Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

What’s The Difference Between Being Prequalified And Preapproved

A quick conversation with your lender about your income, assets and down payment is all it takes to get prequalified. But if you want to get preapproved, your lender will need to verify your financial information and submit your loan for preliminary underwriting. A preapproval takes a little more time and documentation, but it also carries a lot more weight when youre ready to make an offer on a home.

Want To Pay Your Loan Off Quicker

With strong property prices, its not uncommon for people to take out loans extending beyond 25 years. However, with the rise of technology and automation, who knows what the world would look like in a quarter century? Paying extra on your home means your balance is lower today AND your balance is lower tomorrow. The earlier you make mortgage overpayments, the more interest expense you will save.

Making early overpayments reduces your balance for the duration of the loan. Just take note of early repayment charges . Some lenders allow you to overpay up to a certain amount before prompting early repayment penalty fees. These fees can range between 1% to 5% of your loan amount. Be sure to make qualified overpayments to avoid this extra cost.

Suppose you want to pay off your loan in 15 years. Your original mortgage has with a 25-year term. To estimate the overpayment amount you need to make, adjust the above calculator to 15 years. For example, a £180,000 loan structured over 25 years will see you pay £56,581.78 in interest over the life of the mortgage. However, if you pay off the loan within 15 years, your monthly payment would jump from £788.61 to £1,182.51. See the example in the table below.

Loan Amount: £180,000

| £56,581.78 | £32,851.43 |

Read Also: What Was The Lowest 15 Year Mortgage Rate

Personal Considerations For Homebuyers

A lender could tell you that you can afford a considerable estate, but can you? Remember, the lenders criteria look primarily at your gross pay and other debts. The problem with using gross income is simple: You are factoring in as much as 30% of your paycheckbut what about taxes, FICA deductions, and health insurance premiums, In addition, consider your pre-tax retirement contributions and college savings, if you have children. Even if you get a refund on your tax return, that doesnt help you nowand how much will you get back?

Thats why some financial experts feel its more realistic to think in terms of your net income and that you shouldnt use any more than 25% of your net income on your mortgage payment. Otherwise, while you might be able to pay the mortgage monthly, you could end up house poor.

The costs of paying for and maintaining your home could take up such a large percentage of your incomefar and above the nominal front-end ratiothat you wont have enough money left to cover other discretionary expenses or outstanding debts or to save for retirement or even a rainy day. Whether or not to be house poor is mostly a matter of personal choice getting approved for a mortgage doesnt mean you can afford the payments.

Common Misconceptions About Homeownership

There are many misconceptions about how difficult it is to become a homeowner. Its important to understand the facts before you start and how they apply to your individual situation so that you dont get overwhelmed or discouraged.

If you have less than 20 percent saved for a down payment, you should add PMI to the list of housing costs when youre figuring your budget.

Low income families can get down payment assistance from the government and non-profits. Before you go all-in with your house hunting. Decide if now is the right time for you to buy a home.

In any event, mortgage rates are currently at a historic low, the average rate on 30-year mortgages stood at 3.04 percent this week, unchanged from last week, according to Bankrates weekly survey of large lenders. If youve been thinking about becoming a homeowner, it may be time to take the plunge and buy now before interest rates rise again.

Most first-time buyers have to dip into savings or investments to have enough for a down payment. And if you have or student loan debt, be aware that some lenders may not approve your mortgage application because of how high the total monthly payment is.

Dont wait to start saving for a down-payment on your home. The sooner you begin putting money towards this goal, the easier it will be for you to become a homeowner.

Don’t Miss: Can You Have Two Mortgage Loans

Mortgage Insurance Vs Life Insurance

Mortgage life insuranceis an optional insurance policy that you can purchase from your mortgage lender that protects your mortgage balance. If you pass away, a death benefit will be paid to your mortgage lender to pay off some or all of the mortgage balance. If you get a critical illness, disability, or lose a job, youll receive a payout that helps cover some or all of your monthly mortgage payments. In all of these cases, your lender is the one that receives the insurance payouts.

With life insurance, youre purchasing a policy with a beneficiary that you get to choose. You can also choose to purchase a policy with a certain payout benefit, rather than having it tied to the balance of your mortgage.

Mortgage life insurance premiums are based on the borrowers age and the balance of their mortgage. Premiums are charged as a certain rate per $1,000 of mortgage balance. Mortgage life insurance in Canada is completely optional. A lender cant force you to purchase mortgage life insurance, no matter your down payment. However, if you make a down payment less than 20%, your lender can require you to purchase mortgage default insurance.

