How Much Income Do I Need For A 200k Mortgage

Before you invest 200k into a home, youll want to be sure you can afford it.

To be able to borrow a 200k mortgage, youll require an income of $61,525 per year.

The income you need is calculated using a 200k mortgage on a payment that is 24% of your monthly income. In your situation, your monthly income should be about $5,127.

Home Affordability And The Covid

The coronavirus pandemic and the resulting economic downturn have shaken up the real estate market. In August, the median home price in the U.S. rose to $290,225 an annualized 15.9 percent from the prior month. Mortgage rates remain near historic lows as of September, but there is no way to know whether they will fall even lower or start to move back up.

The fact remains that interest rates are lower right now than they have ever been. If you are in a good financial position to purchase a home at the moment meaning you have enough cash for a down payment, a good or great credit score, stable employment, and a low debt-to-income ratio it may make sense for you to take that step now rather than later.

Mortgage Calculations And Mortgage Considerations

Use the free online Mortgage calculator to calculate your monthly repayments, compare Mortgage repayments over different periods and define what is the most affordable option for your financial situation. The Mortgage calculator will provide you a monthly interest repayment over 1 year,2 years,3 years,4 years,5 years, 10 years and compare them to a monthly repayment period of your choosing .

Also Check: 10 Year Treasury Yield Mortgage Rates

Let’s Start With The Basics

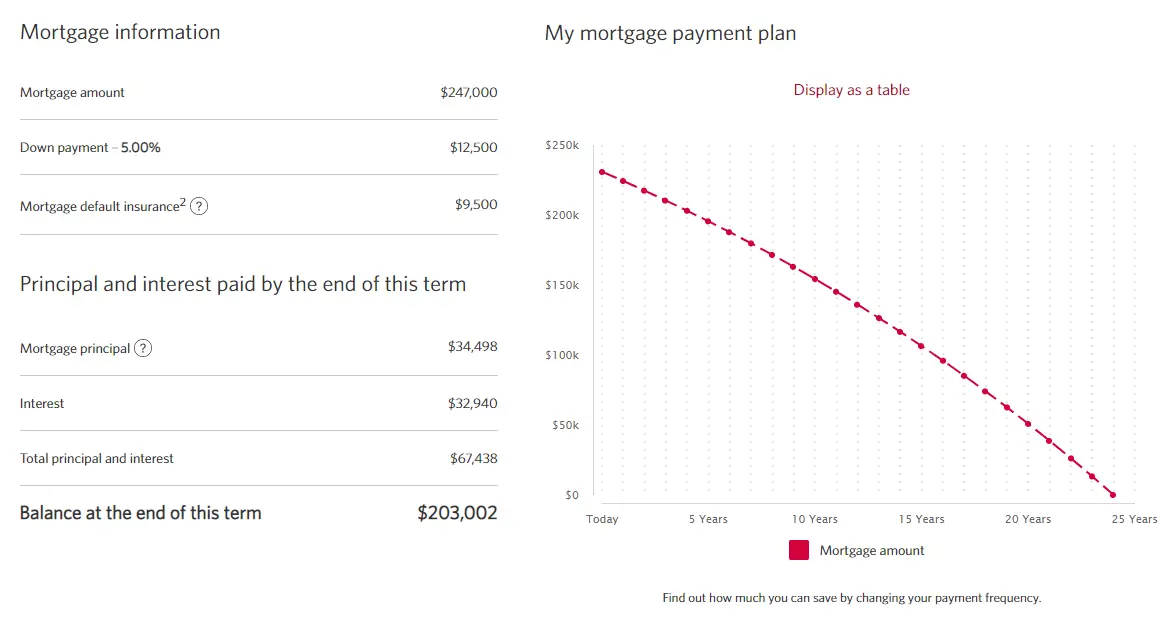

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage. Enter an income between $1,000 and $1,500,000.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

Selecting your province or territory helps us personalize your mortgage results.

