How To Purchase A Home That Has A Reverse Mortgage

We are looking to buy a home, and signed a contract for sale for $730,000. The house appraised for just over that amount. Afterwards, we learned that the seller owes more than that on a reverse mortgage. Does HUD/FHA need to approve the sales price before we can close? It seems that because the sales price is within 95% of the amount owed, the seller would be able to complete the transaction. Does HUD/the lender get to keep the difference between what is owed and what the sales price will be?

Are you sure that it is a HUD HECM? That balance seems very high for the HUD loan and while it is possible that it was one of the earlier fixed rate loans for an older borrower with a full draw, it would be very difficult to get that high otherwise unless it was a jumboorproprietary reverse mortgage and then it is a whole different animal.

I cant say for sure based on what information I have here. If the loan was done on a proprietary or private program, I could not make the same assurances as to what the options might be. If it was the HUD program, if the borrowers have passed, the lender would allow the borrowers heirs to pay the loan off and keep the home at 95% of the current market value but there is no option to sell the home for a short sale and let the heirs keep 5% of the sale proceeds.

Since that number is a negative number indicating a loss and not a surplus on the sale, there is nothing left to keep.

Do I Have To Complete In

The answer depends on the type of reverse mortgage loan for which you are applying. In New York, in order to get a proprietary reverse mortgage loan , the borrower must either complete in-person counseling or waive such requirement in writing. In order to get a HECM reverse mortgage loan , a borrower may not waive the counseling requirements but he or she may opt to complete the required counseling either in person or over the telephone. You can find a list of non-profit housing counselors on the Departments website.

Hire A Real Estate Attorney

You may or may not feel the need to hire a lawyer to help with the sale. However, itâs actually required in some states. A real estate attorney will help you navigate the timeline and process so you donât make any errors that could cost you. Keep in mind that this will result in additional fees that will come out of any profits from the sale.

