Can I Pay Off My Mortgage Early

For most people, a mortgage payment is the largest monthly expense. It is possible to get rid of that mortgage payment — but first, find out if your lender charges a prepayment penalty.

A prepayment penalty is a fee some lenders charge customers who pay off a mortgage loan early. Mortgage interest is the lifeblood of mortgage companies, and when you pay off your principal balance early, the lender loses out on years of interest payments you would have made. That’s why lenders will sometimes charge a prepayment penalty when a mortgage is paid off early. Check your mortgage contract or call your lender to learn whether it charges a prepayment penalty for early payoff.

A quick note about prepayment penalties: Even if your lender charges a prepayment penalty, there is likely a loophole. For example, most lenders allow you to pay off up to 20% of your principal balance each year without penalty. Say your principal balance is $200,000. You can pay an extra $40,000 each year toward the mortgage balance without a penalty.

If you’re one of the lucky borrowers whose lender does not charge a prepayment penalty, you’re good to go. And even if your lender does charge a prepayment penalty, weigh the cost of the penalty against how much money you save by paying the mortgage debt off early.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Adding An Extra Mortgage Payment Of $10 Per Month

- Even adding a nominal amount such as $5 or $10

- On a monthly basis over a long period of time

- Can save you thousands of dollars on your mortgage

- And shorten your loan term at the same time

Lets start with a simple scenario where you add just $10 a month in extra payment to principal.

Assuming youve got a $100,000 loan amount set at 4% on a 30-year fixed mortgage, that extra $10 payment would save you $3,191.81 over the full loan term.

It would also shorten your mortgage by 13 months, meaning your 30-year mortgage would be a 28-year mortgage.

So thats good news, right? You save thousands and you only have to pay a measly $10 extra per month. You probably wouldnt even notice the difference.

What if you bumped up that extra payment to $25? Well, you would shave 32 months off your mortgage, nearly three years, and reduce total interest by $7,450.04.

Feeling ambitious? Add $100 a month and you reduce your term by 101 months, or nearly 8.5 years, while saving $22,463.79 in interest.

You can also just make your mortgage payments a solid round number and save money that way too.

The world is your oyster really, so long as your loan servicer understands and accepts that these payments are to go toward the outstanding principal balance.

Speaking of, make sure its very clear that any extra payments go to the right place. Often, you cant make split payments, or payments for less than the total amount due.

So any extra should be on top of the minimum amount due for the month.

Recommended Reading: What Is The Federal Interest Rate For Mortgage

Overview: Paying Off Your Mortgage Early

Every time you make a mortgage payment, its split between your principal and your interest. Most of your payment goes toward interest during the first few years of your loan. You owe less in interest as you pay down your principal, which is the amount of money you originally borrowed. At the end of your loan, a much larger percentage of your payment goes toward principal.

You can apply extra payments directly to the principal balance of your mortgage. Making additional principal payments reduces the amount of money youll pay interest on before it can accrue. This can knock years off your mortgage term and save you thousands of dollars.

Lets say you borrow $150,000 to buy a home at 4% interest with a 30-year term. By the time you pay off your loan, youll have paid a whopping $107,804.26 in interest. This is in addition to the $150,000 you initially borrowed.

Now, lets say that you pay an extra $100 every month toward a loan with the exact same term, principal and interest rate. At the end of the term, youll have paid $82,598.49 total in interest. Thats $25,205.77 less than you would have paid if you didnt make any extra payments. Youll also pay your loan off 74 months earlier than you would if you only paid your premium each month.

The decision to pay off your mortgage early is a personal one that depends heavily upon your individual circumstances.

What If I Make Two Extra Mortgage Payments A Year

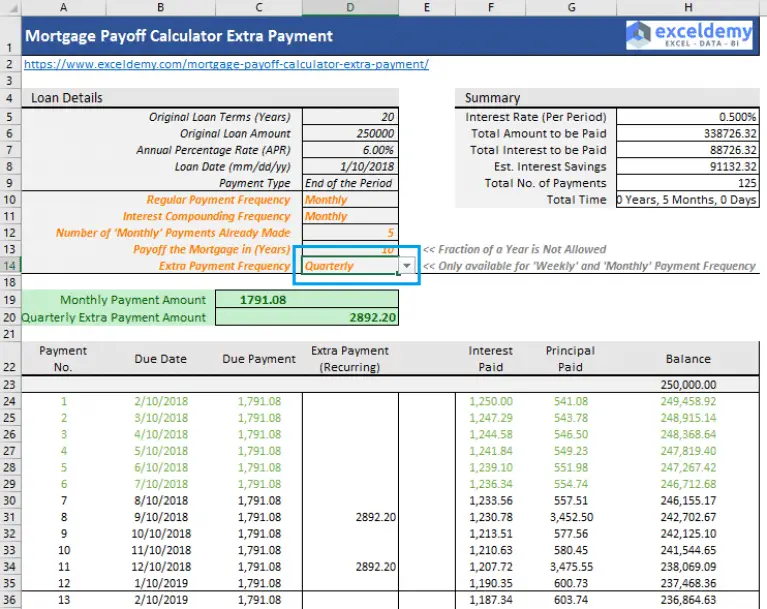

![Mortgage calculator with extra payments and lump sum [Excel Template] Mortgage calculator with extra payments and lump sum [Excel Template]](https://www.mortgageinfoguide.com/wp-content/uploads/mortgage-calculator-with-extra-payments-and-lump-sum-excel-template.png)

If making an additional payment on top of what youd already be paying extra through a biweekly schedule or committing to one annual extra payment is a feasible financial option for you, doing so can be a great way to gain full ownership of your home even faster.

