I Have My Results Now What

Once you have your results, the next step is to start getting personalized quotes from lenders to see what sort of rates they’re offering and see if you prequalify. An easy way to do it is through our Get a FREE Quote option. Answer a few simple questions and have the lenders come to you, rather than you looking for them.

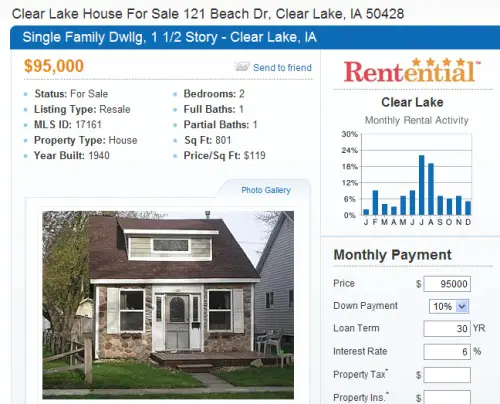

Compare 95000 Mortgage Rates & Repayments

Find out how much your repayments will be for a £95000 mortgage. Compare mortgages across the whole market – 20000 mortgages from 90+ lenders online now.

7. $95,000 Mortgage Loan Calculator. What’s the monthly payment of a …

$95,000 Mortgage Payment Calculator. Calculate a monthly payment for a $95,000 mortgage. What’s the monthly payment of a $95k home loan? Fill out the loan …

8. Monthly Payment For $95,000 Mortgage

Mortgage calculator to calculate monthly payment for 95000 Mortgage. Calculate 95000 mortgage monthly payment with our mortgage calculator quickly and …

9. $95,000 Income Tax Calculator 2021 – Oregon – Forbes Advisor

If you make $95000 in Oregon, what will your salary after tax be? Our income tax and paycheck calculator can help you understand your take home pay.

10. What is the monthly payment of a 95,000 dollar house

Why Does Your Monthly Calculator Have Four Columns

We think it’s important for you to compare your options side by side. We start the calculator by outlining the four most common options for down payment scenarios, but you are not limited to those options. We also allow you to vary amortization period as well as interest rates, so you’ll know how a variable vs. fixed mortgage rate changes your payment.

Recommended Reading: What Is A Conventional Home Mortgage Loan

What Is The Monthly Payment Of A 95000 Dollar House

- Article author: www.budgetworksheets.org

- Top rated: 4.8

- Lowest rated: 1

- Summary of article content: Articles about What is the monthly payment of a 95,000 dollar house $95,000 Home Calculator What is the monthly loan payment of a 95,000 dollar house? How much is the payment on a $95k home? This calculator will determine

- Most searched keywords: Whether you are looking for What is the monthly payment of a 95,000 dollar house $95,000 Home Calculator What is the monthly loan payment of a 95,000 dollar house? How much is the payment on a $95k home? This calculator will determine

See more articles in the same category here:

Costs To Expect When Buying A Home In North Carolina

Further costs to include in home buying is the price of a home inspection prior to closing on a property. Youll likely want to hire someone as your due diligence about the condition of the property. Its always best to get the most complete picture of the home youre planning to buy. Home inspections cost between $400 and $500, with larger homes at the upper end of the range, and condos and smaller homes at the lower end. Optional add-on tests include mold, radon, termite and infrared, which you can arrange if you want. While inspections arent a requirement of a contract , its a prudent step to take before making the big financial decision of buying a home. In some cases, it can help you negotiate the asking price or repairs.

After the inspection period, youll continue with the home buying process and eventually make it to the final step: closing. At the time of closing, youll be required to pay a number of fees for various services ranging from your mortgage lenders origination fees, to the county clerks charges. These fees are collectively referred to as closing costs.

Read Also: How To Hire A Mortgage Broker

Mortgage Payment Calculator Canada

Content last updated: March 2, 2022

Looking to buy a home and get a mortgage some time soon? Know what you’ll be signing up for with Ratehub.cas mortgage payment calculator. Understanding how much your monthly mortgage payments will be is crucial to getting a mortgage that you can afford.

