMI loans. But remember, theres no free lunch. To avoid PMI, youll likely have to pay a higher interest rate. And many banks with noPMI loans have special qualifications, like being a firsttime or lowincome home buyer.

What are the benefits of putting 20% down on a house? Is it OK to put 10% down on a house?

How Are Mortgage Rates Impacting Home Sales

The total number of mortgage applications inched lower during the week ending December 17, 2021. The 0.6% decline was driven by a decrease in the number of purchase loan applications, according to the Mortgage Bankers Association.

- The total number of purchase loan applications decreased by 6% week-over-week, breaking a five-week run of increases. Compared to the same week last year, there were 9% fewer applications.

- Refinance applications, on the other hand, increased by 2% from the week prior but were 42% lower year-over-year. Refis made up a little over 65% of all applications.

Recommended Reading: Can I Get A Reverse Mortgage On A Condo

What Mortgage Can I Afford On 80k

So, if you make $80,000 a year, you should be looking at homes priced between $240,000 to $320,000. You can further limit this range by figuring out a comfortable monthly mortgage payment. To do this, take your monthly after-tax income, subtract all current debt payments and then multiply that number by 25%.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

How Much Do I Need To Make To Buy A $300 K House

Before you get into determining if you can afford monthly payments, figure out how much money you have available now for up-front costs of a home purchase. These include: A down payment: You should have a down payment equal to 20% of your homes value. This means that to afford a $300,000 house, youd need $60,000.

A Down Payment Makes You Less Risky To Lend To

Putting money down helps mitigate risk for the lender in a couple of ways:

Its important to note that the down payment requirement isnt set by the lender alone. In many cases, the down payment requirement comes from the investor of the loan .

You May Like: Chase Mortgage Recast Fee

How To Prepare Yourself To Get The Best Mortgage Rate On A Home Loan

Since credit score is the most important factor in determining your mortgage rate, be sure to have your credit card balances down to no more that 35% of your credit limit at least 30 days prior to applying for a home loan. It also helps to obtain a personal copy of your credit report from all three credit bureaus to ensure that there are no errors on your credit report such as collection accounts. As long as your credit score is over 740, you are good to go since lenders typically offer the same rate to borrowers with credit score of 740 plus.

Minimum Down Payment On A House

The required minimum down payment for a house depends on the type of loan and a lenders criteria. Here are the minimum down payment requirements for the most common types of loans.

-

Conventional loans, which arent guaranteed by the federal government, can have down payments as low as 3% for qualified buyers. Some lenders offer down payment assistance grants to allow even lower down payments.

-

FHA loans, backed by the Federal Housing Administration, require a minimum 3.5% down. FHA loans allow lower minimum credit scores than conventional loans.

-

VA loans for military service members and veterans, and USDA loans for certain rural and suburban buyers, usually require no down payment. VA loans are backed by the U.S. Department of Veterans Affairs, and USDA loans are guaranteed by the U.S. Department of Agriculture.

» MORE:to track your savings and reach your down payment goals.

Recommended Reading: Recast Mortgage Chase

Also Check: 70000 Mortgage Over 30 Years

How Will Your Home Value Influence Your Mortgage Rates

This factor can influence your rate up to another 0.5%.

Aside from your credit score, lenders also look at your loan size in a couple of ways. Not only do they look at the dollar amount of your loan, but they also look at a metric known as your loan to value , or what percent of a homes sale price you are borrowing. This is a number expressed as a percentage.

Take a $500,000 house: If you put $100,000 down to buy the home and borrowed the remaining $400,000 , then your loan to value would be 80% because the loan is 80% of the homes value. Lenders prefer to see an LTV of 80% or below.

Lenders can also adjust loan rates up or down based on a combination of your FICO score and loan to value. Generally speaking, the higher your loan to value the higher your mortgage interest rate will be. However, the interest rate uptick applied for having a high loan to value will typically be steeper for a borrower with poor credit than for one with good scores.

Some popular loan programs for first-time buyersFHA loans, VA loans, and USDA loansdo allow high LTV. These programs accept very low down payments of 0% to 3.5%, meaning these are loans where its possible to see 96.5% to 100% LTVs. While these loans permit high LTV rates, the catch is that there are typically low loan maximumsthus you cant necessarily use one of these programs to finance a luxury property. In addition, youll also have to buy private mortgage insurance .

Should You Strive To Put Down 20%

A 20% down payment is a significant amount of money for most people. According to Opendoors report, 82% of Gen Xers and 93% of millennials say theyd need to save up for a down payment. For some people, it can make more sense to put down less and accept a higher interest rate and monthly payment if it means building equity in a home instead of paying rent elsewhere.

But putting down 20% or more is an important goal for those who want to spend less overall on their mortgage. It can make the home more affordable by helping you save money over time with lower interest rates and monthly payments, says Aziz.

So while making a 20% down payment isnt a hard-and-fast requirement when it comes to buying a home, its a good idea if you can pull it off. But dont assume that youll be locked out of the homebuying market just because you dont have a lot of cash. Instead, look at your options and consider whether making a down payment of less than 20% makes sense for you.

You May Like: Reverse Mortgage For Condominiums

What Credit Score Do You Need For The Best Mortgage Rate

A credit score of 700-plus will usually land a borrower a lower interest rate, and while mortgage industry experts say you can still qualify for certain loans with a score under 680, the 700s are where you can expect to pay the lowest rates.

Creditors set their own standards for what constitutes an acceptable score, but these are general guidelines:

-

A score of 740or higher is generally considered excellent credit.

-

A score between 700 and 739 is considered good credit.

-

Scores between 630 and 699 are fair credit.

-

And scores of 629 and below are poor credit.

The lending industry carves up the credit score scale into 20-point increments and adjusts the rates it offers borrowers each time a credit score moves up or down by about 20 points. For instance, if your score drops to 740 from 760, youre likely to see a small bump up in the rate youll be offered.

Why Your Credit Score Matters To Lenders

Along with a low debt-to-income ratio and a strong financial history, youll need a high credit score for the lowest mortgage rates. Why?

Youd probably hesitate to lend money to a friend who usually takes forever to pay you back or doesnt pay you back at all. Lenders feel the same way about mortgages. They want to lend to people who have a record of on-time payments to creditors.

Lenders rely on credit scores as an indication that a borrower will meet obligations. A higher credit score, experts say, reassures lenders that they will be paid back.

Your credit score is calculated most often with the FICO scoring model and is derived from the information on your credit reports, which are compiled by credit reporting companies. Your reports include a history of your payment habits with borrowed money.

» MORE:Check your credit score for free

Your credit score is one of the most important parts to qualify, but it is a part, says Michelle Chmelar, vice president of mortgage lending with Guaranteed Rate in New York. You have to have the whole package: income, sufficient assets and credit.

Also Check: How Does The 10 Year Treasury Affect Mortgage Rates