Mortgage life insurance can be easier to obtain, but having a potential insurance benefit that gradually decreases as you make mortgage payments means that the benefit gets smaller while your insurance premiums stay the same.

Can You Get A Home Mortgage Loan Without A Credit Score

The answer is, yes! If you apply for a mortgage without a credit score, youll need to go through a process called manual underwriting. Manual underwriting simply means youll be asked to provide additional paperworklike paystubs and bank statementsfor the underwriter to review. This is so they can evaluate your ability to repay a loan. Your loan process may take a little longer, but buying a home without the strain of extra debt is worth it! Keep in mind, not having a credit score is different than having a low credit score. A low credit score means you have debt, but having no credit score means you dont like debt!

You May Like: How Much Salary For 200k Mortgage

Conforming Loans Vs Non

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

What Are 2 Cons For Paying Off Your Mortgage Early

Cons of Paying Your Mortgage Off Early

- You Lose Liquidity Paying Off Your Mortgage. Liquidity refers to how easy it is to access and spend the money you have. …

- You Lose Access to Tax Deductions on Interest Payments. …

- You Could Get a Small Knock on Your Credit Score. …

- You Cannot Put The Money Towards Other Investments.

Read Also: How To Pay Your Mortgage Quicker

How To Calculate Your Dti

We talked a lot about debt-to-income ratios in this article. Knowing yours is key to learning how much house you can afford.

So, in case you were wondering, heres how you can calculate your own DTI ratio for mortgage qualifying.

- First, add up all the monthly expenses included in your DTI:

- Estimated monthly housing expenses

- Minimum credit card payments

- Obligations like alimony and child support

Next, you need to know your gross monthly income.

Remember, thats the highest figure on your pay stub, before deductions for tax and so on. If your income varies considerably perhaps seasonally use an average over the last year or two.

Now, divide the first figure by the second .

Federal regulator the Consumer Financial Protection Bureau gives an example:

If you pay $1,500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2,000.

If your gross monthly income is $6,000, then your debt-to-income ratio is 33 percent.

If you use a calculator, youll need to multiply the result by 100 to get a percentage. So your display says 0.3333 but your DTI is 33.33% .

How Much Is Cmhc Insurance

CMHC insurance premiums are a percentage of your mortgage and are paid by your mortgage lender.Provincial sales taxis added to premiums for mortgages located in Ontario, Quebec, Manitoba. and Sadkatachewan.

Premiums start at 2.4% of the mortgage amount for down payments of 20% or less, going up to 4% for a down payment of 5%. While your mortgage lender will pay the insurance premium, they will usually pass this cost indirectly onto you. However, you may still save money after these premiums through lower mortgage rates that insured mortgages usually have.

To find out how much CMHC insurance would cost for your home, visit ourCMHC insurance calculator.

Read Also: When Should You Prequalify For A Mortgage

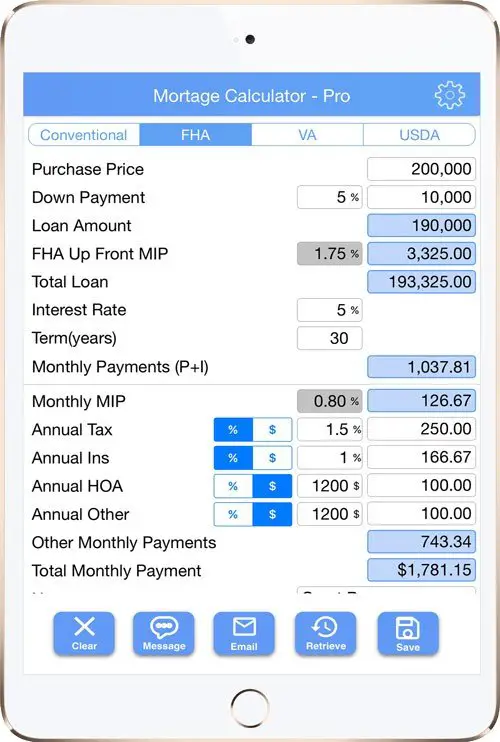

How Do I Use The Mortgage Calculator

Start by providing the home price, down payment amount, loan term, interest rate and location. If you want the payment estimate to include taxes and insurance, you can input that information yourself or well estimate the costs based on the state the home is located in. Then, click Calculate to see what your monthly payment will look like based on the numbers you provided.