However, you should only consider this option if it wont put your ability to pay for your other financial responsibilities at risk.

You May Like: Who Does 100 Percent Mortgages

Recast Your Mortgage Instead Of Refinancing

Mortgage recasting is different from refinancing because you get to keep your existing loan.

You just pay a lump sum toward the principal, and the bank will adjust your payoff schedule to reflect the new balance. This will result in a shorter loan term.

One major benefit to recasting is that the fees are significantly lower than refinancing.

Typically, mortgage recasting fees are just a few hundred dollars. Refinance closing costs, by comparison, are usually a few thousand.

Plus, if you already have a low interest rate, you get to keep it when you recast your mortgage. If you have a higher interest rate, refinancing might be a better option.

Check with your lender or servicer if you like this option. Not all companies will allow a mortgage recast.

Can You Afford To Prepay Your Mortgage

Before you pay down your mortgage ahead of schedule, you need to make sure you aren’t neglecting other important needs. For instance, if you have high-interest credit cards, higher-interest short-term debt on a car, or a private student loan, you should look at paying off that debt before you consider paying off what may be a lower-interest-rate mortgage.

Also, if you are still working and have not taken full advantage of an IRA or 401, those savings options come with significant tax benefits, and maybe even an employer match. The tax benefits and match may make investing in these accounts more appealing than paying off low-interest-rate debt, like a mortgageparticularly if you are concerned you won’t have enough funds for retirement.

Also Check: What Would My Mortgage Be With Taxes And Insurance

Take Advantage Of Prepayment Privileges

Pay off your home quicker with mortgages that have prepayment privileges. Lenders offer open, closed and convertible mortgages Opens a popup.. Open mortgages usually have higher interest rates than closed mortgages, but they’re more flexible because you can prepay open mortgages, in part or in full, without a prepayment charge. Closed and convertible mortgages often let you make a 10% to 20% prepayment. Your loan agreement explains when you can make a prepayment, so get the details from your lender beforehand. Also, decide which privileges you want before finalizing your mortgage.

How To Avoid Risk When Making Extra Principal Payments On Your Mortgage

If you are making extra principal payments on your mortgage, heres a simple way to avoid the risk of your bank not applying your payments properly: check your remaining loan balance before you make an extra principal payment. If you dont know how to get this information, we have a short video on where to find it. Then, on your next statement, make sure that your remaining loan balance has decreased by the same amount as your extra payment plus the principal you paid in your monthly mortgage payment. For example, if your remaining loan balance is $100,000, and you pay $2,000 as an extra principal payment, make sure your loan balance decreases by $2,000 plus the principal you paid in your monthly mortgage payment. For example, if you current monthly mortgage payment is $2,400, and $1,800 of it is your interest payment and $600 is your principal payment, make sure that your remaining loan balance at your very next statement is $97,400.

Dont delay! Errors in the way that payments are applied are then amortized and can cost you even more money over time as you may end of paying interest on the amount that you intended to go to paying down your loan balance. Its essential that you pay attention to your remaining loan balance to avoid this risk.

Recommended Reading: How To Find A Reputable Mortgage Lender

One Extra Lump Sum Mortgage Payment

- An extra lump sum mortgage payment could be more valuable

- If made soon after you take out your mortgage

- Its value diminishes over time since less interest is due later in the loan term

- But it could be a better option than paying a little each month

Now lets assume that you came upon some extra dough and want to make one lump sum payment to reduce your mortgage balance.

Using our same loan details from above, if you made a one-time extra payment of $5,000 to principal in month 13, youd save $10,071.67 and reduce your loan term by 31 months.

Amazingly, this single extra mortgage payment would save you money each month for the next 30 years.

Just look at the amount of interest paid each month after the extra mortgage payment is made versus the same home loan without extra payments below.

As you can see, payment 14 above consists of $310.30 in interest, while its $326.96 for the mortgage without extra payments.

In month 15 we see the same disparity, with $309.74 in interest versus $326.46. So each and every month after the extra payment has been made, interest savings are realized.

Want a fast, free rate quote? Quickly get matched with a top mortgage lender today!

Assuming the loan term is 360 months, its easy to see how the savings can really add up over time.

Of course, the borrower who pays extra wont have to make payments the full 360 months because theyll also wind up paying off their mortgage ahead of schedule.

So again, it matters when you pay extra.

When Making Minimum Monthly Payments Works

It may not be a good idea to focus on paying off your mortgage early if you have other debt to worry about. Credit card debt, student loan debt and other types of loans often have higher interest rates than most mortgages. This means that they accrue interest faster.