Enter your total monthly payments towards any car loans, student loans or personal loans.

How Much Mortgage Can I Afford

While the idea of buying a house may sound fun, the actual securing of a mortgage usually isnt. Pretty much nobody looks forward to the day they take out a mortgage. Rarely do you hear someone talk about how much they enjoy going through the mortgage process. Theres good reason for this: taking out a mortgage can be a painful, laborious, even depressing endeavor . All the more incentive to make enough money that you dont even need a mortgage. Odds are, though, youre not in that lucky minority. So instead, were here to help make the process a little easier. Well walk you through the answer to that all-important question, How much mortgage can I afford?

Don’t Miss: 10 Year Treasury Vs Mortgage Rates

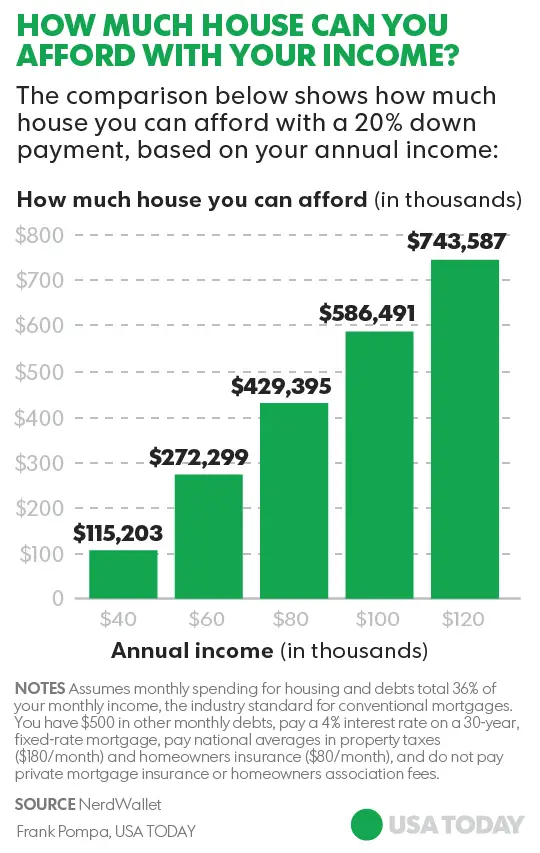

How Much House Can I Afford Making 140k A Year

I make $ 140,000 a year. How many houses can I afford? You can afford a house for $ 476,000.

How much house can I afford on 120k salary?

If you earn $ 50,000 a year, the total annual housing cost should ideally be no more than $ 14,000, or $ 1,167 a month. If you earn $ 120,000 a year, you can go up to $ 33,600 a year, or $ 2,800 a month as long as your other debt does not push you beyond the 36 percent limit.

How much do I need to make to afford a $350000 house?

You have to earn $ 107,668 a year to afford a 350k mortgage. We base the income you need on a 350k mortgage on a payment that is 24% of your monthly income. In your case, your monthly income should be around $ 8,972. The monthly payment on a 350,000 home loan is $ 2,153.

Is A Fair Credit Score Good Enough For A Mortgage

There is no minimum for the credit score that you have to have in order to be approved for a mortgage. When you apply for credit, mortgage lenders will instead make their decision based on their companys lending criteria. The better your credit score is, the more likely you will be approved for a mortgage loan.

Also Check: Reverse Mortgage On Condo

Can I Buy A House If I Make 25k A Year

HUD, nonprofit organizations, and private lenders can provide additional paths to homeownership for people who make less than $25,000 per year with down payment assistance, rent-to-own options, and proprietary loan options.

Also Is a mortgage 3 times your salary? Is a mortgage 3 times your salary? Not necessarily. Most lenders offer eligible borrowers mortgages based on 3-4.5 times their income, but others go higher than this, under the right circumstances. You can read more about this in our guide to income multiples.

What is the average mortgage payment?