Also Check: What Are Current Mortgage Rates In Oregon

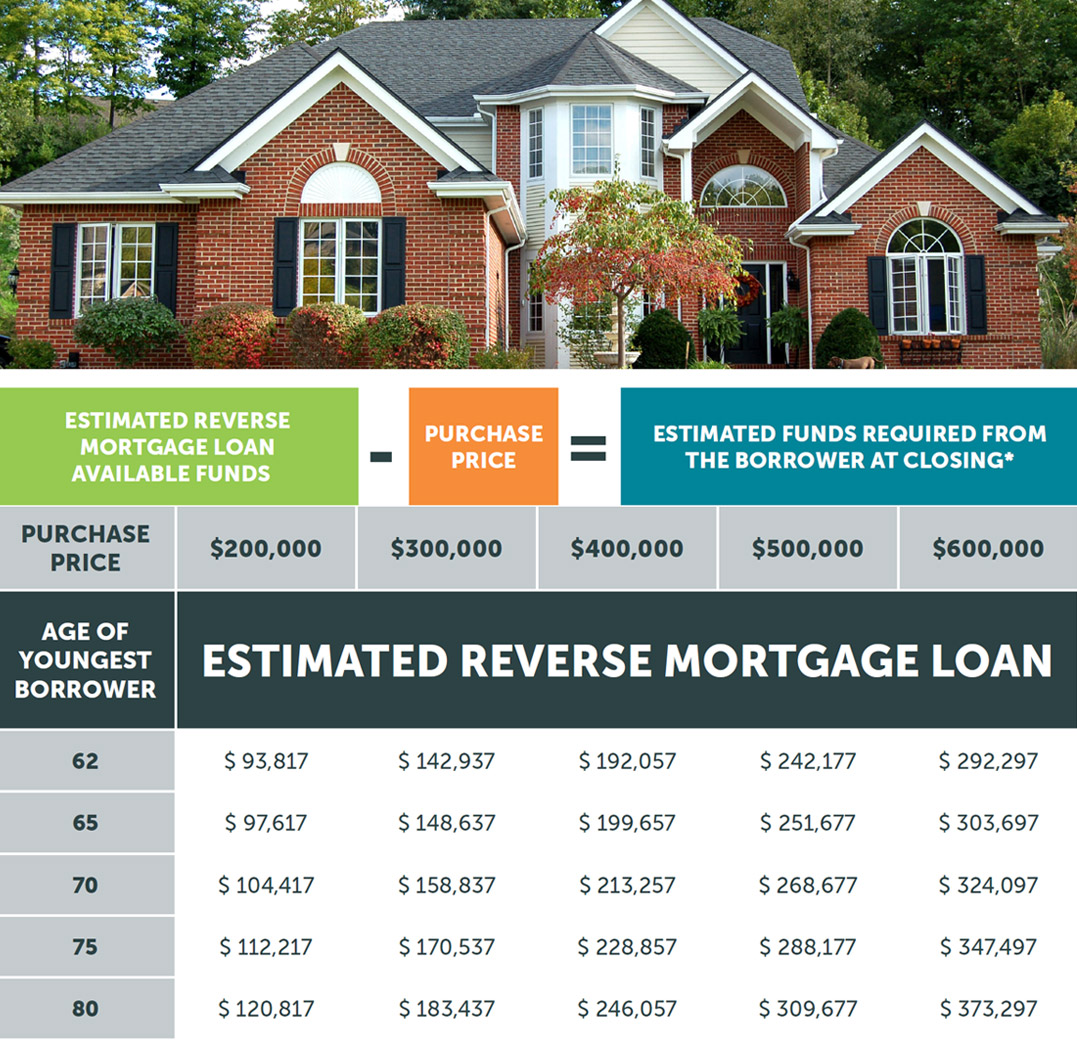

How To Estimate Your Reverse Mortgage For Purchase Loan Amount

You dont need a special reverse mortgage calculator to estimate whether or not you can do a reverse mortgage for purchase. Instead, you can simply do the following:

- When the tool asks for the homes value, put the purchase price.

- Enter the ages of all titleholders on the new property

- Set the mortgage balance to $0

The loan amount shown is roughly how much you will be able to borrow. The difference is how much you will need for the down payment.

Can You Refinance A Reverse Mortgage

Yes, you can refinance a reverse mortgage. Because of the origination fee, upfront mortgage insurance premium, and other closing costs, refinancing a reverse mortgage should be reserved for situations where a spouse needs to be added to the loan, more equity is needed, or the interest rate can be lowered substantially.

You May Like: How To Save On Interest On Mortgage

You Could Lose Your Home To Foreclosure

In order to qualify for a reverse mortgage, you have to be able to afford your property taxes, homeowners insurance, HOA fees and other costs associated with owning your home. Youâre also required to live inside the home as your principal residence for most of the year.

If at any point during the loan period you become delinquent on these expenses, or spend the majority of the year living outside the property, you could default on the reverse mortgage and lose your home to foreclosure.

When You Settle A Reverse Mortgage You Pay Off:

- Principal amount you borrowed throughout the reverse mortgage

- Accrued interest on the borrowed amount

- Unpaid fees such as mortgage insurance

If your reverse mortgage balance exceeds the homes value, then the borrower or the heirs arent liable to pay the difference.

The good news is a reverse mortgage is a non-recourse mortgage. This means that reverse mortgages allow homeowners to receive the funds from a house sale, but they cant owe more than the value of the property.

Don’t Miss: Does Chase Sell Their Mortgages

How To Buy A New Home With A Reverse Mortgage

The reverse for purchase requires a down payment calculated according to the purchase price and the borrowers age. Its typically between 45% and 62% of the purchase price.

Because they dont require monthly mortgage payments and dont have to be repaid until the mortgagee leaves the home or the borrower defaults, they require the homeowner to have a lot more equity in the property to protect the lender as the principal increases, says Khari Washington, a real estate broker and owner of1st United Realty & Mortgage.

Most seniors who are selling one home and buying another with a reverse mortgage fund the down payment with home sale proceeds. You can also use savings.

Reverse Mortgage Interest Rates

Only the lump sum reverse mortgage, which gives you all of the proceeds at once when your loan closes, has a fixed interest rate. The other five options have adjustable interest rates, which makes sense since youre borrowing money over many years, not all at once, and interest rates are always changing. Variable-rate reverse mortgages are tied to a benchmark index, often the Constant Maturity Treasury index.

In addition to one of the base rates, the lender adds a margin of one to three percentage points. So if the index rate is 2.5% and the lenders margin is 2%, then your reverse mortgage interest rate will be 4.5%. Interest compounds over the life of the reverse mortgage, and your does not affect your reverse mortgage rate or your ability to qualify .

You May Like: What Are 15 Year Mortgage Interest Rates

How To Apply For A Hecm For Purchase

The reverse for purchase application process is similar to most mortgage applications, except youll work with anFHA-approved HECMlender. Because of that, your current financial institution might not be yourreverse-for-purchase lender.