Youll save more money by paying these debts down than you would if you put all your money toward your mortgage. Its best to sit down with your financial paperwork and compare interest rates of your other debts to your mortgage interest rate. If your other debts have a higher interest rate, you should pay them down first.

You also may want to avoid paying your loan off early if it carries a prepayment penalty. This is a fee your lender charges if you pay off your mortgage prematurely. Prepayment penalties are usually equal to a certain percentage you would have paid in interest.

This means that if you pay off your principal very early, you might end up paying the interest you would have paid anyway. Prepayment penalties usually expire a few years into the loan.

Consult your mortgage lender and ask about any prepayment penalties on your loan before you make a large extra payment. Prepayment penalties are also noted in your mortgage contract.

Don’t Miss: What Is Overage Shortage In A Mortgage

What To Consider Before Prepaying Your Mortgage

Prepaying your mortgage is a great goal to work toward, but before you do, make sure youve met these financial milestones first:

Once those bases are covered, prepaying a mortgage comes down to discipline and comfort level. Do you want to be completely debt-free, or would you prefer your money working harder for you in other ways? Ideally, you want to pay off your mortgage before retirement so you dont have those monthly payments to worry about if your income becomes more limited.

Reason #: Pay Off Your Mortgage Early

What can one extra payment a year really do to the term of your loan?

That one additional payment may help you pay off your mortgage as much as three to four years earlyand if you make more than one additional payment per year, its even faster!

Not only do you save money on interest, but youll be clear of having a mortgage payment at all much more quickly.

Just think about what those dollars could be used for. College tuition, vacations, a second home, or even an investment property. That one extra payment allows you to build long-term wealth.

In the end, it doesnt matter what you do with the extra moneythe point is that its your decision to make. Even if your goal is simply to become debt-free, those extra mortgage payments will get you there faster.

You May Like: What Is A Good Mortgage Interest Rate

What Are The Advantages Of Making Extra Payments Versus Refinancing

One advantage of paying off your mortgage early instead of refinancing is you don’t have to pay closing costs. The money you might spend on these costs goes to paying down your mortgage principal instead.

Another advantage is you aren’t committed to paying more each month. Sometimes when homeowners refinance, they shorten the loan term. This can save money, but it can also increase your minimum monthly payment. When you decide to make extra payments on your current mortgage, you can pay as much or as little extra as you want each month – including nothing extra at all.

Commit To Making One Extra Payment A Year

The average American gets about $2,833 in their tax refund, according to the IRS. For most people, this is more than enough money to cover an extra mortgage payment every year.

You can put your tax return to good use and make an extra mortgage payment. On a $150,000, 30-year loan with a 4% interest rate, a single extra payment every year will help you pay off your mortgage 4 years early.

Don’t Miss: Will Mortgage Rates Continue To Rise

Extra Mortgage Payments Are More Valuable Early On

- You get more value out of extra mortgage payments early on in the loan term

- Because the outstanding balance is larger at the outset

- And early payments are composed mostly of interest

- Any extra payments will lower future interest for the remaining months, which will be more plentiful if you make them during the early years

As you can see, its not that hard to save a ton of money via extra mortgage payments, but it also matters when you start making those additional payments.

Using our $100 example, if you started making extra payments in year six of your 30-year mortgage , youd only save $15,095.21, and shed just 78 months off your mortgage.

Even if you procrastinated for just one year to initiate the extra $100 payment, your total savings would drop to $20,989.55, and only eight years would come off your mortgage term.

In short, the earlier you start making extra payments, the more youll save. This is mainly because mortgage payments are interest-heavy in the beginning of the term.

Drawbacks To Paying Down Your Principal Early

Paying down principal requires discipline and dedication for long-term benefits. Youre using money you could spend on alternatives, like a vacation or a nicer car or could be earning interest if invested elsewhere. Putting extra money toward your mortgage can also hinder your ability to pay off debts with higher interest rates. And if you lack an emergency fund, you should think twice before you put an unexpected cash infusion toward your mortgage. Finally, some lenders may charge fees for additional payments or early payoff. Make sure you ask about any extra fees.

Don’t Miss: How Do I Get A Second Mortgage

How To Pay Down Your Principal

Buying a home is an exciting experience. There’s nothing like receiving the keys to your home, especially after youve worked so hard to save for a down payment and qualify for a loan. But there are many responsibilities that come along with owning a home. At the top of this list is your monthly mortgage payment.

Like many homeowners, your mortgage payment can be your largest monthly expense. The thought of paying hundreds or thousands of dollars a month for decades can be overwhelming. Paying your mortgage principal faster can reduce the amount of interest you pay and also help you pay your loan off sooner.

Increase Your Mortgage Payment

Increase the size of your regular mortgage payment to take a large chunk off your mortgage principal. Choose a higher payment amount when you arrange your mortgage, or at any time during the term. This lets you pay down the principal faster.

Example: If you increase your monthly mortgage payment amount by $170 from $830 to $1,000, you’ll save almost $48,000 in interest over the amortization period. And you’ll own your home about 8 years sooner.1

Read Also: What Is Considered A High Interest Rate On A Mortgage