State-By-State Average Mortgage Payments

| $ 190,846 |

Nov 19, 2021

Can I buy a house making 25k a year? HUD, nonprofit organizations, and private lenders can provide additional paths to homeownership for people who make less than $25,000 per year with down payment assistance, rent-to-own options, and proprietary loan options.

The Homebuyers Guide To Qualifying For A Mortgage

Buying a house is one of the largest purchases people make in a lifetime. Its an expensive proposition, with most consumers relying on loans to acquire their own home. And since mortgage payments typically take decades to pay down, it requires financial commitment and a level of stability. With this in mind, mortgage lenders assess your financial disposition and creditworthiness to make sure you can afford to make regular payments.

The following guide will walk you through the basic qualifying process to secure a mortgage. Well also rundown the primary financial requirements you must satisfy before you can buy a home. This includes factors such as your credit score, income, and debt-to-income ratio, to name a few. Finally, using our calculator above, well provide an example of how you can estimate your required annual income in order to purchase a home with a specific amount.

Understanding the Mortgage Qualifying Process

You May Like: Rocket Mortgage Payment Options

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

Monthly Payments On A $200000 Mortgage

What is each mortgage payment made up of?

- Principal payment. This goes towards the amount you borrowed from the lender . As you gradually pay off the amount you borrowed, you will be paying interest on a smaller loan amount, so your interest payments will slowly reduce.

- Interest payment. This is the cost to borrow from the lender. The higher your principal and the higher your interest rate, the more interest youll need to repay.

$948.42$1,931.21

Monthly payments by interest rate

| Interest |

|---|

Read Also: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Know Whats Standing In Your Way