Our mortgage payment calculator shows you how much you’ll need to pay each month. You can even compare scenarios for different down payments amounts, amortization periods, and variable and fixed mortgage rates. It also calculates your mortgage default insurance premiums and land transfer tax. Advertising Disclosure

| Select |

How To Lower Your Mortgage Payments

There are a few ways to lower your monthly mortgage payments. You can reduce the purchase price, make a bigger down payment, extend the amortization period, or find a lower mortgage rate. Use the calculator to see what your payment would be in different scenarios.

Keep in mind that if your down payment is less than 20%, your maximum amortization period is 25 years. As for finding a lower mortgage rate, its a good idea to speak to a mortgage broker for assistance.

You May Like: How Much Mortgage Can I Afford With 150k Salary

Mortgage Payment Calculator Loan Amount = $95000 Interest Rate = 35% Loan Term = 30 Years

- Article author: www.searchlawrence.com

- Top rated: 4.8

- Lowest rated: 1

- Summary of article content: Articles about Mortgage Payment Calculator Loan Amount = $95000 Interest Rate = 3.5% Loan Term = 30 years Updating

- Most searched keywords: Whether you are looking for Mortgage Payment Calculator Loan Amount = $95000 Interest Rate = 3.5% Loan Term = 30 years Updating

How Do Payments Differ By Province In Canada

Most mortgage regulation in Canada is consistent across the provinces. This includes the minimum down payment of 5%, and the maximum amortization period 35 years, for example. However, there are some mortgage rules that vary between provinces. This table summarizes the differences:

| PST on CMHC insurance |

|---|

| YES |

Don’t Miss: How Long Do You Need To Pay Mortgage Insurance

How Lenders Decide How Much You Can Afford To Borrow

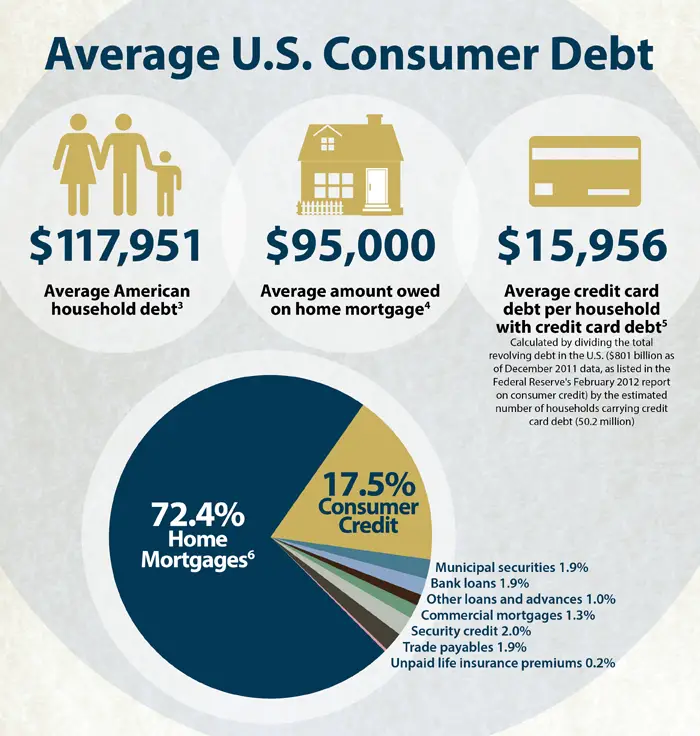

Mortgage lenders are required to assess your ability to repay the amount you want to borrow. A lot of factors go into that assessment, and the main one is debt-to-income ratio.

Your debt-to-income ratio is the percentage of pretax income that goes toward monthly debt payments, including the mortgage, car payments, student loans, minimum credit card payments and child support. Lenders look most favorably on debt-to-income ratios of 36% or less or a maximum of $1,800 a month on an income of $5,000 a month before taxes.

Estimate Your Monthly Usda Loan Payments

This calculator provides those searching in rural and semi-rural areas a way to quickly and easily estimate their monthly payments with a USDA loan. Included in the calculator are features unique to the USDA loan, including the USDA’s upfront mortgage insurance and annual fees.

Estimating monthly mortgage payments is an excellent way of getting a sense of your buying power and what you could potentially afford with a USDA loan.