In addition, you will meet with a counselor from an independent, HUD-approved housing counseling agency to ensure you understand what makes a reverse mortgage different.

In addition to doing a credit check and establishing that you can continue to afford your homes insurance and upkeep, the lender will conduct a financial assessment to make sure you dont have delinquent federal debt. It will also appraise your home and do a title search before approving your application.And you will have to provide income verification, including Social Security, pension income, investments, 401Ks, IRA, etc.

Example Moving Into A Better Retirement

Lets say you simply do not need as much home as you own currently, would like to move closer to family, or simply want to move to a retirement community that offers greater amenities and access to activities.

Using a Reverse Mortgage could give you the ability to sell your current home, and put a fraction of the proceeds into a new Equity Conversion Mortgage, leaving the remainder of the proceeds as reserves, or to invest in vehicle that increases monthly cash flow with no mortgage payments to be made on your new home.

As an example, lets say a homeowner is 71 years old and has $300,000 of equity in your current home. For this example, you are also purchasing a home that costs $300,000.

The quick and easy answer would be to sell your existing home, and use the proceeds to purchase your new retirement lifestyle, leaving you with only property taxes and homeowners insurance to worry about.

With a Reverse Mortgage, you could put down just over $140,000 toward the purchase of the new home, and still have NO PAYMENTS for as long as you live in the home, again only being responsible for property taxes and homeowners insurance.

You accomplish the exact same goal as before, except you are now $160,000 more liquid, which you can use to set up college funds for your Grandchildren, invest in cash flow vehicles to increase your monthly income, or keep as cash reserves for emergencies.

You May Like: How To Shop For Home Mortgage Loan

If Your Spouse Or Partner Isnt A Co

If your spouse is not a co-borrower on your reverse mortgage, then they may have to repay the loan as soon as you move or die. As for whether they can remain in your home without repaying, that depends on the timing of the HECM and the timing of your marriage.

If a reverse mortgage borrower took out an HECM before Aug. 4, 2014, then a non-borrowing spouse doesnt have a guaranteed right to stay in the house. The lender may start foreclosure proceedings or permit the non-borrowing spouse to stay in the home through Mortgagee Optional Assignment. Through this process, the non-borrowing spouse may stay in the house by certifying specific information each year. This information includes:

- Confirming the non-borrowing spouse was married to the borrower when the reverse mortgage was originated and upon the borrowers death

- Verifying they do and have lived in the home as a primary residence

- Providing their Social Security number or Tax Identification Number

- Continuing to meet all loan obligations

- Ensuring the loan will not come due and payable

- Agreeing that they will no longer receive any payments from the loan

The rules are different for HECM loans that were issued after Aug. 4, 2014. With these loans, an eligible, non-borrowing spouse can stay in the home after the borrowing spouse moves out or dies, but only if they meet these criteria:

If youre an eligible non-borrowing spouse, the reverse mortgage wont need to be paid until you die or move out of the house.

How To Get Your Hecm For Purchase Loan

When youre ready to apply for an HECM for Purchase Loan, youll need to find a lender. Dont forget to explain that you intend to buy a new home with the proceeds from your reverse mortgage. That way, your lender can figure out how much you can borrow based on your financial situation.

Unlike a standard reverse mortgage, the HECM for Purchase Loan requires a down payment. In some cases, you may be expected to put down 50% of the homes purchase price. Since the funds for your down payment cannot be borrowed, youll have to use your savings, gifts or the proceeds from your home sale to come up with the cash you need.

Youll also be required to participate in a counseling program facilitated by the Department of Housing and Urban Development. A counselor can help you understand the consequences of taking out a reverse mortgage loan.

Don’t Miss: What Does A Cosigner Do For A Mortgage

Buy A Home With A Reverse Mortgage

A reverse mortgage for purchase may help some seniors finance a new place to live.

Most seniors take out a reverse mortgage to help them stay in their existing home as they get older. But Myra Simmons, 67, took advantage of a little-known product: She used a reverse mortgage to finance a new home.

Myra’s 83-year-old husband, Billy, was having trouble using the stairs in their two-story townhome in Fort Myers, Fla. The couple sold their home and used a “reverse mortgage for purchase” to move into a one-story house nearby last summer. “Now I take what would have been my mortgage payment and put it in savings,” says Myra, who works for the local county sheriff’s office.