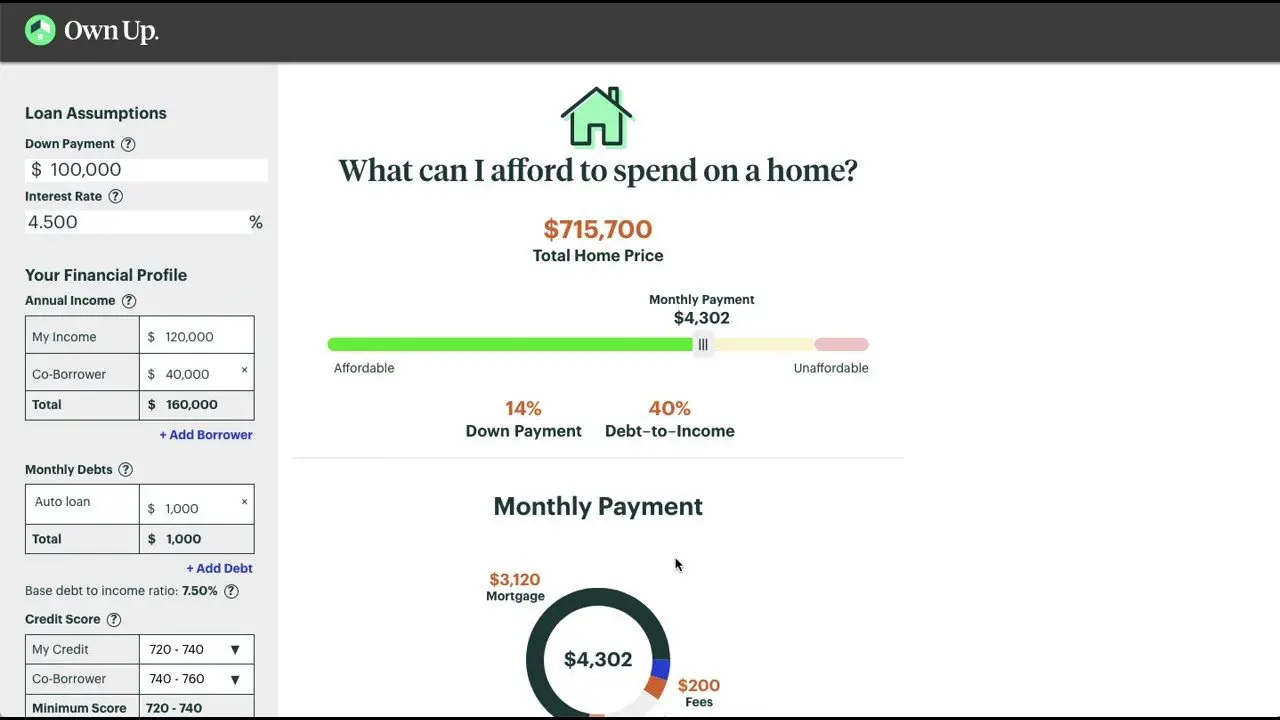

Unfortunately, not everyone is financially ready to buy a home. This Mortgage Income Calculator will show some people that buying, at least at this point, is not within their grasp and offer an understanding of what financial obstacles stand in the way.

This calculator may show you that not enough down payment is your problem. Or maybe its too much debt. Perhaps you simply need to earn more to buy the home you want and need. Or, if you reassess your ambitions, can you afford a less-expensive home?

Is 10000 Enough To Buy A House

Conventional mortgages, like the traditional 30-year fixed rate mortgage, usually require at least a 5% down payment. If youre buying a home for $200,000, in this case, youll need $10,000 to secure a home loan. FHA Mortgage. For a government-backed mortgage like an FHA mortgage, the minimum down payment is 3.5%.

Read Also: Recast Mortgage Chase

The Homebuying Process: Step

Buying a house is likely to be the biggest financial commitment that you will make for your entire life, and while the experience can be both exciting and nerve-wracking, its important to get it right in order to avoid excessive extra costs in the future. Dont buy a home without reading this.

When its your first time buying it can be a little overwhelming, with lots of unknowns, legal wranglings, and lists of things to do in order to get the keys to your first home.

A few essentials youll want to do straight off include:

- Check your credit and strengthen your credit score

- Find out how much you might be able to borrow

- Save for down payment, closing costs

- Build a healthy savings account

- Get preapproved for a mortgage

- Start speaking to realtors and finding one you like and is recommended

- Find suitable mortgage lenders

- Buy a house you like

Luckily, when youre ready to make your first move, weve got this extremely thorough home buying guide to walk you through the must-dos of your first purchase.

How To Calculate An Affordable Mortgage

Now that you have an idea of how much of a monthly mortgage payment you can afford, youll probably want to know how much house you can actually buy.

Although you cannot determine an exact budget until you know what , you can estimate your budget. Assuming an average 6% interest rate on a 30-year fixed-rate mortgage, your mortgage payments will be about $650 for every $100,000 borrowed.

For the couple making $80,000 per year, the Rule of 28 limits their monthly mortgage payments to $1,866.

x $100,000 = $290,000

Ideally, you have a down payment of at least 10%, and up to 20%, of your future homes purchase price. Add that amount to your maximum mortgage amount, and you have a good idea of the most you can spend on a home.

Note: If you put less than 20% down, your mortgage lender will required you to pay private mortgage insurance , which will increase your non-mortgage housing expenses and decrease how much house you can afford.

You May Like: Can You Get A Reverse Mortgage On A Condo

Can I Get A 200000 Mortgage If Im Self

What you do for a living can have a significant impact on your mortgage eligibility. When lenders review applications, they want to be assured that the applicant can comfortably afford their repayments.

If youre self-employed the nature of your work poses a greater risk, which could ring warning bells for mortgage providers affordability requirements. Be prepared to provide evidence that your income is both regular and substantial enough to make your mortgage payments alongside any other outgoings.

To assess whether or not you can afford a £200k mortgage, lenders will likely request:

-

Two or more years’ worth of certified accounts.

-

SA302 forms.