Recommended Reading: How To Get A Mortgage License In Florida

Details Of North Carolina Housing Market

North Carolina, home to coastline, mountains, farms and cities, is the ninth-largest state by population with an estimated 10.5 million residents. The largest cities are mostly located toward the central area of the state and include Charlotte, Raleigh, Greensboro, Durham and Winston-Salem.

North Carolina’s real estate market falls near the middle of the nation in SmartAssets Healthiest Housing Market study. We looked at stability, affordability, fluidity and risk of loss for the study. As ranked by the study, some of the best places to be a homeowner in North Carolina include Kings Mountain, Harrisburg, Sanford and Gastonia. Home values have increased 7.1% from 2018 to 2019, and the median home value in the state is $193,200, according to data from the Census Bureau.

The most affordable places to live in North Carolina are Sawmills, St Stephens, Archdale, Half Moon and Wrightsboro, as determined by our Most Affordable Places in America study. We considered closing costs, real estate taxes, homeowners insurance and mortgage payments to determine the rankings.

Looking to live in one of North Carolina’s larger urban areas? Property taxes in the state rank 17th-lowest in the country, based on Census data. The median home value in Charlotte is $200,500. Raleigh, home to North Carolina State University, has a median home value of $236,700. And if you’re looking into the outdoor mecca of Asheville, youll have to shell out even more based on a median home value of $242,500.

How To Use The Mortgage Payment Calculator

To use the calculator, start by entering the purchase price, then select an amortization period and mortgage rate. The calculator shows the best rates available in your province, but you can also add a different rate. The calculator will now show you what your mortgage payments will be.

Our calculator also shows you what the land transfer tax will be, and approximately how much cash youll need for closing costs. You can also use the calculator to estimate your total monthly expenses, see what your payments would be if mortgage rates go up, and show what your outstanding balance will be over time.

If youre buying a new home, its a good idea to use the calculator to determine what you can afford before you start looking at real estate listings. If youre renewing or refinancing and know the total amount of the mortgage, use the Renewal or Refinance tab to estimate mortgage payments without accounting for a down payment.

You May Like: How Much Is A Mortgage Point Worth

Determine What Your Ideal Down Payment Amount Should Be

A down payment is a portion of the cost of a home that you pay up front. It demonstrates your commitment to investing in your new home. Generally, the more you put down, the lower your interest rate and monthly payment. There are also low or no-down payment options available on certain types of mortgage products, to qualified home buyers. Use this down payment calculator to help you answer the question how much should my down payment be?.

Estimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with a down-payment of 20% would result in an estimated monthly payment of $1,058.04 with an Annual Percentage Rate of 3.946%.1

$95000 Mortgage Loan Monthly Payments Calculator 95000 Loan Savingorg

- Article author: www.saving.org

- Top rated: 4.6

- Lowest rated: 1

- Summary of article content: Articles about $95,000 Mortgage Loan Monthly Payments Calculator 95000 Loan Saving.org $95,000 Mortgage Loan Monthly Payments Calculator 1.25%, 316.59, 579.08 1.50%, 327.86, 589.71 1.75%, 339.38, 600.46 2.00%, 351.14, 611.33

- Most searched keywords: Whether you are looking for $95,000 Mortgage Loan Monthly Payments Calculator 95000 Loan Saving.org $95,000 Mortgage Loan Monthly Payments Calculator 1.25%, 316.59, 579.08 1.50%, 327.86, 589.71 1.75%, 339.38, 600.46 2.00%, 351.14, 611.33

Read Also: What Mortgage Rate With 650 Credit Score

Getting Your First Mortgage

The traditional period for amortization of a mortgage is 25 years. But this is done in periods of five years at a time, though it is possible to pay the mortgage down in a shorter period, just not longer. The longer the amortization period, the smaller the monthly payments will be, but the more the loan will cost in total.

Most mortgages have a five year term, though shorter terms are possible. The five-year mortgage term is the amount of time a mortgage contract is in effect. At the end of each term, the mortgage must be renewed for another term, at which point there is an opportunity to consider making any changes. Possible changes include renegotiating the rate as well as other details of the contract for the next term. The agreed-upon interest rate remains in effect for the term.