Adding different information to the mortgage calculator will show you how your monthly payment changes. Feel free to try out different down payment amounts, loan terms, interest rates and so on to see your options.

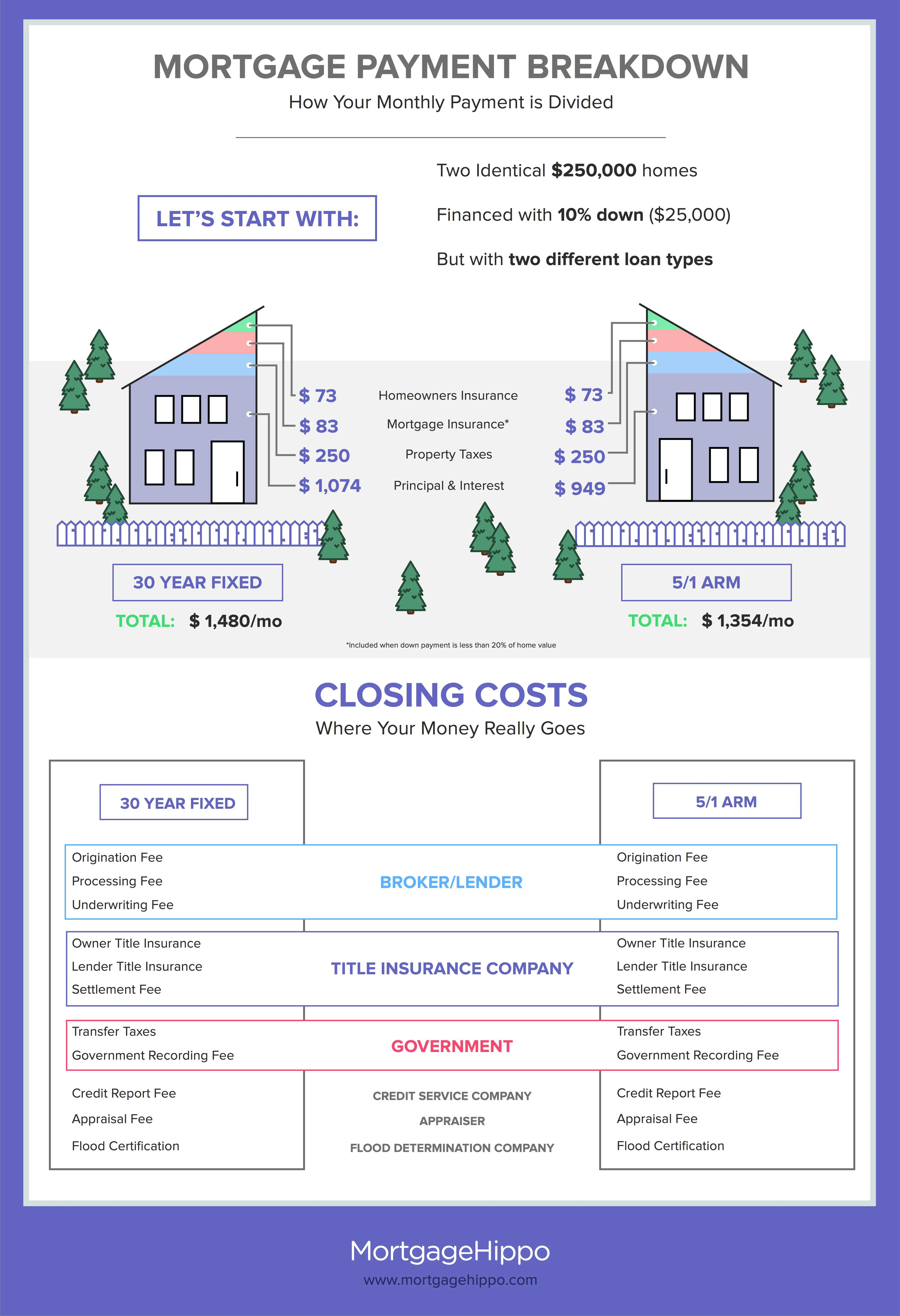

Whats Included In My Mortgage Payment

A typical monthly mortgage payment has four parts: principal, interest, taxes and insurance. These are commonly referred to as PITI.

The mortgage payment estimate youll get from this calculator includes principal and interest. If you choose, well also show you estimated property taxes and homeowners insurance costs as part of your monthly payment.