-

A tax year overview for the past two or three years.

If you have an unconventional job type, dont panic working with a mortgage broker means theyll only recommend suitable lenders , and secure you a deal to match your requirements.

Is A 676 A Good Credit Score

A 676 FICO® Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to check your credit score to find out the specific factors that impact your score the most and get your free credit report from Experian.

Recommended Reading: How Does Rocket Mortgage Work

How To Calculate Your Required Income

To use the Mortgage Income Calculator, fill in these fields:

-

Homes price

-

Loan term

-

Mortgage interest rate

-

Recurring debt payments. Heres where you list all your monthly payments on loans and credit cards. If you dont know your total monthly debts, click No and the calculator will ask you to enter monthly bill amounts for:

-

Car loan or lease

-

Minimum credit card payment

-

Personal loan, child support and other regular payments

Monthly property tax

Monthly homeowners insurance

Monthly homeowners association fee

How Much Do You Need To Make A Year To Afford A 550k House

You need to make $ 169,193 a year to get a 550k mortgage loan. We base your income on a 550k mortgage by paying 24% of your monthly income. In your case, your monthly income must be about $ 14,099. The monthly repayment of the 550k loan is $ 3,384.

How much income do I need for a 200K mortgage?

A $ 200k loan with 4.5% interest rate over 30 years and a $ 10k down payment will require an annual income of $ 54,729 to qualify for the loan. You can even calculate further variations on these dimensions using the Loan Required Income Accountant.

How much do I need to make to buy a 300k house?

This means that to buy a $ 300,000 home, you will need $ 60,000. Closing costs: Typically, you will pay about 3% to 5% of the value of the home for closing costs.

How much do I need to make a year to afford a 400k house?

What is the required income for a 400k loan? To be able to afford a $ 400,000 home, lenders need $ 55,600 in cash to make a 10 percent reduction. When you have a 30-year loan, your monthly income must be at least $ 8200 and your monthly repayment of existing debt should not exceed $ 981.

You May Like: Mortgage Recast Calculator Chase

What Are Additional Costs Associated With Buying A Home

Purchasing a home entails a major number of costs, some large and some less so. Many expenses associated with a home purchase, such as down payment, origination fees and PMI are incorporated into the final financing arrangements: The down payment is due at closing . Origination fees typically are due at closing as well, although some loan terms allow them to be “rolled up” into the monthly payment and paid out over the life of the loan. PMI, when required, is incorporated into the monthly payment as well.

Additional one-time costs associated with a home purchase include:

- Fees for an appraisal, which is required by the lender to ensure the purchase price doesn’t exceed the home’s resale value.

- A property inspection .

- Fees for a lawyer to review sales documents and attend the closing as your legal representative.

Recurring costs you may incur with the home purchase may include:

- A homeowners property/casualty insurance policy that covers the value of the home .

- Homeowners association fees. The amount of these fees, and the services provided in exchange for them, vary among different associations. Some include trash and snow removal, landscaping services, maintenance of common areas such as a clubhouse, pool or racquet courts, and so on.

Note that any recurring expenses directly connected to the property you plan to purchase will be added to the mortgage payment for purposes of calculating your front-end DTI.

How To Find Your Maximum Loan Amount

Use our mortgage calculator to estimate how much you can borrow, just as we did earlier. But dont miss the three tabs near the top of the page:

Also Check: Can You Get A Reverse Mortgage On A Manufactured Home

Percentage Of Income Toward Monthly Payment

While the 28% rule is a good starting guideline, there are other factors to think about. Lenders are legally obligated to learn about your assets, expenses and credit history before offering you a mortgage. How reliable your income is can also matter. If much of your earnings come from a source that varies from month to month, like commissions, a lender might not be willing to lend as much to you as it would to someone who earns a consistent salary.

Consider what you can comfortably afford to spend on a monthly basis without affecting other financial goals, such as saving for an emergency fund or investing toward retirement.