It is possible to choose between an open mortgage, which provides a person the flexibility of being able to repay all or part of a mortgage at any time without a prepayment charge, or a closed mortgage, which limits prepayment options. The latter usually has a lower interest rate.

Traditionally, mortgage payments are made every month. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. A biweekly payment means making a payment of one-half of the monthly payment every two weeks. This results in 26 payments a year instead of 24.

There are also options for flexible or skipped payments.

Mortgage Calculations And Mortgage Considerations

Use the free online Mortgage calculator to calculate your monthly repayments, compare Mortgage repayments over different periods and define what is the most affordable option for your financial situation. The Mortgage calculator will provide you a monthly interest repayment over 1 year,2 years,3 years,4 years,5 years, 10 years and compare them to a monthly repayment period of your choosing .

Don’t Miss: How Long Is A Normal Mortgage

$95000 Mortgage Loans For 30 Years Monthly Payments Calculator

- Article author: www.dollartimes.com

- Top rated: 3.8

- Lowest rated: 1

- Summary of article content: Articles about $95,000 Mortgage Loans for 30 years. Monthly Payments Calculator Whats the monthly payment of a $95,000 loan? How much does it cost? Monthly payment for a $95,000 loan by loan length and interest rate

- Most searched keywords: Whether you are looking for $95,000 Mortgage Loans for 30 years. Monthly Payments Calculator Whats the monthly payment of a $95,000 loan? How much does it cost? Monthly payment for a $95,000 loan by loan length and interest rate

Your Tool To Determine Land Mortgage Rates Interest And More

If you are in the market for a property loan from a professional agriculture finance lender, a land loan calculator can help you determine estimated payments on your loan. This tool can be used for loan payment estimations on a new tract of land, or for loan requests for expanding at your existing farm, ranch, or rural property. Anyone can use the land loan calculator tool. It is a quick and easy way to get an idea of what you will need to contribute, based on several different factors.

You May Like: Should I Add My Spouse To My Mortgage

Mortgage Legal Issues In North Carolina

Homebuyers enjoy certain protections under the North Carolinas Residential Property Disclosure Act law, such as required seller disclosures. The four-page document detailing the home and any issues wont cover every single property concern , but will help add an element of transparency. If the seller doesnt provide a disclosure within a set amount of time, the buyer can rescind the offer under certain conditions.

North Carolina also has laws and resources to help prevent predatory home loans. The North Carolina Department of Justice outlines tips for homebuyers and provides the contact information for the Commissioner of Banks which can help you verify that the lender youre working with is licensed and credible.

Turning to North Carolina foreclosure processes, youll find that its relatively quick in this state. This is due to a large majority of non-judicial foreclosures, which means that lenders dont have to initiate a lawsuit for a foreclosure. North Carolina lenders generally use deeds of trust and promissory notes when issuing home loans. Most of these loans will include a power of sale clause which is a pre-authorization for a lender to sell the property in the event that you dont pay your mortgage, which is known as defaulting on a loan.

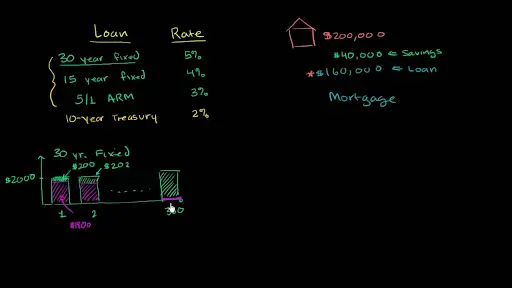

How To Calculate Mortgage Payments

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

Don’t Miss: Can You Have 2 Mortgages On The Same Property

What Is A Prepayment Penalty

A prepayment penalty is a fee that your mortgage lender may charge if you:

- pay more than the allowed additional amount toward your mortgage

- break your mortgage contract

- transfer your mortgage to another lender before the end of your term

- pay back your entire mortgage before the end of your term, including when you sell your home

Your lender may also call the prepayment penalty a prepayment charge or breakage cost.

Prepayment penalties can cost thousands of dollars. Its important to know when they apply and how your lender calculates them.

If you have an open mortgage, you can make a prepayment or lump-sum payment without paying a penalty.