This calculator doesnt include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose.

Also Check: Can I Use My Partner’s Income For A Mortgage

The Homebuying Process: Step

Buying a house is likely to be the biggest financial commitment that you will make for your entire life, and while the experience can be both exciting and nerve-wracking, its important to get it right in order to avoid excessive extra costs in the future. Dont buy a home without reading this.

When its your first time buying it can be a little overwhelming, with lots of unknowns, legal wranglings, and lists of things to do in order to get the keys to your first home.

A few essentials youll want to do straight off include:

- Check your credit and strengthen your credit score

- Find out how much you might be able to borrow

- Save for down payment, closing costs

- Build a healthy savings account

- Get preapproved for a mortgage

- Start speaking to realtors and finding one you like and is recommended

- Find suitable mortgage lenders

- Buy a house you like

Luckily, when youre ready to make your first move, weve got this extremely thorough home buying guide to walk you through the must-dos of your first purchase.

How Often Can I Skip Mortgage Payments

| Lender |

|---|

| – |

RBC lets you make a mortgage prepayment that is up to the amount of your regular mortgage payment during your regular payment date. The minimum amount for Double-Up payments is $100, and goes up to 100% of your regular payment amount. The Double-Up payment is used to pay your mortgage principal balance.

Scotiabanks Match-a-Payment allows you to double your regular mortgage payment for any payment. You’ll also be able to increase your mortgage payment by up to 15% once per year.

You can choose to increase your regular TD mortgage payments by up to 100% once every calendar year, up until the increase is equivalent to 100% of your regular mortgage payment. This allows you to double your regular payments.

BMO allows you to increase your regular mortgage payments by up to 20% once per calendar year, or up to 10% for BMO Smart Fixed Mortgages.

You can double your mortgage payments or increase it up to 100% at any time with CIBC.

National Bank lets you make an additional payment on top of your regular payment, which can be up to 100% of your regular payment amount, on each of your regular payment dates.

Don’t Miss: How Often Are Mortgage Rates Updated

How Piti Affects Your Mortgage Qualification

When lenders assess whether or not you can afford a mortgage loan, theyll compare your estimated PITI with your gross monthly income .

Your PITI, combined with any existing monthly debts, should not exceed 43% of your monthly gross income this is called your debt-to-income ratio .

Your DTI is a primary factor in whether or not youll qualify for a mortgage.

How To Lower Your Monthly Payments

If your mortgage calculator results are not yielding the lower monthly payments you hoped for, here are several techniques to try:

- Lower purchase price: The less you borrow, the lower your mortgage payment

- Bigger down payment: Putting more money down means youll borrow less. Also, the best mortgage rates generally go to borrowers with larger down payments, among other qualifying factors

- Avoid private mortgage insurance: When you put at least 20% down on a conventional loan or 20% home equity on a refinance you can avoid paying monthly private mortgage insurance premiums

- Longer loan term: A longer loan term means lower monthly payments. However, you will pay more in total interest over the life of the loan

- Shop for a lower rate: Rate shopping doesnt have to take long, and its well worth the savings. Here are tips to get your best mortgage rate

Read Also: How To Get Approved For A 400k Mortgage

Structural Mortgage Market Shifts: Increasing Loan Duration & Explicit Government Backing

While the stamp duty holiday was widely discussed, the UK also pushed through other structural shifts to the mortgage market in the wake of the COVID-19 crisis.

“In the UK, usually the longest term fixed mortgage you could normally get was five years. Boris Johnson has now. Nobody can pretend that this has anything to do with Covid, and in fact when Johnson announced it, his stated aim was to give young people access onto the housing ladder. This is a good example of how the magic money tree was discovered for Purpose A, i.e. Covid, and is being used for Purpose B, furthering social justice.” – Russell Napier

When governments guarantee loans they lower the risk of making the loans, which in turn increases the flow of capital into the associated market. That typically leads to faster appreciation.

Programs created to “help” people get into the market are initially effective, but after prices adjust to reflect said capital shifts and risk-free profits the market becomes structurally dependent on such programs & the incremental help they offer declines as prices rise.

The property market has been frenzied throughout the first half of 2021 with Rightmove stating the first half of the year has been the busiest since 2000. Average home prices across England, Wales and Scotland rose to £338,447, an increase of £21,389 or 6.7% since the end of 2020.

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make.

Don’t Miss: How Long Will It Take To Pay Off Mortgage