The Home Equity Conversion Mortgage for Purchase was created by Congress four years ago to streamline home-buying transactions and cut costs, says Peter Bell, president of the National Reverse Mortgage Lenders Association. Before, seniors would buy a new home, incurring closing costs, and then take out a reverse mortgage on the new home, triggering new closing costs. The HECM for Purchase rolls this into one transaction and one set of closing costs.

What Fees Can My Lender Charge Me

With respect to reverse mortgages under New Yorks Real Property Law sections 280, or 280-a, lenders may only charge those fees authorized by the Department in Part 79.8. All costs and fees must be fully disclosed and reasonably related to the services provided to or performed on behalf of the consumer. Specifically, a lender may charge the following fees, among others, in association with a reverse mortgage loan:

- An application fee

Also Check: What Is Needed To Get Approved For A Mortgage

Hecm For Purchase: How It Works

- If you qualify, you can buy a home or FHA approved condo as your principal residence by taking out a HECM reverse mortgage on that property.

- Using proceeds from the sale of your current home, or cash on hand, you make a down payment and cover closing costs.

- The balance of the purchase is covered by your HECM proceedsany remaining funds can be used as you choose.

- Theres just a single closing, as the home purchase and HECM reverse mortgage are executed in one transaction.

- You make no monthly mortgage payments on the new home1.

- You own the homenot the bankand you can continue to live in it, as long as the terms of the loan are met.

- The loan is repaid, including principal plus accrued fees and interest, when the last surviving homeowner vacates the property for 12 months of the home or passes away.

Age Makes A Difference

Like any reverse mortgage, the older you are, the more money you can get from the loan and the less you must bring to the closing table. For instance, a 62-year-old who buys a $400,000 home with a reverse mortgage for purchase must make a down payment of $159,450, according to a recent quote using All Reverse Mortgage Company’s calculator . He can get a loan for $250,000 at a fixed rate of 3.99%, and the proceeds will cover $9,450 in fees and $240,550 of the purchase price.

If instead the homeowner is 82, the down payment drops to $115,450. The loan proceeds, which cover fees and the rest of the home price, rise to $294,000.

Be careful, though. While you don’t have to make monthly payments, the interest can eventually devour the money you put down. “If you live there long enough, the equity could disappear,” says Anthony Webb, a research economist at the Center for Retirement Research at Boston College. This could be an issue for seniors who want to leave the house to heirs or later need the equity to pay for long-term care.

You must still pay insurance, maintenance and taxes on the homeor the lender can foreclose. Keep that in mind if you trade up to a house that has more expensive upkeep than your current home. And snowbirds, take note: You can only get a reverse mortgage for a home that will be your primary residence.

Don’t Miss: How To Sell A House Before Mortgage Is Paid Off

Deed In Lieu Of Foreclosure

If you arent able to sell the home after a maturity event and you dont want to risk foreclosure, you can often deed the home back to the lender and walk away without the house but without a foreclosure on your credit report. Heirs sometimes take this path if they feel the amount of money theyll get out of the house isnt worth the hassle of going through the listing process.

Related Articles

How To Calculate Bridging Finance To Buy A Property

What is a bridge loan calculator designed to do? It can work out how much you should be able to borrow for a bridge loan. When youre looking for bridging finance to buy property, most bridge loan calculators want the following information:

- Home sale price

- Mortgage penalty

- Realtors commission

The bridge loan calculator will then provide you with the amount typically available for a bridge loan.

Recommended Reading: What Does Qc Mean In Mortgage

When Does The Reverse Mortgage Need To Be Paid

You may not be required to make monthly payments on your reverse mortgage, but the loan will come due eventually and you will need to pay it back. A reverse mortgage must be repaid:

- When the borrower no longer resides in the home or the home is no longer their primary residence.

- When the borrower sells the home or transfers the house title.

- If the borrower doesnt uphold their loan obligations, including paying their property taxes and homeowners insurance.

What Is Home Equity

In simple terms, home equity is whats left when you take away the value of your house from your outstanding mortgage debt.

- Lets say your home is worth $500,000

- You owe $200,000 on your mortgage

- You have $300,000 in home equity

Homeowners can build equity in their properties over timeequity increases with the value of your home and the payments you make on your mortgage.

Lets say its been 3 years since you took out your mortgage and the value of your home has increased.

- Your home is now worth $550,000

- Your remaining mortgage debt has been reduced to $150,000

- Your home equity is now $400,000

You can borrow funds using the equity in your home as leverage or collateral , which you can then use to buy a rental property, a second home or a weekend getaway.

You May Like: What Fico Score Does Mortgage Use